Score

島大証券

http://shimadai.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

SHIMADAI Securities Co.,Ltd

Abbreviation

島大証券

Platform registered country and region

Company address

Company website

http://shimadai.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.11%

Margin Trading

YES

Regulated Countries

1

Products

5

| SHIMADAI Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1909 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Japanese Domestic/Foreign Stocks, Investment Trust, Foreign Bonds |

| Commissions | Domestic securities: 0.11-1.265% plus tiered fixed rate based on transaction volume, min 2750 yen |

| Domestic stocks: 0.165-1.1% plus tiered fixed rate based on transaction volume | |

| US stocks: 11% for volume below ¥25,000; (1.20%% of Transaction Fee Basis)x 1.1, min ¥2,750 for volume over ¥25,000 | |

| Customer Service | Head office: 〒930-0044 2-4-9 Chuo-dori, Toyama City, Toyama Prefecture |

| Tel: 076-423-8331 (Business hours : 9:00~17:00 during workdays); inquiry form; FAQ |

SHIMADAI Securities Information

Established in 1909, SHIMADAI Securities is a venerable financial services firm that provides a comprehensive selection of investment products, including Japanese domestic and foreign stocks, investment trusts, and foreign bonds. The firm actively releases monthly investment reports to equip investors with up-to-date information and analyses of the financial landscape.

Regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Hokuriku Finance Bureau (Kinsho) No. 6, SHIMADAI Securities maintains steadfast adherence to stringent standards of integrity and credibility in all its financial operations.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Online Support |

| Established History |

- Regulated by the FSA:SHIMADAI Securities is regulated by the Japan Financial Services Agency (FSA) ensuring adherence to stringent regulatory standards, providing a level of security and trust for investors.

- Established History: SHIMADAI Securities has been operating since 1909, which is a long history that indicate stability and experience in the financial market. Cons:

- Limited Online Support: SHIMADAI Securities lacks comprehensive online support options such as email, live chat, or social media customer service. This can be inconvenient for clients who prefer digital communication or require assistance outside of business hours.

- Domestic Listed Securities

- Domestic Listed Stocks with Stock Warrants

- US Stock Overseas Order (routed via NYSE or NASDAQ)

- For selling: Contract value in USD (after deducting SEC Fee) converted to JPY using the company's exchange rate.

- For buying: Contract value in USD converted to JPY using the company's exchange rate.

- Is SHIMADAI Securities regulated by any financial authority?

- Yes, SHIMADAI Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director-General of the Hokuriku Finance Bureau (Kinsho) No. 6.

- What types of products does SHIMADAI Securities provide?

- Domestic and foreign stocks, investment trusts (mutual funds), and foreign bonds.

- Is SHIMADAI Securities suitable for beginners?

- Yes, SHIMADAI Securities is well regulated by FSA and provides resources and guidance through monthly investment information report publication, which is also helpful to beginners, helping them navigate the investment landscape with ease.

- What are the risks associated with the products offered by SHIMADAI Securities ?

- Investment products offered by SHIMADAI Securities Ltd, such as stocks and bonds, carry risks including market volatility, price slumps, and potential issuer bankruptcy. Mutual funds are not principal-guaranteed and can result in losses due to poor performance.

- How does SHIMADAI Securities ensure timely investment information for its clients?

- SHIMADAI Securities publishes a monthly investment information report called “Flower Stock,” which includes a selection of noteworthy domestic and foreign stocks, as well as investment trusts, to help clients make informed decisions.

Is It Safe?

Regulation:

SHIMADAI Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Hokuriku Finance Bureau (Kinsho) No. 6, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores SHIMADAI Securities's commitment to integrity and credibility in its services.

Safety Measures:

So far, we have not found security measures of SHIMADAI Securities on their website. If you intend to trade with the company, seek for clarification about this to make sure your funds are protected before commiting any actual captials.

What are Securities to Trade with SHIMADAI Securities?

Shimadai Securities offers a diverse range of investment products tailored to different investor needs and preferences.

For those who are sensitive to stock prices and the economy, Japanese domestic stocks provide a stable and accessible option. These stocks offer potential returns from dividends and sales gains, although they carry risks such as price slumps and company bankruptcy. The Japanese stock market has seen renewed energy due to economic policies like Abenomics and monetary easing, presenting opportunities to invest in promising companies.

For investors familiar with world affairs, foreign stocks can be an attractive option, offering higher potential returns but with increased risk. Shimadai Securities handles a variety of well-known overseas companies, including Apple, Amazon.com, and Microsoft etc. These stocks provide opportunities for dividends and sales gains, but also come with risks similar to domestic stocks.

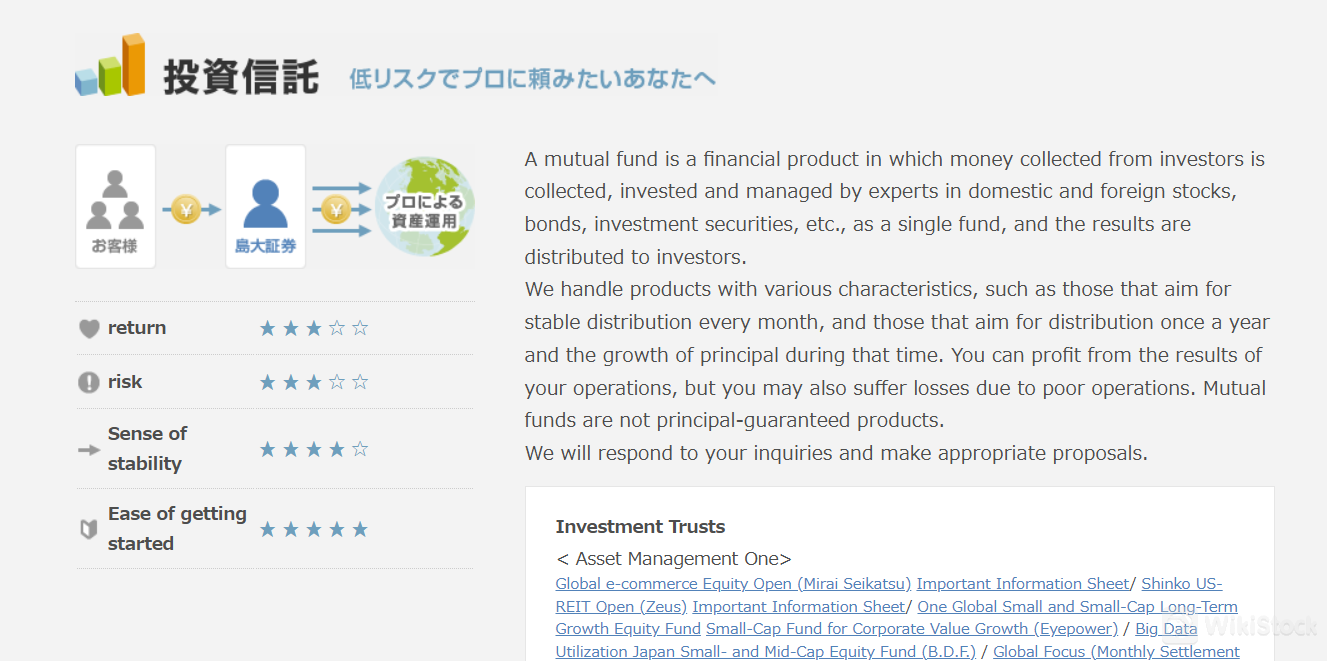

For those seeking diversification with professional management, investment trusts (mutual funds) are an excellent choice. These funds pool money from investors to invest in a diversified portfolio of domestic and foreign stocks, bonds, and other securities. Managed by experts, mutual funds offer a balance of risk and return, with various options to suit different investment goals.

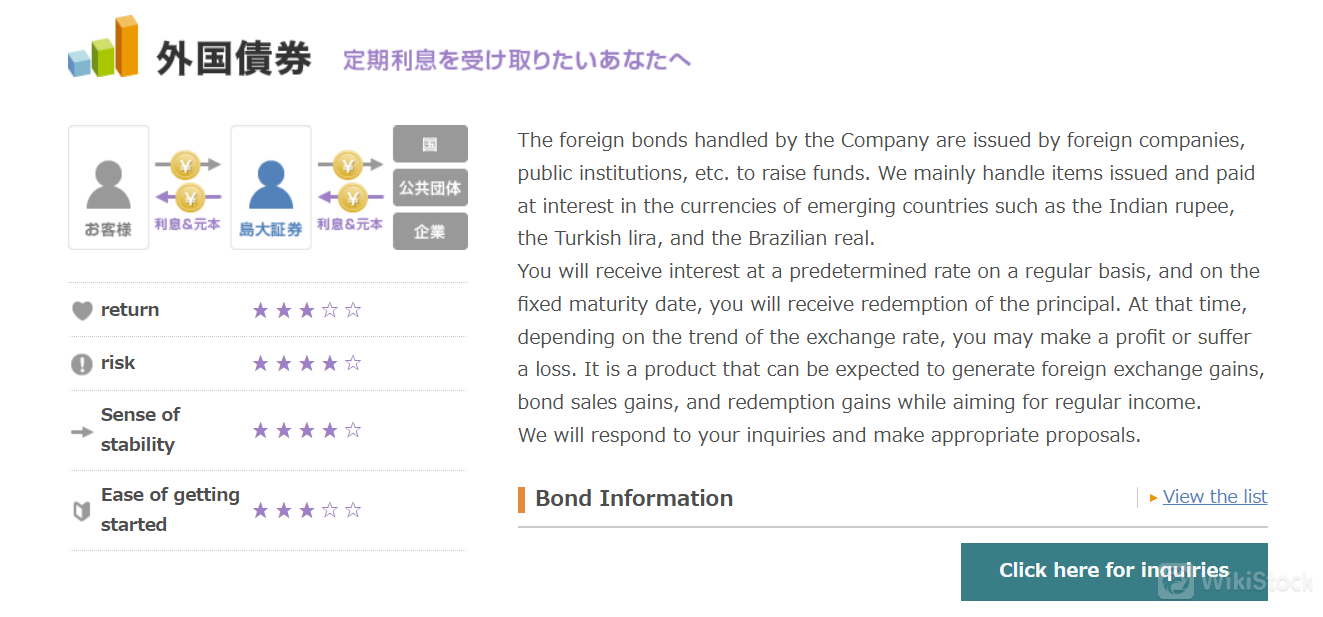

Lastly, Shimadai Securities offers foreign bonds, which provide regular interest income and potential foreign exchange gains. These bonds, issued by foreign companies and public institutions, are primarily denominated in emerging market currencies like the Indian rupee, Turkish lira, and Brazilian real. While offering steady income and the possibility of capital gains, foreign bonds also carry exchange rate and issuer risks.

Fees Review

Shimadai Securities offers transparent and tiered fee structures basing on trading volume for different products.

| Transaction Value | Base Commission (consumption tax included) |

| Up to ¥1,000,000 | Transaction Value x 1.265% (minimum ¥2,750) |

| ¥1,000,000 - ¥5,000,000 | Transaction Value x 0.968% + ¥2,970 |

| ¥5,000,000 - ¥10,000,000 | Transaction Value x 0.726% + ¥15,070 |

| ¥10,000,000 - ¥30,000,000 | Transaction Value x 0.605% + ¥27,170 |

| ¥30,000,000 - ¥50,000,000 | Transaction Value x 0.275% + ¥126,170 |

| Over ¥50,000,000 | Transaction Value x 0.110% + ¥208,670 |

| Transaction Value | Base Commission (consumption tax included) |

| Up to ¥1,000,000 | Transaction Value x 1.100% |

| ¥1,000,000 - ¥5,000,000 | Transaction Value x 0.990% + ¥1,100 |

| ¥5,000,000 - ¥10,000,000 | Transaction Value x 0.770% + ¥12,100 |

| ¥10,000,000 - ¥30,000,000 | Transaction Value x 0.605% + ¥28,600 |

| ¥30,000,000 - ¥50,000,000 | Transaction Value x 0.440% + ¥78,100 |

| ¥50,000,000 - ¥100,000,000 | Transaction Value x 0.275% + ¥160,600 |

| ¥100,000,000 - ¥1,000,000,000 | Transaction Value x 0.220% + ¥215,600 |

| Over ¥1,000,000,000 | Transaction Value x 0.1650% + ¥765,600 |

| Transaction Fee Basis | Base Commission (consumption tax included) |

| Up to ¥25,000 | 11% of Transaction Fee Basis |

| Over ¥25,000 | (1.20% of Transaction Fee Basis) x 1.1 (minimum ¥2,750) |

For the most up-to-date info, investors are encouraged to contact with the company directly for clarification.

Research & Education

Shimadai Securities enhancese customer service by offering timely and insightful investment information through its newly launched initiative, “Flower Stock” to improve their information-gathering and analytical capabilities. This monthly publication features a curated selection of noteworthy stocks, including Japanese stocks, U.S. stocks, and investment trusts, that have piqued their interest.

