Forthright Securities Co., Ltd. (hereinafter referred to as Forthright (Hong Kong)) established in August 2015, is an international financial institution based in Hong Kong, facing the Mainland and aiming at the world. It provides global securities and futures brokerage services for individual and institutional investors. Forthright (Hong Kong) holds 1, 2, 4, and 5 regulated activity issued by the Hong Kong Securities and Futures Commission. With sincerity, integrity and excellent professional standards, Forthright (Hong Kong) aims high and is committed to provide a wide range of investment products to our customers. Our efficient trading platforms provide convenient and professional trading support services to customers.

What is Forthright Securities?

Forthright Securities offers a flexible investment platform with no specified account minimum, making it accessible to a wide range of investors. Fees vary from free for certain accounts to variable fees depending on the type of transaction, with new accounts enjoying fee-free setup. While information on interests on uninvested cash and margin interest rates is not specified, the platform does not offer mutual funds. Investors can access the platform conveniently through its app available on iOS, Android, and web platforms. Additionally, Forthright Securities provides promotions to enhance the investing experience for its clients.

Pros and Cons of Forthright Securities

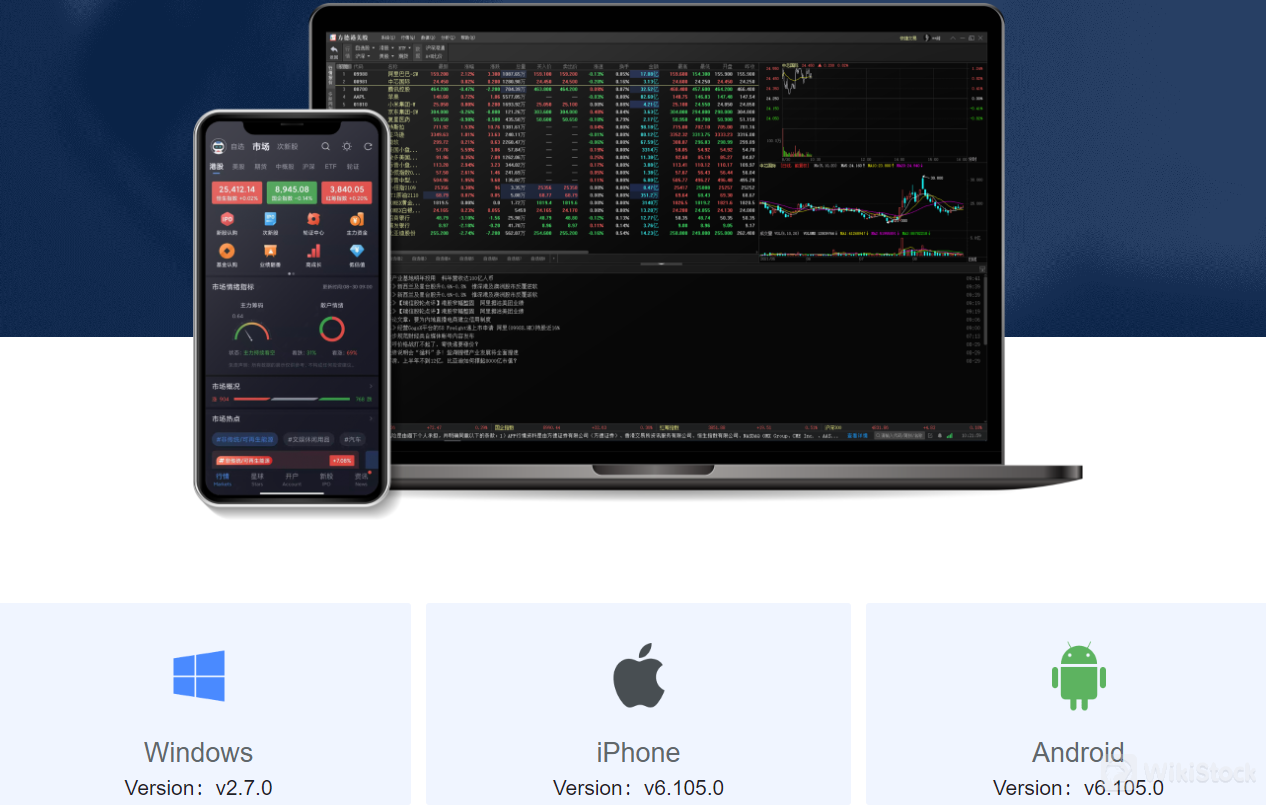

Forthright Securities boasts several strengths, including regulatory compliance with the SFC and a diverse range of asset offerings, ensuring a secure and versatile investment environment. The platform's accessibility across multiple devices, including iOS, Android, Mac, Windows, and web platforms, provides convenience for investors. However, challenges may arise from its complex fee structure and lack of clarity on interest rates for uninvested cash. Additionally, specific account types are not clearly specified, which can be a drawback for investors seeking tailored account options.

Is Forthright Securities safe?

Forthright Securities Company Limited is a broker-dealer registered with the Securities and Futures Commission (SFC) of Hong Kong.

Independent Custody of Customer Funds: They state that client funds are held in custody by a bank, separate from the company's own assets. This helps protect client funds in case Forthright Securities Company Limited faces financial difficulties.

Licensed Entity: The company claims to be a licensed corporation by the Hong Kong Securities and Futures Commission (SFC). This means they are subject to SFC regulations which aim to protect investors.

What are securities to trade with Forthright Securities?

Forthright Securities offers a comprehensive range of securities for trading, including IPO subscriptions, Hong Kong stocks (underlying stocks, ETFs, and Warrant CBBCs), US stocks (underlying stocks and ETFs), CSI (underlying stocks), and futures contracts from CMEGroup and HKEx. Additionally, the platform supports trading in funds and bonds, providing investors with a diverse set of investment options across different asset classes.

Stocks: Direct investment in publicly listed companies, suitable for investors seeking capital appreciation and dividends.

Options: Provide experienced investors with more strategic choices, allowing them to hedge risks or speculate by buying rights or obligations.

ETFs: Funds that invest in a variety of assets, typically tracking a specific index, offering immediate market exposure and liquidity.

Bonds: Debt investment products where investors lend money to a borrower (corporate or government) expecting to get back the principal plus interest in the future, suitable for low-risk investors.

Forthright Securities Fees Review

Future Trading:

Hang Seng Index Futures (HSI) - 35HKD per contract

Mini Hang Seng Index Futures (MHI) - 15HKD per contract

Hang Seng China H-Shares Index Futures (HHI) - 30HKD per contract

Mini Hang Seng China H-Shares Index Futures (MCH) - 15HKD per contract

Hang Seng TECH Index Futures (HTI) - 20HKD per contract

MSCI China A50 Index Futures (MAC) - 4USD per contract

Stocks

Hong Kong Stocks:

Mainland China Stocks (via Shanghai-Hong Kong Stock Connect)

IPO (Initial Public Offerings)

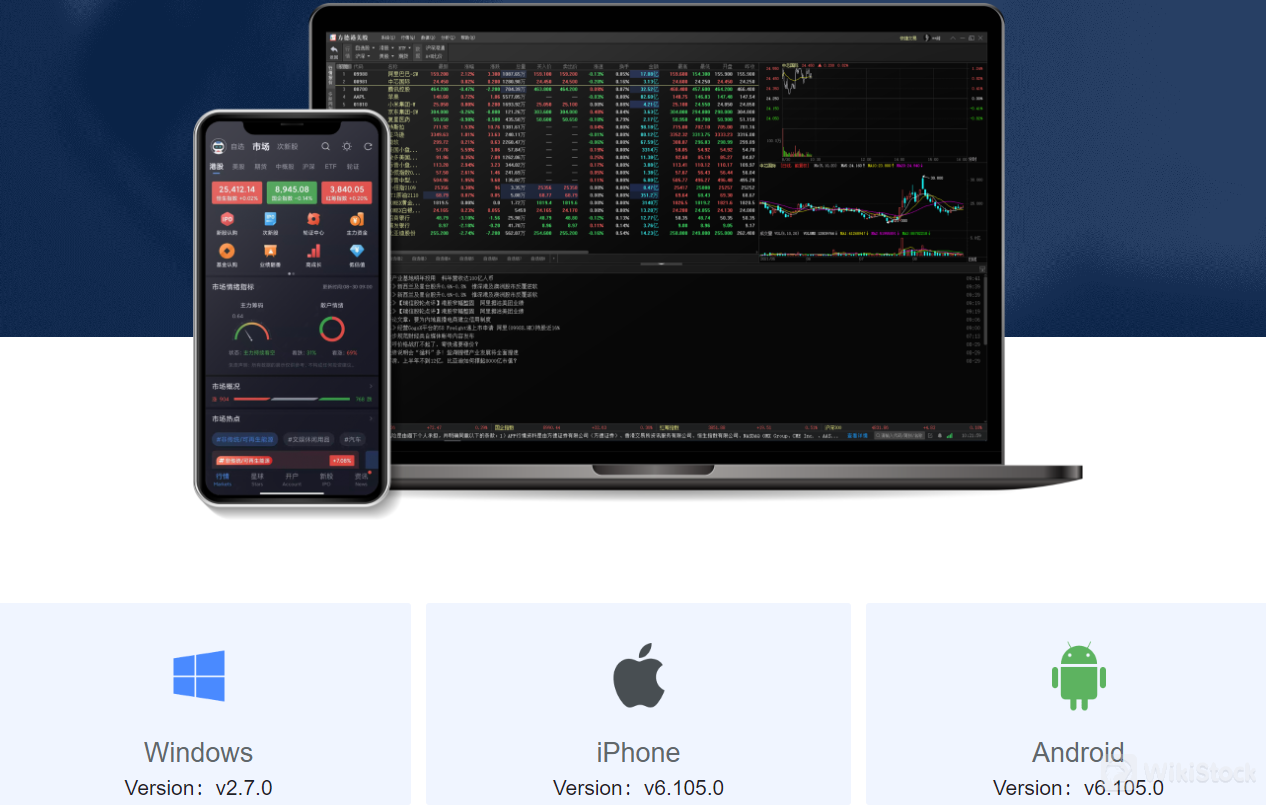

Forthright Securities App Review

Forthright Securities's mobile app is a cutting-edge and intuitive trading platform designed for on-the-go traders. It provides a comprehensive trading experience, available on iOS and Android devices, facilitating easy access to markets anytime, anywhere. In addition to the mobile app, Forthright Securities also offers a versatile range of platforms and tools for different devices and operating systems, including Web Trading platforms, as well as dedicated applications for Mac and Windows. This variety ensures that all users, regardless of their preferred device, can access the trading services seamlessly.

Research and Education

Forthright Securities provides comprehensive research and education resources for investors. Their market outlook covers insightful analyses of current market trends and projections, enabling investors to make informed decisions. Additionally, their investment special topics delve into specific investment areas, offering in-depth knowledge and strategies to help investors navigate various investment opportunities effectively. Overall, Forthright Securities' research and education materials aim to empower investors with the information and tools needed to optimize their investment portfolios.

Customer Service

Forthright Securities offers robust customer support through multiple channels. Clients can reach the service hotline at 400-100-1359 or (852)2957-6133 (HK) during business hours from Monday to Friday, excluding public holidays. For phone orders, the hotline is available from 8:00 to 00:00, with specific instructions for pressing options. Additionally, clients can access FAQs for quick answers to common queries, ensuring comprehensive support for their investment needs.

Conclusion

In conclusion, Forthright Securities stands out for its regulatory compliance with the SFC and its diverse range of investment assets, offering a secure and versatile platform for investors. Its availability on multiple devices, including iOS, Android, Mac, Windows, and web platforms, adds to its appeal for investors seeking accessibility. It is well-suited for investors looking for a regulated environment with a variety of investment options, although potential users should be mindful of the complex fee structure and the need for clarity on certain aspects such as interest rates on uninvested cash and specific account types.

FAQs

Is Forthright Securities safe to trade?

Yes, Forthright Securities is safe to trade as it is regulated by the Securities and Futures Commission (SFC) and complies with financial regulations, ensuring a secure trading environment for investors.

Is Forthright Securities a good platform for beginners?

Forthright Securities can be a good platform for beginners due to its accessibility on multiple devices and its diverse range of investment assets. However, beginners should be aware of the complex fee structure and seek guidance to navigate the platform effectively.

Is Forthright Securities legit?

Yes, Forthright Securities is a legitimate platform. It is regulated by the SFC, demonstrating compliance with regulatory standards and industry practices.

Is Forthright Securities good for investing/retirement?

Forthright Securities offers a variety of investment assets, making it suitable for various investment strategies, including long-term investing and retirement planning. However, investors should consider the platform's fee structure and seek clarity on specific aspects such as interest rates on uninvested cash before making investment decisions.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--