Founded in 2010 as an institutional fixed income broker, Shard Capital has evolved into an organisation with over 80 professionals. It focuses on providing core custody and dealing services, with linked investment management and broking offerings. These business areas are distinct from each other, but benefit from shared expertise, networks and resources.

What is Shard Capital?

Founded in 2010 as an institutional fixed income broker, Shard Capital has grown into an institution with more than 80 professionals. It focuses on providing core custody and trading services, as well as providing related investment management and brokerage services. The main business of Shard Capital includes Investment Services, Custody and Dealing Services custody, Institutional Services, Capital Markets. Shard Capital serves as an alternative investment fund manager for a direct lending fund aimed at small to mid-size enterprises (SMEs), as well as a seed stage tech fund that concentrates on augmented reality/virtual reality, artificial intelligence, and the internet of things.

Pros and Cons of Shard Capital

Shard Capital has a good reputation and operates under formal regulatory oversight. Their front office team is supported by a central infrastructure team that covers finance, operations, risk, legal and compliance, technology, marketing and product management functions. Also, Shard Capital has supported Walking With The Wounded since 2014, helping raise over £30,000 for the charity. The investment management team at the firm possesses profound knowledge and extensive experience. However, it lacks transparency regarding the cost of margin interest rates and does not offer substantial professional educational resources.

Is Shard Capital safe?

Yes, Shard Capital is regulated. It is effectively regulated by regulators and offers Margin Interest. However, it is wise to conduct thorough research and consideration before engaging in trading activities to ensure a safer and more reliable trading experience.

What are securities to trade with Shard Capital?

The business scope of Shard Capital covers Investment Services, Custody and Dealing Services custody, Institutional Services, Capital Markets.

Investment Services: Shard Capitals investment management services cater for intermediaries, institutional investors and high net worth individuals as well as retail clients.

Custody and Dealing Services custody: Shard Capital provides a comprehensive custody and dealing service covering almost any global or UK based asset type.

Institutional Services: The firm's institution-oriented team provides expertise in many niche market areas. They cater to a wide range of institutions, including asset managers, investment funds, private and commercial banks, corporations, family offices and high net worth professional investors.

Capital Markets: Working closely with corporate clients, the Capital Markets team offers a full range of services to small and lower mid-cap companies, helping them with equity or debt financing with a tailored approach to each unique requirement.

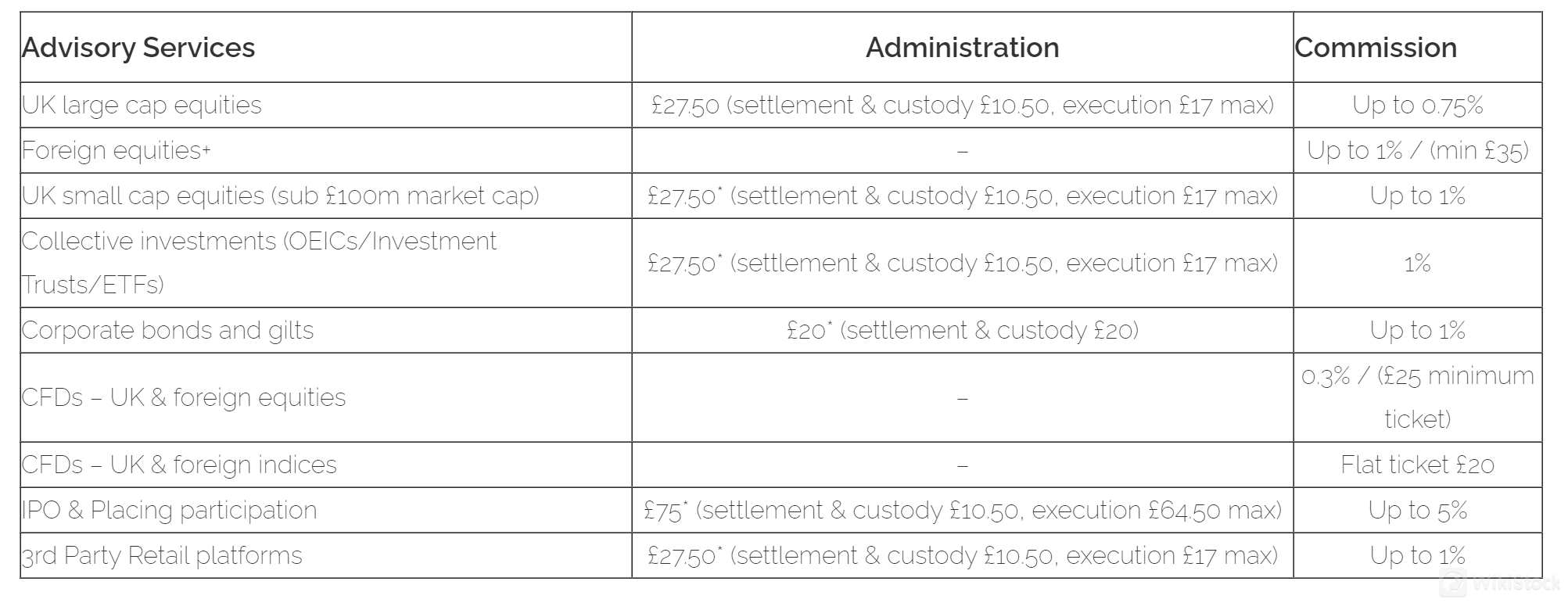

Shard Capital Fees Review

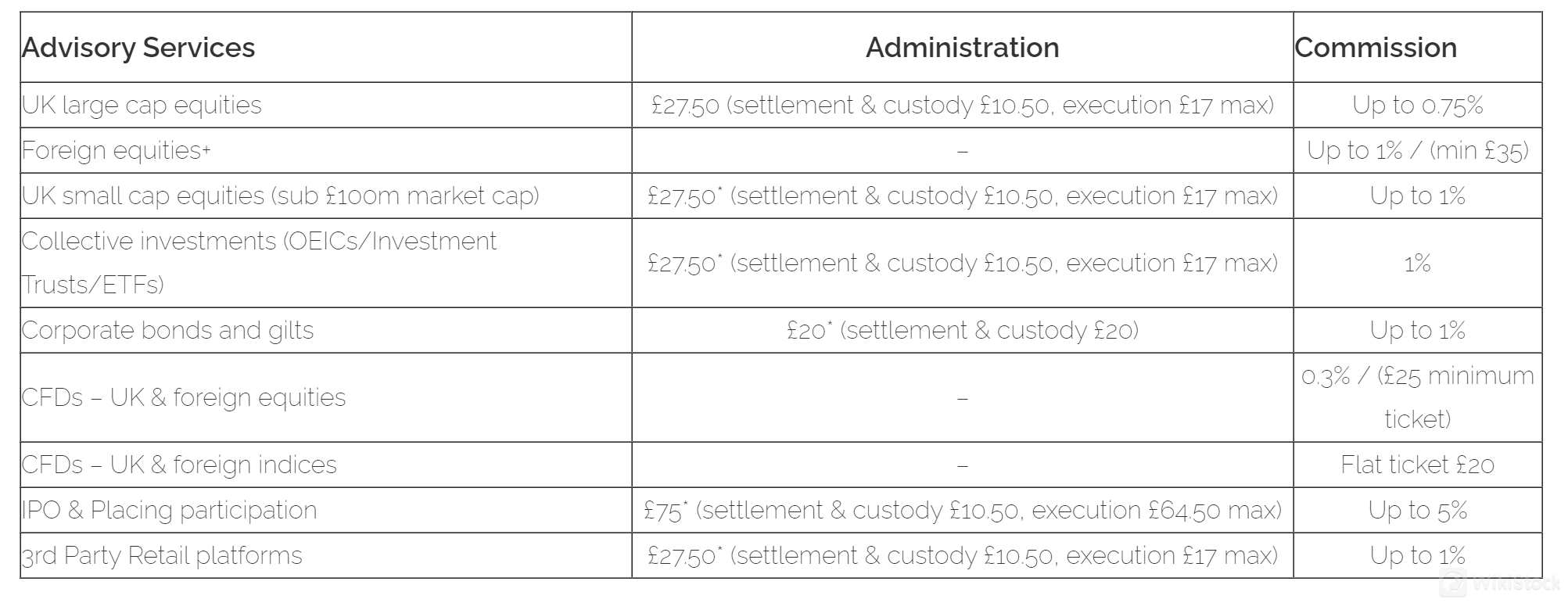

Fess on advisory services and investment products are listed clearly. Their services includes administration, commission-based trading, and advisory services. Notably, their fees for UK large cap equities trading are £27.50, comprising £10.50 for settlement and custody, and a maximum execution fee of £17, with commissions capped at 0.75%. Foreign equities attract fees of up to 1%, with a minimum of £35. UK small cap equities (sub £100m market cap) incur a fee of £27.50, with a commission of up to 1%. Collective investments, such as OEICs, Investment Trusts, and ETFs, are subject to a £27.50 fee and a 1% commission. Corporate bonds and gilts carry a £20 fee, with commissions of up to 1%. CFDs on UK and foreign equities have a commission of 0.3%, with a minimum ticket of £25, while CFDs on UK and foreign indices have a flat ticket fee of £20. IPO and Placing participation comes with a £75 fee, comprising £10.50 for settlement and custody, and a maximum execution fee of £64.50, with commissions of up to 5%. Lastly, third-party retail platforms incur a £27.50 fee, with commissions of up to 1%.

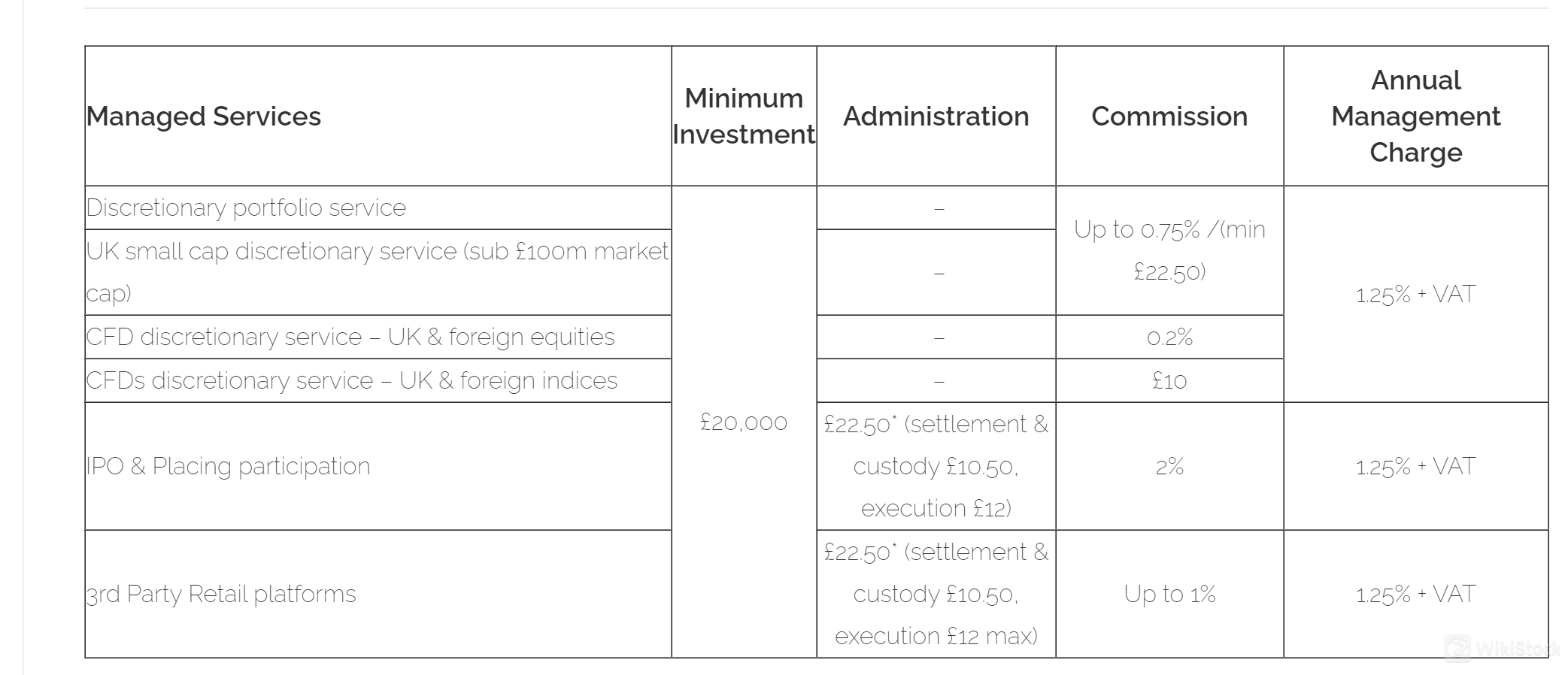

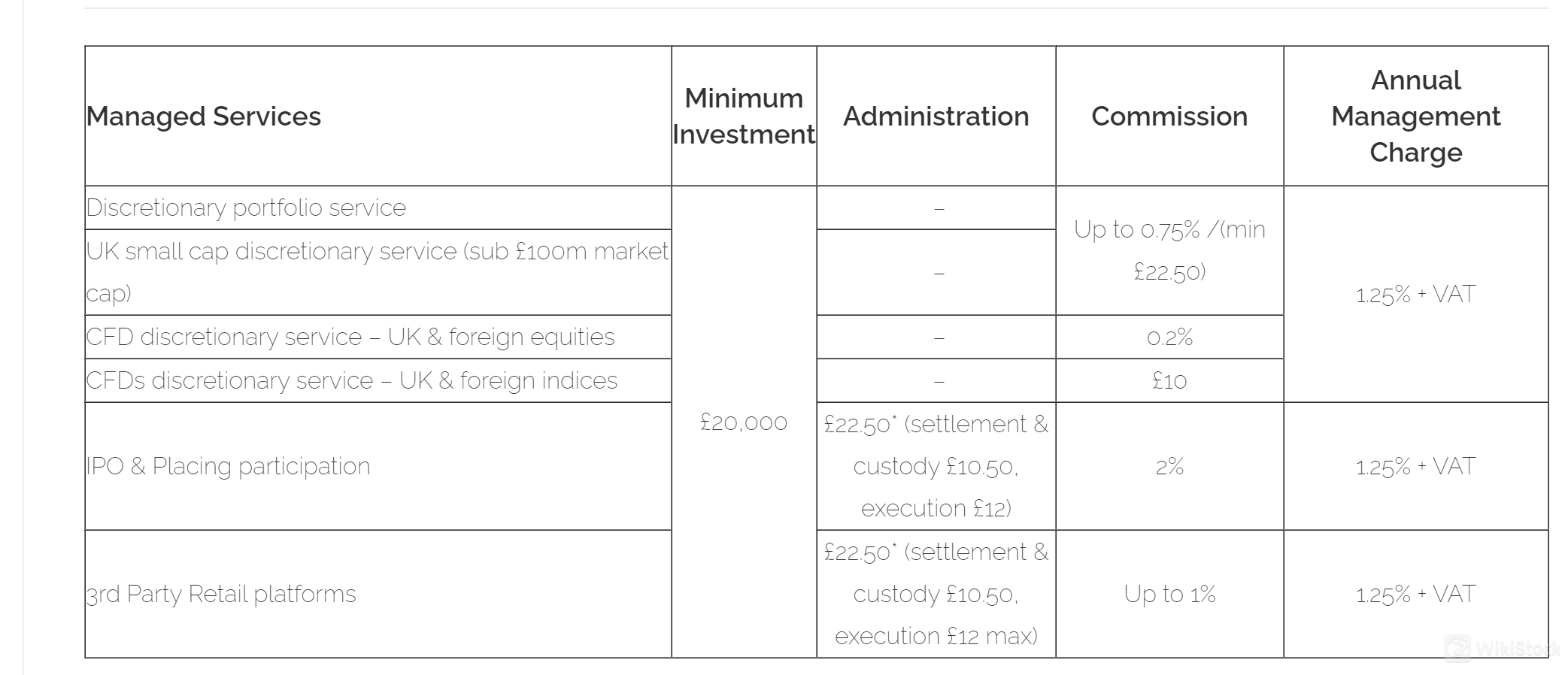

The Discretionary Portfolio Service requires a minimum investment of £20,000 and incurs an annual management charge of 1.25% plus VAT, along with commissions of up to 0.75% (minimum £22.50). The UK Small Cap Discretionary Service, focused on companies with a market capitalization below £100 million, attracts a commission of up to 0.75%. The CFD Discretionary Service for UK and foreign equities charges a commission of 0.2%, while the corresponding service for UK and foreign indices carries a flat fee of £10. IPO and Placing participation involves a fee of £22.50, consisting of £10.50 for settlement and custody, and a maximum execution fee of £12, along with a 2% commission and an annual management charge of 1.25% plus VAT. For investments through third-party retail platforms, Shard Capital levies a fee of £22.50, comprising £10.50 for settlement and custody, and a maximum execution fee of £12, with commissions of up to 1% and an annual management charge of 1.25% plus VAT.

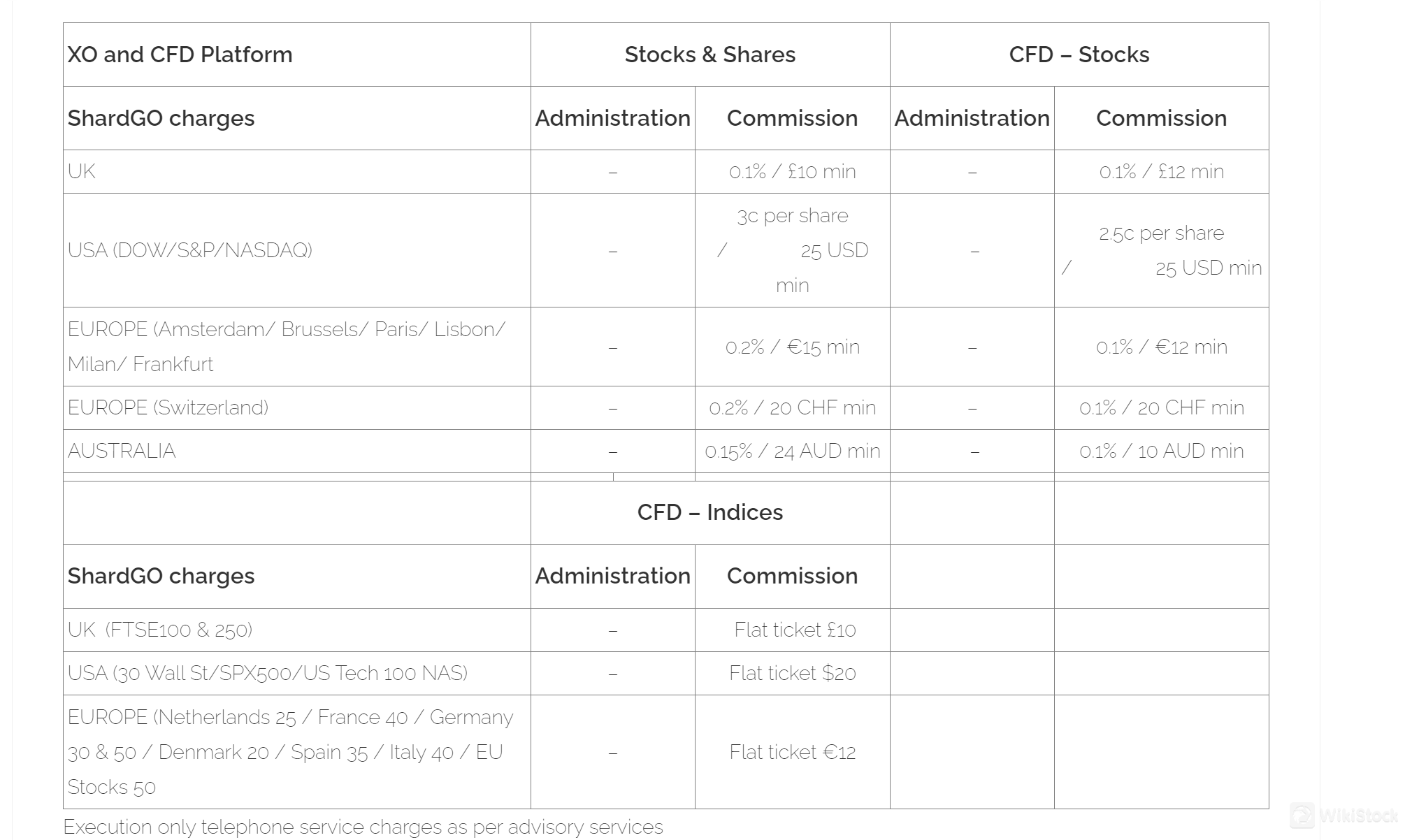

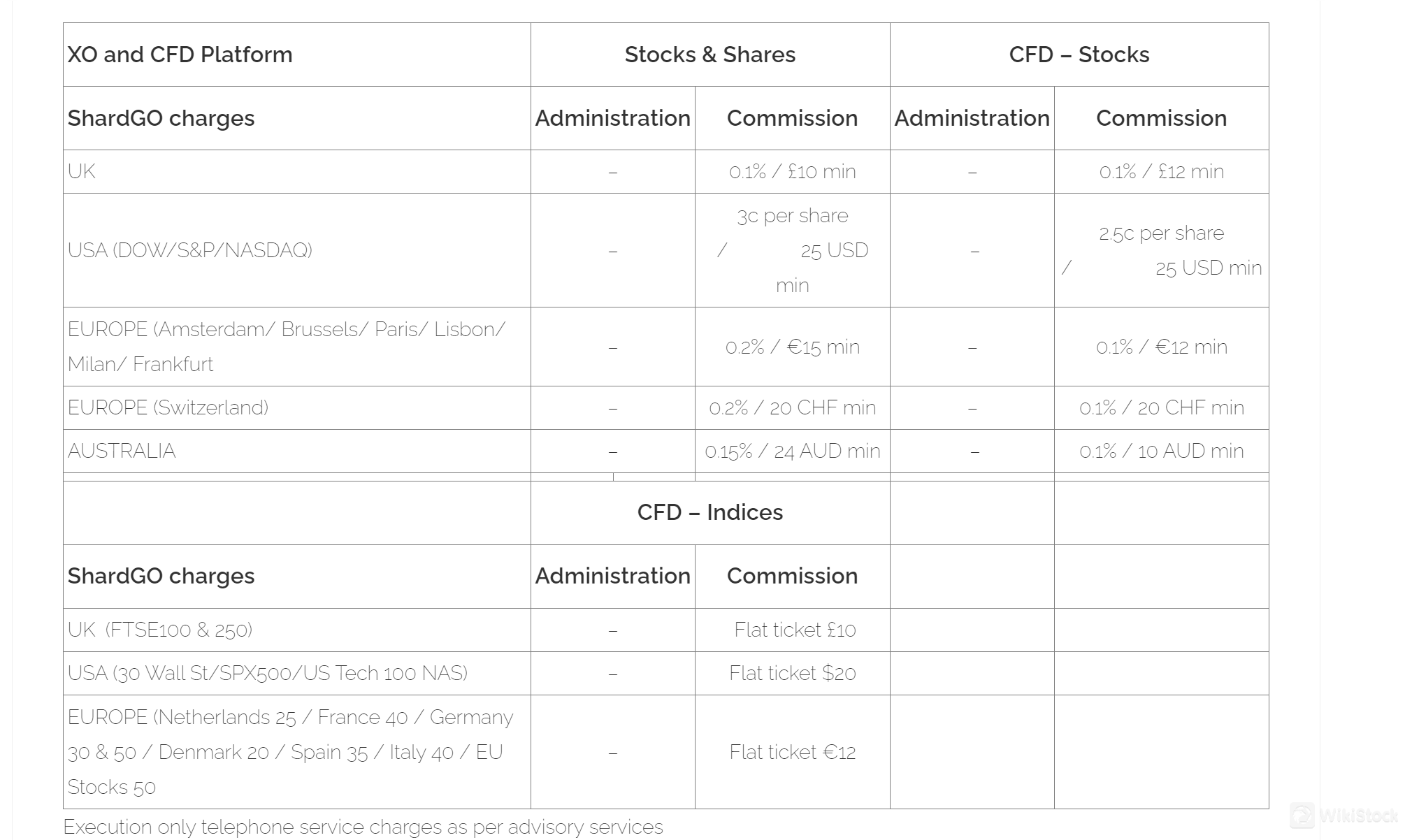

For stocks and shares trading, Shard Capital charges a commission of 0.1% with a minimum of £10 for UK equities, $0.03 per share (minimum $25) for US equities, 0.2% (minimum €15) for most European equities, 0.2% (minimum 20 CHF) for Swiss equities, and 0.15% (minimum 24 AUD) for Australian equities.

When it comes to CFD trading on stocks, the commissions are slightly lower, with 0.1% (minimum £12) for UK equities, $0.025 per share (minimum $25) for US equities, 0.1% (minimum €12) for most European equities, 0.1% (minimum 20 CHF) for Swiss equities, and 0.1% (minimum 10 AUD) for Australian equities.

For CFD trading on indices, Shard Capital charges a flat ticket fee of £10 for UK indices (FTSE 100 and 250), $20 for US indices (Dow Jones Industrial Average, S&P 500, and NASDAQ-100), and €12 for major European indices, including the Netherlands AEX, French CAC 40, German DAX and MDAX, Danish OMX 20, Spanish IBEX 35, Italian FTSE MIB, and Euro STOXX 50.

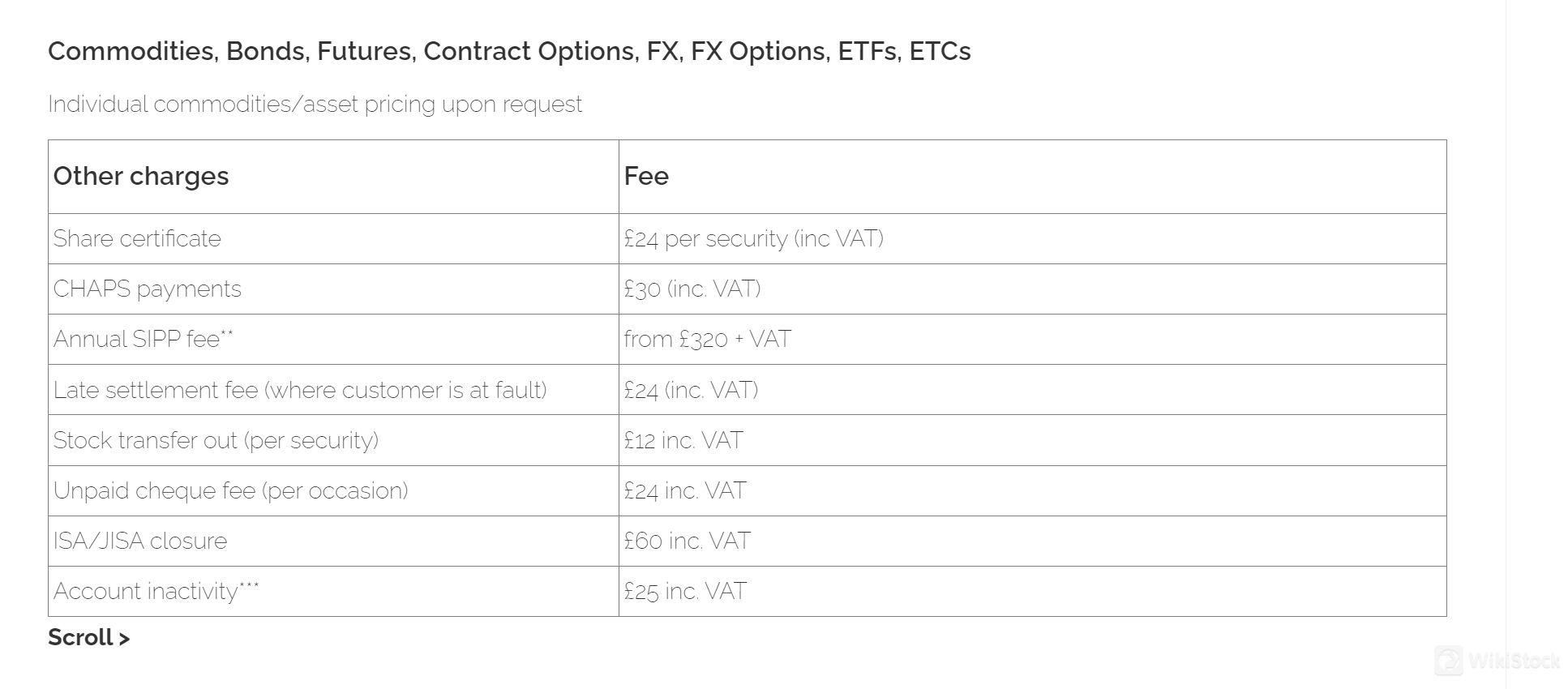

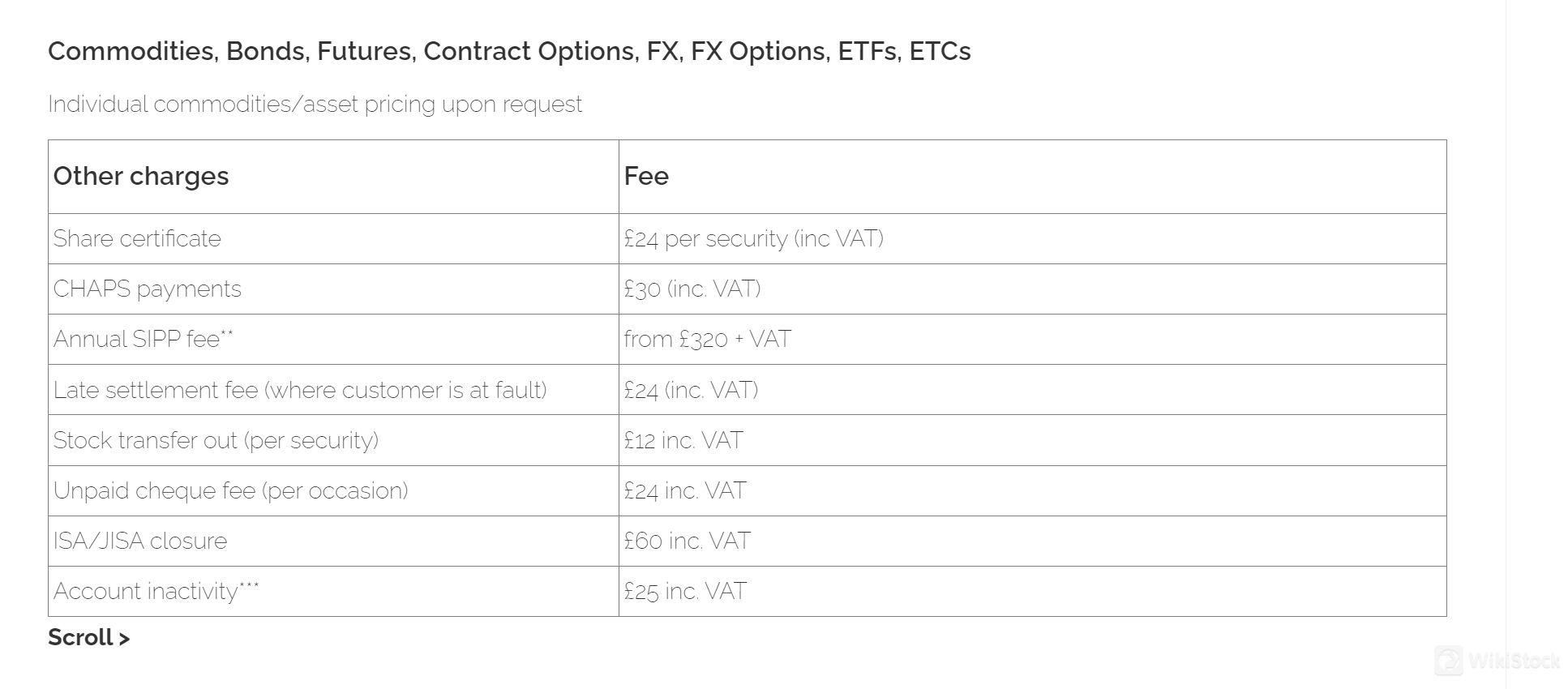

For trading on commodities, bonds, futures, contract options, foreign exchange (FX), FX options, exchange-traded funds (ETFs), and exchange-traded commodities (ETCs), various fees are also applied. The pricing for these individual asset classes is provided upon request, reflecting Shard Capital's commitment to transparency and tailored solutions.

In addition to the asset-specific fees, Shard Capital charges various ancillary fees for administrative services. These include a fee of £24 per security (inclusive of VAT) for share certificates, £30 (inclusive of VAT) for CHAPS payments, and an annual SIPP fee starting from £320 plus VAT. Late settlement fees, where the customer is at fault, are £24 (inclusive of VAT), while stock transfers out are subject to a charge of £12 per security, inclusive of VAT. Unpaid cheques incur a fee of £24, also inclusive of VAT, and ISA/JISA account closures attract a fee of £60, inclusive of VAT. Furthermore, an account inactivity fee of £25, inclusive of VAT, may be charged for dormant accounts.

Customer Service

Shard Capital can be contacted (0)203 971 7000 by call or info@shardcapital.com by email for any inquiries or assistance.

Physical Address: Shard Capital Partners LLP, 70 Mark Lane, London, EC3R 7NQ

Shard Capital also remain presence on some social media platforms, like Linkedin, Youtube and X.

Conclusion

In conclusion, Shard Capital, established in 2010 in London, has evolved from an institutional fixed income broker to a comprehensive financial services provider with over 80 professionals. The firm offers a range of services including investment management, custody and dealing services, institutional services, and capital markets. It also acts as an alternative investment fund manager for SMEs and tech-focused seed stage funds. While Shard Capital is praised for its regulatory compliance and secure infrastructure, it faces challenges such as lack of transparency in pricing and insufficient educational resources for clients. Clients should conduct thorough research and consider these aspects to ensure a secure and informed trading experience with Shard Capital.

FAQs

Is Shard Capital safe to trade with?

Yes, Shard Capital is considered safe for trading. It is regulated by competent authorities and adheres to strict regulatory standards to ensure the security of client accounts and funds. However, as with any investment, it is advisable to conduct thorough research before engaging in trading activities.

Is Shard Capital a good platform for beginners?

While Shard Capital offers a range of investment services, it may not provide extensive educational resources for beginners. New investors should be prepared to seek learning materials from external sources or inquire directly with the firm about support for novice traders.

Is Shard Capital legit?

Yes, Shard Capital is a legitimate financial services provider established in 2010 and based in London. It operates under formal regulatory oversight and offers various services including investment management, custody, and capital markets expertise.

Is Shard Capital good for investing/retirement?

Shard Capital provides a variety of services that can be suitable for long-term investing and retirement planning, such as asset management and alternative investments. Its capabilities in managing direct lending funds and technology-focused investments might appeal to those looking for diversified retirement portfolios. However, potential investors should consider their individual financial goals and risk tolerance when planning for retirement.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United Kingdom

United KingdomObtain 1 securities license(s)

![]() Owns 3 seat(s)

Owns 3 seat(s)