Ericsson Gains Premarket After Q2 Print, What's Going On? - Telefonaktiebolaget L M (NASDAQ:ERIC)

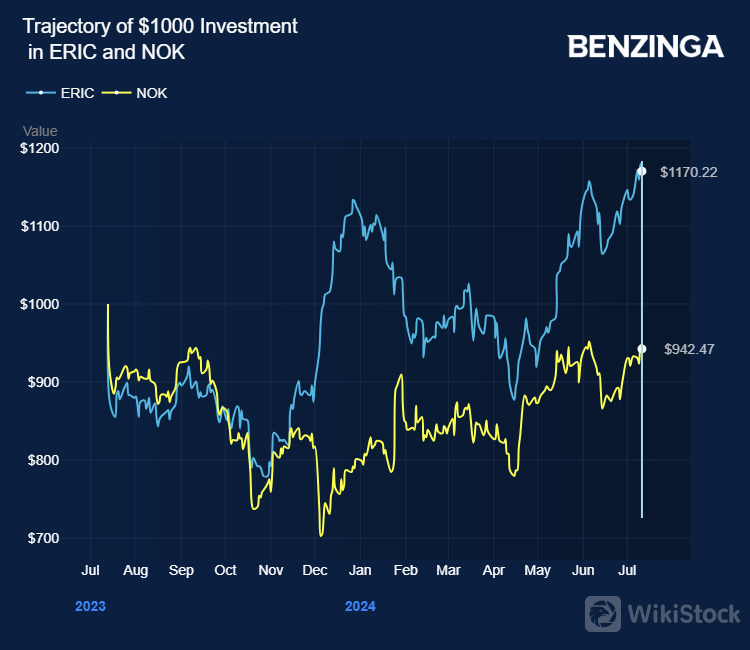

Ericsson and its Nordic competitor Nokia CorpNOK have struggled with a lackluster telecom equipment market for years as the anticipated surge in 5G technology spending did not materialize. Despite this, there are signs that sales will stabilize this year. Ericssons $14 billion network deal with US operator AT&T IncT will likely start contributing to revenue in the second half of the year.

The prolonged downturn led Ericsson to cut approximately 8% of its workforce, or 8,500 employees, last year to reduce expenses. In March, the company announced the elimination of 1,200 jobs in Sweden. CEO Börje Ekholm acknowledged the challenging market conditions due to the slow pace of investments in India but anticipated benefits from North American contract deliveries in the latter half of the year.

Outlook: Ericsson expects a third-quarter adjusted gross margin of 45-47% and restructuring charges of SEK 3.0-4.0 billion in 2024.

Price Action:ERIC shares are up 2.97% at $6.58 premarket at the last check Friday.

Photo by Mats Wiklund via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP