East Asia Securities Company Limited, (a wholly-owned subsidiary of The Bank of East Asia, Limited), established in 1985, is a licensed Corporation registered with the Securities & Futures Commission of Hong Kong and a participant of Hong Kong Exchanges and Clearing Exchange Participant for China Connect. We own 6 trading rights on Hong Kong Exchanges and Clearing and operate China B shares direct dealing seats in the Shanghai and Shenzhen Stock Exchanges.

What is BEA Securities?

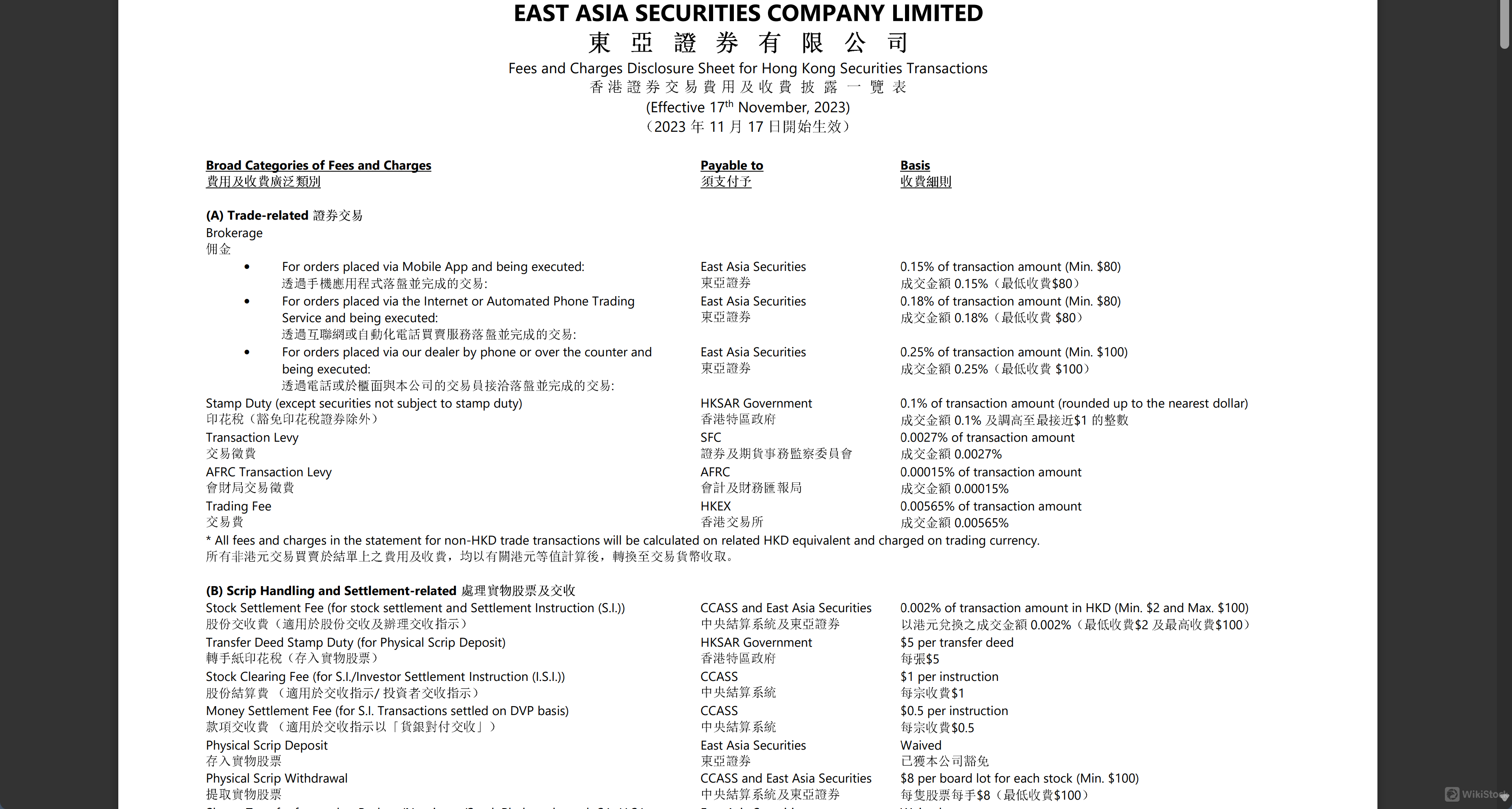

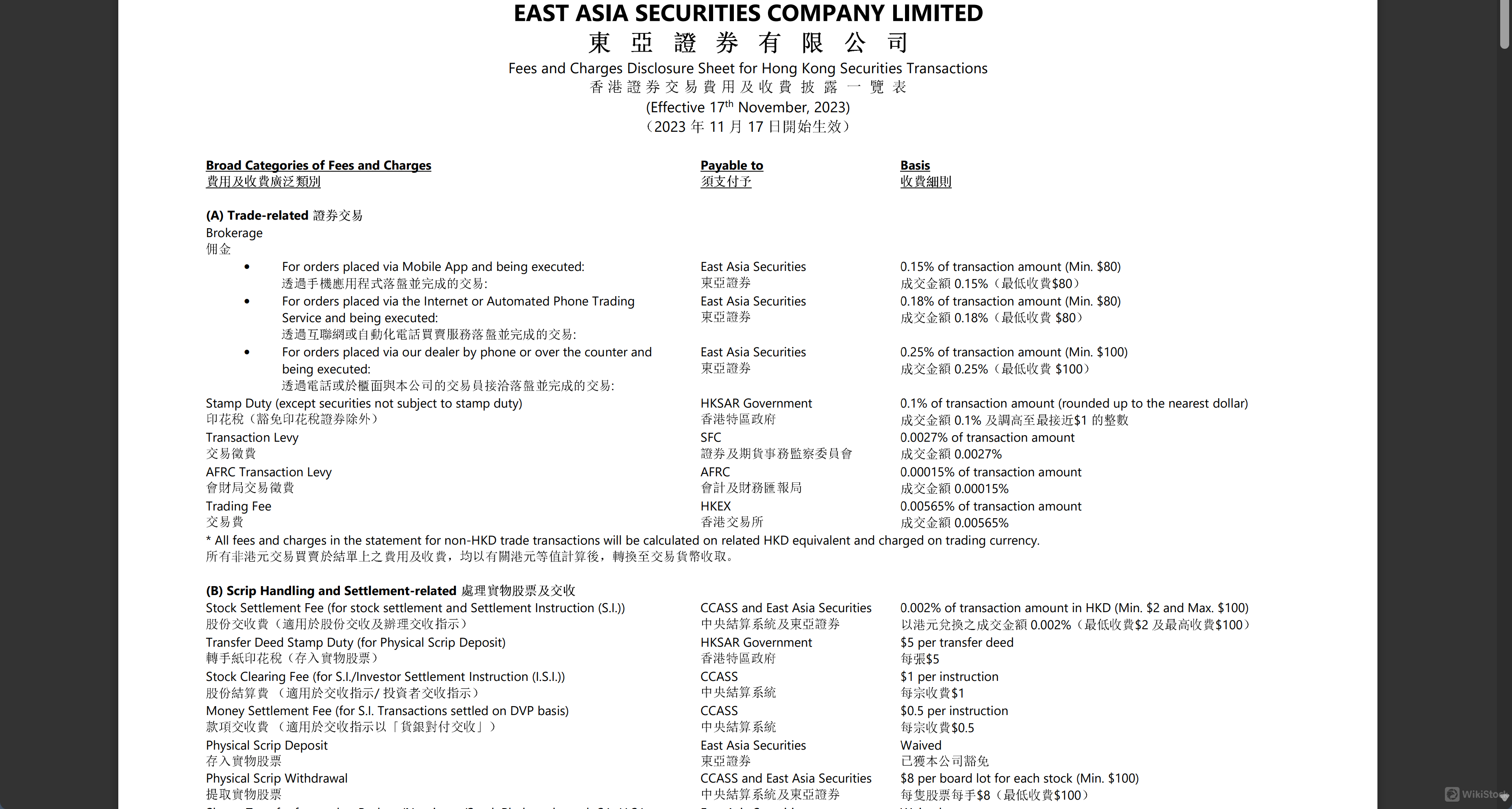

BEA Securities holds a solid three-star rating from WikiStocks and offers a competitive fee structure with commissions starting at 0.15%, with a minimum charge of HK$80.

The platform features EAS i-Token, which enhances user trading experience with its friendly interface. BEA Securities also offers an attractive interest rate of 3.5% p.a. on Retail Green Bonds issued in 2023.

However, a potential downside is the relatively high interest rate of 6.77% on uninvested cash, which could be costly for investors holding significant uninvested balances.

Pros & Cons

BEA Securities is regulated by the SFC, ensuring compliance with financial regulations and offering investor protection. The platform supports a diverse array of tradable securities including stocks, bonds, and ETFs, meeting a wide range of investment preferences. It features a unique trading platform, EAS i-Token, known for its user-friendly interface. Additionally, BEA Securities

Despite its strengths, BEA Securities lacks around-the-clock customer support, which might inconvenience traders needing assistance during off-hours. Another limitation is the absence of diverse account options, potentially restricting investors looking for tailored trading conditions or account features that match different investment strategies.

Is BEA Securities Safe?

Regulations:

BEA Securities is regulated by the Securities and Futures Commission of Hong Kong (SFC), with the license number: AAE876. It's a key indicator of its legitimacy and adherence to strict regulatory standards. This oversight ensures that BEA Securities operates within the legal frameworks designed to protect investors.

Funds Safety:

Client funds with BEA Securities are insured, providing a layer of financial security in the event of company insolvency or other financial issues. The coverage amount typically aligns with industry standards, although specific figures can vary based on the account type and the regulations of the Hong Kong Securities and Futures Commission (SFC). Clients are encouraged to review the specific insurance terms directly with BEA Securities or through the official SFC website to understand the extent of coverage provided.

Safety Measures:

BEA Securities employs robust encryption technologies to safeguard the storage of client funds and sensitive information. This includes the use of Transport Layer Security (TLS) protocols to secure online transactions and communications.

Additionally, the broker implements various account safety measures such as two-factor authentication (2FA) to enhance login security, automated monitoring systems to detect and prevent unauthorized access, and strict data privacy policies to prevent the leakage of user information. These measures ensure that client assets and personal data are protected against cyber threats and unauthorized access.

What are securities to trade with BEA Securities?

With BEA Securities, clients have access to a diverse array of securities to trade.

These include all Hong Kong listed securities, which can be traded using their fully automated online Cybertrading service that processes orders straight through the AMS system of Hong Kong Exchanges and Clearing. This service is accessible via the internet, mobile phone, or Automated Phone Service, and in person or via the Securities Hotline.

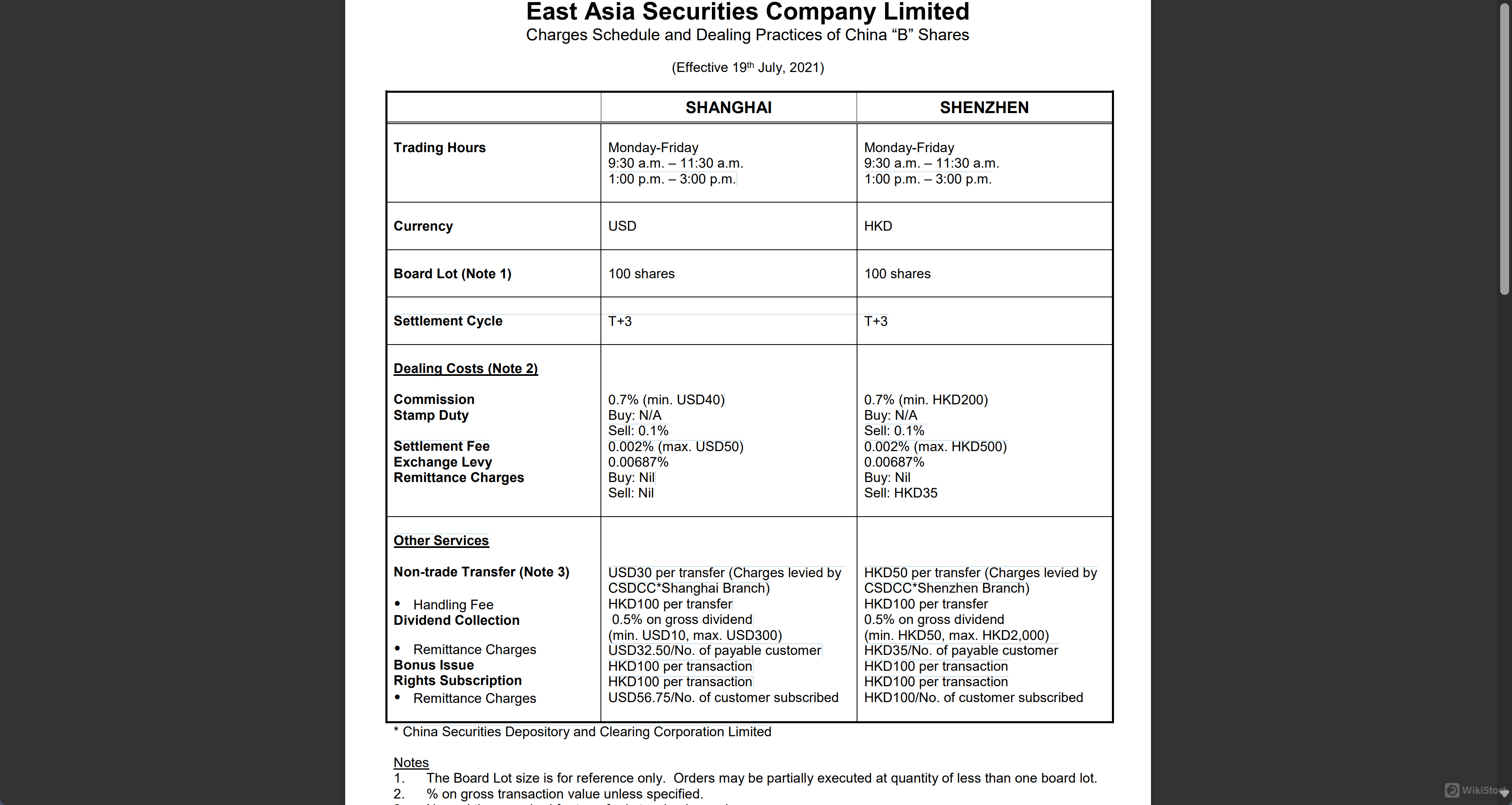

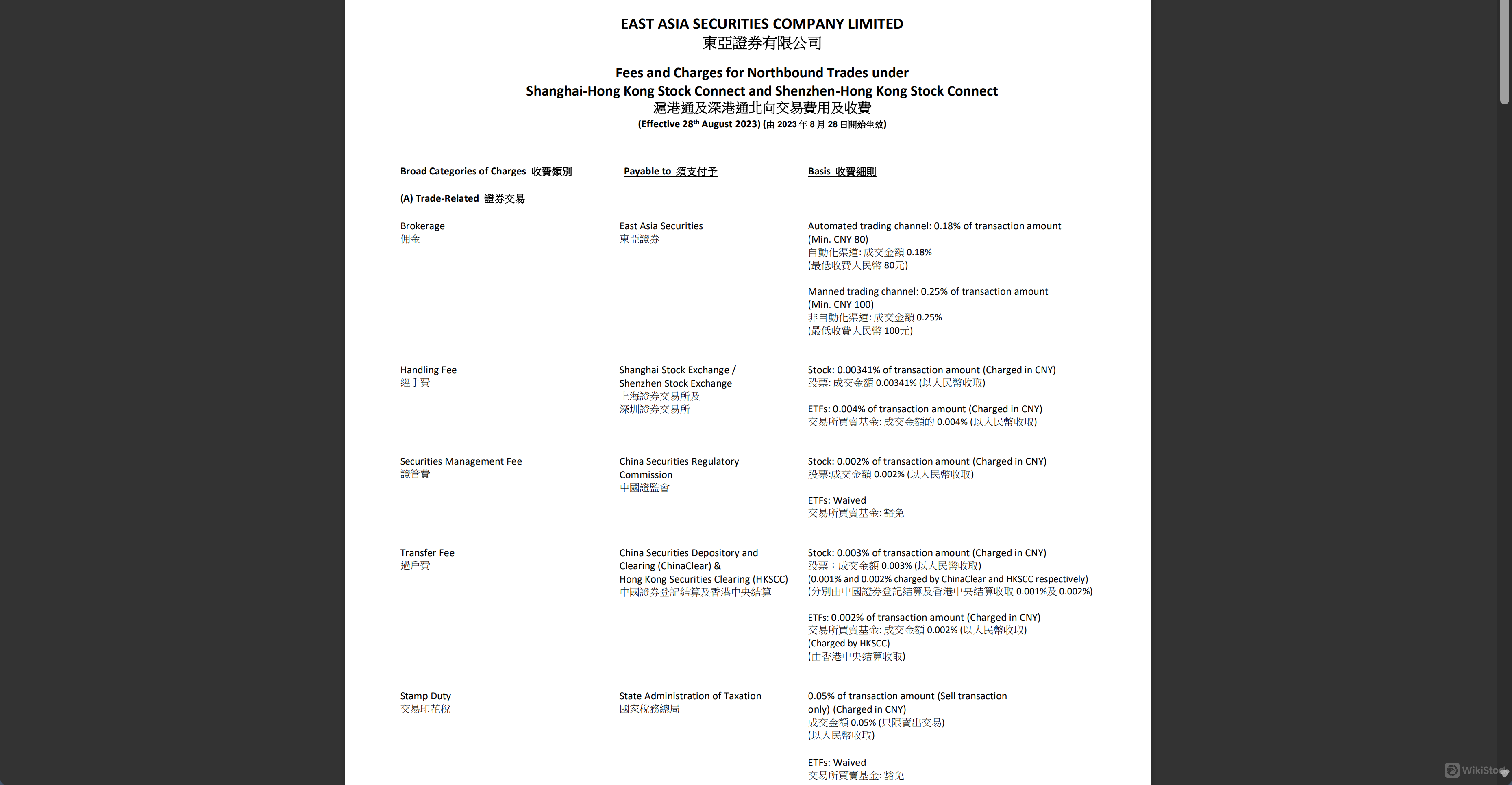

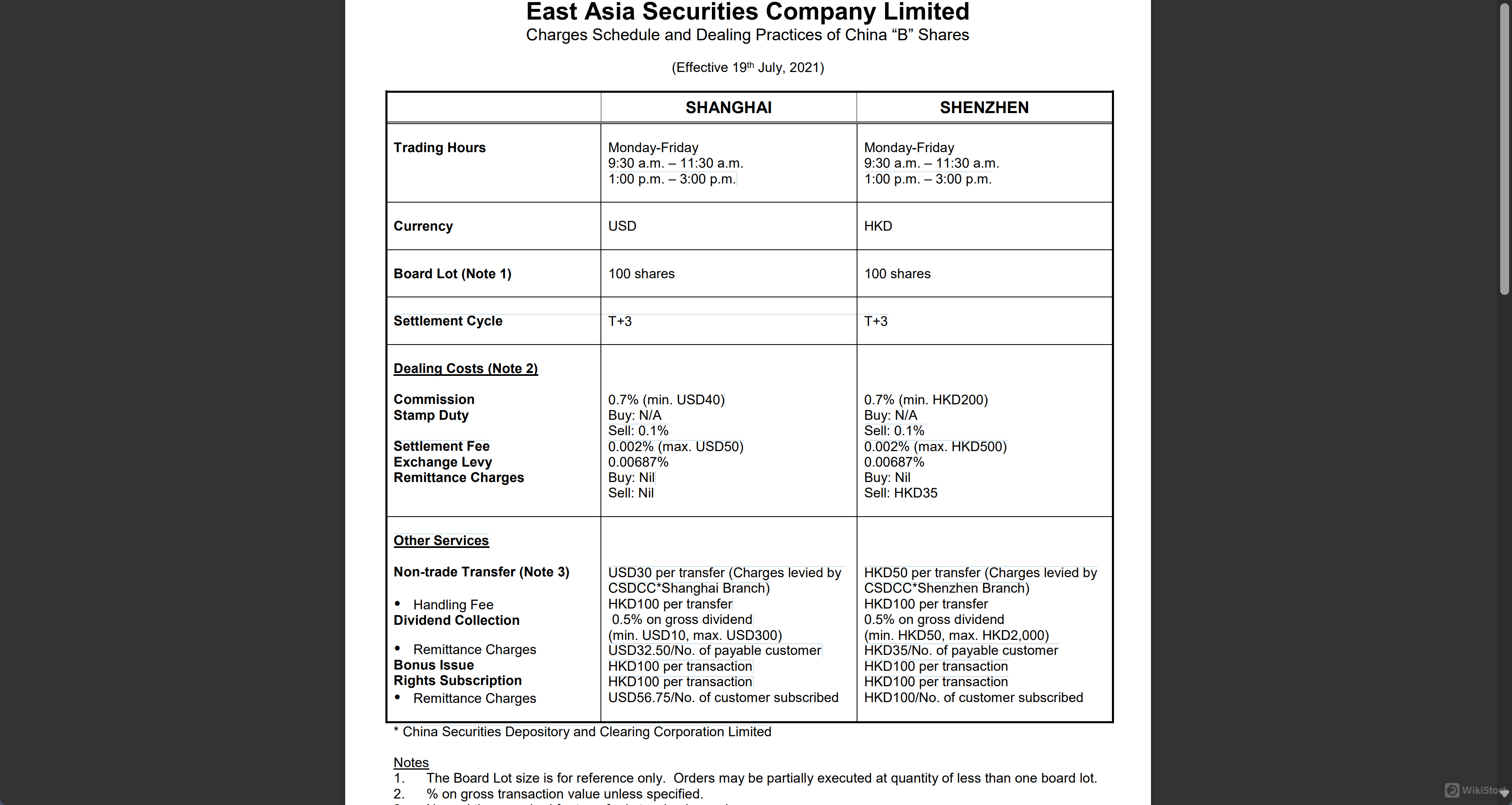

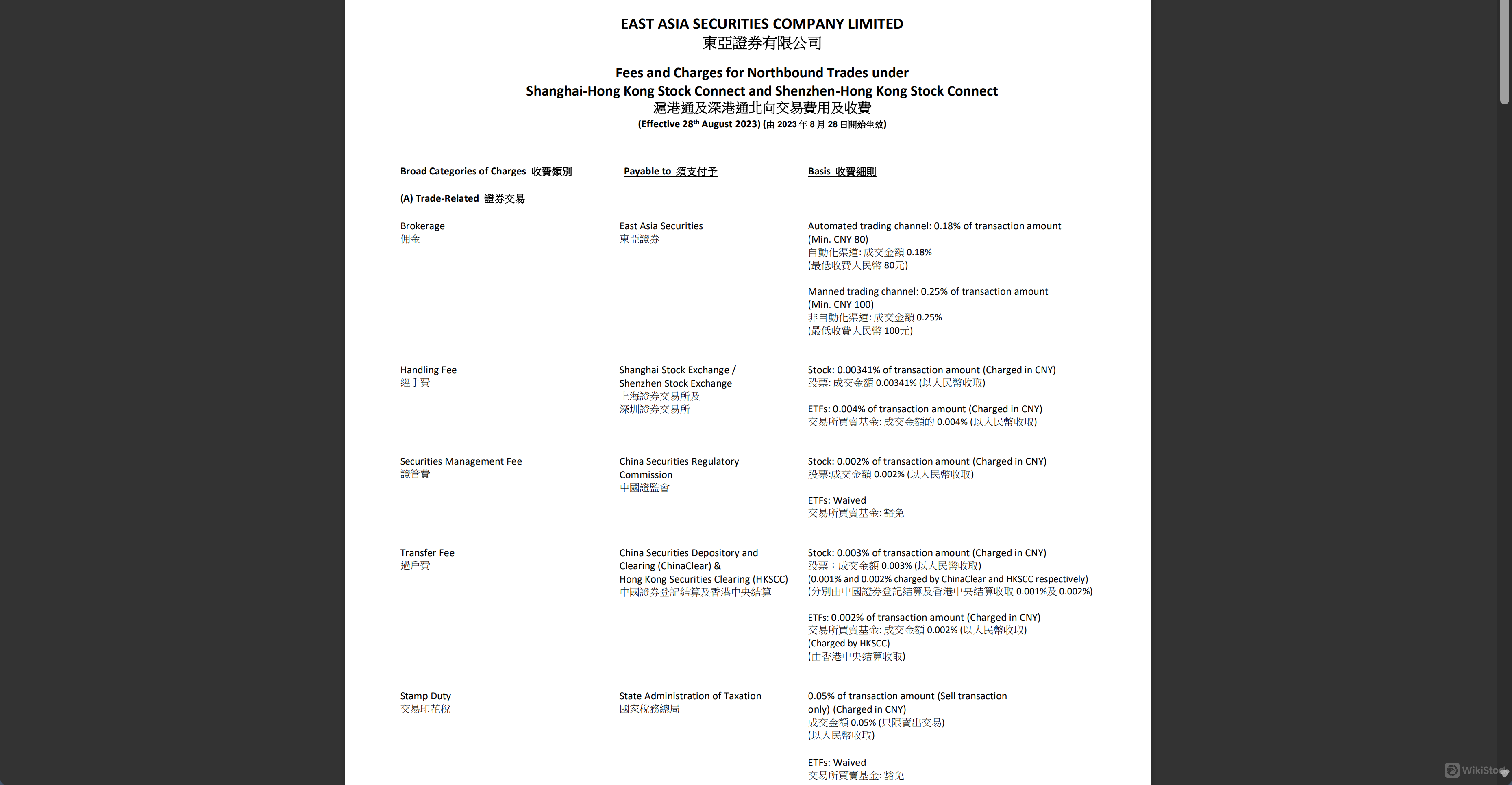

Additionally, BEA Securities offers specialized broking services for China A shares as part of the Shanghai-Hong Kong Stock Connect scheme, and for China B shares, both of which attract investors looking to engage with mainland Chinese markets. Orders for these services can also be placed via their Internet Trading Platform or by phone.

Clients interested in derivatives can trade stock options through phone-based ordering. For those looking to leverage their investments, BEA Securities provides flexible margin financing facilities with up to 70% financing ratio, competitive interest rates, and daily interest charges.

For new listings, the firm facilitates applications for Initial Public Offerings (IPOs) through various channels including over the counter at their Head Office, by phone, or electronically via their website. They also offer staggering loans for IPOs, allowing loans up to 90% of the subscription amount.

On the research front, BEA Securities provides weekly market commentaries to keep investors informed. Their Cybertrading service ensures an easy trading experience with features like real-time stock price quotes, instant order status updates, and the ability to cancel or modify orders pre-execution.

BEA Securities Fee Review

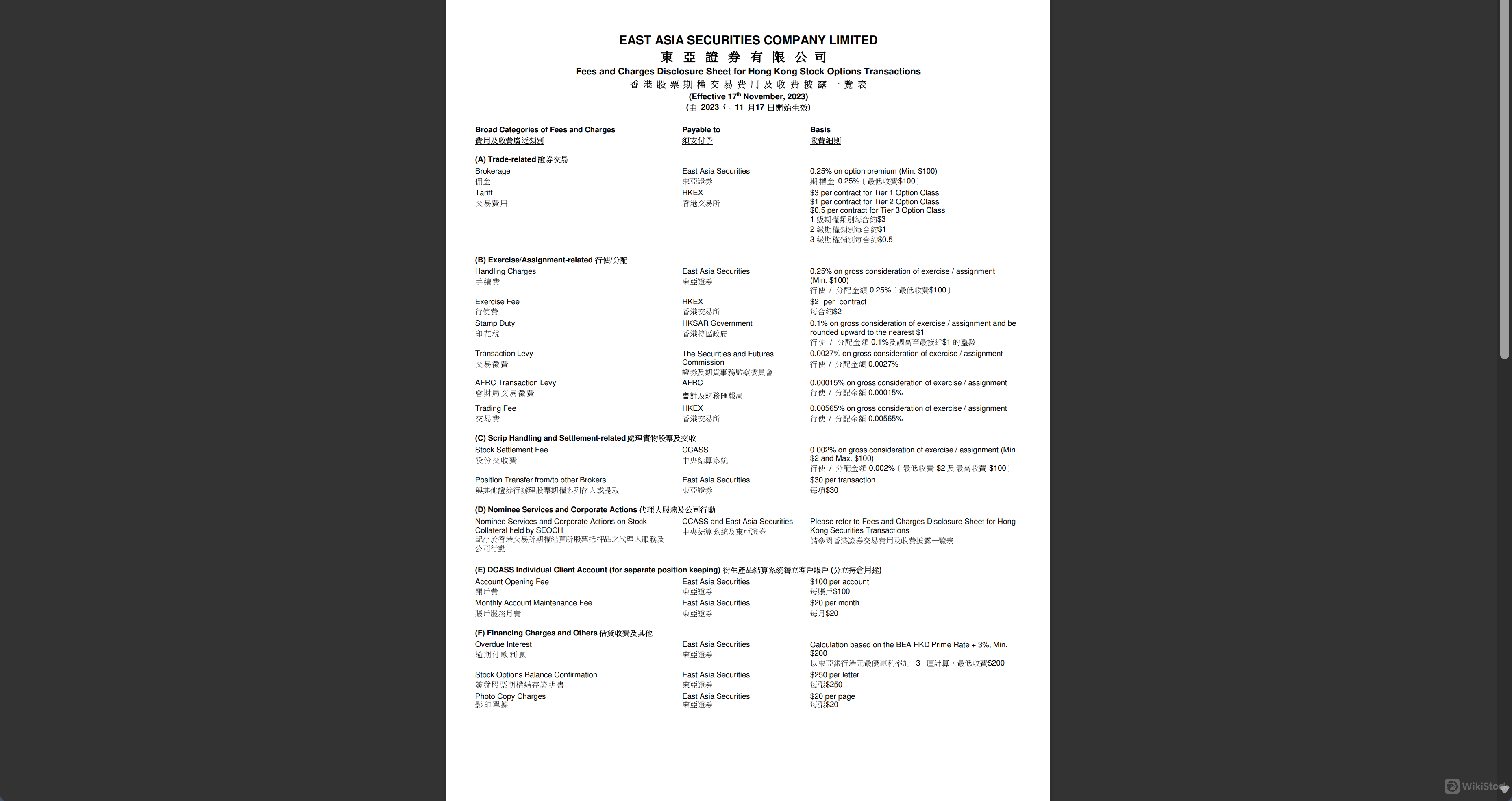

BEA Securities provides a structured fee framework for different categories of services related to Hong Kong stock options transactions, with distinct fees for trading, exercise/assignment-related activities, scrip handling and settlement, nominee services, and account maintenance.

Trade-Related Fees: The brokerage for options trading is set at 0.25% of the option premium, with a minimum of $100. Tariffs vary by option class, with HKEX charging $3, $1, and $0.5 per contract for Tier 1, Tier 2, and Tier 3 option classes, respectively.

Exercise/Assignment-Related Fees: These include handling charges of 0.25% on gross consideration with a minimum of $100, an exercise fee of $2 per contract, a stamp duty of 0.1% rounded up to the nearest dollar, a transaction levy of 0.0027%, an AFRC transaction levy of 0.00015%, and a trading fee of 0.00565% of the gross consideration.

Scrip Handling and Settlement-related Fees: The stock settlement fee is 0.002% of the gross consideration (min $2, max $100), and the position transfer fee is $30 per transaction.

BEA Securities Trading Platform Review

BEA offers the “EAS Mobile Trading App.”to its users. This app integrates the i-Token feature, which is used to fulfill the 2-factor authentication (2FA) login requirement, enhancing the security of the trading platform.

The i-Token serves as an alternative to the traditional One-Time Password (OTP) method, allowing users to log in without the need for receiving an OTP via SMS.

This feature is particularly useful for logging in from overseas or in situations where the network service provider is unavailable. The app must be installed on a mobile device to use the i-Token feature for secure and convenient access to the trading platform.

Promotion

The promotion offered by East Asia Securities Company Limited (EAS) is centered on its Margin Securities Financing Services. This exclusive offer is available only to “EAS” customers who purchase or transfer in Retail Green Bonds issued in 2023.

Participants can enjoy a preferential margin securities interest rate of 3.5% per annum with a margin ratio of 90%. This preferential interest rate is subject to availability and is offered on a first-come, first-served basis. The promotional period for this offer runs from 16 October 2023 to 15 October 2024.

Research & Education

The research and educational content provided by East Asia Securities Company Limited is designed for informational purposes only.

It includes market commentaries based on publicly available sources that are believed to be reliable, though not independently verified. These materials are not intended as investment advice or a solicitation for any specific investment.

It's also noted that these opinions and contents have not been reviewed by the Securities and Futures Commission of Hong Kong and are subject to change without notice.

Customer Service

East Asia Securities offers a range of customer support services, accessible through various hotlines and email addresses tailored to specific needs:

Securities Trading - For inquiries related to trading, customers can call (852) 2308 8200 or email dealing@easecurities.com.hk.

Account Services - For account-related queries, the contact number is (852) 3608 8021, and the email is accounts@easecurities.com.hk.

Nominee Services - This service can be reached at (852) 3608 5575 or via email at nominees@easecurities.com.hk.

Settlement - Questions regarding settlement can be directed to (852) 3608 5560 or settlement@easecurities.com.hk.

Technical Support - For technical assistance, customers can contact (852) 3608 8068 or send an email to info@easecurities.com.hk.

Additionally, their central head office is located on the 9th floor of The Bank of East Asia Building, 10 Des Voeux Road Central, Hong Kong. The office can be contacted via phone at (852) 3608 8077 and fax at (852) 3608 6128.

Conclusion

East Asia Securities Company Limited (EAS) offers a suite of financial services including securities trading, account services, nominee services, and settlement, supported by a robust technical support system.

Based in Hong Kong, EAS operates from its central head office located in the Bank of East Asia Building. With a dedicated focus on customer satisfaction, EAS provides tailored support through specialized hotlines and email channels, ensuring that all client needs are met efficiently and effectively.

East Asia Securities Company Limited (EAS) offers a suite of financial services including securities trading, account services, nominee services, and settlement, supported by a robust technical support system.

FAQ

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--