Customer Services

SHIMADAI Securities provides a smooth and supportive customer experience by offering multiple avenues for client interaction.

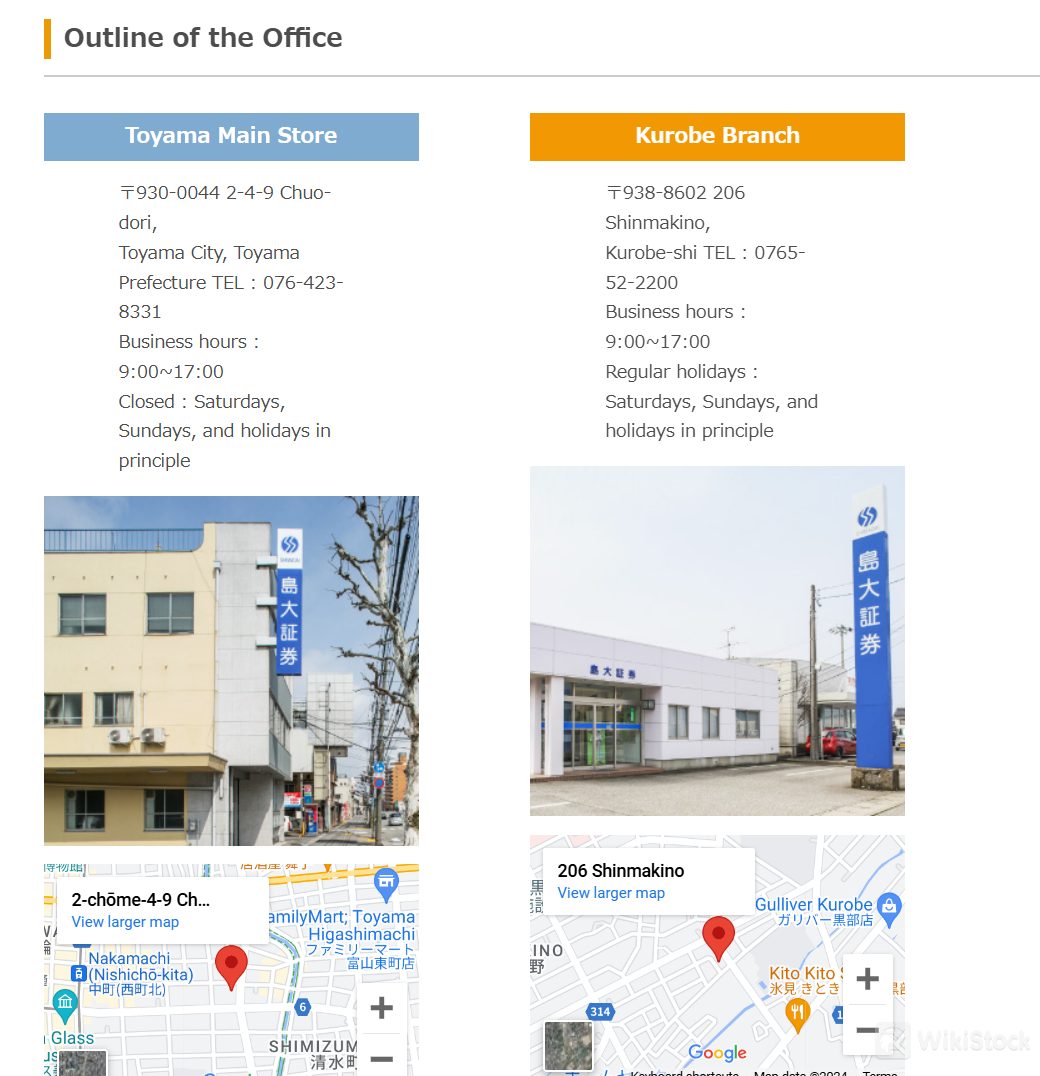

The head office, conveniently located at 〒930-0044 2-4-9 Chuo-dori, Toyama City, Toyama, is accessible for in-person consultations. Clients can also contact the head office by telephone at 076-423-8331 on workdays between 9:00 and 17:00 for general inquiries.

Additionally, SHIMADAI Securities has a branch office in Kurobe, which is located at 〒938-8602 206 Shinmakino, Kurobe-shi, which can be reached at 0765-52-2200.

In addition, an FAQ section is for your quick lookup for answers to general inquiries.

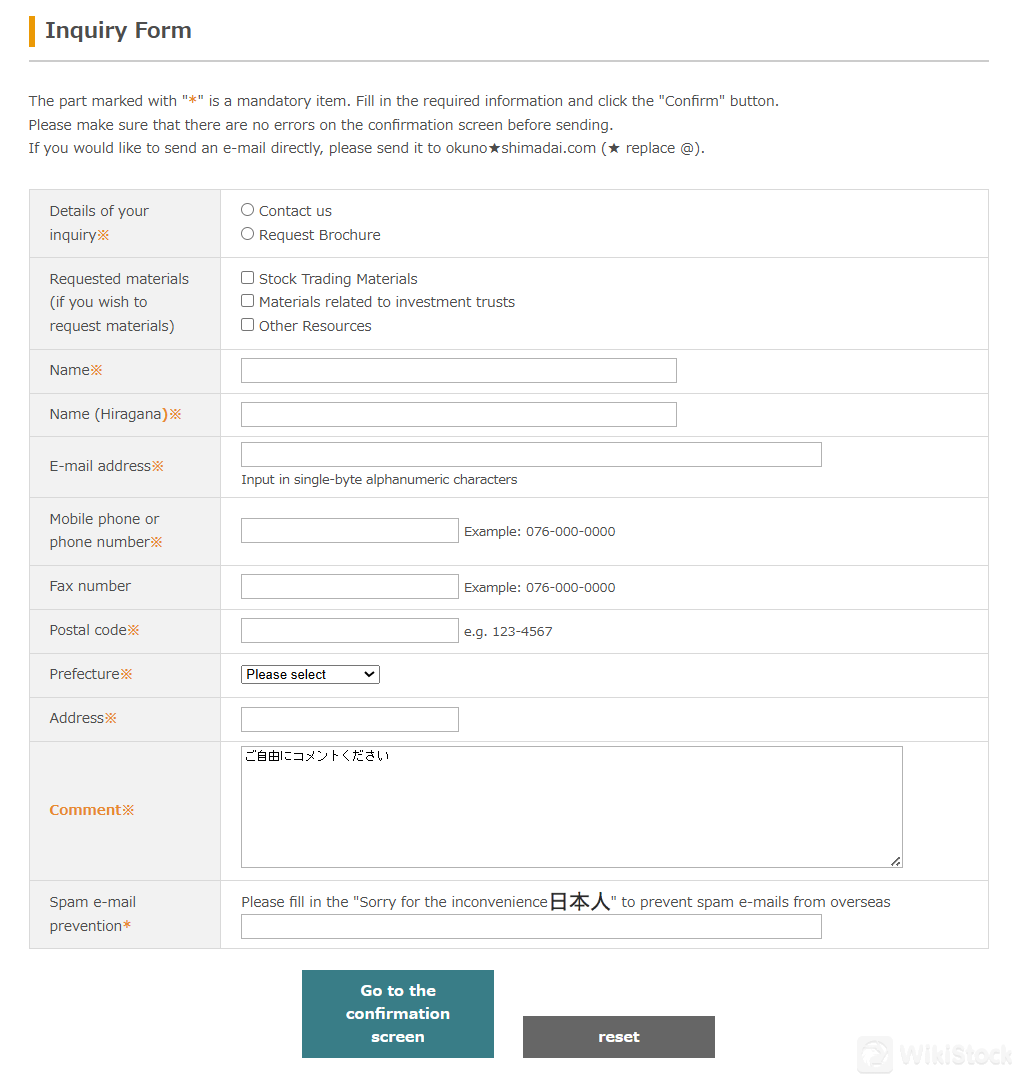

For those who prefer written communication, an inquiry form is available on the company's website.

However, some might find such customer service channels very limited, without comprehensive supports via email, live chat or social media platforms, there is chance that customer cannot address their inquiries timely.

Conclusion

SHIMADAI Securities is a trusted financial services provider, committed offering a diverse range of investment products, including domestic and foreign stocks, investment trusts, and foreign bonds.

Operating under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Hokuriku Finance Bureau (Kinsho) No. 6, the company upholds the highest standards of integrity and credibility in its financial operations. This regulatory adherence and comprehensive product offerings make SHIMADAI Securities a reliable choice for investors.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

IBKR

Score

Mizuho Securities

Score

Webull

Score

NOMURA

Score

PhillipCapital

Score

OANDA

Score

Daiwa

Score

Saxo

Score

IG

Score

Standard Chartered

Score