U.S. Nonfarm Data Revised Down Multiple Times, Possible Rate Cut in September

The U.S. Department of Labor data revealed a gain of 206,000 nonfarm jobs in June, surpassing the anticipated 190,000, but significantly down from May. The unemployment rate rose to its highest level in two and a half years, indicating a significant cooling in the labor market. Coupled with easing wage inflation pressures, these factors provide support for a potential rate cut by the Federal Reserve in September.

June Nonfarm Data

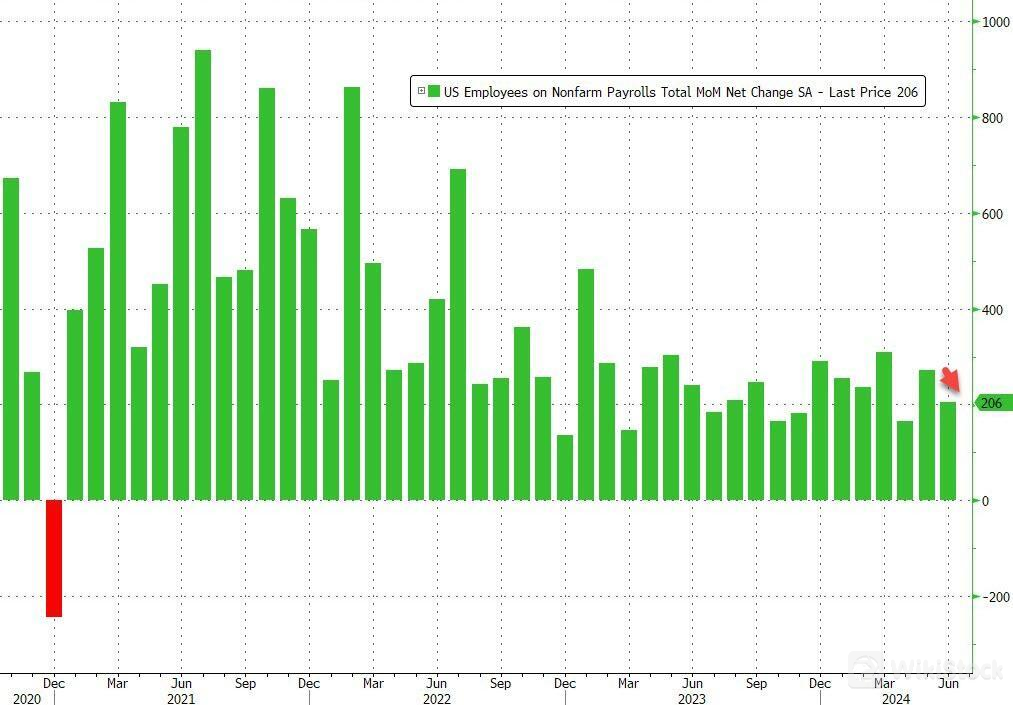

On Friday, the U.S. Department of Labor released June nonfarm data, showing an increase of 206,000 jobs, surpassing the expected 190,000 but significantly down from the previous 272,000.

Image Source: Wall Street

April's nonfarm job additions were revised down from 165,000 to 108,000, while May's were revised down from 272,000 to 218,000. After revisions, the total job additions for April and May were reduced by 111,000 compared to the original estimates. Over the past 5 months, job numbers have been revised downward in 4 months.

Frequent downward revisions in employment data have diminished its market impact. The U.S. Department of Labor releases initial estimates monthly, followed by revised figures the following month and final figures the month after that. Between January 2023 and April 2024, final nonfarm employment figures were lower than initial estimates in 13 out of 16 months, with only 3 months showing upward revisions. This time, the Labor Department revised down May's nonfarm payroll from 272,000 to 218,000 and April's from 165,000 to 108,000, totaling an 111,000 reduction.

The reasons for the frequent downward revision of data are twofold: firstly, the response rate of employment surveys after the epidemic has significantly decreased, and secondly, employment data is mostly raised by the public sector.

In June 2023, the response rate for the Current Employment Statistics (CES) survey hit an all-time low of 41.6%. While the response rate rebounded to 43.5% in March this year, it remains well below the pre-pandemic level of about 60%. Slow questionnaire recovery has led the U.S. Department of Labor to frequently revise data downward after releasing initial estimates.

Most of June's new jobs were concentrated in construction (27,000), education and health services (82,000), and government (70,000), accounting for 86.9% of the month's new nonfarm employment. JOLTS job openings released on Tuesday totaled 8.14 million, an increase of 221,000 from the previous month. Although this growth exceeded expectations, it was primarily driven by the government sector, manufacturing, and healthcare industries. Meanwhile, job openings in leisure and hospitality decreased significantly by 146,000 on a month-on-month basis.

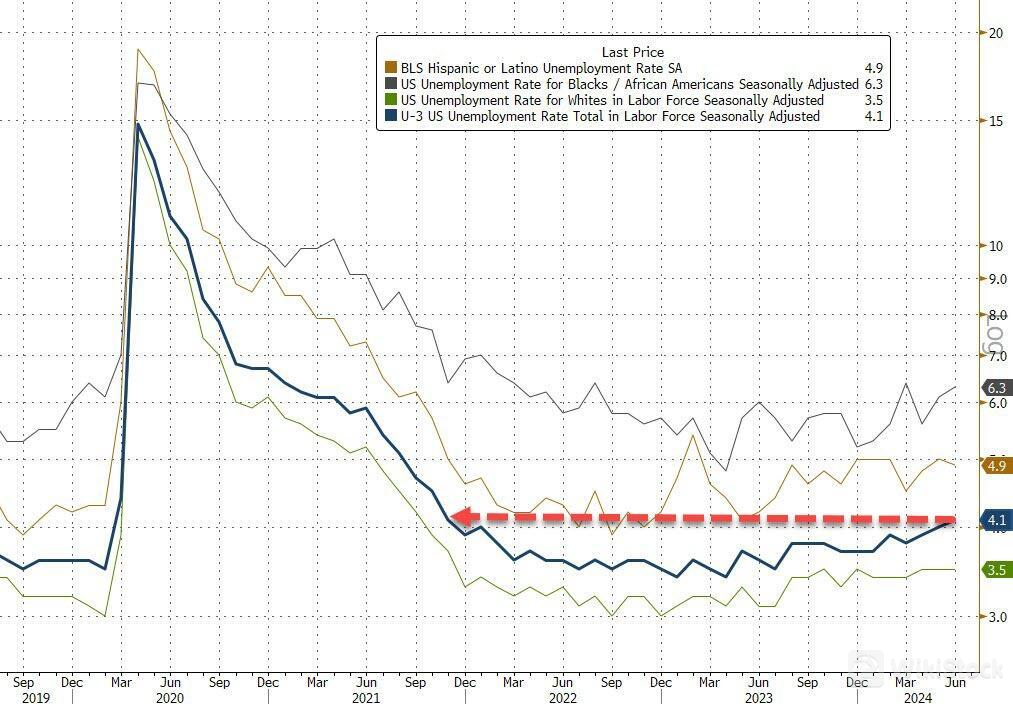

The market is increasingly focused on the unemployment rate, which rose to 4.1% in June, exceeding both the expected and previous values of 4%. This is the highest level since November 2021.

Image Source: Wall Street

Over the past three months, the average U.S. unemployment rate has been 4%, with a low point of 3.57% over the past 12 months, resulting in a difference of 0.43%, further approaching the critical threshold of 0.5%. According to the “Sam Rule,” if the three-month moving average unemployment rate exceeds the lowest point of the past 12 months by 0.5%, it indicates that the U.S. economy may be entering the early stages of a recession.

On the demand side, signs of cooling are evident in wage growth and job vacancy data. Currently, there are 1.22 job openings per unemployed person, nearing pre-pandemic levels (1.19). Private sector hourly wage growth slowed to 3.86% year-on-year in June from 4.05% previously.

On the supply side, besides the rise in labor force participation rate, attention is also drawn to the impact of immigration on the market. Since 2022, the number of foreign-born workers has grown significantly faster than the pre-pandemic trend.

Discrepancies in immigration data, CES and CPS calculations, and frequent data revisions have disrupted our assessment of the labor market. In conclusion, while there is a clear cooling trend in the labor market, further observation is needed to determine whether it will trigger an economic recession.

Potential Rate Cut by Fed in September

In the June employment report, economists noted signs of a slowdown in the labor market. The unemployment rate rose to 4.1%, the highest since November 2021. Meanwhile, job additions in April and May were revised down by 111,000, indicating that the labor market's growth in recent months has been less robust than initially thought.

The market believes this data will prompt the Federal Reserve to cut rates in September.

Federal Reserve officials are increasingly concerned about downside risks in the labor market. The June data reinforced market expectations for potential rate cuts by the Federal Reserve at its meetings in September and subsequent months.

Neil Dutta, Chief Economist at Renaissance Macro, stated in his report to clients last Friday that the report should “firm up expectations for a rate cut in September.” He added, “Economic conditions are slowing down, altering the Fed's balancing act. Powell should use July to prepare for a rate cut in September.”

Image Source: The Paper

According to the FedWatch tool from the Chicago Mercantile Exchange (CME), investors estimate a 75% probability of the Federal Reserve cutting rates at its September meeting. This week, Powell will testify before Congress for the semi-annual testimony, and investors will closely watch for any policy signals ahead of the July 30-31 meeting.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP