Assestment

Marka ng Indeks

Appraisal ng Brokerage

Impluwensiya

B

Index ng Impluwensiya BLG.1

Tsina

TsinaMga Produkto

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Lisensya sa seguridad

kumuha ng 2 (mga) lisensya sa seguridad

FCAKahina-hinalang Clone

United KingdomLisensya sa Pagkalakal ng Seguridad

FSCAKahina-hinalang Clone

South AfricaLisensya sa Pagkalakal ng Seguridad

Impormasyon sa Brokerage

More

Kumpanya

DBG MARKETS LIMITED

Pagwawasto

DBG Markets

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Suriin kahit kailan mo gusto

WikiStock APP

Nakaraang Pagtuklas: 2024-12-22

- Ang regulasyon ng United Kingdom Financial Conduct Authority (Lisensya Blg.: 469459) na inaangkin ng brokerage firm ay pinaghihinalaang isang clone firm, mangyaring magkaroon ng kamalayan sa mga panganib!

- Ang regulasyon ng South Africa Financial Sector Conduct Authority (Lisensya Blg.: 41920) na inaangkin ng brokerage firm ay pinaghihinalaang isang clone firm, mangyaring magkaroon ng kamalayan sa mga panganib!

Mga Serbisyo sa Brokerage

Gene ng Internet

Index ng Gene

Rating ng APP

Mga tampok ng brokerage

Rate ng komisyon

0%

Margin Trading

YES

Mga Reguladong Bansa

2

Mga produkto

8

| DBG Markets Pag-review ng Buod | |

| DBG Markets |  |

| WikiStock Rating | ⭐⭐⭐ |

| Itinatag | 2007 |

| Rehistradong Rehiyon | Anguilla |

| Regulatory Status | FSCA |

| Mga Produkto | Forex, mga pambihirang metal, mga shares, mga indeks, mga komoditi, mga kriptocurrency, atbp. |

| Demo Account | Oo |

| Spread | Mula sa 1.6 pips |

| Leverage | Hanggang sa 1:500 |

| Mga Bayarin | Walang bayad sa pagdedeposito/pagwiwithdraw, walang komisyon |

| App/ Platform | MT4/5 |

| Customer Service | Address: No. 9 Cassius Webster Building, Grace, Complex, PO Box 1330, The Valley, AI-2640 Anguilla |

| Tel : +27 0861888221 | |

| Email: support@dbgmfx.com; live chat; contact us form; FAQ | |

Ano ang DBG Markets?

Ang DBG Markets, itinatag noong 2007 na may punong tanggapan sa London at Melbourne, ay nag-ooperate sa buong mundo na may mga tanggapan sa rehiyon ng Asia-Pacific, Europa, Timog Amerika, Gitnang Silangan, at Hilagang Aprika. Nag-aalok ang kumpanya ng mga oportunidad sa pag-trade sa iba't ibang uri ng mga asset, kasama ang forex, mga pambihirang metal, mga shares, mga indeks, mga komoditi, at mga kriptocurrency, na may mga spread na nagsisimula sa 1.6 pips at leverage na hanggang sa 1:500.

Ang DBG Markets ay nagbibigay ng isang environment na walang bayad para sa mga deposito at pagwiwithdraw, na walang komisyon. Kasama sa mga pagpipilian ng platform ang MT4/5 at WebTrader. Sa ilalim ng regulasyon at pagbabantay ng South Africa Financial Sector Conduct Authority (FSCA) na may lisensyang numero 41920, ipinaprioritize ng DBG Markets ang transparency at kredibilidad sa kanilang mga operasyon.

Para sa mas detalyadong impormasyon, maaari mong bisitahin ang kanilang opisyal na website: https://www.dbgmarketsglobal.com/en o makipag-ugnayan sa kanilang customer service nang direkta.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages | |

| Regulated ng mga reputableng awtoridad | Hindi tumatanggap ng mga kliyente mula sa ilang mga rehiyon | |

| Malawak na hanay ng mga instrumento sa pag-trade | ||

| Kompetitibong mga kondisyon sa pag-trade | ||

| Advanced na mga platform sa pag-trade | ||

Regulated: Ang DBG Markets ay regulado ng mga reputableng awtoridad sa pinansya tulad ng South Africa Financial Sector Conduct Authority (FSCA) na may lisensyang numero 41920, na nagbibigay ng kumpiyansa at katiyakan sa mga trader sa regulatory compliance.

Malawak na Hanay ng mga Instrumento: Nag-aalok ang DBG Markets ng iba't ibang uri ng mga instrumento sa pag-trade, kasama ang forex, mga pambihirang metal, mga shares, mga indeks, mga komoditi, at mga kriptocurrency, na nagbibigay-daan sa mga trader na mag-diversify ng kanilang mga portfolio at mag-explore ng iba't ibang merkado.

Kompetitibong mga Kondisyon sa Pagkalakalan: Ang brokerage ay nagbibigay ng kompetitibong mga kondisyon sa pagkalakalan, kasama ang mga mahigpit na spreads, at libreng pagdedeposito/pagwiwithdraw at komisyon para sa iba't ibang paraan, na nagpapabuti sa pangkalahatang karanasan sa pagkalakalan.

Mga Advanced na Platform sa Pagkalakalan: Nag-aalok ang DBG Markets ng access sa mga pangunahing platform sa pagkalakalan tulad ng MetaTrader 4 (MT4) at MetaTrader 5 (MT5), na may mga advanced na tool sa pag-chart, mga feature sa pagsusuri, at mga personalisadong opsyon, na nagbibigay ng kakayahan sa mga mangangalakal na maipatupad ang kanilang mga estratehiya nang epektibo.

Mga Cons:Hindi tinatanggap ang mga kliyente mula sa ilang mga rehiyon: Hindi tinatanggap ng DBG Markets ang mga kliyente mula sa ilang mga rehiyon tulad ng Estados Unidos ng Amerika, Canada, United Kingdom, mga Bansa ng European Union, Iran, Afghanistan, Belgium at iba pa dahil sa mga legal at regulasyon na mga paghihigpit, na naglilimita sa pagiging accessible para sa mga mangangalakal na naninirahan sa mga hurisdiksyon na iyon.

Regulatory sight

Mga Hakbang sa Kaligtasan

Encryption: Ang DBG Markets ay nag-eencrypt ng mga password at sensitibong data upang maiwasan ang hindi awtorisadong pag-access at tiyakin na nananatiling kumpidensyal ang impormasyon ng kliyente.

Secure Servers: Ang mga detalye ng personal ay nakaimbak sa mga secure na server na may mahigpit na mga kontrol sa pag-access, na nagpoprotekta sa mga ito mula sa hindi awtorisadong pag-access o paglabag.

Limitadong Access: Ang access sa impormasyon ng kliyente ay limitado sa napakaliit na bilang ng awtorisadong mga tauhan, na nagpapababa ng panganib ng pagkahayag o pang-aabuso sa data.

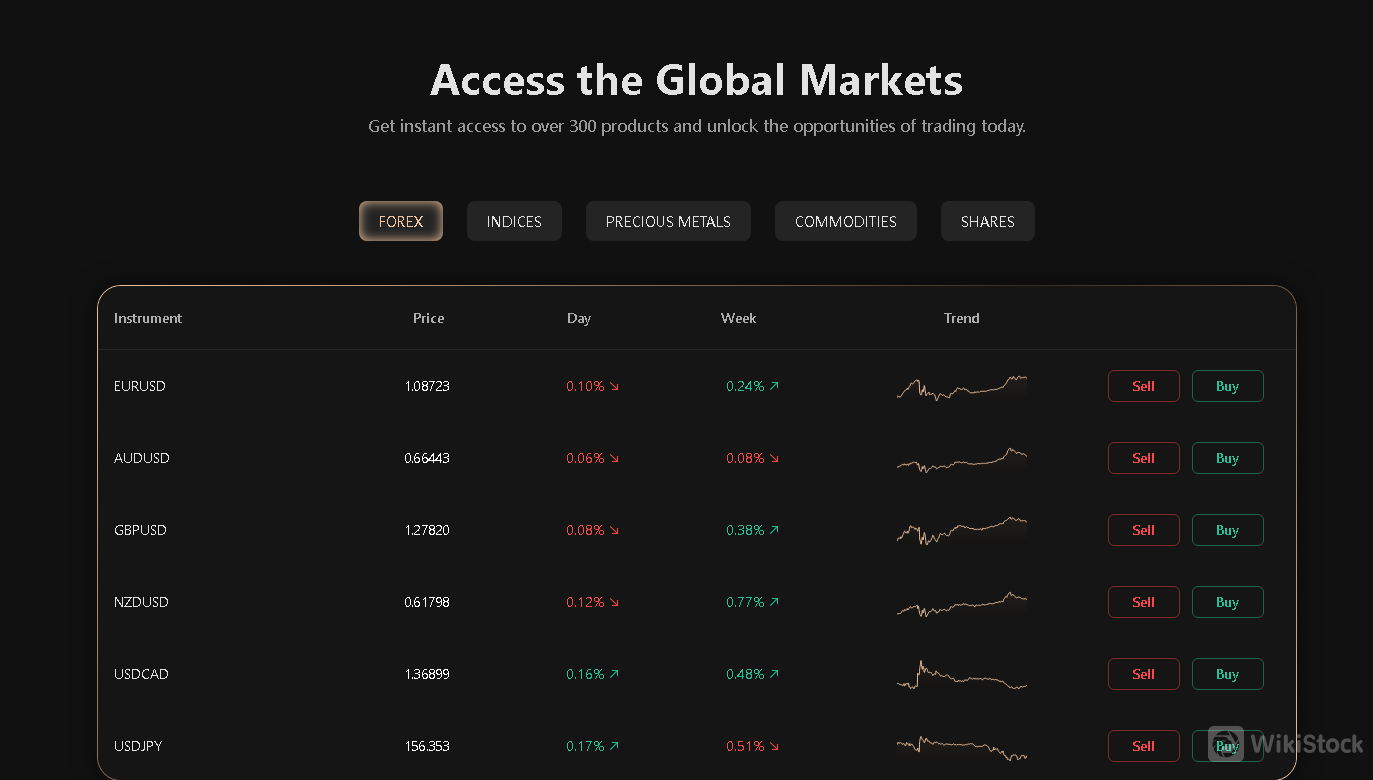

Forex: Magkalakal ng mga major, minor, at exotic na currency pairs, na nagbibigay ng oportunidad sa dinamikong merkado ng palitan ng mga banyagang salapi.

Mga Indeks: Access sa mga sikat na indeks ng stock market mula sa iba't ibang panig ng mundo, na nagbibigay ng pagkakataon para sa iba't ibang mga estratehiya sa pagkalakalan batay sa pangkalahatang mga trend sa merkado.

Mga Mahahalagang Metal: Maglagay ng mga posisyon sa ginto, pilak, platinum, at iba pang mga mahahalagang metal, na nag-aalok ng oportunidad para sa hedging at speculative na pagkalakalan.

Mga Kalakal na Pang-agrikultura: Magkalakal ng mga kalakal tulad ng langis, natural gas, mga produktong pang-agrikultura, at iba pa, na nakikinabang mula sa mga pagbabago sa suplay at demand sa pandaigdigang merkado.

Mga Hati-hating Stocks: Mag-invest sa iba't ibang mga indibidwal na stocks mula sa iba't ibang industriya at sektor, na nagbibigay ng pagkakaiba-iba sa mga portfolio at pagkakataon para sa mga pangyayari na nauugnay sa kumpanya.

Mga Cryptocurrency: Makilahok sa lumalagong merkado ng digital na mga asset sa pamamagitan ng pagkalakal ng mga sikat na cryptocurrency tulad ng Bitcoin, Ethereum, at iba pa, na nagpapalawak sa mga pagbabago at trend sa merkado para sa potensyal na kita.

DBG INTERNATIONAL LIMITED (England and Wales): 110 Bishopsgate, London, England, EC2N 4AY;

DBG MARKETS GROUP LTD: 218 Guava Street, Belama Phase 1, Belize City, Belize Central America;

DBG MARKETS ZA (PTY) LTD: 16 Bedfordview Terrace 48 Arterial Road East Bedfordview;

DBG Markets (UK) LLP: 110 Bishopsgate, London, England, EC2N 4AY;

DBG Markets (V) LIMITED: Govant Building, BP 1276, Port Vila, Vanuatu;

DBG MARKETS (AUSTRALIA) PTY LTD: Suite14 Level 11,65 York Street, Sydney NSW 2000,

DBG MARKETS LIMITED (HK): Kuwarto 1804 Beverly House, 93-107 Lockhart Road, Wan Chai, Hong Kong.

Ang DBG Markets ba ay regulado ng anumang awtoridad sa pananalapi?

Ano ang mga uri ng mga produkto na maaaring pasukin sa DBG Markets?

Ang DBG Markets ba ay angkop para sa mga nagsisimula pa lamang?

Ano ang mga pagpipilian sa leverage na inaalok ng DBG Markets?

Mayroon bang mga bayad na kaugnay sa mga deposito at pag-withdraw?

Tumatanggap ba ang DBG Markets ng mga kliyente mula sa lahat ng mga bansa?

Ligtas ba Ito?

Ang DBG Markets ay nag-ooperate sa ilalim ng hurisdiksyon ng mga kilalang global na mga awtoridad sa pinansyal. Ito ay regulated by the South Africa Financial Sector Conduct Authority (FSCA) under license No.41920. Ang regulatory background na ito ay nagpapakita ng pagsunod ng DBG Markets sa pinakamataas na pamantayan ng mga operasyon sa pinansya, na nagbibigay ng isang maaasahang kapaligiran sa pagkalakalan para sa kanilang mga kliyente.

Ang DBG Markets ay gumagamit ng matatag na mga hakbang sa seguridad upang pangalagaan ang personal at pinansyal na impormasyon ng kanilang mga kliyente. Kasama sa mga hakbang na ito ang:

Ano ang mga Securities na Maaring Ikalakal sa DBG Markets?

Ang DBG Markets ay nagbibigay ng access sa iba't ibang mga instrumento sa pinansya, na nagbibigay ng kakayahan sa mga mangangalakal na mag-explore sa mga pandaigdigang merkado nang madali. Sa higit sa 300 na mga produkto na available, maaaring mag-explore ang mga mangangalakal sa iba't ibang uri ng mga asset, kasama ang mga sumusunod:

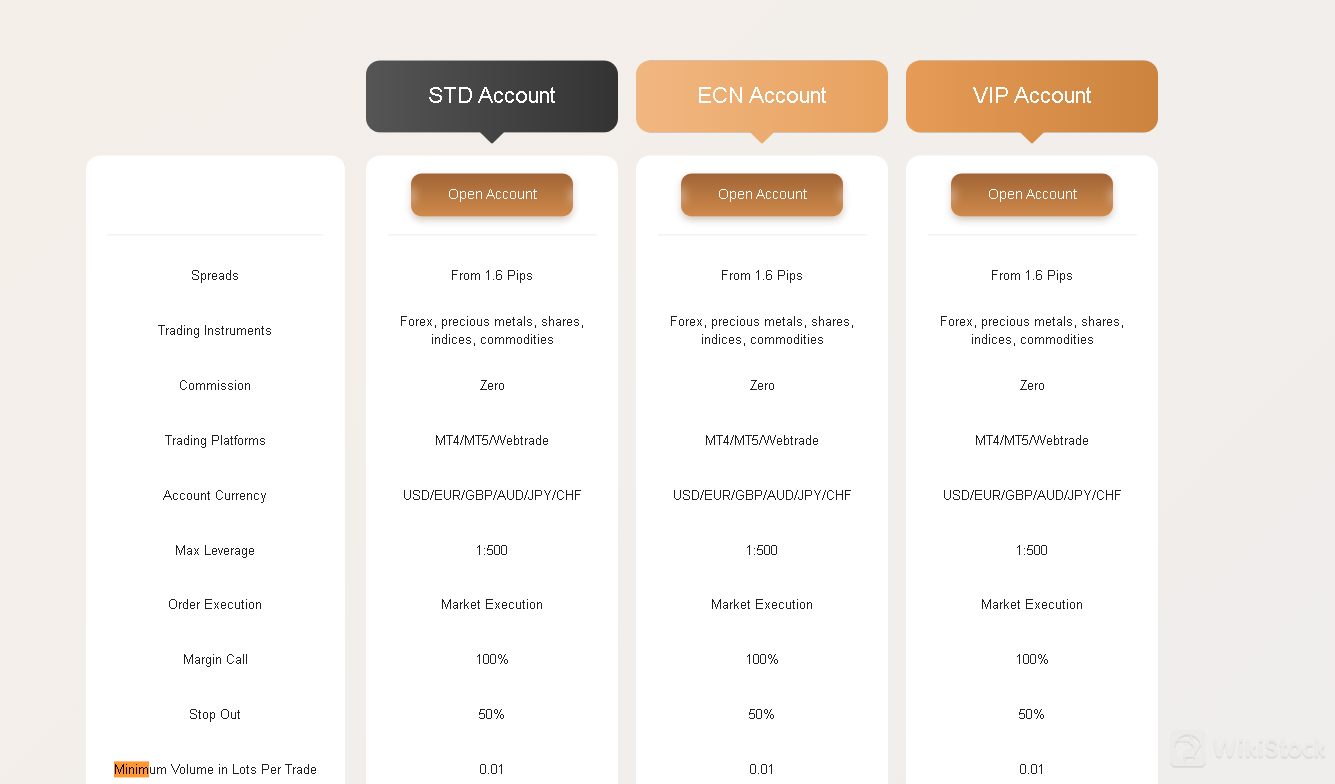

Mga Uri ng Account

Ang DBG Markets ay nag-aalok ng apat na uri ng account: STD, ECN, VIP, at demo accounts.

Lahat ng mga account ay may mga spreads mula sa 1.6 pips, leverage hanggang 1:500, at walang komisyon, at ang mga VIP accounts ay nag-aalok ng karagdagang mga benepisyo.

Ang demo account ay nagbibigay ng risk-free na pagsasanay gamit ang virtual na pondo, na sumasalamin sa mga live na kondisyon sa pagkalakalan.

Lahat ng mga account ay sumusuporta sa maramihang base na mga currency para sa USD/EUR/GBP/AUD/JPY/CHF at kasama ang market execution, margin call, at stop-out features para sa epektibong pamamahala ng panganib.

Pagsusuri ng App ng DBG Markets

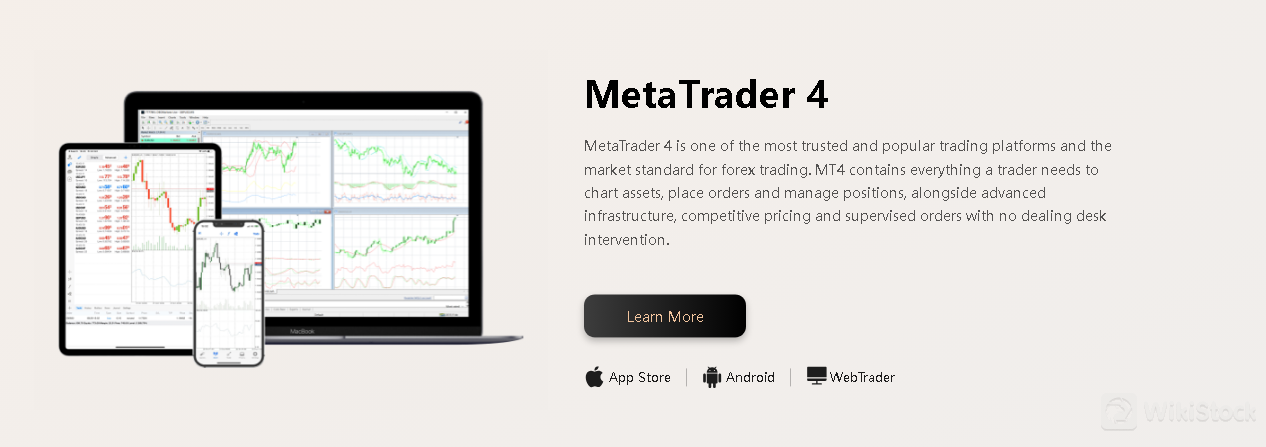

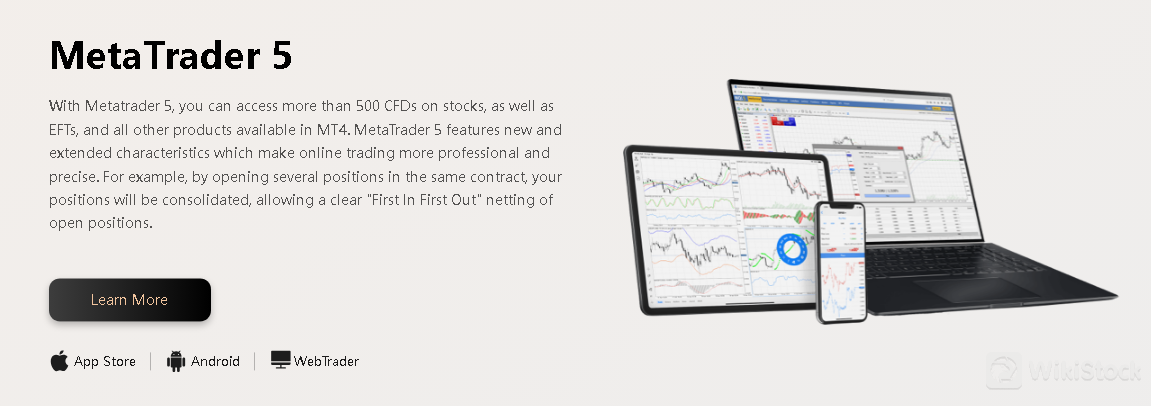

Ang DBG Markets ay nagbibigay ng malakas na seleksyon ng mga plataporma sa pag-trade na angkop sa iba't ibang mga istilo at mga kagustuhan sa iOS, Android, at web.

Una, ang MetaTrader 4 (MT4), isang pinagkakatiwalaang pamantayan ng industriya, ay nag-aalok ng higit sa 1000 mga instrumento, kasama ang Forex, CFDs, at Futures. Sa user-friendly na interface nito, buong kakayahan ng EA, at pagkakaroon nito sa mga desktop, mobile, at tablet devices, pinapayagan ng MT4 ang mga trader na magkaroon ng kumpletong mga tool sa pagsusuri at mababang spread na mababa sa 0 pips.

Bukod dito, pinapabuti ng MetaTrader 5 (MT5) ang pag-trade sa pamamagitan ng pinabuting kakayahan, 21 time frame, at 8 uri ng order. Nag-aalok ito ng mas mabilis na pagproseso, advanced customization options, at mga tampok na optimized para sa pagproseso ng mga expert advisor at indicator, na nagbibigay ng mas malalim na presisyon at kontrol sa mga trade ng mga trader.

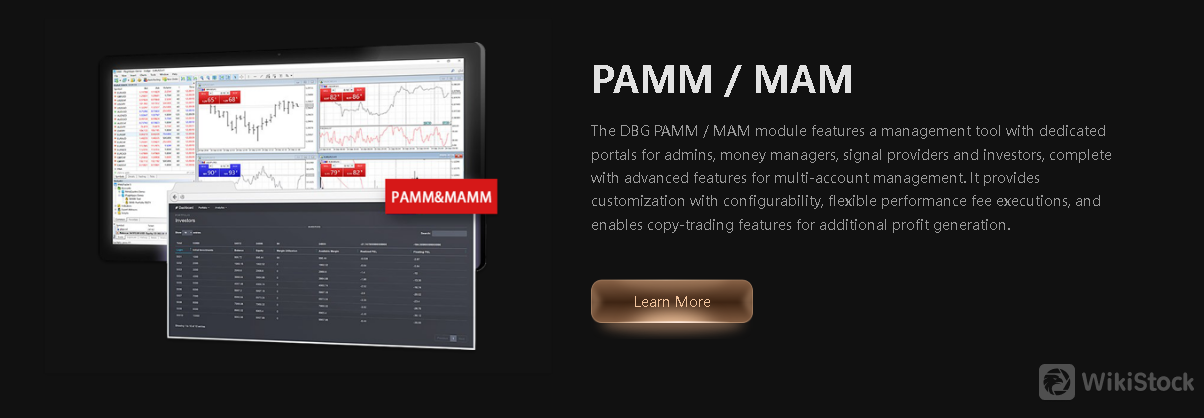

Bukod pa rito, nag-aalok ang DBG Markets ng PAMM/MAM module na integrated sa mga plataporma ng MT4/5, na nagpapadali ng pamamahala ng maramihang account na may mga dedikadong portal para sa mga admin, money manager, signal provider, at mga investor. Ang module na ito ay may magandang interface, maramihang mga paraan ng alokasyon, advanced na mga estadistika sa performance, awtomatikong pamamahagi ng mga resulta, at nagpapagana ng mga feature ng copy-trading para sa karagdagang pagkakakitaan, na ginagawang perpekto para sa mga trader na naghahanap ng mabisang at transparent na pamamahala ng kanilang mga investment.

Pagdedeposito at Pagwiwithdraw

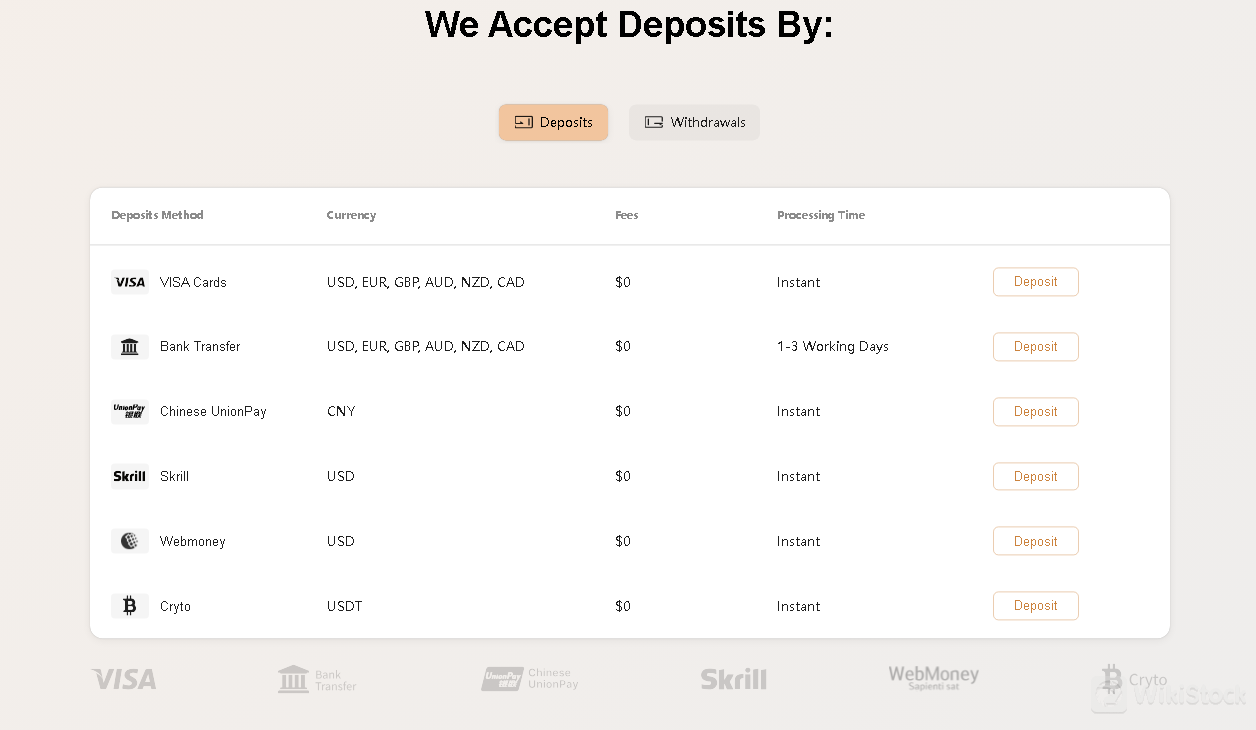

Nag-aalok ang DBG Markets ng walang-hassle na karanasan sa pagdedeposito at pagwiwithdraw na may iba't ibang mga paraan at currency.

Ang pagdedeposito ay maaaring gawin agad gamit ang VISA Cards, Chinese UnionPay, Skrill, Webmoney, at Crypto (USDT), na walang bayad. Magagamit din ang bank transfers, na kailangan ng 1-3 na working days para sa pagproseso.

Gayundin, ang mga pagwiwithdraw ay mabilis at walang abala, na may mga opsyon tulad ng VISA Cards, Chinese UnionPay, Skrill, Webmoney, at Crypto (USDT), lahat na may walang bayad.

Customer Service

Nagbibigay ang DBG Markets ng malakas na mga channel ng customer service upang matulungan ang mga trader nang mabilis. Sa mga dedikadong opisina para sa korespondensiya, mabilis na telephone support, at isang kumportableng live chat na feature sa kanilang website, maaaring makatanggap ng agarang tulong ang mga trader.

Bukod pa rito, nag-aalok sila ng suporta sa email at isang user-friendly na contact us form, na nagbibigay ng maraming paraan para makipag-ugnayan sa kanilang responsive na customer service team.

Bukod pa rito, mayroon ding isang FAQ section para sa mabilis na paghanap ng mga sagot sa pangkalahatang mga katanungan.

Address: No. 9 Cassius Webster Building, Grace, Complex, PO Box 1330, The Valley, AI-2640 Anguilla

Tel : +27 0861888221

Email: support@dbgmfx.com

Co-brand offices address:

Konklusyon

Ang DBG Markets, na regulado ng South Africa Financial Sector Conduct Authority (FSCA) na may lisensyang numero 41920, ay nagtataguyod ng pagsunod sa regulasyon at proteksyon ng mga kliyente. Nag-aalok ang DBG Markets ng iba't ibang uri ng mga instrumento sa kalakalan kabilang ang forex, mga pambihirang metal, mga shares, mga indeks, mga komoditi, at mga cryptocurrency, na nagbibigay ng isang ligtas at transparent na kapaligiran sa kalakalan na sinusuportahan ng malakas na regulasyon.

Mga Madalas Itanong (FAQs)

Oo, ang DBG Markets ay regulado ng South Africa Financial Sector Conduct Authority (FSCA) na may lisensyang numero 41920, na nagtitiyak ng pagsunod sa mga pamantayan sa regulasyon at proteksyon ng mga kliyente.

Forex, mga pambihirang metal, mga shares, mga indeks, mga komoditi, at mga cryptocurrency.

Oo, ang DBG Markets ay angkop para sa mga nagsisimula pa lamang, lalo na dahil sa pagbabantay nito ng FSCA na may lisensyang numero 41920. Ang katiyakan na ito sa regulasyon ay nagbibigay ng dagdag na kumpiyansa at seguridad para sa mga bagong mangangalakal na pumapasok sa mga pandaigdigang merkado sa unang pagkakataon. Bukod dito, nag-aalok ang DBG Markets ng mga platform na madaling gamitin at responsableng suporta sa customer upang matulungan ang mga nagsisimula sa paglilibot sa mga kumplikasyon ng kalakalan.

Hanggang sa 1:500.

Nag-aalok ang DBG Markets ng mga deposito at pag-withdraw na walang bayad para sa iba't ibang paraan.

Hindi, hindi nag-aalok ang DBG Markets ng mga serbisyo sa mga residente ng tiyak na hurisdiksyon, kabilang ang Estados Unidos ng Amerika, Canada, United Kingdom, mga Bansa ng European Union, Iran, Afghanistan, Belgium, Hong Kong, Australia, New Zealand, Israel, Japan, Singapore, Malaysia, o sinumang tao sa anumang bansa o hurisdiksyon kung saan ang gayong pamamahagi o paggamit ay labag sa lokal na batas o regulasyon.

Babala sa Panganib

Ang online trading ay may malaking panganib, at maaaring mawala mo ang lahat ng iyong ininvest na kapital. Ito ay hindi angkop para sa lahat ng mga mangangalakal o mamumuhunan. Mangyaring tiyakin na nauunawaan mo ang mga panganib na kasama nito at tandaan na ang impormasyong ibinigay sa pagsusuri na ito ay maaaring magbago dahil sa patuloy na pag-update ng mga serbisyo at patakaran ng kumpanya.

iba pa

Rehistradong bansa

Anguilla

Taon sa Negosyo

1-2 taon

Mga produkto

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Mga Kaugnay na Negosyo

Bansa

Pangalan ng Kumpanya

Mga Asosasyon

South Africa

DBG MARKETS ZA (PTY) LTD

Gropo ng Kompanya

Hong Kong

DBG MARKETS LIMITED (HK)

Gropo ng Kompanya

Belize

DBG MARKETS GROUP LTD

Gropo ng Kompanya

Australia

DBG MARKETS (AUSTRALIA) PTY LTD

Gropo ng Kompanya

United Kingdom

DBG Markets (UK) LLP

Gropo ng Kompanya

United Kingdom

DBG INTERNATIONAL LIMITED

Gropo ng Kompanya

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

Daiwa

Assestment

Saxo

Assestment

IG

Assestment

Standard Chartered

Assestment

AJ Bell

Assestment

CommSec

Assestment

BTIG

Assestment

Jane Street

Assestment

Jefferies

Assestment

STIFEL

Assestment