Score

とうほう証券

https://toho-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Toho Securities Co.,Ltd

Abbreviation

とうほう証券

Platform registered country and region

Company address

Company website

https://toho-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Toho Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 2015 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Domestic/foreign stocks, Investment Trust, Bonds |

| Fees | Japanese domestic stock trading fees: 0.11-1.21% of contract amount, min 2,750 yen, max 275,000 yen, depending on trading volume |

| Convertible bonds trading fees: 0.11-1.1% of contract amount , min 2,750 yen, max 275,000 yen, depending on trading volume | |

| Foreign stock trading fees: 0.33-1.1% + tiered fixed rate | |

| Customer Service | Head office: 〒960-8633, 3-25 Omachi, Fukushima, City (3rd floor, Toho Bank Head Office) |

| Tel: 024-523-3284,024-523-5550(Workdays 9:00~17:00) |

Toho Securities Information

Established in 2015 as a subsidiary of Toho Bank, Toho Securities offers a comprehensive range of financial products, including stocks, investment trusts, ETFs, and bonds, etc.

The company maintains transparent fee structures, for example, for Japanese domestic stock trades, fees range from 0.11% to 1.21% of the contract amount, with a minimum charge of ¥2,750 and a maximum of ¥275,000 based on trading volumes. While foreign stock trading fees vary from 0.33% to 1.1%, augmented by fixed-tier rates.

Regulated by the Japan Financial Services Agency (FSA) with license no. Director-General of the Tohoku Finance Bureau (Kinsho) No. 36, Toho Securities upholds stringent standards of integrity and credibility in all financial operations.

For more detailed information, you can visit their official website: https://toho-sec.co.jp/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Customer Service Channels |

| Segregated Management of Customer Assets | Fees and Costs |

| Longevity and Stability |

- Regulatory Oversight: Operates under the regulatory framework of the Japan Financial Services Agency, ensuring compliance and security for clients.

- Segregated Management of Customer Assets: Adheres to regulations for the segregated management of customer assets, enhancing safety and trust.

- Longevity and Stability: Backed by Toho Bank, which adds a layer of stability and long-term credibility. Cons:

- Limited Customer Service Channels: Relies heavily on physical offices for customer service, which will limit accessibility for clients preferring digital communication.

- Fees and Costs: Depending on specifics, brokerage fees and transaction costs could be perceived as high compared to some competitors.

- Is Toho Securities regulated by any financial authority?

- What types of products does Toho Securities provide?

- Is Toho Securities suitable for beginners?

- What are the fees for trading domestic stocks with Toho Securities?

- Can I trade foreign stocks through Toho Securities?

Is It Safe?

Regulation:

Toho Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Tohoku Finance Bureau (Kinsho) No. 36, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Toho Securities's commitment to integrity and credibility in its services.

Safety Measures:

Toho Securities prioritizes the rigorous safeguarding of customer assets, adhering strictly to the Financial Instruments and Exchange Act and the guidelines set forth by the Japan Securities Dealers Association.

They have implemented comprehensive security measures, including regular audits conducted by EY Shin Japan LLC to ensure compliance with the Guarantee Business Practice Guidelines 3802. This commitment underscores their dedication to maintaining the segregated management of customer assets, providing assurance of transparency and reliability in their financial operations.

What are Securities to Trade with Toho Securities?

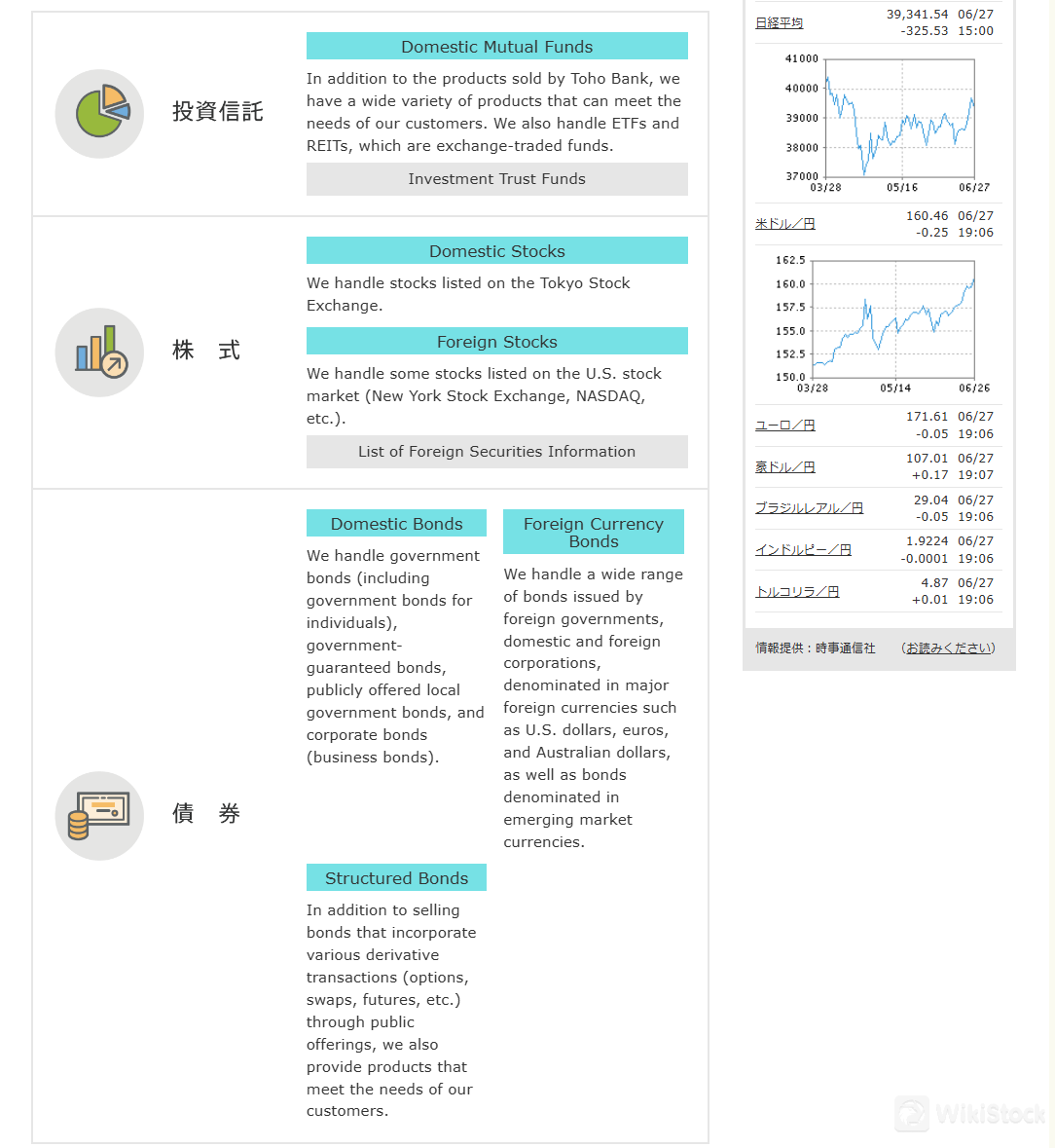

Toho Securities offers a comprehensive range of financial products.

They provide domestic mutual funds alongside ETFs and REITs for those seeking diversified investment options.

Their stock offerings include Japanese stocks listed on the Tokyo Stock Exchange, while in foreign stocks, they handle selections from major U.S. exchanges like the New York Stock Exchange and NASDAQ.

For bonds, Toho Securities covers government bonds, including those for individuals, government-guaranteed bonds, local government bonds, and corporate bonds. They also offer foreign currency bonds in major currencies and structured bonds incorporating various derivativesb (options, swaps, futures, etc.).

Fees Review

Toho Securities provides a detailed fee structure across various financial transactions, ensuring transparency and clarity for its customers.

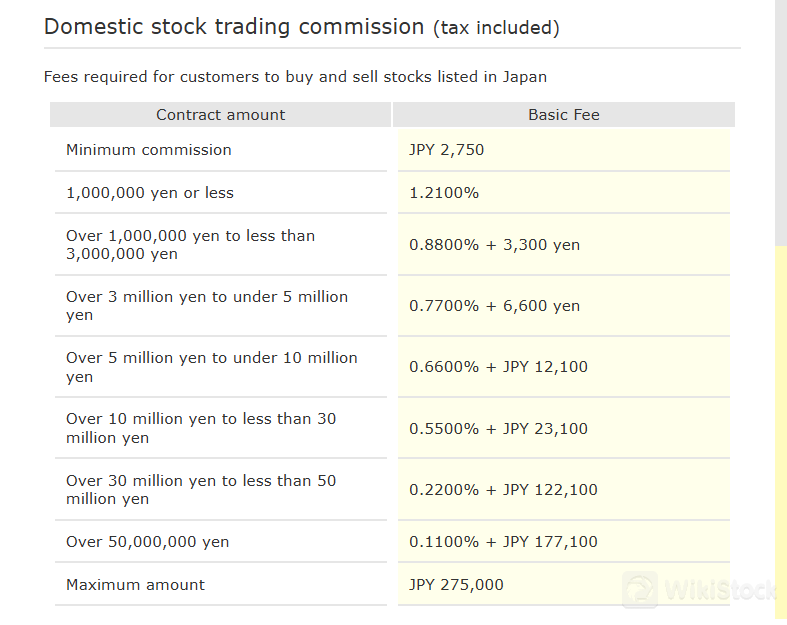

For domestic stock trading, fees include a minimum commission of JPY 2,750 and a tiered percentage of the contract amount plus tiered fix rate: 1.21% for transactions up to JPY 1,000,000, reducing to 0.11% plus JPY 177,100 for transactions over JPY 50,000,000, capped at JPY 275,000.

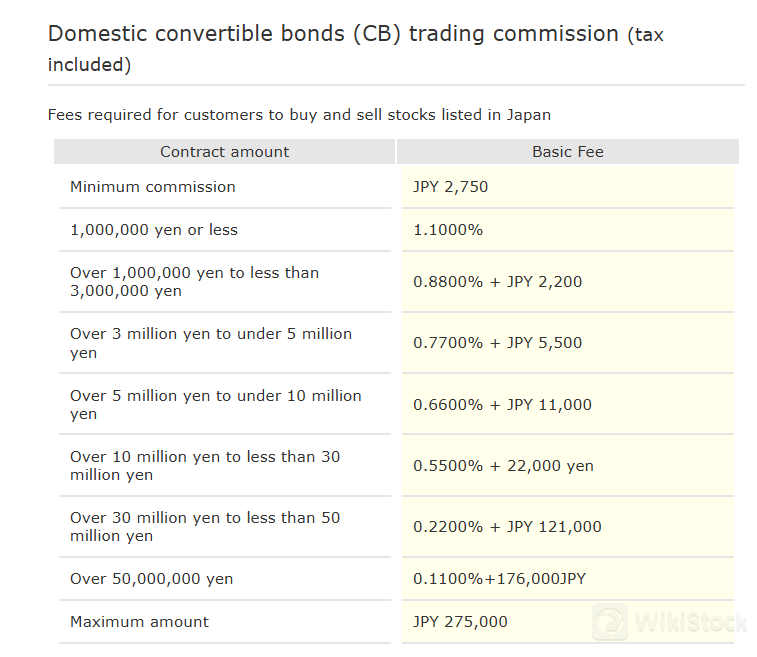

Convertible bonds trading fees start at 1.1% for amounts up to JPY 1,000,000 and 0.11% for amounts over 50,000,000 yen, with additional charges based on transaction size. The minimum trading fee is JPY 2,750 and the maximum is JPY275,000.

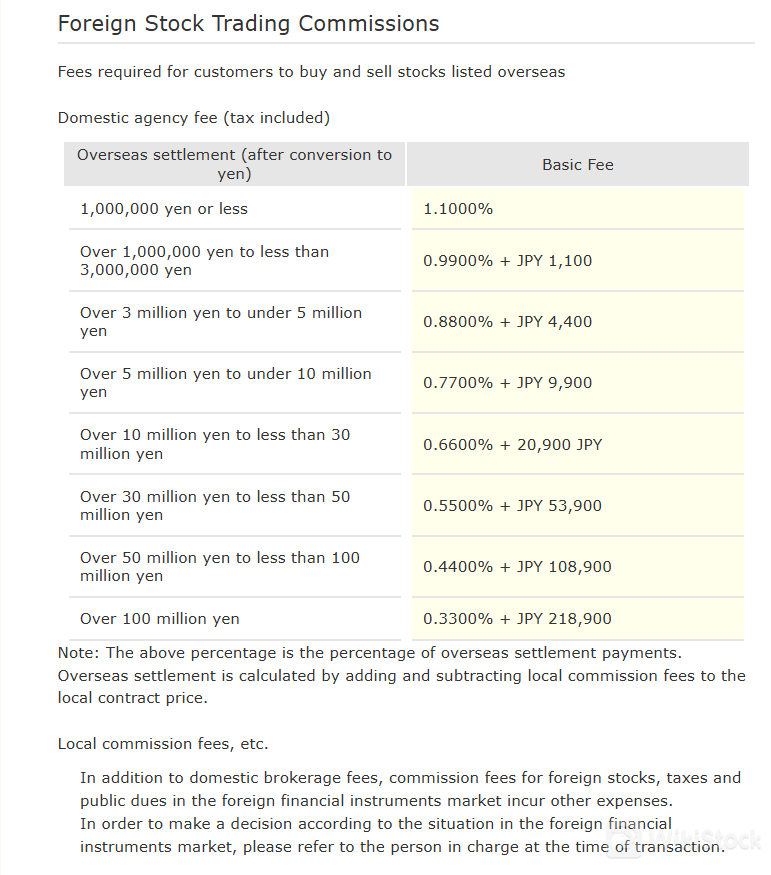

Foreign stock trading fees vary similarly, ranging from 1.1% for smaller amounts up to 0.33% for transactions exceeding JPY 100,000,000, with fixed tiered fixed rates apply.

Additionally, there are fees for securities transfers and foreign currency exchanges which align with market standards. For more detailed and most updated info regarding fees, you can contact Toho Securities for direct clarification, or visit https://toho-sec.co.jp/account/charge.html to look up for the info you want.

Customer Service

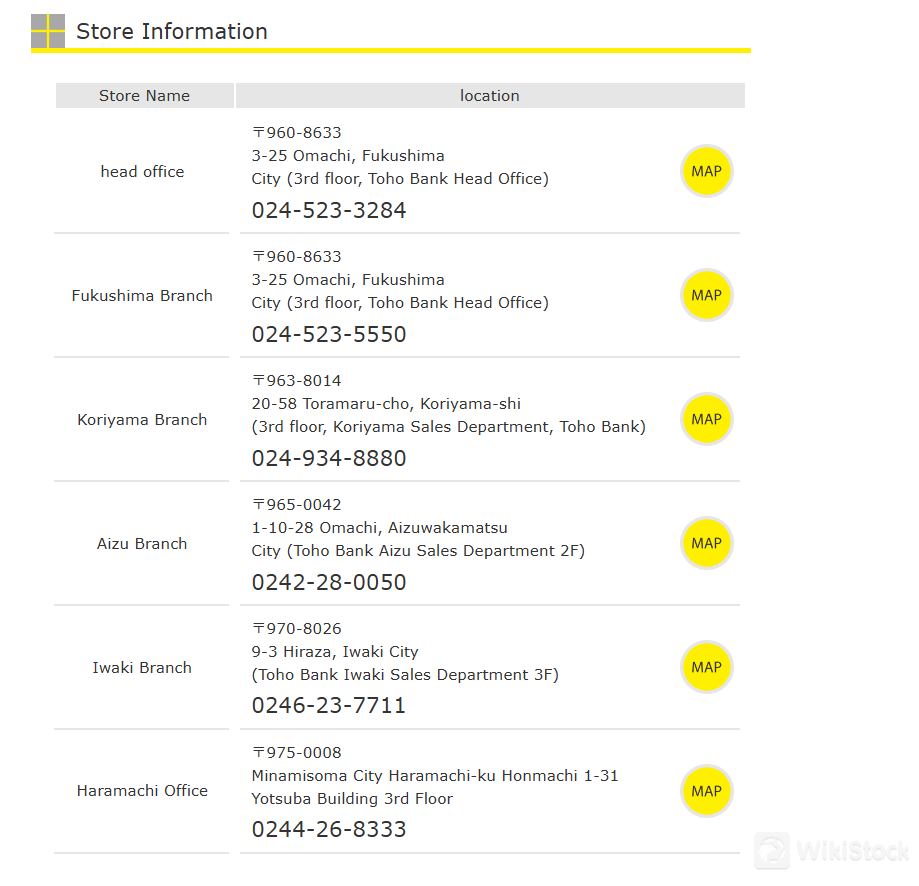

Toho Securities provides physical address and phone contact for its head office and four branches across Japan as customer service for smooth and supportive experience for its clients.

The head office, located at 〒960-8633, 3-25 Omachi, Fukushima, City (3rd floor, Toho Bank Head Office) is easily accessible for in-person consultations.

Customers can reach out via telephone at 024-523-3284 and 024-523-5550 on workdays between 9:00 and 17:00 for general inquiries.

Contact for branches in Koriyama, Aizu, Iwaki and Haramachi can be found at https://toho-sec.co.jp/store/.

However, some might find such customer service channels very limited, without comprehensive supports via email, live chat or social media platforms, there is chance that customer cannot address their inquiries timely.

Conclusion

Toho Securities, established in 2015 as a subsidiary of Toho Bank, offers a wide array of financial products including stocks, bonds, ETFs, and investment trusts.

The firm operates under stringent regulatory oversight by Japan's Financial Services Agency with license no. Director-General of the Tohoku Finance Bureau (Kinsho) No. 36, ensuring compliance and credibility.

Despite limited customer service channels primarily through physical offices across Japan, Toho Securities provides robust financial services tailored to meet diverse investment needs. The company's commitment to regulatory standards underscores its dedication to transparency and reliability in financial markets.

Frequently Asked Questions (FAQs)

Yes, Toho Securitiesoperates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Tohoku Finance Bureau (Kinsho) No. 36.

Stocks, bonds, ETFs, and investment trusts.

Yes, Toho Securities is suitable for beginners. It is well regulated by FSA and offers transparent fee structures, which is beginner friendly.

Fees range from 0.11% to 1.21% of the contract amount, with a minimum of 2,750 yen and a maximum of 275,000 yen, depending on the transaction size.

Yes, Toho Securities facilitates trading in foreign stocks with fees ranging from 0.33% to 1.1% plus additional fixed rates based on transaction size.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

5-10 years

Commission Rate

1.21%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

Plus500

Score

BlackRock

Score

SBI THAI ONLINE

Score

Schroders

Score

AVA Trade

Score

Hantec Financial

Score

Monex

Score

Rakuten Trade

Score

LEADING

Score

auカブコム証券

Score