Spectrum Brands' Strategic Efforts Aid: Apt to Hold? - Lululemon Athletica (NASDAQ:LULU), G-III Apparel G

Spectrum Brands Holdings Inc.SPB looks well-poised for growth, thanks to its robust strategic efforts. The company is benefiting from increased pricing, cost improvements and a favorable mix. Its Global Productivity Improvement Plan (“GPIP”), which aims at improving the company's operating efficiency and effectiveness, appears encouraging.

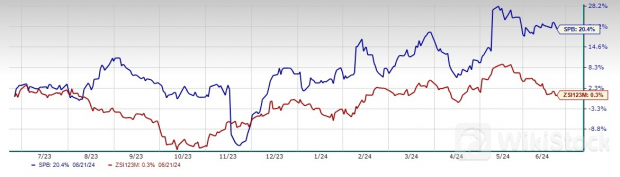

Driven by such upsides, the stock has gained 20.4% in the past year, outperforming the industry's 0.3% growth.

Analysts seem quite optimistic about this Zacks Rank #3 (Hold) company. The Zacks Consensus Estimate for fiscal 2024 sales and earnings per share is pegged at $2.92 billion and $4.68, respectively, indicating year-over-year growth of 0.1% and 205.9%.

Delving Deeper

Spectrum Brands is on track with the four core pillars to drive growth. In this regard, the company is streamlining its organizational structure and re-energizing its employee base. It is committed to improving operational efficiencies while limiting risk. Management is protecting and deleveraging its balance sheet while solidifying liquidity. It is focused on transforming the company into a pure-play global Pet and Home & Garden business.

The GPIP is focused on consumer insights and growth-enabling functions, including technology, marketing and research and development. This plan will also enable the company to deliver value creation and sustainable growth in the long term. In addition, SPB is focused on delivering savings, the majority of which are expected to be reinvested into growth initiatives.

Spectrum Brands' initiatives like pricing, cost improvements and a favorable mix have been driving margins for a while now. The company has been proactive in its cost-takeout actions, which were implemented in the second half of fiscal 2022 and include fixed cost reduction by eliminating permanently salaried headcount and reducing advertising and promotional spending.

Driven by improved pricing and cost improvements, the gross margin expanded 870 basis points (bps) to 38.1% in the fiscal second quarter while gross profit improved 27.5% year over year. Adjusted EBITDA advanced 120.2% year over year to $112.3 million. The adjusted EBITDA margin expanded 860 bps 15.6%, driven by better gross margins and lower operating expenses.

Looking ahead, Spectrum Brands now projects reported sales to remain flat year over year in fiscal 2024. Adjusted EBITDA, excluding the investment income, is likely to grow in the low-double digits.

However, Spectrum Brands has been witnessing soft demand in the small kitchen appliances category, volume declines in certain pet channels and the impact of SKU rationalizations. In addition, the company's Home & Personal Care segment continues to be sluggish. Sales for the segment dipped 4% year over year in the fiscal second quarter, due to lower sales in small kitchen appliances. Nonetheless, the aforesaid initiatives are likely to boost overall growth.

Key Consumer Discretionary Picks

Some better-ranked companies are G-III Apparel Group GIII, Royal Caribbean RCL and lululemon athletica LULU.

G-III Apparel Group sports a Zacks Rank #1 (Strong Buy) at present.

G-III Apparel Group has a trailing four-quarter earnings surprise of 547.9%, on average. The Zacks Consensus Estimate for GIII's fiscal 2024 sales indicates an increase of 3.7% from the year-ago period's reported level.

Royal Caribbean sports a Zacks Rank of 1, currently. RCL has a trailing four-quarter earnings surprise of 18.3%, on average.

The consensus estimate for RCL's 2024 sales and EPS indicates increases of 16.6% and 61.9%, respectively, from the year-ago period's reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank # 2 (Buy) at present.

The Zacks Consensus Estimate for lululemon athletica's current financial-year sales and EPS indicates growth of 11.9% and 10.6%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.7%, on average.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP