Nvidias surge reveals a pitfall of passive investing: Morning Brief

Nvidia (NVDA) notched its 43rd record closing high on Tuesday, bringing its 2024 return close to 175%.

Unfortunately, passive investors relying on mutual funds and ETFs as investment vehicles haven't been able to participate in all of these gains.

Micron (MU), Qualcomm (QCOM), KLA Corp (KLAC), and Lam Research (LRCX) also closed at all-time highs on Tuesday, catapulting the broader S&P 500 Tech Index to its own record and bumping up its year-to-date return to an enviable 31%.

But the closest investable match — the Technology Select Sector SPDR Fund (XLK) — is underperforming its tech sector benchmark by over 10 percentage points this year.

And the issue arises from the very success of the largest tech names.

The heart of passive investing is premised on managing risk through diversification. In theory, a diversified tech index is “safer” than one in which three stocks dominate the index.

But over the last four years, Apple (AAPL), Microsoft (MSFT), and Nvidia have so thoroughly trounced the rest of the market that ETFs are bumping up against rules and regulations that limit the weight of individual stocks in funds.

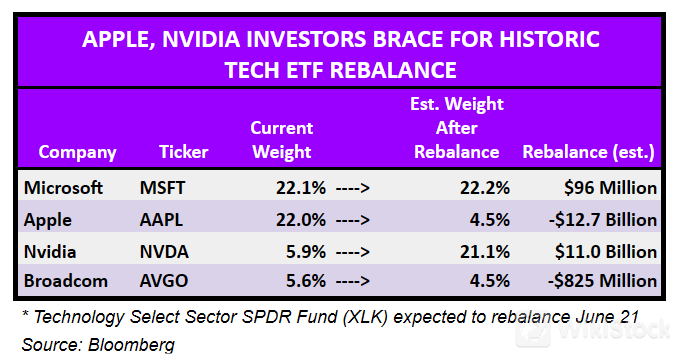

In theory, each of these three behemoths should be weighted at just over 20% of the XLK fund — if it matched the benchmark. However, many investors (including this author), were recently surprised to learn that Nvidia only comprises 5.9% of the ETF.

Technology Select Sector SPDR Fund (XLK) expected to rebalance June 21

This state of affairs will soon change — drastically. With it, however, will arise another complication: Apple's weight dropping sharply.

After the close Friday, the XLK ETF will be rebalanced to drop Apple's 22% share down to 4.5% and increase Nvidia's 5.9% share up to 21.1%, based on Bloomberg estimates.

All of this stems from Great Depression-era investor protection laws, which require that indexes limit the concentration of individual stocks to earn the label “diversified.”

Investors who are fond of reading prospectuses might enjoy the wonky legalese that explains the need for these changes as expressed in this FAQ and corresponding index methodology published by S&P Dow Jones Indices.

Briefly stated, there are four companies — Nvidia, Apple, Microsoft, and Broadcom — that overrun the critical 4.8% threshold for individual names in a diversified index. And because they collectively exceed 50% of the entire index by weight, the weights of the smallest members are reduced according to a formula until all of the legal thresholds are respected.

Story continues

All told, Friday's rebalance should force $12.7 billion in Apple stock to be sold and $11 billion of Nvidia to be bought.

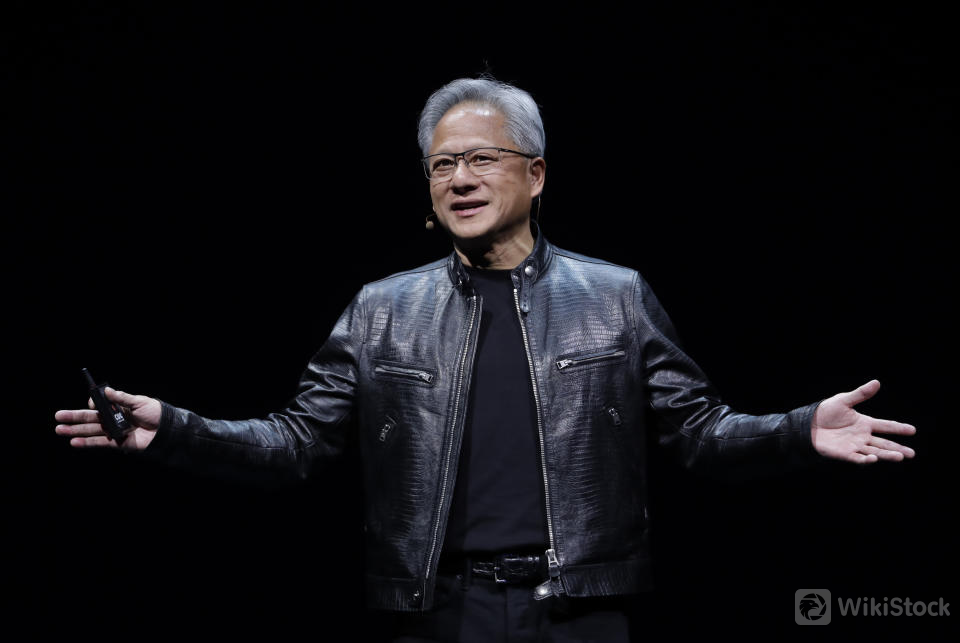

President and CEO of Nvidia Corporation Jensen Huang delivers a speech during the Computex 2024 exhibition in Taipei, Taiwan, Sunday, June 2, 2024. (AP Photo/Chiang Ying-ying) (ASSOCIATED PRESS)

That's close to the dollar amount of Apple shares that trade any given day, and about one-quarter of the dollar amount that Nvidia trades daily. In other words, these are material amounts.

Fortunately for investors, these are highly liquid stocks, and the investment community will have had a full week to digest the scenario by the time the rebalancing goes into effect Friday.

Of course, there are plenty of companies not in the trillion-dollar club — and companies that aren't exactly AI plays — that have rewarded investors handsomely this year.

Dow component Walmart (WMT) is up nearly 30%. GameStop (GME) is up 40%. And Abercrombie & Fitch (ANF) stock has returned a whopping 110% this year.

But the rebalance does raise the issue of an overlooked risk for the passive investing strategy preferred by the masses, which is that they may miss out when only a few names are carrying the lot.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP