Assestment

Spring Securities 泉湧證券

https://springgroup.com.hk/spring/

Website

Marka ng Indeks

Appraisal ng Brokerage

Mga Produkto

1

Stocks

Lisensya sa seguridad

kumuha ng 1 (mga) lisensya sa seguridad

SFCKinokontrol

Hong KongLisensya sa Pagkalakal ng Seguridad

Mga Pandaigdigang Upuan

![]() Nagmamay-ari ng 1 (na) upuan

Nagmamay-ari ng 1 (na) upuan

Hong Kong HKEX

Seat No. 02121

Impormasyon sa Brokerage

More

Kumpanya

Spring Securities Limited

Pagwawasto

泉湧證券

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Suriin kahit kailan mo gusto

WikiStock APP

Mga Serbisyo sa Brokerage

Gene ng Internet

Index ng Gene

Rating ng APP

| Spring Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | Hindi Nabanggit |

| Fees | Oo |

| Interests on Uninvested Cash | Hindi Nabanggit |

| Margin Interest Rates | Hindi Nabanggit |

| Mutual Funds Offered | Hindi Nabanggit |

| App/Platform | Hindi Nabanggit |

| Promotions | Hindi Nabanggit |

Ano ang Spring Securities?

Ang Spring Securities ay isang financial intermediary na nag-aalok ng iba't ibang mga produkto at serbisyo sa pamumuhunan. Lisensyado ng Securities and Futures Commission ng Hong Kong, nagbibigay ito ng mga serbisyo sa pagtitingi ng mga securities sa mga stock ng Hong Kong, U.S. stocks, Taiwan stocks, at China Connect A shares.

Mga Kalamangan at Disadvantages ng Spring Securities

| Kalamangan | Disadvantages |

| Transparent fee structures and no hidden charges | Kawalan ng impormasyon tungkol sa mga account |

| Regulated | |

| Malawak na hanay ng mga produkto at serbisyo sa pamumuhunan |

Transparent fee structures and no hidden charges: Ang Spring Securities ay nagbibigay-diin sa pagiging transparent ng mga istraktura ng bayarin nito, nagbibigay ng malinaw na impormasyon sa mga kliyente tungkol sa mga bayarin at pinapangalagaan na walang mga nakatagong bayad. Ang transparensiyang ito ay nagbibigay ng kakayahang magdesisyon at pamahalaan ng mga kliyente ang kanilang mga gastos sa pamumuhunan nang epektibo.

Regulated: Ang Spring Securities ay nagbibigay-prioridad sa pagsunod sa mga regulasyon na itinakda ng Securities and Futures Commission ng Hong Kong. Ang pagkakasunod na ito ay nagtitiyak na ang mga pamumuhunan ng mga kliyente ay hina-handalang nasa loob ng isang regulasyon at ligtas na kapaligiran.

Malawak na hanay ng mga produkto at serbisyo sa pamumuhunan: Ang Spring Securities ay nag-aalok ng iba't ibang mga pagpipilian sa pamumuhunan, kasama ang pag-access sa mga stock ng Hong Kong, mga pamumuhunan sa stock market ng China, U.S. stocks, global stocks, at mga darating na IPO. Ito ay nagbibigay-daan sa mga kliyente na mag-diversify ng kanilang mga portfolio at mag-explore ng iba't ibang oportunidad sa merkado.

DisadvantagesKawalan ng impormasyon tungkol sa mga account: Ang opisyal na website ng Spring Securities ay kulang sa detalyadong impormasyon tungkol sa mga uri ng account, na nagiging hindi komportable para sa mga trader.

Regulatory Sight: Ang Spring Securities ay gumagana sa ilalim ng regulasyon ng China Hong Kong Securities (No.BJL236) at Futures Commission sa Hong Kong, na mayroong balidong lisensya sa security trading. Ang awtoridad na ito sa regulasyon ay nagtitiyak na ang mga institusyong pinansyal ay sumusunod sa mga naaangkop na batas at regulasyon upang protektahan ang mga mamumuhunan at mapanatili ang integridad ng merkado.

User Feedback: Dapat suriin ng mga user ang mga review at feedback mula sa ibang mga kliyente upang makakuha ng mas malawak na pananaw tungkol sa broker, o hanapin ang mga review sa mga reputable na website at forum.

Mga Hakbang sa Seguridad: Hanggang ngayon, hindi pa kami nakakahanap ng anumang impormasyon tungkol sa mga hakbang sa seguridad para sa mga securities na ito.

Telepono: Maaaring tawagan ng mga kliyente sila sa (852) 3468 4549 para sa anumang mga katanungan.

Fax: Maaaring i-fax ng mga kliyente sila sa (852) 2838 8687.

Email: Nag-aalok ang kumpanya ng tulong sa pamamagitan ng email sa general@springgroup.com.hk.

Seguro ba ang Spring Securities?

Ano ang mga Securities na Maaring I-trade sa Spring Securities?

Nagbibigay ang Spring Securities ng iba't ibang mga produkto at serbisyo sa pamumuhunan, kasama ang pag-access sa mga stock sa Hong Kong, mga pamumuhunan sa merkado ng Tsina, mga stock sa US, mga stock sa pandaigdigang merkado, at mga paparating na initial public offerings (IPOs) para sa bagong pag-subscribe ng mga shares. Sa layuning magbigay ng iba't ibang pagpipilian sa mga mamumuhunan na nagnanais mag-diversify ng kanilang mga portfolio sa iba't ibang merkado at uri ng mga assets, nag-aalok ang Spring Securities ng mga opsyon.

Pagsusuri sa mga Bayarin ng Spring Securities

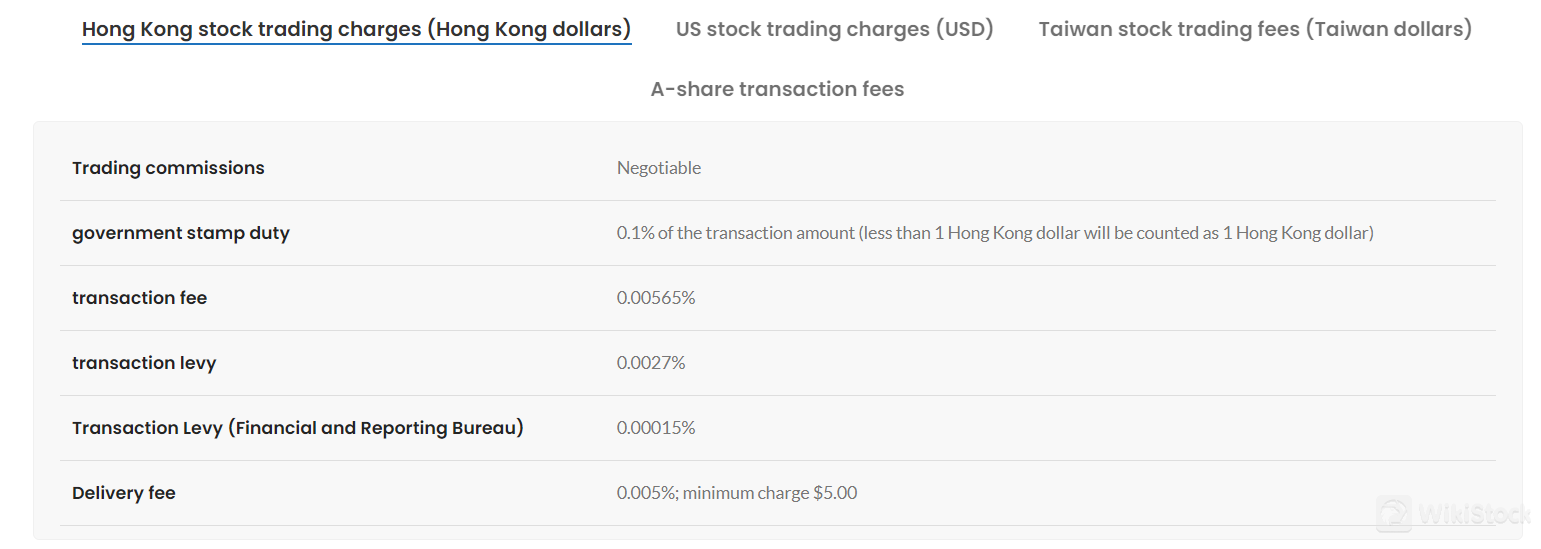

Ipinagmamalaki ng Spring Securities ang kanilang pangako sa pagiging transparent sa pamamagitan ng pagbibigay ng malinaw at transparent na istraktura ng bayarin para sa kanilang mga serbisyo. Ito ay nagbibigay ng katiyakan na ang mga kliyente ay lubos na pamilyar sa mga gastos na kaugnay ng kanilang mga pamumuhunan, na nagbibigay sa kanila ng kakayahang gumawa ng mga pinag-isipang desisyon.

Para sa pag-trade ng mga stock sa Hong Kong, kasama sa istraktura ng bayarin ang mga negotiable na komisyon sa pag-trade, isang government stamp duty na 0.1% ng halaga ng transaksyon (kung ang halaga ay mas mababa sa 1 Hong Kong dollar, ito ay bibilangin bilang 1 Hong Kong dollar), isang bayad sa transaksyon na 0.00565%, isang bayad sa transaksyon na 0.0027%, isang Transaction Levy (Financial and Reporting Bureau) na 0.00015%, at isang bayad sa paghahatid na 0.005% na may minimum na bayad na $5.00.

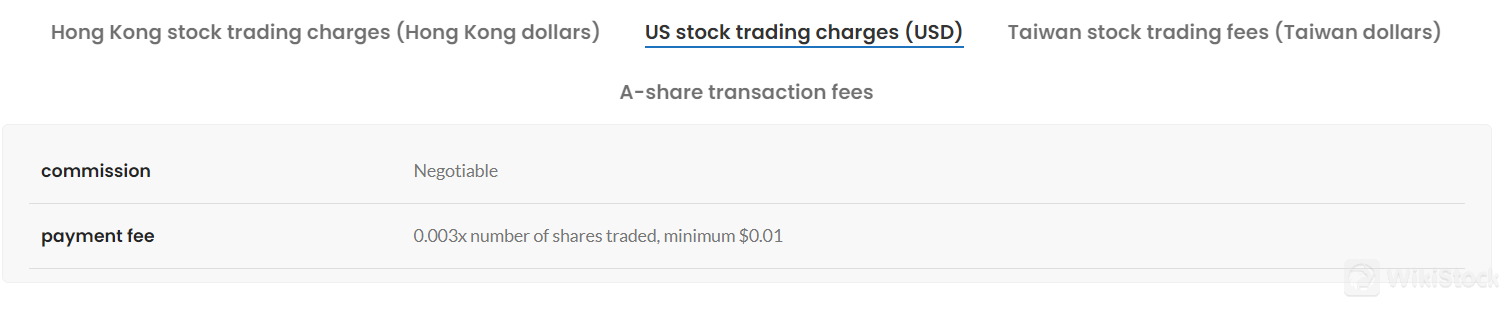

Pagdating sa pag-trade ng mga stock sa US, nagpapataw ang Spring Securities ng bayad na 0.003 beses ang bilang ng mga shares na na-trade, na may minimum na bayad na $0.01.

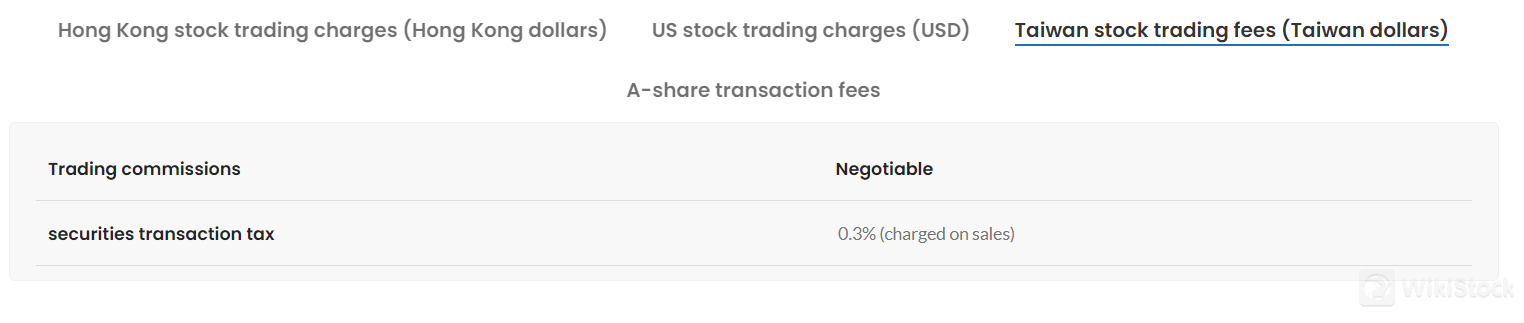

Para sa mga kliyenteng interesado sa pag-trade ng mga stock sa Taiwan, ang mga komisyon sa pag-trade ay negotiable, at mayroong isang securities transaction tax na 0.3% na ipinapataw sa mga benta.

Ang pangako ng Spring Securities sa transparent na istraktura ng bayarin ay pinupuri dahil ito ay nagbibigay ng malinaw na pang-unawa sa mga kliyente sa mga gastos na kaugnay ng kanilang mga pamumuhunan. Sa pamamagitan ng pagbibigay ng detalyadong impormasyon sa mga bayarin para sa iba't ibang uri ng pag-trade, kasama ang mga stock sa Hong Kong, US stocks, at Taiwan stocks, ang mga kliyente ay maaaring gumawa ng mga pinag-isipang desisyon tungkol sa kanilang mga estratehiya sa pamumuhunan. Ang kakayahang mag-negotiate ng mga komisyon sa pag-trade sa Hong Kong at Taiwan ay nagbibigay ng kakayahang mag-adjust ng mga bayarin, na nagbibigay-daan sa mga indibidwal na pangangailangan ng mga kliyente.

Pagsusuri sa Spring Securities App

Nagbibigay ang Spring Securities ng Spring App, na maaaring i-download sa parehong Apple Store at Google Play. Ang Spring App ay dinisenyo upang magbigay ng mobile platform sa mga gumagamit para ma-access ang mga serbisyo at mga tampok na ibinibigay ng Spring Securities. Sa pamamagitan ng app, maaaring madaling pamahalaan ng mga gumagamit ang kanilang mga investment account, ma-access ang impormasyon sa merkado, at mag-execute ng mga trade.

Customer Service

Nag-aalok ang Spring Securities ng kumpletong suporta sa customer sa kanilang mga kliyente. Maaaring makipag-ugnayan ang mga kliyente sa Spring Securities sa pamamagitan ng iba't ibang mga paraan.

Nagbibigay din ang kumpanya ng kanilang pisikal na address, Room 01, 28th Floor, 118 Connaught Road West, Sai Ying Pun, Hong Kong.

Konklusyon

Sa buod, ang Spring Securities ay isang lisensyadong financial intermediary na nag-aalok ng iba't ibang mga produkto at serbisyo sa pamumuhunan. Bagaman nagbibigay sila ng access sa iba't ibang mga merkado at nagbibigay-diin sa regulatory compliance, may ilang mga limitasyon na dapat isaalang-alang. Kasama dito ang potensyal na epekto sa mga investment returns dahil sa iba't ibang mga bayarin at fees, limitadong pisikal na presensya para sa mga personal na pakikipag-ugnayan, at limitadong impormasyon sa karagdagang mga serbisyo. Mahalagang maingat na suriin ng mga mamumuhunan ang kanilang mga indibidwal na pangangailangan at mga kagustuhan bago isaalang-alang ang Spring Securities bilang isang potensyal na kasosyo sa pamumuhunan.

Mga Madalas Itanong (FAQs)

Legit ba ang Spring Securities?

Oo. Ang Spring Securities ay nag-ooperate sa ilalim ng regulatory oversight ng China Hong Kong Securities and Futures Commission sa Hong Kong, na mayroong balidong lisensya sa security trading.

Paano ko makokontak ang Spring Securities?

Maaari kang makipag-ugnayan sa Spring Securities sa iba't ibang mga paraan, kabilang ang telepono sa (852) 3468 4549, fax sa (852) 2838 8687, at email sa general@springgroup.com.hk.

Anong mga merkado ang maaaring i-trade sa Spring Securities?

Nagbibigay ng access ang Spring Securities sa mga stocks sa Hong Kong, mga investment sa Chinese stock market, US stocks, global stocks, at mga darating na IPOs.

Babala sa Panganib

Ang impormasyong ibinigay ay batay sa expert evaluation ng WikiStock sa data ng website ng brokerage at maaaring magbago. Bukod dito, ang online trading ay may malalaking panganib na maaaring magresulta sa kabuuang pagkawala ng ininvest na pondo, kaya mahalagang maunawaan ang mga kaakibat na panganib bago magpatuloy.

iba pa

Rehistradong bansa

Hong Kong

Taon sa Negosyo

2-5 taon

New Stock Trading

Yes

Mga Reguladong Bansa

1

Mga produkto

Stocks

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

WK Securities

Assestment

Orient Securities Limited

Assestment

MFAM

Assestment

Gransing

Assestment

OPSL

Assestment

Greater China Securities

Assestment

CGG

Assestment

Alphafin

Assestment

BSL

Assestment

維恩金控

Assestment