Sunwah Kingsway Capital Holdings Limited is a Hong Kong based financial services provider catering to clients across a well-anchored service platform. In addition to award-winning brokerage operations, which comprise solutions in institutional sales, retail trading and research, our synergistic base of offerings includes a range of premium corporate finance and asset management services.

Sunwah Kingsway Information

Sunwah Kingsway Capital Holdings Limited, based in Hong Kong, is a financial services provider offering award-winning brokerage operations, corporate finance, and asset management services.

Their brokerage services feature competitive fees with a 0.25% commission on transactions, a minimum of HK$50.00 to HK$100.00, and a 1.56% interest rate on uninvested cash.

The firm provides a user-friendly electronic trading platform and mobile apps for both Android and iOS. However, the platform could benefit from further enhancement to stay ahead in a highly competitive market.

Pros & Cons

Pros:

Sunwah Kingsway offers several advantages, including regulation by the Securities and Futures Commission (SFC), providing assurance of a secure and compliant trading environment. The firm attracts both individual and institutional investors, offering flexibility in account types. Their unique trading platform, which includes a mobile app for both Android and iOS, enhances user convenience. Additionally, they have low brokerage commissions, starting as low as HK$50, and offer interest on uninvested cash at a rate of 1.56%.

Cons:

On the downside, Sunwah Kingsway asks for account maintenance fees, which may be a deterrent for some investors. The range of tradable securities is somewhat limited compared to other platforms. Despite the low minimum commission, the overall fee structure may not be the most cost-effective for smaller transactions.

Is Sunwah Kingsway Safe?

Regulations:

Sunwah Kingsway is regulated by the Securities and Futures Commission (SFC) of Hong Kong, a highly respected independent statutory body established in 1989 to oversee Hong Kong's securities and futures markets(License Number:ADF346).

The SFC operates independently from the Hong Kong Special Administrative Region's government and is primarily funded by transaction levies and licensing fees. The SFC's stringent regulatory framework ensures that Sunwah Kingsway adheres to high standards of market integrity and investor protection.

Funds Safety:

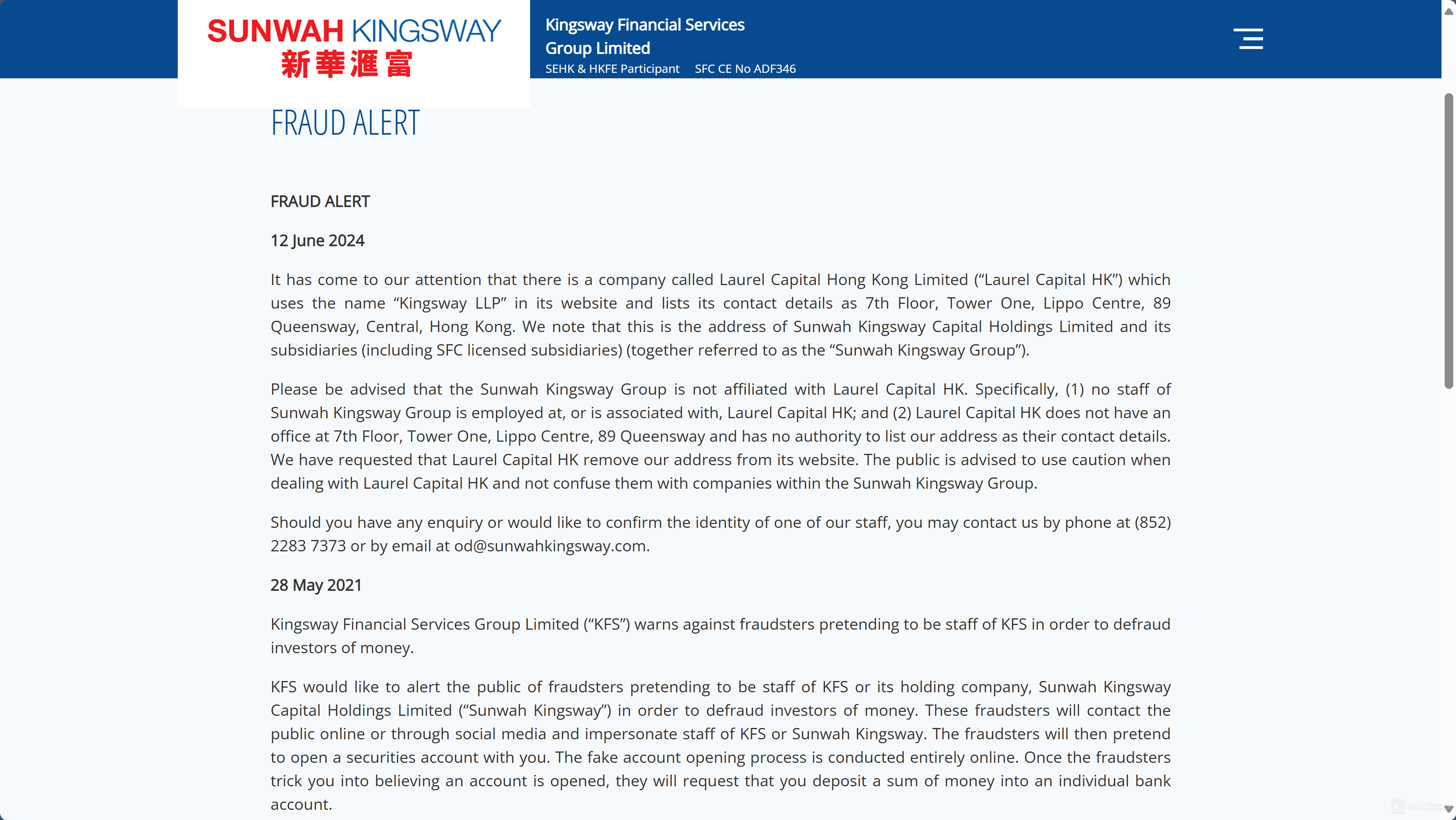

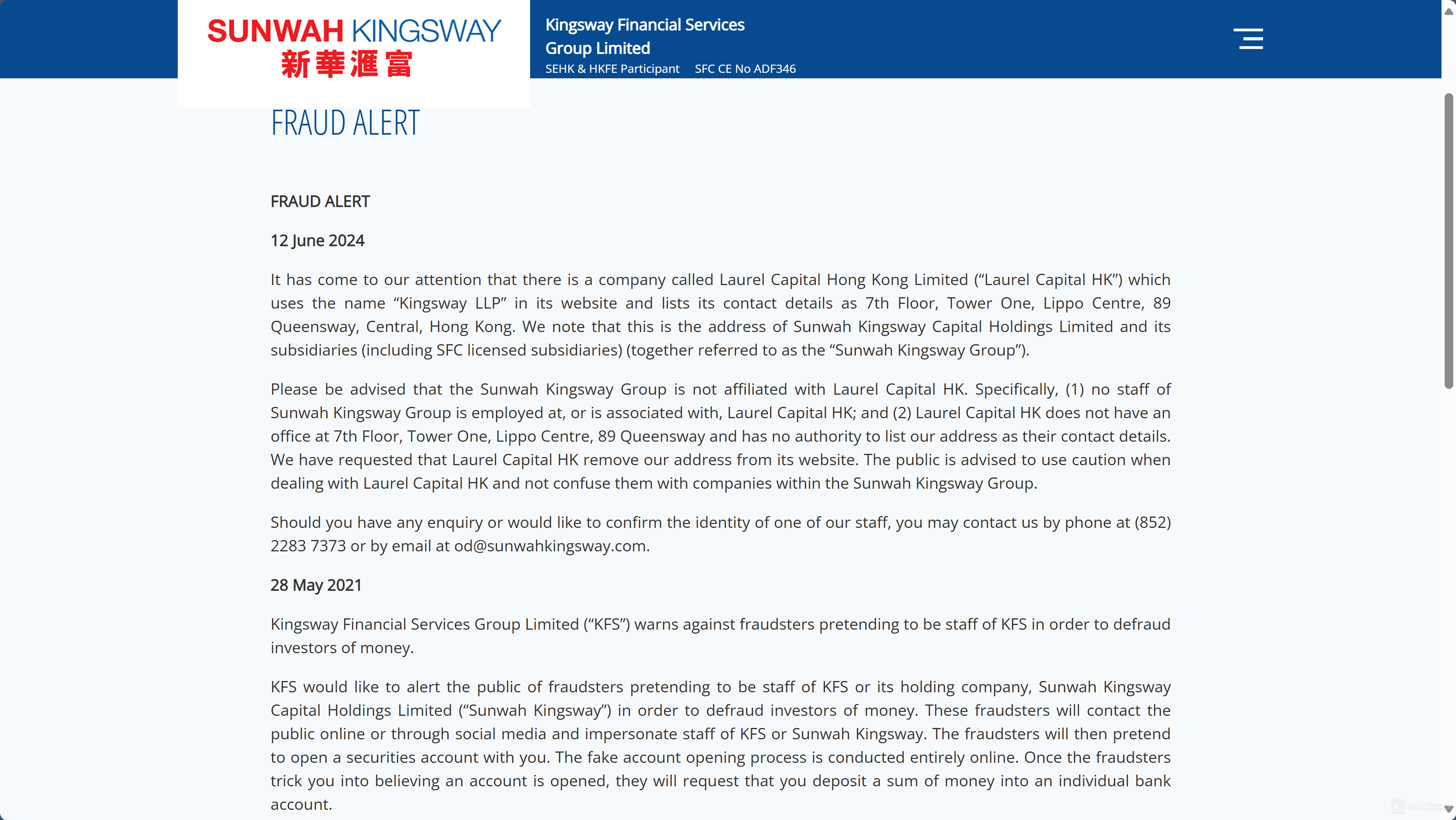

Sunwah Kingsway ensures the protection of client funds by adhering to strict regulatory requirements set by the SFC. The company maintains compliance with the highest standards of security and confidentiality as part of its policy.

They safeguard all client-provided information, ensuring that funds are handled securely. Additionally, Sunwah Kingsway alerts clients about potential fraud and advises against making deposits into unauthorized accounts, ensuring that client transactions are only made through verified channels. This proactive approach in fraud prevention and funds handling underscores their commitment to the safety of client assets.

Safety Measures:

Sunwah Kingsway employs robust safety measures to protect client information and funds. The company pledges to comply with internationally recognized standards of personal data privacy protection, as mandated by the Personal Data (Privacy) Ordinance.

This includes strict adherence to security and confidentiality standards by its staff. Additionally, Sunwah Kingsway implements encryption technologies to ensure the security of funds storage and has measures in place to prevent the leakage of user information. Furthermore, the company does not offer online account opening and advises clients to be cautious of fraudulent entities impersonating its staff or misusing its name.

What are securities to trade with Sunwah Kingsway?

Sunwah Kingsway offers a range of securities for trading, attracting both institutional and retail clients. Their offerings include:

- Equities: Sunwah Kingsway provides brokerage services for trading stocks on various exchanges, including the Stock Exchange of Hong Kong, the Shanghai Stock Exchange, and the Shenzhen Stock Exchange. They are recognized for their solid track record and have been ranked among the top local brokerage firms in Hong Kong.

- Futures & Commodities: Clients can trade futures and commodities through Sunwah Kingsways brokerage platform, allowing for diversified investment strategies and hedging opportunities.

- Securities Margin Financing: The company offers margin financing services, enabling clients to leverage their investments by borrowing funds to purchase additional securities.

- Initial Public Offerings (IPO) Subscription: Sunwah Kingsway provides services for subscribing to initial public offerings, giving clients access to new investment opportunities in the market.

