Wan Lung Securities Ltd. (hereafter referred to as "Wan Luing") was registered in Hong Kong in November 2016 andis a comprehensive licensed company regulated by the Securities and Futures Commission of Hong Kong. The Company currently provides securities trading, advising on securities, asset and wealth management for clients from Hong kong and around the globe.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is Wan Lung Securities?

Wan Lung Securities is a regulated brokerage firm based in Hong Kong, dedicated to providing comprehensive financial services to its clients. The company offers a diverse range of services, including securities trading, asset management, and investment consulting.

Pros & Cons

Pros Regulated by SFC: Being regulated by the Securities and Futures Commission (SFC) ensures that Wan Lung Securities adheres to strict standards, providing a level of investor protection.

Diverse Range of Services: Wan Lung Securities offers a comprehensive suite of financial services, including securities trading, asset management, and investment consulting.

User-Friendly Mobile Trading App: Wan Lung Securities offers a user-friendly mobile trading app, allowing clients to manage their portfolios and execute trades conveniently on the go.

Comprehensive Customer Support: The company provides comprehensive and accessible customer support through email, phone, address, and fax, ensuring clients receive timely assistance when needed.

Transparent Deposit and Withdrawal Process: Wan Lung Securities maintains a straightforward and efficient process for depositing and withdrawing funds, enhancing the overall client experience.

Cons Unclear Fee Structure: Detailed information on fees, account fees, interest on uninvested cash, and margin interest rates is not readily available. This lack of transparency can make it challenging for clients to fully understand the cost of trading and investing with Wan Lung Securities.

No Promotions Available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is Wan Lung Securities Safe?

Wan Lung Securities is regulated by the oversight of the oversight of the Securities and Futures Commission (SFC), holding license No. BLG359. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Wan Lung Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Wan Lung Securities?

Wan Lung Securities stands out in the financial industry by offering a comprehensive suite of services designed to cater to the diverse needs of its clients.

In the realm of Securities Trading, Wan Lung Securities facilitates access to initial public offerings (IPOs), enabling investors to participate in new opportunities in the stock market. With its Brokerage Trading services, clients can execute trades efficiently through Wan Lung's robust trading platform, backed by advanced technology and real-time market data. The Mobile Trading feature further enhances accessibility, allowing clients to manage their portfolios and execute trades conveniently on the go.

In Asset Management, Wan Lung Securities provides tailored solutions for wealth management, ensuring that clients' investment portfolios align with their financial goals and risk preferences. Through Fund Management services, Wan Lung offers professionally managed investment funds, enabling clients to diversify their portfolios and achieve long-term growth.

Wan Lung Securities excels in Investment Consulting, offering expertise in navigating complex financial landscapes. With access to platforms like the Shanghai-Hong Kong Stock Connect, clients can explore investment opportunities in both mainland China and Hong Kong markets. Wan Lung's seasoned advisors provide personalized Investment Advice, helping clients make informed decisions based on their unique financial situations and market insights.

Additionally, Wan Lung Securities produces insightful Research Reports, offering in-depth analysis and market intelligence to guide clients in their investment strategies and decision-making processes.

Wan Lung Securities Accounts

Wan Lung Securities caters to a diverse clientele by providing a range of account options tailored to meet varying investment needs. Clients can choose from Overseas Company Accounts, Hong Kong Company Accounts, and Personal Accounts, each offering distinct features and benefits.

Overseas Company Accounts are ideal for foreign entities seeking to access the Hong Kong financial markets, providing a platform to invest and manage assets efficiently. Hong Kong Company Accounts offer local companies a convenient avenue to trade securities and manage investments in compliance with regulatory requirements. Personal Accounts cater to individual investors, offering a straightforward solution to access Wan Lung Securities' brokerage services for personal investment objectives.

Deposit & Withdrawal

Wan Lung Securities provides a straightforward and efficient process for depositing and withdrawing funds to and from client accounts.

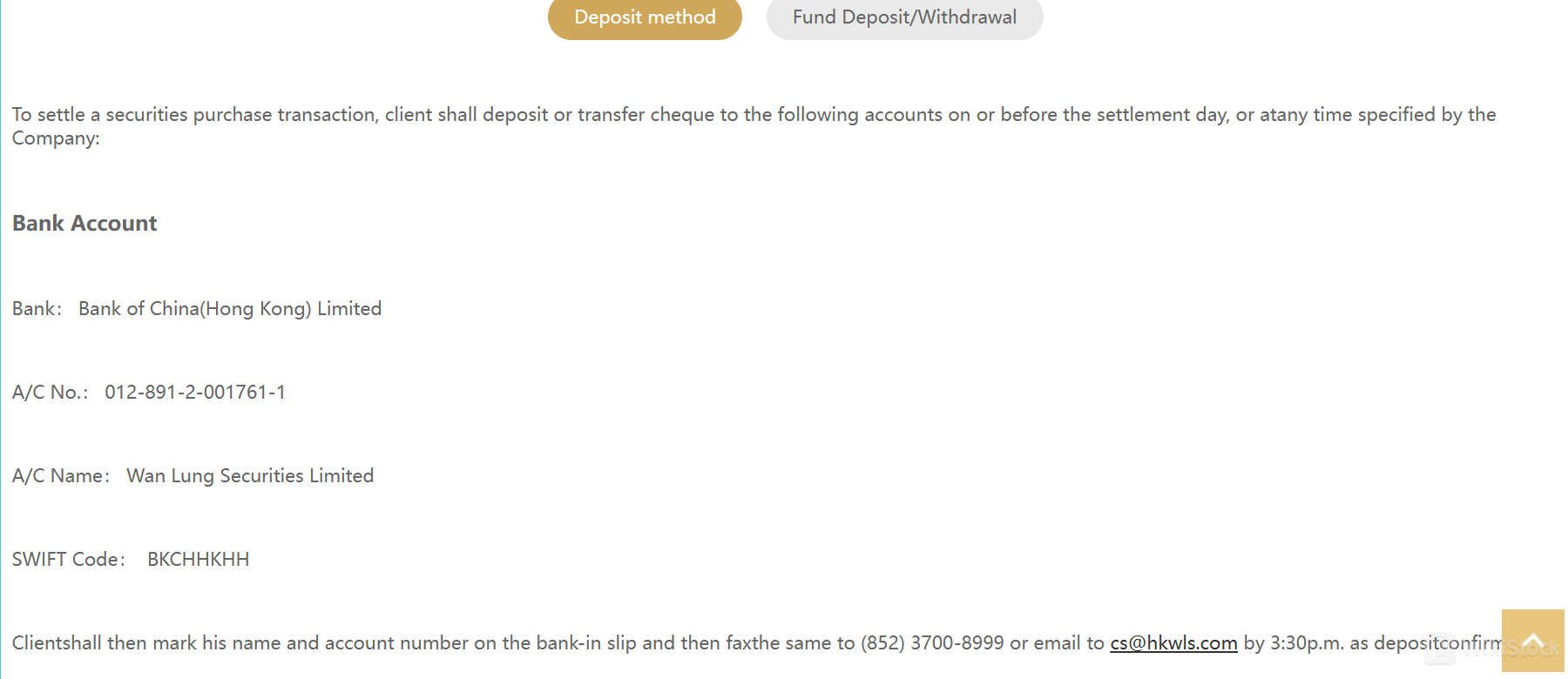

To settle a securities purchase transaction, clients are required to deposit or transfer the specified amount to Wan Lung Securities Limited's bank account at Bank of China (Hong Kong) Limited. Clients must ensure to include their name and account number on the bank slip and fax it to 852 3700-8999 or email it to cs@hkws.com for deposit confirmation.

For cash withdrawals, clients need to submit a fund withdrawal form via fax or email. Upon receipt, Wan Lung Securities issues a cheque payable to the client and deposits it into the client's designated bank account, as specified on the Client Information Statement. It's important to note that Wan Lung Securities typically does not accept third-party cheques or issue cheques payable to third parties.

To ensure timely processing, clients are advised to fax the fund deposit/withdrawal forms before 1:00 am Hong Kong time on a business day. Instructions received after the cut-off time or on Saturdays, Sundays, and public holidays will be processed on the next business day.

Wan Lung Securities App Review

Wan Lung Securities presents its clients with the Wan Lung Trading App (萬隆交易寶), a powerful tool designed to streamline the trading experience. This user-friendly app provides traders with convenient access to the financial markets at their fingertips. With real-time market data, advanced charting tools, and customizable features, the Wan Lung Trading App empowers users to stay informed and execute trades swiftly and securely.

Customer Service

Wan Lung Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address:FT 1712,17/F, SHUN TAK CTR WEST168-200 CONNAUGHT RD CENTRALSHEUNG WAN, HONG KONG

Phone:+852 3700 8900 Hong Kong

Fax:+852 3700 8999

Email:cs@hkwls.com

Conclusion

In conclusion, Wan Lung Securities presents itself as a reputable brokerage firm regulated by SFC, ensuring compliance with industry standards. With a diverse range of services, Wan Lung caters to the needs of different investors. The Wan Lung Trading App enhances the trading experience with real-time data and advanced features.

However, the lack of transparency regarding fees can deter some clients. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Wan Lung Securities suitable for beginners?

Wan Lung Securities is suitable for beginners due to its user-friendly platform, diverse range of services, and comprehensive customer support.

Is Wan Lung Securities legit?

Yes, Wan Lung Securities is regulated by the Securities and Futures Commission (SFC).

What securities can I trade with Wan Lung Securities?

Wan Lung Securities offers access to initial public offerings (IPOs), brokerage trading, and mobile trading.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)