Top 4 Consumer Stocks that May Keep You Up At Night This Month - La-Z-Boy (NYSE:LZB)

As of June 20, 2024, four stocks in the consumer discretionary sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock‘s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

La-Z-Boy Inc LZB

On June 17, La-Z-Boy reported better than expected fourth-quarter fiscal 2024 (ended Apr 27, 2024) results. The company's stock gained around 14% over the past five days and has a 52-week high of $41.08.

RSI Value:81.68

LZB Price Action:Shares of La-Z-Boy rose 19.4% to close at $40.70 on Tuesday.

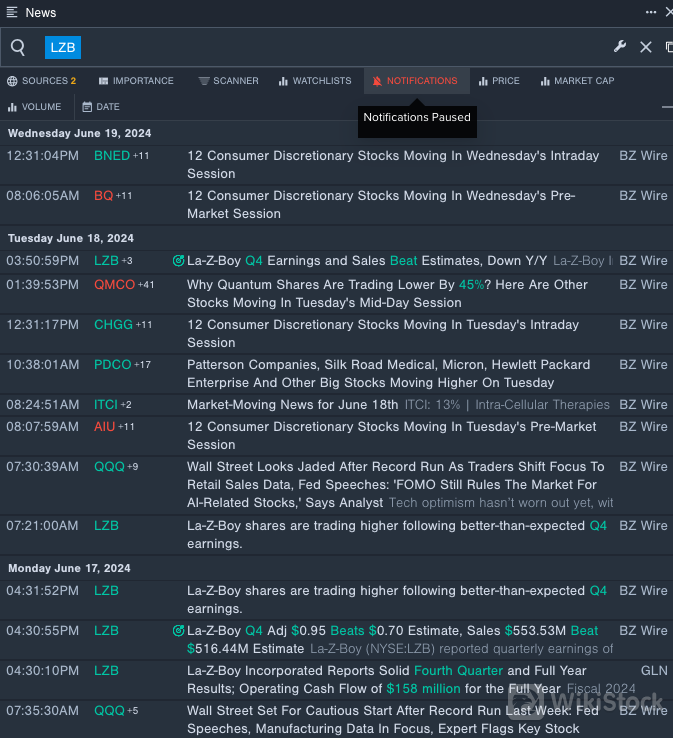

Benzinga Pro's real-time newsfeed alerted to latest LZB's news

Chewy Inc CHWY

On May 29, Chewy reported better-than-expected first-quarter 2024 results. “Fiscal year 2024 is off to a solid start. We delivered strong net sales as well as record-breaking Adjusted EBITDA in the first quarter,” said Sumit Singh, Chief Executive Officer of Chewy. “Chewy's value proposition continues to resonate with our customers, and I am proud of the teams at Chewy who are executing flawlessly on our strategic roadmap and the controllable elements of our business.” The company's stock gained around 60% over the past month and has a 52-week high of $40.22.

RSI Value:80.07

CHWY Price Action:Shares of Chewy rose 13.9% to close at $25.97 on Tuesday.

Benzinga Pro's charting tool helped identify the trend in Chewy's stock

Chipotle Mexican Grill, Inc. CMG

On June 18, Argus Research maintained a Buy rating on the stock and raised its price target from $3,668 to $3,888. The company's stock gained around 10% over the past five days and has a 52-week high of $3,463.07.

RSI Value:75.97

CMG Price Action:Shares of Chipotle gained 1.9% to close at $3,427.61 on Tuesday.

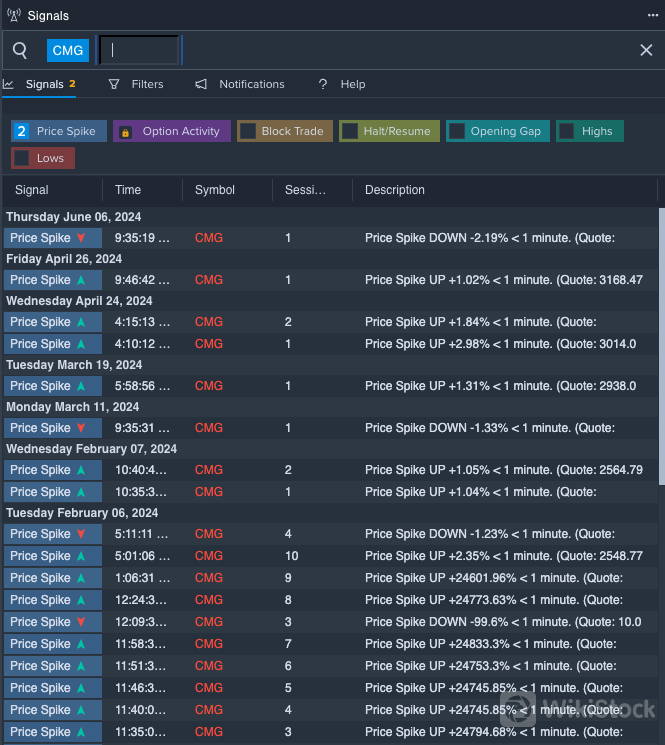

Benzinga Pro's signals feature notified of a potential breakout in CMGs shares.

Best Buy Co Inc BBY

On June 17, UBS upgraded the stock from Neutral to Buy and raised its price target from $85 to $106. The company's stock jumped around 27% over the past month and has a 52-week high of $93.72.

RSI Value:80.02

BBY Price Action:Shares of Best Buy gained 2.6% to close at $93.63 on Tuesday.

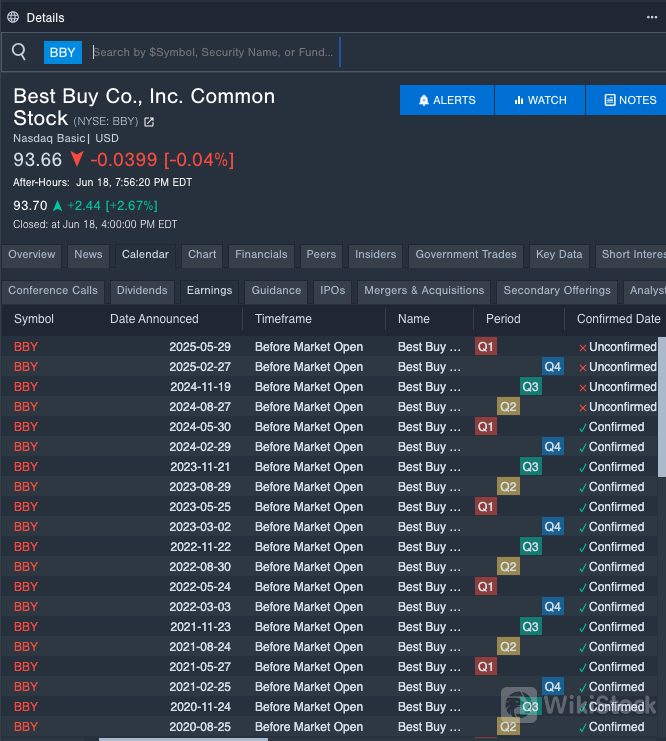

Benzinga Pro's earnings calendar was used to track BBYs upcoming earnings report

Also Check This Out: Wall Streets Most Accurate Analysts Weigh In On 3 Real Estate Stocks With Over 8% Dividend Yields

Market News and Data brought to you by Benzinga APIs

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP