Assestment

GHC Capital Markets

https://www.ghcl.co.uk/capitalmarkets/

Website

Marka ng Indeks

Appraisal ng Brokerage

Impluwensiya

C

Index ng Impluwensiya BLG.1

United Kingdom

United KingdomMga Produkto

5

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Lisensya sa seguridad

kumuha ng 1 (mga) lisensya sa seguridad

FCAKinokontrol

United KingdomLisensya sa Pagkalakal ng Seguridad

Mga Pandaigdigang Upuan

![]() Nagmamay-ari ng 1 (na) upuan

Nagmamay-ari ng 1 (na) upuan

United Kingdom LSE

Seat No. GHCCGB21

Impormasyon sa Brokerage

More

Kumpanya

GHC Capital Markets Limited

Pagwawasto

GHC Capital Markets

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Suriin kahit kailan mo gusto

WikiStock APP

Mga Serbisyo sa Brokerage

Gene ng Internet

Index ng Gene

Rating ng APP

| GHC Capital Markets Limited |  |

| WikiStock Rating | ⭐⭐⭐ |

| Minimum ng Account | £500 |

| Mga Bayad | Nag-iiba ayon sa serbisyo |

| Mga Bayad sa Account | 1% taunang bayad sa pamamahala para sa mga advisory account |

| Mga Interes sa Hindi na Invest na Pera | Wala |

| Mga Rate ng Margin Interest | 4.5% - 7.5% |

| Mga Inaalok na Mutual Funds | Iba't ibang UK at Irish na mga pondo |

| App/Platform | Madaling gamitin na online na platform para sa pagtitingi |

| Mga Promosyon | Wala kasalukuyang available |

Ano ang GHC Capital Markets Limited?

Ang GHC Capital Markets Limited ay isang kumpanya sa pamamahala ng pamumuhunan at stockbroking na nakabase sa UK na kilala sa mababang mga bayarin at madaling gamiting platform para sa pagtitingi. Nag-aalok ito ng malawak na pagsunod sa regulasyon sa ilalim ng LSE, na nagtitiyak ng mahigpit na pagsunod sa mga pamantayan sa pananalapi at matatag na mga hakbang sa seguridad. Gayunpaman, ang kumpanya ay hindi na nagpapatuloy sa operasyon, na nagdudulot ng mga alalahanin tungkol sa pagiging accessible at ligtas ng mga pondo ng mga kliyente.

Mga Kalamangan at Disadvantages ng GHC Capital Markets Limited

May ilang mga kalamangan ang GHC Capital Markets Limited dahil sa pagsunod nito sa regulasyon, mga hakbang sa seguridad ng mga pondo ng mga kliyente, at matatag na mga protocolo sa seguridad. Gayunpaman, may ilang mga limitasyon ito, kasama na ang pagsasara nito, na nagdudulot ng mga alalahanin tungkol sa kasalukuyang kalagayan ng operasyon nito. Ang pagsunod sa regulasyon sa ilalim ng LSE ay nagbibigay ng matibay na pundasyon para sa tiwala ng mga mamumuhunan, na nagtitiyak ng mahigpit na pagsunod sa mga pamantayan sa pananalapi. Karaniwan, ang mga pondo ng mga kliyente ay hiwalay at may seguro sa ilalim ng FSCS, na nag-aalok ng proteksyon para sa mga mamumuhunan. Bukod dito, malamang na ginagamit ang advanced na pag-encrypt at mga hakbang sa seguridad upang protektahan ang data at transaksyon ng mga kliyente.

Gayunpaman, ang pagsasara ng GHC Capital Markets Limited ay nagdudulot ng malalaking mga kahinaan. Ang pagsasara ay nagdudulot ng epekto sa katiyakan at patuloy na operasyon ng kumpanya, na nagdudulot ng mga alinlangan tungkol sa pagiging accessible ng mga pondo ng mga kliyente at suporta sa hinaharap. Bukod dito, ang kakulangan ng mga na-update na impormasyon tungkol sa kasalukuyang regulasyon at seguro na sakop ay maaaring hadlangan sa mga potensyal na mamumuhunan na naghahanap ng matatag at transparent na mga serbisyo sa pananalapi.

| Mga Kalamangan | Mga Disadvantages |

|

|

|

|

|

|

|

|

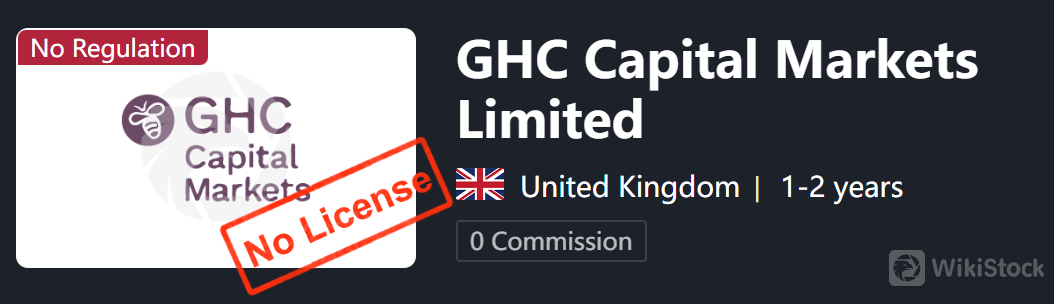

Ligtas ba ang GHC Capital Markets Limited?

Regulasyon

Ang GHC Capital Markets Limited ay dating niregulahan ng London Stock Exchange (LSE) sa ilalim ng seat number GHCCGB21. Bagaman ito ay ngayon ay sarado at hindi na nasa ilalim ng regulasyon, dati itong sumusunod sa mahigpit na mga panuntunan na ipinatutupad ng mga ahensya ng regulasyon tulad ng Financial Conduct Authority (FCA) sa UK. Dapat maging maingat ang mga mamumuhunan sa mga panganib na kaakibat ng pakikipagtransaksyon sa mga kumpanyang hindi na niregulahan.

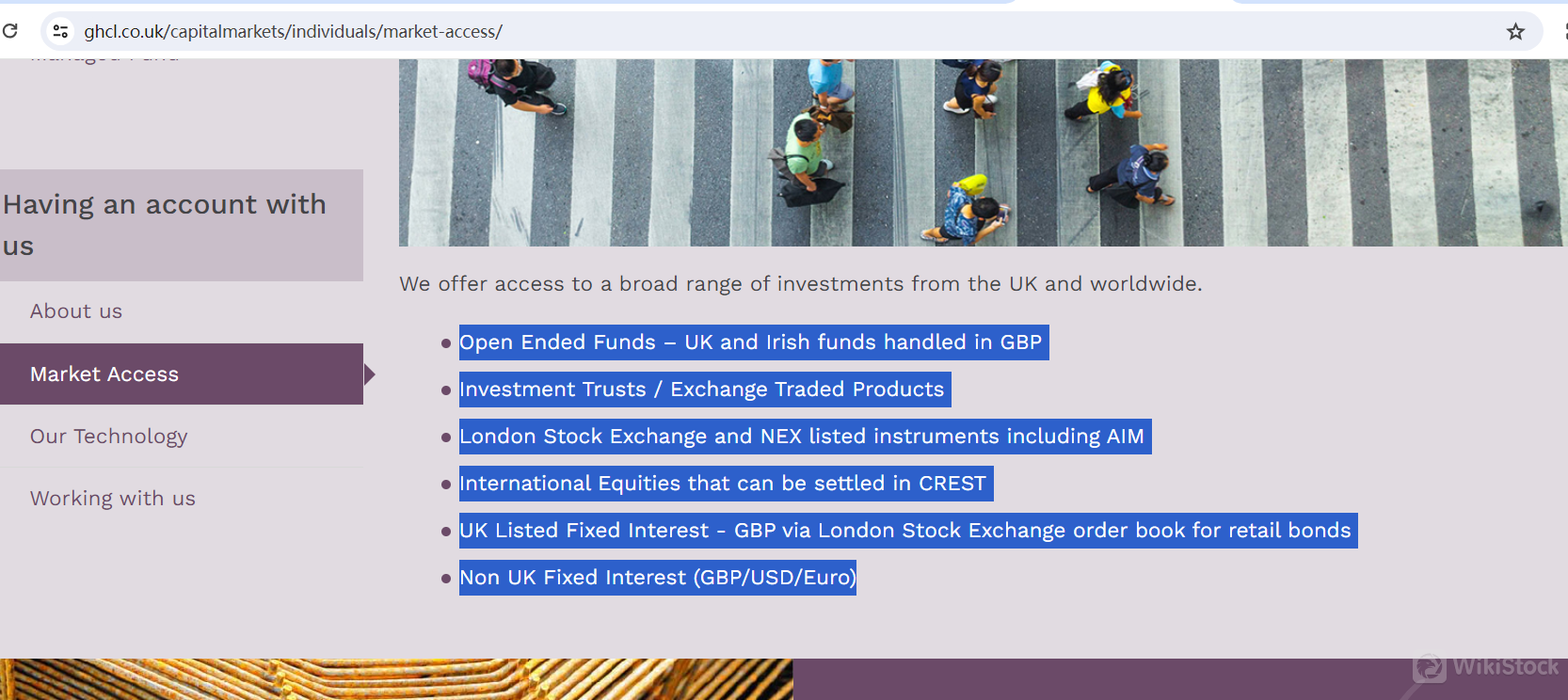

Ano ang mga securities na maaaring i-trade sa GHC Capital Markets Limited?

Nag-aalok ang GHC Capital Markets Limited ng iba't ibang mga produkto sa pagtitingi na kasama ang mga sumusunod:

Mga Open Ended Funds (UK at Irish funds na hawak sa GBP): Ito ay mga investment fund na walang mga limitasyon sa dami ng mga shares na maaaring ilabas ng pondo. Ang mga pondo ay patuloy na maaaring maglabas ng mga bagong shares o magbawi ng mga umiiral na shares, na nagbibigay ng kakayahang mag-adjust at likwidasyon para sa mga mamumuhunan.

Investment Trusts / Exchange Traded Products: Ang mga investment trust ay mga closed-end fund na ipinapatakbo sa stock exchange. Sila ay nag-iinvest sa isang diversified portfolio ng mga assets. Kasama sa Exchange Traded Products (ETPs) ang Exchange Traded Funds (ETFs) at Exchange Traded Notes (ETNs), na ipinapatakbo sa mga stock exchange at nagbibigay ng exposure sa iba't ibang mga assets o indices.

Mga instrumento na nakalista sa London Stock Exchange at NEX kasama ang AIM: Kasama dito ang malawak na hanay ng mga securities na nakalista sa London Stock Exchange (LSE) at sa NEX Exchange, kasama ang AIM (Alternative Investment Market) na isang sub-market ng LSE na nakatuon sa mga mas maliit ngunit lumalagong mga kumpanya.

International Equities na maaaring ma-settle sa CREST: Ang CREST ay ang sentral na securities depository para sa mga merkado sa United Kingdom at Ireland, na nagpapahintulot ng electronic transfer at settlement ng mga international equities.

UK Listed Fixed Interest - GBP sa pamamagitan ng London Stock Exchange order book para sa retail bonds: Ito ay mga bond na nakalista sa London Stock Exchange na nagbabayad ng fixed interest rate at denominado sa GBP. Ang mga retail bond ay dinisenyo upang maging accessible sa mga indibidwal na mamumuhunan.

Non UK Fixed Interest (GBP/USD/Euro): Ito ay mga fixed interest securities na inilabas sa labas ng UK ngunit denominado sa GBP, USD, o Euro. Maaaring kasama dito ang mga government bonds, corporate bonds, at iba pang mga debt instruments.

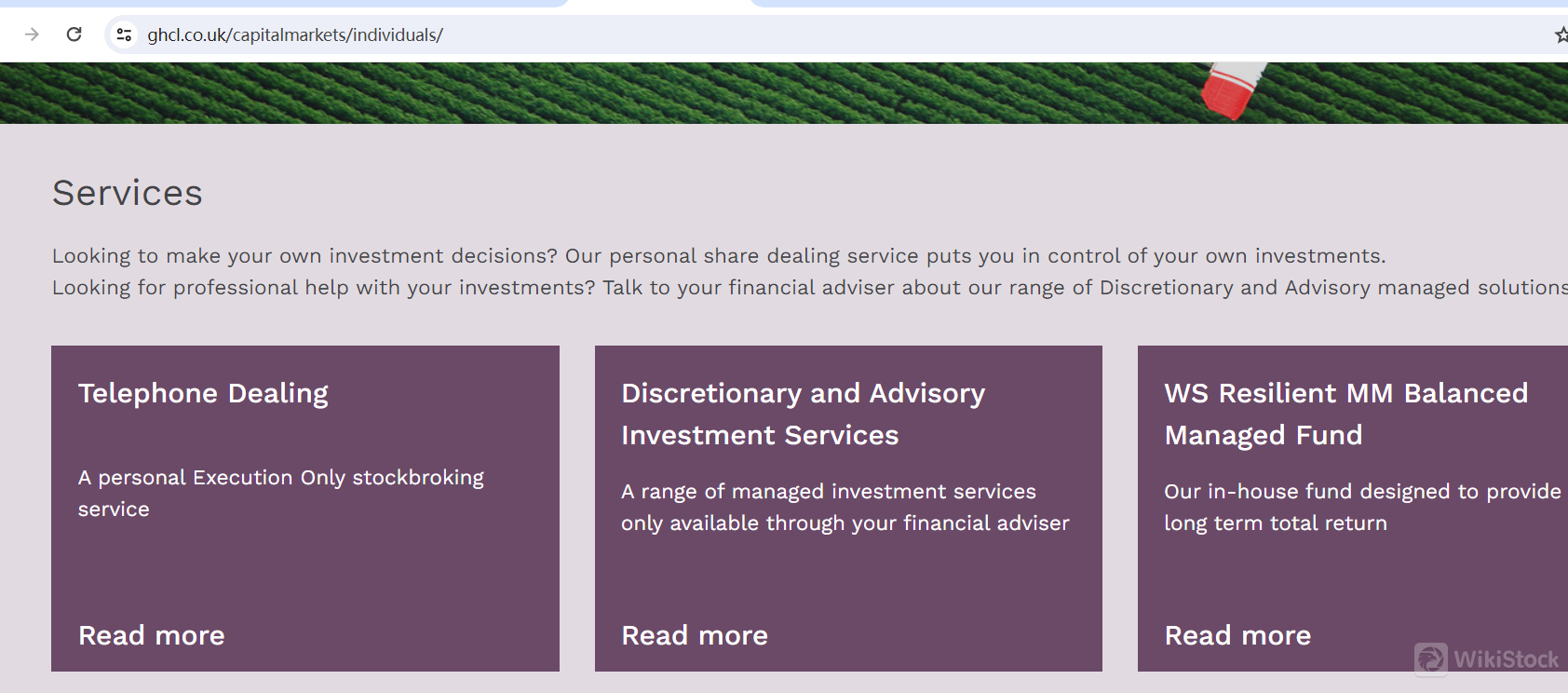

Mga Account ng GHC Capital Markets Limited

Ang GHC Capital Markets Limited ay nag-aalok ng iba't ibang uri ng mga account na tumutugon sa iba't ibang pangangailangan sa investment:

Execution Only Accounts: Ang mga account na ito ay nagbibigay-daan sa mga kliyente na gumawa ng kanilang sariling mga desisyon sa investment at maglagay ng mga trades sa pamamagitan ng telepono o email, na ang mga transaksyon ay pinatutupad ng mga kwalipikadong stockbroker. Ang serbisyong ito ay nagbibigay ng direktang paraan upang pamahalaan ang mga investment nang walang advisory services.

Discretionary and Advisory Investment Services: Ang mga account na ito ay pinamamahalaan ng mga financial adviser na nagbibigay ng mga tailor-made na investment strategies. Ang mga discretionary account ay nagbibigay-daan sa mga adviser na gumawa ng mga desisyon sa investment para sa mga kliyente, samantalang ang mga advisory account ay nangangailangan ng konsultasyon sa mga kliyente bago isagawa ang mga trades.

WS Resilient MM Balanced Managed Fund: Ito ay isang in-house fund na pinamamahalaan ng GHC, na dinisenyo upang makamit ang pangmatagalang kabuuang kita sa pamamagitan ng pag-iinvest sa isang diversified portfolio ng global assets, kasama ang mga equities, fixed interest, commodities, at iba pa. Ito ay nag-aalok ng isang handa nang ginawang, diversified na solusyon sa investment na ideal para sa core holdings.

Pagsusuri sa Mga Bayad ng GHC Capital Markets Limited

Ang GHC Capital Markets Limited ay nag-aalok ng detalyadong istraktura ng bayad para sa kanilang mga serbisyo, na dinisenyo upang tumugon sa iba't ibang uri ng pangangailangan sa investment.

Execution Only Accounts: Karaniwang singilin ang mga bayad para sa pagpapatupad ng mga trades kada transaksyon. Ang mga bayad na ito ay sumasakop sa mga kasunduan, pagpapatupad, at paglilinaw ng mga trades. Karaniwang ibinibigay ang mga detalye tungkol sa partikular na mga bayad sa transaksyon kapag hiningi o sa panahon ng proseso ng pag-set up ng account.

Discretionary and Advisory Investment Services:

Initial Review: Ang gastos para sa isang initial financial planning review ay nag-iiba depende sa kumplikasyon. Halimbawa, ang isang pre-retirement pension review ay nagkakahalaga mula £750 hanggang £1,500, samantalang ang isang buong financial plan at report ay maaaring magkakahalaga mula £1,000 hanggang £2,500. Implementation: Maaaring singilin ang isang bayad na hanggang sa 3% ng bagong investment para sa pagpapatupad ng mga investment recommendations. Ongoing Charges: Singilin ang isang taunang management fee, karaniwang nasa 1% ng mga pondo sa ilalim ng pamamahala, para sa mga patuloy na serbisyo. Ang bayad na ito ay sumasakop sa mga regular na pagsusuri upang tiyakin ang pagiging angkop ng mga investment.

WS Resilient MM Balanced Managed Fund: Ang in-house fund na ito ay may sariling mga bayarin, na maaaring maglaman ng mga bayad sa pamamahala at iba pang mga singil na kaugnay ng operasyon ng pondo. Ang mga detalye ng tiyak na bayarin ay makukuha sa prospektus ng pondo at key investor information document (KIID).

Transactional Services: Para sa mga di-reguladong serbisyo sa pangangasiwa ng mga pinansyal, ang mga bayarin ay batay sa oras na rate na nag-iiba depende sa antas ng suporta at kumplikasyon na kinakailangan.

Para sa eksaktong mga detalye ng bayarin at personalisadong mga quote, hinihikayat ng GHC Capital Markets ang mga potensyal na kliyente na makipag-ugnayan nang direkta sa pamamagitan ng kanilang website o sa pamamagitan ng pagkontak sa kanilang customer service.

Pagsusuri ng GHC Capital Markets Limited App

Ang GHC Capital Markets Limited ay nag-aalok ng isang madaling gamiting online trading platform na nagpapahintulot sa mga kliyente na pamahalaan ang kanilang mga account, magpatupad ng mga kalakalan, at suriin ang pagganap ng portfolio. Ang platform ay sumusuporta sa iba't ibang mga kalakalan, kasama ang mga equities at mga pondo, at nagbibigay ng seguridad sa pamamagitan ng mga advanced na hakbang. Nagbibigay ito ng madaling access sa impormasyon ng account, mga pangunahing dokumento, at personalisadong mga ulat sa pagganap, na lahat ay maaaring ma-access mula sa iba't ibang mga aparato. Ang mga kliyente ay maaari rin makatanggap ng propesyonal na tulong mula sa mga kwalipikadong stockbroker, na nagpapabuti sa pangkalahatang karanasan sa kalakalan.

Pananaliksik at Edukasyon

Ang GHC Capital Markets Limited ay nag-aalok ng isang matatag na online trading platform na nagbibigay ng malawak na mga mapagkukunan sa pananaliksik at edukasyon para sa mga mamumuhunan. Ang platform ay nagbibigay ng access sa parehong panloob at panlabas na pananaliksik, na nagtitiyak na ang mga kliyente ay maaaring gumawa ng mga pinagbatayang desisyon sa pamumuhunan batay sa pinakabagong datos at analisis sa merkado. Bukod dito, nag-aalok ang GHC ng komprehensibong literatura sa pinansyal at regular na mga update sa merkado upang manatiling maalam ang mga mamumuhunan tungkol sa mga trend at oportunidad sa merkado.

Para sa mas personalisadong suporta, nagbibigay ang GHC Capital Markets ng propesyonal na tulong sa pamamagitan ng mga kwalipikadong stockbroker at mga tagapayo sa pinansyal, na maaaring magbigay ng mga payo at detalyadong ulat na batay sa indibidwal na mga layunin at estratehiya sa pamumuhunan. Ang kombinasyon ng malawak na mga mapagkukunan sa pananaliksik at propesyonal na gabay ay naglalayong mapabuti ang pangkalahatang karanasan sa kalakalan at mga resulta ng pamumuhunan para sa kanilang mga kliyente.

Serbisyo sa Customer

Ang GHC Capital Markets Limited ay nag-aalok ng komprehensibong suporta sa customer na dinisenyo upang matulungan ang mga kliyente sa kanilang iba't ibang mga pangangailangan sa pamumuhunan. Maaaring makipag-ugnayan ang mga kliyente sa GHC Capital Markets sa kanilang head office na matatagpuan sa Norwich House, 22-30 Horsefair Street, Leicester, LE1 5BD. Para sa mga direkta na katanungan, maaari silang tumawag sa 0345 607 1914 o magpadala ng email sa customerservices@ghcl.co.uk. Ang mga paraang ito ng pakikipag-ugnayan ay nagtitiyak na madaling maabot ng mga kliyente ang suporta at makatanggap ng timely na tulong mula sa mga propesyonal na kwalipikado.

Bukod sa direkta at email na suporta, nagbibigay din ang GHC Capital Markets ng isang online na form ng pakikipag-ugnayan sa kanilang website. Ang form na ito ay nagbibigay-daan sa mga kliyente na magsumite ng kanilang personal na mga detalye, kasama ang kanilang pangalan, kumpanya, numero ng telepono, at email address. Maaaring tukuyin ng mga kliyente ang kanilang interes at mag-iwan ng karagdagang mga komento. Ang form ay nangangailangan din sa mga gumagamit na sumang-ayon sa patakaran sa privacy, na nagtitiyak na ang kanilang impormasyon ay hahawakan nang ligtas at alinsunod sa mga regulasyon.

Konklusyon

Ang GHC Capital Markets Limited ay dating isang kilalang kumpanya sa pamamahala ng pamumuhunan at stockbroking sa UK, na kilala sa kanilang pagsunod sa regulasyon, mga hakbang sa seguridad, at madaling gamiting platform. Gayunpaman, ang kamakailang pagsasara nito ay nagdudulot ng pag-aalinlangan sa kanyang kapani-paniwala at sa seguridad ng mga pondo ng mga kliyente. Kung nag-iisip kang mag-invest, mahalagang hanapin ang mga na-update na impormasyon at mabigat na timbangin ang mga alalahanin na ito.

Mga Madalas Itanong

Ang GHC Capital Markets Limited ba ay ligtas para sa kalakalan?

Ang GHC Capital Markets Limited ay regulado ng London Stock Exchange (LSE), na ipinatutupad ang mahigpit na pamantayan at mga alituntunin sa pananalapi. Bagaman pinangangalagaan ng kumpanya ang kaligtasan ng pondo ng mga kliyente at gumagamit ng mga advanced na seguridad na hakbang, ito ay nagtapos na sa operasyon, na nagdudulot ng mga alalahanin tungkol sa kasalukuyang pagiging accessible at kaligtasan ng mga pondo ng mga kliyente.

Ang GHC Capital Markets Limited ba ay isang magandang plataporma para sa mga nagsisimula?

Ang GHC Capital Markets Limited ay kilala sa kanyang madaling gamiting plataporma sa pagtetrade, na ginagawang accessible ito para sa mga nagsisimula. Nagbibigay ito ng malawak na mga mapagkukunan sa pananaliksik, mga materyales sa edukasyon, at propesyonal na tulong mula sa mga kwalipikadong stockbroker, na kapaki-pakinabang para sa mga bagong mamumuhunan. Gayunpaman, dahil sa pagkatapos ng operasyon nito, dapat hanapin ng mga nagsisimula ang ibang mga plataporma na nag-aalok ng parehong suporta at mapagkukunan.

Ang GHC Capital Markets Limited ba ay lehitimo?

Oo, ang GHC Capital Markets Limited ay isang lehitimong kumpanya na regulado ng LSE. Sumusunod ito sa mahigpit na mga pamantayan sa regulasyon at nagpapanatili ng malalakas na hakbang sa seguridad upang protektahan ang mga pondo ng mga kliyente at personal na impormasyon. Gayunpaman, dahil sa pagsasara nito, dapat hanapin ng mga potensyal na mamumuhunan ang ibang mga reguladong at operasyonal na kumpanya.

Babala sa Panganib

Ang ibinigay na impormasyon ay batay sa ekspertong pagtatasa ng WikiStock sa mga datos ng website ng brokerage at maaaring magbago. Bukod dito, ang online trading ay may malalaking panganib na maaaring magresulta sa kabuuang pagkawala ng ininvest na pondo, kaya mahalaga ang pag-unawa sa mga kaakibat na panganib bago sumali.

iba pa

Rehistradong bansa

United Kingdom

Taon sa Negosyo

Higit sa 20 (na) taon

Mga Reguladong Bansa

1

Mga produkto

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

SI Capital

Assestment

Jarvis Investment Management Ltd

Assestment

Spread Co

Assestment

BancTrust & Co.

Assestment

iDealing.com Limited

Assestment

Redmayne Bentley

Assestment

James Sharp

Assestment

Tio Markets

Assestment

Noor Capital UK

Assestment

Hedley & Co

Assestment