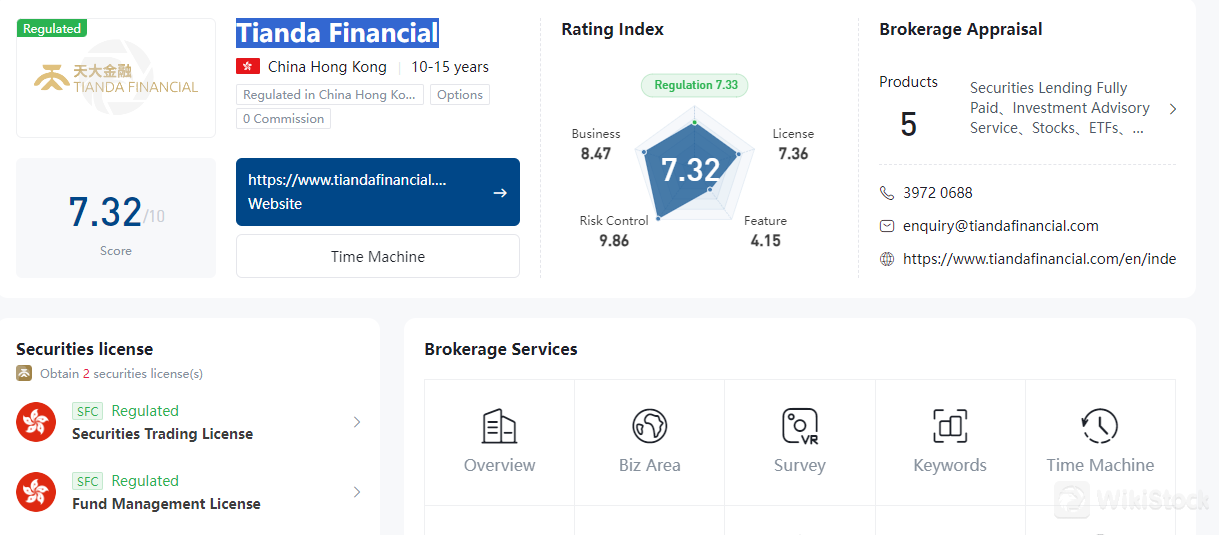

Tianda Group develops financial services through its subsidiary Tianda Financial Limited. Established in 2010, Tianda Financial, through its subsidiaries namely Tianda Securities Limited, Tianda Asset Management Limited and Tianda Capital Limited, primarily engaged in securities booking, corporate finance, asset management, strategic investment.

What is Tianda Financial?

Tianda Financial is a well-regulated financial service provider known for its low fees and user-friendly mobile trading app. It offers robust security measures and comprehensive educational resources for investors. However, specific details about insurance coverage for client funds are not readily available.

Pros and Cons of Tianda Financial

Tianda Financial offers a range of benefits, including robust regulatory oversight by the SFC, advanced security measures for client funds, and comprehensive educational resources. However, there are also some potential downsides, such as specific fee structures and the need for more detailed information on insurance coverage for client funds.

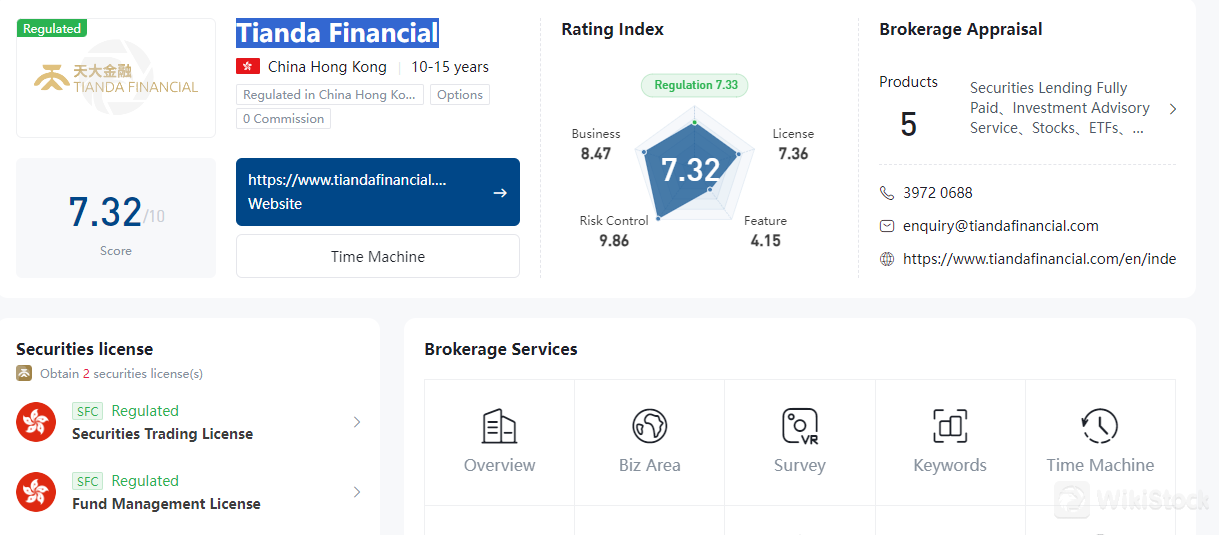

Is Tianda Financial safe?

Regulations

Tianda Financial is regulated by the Securities and Futures Commission (SFC) of Hong Kong. This regulatory oversight ensures that the company adheres to strict financial and operational standards, providing a layer of protection for clients. The SFCs regulatory framework is designed to maintain market integrity, protect investors, and promote fair and efficient markets.

Funds Safety

Regarding the safety of client funds, it is essential to know whether Tianda Financial has insurance for client account funds and the coverage amount. Typically, financial institutions regulated by the SFC are required to segregate client funds from the firm's assets, ensuring that client funds are protected in case of insolvency. However, specific details about insurance coverage, such as the amount insured, should be confirmed directly with Tianda Financial.

Safety Measures

Tianda Financial likely implements advanced encryption technologies to ensure the security of fund storage and transactions. This helps protect client funds from cyber threats and unauthorized access. Additionally, the company probably adopts robust account security measures to prevent information leakage and unauthorized account access. These measures may include two-factor authentication (2FA), secure login procedures, and regular security audits to safeguard client information.

To get detailed and specific information about the safety measures and insurance coverage, it is advisable to contact Tianda Financial directly or review their official documentation and disclosures.

What are securities to trade with Tianda Financial?

Tianda Financial offers a comprehensive suite of securities trading services designed to meet the diverse needs of its clients. One of its key offerings is the facilitation of IPO Stocks. This service allows investors to participate in Initial Public Offerings, providing them the opportunity to invest in companies at their debut in the stock market. Tianda Financial ensures that clients are well-informed and prepared to seize these investment opportunities by providing timely and detailed information about upcoming IPOs.

Securities Margin Trading is another significant product provided by Tianda Financial. This service enables clients to borrow funds to purchase securities, allowing them to leverage their investments and potentially enhance their returns. With competitive margin rates and flexible borrowing options, Tianda Financial supports clients in optimizing their investment strategies and managing their portfolios more effectively.

In addition to these services, Tianda Financial provides access to a wide range of trading products, including HK Stocks, US Stocks, and SH/SZ Stocks. These options allow clients to diversify their portfolios across different markets and take advantage of various growth opportunities. Furthermore, the company offers China B shares, which are equity shares traded on the Shanghai and Shenzhen stock exchanges and are available to foreign investors.

Overall, Tianda Financials trading products are designed to empower clients to make the most of their investment opportunities with robust tools, comprehensive services, and competitive pricing.

Tianda Financial Accounts Opening Procedure

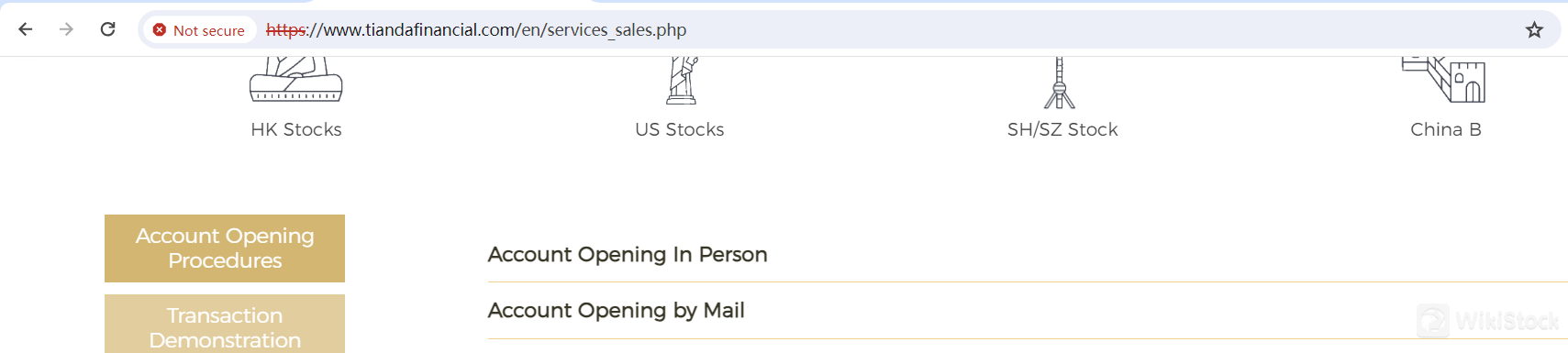

In-Person Account Opening

To open an account with Tianda Financial in person, clients must bring specific supporting documents. For an individual or joint account, clients need to provide copies of their ID card(s) or passport(s), along with residential and/or correspondence address proof issued within the last three months. Acceptable documents for address proof include a bank statement or utility bill, such as a water, electricity, gas, or telephone bill. If the correspondence address is different from the residential address, proof for both addresses is required.

For corporate accounts, additional documentation is necessary. Clients must submit a document that grants authority to the authorized person(s) to open the account, such as the Minutes of the Board of Directors meeting. Certified true copies of the Certificate of Incorporation, Business Registration Certificate, and the Memorandum and Articles of Association of the client company are required. Additionally, clients must provide certified true copies of the Register of Directors and the Register of Members. Certified true copies of the Hong Kong ID cards or passports of all authorized persons, directors, and ultimate beneficial owners, as well as their recent bank statements or utility bills for address proof, are also needed. If the company is incorporated overseas, a certified true copy of the Certificate of Incumbency is required. All certified true copies must be issued by a solicitor or certified public accountant.

Users should read the terms and conditions, fees, and commission details before proceeding with the account opening. Generally, the processing time is three working days, after which clients will receive a password to initiate internet trading.

Account Opening by Mail

To open an account by mail, clients must follow several steps. First, they need to print and fill out the relevant account opening forms, which can be obtained by contacting the customer service hotline. For individual or joint accounts, clients must complete the Cash Account or Margin Account Opening Form and the Standing Authoring Form. Corporate accounts require additional forms such as the Client Information Sheet, Letter of Personal Guarantee, and Board Resolution.

After reading the terms and conditions, fees, and commission details, clients should fill in the forms and sign them in the presence of a qualified witness. The same documents required for in-person account opening must be submitted, including certified true copies where applicable. These documents should be mailed to Tianda Securities Limited at their Central, Hong Kong address.

Upon receipt of the completed forms and supporting documents, Tianda Financials customer service staff will make a confirmation call within three working days. The account opening process usually takes three working days, after which clients will receive a password to initiate internet trading. If the client's identity cannot be verified by a qualified witness, they can provide a personal crossed cheque issued by a Hong Kong licensed bank with an amount not less than HK$10,000 for identity verification. The trading account will be activated once the cheque clears.

For any inquiries during the account opening process, clients can contact customer service via the hotline or email.

Tianda Financial Fees Review

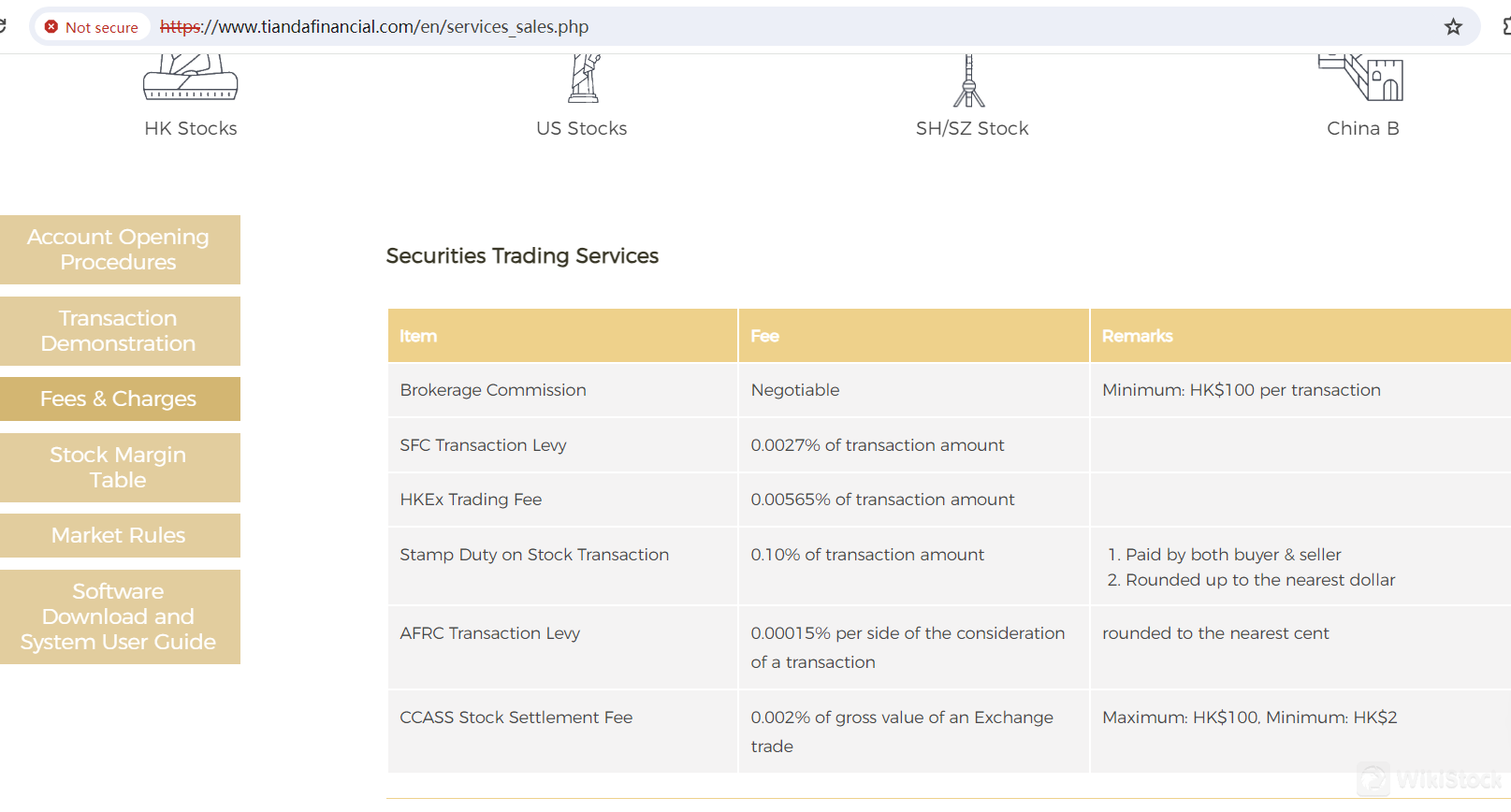

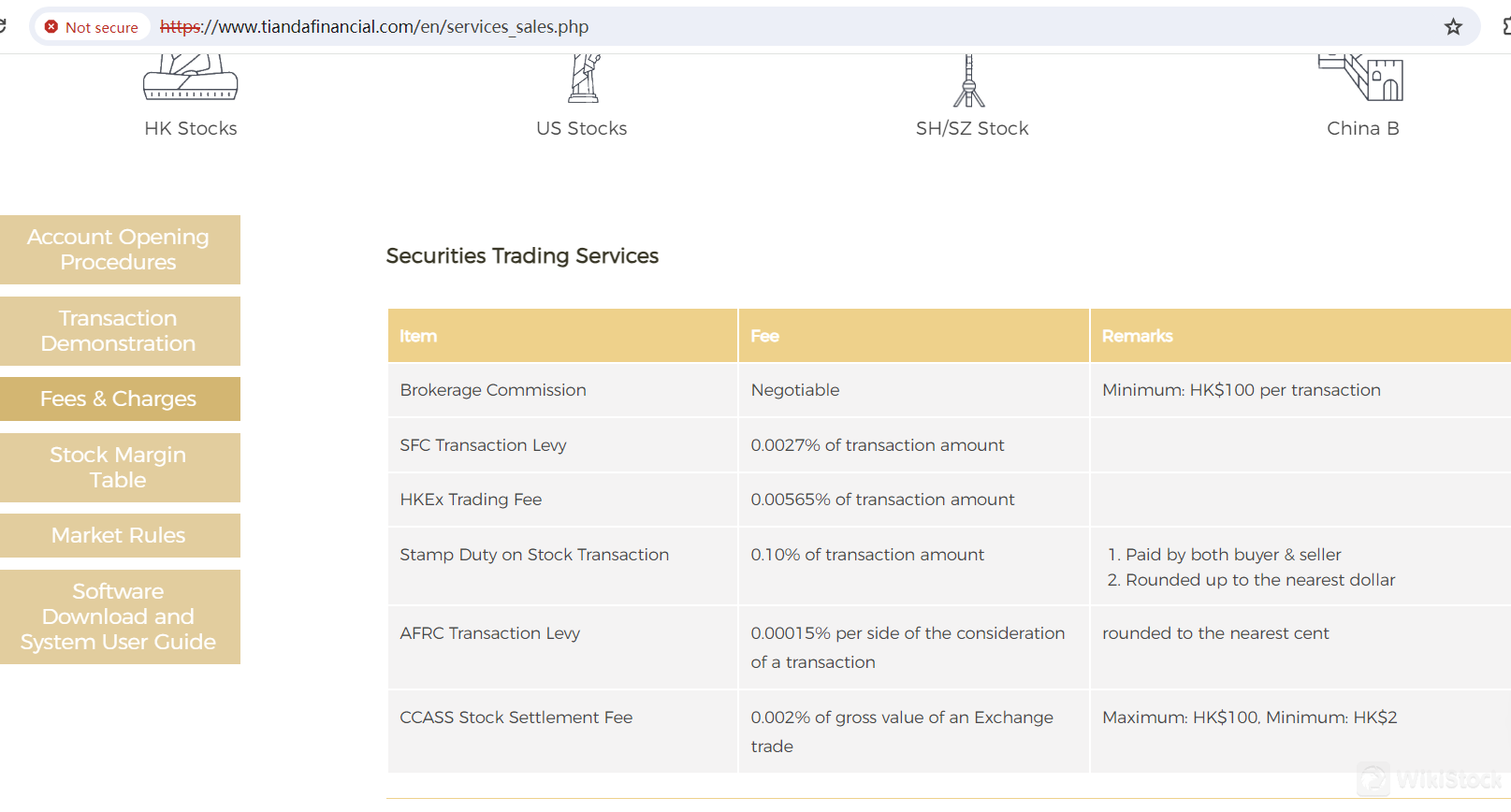

Securities Trading Services Fees

Tianda Financial offers negotiable brokerage commission rates for securities trading, with a minimum fee of HK$100 per transaction. In addition to the commission, several regulatory fees apply. The SFC Transaction Levy is 0.0027% of the transaction amount, and the HKEx Trading Fee is 0.00565% of the transaction amount. Additionally, there is a stamp duty of 0.10% on the stock transaction amount, paid by both the buyer and seller, and rounded up to the nearest dollar. An AFRC Transaction Levy of 0.00015% per side of the consideration of a transaction, rounded to the nearest cent, is also charged. Finally, the CCASS Stock Settlement Fee is 0.002% of the gross value of an exchange trade.

Scrip Handling and Settlement Services Fees

For physical scrip deposit, Tianda Financial waives the fee, but there is a HK$5 charge per transfer deed. Withdrawing physical scrip incurs a CCASS charge of HK$3.5 per board lot plus a company handling fee of HK$1 per board lot, with a minimum total fee of HK$20. Stock deposits via CCASS Settlement Instructions (SI) and CCASS Investor Settlement Instructions (ISI) are waived. However, stock withdrawals via SI are charged at 0.02% of the total market value based on the previous closing price, with a maximum fee of HK$500 and a minimum of HK$50. Withdrawals via ISI have a flat fee of HK$10 per transaction. For compulsory share buy-back, the company handling fee is HK$100, in addition to any CCASS penalties and other related charges.

Account Maintenance Fees

Tianda Financial charges HK$100 per application for stock balance or account confirmation. Copies of contract notes, daily statements, or monthly statements are also HK$100 per duplicate copy if they are older than three months, as the latest three months are provided for free. There is no stock custody fee charged by the company.

Nominee Services and Corporate Actions Fees

For nominee services and corporate actions, the scrip fee is HK$1.5 per board lot at the book close date when stocks are stored in CCASS during dividend issuance. The collection fee for cash or scrip dividends is 0.5% of the dividend amount, with a minimum fee of HK$20. The collection fee for bonus shares is HK$20 per stock. The right issue entitlement charge includes a HK$100 fee plus a CCASS charge of HK$0.8 per board lot per transaction. Other charges, such as fees for right exercise, excess rights application, cash offer, special/open/unconditional offer, and tendering shares under a takeover bid, are determined as per transaction specifics. Changing registration at the share registrar costs HK$5 per board lot, with a minimum fee of HK$20. Claiming unclaimed benefit entitlements incurs a fee of HK$300 per claim, in addition to CCASS and other relevant service fees.

Financing and Other Services Fees

For IPO subscription, Tianda Financial charges a handling fee of HK$100 per application. The financing chargefor subscription of securities is subject to market rates. Overdue interest on cash accounts is set at the PrimeRate plus 6%, and for margin accounts, it is the Prime Rate plus 3%, both negotiable. Remittance fees are HK$100 per transaction for CHATS (local) and HK$200 plus bank charges for T/T (overseas). The foreign currency exchange handling charge is HK$100 per case plus any bank charges per transaction. The bank transfer handling charge for withdrawal is HK$100 per case, and the returned cheque charge is HK$100 per case. For deposits unclaimed for over one month, a charge of HK$50 per deposit is applied.

Tianda Financial App Review

The Tianda Financial Mobile Trading Platform keeps users updated with the latest market trends, allowing them to monitor market movements, execute trades, and manage portfolios directly from their mobile devices. It provides real-time data and a user-friendly interface, making it easy to stay informed and make timely decisions.

Security is a top priority, with advanced encryption technologies protecting personal and financial information. This ensures all transactions and data exchanges are secure, giving users peace of mind.

The platform is designed for stability and speed, allowing seamless and quick trade executions. Its fast processing capabilities ensure users can act swiftly in the dynamic trading environment, making the most of market opportunities.

In short, the Tianda Financial Mobile Trading Platform offers up-to-date market information, strong security, and efficient trading, helping users stay ahead in the financial markets.

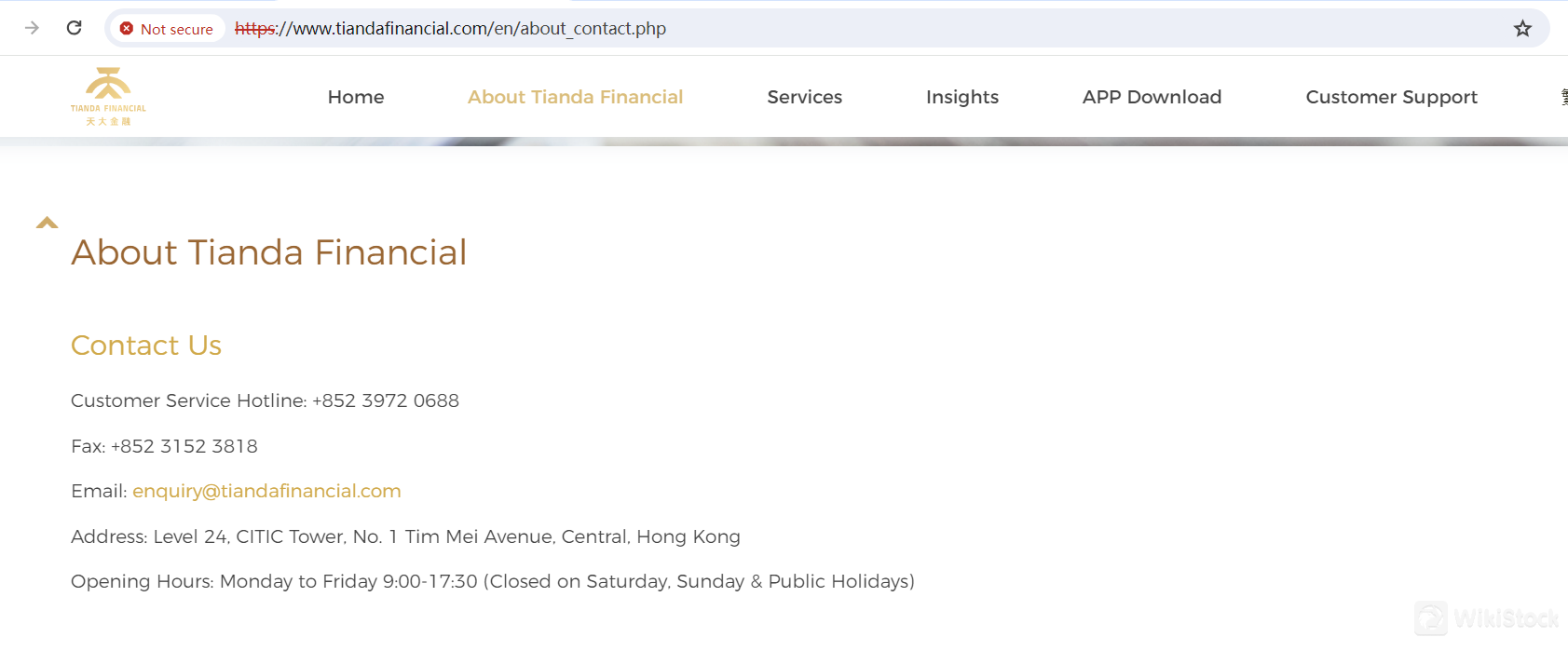

Customer Service

Tianda Financial offers multiple channels for customer support. Clients can reach the customer service team by calling the hotline at +852 3972 0688 during business hours. For written communication, inquiries can be sent via fax to +852 3152 3818 or by email to enquiry@tiandafinancial.com. These contact methods ensure that clients can get assistance with their accounts, trading activities, or any other financial services provided by Tianda Financial.

The companys office is located at Level 24, CITIC Tower, No. 1 Tim Mei Avenue, Central, Hong Kong. The office is open from Monday to Friday, 9:00 AM to 5:30 PM, and is closed on Saturdays, Sundays, and public holidays. This central location provides clients with the option to visit in person for more direct support and consultations.

Conclusion

Tianda Financial is a well-regulated financial services provider in Hong Kong, known for its low fees, user-friendly mobile trading app, and robust security measures. It offers a wide range of trading products, including IPO stocks and margin trading, along with comprehensive educational resources for investors. While it provides strong regulatory oversight and advanced security, details about insurance coverage for client funds are not readily available. Overall, Tianda Financial is a reliable choice for investors seeking a versatile and secure trading platform.

FAQs

Is Tianda Financial safe to trade?

Yes, Tianda Financial is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring adherence to strict financial and operational standards. It also implements advanced encryption and robust account security measures to protect client funds and information.

Is Tianda Financial a good platform for beginners?

Yes, Tianda Financial is a good platform for beginners. It offers a user-friendly mobile trading app and comprehensive educational resources, which help new investors make informed decisions and manage their portfolios effectively.

Is Tianda Financial good for investing/retirement?

Tianda Financial provides a wide range of trading products and services, making it suitable for various investment strategies, including retirement planning. Its robust security measures, regulatory oversight, and competitive fees support long-term investment and retirement goals.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--