Limited Product Offerings: AFG Securities primarily focuses on Hong Kong Securities trading, which limits options for clients seeking a broader range of financial products.

Complex Fee Structure: While they do not charge account opening fees, navigating their fee schedule for transactions and services require careful attention to avoid unexpected costs.

Regulatory Status

Regulations:AFG operates under the regulatory oversight of the China Hong Kong Securities and Futures Commission (SFC) with license no. BIH335, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores AFG's commitment to integrity and credibility in its services.

Safety Measures:

Safety Measures: AFG implements robust security measures including heeToken for two-factor authentication, ensuring secure access to their trading platforms. This enhances protection against unauthorized access and safeguards client accounts during transactions.

Products & Services

AFG Securities Limited, an Exchange Participant of the Stock Exchange of Hong Kong Limited (Broker No. 0198) and a Licensed Corporation (CE No. BIH335) with the Securities and Futures Commission, specializes in offering local securities trading services.

AFG Securities provides streamlined and secure clearing and settlement procedures, real-time securities quotes, and timely issuance of detailed daily and monthly account statements. They also offer various supplementary functions such as managing cash dividends, handling bonus shares and warrants, facilitating new shares subscriptions, managing stock splits and consolidations, and executing warrant exercises.

Account Types

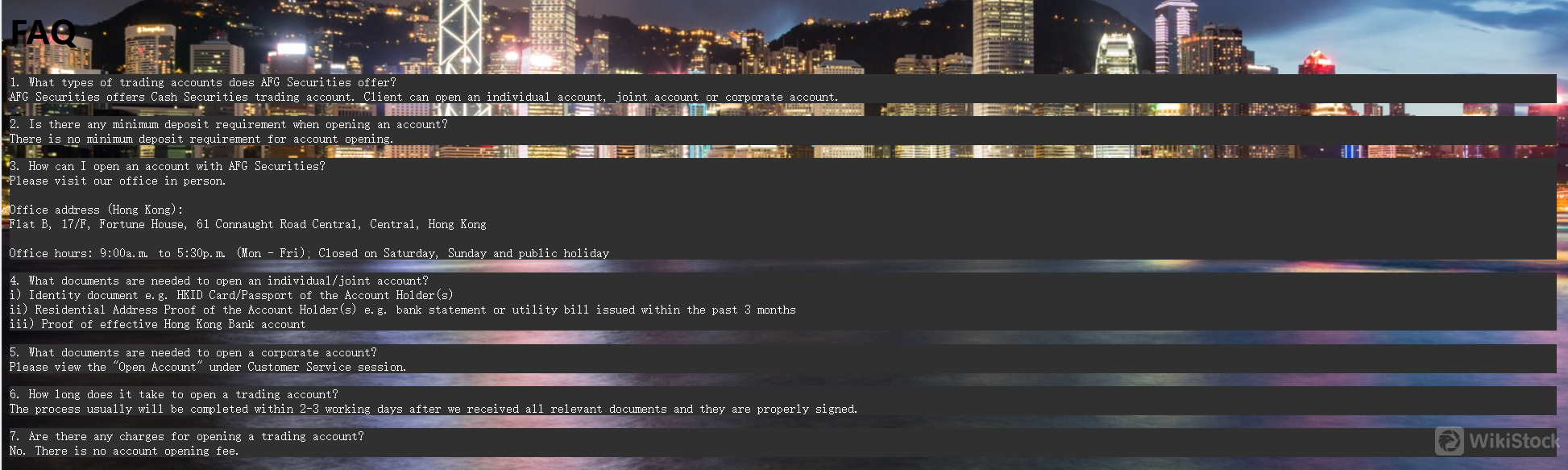

AFG offers Cash Securities trading accounts tailored to individual, joint, and corporate clients.For individual and joint accounts, clients need to provide identity documents such as HKID card or passport, proof of residential address like a recent bank statement or utility bill, and proof of an active Hong Kong bank account. The account opening process typically completes within 2-3 working days upon receipt of all necessary documents. AFG does not charge any fees for opening accounts and does not impose a minimum deposit requirement, providing flexibility for clients entering the market.

Fees Review

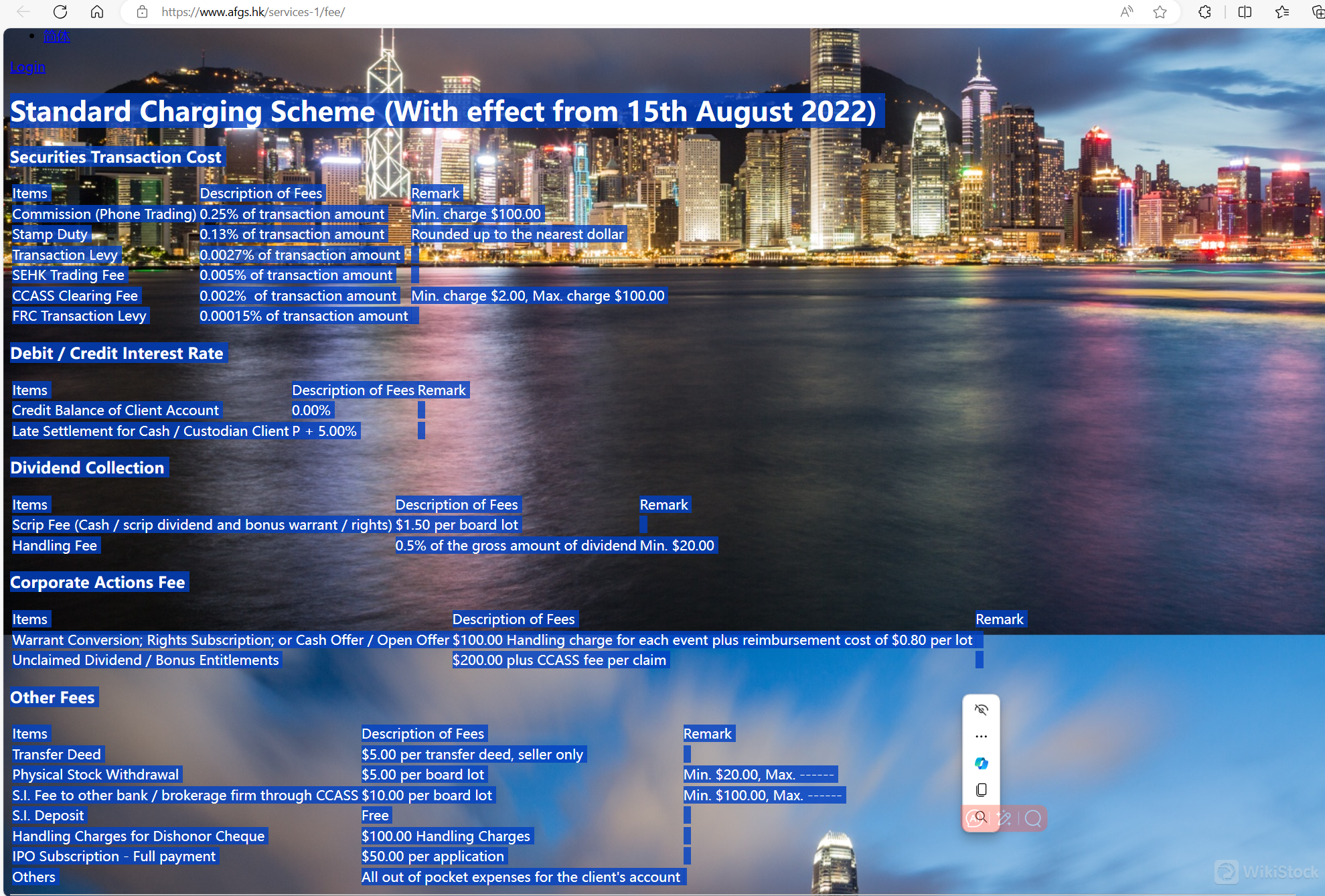

AFG applies a structured fee schedule for various services related to securities transactions and account management.

For phone trading, they charge a commission of 0.25% of the transaction amount, with a minimum fee of $100.

Stamp duty is set at 0.13% of the transaction amount, rounded up to the nearest dollar.

Additional fees include a transaction levy of 0.0027%, an SEHK trading fee of 0.005%, and a CCASS clearing fee of 0.002% of the transaction amount, with a minimum charge of $2.00 and a maximum of $100.00.

Regarding account management, AFG Securities does not provide interest on credit balances. For late settlement by cash or custodian clients, a fee of Prime Rate (P) plus 5.00% is applied.

In terms of dividend collection, AFG Securities charges a $1.50 fee per board lot for scrip dividends and bonus warrants or rights. They also impose a handling fee of 0.5% of the gross dividend amount, with a minimum of $20.00.

For corporate actions such as warrant conversion, rights subscription, or cash offers, AFG Securities applies a handling charge of $100.00 per event plus a reimbursement cost of $0.80 per lot.

Other fees include a $5.00 charge per transfer deed for the seller, a $5.00 per board lot fee for physical stock withdrawals (with a minimum of $20.00), and a $10.00 per board lot fee (minimum $100.00) for Stock-In (S.I.) transfers to other banks or brokerage firms through CCASS.

AFG Securities also levies a $100.00 handling charge for dishonored checks and charges $50.00 per application for IPO subscriptions requiring full payment.

Additional expenses incurred on behalf of clients are reimbursed directly from the client's account.

App Review

AFG Securities Limited offers the AFG Trader platform, a robust online trading solution designed to empower clients with seamless access to Hong Kong securities markets. Available on both iOS and Android platforms (available on Android only for customers from Mainland China), the AFG Trader app allows users to execute trades swiftly and securely from their mobile devices.For enhanced security, the platform integrates heeToken, providing two-factor authentication for login processes. Customers can download the app directly from the App Store for iOS or Google Play for Android, ensuring convenience and reliability in managing investments on-the-go.

Customer Service

AFG provides comprehensive customer service through various channels, including phone (+852 3105 1733), email (info@greenharmony.com.hk), and a contact form on their website. For in-person visits and correspondence, you can go to Admiralty Centre Tower I, Hong Kong.Additionally, their active presence on LinkedIn allows clients to engage and inquire.

Conclusion

AFG Securities is a prominent player in Hong Kong's financial sector, regulated by the Securities and Futures Commission (CE No. BIH335) for Dealing in Securities (Type 1). They specialize in offering secure and efficient Cash Securities trading accounts, catering to individual, joint, and corporate clients. AFG's commitment to regulatory compliance ensures clients benefit from transparent and reliable investment services in Hong Kong's dynamic market environment.

Frequently Asked Questions (FAQs)

Is AFG regulated by any financial authority?

Yes, AFG Securities is regulated by the Securities and Futures Commission of Hong Kong (CE No. BIH335).

What types of products and services does AFG provide?

AFG provides local Hongkong securities trading for individual, joint, and corporate clients.

Is AFG suitable for beginners?

AFG Securities is suitable for beginners due to its user-friendly platforms, comprehensive support, and regulatory oversight by the Securities and Futures Commission (CE No. BIH335). This ensures newcomers have access to a secure and regulated environment.

What are the trading platforms offered by AFG?

AFG offers the AFG Trader platform for online trading, available on iOS and Android, equipped with features like heeToken for enhanced security.

What is the minimum deposit required to open an account with AFG?

There is no minimum deposit requirement for opening a trading account with AFG Securities.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)