JVSakk Group (JVSakk) is a unique investment house that provides securities brokerage, asset management and private banking solutions. We are based in Hong Kong and search for opportunities around the globe, seeking for private, exclusive investment opportunities for our clients to deliver sustainable capital appreciation. Our goal is to provide low volatility, alpha enhancing returns through active investment management in changing economic climates.

What is JVSakk?

JVSakk Group (JVSakk) is a unique investment company offering securities brokerage, asset management and private banking solutions. Established in Hong Kong in 2007, JVSakk currently six lines of core businesses including Family Office, Asset Management, Alternative Investment, Dealer Broker, Risk Management, Real Asset. It offers a family office approach in providing investment services, combining the advantages of both traditional private banking and asset management. Also, it collaborates with prominent private banks and acts as an independent asset manager in offering execution, investment advisory and managed discretionary portfolio services to private clients and institutions.

Pros and Cons of JVSakk

JVSakkka has an excellent reputation and operates under formal regulatory oversight. The company has a sound corporate governance structure and scientific management system, to ensure the healthy development of various businesses. The company has a knowledgeable and experienced investment management team and their relationship managers are innovative, diligent and responsive listeners. But it does not specify the margin rate, nor does it provide some professional educational resources and convenient customer service channels.

Is JVSakk safe?

Yes, JVSakk is regulated. It is effectively regulated by a regulator and provides a margin. However, traders should fully investigate before engaging in trading activities to ensure a safer and more reliable trading experience.

What are securities to trade with JVSakk?

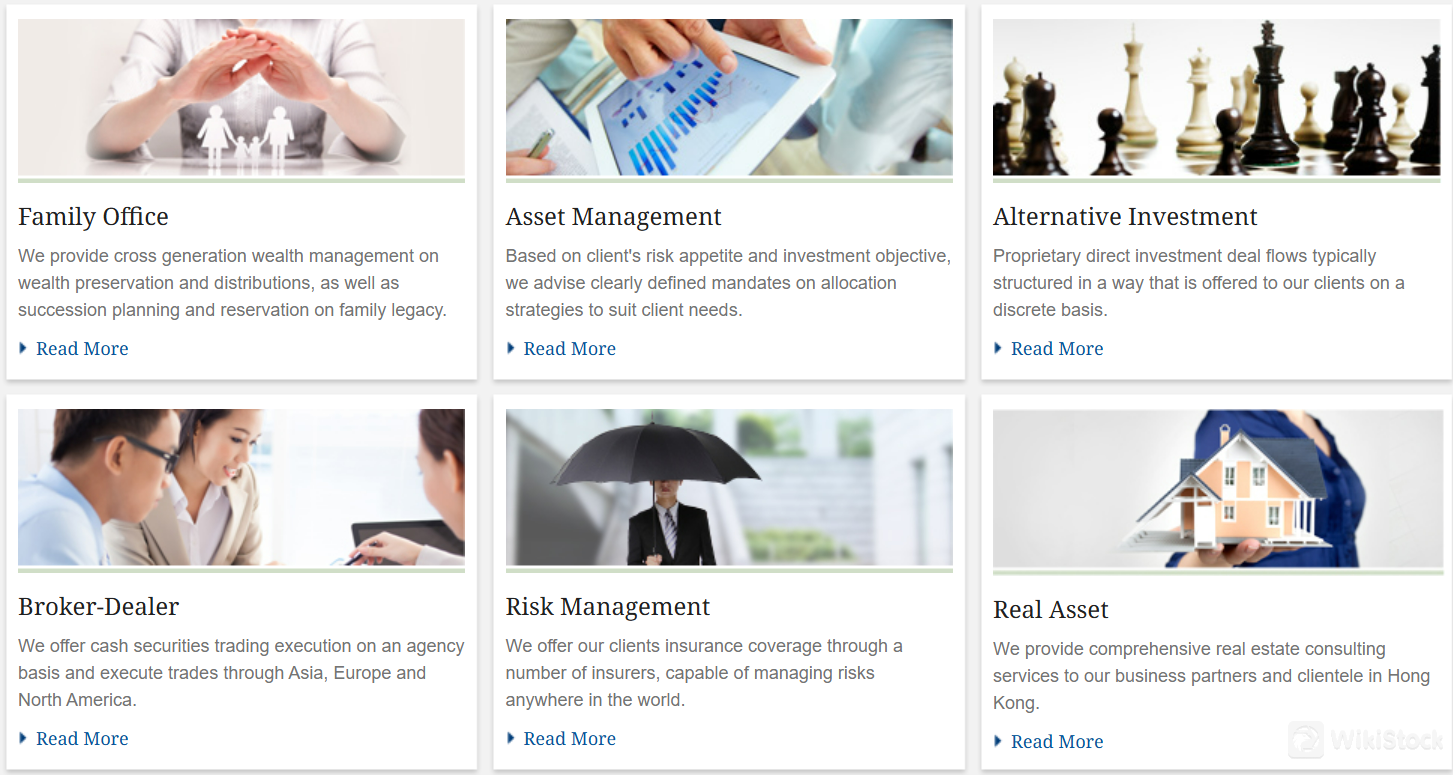

The company currently has six core businesses: family office, asset management, alternative investment, broker-dealer, risk management and real asset.

Family Office: JVSakk provides customized, comprehensive advisory services for family offices. Through its strategic partnership with Isola Capital Group, a distinguished multi-family office platform boasting over fifty years of experience in the sector, JVSakk delivers a broad spectrum of solutions tailored to meet the specific needs of your family or family office.

Asset Management: Taking into account the client's risk tolerance and investment objectives, it provides clearly defined mandates on allocation strategies that are tailored to meet individual client needs.

Alternative Investment: Isola Capital boasts an extensive global network that provides access to exclusive direct investment deal flows. Their direct investment team typically evaluates around 80 deals per quarter. As Isola Capital's strategic partner in the Greater China region, these unique investment opportunities are discreetly offered to their clients and partners.

Broker-Dealer: At JVSakk, they offer cash equity trading execution on an agency basis and executes trades through Asia, Europe and North America.

Risk Management: They provide their clients with insurance coverage from a variety of insurers, equipped to manage risks globally.

Real Asset: They offer a full range of real estate consulting services to their business partners and clients in Hong Kong, specializing in sales, acquisitions, consultations, renovations, and the leasing of residential or investment properties.

JVSakk Platform Review

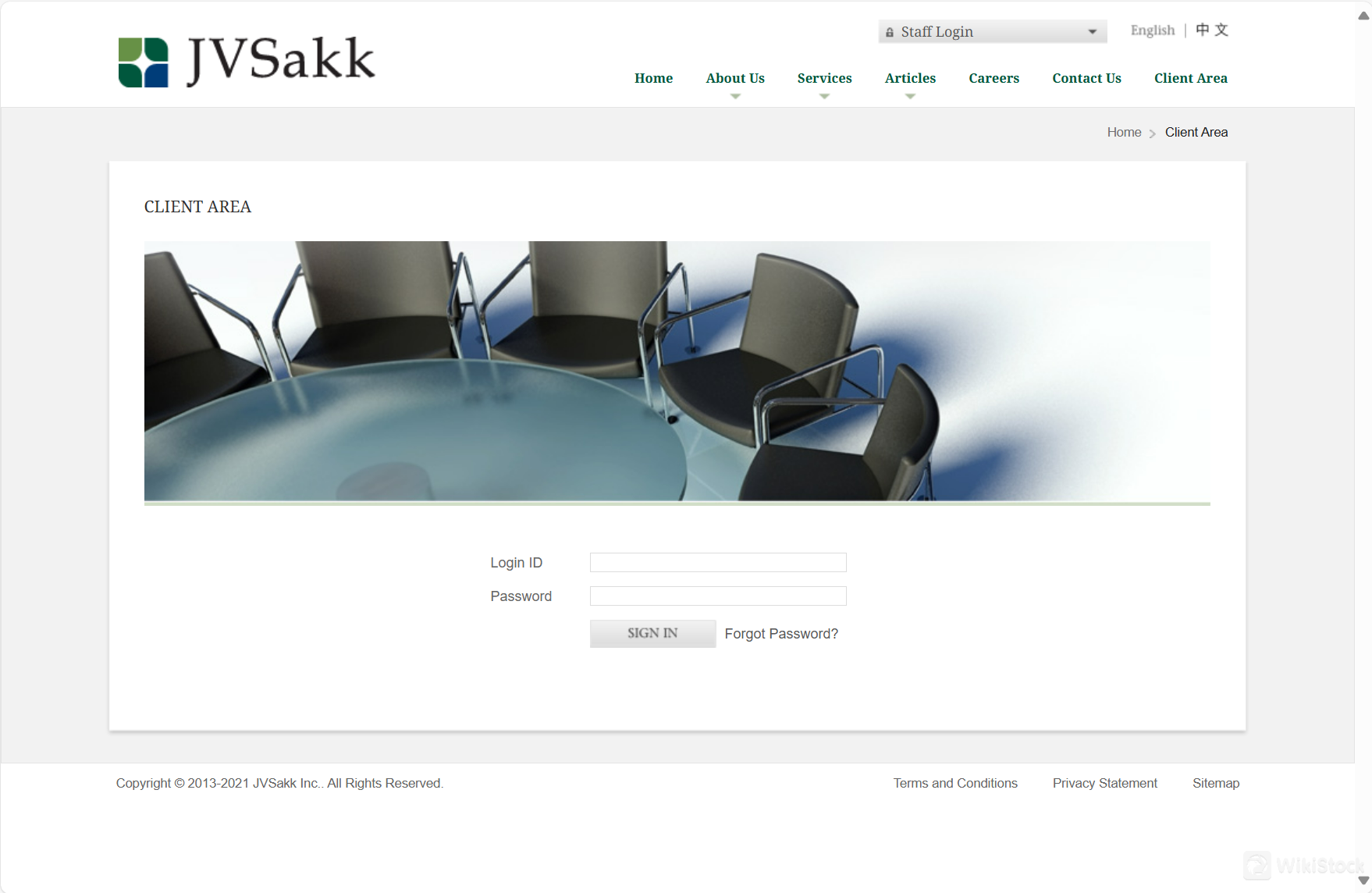

To begin trading on JVSakk, follow these steps:

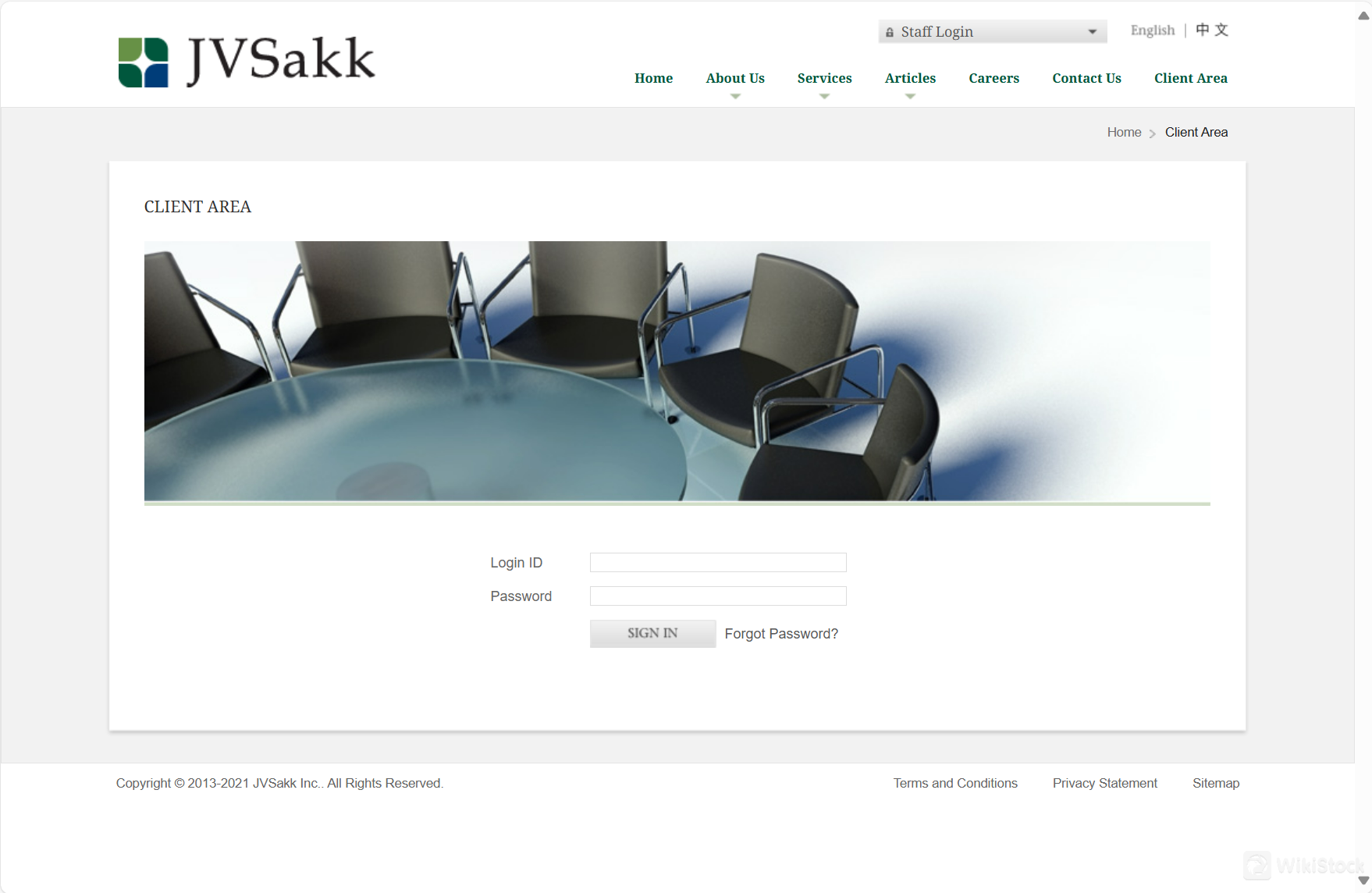

Access the JVSakk website and locate the “Client Area” section, typically found on the top navigation menu or sidebar.

Click on the “Client Area” link, which will redirect you to the login page.

On the login page, you will see fields to enter your login ID and password.

Once you have your login credentials, enter your ID and password in the respective fields.

After successfully logging in, you will be taken to your personalized client dashboard or account area.

Customer Service

JVSakk can be contacted at info@jvsakk.com by email or +(852) 3983 1188 by call for any inquiries or assistance.

Conclusion

In conclusion, JVSakk Group, established in 2007 in Hong Kong, is a distinguished investment company offering a wide range of services including securities brokerage, asset management, and private banking solutions. With a focus on six core business lines—Family Office, Asset Management, Alternative Investment, Dealer Broker, Risk Management, and Real Asset—JVSakk provides tailored investment services that combine traditional private banking with modern asset management strategies. Despite its good reputation and regulatory compliance, the company faces challenges such as limited customer support options and a lack of clarity on some costs.

FAQs

Is JVSakk safe to trade with?

Yes, JVSakk is considered safe to trade with. It operates under strict regulatory oversight and adheres to the regulations set by financial authorities, ensuring a secure trading environment for its clients. However, as with any trading activity, it is recommended that traders conduct thorough research and understand the risks involved.

Is JVSakk a good platform for beginners?

JVSakk offers a range of services that could benefit both experienced traders and beginners. However, the company does not specifically highlight educational resources for new traders. Beginners might find it challenging without these resources but can benefit from the company's comprehensive investment services if they seek additional learning materials externally.

Is JVSakk legit?

Yes, JVSakk is a legitimate investment company established in 2007 and based in Hong Kong. It is regulated by relevant financial authorities and offers various financial services including asset management, securities brokerage, and private banking solutions.

Is JVSakk good for investing/retirement?

JVSakk provides various services that could be suitable for long-term investing and retirement planning, such as asset management and alternative investments. The firms strategic partnerships and global investment opportunities can offer valuable options for building a diversified retirement portfolio. Clients should consider their personal financial goals and consult with financial advisors at JVSakk to tailor an investment strategy that fits their retirement needs.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Taiwan

China TaiwanObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)