S&P 500 Ends First Half Shy Of All-Time Highs. Here Are The Leaders And Laggards — And 5 Stocks That Coul

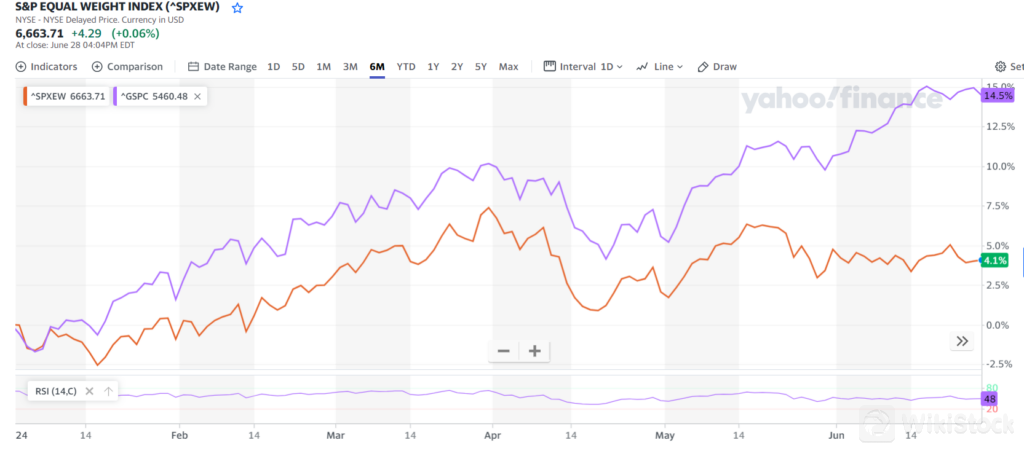

The 10 largest stocks as a percentage of the S&P 500‘s overall market cap have surged to 38%, Charles Schwab said in a recent report. Ark Invest’s Cathie Wood stated in a recent webinar that market concentration has reached an extreme, surpassing levels seen during the Great Depression in 1932.

See Also: Best Value Stock

Heres a look at S&P 500 leaders and laggards of the first-half:

| Leaders | ||

| 1. | Super Micro Computer Inc. SMCI | +188.2% |

| 2. | Nvidia Corp. NVDA | +149.5% |

| 3. | Vistra Corp. VST | +123.2% |

| 4. | Constellation Energy Corporation CEG | +71.3% |

| 5. | General Electric Company GE | +56.2% |

| Laggards | ||

| 1. | Walgreens Boots Alliance, Inc.WBA | -53.7% |

| 2. | Lululemon Athletica Inc. LULU | -41.6% |

| 3. | Intel Corporation INTC | -38.4% |

| 4. | EPAM Systems, Inc.EPAM | -36.7% |

| 5. | Warner Bros. Discovery, Inc.WBD | -34.46% |

Nvidia and Texas-based utility company Vistraalso feature among the top five gainers for the second quarter. Others rounding off the list are First Solar, Inc.FSLR, GE Vernova Inc. GEV, a utility company splintered from GE, and semiconductor testing company Teradyne, Inc.TER.

Second-quarter decliners include the year-to-date laggards Walgreens Boots Alliance, Intel and EPAM Systems. The other two top-five poor performers are Estée Lauder Companies Inc. EL and building products and equipment maker Builders FirstSource, Inc. BLDR.

The top five gainers belonged mostly to the tech and utility sectors, while the laggards were mostly from consumer stocks.

Look Ahead: The outlook is largely positive heading into the second half of 2024, said Morgan Stanley analysts in the firm‘s mid-year outlook. The firm’s expectation is predicated on the Fed rate cut materializing in September. The futures market is pricing in a 64% probability of a rate cut in September.

JPMorgan analysts also see positive momentum continuing.

“The end of monetary tightening combined with strong nominal GDP growth provide a constructive backdrop for U.S. equities over the remainder of the year,” the analysts said.

Fed rate cuts are widely seen as a precursor for the broadening of the stock market rally. The underperformers of the first-half of the year could bounce back strongly when inflation eases further, allowing the central bank to take down interest rates from 22-year highs.

Ark Invests Wood sees the scope of a strong rebound. After concentration peaked during the Great Depression, the market rose 62% over the next three to four years. The gains were disproportionately favoring the smaller and mid-cap stocks as opposed “to the mega-cap cash fortresses,” she said.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP