Stock market today: S&P 500, Nasdaq hover near records as Nvidia becomes most valuable stock

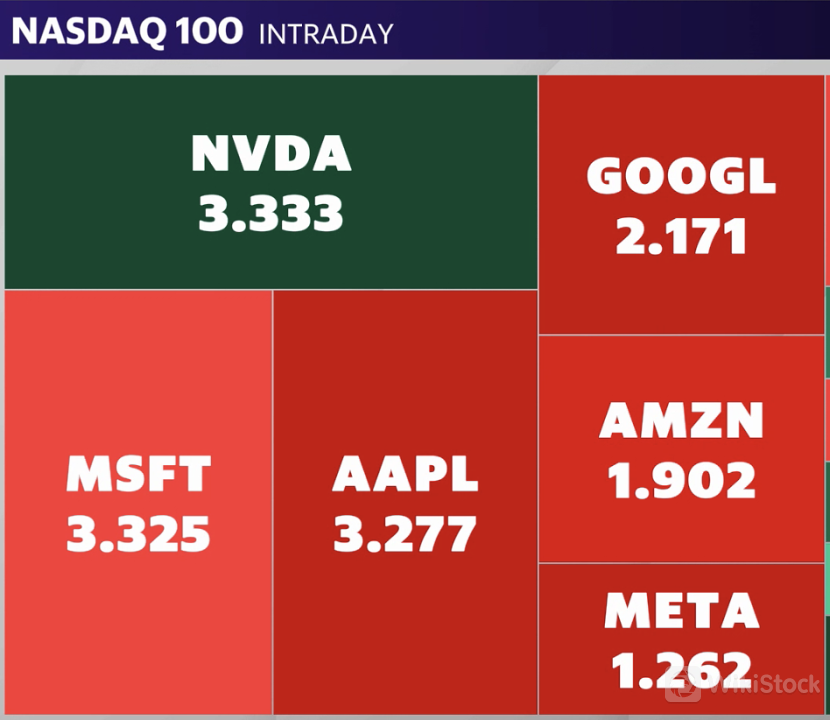

US stocks held near record highs on Tuesday, as Nvidia (NVDA) surpassed Microsoft (MSFT) to become the most valuable public company.

Both the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) climbed in afternoon trading, up about 0.3% and 0.2%, respectively, after the benchmark index secured its 30th record close of 2024 while the tech-heavy Nasdaq aims to build on a sixth straight record close.

The Dow Jones Industrial Average (^DJI) also moved higher, up roughly 0.1%.

As of afternoon trading, Nvidia's stock price rose more than 3.5% to north of $135 per share, giving the chipmaker a market capitalization just over $3.34 trillion. With a 0.2% slide on Tuesday, Microsoft's market cap stood at around $3.33 trillion.

Techs have continued to lead an AI-driven rally that, as Yahoo Finance's Myles Udland wrote, investors simply can't afford to miss out on. The enthusiasm is leading several Wall Street banks to chase their year-end S&P targets higher, with one strategist saying the AI revolution is still in its early innings.

Still, it wasn't all positive news after May's retail sales numbers disappointed.

Government data released on Tuesday showed that retail sales increased just 0.1%, missing economist expectations, Yahoo Finance's Josh Schafer reported. Meanwhile, April's numbers were revised to show a decline. It could be a sign of more consumer strain amid high interest rates and persistently stubborn inflation.

Also on Tuesday, a roster of Fed officials offered more commentary on the path of interest rates. Fed governor Ariana Kugler said she remained “optimistic that improving supply and cooling demand will support continued disinflation.”

“If the economy evolves as I am expecting, it will likely become appropriate to begin easing policy sometime later this year,” she said.

So far the message after last week's rate decision and forecast update has been clear: Expect one rate cut in 2024. Investors seemingly haven't yet taken this to heart, with over 60% still expecting two cuts by the end of the year, according to the CME FedWatch tool.

Live8 updates

Wed, June 19, 2024 at 1:35 AM GMT+8

Alexandra Canal

Nvidia surpasses Microsoft to become most valuable stock

Nvidia (NVDA) is now the most valuable public company in the world.

The chip maker surpassed Microsoft's (MSFT) market cap on Tuesday, just two weeks after it took the number two spot from Apple (AAPL).

Yahoo Finance's Josh Schafer and Dan Howley with the story:

Nvidia's stock price rose more than 3.5% to north of $135 per share, giving the chipmaker a market capitalization just over $3.33 trillion. With a 0.3% slide on Tuesday, Microsoft's market cap stood at $3.32 trillion.

Nvidia surpasses Microsoft in market cap

Shares of Nvidia are up more than 215% over the last 12 months and more than 3,400% over the last five years. Year to date, Nvidia has gained 173%; Microsoft stock is up just less than 19% in 2024.

