Score

維恩金控

http://www.we-holding.com/

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China Hong Kong

China Hong Kong Products

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02153

Brokerage Information

More

Company Name

WE FINANCIAL GROUP LIMITED

Abbreviation

維恩金控

Platform registered country and region

Company address

Company website

http://www.we-holding.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| WE FINANCIAL |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | Not Mentioned |

| Fees | 0.25 % of commission, 0.0027% of transaction levy, 0.005% of trading fee and so on |

| Mutual Funds Offered | Not Mentioned |

| App/Platform | Venn Trading Treasure and Venn Encoder Mobile Software |

| Promotions | No |

| Customer Support | Phone, email, and online messaging |

WE FINANCIAL Introduction

WE FINANCIAL Fees Review

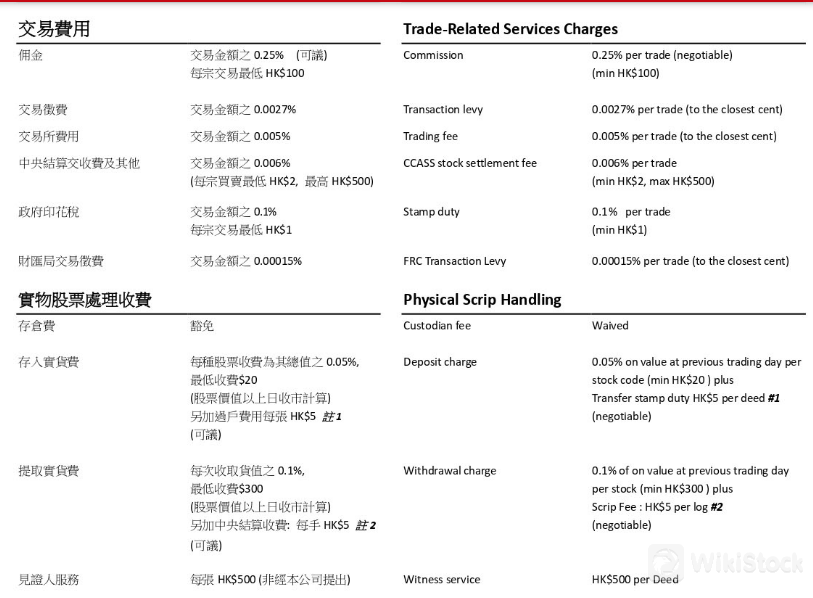

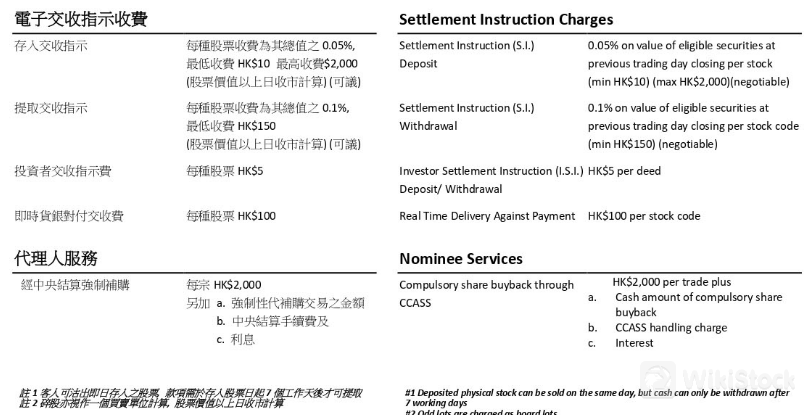

Commission: This is the core fee WE Financial charges for executing your trade. It's a percentage (0.25%) of the total trade value, with a minimum fee of HK$100, even for smaller trades. This fee can be negotiated depending on your trading volume or relationship with the company.

Transaction Levy: This is a small fee (0.0027%) levied by the Hong Kong Stock Exchange on each trade. It's a minuscule percentage rounded to the nearest cent.

Trading Fee: Similar to the transaction levy, this is another exchange-based fee (0.005%) charged per trade and rounded to the nearest cent.

CCASS Stock Settlement Fee: The Central Clearing and Settlement System (CCASS) is the central securities depository in Hong Kong. This fee (0.006% of the trade value, minimum HK$2 and maximum HK$500) covers the settlement process for your stock trade through CCASS.

Stamp Duty: This is a government tax (0.1%) applied to all stock exchange transactions in Hong Kong. There's also a minimum charge of HK$1 for this tax.

Custodian Fee: WE Financial waives this fee for holding your physical stock certificates.

Deposit Charge: When you deposit physical stock certificates with WE Financial, they charge a fee (0.05% of the stock's previous day value per stock code, minimum HK$20) along with a HK$5 fee per transfer deed (negotiable).

Withdrawal Charge: Withdrawing your physical stock certificates incurs a higher fee (0.1% of the stock's previous day value per stock + HK$300 minimum + HK$52 scrip fee per log). This fee can also be negotiated.

Deposit Instruction: When you instruct WE Financial to deposit eligible securities into your account, there's a fee (0.05% of the security value at the previous day's closing price per stock code, minimum HK$10 and maximum HK$2,000). This fee can be negotiated.

Withdrawal Instruction: Withdrawing your securities from WE Financial incurs a higher fee (0.1% of the security value at the previous day's closing price per stock code, minimum HK$150). This fee can also be negotiated.

Investor Settlement Instruction: This is a flat fee of HK$5 per deed (deposit or withdrawal) charged for processing your settlement instructions.

There's a 7-day waiting period after depositing physical stock certificates before you can withdraw the cash from the sale.

When trading odd lots (less than 100 shares), WE Financial charges the full board lot fee (fee based on a standard trading unit of 100 shares).

The fee schedule is subject to change by WE Financial without prior notice. It's advisable to confirm the latest fees before placing any trades.

- Deposit Methods:

- Withdrawal Methods:

WE FINANCIAL, a financial platform centered around client needs, was established in Hong Kong in 2022 and operates three subsidiaries. Headquartered in Hong Kong and Shanghai, WE FINANCIAL serves as a pivotal link between mainland and global markets, offering tailored services to domestic and international enterprises. Regulated by the SFC, WE FINANCIAL adheres to stringent regulatory standards.

| Pros | Cons |

| Regulated by SFC | Complexity in Offerings |

| Comprehensive Financial Services | Language barriers |

| Customized Solutions | |

| Innovative Financial Products |

Regulated by SFC: Being regulated by the Securities and Futures Commission (SFC) is a significant advantage. It ensures that WE FINANCIAL operates under regulatory guidelines, which enhances credibility and protects investors.

Comprehensive Financial Services: Offers a comprehensive suite of services including asset management, equity derivatives, strategic investment, leveraged trading, and market value management.

Customized Solutions: Providing customized financial solutions suggests that WE FINANCIAL can tailor their services to meet individual client requirements.

Innovative Financial Products: The presence of innovative financial products indicates that WE FINANCIAL is proactive in adapting to market trends and customer demands.

Cons:Complexity in Offerings: While offering a wide range of products is a strength, it can also pose a challenge in terms of complexity. Customers and investors can find it overwhelming to navigate through numerous options without clear guidance or support.

Language Barriers: While it operates in Hong Kong and Shanghai, language barriers may still exist for clients who are not fluent in Chinese or English, potentially affecting communication and service accessibility for some clients.

Is WE FINANCIAL Safe?

WE FINANCIAL is subject to regulation by the Securities and Futures Commission (SFC) under License No. BMQ962 and BKF788. The SFC, as a leading financial regulator in a global financial hub, plays a crucial role in enhancing and safeguarding the stability and reliability of Hong Kong's securities and futures markets.

This regulatory body is dedicated to ensuring a fair and transparent marketplace, promoting investor confidence, and fostering a level playing field for all participants. By enforcing stringent regulatory standards and monitoring market activities, the SFC aims to uphold the integrity of financial transactions and protect the interests of investors and the broader financial industry in Hong Kong.

What are Securities to Trade with WE FINANCIAL?

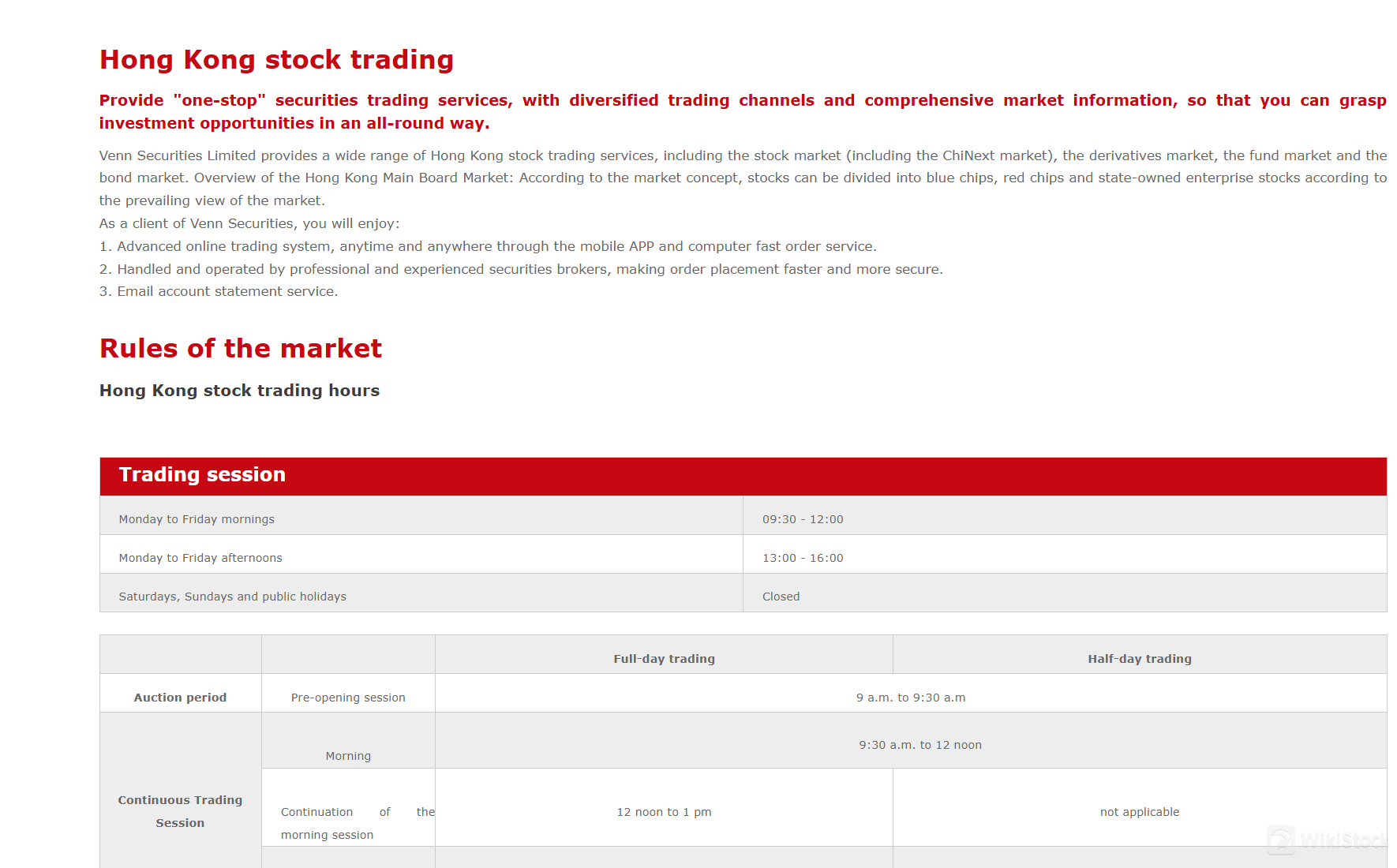

WE FINANCIAL offers wide range of Hong Kong stock trading services, including the stock market (including the ChiNext market), the derivatives market, the fund market and the bond market.

Stock Market: Includes a broad spectrum of stocks listed on the Hong Kong Stock Exchange (HKEX), allowing investors to trade in companies across different sectors.

ChiNext Market: Specifically focuses on innovative and growth-oriented companies listed on the Shenzhen Stock Exchanges ChiNext board.

Derivatives Market: Offers trading in derivatives such as futures and options, providing tools for hedging, speculation, and leveraging investment strategies based on underlying assets like stocks or indices.

Fund Market: Provides access to a range of investment funds, including mutual funds and exchange-traded funds (ETFs).

Bond Market: Facilitates trading in bonds issued by governments, corporations, and other entities, offering fixed-income investment opportunities with varying risk profiles and maturities.

WE FINANCIAL offers asset management and equity derivatives.

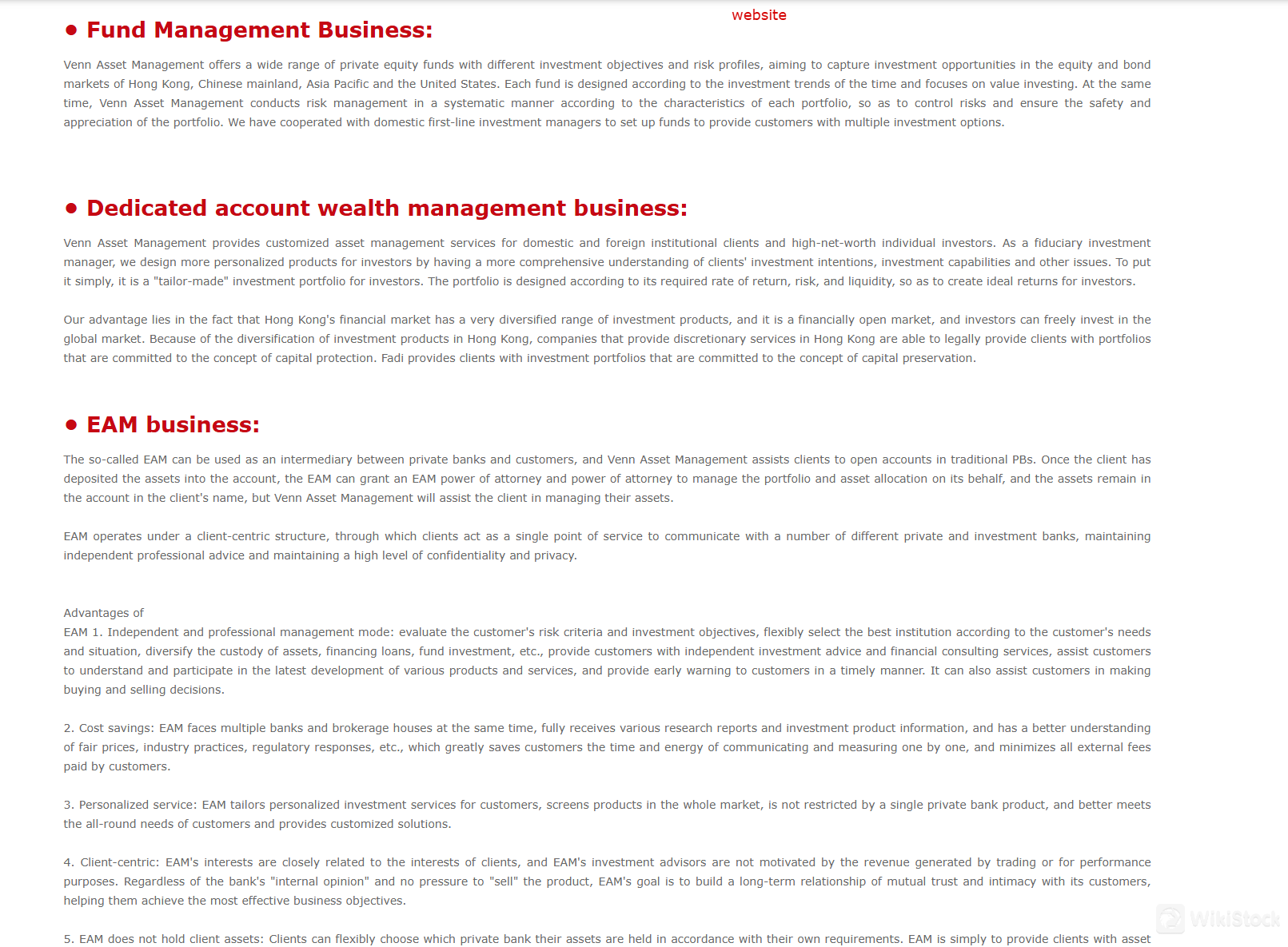

Asset Management: Through its Fund Management Business, Dedicated Account Wealth Management Business, and EAM Business, WE FINANCIAL provides professional management of assets, catering to various risk appetites and investment objectives.

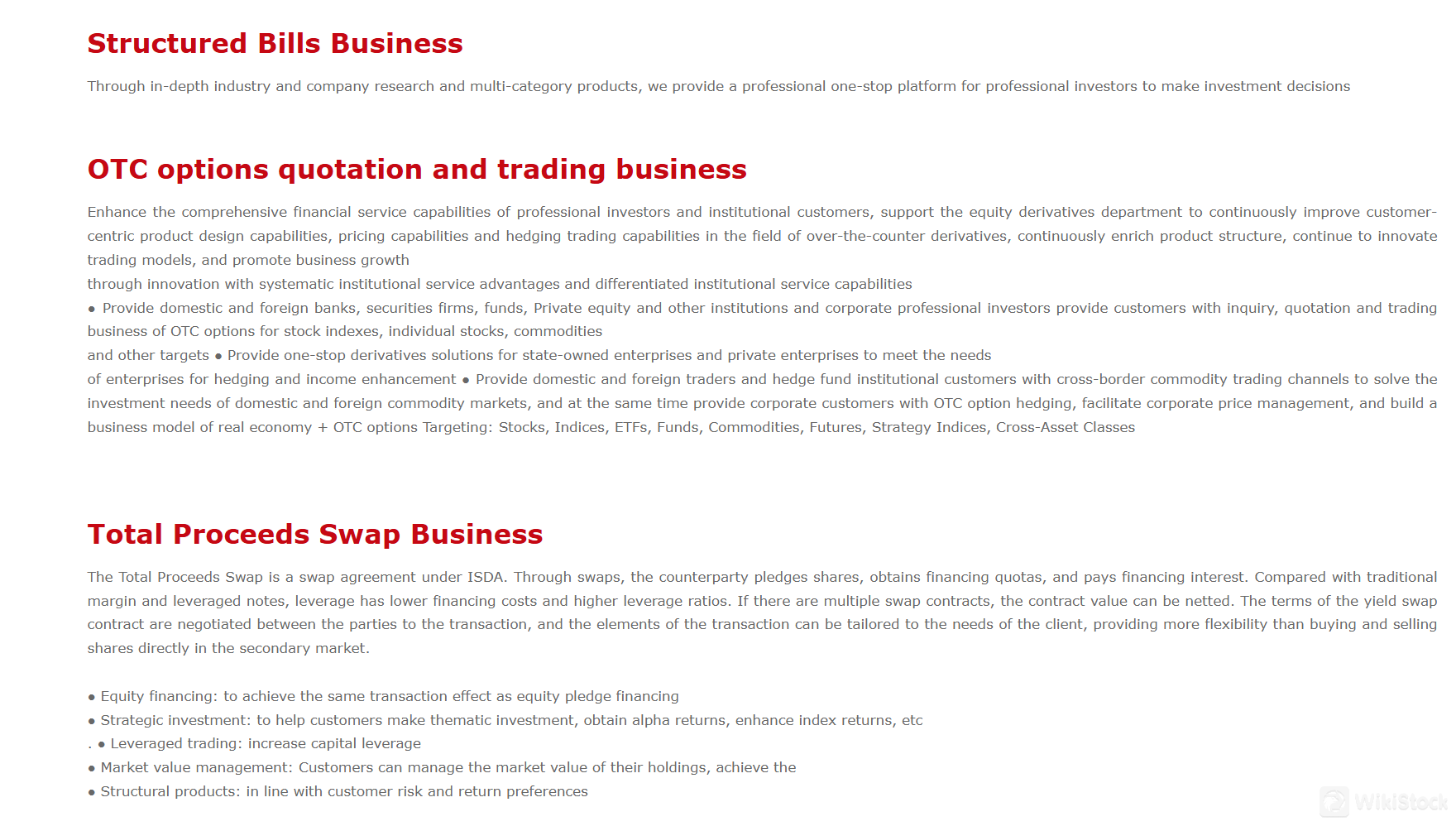

Equity Derivatives: Offering a range of products such as Structured Bills Business, OTC Options Quotation and Trading Business, and Total Proceeds Swap Business, WE FINANCIAL enables clients to access innovative financial instruments for leveraging, strategic investments, market value management, and structural products.

Total Proceeds Swap: A specialized swap agreement under ISDA, allowing counterparty shares to be pledged for financing quotas while minimizing financing costs and maximizing leverage ratios.

Equity Financing: Providing equivalent transaction effects as equity pledge financing.

Strategic Investment: Assisting clients in thematic investments to attain alpha returns and enhance index returns.

Leveraged Trading: Enabling clients to increase capital leverage for potentially higher returns.

Market Value Management: Allowing clients to manage the market value of their holdings effectively

Structural Products: Offering products aligned with client risk and return preferences, enhancing portfolio diversification and risk management.

WE FINANCIAL charges different types of fee items such as trade-related services charges, physical scrip handling, witness services, real time delivery against payment (RTGS) and settlement instruction charges.

Trade-Related Services Charges:

Physical Scrip Handling:

These fees apply if you choose to hold your stock certificates in physical form instead of electronic records:

Witness Service:

This service involves having a witness present when signing stock transfer documents. WE Financial itself doesn't offer this service, but the document mentions a third-party fee of HK$500 per deed if you require a witness.

Settlement Instruction Charges:

These fees come into play when you instruct WE Financial to deposit or withdraw your securities:

Real Time Delivery Against Payment (RTGS):

This service allows for immediate delivery of securities against payment. It comes with a fee of HK$100 per stock code.

Nominee Services:

If a company you've invested in is undergoing a compulsory share buyback, WE Financial charges a fee (HK$2,000 per trade) to handle the process on your behalf. This fee is in addition to the buyback amount, CCASS handling charges, and any applicable interest.

Important Notes:

| Trade-Related Services Charges | |

| Commission | 0.25% per trade (negotiable), minimum HK$100 per trade |

| Transaction Levy | 0.0027% per trade (rounded to nearest cent) |

| Trading Fee | 0.005% per trade (rounded to nearest cent) |

| CCASS Stock Settlement Fee | 0.006% per trade (minimum HK$2, maximum HK$500) |

| Stamp Duty | 0.1% per trade, minimum HK$1 |

| Physical Scrip Handling | |

| Custodian Fee | Waived |

| Deposit Charge | 0.05% of stock value at previous trading day (min HK$20) + HK$5 per transfer deed (negotiable) |

| Withdrawal Charge | 0.1% of stock value at previous trading day (min HK$300) + HK$52 scrip fee per log (negotiable) |

| Settlement Instruction Charges | |

| Deposit Instruction | 0.05% of value of eligible securities at previous trading day (min HK$10, max HK$2,000, negotiable) per stock code |

| Withdrawal Instruction | 0.1% of value of eligible securities at previous trading day (min HK$150, negotiable) per stock code |

| Investor Settlement Instruction | HK$5 per deed (deposit/withdrawal) |

| Real Time Delivery Against Payment | |

| Real Time Delivery Against Payment | HK$100 per stock code |

| Nominee Services | |

| Compulsory Share Buyback | HK$2,000 per trade + cash amount of compulsory share buyback + CCASS handling charge + interest |

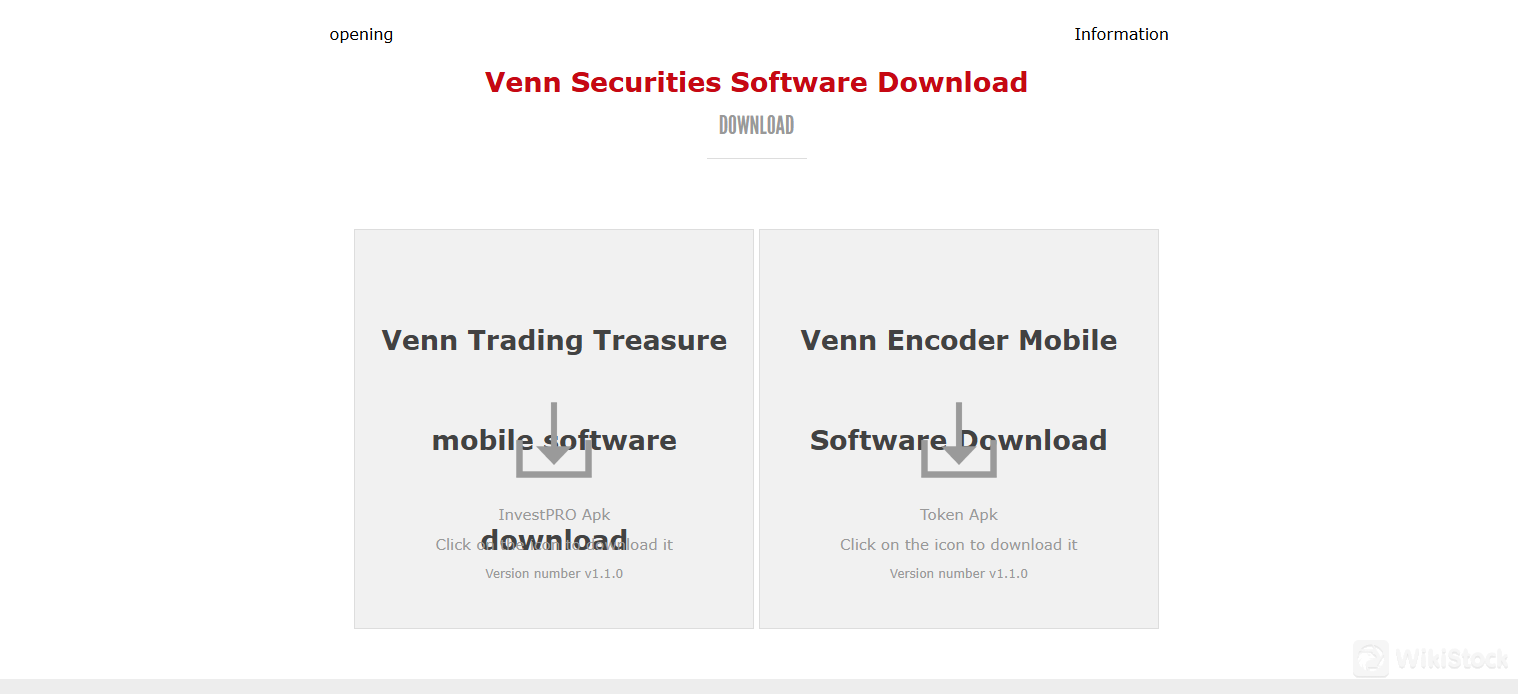

WE FINANCIAL offers two distinct trading platforms: Venn Trading Treasure and Venn Encoder Mobile Software.

Venn Trading Treasure is a comprehensive mobile software solution, known as InvestPRO Apk, specifically tailored for trading and investment activities. This platform provides users with robust tools and features to facilitate seamless trading experiences. It includes functionalities such as real-time market data, trading execution capabilities across different asset classes, portfolio management tools, and possibly research and analysis resources. The emphasis is on accessibility and convenience, allowing investors to manage their investments efficiently from their mobile devices.

Venn Encoder Mobile Software (token APK) represents another offering from WE FINANCIAL, focusing on a specialized aspect of trading or investment management. While specific details about this platform are not provided, it suggests a niche focus or unique feature set that distinguishes it within the companys suite of services.

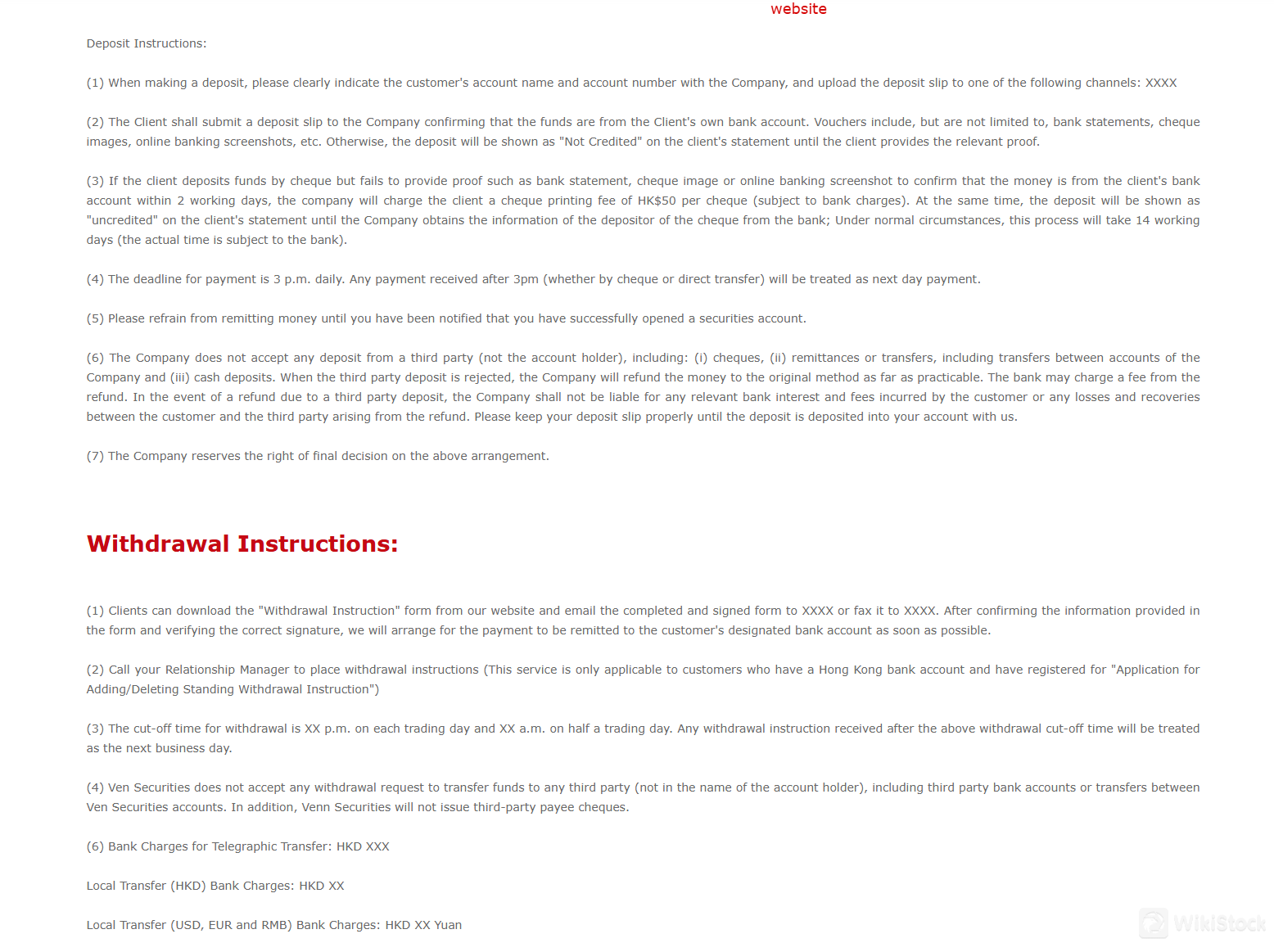

Documentation Requirements: Deposit instructions emphasize the need for clear indication of account name and number, along with uploading deposit slips via specified channels.

Verification Process: Clients must provide proof that funds originate from their own bank account (e.g., bank statements, cheque images, online banking screenshots) to avoid delays or fees.

Cheque Deposits: Clients depositing by cheque must provide proof of origin within 2 working days to avoid a HK$50 fee per cheque and potential delays until verification from the bank, which may take up to 14 working days.

Payment Deadline: Payments received after 3 p.m. are processed the following day.

Third-Party Deposits: WE FINANCIAL does not accept deposits from third parties, including cheques, remittances, transfers, or cash deposits. Refunds for rejected third-party deposits are subject to bank fees and are at the discretion of WE FINANCIAL.

Submission: Clients can submit withdrawal instructions via a downloadable form from the website, email, or fax.

Verification: Withdrawal instructions are processed after verifying the information and signature on the form.

Cut-off Times: Withdrawal requests must be received before the specified cut-off times to be processed on the same trading day.

Restrictions: Withdrawals cannot be made to third-party accounts or between WE FINANCIAL accounts.

Bank Charges: Fees apply for telegraphic transfers and local transfers in different currencies.

WE FINANCIAL's Research and Education offerings provide valuable insights and knowledge related to company news, financial information, and risk warnings. This aspect of their services is aimed at educating clients about market trends, investment opportunities, and potential risks associated with financial decisions. This educational component helps clients make informed choices by staying updated on relevant developments and understanding the implications for their investments.

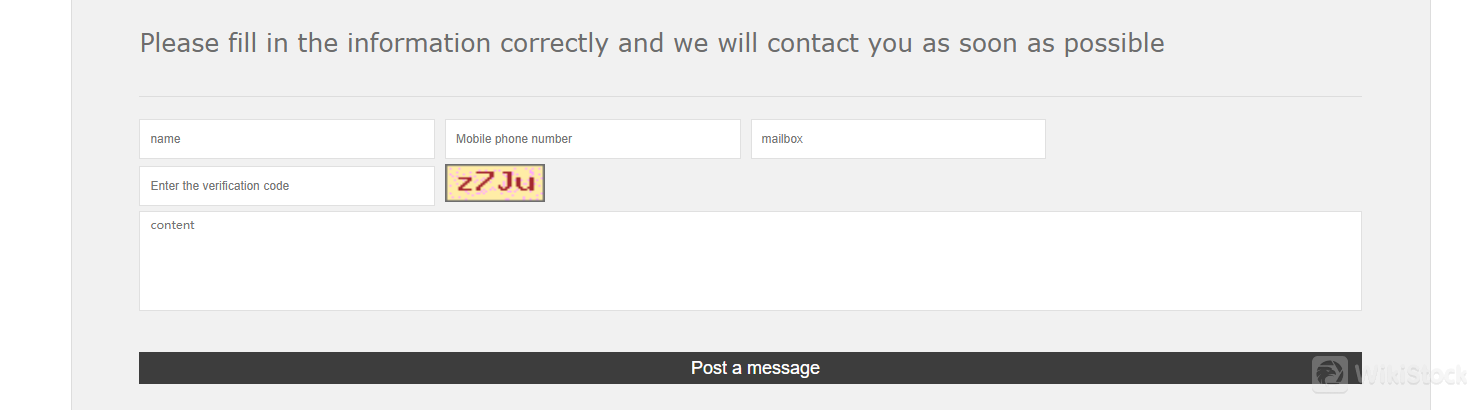

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: ( 852 ) 37008169 / +86 ( 0571 ) 85152359 / 0086 577 63778818

Email: information@we-holding.com

Address: 26th Floor, OVEST, 77 Wing Lok Street, Sheung Wan, Hong Kong

WE FINANCIAL offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform.

WE FINANCIAL stands out due to its strong regulatory oversight by SFC and diverse range of comprehensive financial services.

However, prospective clients should be mindful of potential challenges such as the complexity of navigating their extensive offerings and the need to address language barriers effectively for diverse clientele.

WE FINANCIAL is well-positioned to serve sophisticated investors seeking regulatory assurance, comprehensive financial solutions, and innovative investment opportunities, provided they are prepared to navigate potential complexities and address language considerations.

Frequently Asked Questions (FAQs)

Is WE FINANCIAL regulated?

Yes. It is regulated by SFC.

What types of securities can I invest in with WE FINANCIAL ?

You can trade stock, futures, options, mutual funds and ETFs and bond.

What are platforms offered by WE FINANCIAL ?

It provides Venn Trading Treasure and Venn Encoder Mobile Software.

How can I contact the customer support team at WE FINANCIAL ?

You can contact via telephone: ( 852 ) 37008169 / +86 ( 0571 ) 85152359 / 0086 577 63778818 , email: information@we-holding.com and online messaging.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

維恩財富

Subsidiary

--

维恩资产管理有限公司

Subsidiary

--

維恩證券

Subsidiary

Download App

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

Sanfull Securities

Score

DL Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score