Sunwah Kingsway Account Review

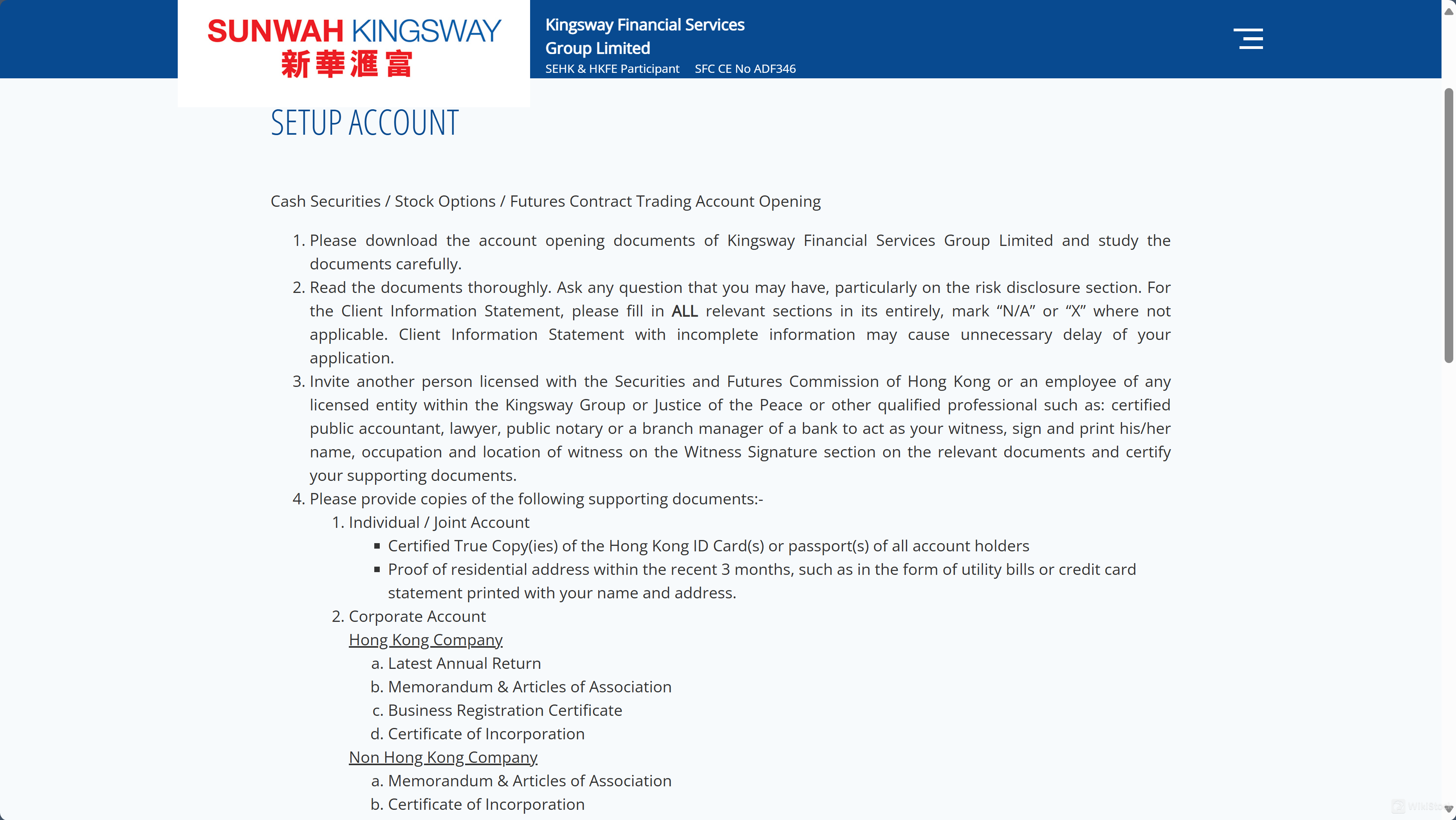

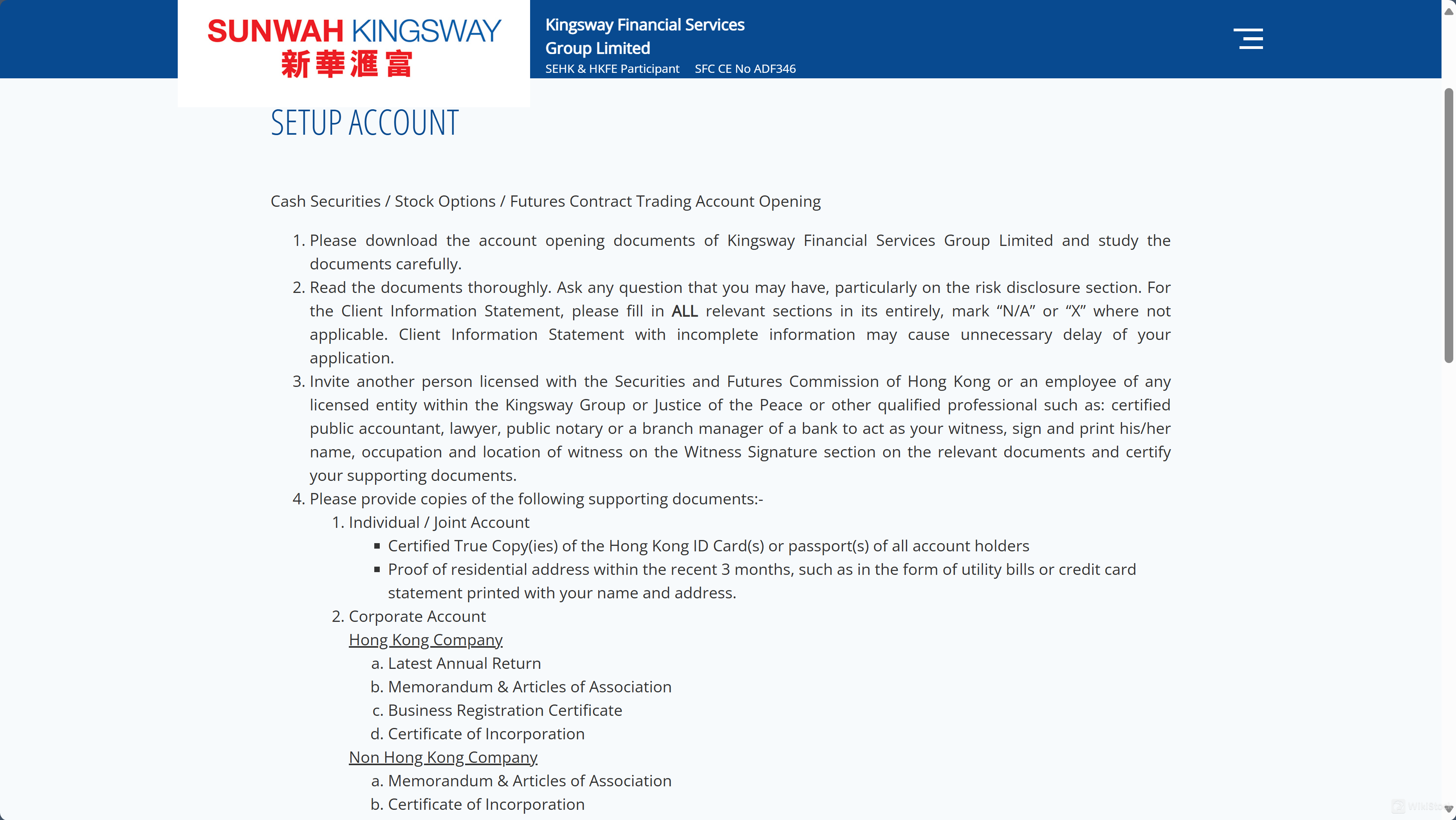

Sunwah Kingsway provides 2 types of accounts for its users.

- Individual / Joint Account: This type of account is available for individual or joint holders. To open this account, applicants need to provide certified true copies of their Hong Kong ID cards or passports, and proof of residential address within the last three months, such as utility bills or credit card statements.

- Corporate Account: Available for both Hong Kong and non-Hong Kong companies. For a Hong Kong company, documents required include the latest annual return, Memorandum & Articles of Association, Business Registration Certificate, and Certificate of Incorporation. Non-Hong Kong companies need to provide the Memorandum & Articles of Association, Certificate of Incorporation, Register of Share/Members & Directors, Certificate of Incumbency and Good-Standing (within 6 months), and certified copies of ID cards or passports of Directors, Authorized Persons, Beneficial Owners, and Guarantors, along with proof of residential address within the last three months.

For both types, a witness, such as a licensed professional or qualified individual, is required to certify the supporting documents.

Sunwah Kingsway Fee Review

- Fee Structure for Hong Kong Securities at Sunwah Kingsway

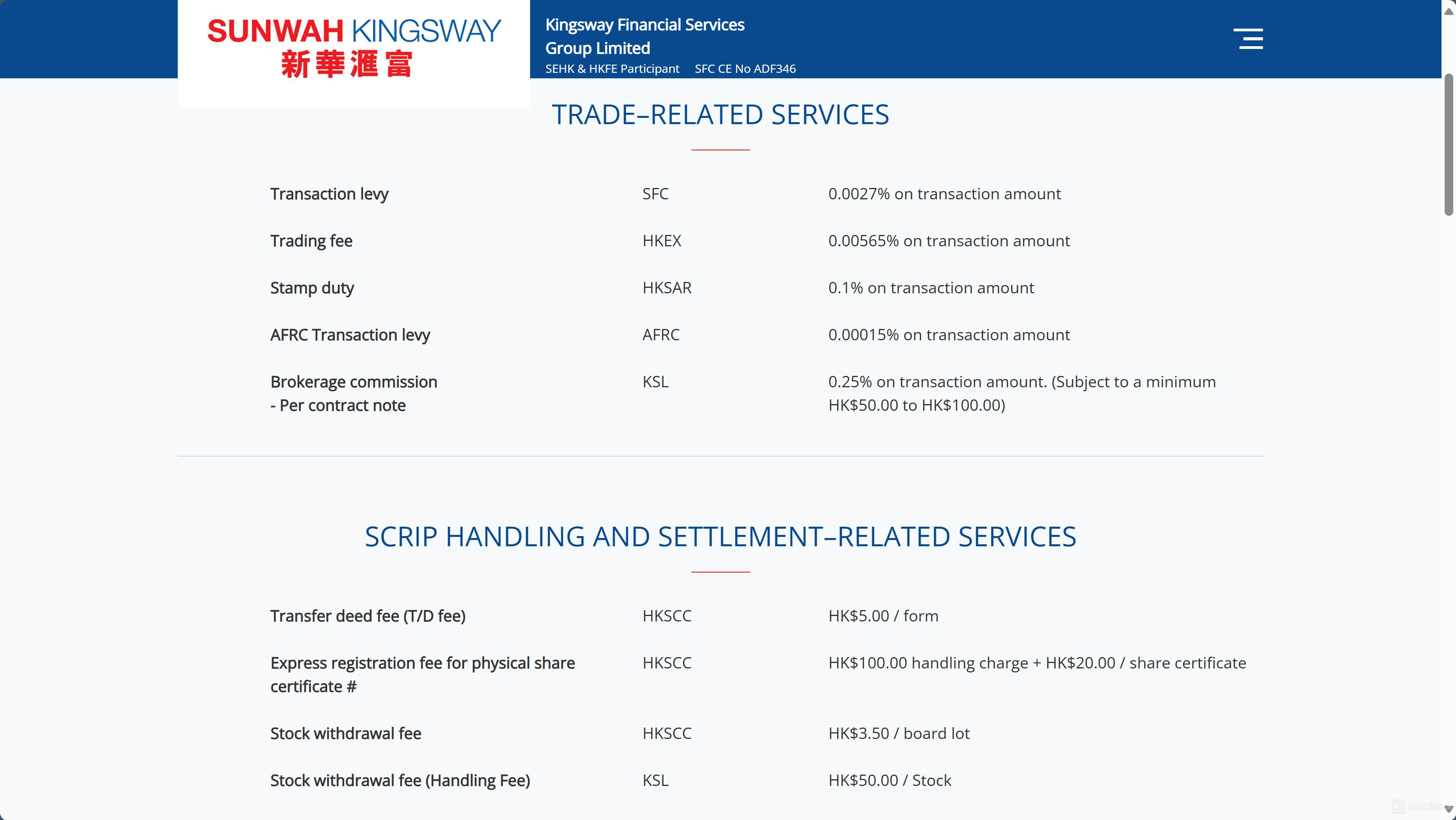

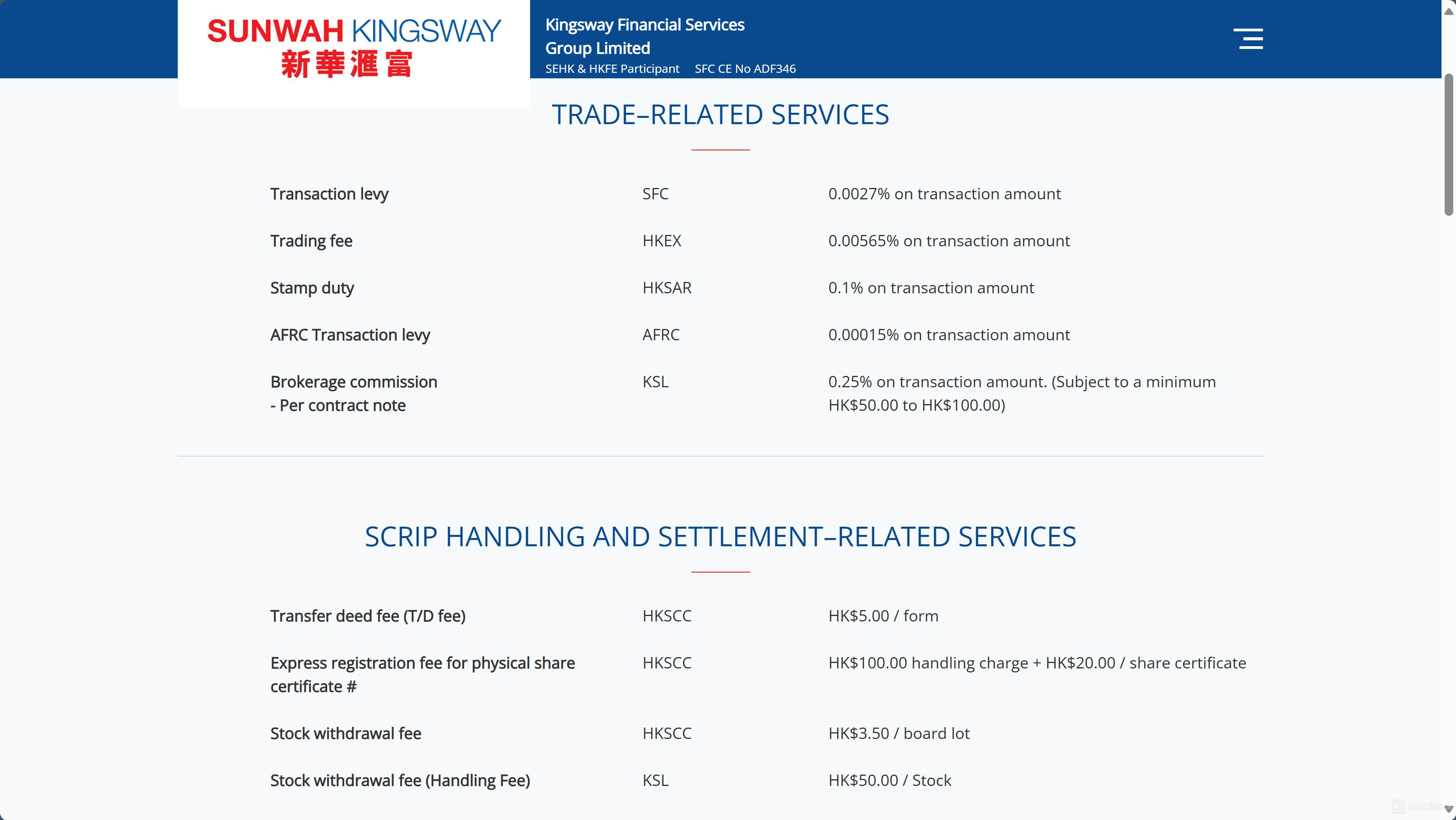

Trade-Related Services:

Sunwah Kingsway charges a transaction levy of 0.0027% (SFC), a trading fee of 0.00565% (HKEX), and a stamp duty of 0.1% (HKSAR) on the transaction amount. Additionally, there is an AFRC transaction levy of 0.00015% and a brokerage commission of 0.25% on the transaction amount, subject to a minimum charge of HK$50.00 to HK$100.00.

Script Handling and Settlement-Related Services:

For scrip handling and settlement, Sunwah Kingsway imposes a transfer deed fee of HK$5.00 per form, an express registration fee for physical share certificates at HK$100.00 plus HK$20.00 per certificate, a stock withdrawal fee of HK$3.50 per board lot, and additional handling fees ranging from HK$50.00 to HK$100.00 per transaction for various services.

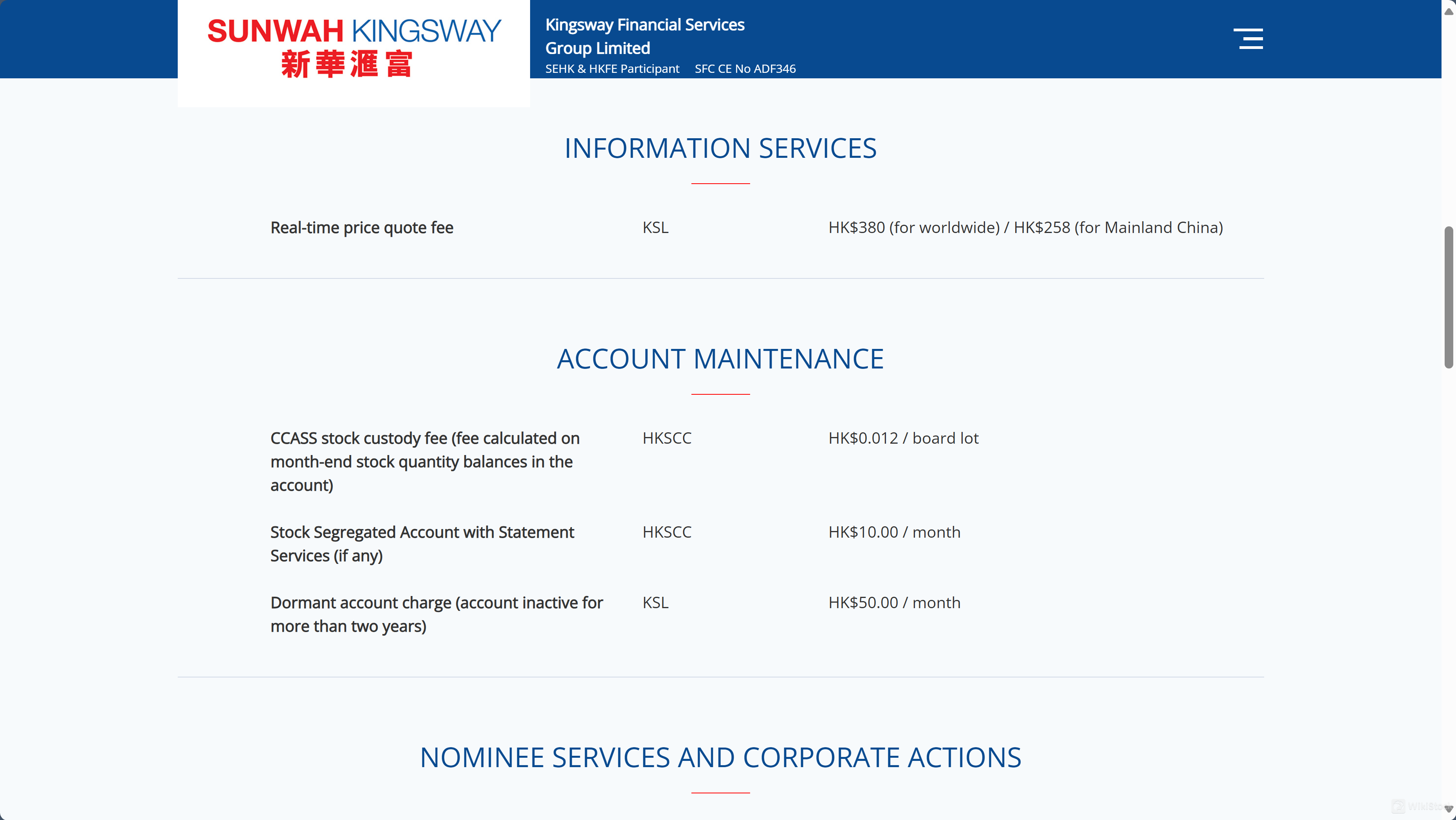

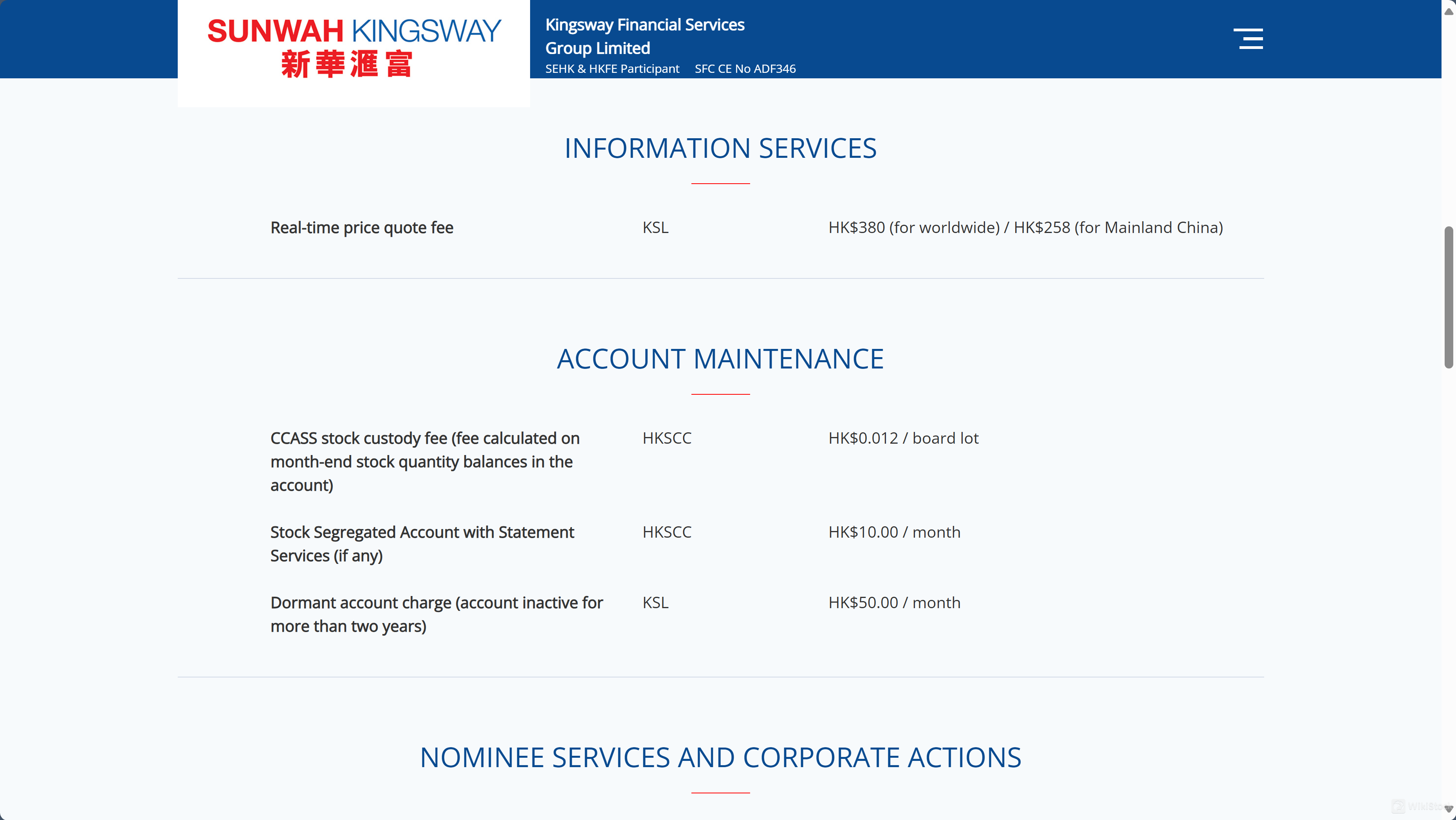

Information Services:

The company offers real-time price quote services, charging HK$380 for worldwide access and HK$258 for Mainland China access.

Account Maintenance:

Account maintenance fees include a CCASS stock custody fee of HK$0.012 per board lot, a stock segregated account statement service fee of HK$10.00 per month, and a dormant account charge of HK$50.00 per month for accounts inactive for over two years.

Nominee Services and Corporate Actions:

Sunwah Kingsway charges nominee services and corporate actions, including a 0.12% fee on dividends, a HK$1.50 scrip fee per board lot, and handling fees for various corporate actions such as dividend claims and rights issues, with fees ranging from HK$5.00 to HK$200.00 depending on the service.

Financing and Other Services:

For financing and other services, the administration fee for CIES is HK$10,000.00 per year. Interest rates for margin clients are set at 8% p.a. plus the higher of Prime or HIBOR for outstanding margin call amounts, and 2% p.a. plus the higher of Prime or HIBOR for other debit balances. Cash clients face interest rates on overdue debit balances based on the higher of Prime or HIBOR, and various transaction fees apply for payments and changes in standing instructions.

| Service Category | Fee Description | Fee Amount |

| Trade-Related Services | Transaction Levy (SFC) | 0.0027% of transaction amount |

| Trading Fee (HKEX) | 0.00565% of transaction amount |

| Stamp Duty (HKSAR) | 0.1% of transaction amount |

| AFRC Transaction Levy | 0.00015% of transaction amount |

| Brokerage Commission (KSL) | 0.25% of transaction amount (Min HK$50.00 - HK$100.00) |

| Scrip Handling and Settlement | Transfer Deed Fee (HKSCC) | HK$5.00 per form |

| Express Registration Fee (HKSCC) | HK$100.00 + HK$20.00 per share certificate |

| Stock Withdrawal Fee (HKSCC) | HK$3.50 per board lot |

| Stock Withdrawal Handling Fee (KSL) | HK$50.00 per stock |

| Outgoing SI / ISI Fee (KSL) | HK$100.00 / HK$50.00 per transaction |

| Multi-Counter Transfer Fee (KSL) | HK$5.00 per transaction |

| Information Services | Real-Time Price Quote Fee (KSL) | HK$380 (worldwide) / HK$258 (Mainland China) |

| Account Maintenance | CCASS Stock Custody Fee (HKSCC) | HK$0.012 per board lot |

| Stock Segregated Account Statement Service (HKSCC) | HK$10.00 per month |

| Dormant Account Charge (KSL) | HK$50.00 per month (inactive > 2 years) |

| Nominee Services and Corporate Actions | Dividend Charge (HKSCC) | 0.12% of dividend amount |

| Scrip Fee (HKSCC) | HK$1.50 per board lot |

| Dividend Claim Fee + Handling Fee (HKSCC) | 0.12% + HK$200.00 per claim |

| Corporate Actions Fee for Rights Issue (HKSCC) | HK$0.80 per board lot |

| Handling Fee for Dividend Claim (KSL) | HK$5.00 per board lot (Min HK$200.00) |

| Handling Fee for Dividend Received (KSL) | 0.50% of dividend amount (Min HK$20.00, Max HK$2,500.00) |

| Handling Fee for Bonus Shares, Rights Issue, Warrants (KSL) | HK$30.00 per stock |

| Handling Fee for Cash / Open Offer (KSL) | 0.25% of gross offer amount (Min HK$20.00, Max HK$5,000.00) |

| Financing and Other Services | Administration Fee of CIES (KSL) | HK$10,000.00 per year |

| Interest Rate for Margin Clients | 8% p.a. + (higher of Prime or HIBOR) for margin call amounts; 2% p.a. + (higher of Prime or HIBOR) for other debit balances |

| Interest Rate for Cash Clients | Based on the higher of Prime or HIBOR |

| Interest Bearing for Free Credit Balance | NIL for < HK$1000; HK$ savings rate for ≥ HK$1000 |

| Payment to Third Party (KSL) | HK$100.00 per transaction |

| CHATs Payment (KSL) | HK$150.00 per transaction (HK$500.00 if translation required) |

| TT Payment (Overseas/Mainland China) (KSL) | HK$550.00 / HK$700.00 per transaction |

| Change of Information in Standing Instruction (KSL) | HK$70.00 per request |

| Returned Cheque Fee (KSL) | HK$100.00 per transaction |

| Cheque Mark Good (KSL) | HK$300.00 per transaction |

| Stop Payment Fee (KSL) | HK$150.00 per transaction |

| Handling Fee for Unidentified Deposit (KSL) | HK$50.00 per deposit |

| Application Fee for IPO – Financing / Non-Financing (KSL) | HK$100.00 / HK$50.00 |

| Receiving Statements by Mail (KSL) | HK$100.00 per month |

| Charges for Past Monthly Statement (KSL) | HK$100.00 per month |

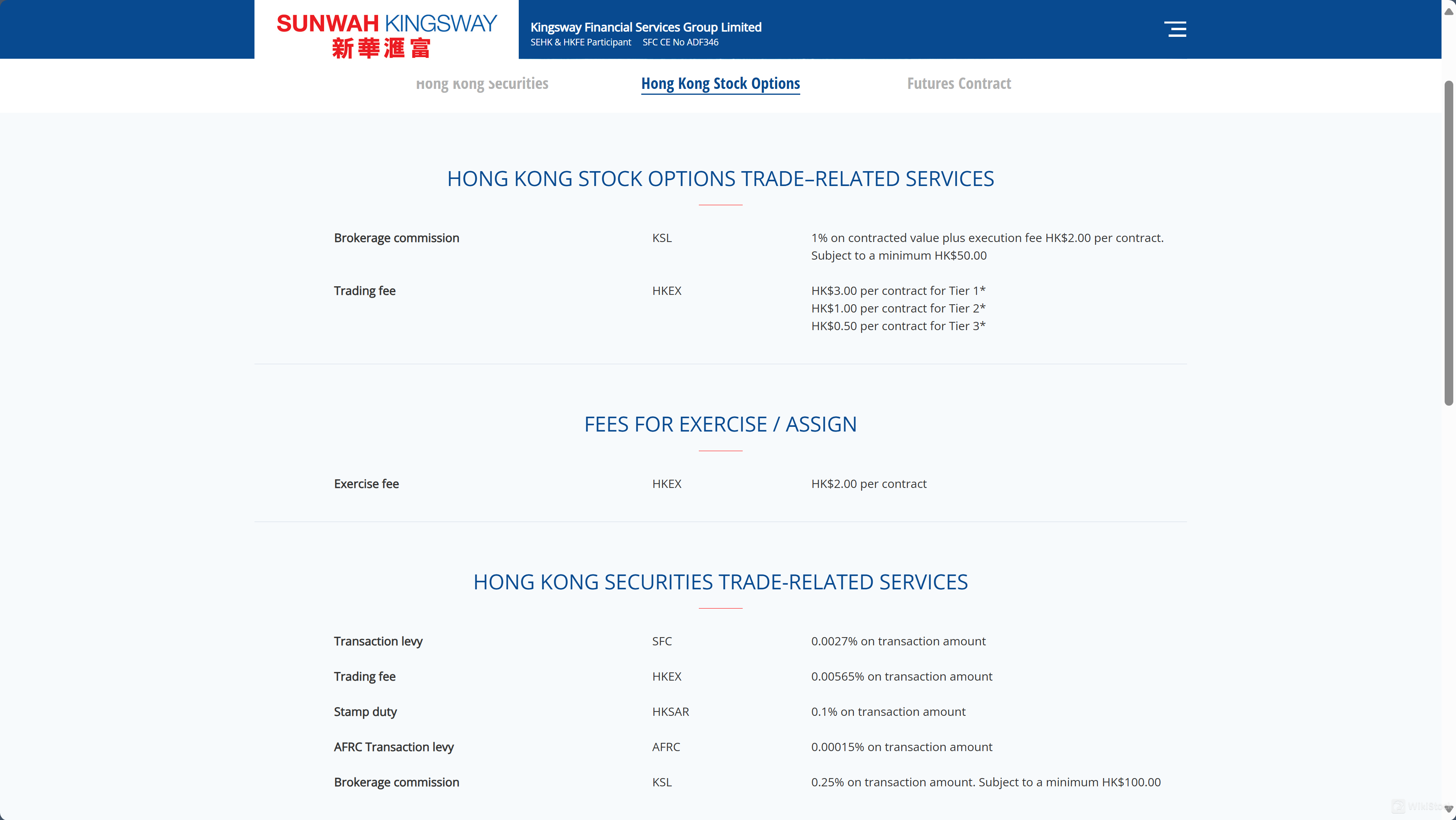

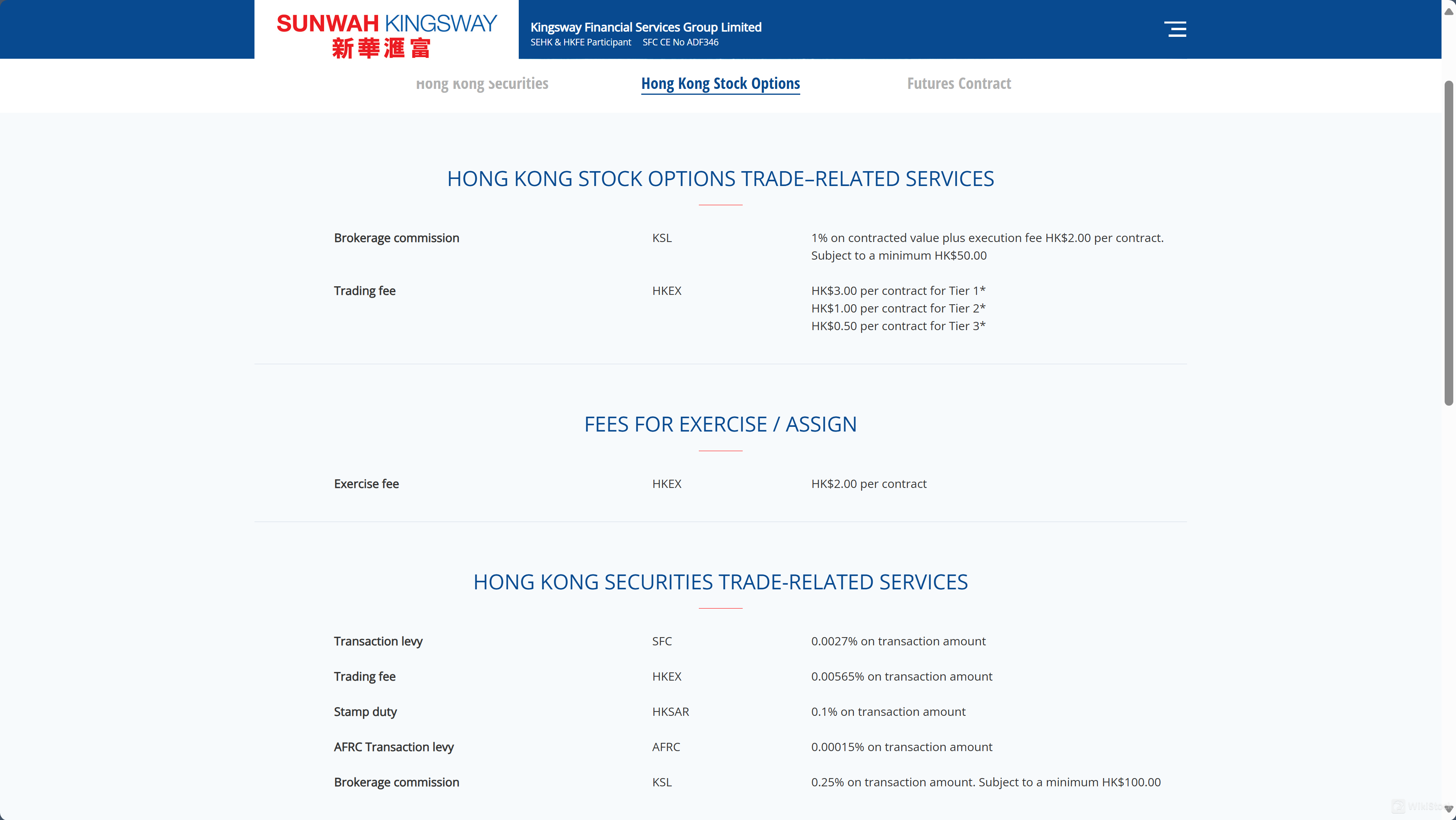

- Fee Structure for Hong Kong Stock Options at Sunwah Kingsway

Trade-Related Services:

- Brokerage Commission (KSL): 1% on contracted value plus an execution fee of HK$2.00 per contract (minimum HK$50.00)

- Trading Fee (HKEX):

- HK$3.00 per contract for Tier 1

- HK$1.00 per contract for Tier 2

- HK$0.50 per contract for Tier 3

Fees for Exercise / Assign:

- Exercise Fee (HKEX): HK$2.00 per contract

Other Services:

- Receiving Statements by Mail (KSL): HK$100.00 per month

- Debit Balance in the Account (KSL): Higher of Prime or HIBOR

*Note: Relevant information regarding the tier level of individual stock options classes can be found at the HKEX website: HKEX Stock Options Class List.

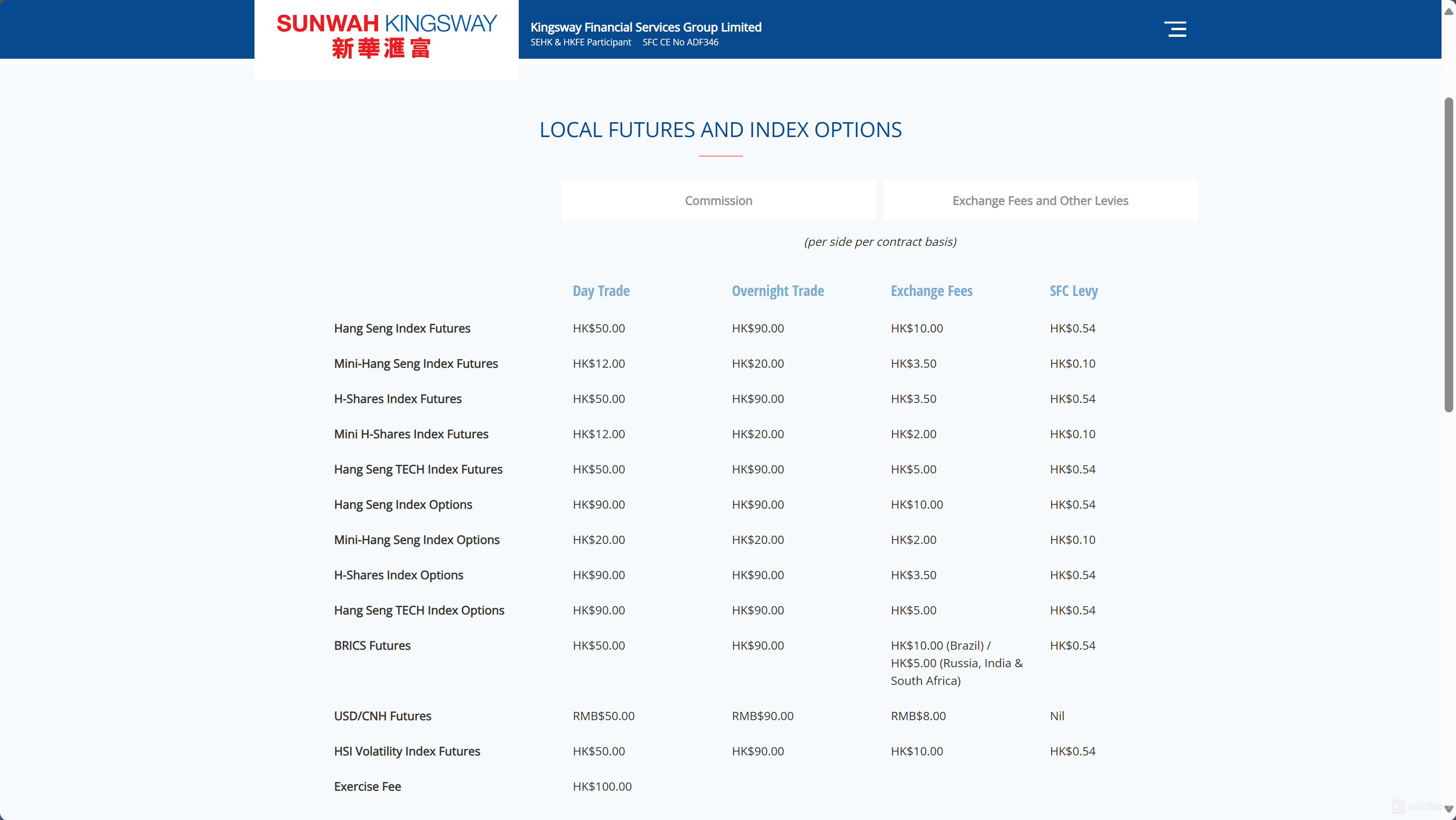

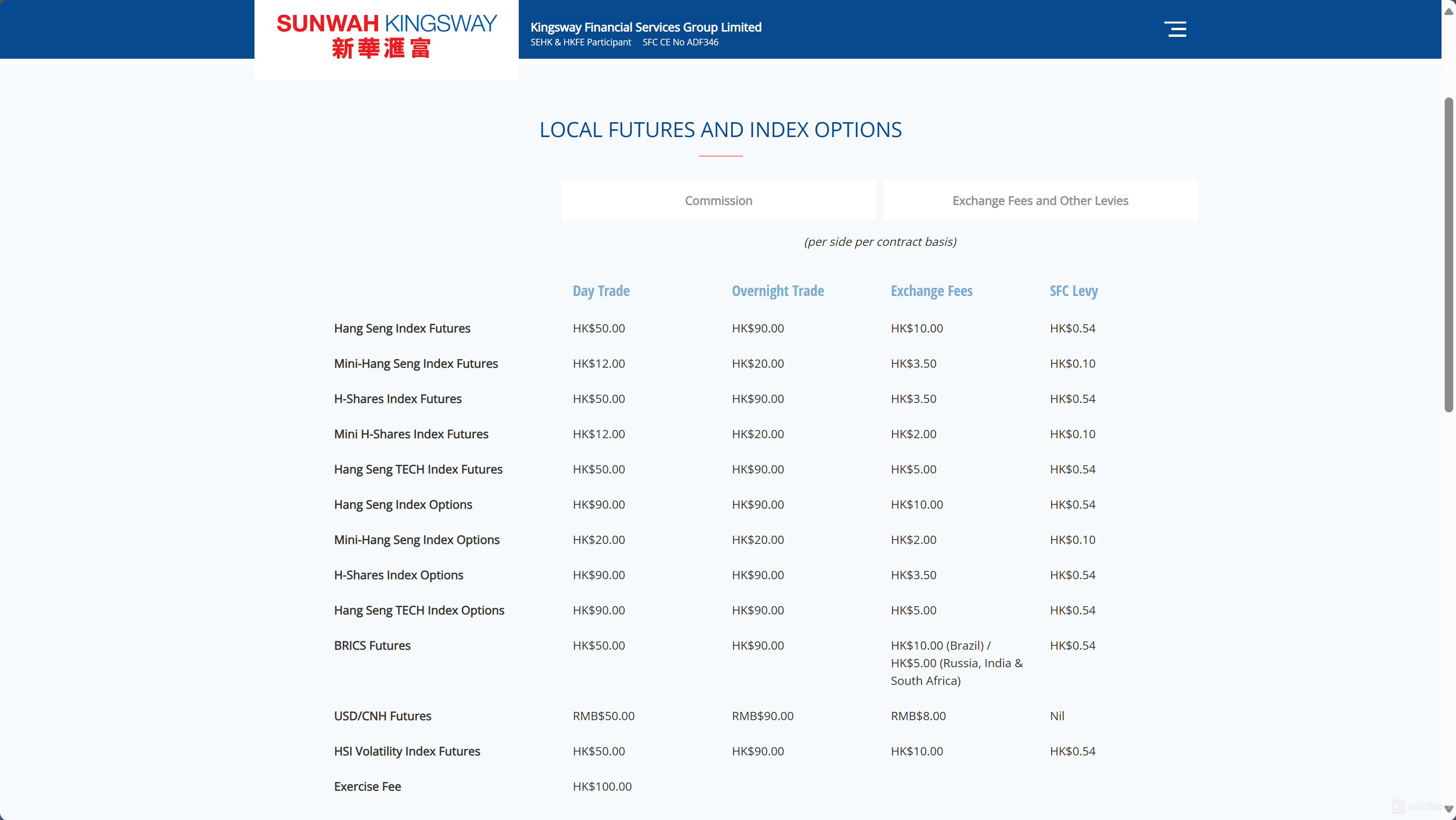

- Fee Structure for Local Futures and Index Option at Sunwah Kingsway

Sunwah Kingsway's fee structure for local futures and index options includes a commission of HK$50.00 for day trades and HK$90.00 for overnight trades on Hang Seng Index Futures, with corresponding exchange fees of HK$10.00 and an SFC levy of HK$0.54. Mini-Hang Seng Index Futures have commissions of HK$12.00 and HK$20.00, exchange fees of HK$3.50, and an SFC levy of HK$0.10.

H-Shares Index Futures and Hang Seng TECH Index Futures follow similar patterns. Hang Seng Index Options incur HK$90.00 for both day and overnight trades, with an HK$10.00 exchange fee and HK$0.54 SFC levy.

Mini-Hang Seng Index Options and H-Shares Index Options have lower commissions and fees. Additional fees include RMB$50.00 for USD/CNH Futures and HK$50.00 to HK$90.00 for BRICS and HSI Volatility Index Futures. An exercise fee of HK$100.00 also applies.

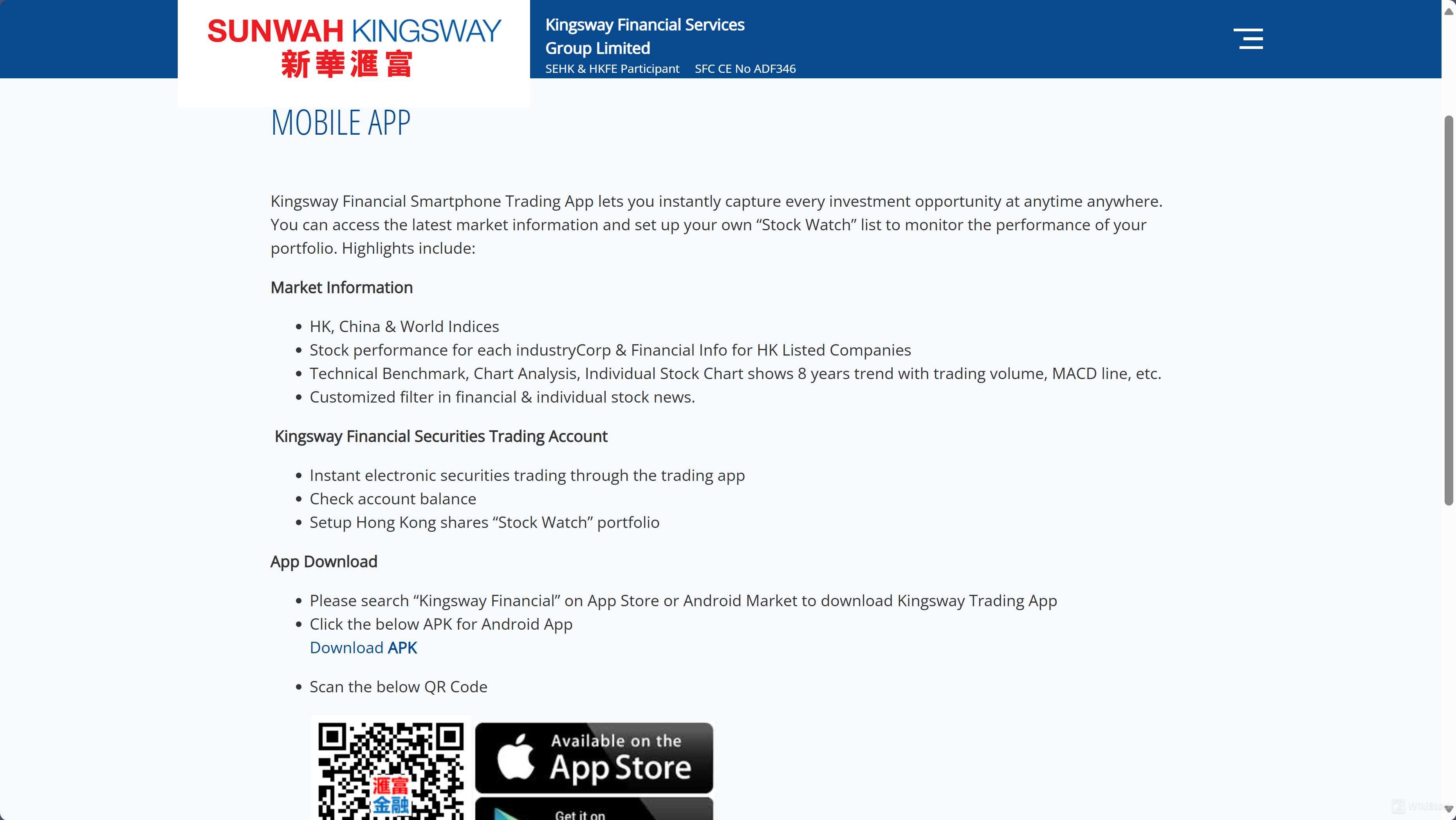

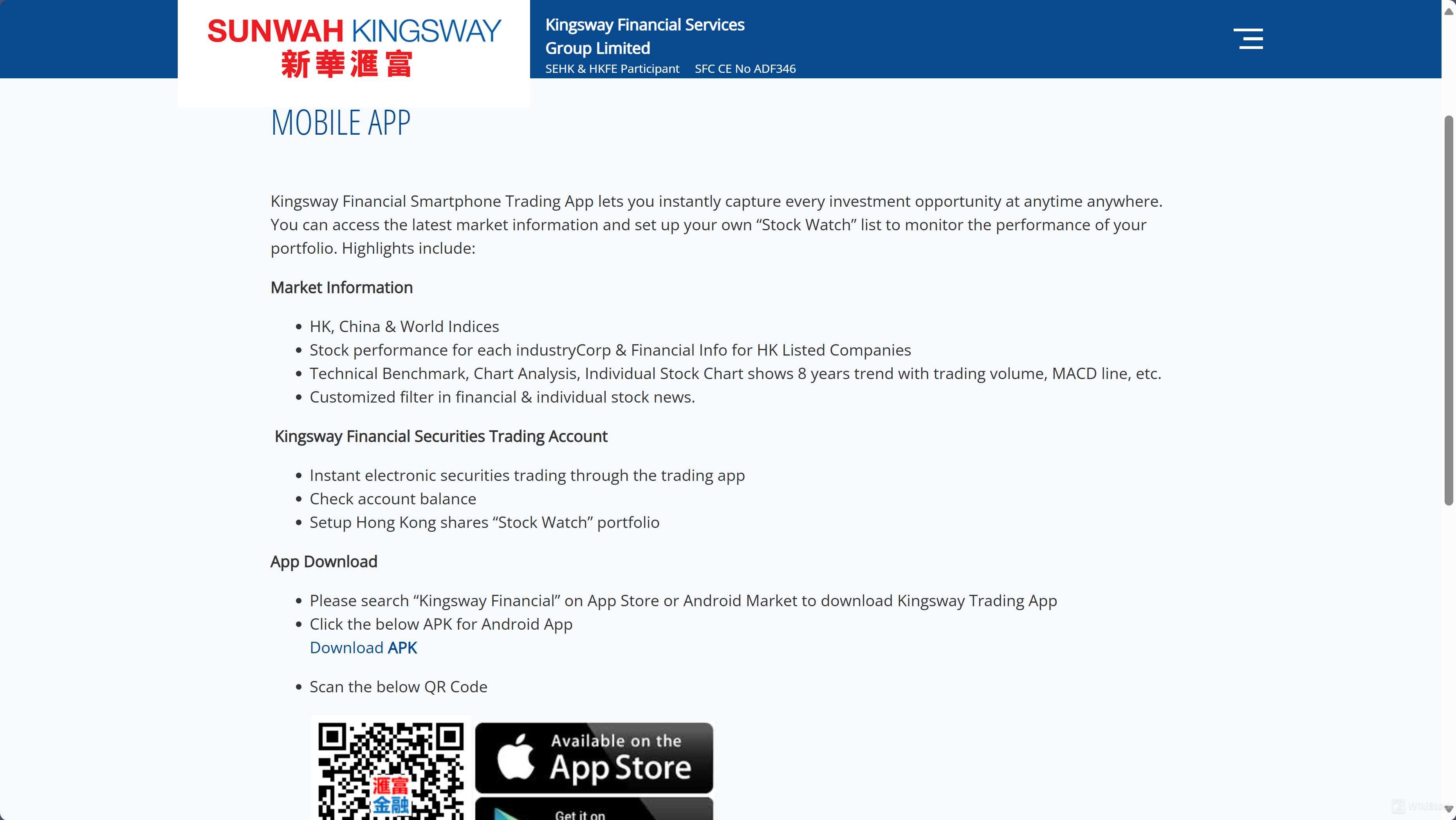

Sunwah Kingsway Trading Platform Review

Sunwah Kingsway offers a robust mobile trading platform through their Kingsway Financial Smartphone Trading App, designed to help users capture investment opportunities instantly, anytime and anywhere. The app provides market information, including HK, China, and world indices, stock performance for each industry, and corporate and financial information for HK listed companies. It features technical benchmarks, chart analysis, and individual stock charts showing up to 8 years of trends with trading volume and MACD line.

Users can customize filters in financial and individual stock news and set up their own “Stock Watch” list to monitor portfolio performance. The app allows instant electronic securities trading, checking account balances, and setting up Hong Kong shares “Stock Watch” portfolios. The Kingsway Trading App is available for download on both the App Store and Android Market.

Customer Support

Kingsway Financial Services offers customer support through various channels. Clients can contact the customer service team by phone at +852 2283 7373 for direct assistance.

Additionally, customers can reach out via email at customerservice@sunwahkingsway.com for inquiries and support. The company is headquartered at 7/F., Tower One, Lippo Centre, 89 Queensway, Hong Kong, providing a central location for in-person consultations and support.

Conclusion

Kingsway Financial Services provides a suite of financial services, including brokerage, asset management, and corporate finance, all supported by their robust mobile trading platform.

Their extensive fee structure covers various trading and account maintenance services, ensuring transparency for their clients. With strong regulatory oversight by the SFC, a dedicated customer support team, and advanced trading tools, Kingsway Financial Services is well-equipped to meet the diverse needs of both retail and institutional investors.

FAQs

How can I download the Kingsway Financial Trading App?

Search “Kingsway Financial” on the App Store or Android Market to download the app.

What is the minimum brokerage commission for Hong Kong Securities at Kingsway?

The minimum brokerage commission is HK$100.00 per transaction.

How can I contact Kingsway Financial Services customer support?

You can contact them by phone at +852 2283 7373 or email at customerservice@sunwahkingsway.com.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)