Nvidia's surge has made it a top weighting in the S&P 500 (^GSPC), and the chipmaker has served a pivotal role in the benchmark index hitting record highs in 2024.

Up until May, the S&P 500 had traded with a near-perfect correlation to Nvidia's price movement, meaning that as Nvidia's stock rose, so did the broader index. As of Monday, Nvidia's stock gains alone had contributed about one-third of the S&P 500's year-to-date rise, according to data from Citi's equity research team.

Nvidia, which is the tech industry's go-to supplier for AI chips and integrated software, completed a 10-for-1 split on June 10.

Wed, June 19, 2024 at 1:20 AM GMT+8

Alexandra Canal

Berkshire Hathaway scoops up more shares in Occidental Petroleum

Warren Buffett's Berkshire Hathaway (BRK-A, BRK-B) has increased its stake in Occidental Petroleum (OXY) to nearly 29% of the company.

Yahoo Finance's Ines Ferré reports:

Buffett has said Berkshire has no interest in buying control of Occidental, but the conglomerate has been a repeat dip buyer of the Houston-based company as the stock sits roughly 12% off its April peak. Prior to the Monday filing, Berkshire disclosed three separate purchases last week totaling 7.3 million shares for $176 million.

Buffett has said Berkshire has no interest in buying control of Occidental, but the conglomerate has been a repeat dip buyer of the Houston-based company as the stock sits roughly 12% off its April peak. Prior to the Monday filing, Berkshire disclosed three separate purchases last week totaling 7.3 million shares for $176 million.

Occidental stock gained more than 1% on Tuesday to trade above the $61 level.

“Mr. Buffett appears to step in and buy more OXY shares whenever the share price falls near or below $60. This bid sure appears to have set a floor on the share price,” James Shanahan, equity analyst at Edward Jones, told Yahoo Finance.

Shanahan notes Berkshire‘s $15.4 billion position makes Occidental its sixth-largest stock holding. The company’s top holding is Apple (AAPL), which currently sits at roughly 20% of Berkshire's market cap, after Berkshire trimmed its position in the iPhone maker in May.

Berkshire is still highly involved in energy plays, as Chevron (CVX) remains a top-five holding despite the company selling some of its position as recently as March.

“Together with the preferred share investment in OXY, Berkshire's bet on oil is almost $43 billion. Interestingly, this total has been $41-51 billion at the end of each quarter dating back to March 2022, which was the quarter when Berkshire began to buy OXY,” said Shanahan.

Buffett has been a vocal backer of Occidental Petroleum, publicly praising the company‘s CEO Vicki Hollub. He was also instrumental in helping finance Occidental’s acquisition of Anadarko Petroleum in 2019.

Wed, June 19, 2024 at 12:05 AM GMT+8

Alexandra Canal

Apple discontinues buy now, pay later service ahead of Affirm integration

Apple is scrapping its buy now, pay later (BNPL) service — just over a year after its US launch.

The service, known as Apple Pay Later, debuted in March 2023 and allowed iPhone users to split purchases of up to $1,000 into four equal payments over six weeks with no added fees or interest.

Amid the service's discontinuation, the company will rely on BNPL platforms like Affirm and Klarna, which were once threatened by Apple's entrance into the space. The tech giant recently announced plans to integrate Affirm into Apple Pay where users will be able to access loans through the third-party app.

“With the introduction of this new global installment loan offering, we will no longer offer Apple Pay Later in the U.S.,” the company said in a statement late Monday.

“Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay, and this solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders.”

Shares of both Apple and Affirm were down more than 1% on Tuesday.

Tue, June 18, 2024 at 11:21 PM GMT+8

Alexandra Canal

Fund managers bullish on 'soft landing' in next year: BofA

Bank of America's Global Fund Manager survey for June was the most bullish since November 2021, driven by low 4% cash levels & big equity allocation.

According to the survey, released Tuesday, investors expect global growth to be unchanged over the next 12 months with 73% of respondents predicting no recession. A “no landing” probability has peaked at 26% while most respondents anticipate a “soft landing” at 64%. Just 5% see a “hard landing” scenario, a new low.

As a refresher, a soft landing would materialize if the Fed is able to bring inflation down without causing a recession or a significant jump in unemployment. A hard landing would result if inflation comes down but at the expense of the US economy. A no landing would materialize if inflation does not come down at all.

Just 8% of respondents say no Fed cuts in the next 12 months. Eight out of ten investors expect two, three or more cuts with the first cut forecast on Sept. 18.

Higher inflation is fading as the biggest risk with geopolitics and the US election on the rise at 22% and 16%, respectively.

When asked which policy areas will most impact the upcoming US election, 38% said trade, 20% said geopolitics, 13% said immigration, 9% said taxation and 7% answered government spending.

Tue, June 18, 2024 at 10:21 PM GMT+8

Dani Romero

'Choppy mortgage rate environment' hits Lennar margin outlook

Lennar stock (LEN) was down more than 2% in early trading after the homebuilder's third quarter outlook for gross margin on home sales disappointed investors.

The company projected gross margin of 23% for the period, below analyst estimates of 24%, per Bloomberg data.

“We suspect the likely culprit is the choppy mortgage rate environment that ended in May, which required elevated incentives that will flow through in 3Q closings,” Buck Horne, Raymond James analyst, wrote in a note.

Homebuilders like Lennar have pulled out all the stops to lure buyers as high mortgage rates keep both would-be buyers and sellers on the sidelines. While incentives like mortgage rate buydowns have helped companies in the space sell homes, Wall Street is concerned about builder profit margins taking a hit.

Lennar expects deliveries to range from 20,500 to 21,000 in the third quarter, with an average closing price of $420,000 to $425,000.

The Miami-based homebuilder reported second quarter earnings of $3.45 per share, higher than estimates for $3.19 per share. Revenue rose 10% to $8.8 billion, beating analysts estimates of $8.5 billion.

“The macroeconomic environment remained relatively consistent with employment remaining strong, housing supply remaining chronically short due to production deficits over a decade, and demand strength driven by strong household formation,” Stuart Miller, executive chairman and co-C of Lennar, said in a statement.

Tue, June 18, 2024 at 10:15 PM GMT+8

Alexandra Canal

Retail sales miss shows 'the strain of elevated interest rates'

The disappointing retail sales report “is showing the strain of elevated interest rates, with housing-related categories of spending continuing to decline in May,” Oxford Economics said in a note early Tuesday.

“There was also a surprise decline in spending at restaurants and bars [which declined 0.4% during the month], though other evidence suggests spending on other services is still holding up well. A price-related fall in gasoline station sales also weighed on the headline figure,” wrote Michael Pearce, Oxford Economics deputy chief US economist.

Retail sales in May increased just 0.1%, falling shy of the 0.3% economists polled by Bloomberg had expected. In April, retail sales ticked down 0.2%, according to revised data from the Commerce Department.

Excluding autos and gas, retail sales edged up 0.1%, below estimates for a 0.4% increase but above the 0.3% decline seen in April.

“Consumer spending is slowing because real income growth is moderating and because some consumers are becoming credit constrained amid elevated interest rates and rising credit card utilization,” Pearce said. “However, with unemployment unlikely to rise much and the state of households balance sheets still looking strong in aggregate, we expect consumer spending growth will remain close to its current pace in the second half of the year.”

Raymond James' chief economist Eugenio Aleman was a bit more pessimistic: “The downward revisions to April shows a very weak start by the US consumer during the second quarter of the year, which is consistent with our view of the US economy.”

Last week, the Federal Reserve signaled it would lower interest rates just one time this year, down from the three cuts the central bank anticipated in its previous March projection.

The central bank still expects a strong economy to end the year. Officials see the unemployment rate holding steady at 4% in 2024, matching the previous forecast. Unemployment is expected to tick higher to 4.2% in 2025 before coming down to 4.1% in 2026.

The Fed maintained its previous forecast for US economic growth, with the economy expected to grow at an annualized pace of 2.1% this year before ticking down slightly to 2% in 2025 and remaining at that level through 2026.

Tue, June 18, 2024 at 9:33 PM GMT+8

Alexandra Canal

Stocks muted at opening bell, hover near records

US stocks hovered near record highs as all three major indexes hugged the flatline.

The benchmark S&P 500 (^GSPC), which secured its 30th record close of 2024, was muted at the opening bell, along with The Dow Jones Industrial Average (^DJI). The tech-heavy Nasdaq Composite (^IXIC) similarly wavered as the tech-heavy index looked to build on a sixth straight record close.

Tue, June 18, 2024 at 9:03 PM GMT+8

Josh Schafer

Retail sales increase less than expected in May

Retail sales increased at a slower-than-expected pace in May as high interest rates and inflation continued to weigh on consumers.

Retail sales increased 0.1%, less than the 0.3% economists had expected. In April, retail sales ticked down 0.2%, according to revised data from the Commerce Department.

Excluding autos and gas, retail sales increased 0.1%, below estimates for a 0.4% increase but above the 0.3% decline in April.

Capital Economics chief North America economist Paul Ashworth noted Tuesday's retail sales reading adds to “signs that consumers are struggling a little.”

“The soft May retail sales data support our view that, after a disappointing first quarter, GDP growth remains a little lackluster in the second quarter too,” Ashworth said.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP