Nvidias 591,078% Rally to Most Valuable Stock Came in Waves

(Bloomberg) — The year was 1999. Steve Jobs had recently returned to lead Apple (AAPL). Intel was the dominant force in semiconductors. And a little-known chipmaker named Nvidia (NVDA) made its debut on the Nasdaq stock exchange.

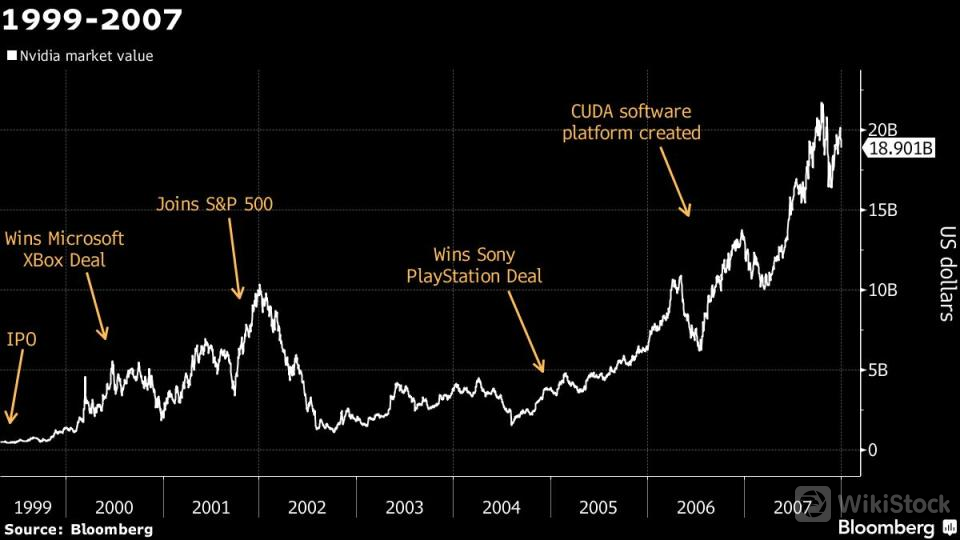

It took less than three years for Nvidia Corp. to ascend into the S&P 500 — replacing the disgraced oil-trading conglomerate Enron, no less.

But even then, few people would have bet that the company would go on to become the best performing stock of the last quarter-century, posting a total return of 591,078% since its initial public offering, including reinvested dividends. Its a difficult number to comprehend and a testament, in part, to the financial mania brewing around artificial intelligence and how investors have come to see Nvidia — which makes the cutting-edge chips powering the technology — as the single-biggest winner of the boom.

On Tuesday, that run culminated in Nvidia unseating Microsoft Corp. (MSFT) as the worlds most valuable company with a market capitalization of $3.34 trillion.

The companys rise was by no means assured — and neither is its staying power at the top of the S&P 500. Long-time investors in Nvidia have had to stomach three annual collapses of 50% or more in the stock. Sustaining the current rally will require customers to keep spending billions of dollars a quarter on AI equipment, whose returns on investment are so far relatively small.

What ultimately paved the way for Nvidia to climb to the top, though, was the companys big bet on graphics chips and the vision of co-founder and Chief Executive Officer Jensen Huang that the industry would shift to what he calls “accelerated computing,” something his chips are inherently better at than the competition.

“You have to give the management team, I think, an enormous amount of credit,” said Brian Mulberry, client portfolio manager at Zacks Investment Management. “They have caught each wave of innovation in hardware perfectly well.”

Heres a look at Nvidia from its IPO to now.

Early Years

Nvidia got off to a hot start.

Between its debut and the time it entered the S&P 500, the stock gained more than 1,600%, giving it a market value of about $8 billion. That rise came as many other technology stocks were cratering in the aftermath of the dot-com bubble, which peaked in March 2000.

Story continues

The company‘s key to early success: getting its technology in video-game consoles like Microsoft’s Xbox and Sony‘s PlayStation. Nvidia’s GeForce graphics processing units, or GPUs, became objects of desire among gamers because they consistently offered the most realistic experience.

“Jensen was always a great communicator, told a good story, and clearly GPUs were becoming more important,” said Rhys Williams, chief strategist at Wayve Capital Management, who was a buyer in the IPO. “Each successive generation of hardware gave a lot better performance, a lot more realistic picture and then PC gaming really came into being.”

Litigation and Competition

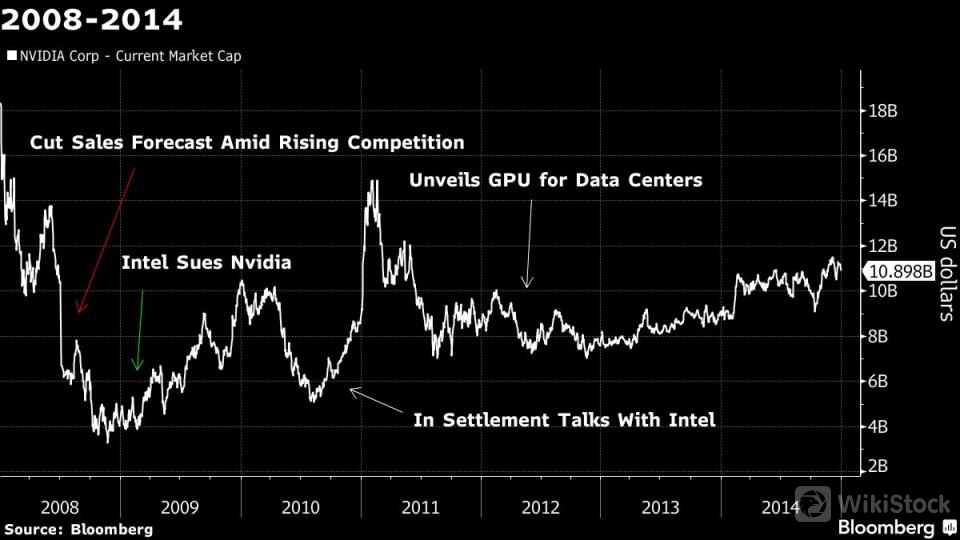

The next six years werent kind to Nvidia. The stock plunged in 2008 as the financial crisis weakened demand and long-struggling rival Advanced Micro Devices Inc. started turning things around.

Meanwhile, an agreement between Nvidia and Intel that allowed the companies to use each others capabilities went sour, forcing Nvidia out of one of its biggest markets. The two settled in 2011, with Intel agreeing to pay Nvidia $1.5 billion.

The following year, Nvidia unveiled graphics chips for servers inside data centers. They could help sophisticated computing work such as oil and gas exploration and weather prediction, giving Nvidia a foothold in what would become a lucrative market. However, those chips did not immediately fly off the shelf. It would take nearly nine years for Nvidia shares to surpass their 2007 high.

Crypto and Covid

Nvidia shares took off again in 2015. During that period, the companys chips were becoming the foundation of emerging technologies, from advanced graphics interfaces to autonomous vehicles to a new wave of AI products.

Thats when Shana Sissel, chief executive officer at Banrion Capital Management, first really took note of the company. She described a 2017 conference where Nvidia was more like a pageant winner than an investment idea.

“Every single speaker talked about Nvidia being the most important company,” Sissel said. “At that point, it was really on my radar screen.”

Even after demand from cryptocurrency miners dried up, data-center sales continued to grow. The Covid-19 pandemic boosted that business, as companies needed to purchase additional computing power to support remote work. Nvidias data-center revenue rose by a multiple of eight from fiscal 2017 to fiscal 2021.

AI Sales Explode

Nvidias shares slumped in 2022 along with the rest of the technology sector, which was reeling from soaring interest rates and falling demand after the Covid-era boom.

OpenAI‘s release of ChatGPT in late-2022 made an instant splash but it took time for investors to realize how Nvidia might benefit. Eventually, interest in ChatGPT and other generative AI products exploded, triggering a frantic surge in orders for Nvidia’s chips.

When the company reported first-quarter 2023 earnings, the scale of the jump in its business shocked nearly everyone on Wall Street. Nvidia gave a forecast for quarterly sales that was more than 50% above the average projection.

Nvidia‘s data-center sales eclipsed its gaming revenue for the first time in fiscal 2023. In Nvidia’s current fiscal year, analysts expect those sales to top $100 billion.

“They have a very defensible place in the industry,” said Williams, the strategist at Wayve Capital Management. “Theyre not gonna be 95% of market share forever, obviously, but it would be almost impossible for anybody to replace them.”

—With assistance from Ian King.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP