Big Tech earnings wont be make or break for the stock market: Morning Brief

Tesla (TSLA) and Alphabet (GOOGL) kicked off Big Tech earnings on Tuesday with mixed results. Each fell in after-hours trading.

But for all the hand-wringing about the concentration of outsized gains in the hands of a magnificent few, stock bulls have two reasons to cheer as earnings season intensifies.

First, markets just completed a violent rotation that shifted winnings from the seven largest US stocks — Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Meta (META), Nvidia (NVDA), Tesla, and Alphabet — to small-cap stocks and interest rate-sensitive names.

Sectors like real estate, homebuilders, and regional banks are among those now leading the way.

The severity of the move — which accelerated with the latest weak inflation numbers — shouldn't be discounted.

Liz Ann Sonders, chief investment strategist at Charles Schwab, wrote that June was the Russell 2000's worst month versus the Nasdaq in over a year. Yet, she notes that July is already tracking the best since 2016.

Meanwhile, in the land of giants, the Magnificent Seven lost $1.25 trillion in market cap value over seven sessions recently — just as the small-cap stocks started asserting strength.

The trillion-plus drop in valuation by the Mag Seven represented an 8% fall in price — yet the overall market (the S&P 500) was off only 2% over the same time. Timing is everything.

The other tailwind favoring bulls is a game of earnings catch-up.

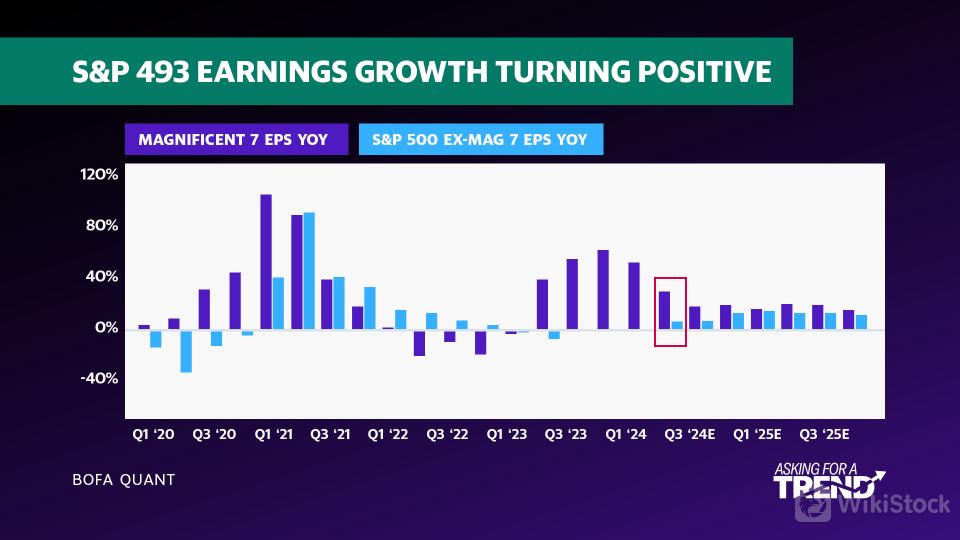

The S&P 493 (the S&P 500 minus the Mag Seven) is finally climbing out of an earnings recession, as noted by the BofA US Equity & Quant Strategy team.

S&P 493 EARNINGS GROWTH TURNING POSITIVE

Earnings per share (EPS) for the S&P 493 have been “flat to down for the past five quarters,” wrote BofA, even as EPS growth for all 500 names turned positive three quarters ago.

This newfound strength for the rest of the market comes just as earnings growth is “expected to slow for the Magnificent Seven for the second straight quarter and again in the [third quarter].”

It appears that even earnings growth is rotating on a higher time frame.

The very fact that overall market volatility remains subdued despite these tectonic shifts taking place under the market's hood is a testament to the resilience of the bull market itself.

And BofA expects the rally to continue through breadth expansion.

“Given the high correlation between Tech's outperformance in stocks vs. earnings,” the bank wrote, “we expect the narrowing growth differential to be the catalyst for the market to broaden out.”

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP