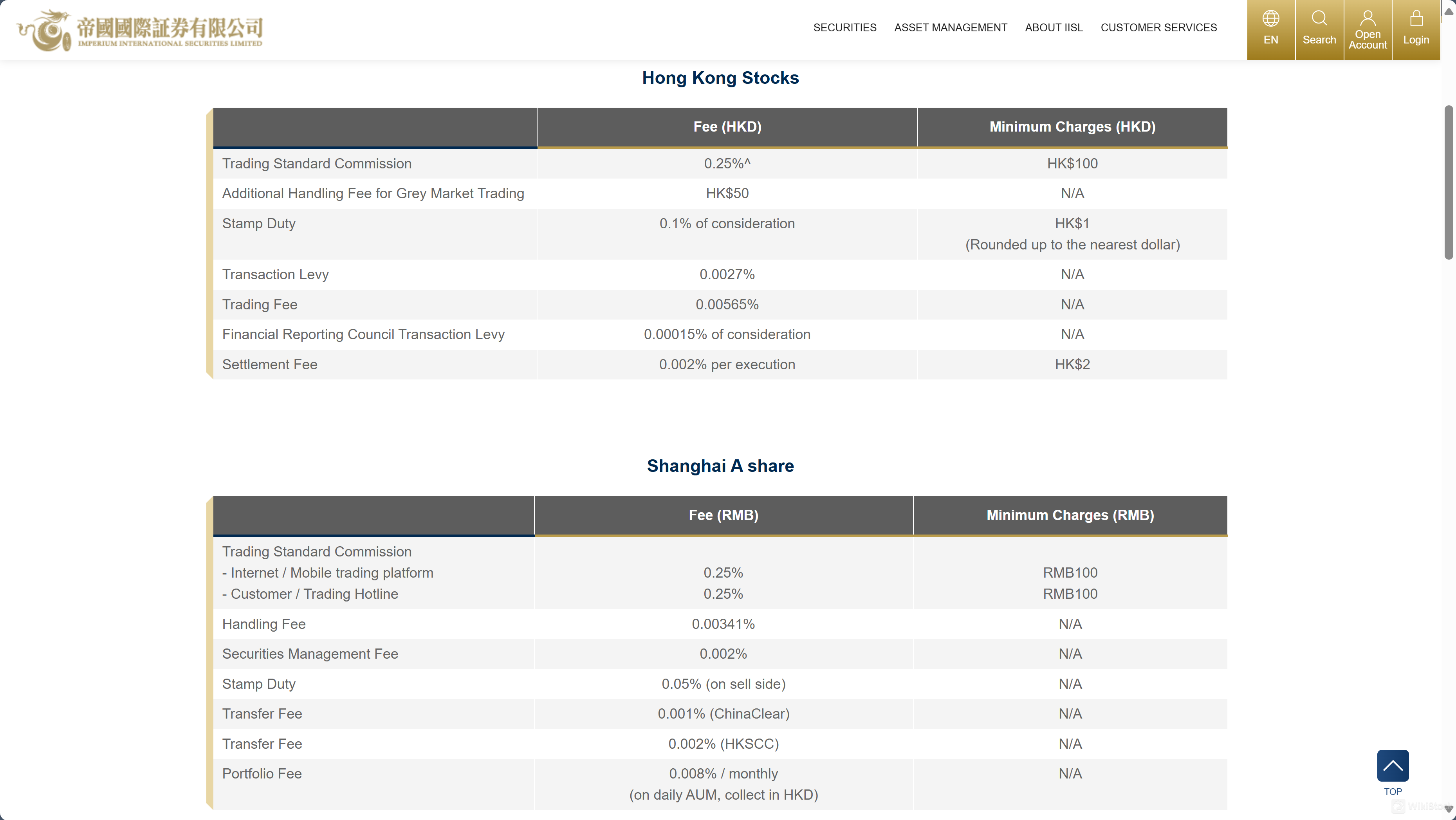

Handling Fee: 0.00341%

Securities Management Fee: 0.002%

Stamp Duty: 0.05% on sell side only.

Transfer Fee: 0.001% (ChinaClear), 0.002% (HKSCC)

Portfolio Fee: 0.008% monthly on daily AUM, collected in HKD.

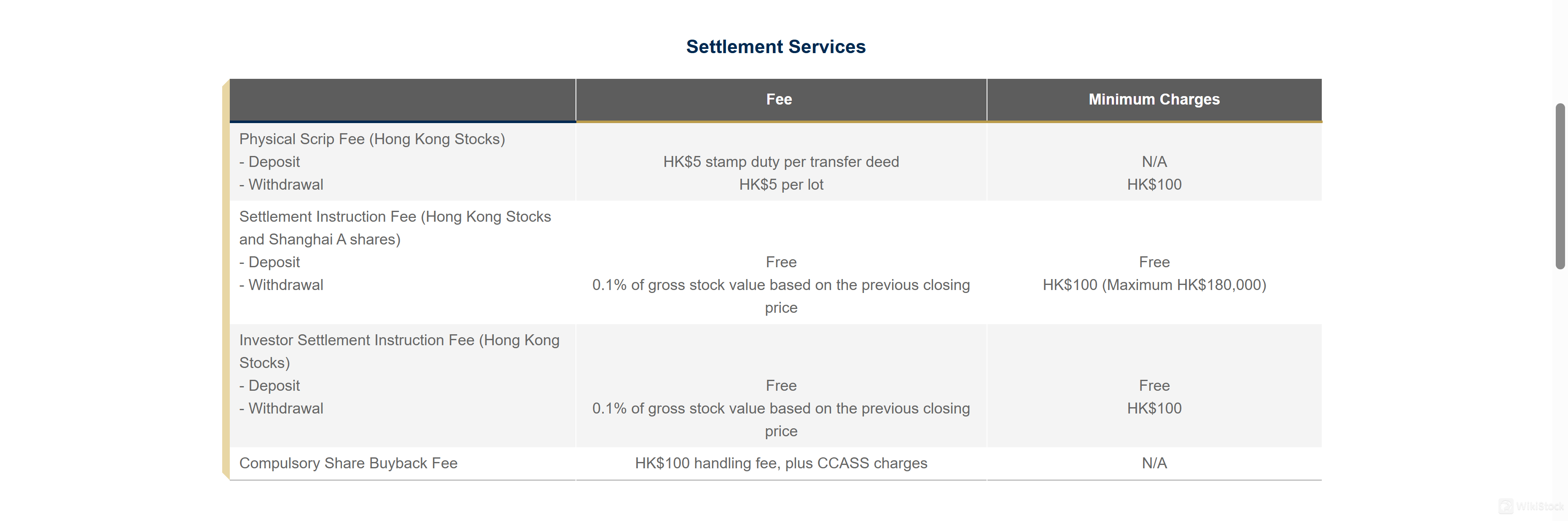

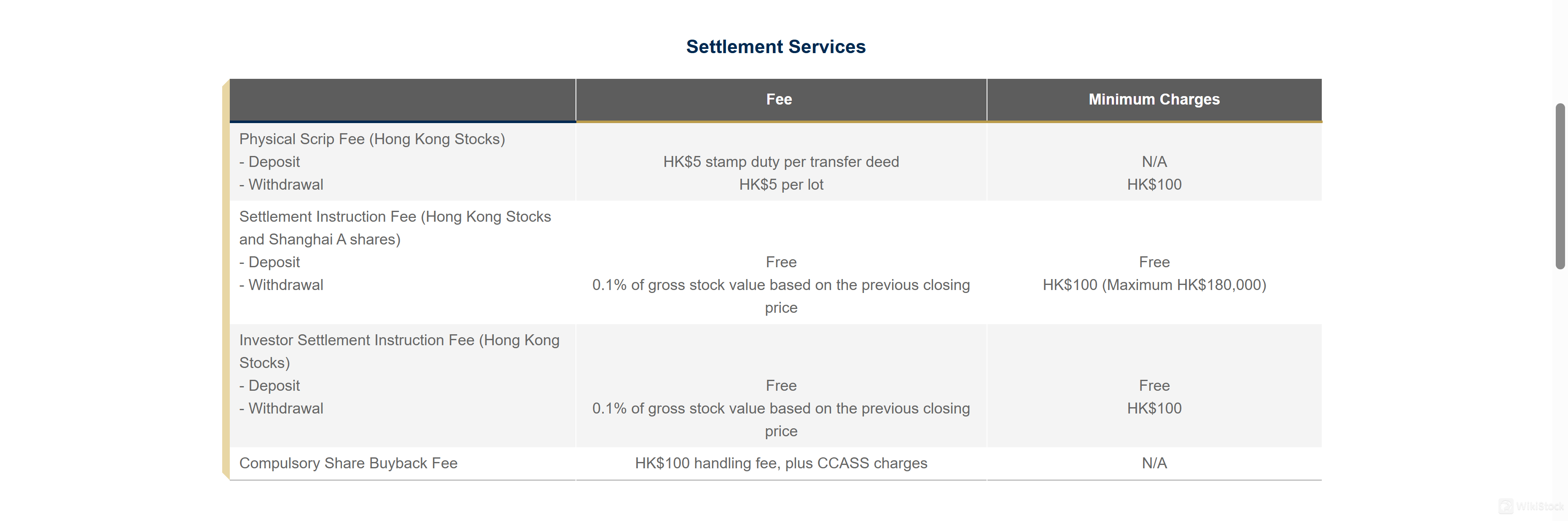

Settlement Services

Physical Script Fee for Hong Kong Stocks: HK$5 per lot for deposit, HK$100 for withdrawal.

Settlement Instruction Fee for Deposits: Free for Hong Kong Stocks and Shanghai A shares.

Settlement Instruction Fee for Withdrawals: 0.1% of gross stock value, HK$100 minimum, maximum HK$180,000.

Investor Settlement Instruction Fee for Withdrawals: 0.1% of gross stock value, minimum HK$100.

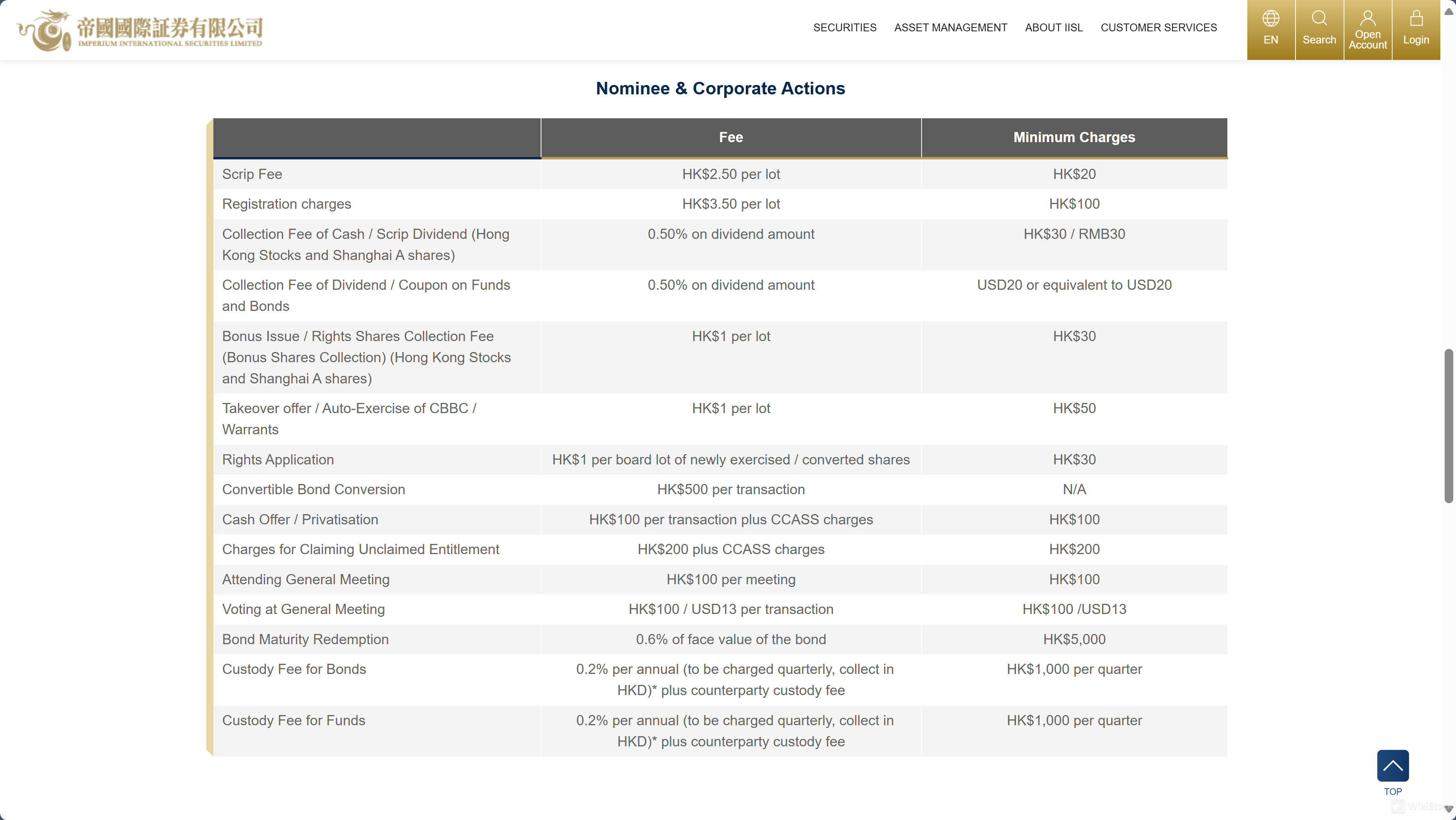

Nominee and Corporate Actions

Scrip Fee: HK$2.50 per lot, minimum HK$20.

Registration Charges: HK$3.50 per lot, minimum HK$100.

Collection Fee for Dividends: 0.50% on dividend amount, minimum HK$30 / RMB30 / USD20.

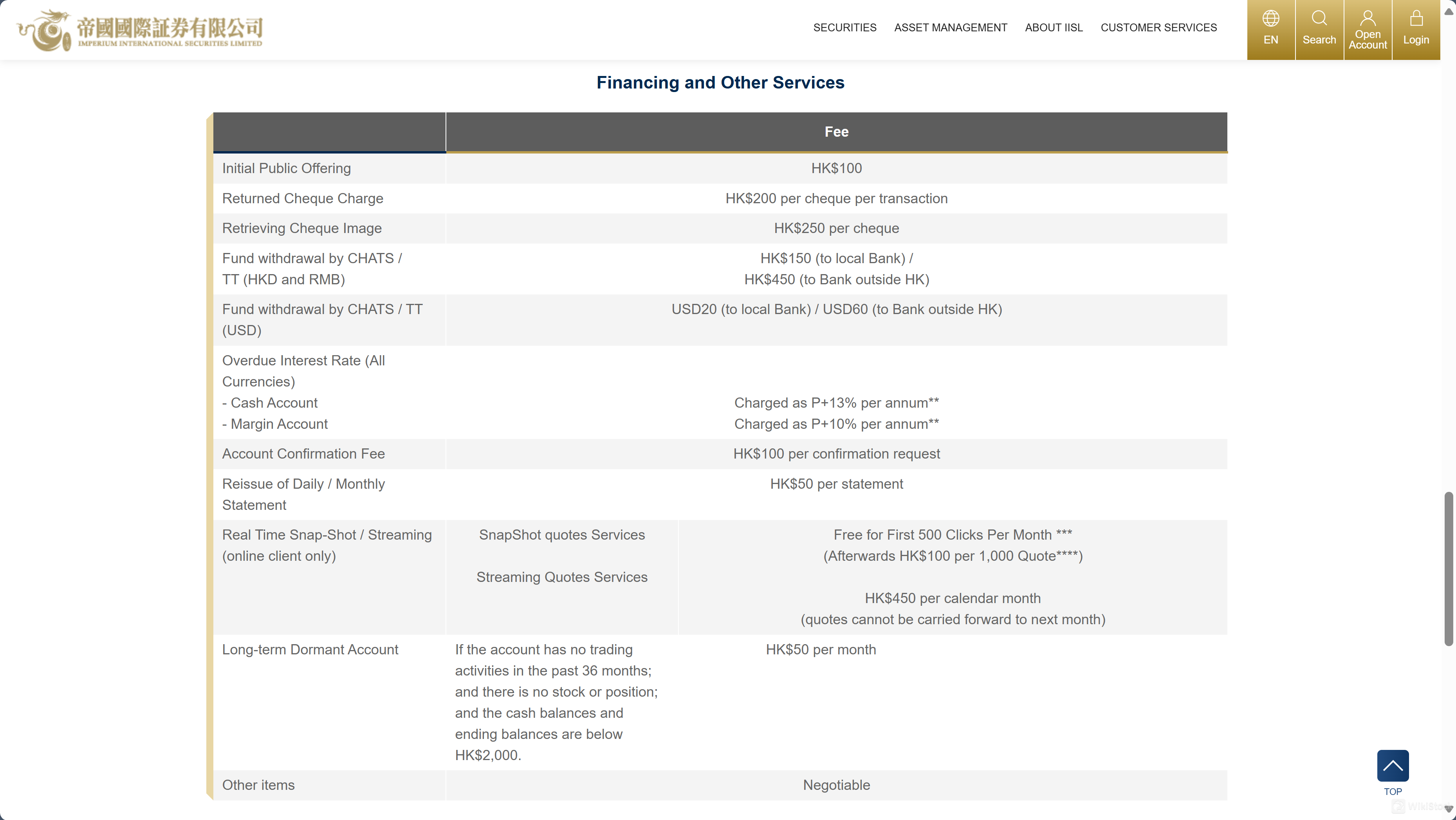

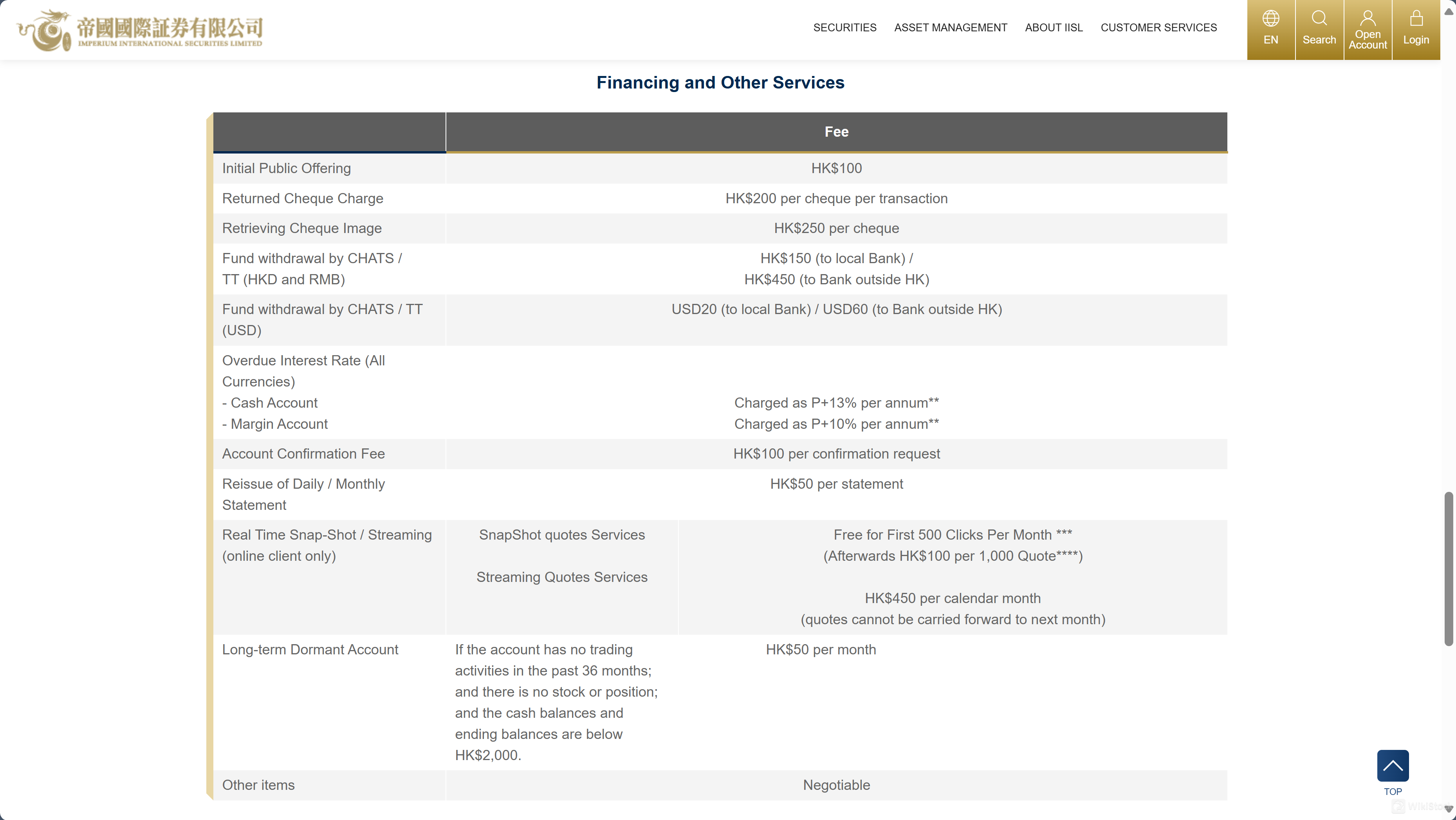

Financing and Other Services

Financing and Other Services

Initial Public Offering Fee: HK$100.

Returned Cheque Charge: HK$200 per cheque.

Fund Withdrawal Charges: HK$150 for local, HK$450 for outside HK bank transfers in HKD/RMB; USD20 for local, USD60 for outside HK bank transfers in USD.

Overdue Interest Rate: Charged at P+13% per annum for cash accounts and P+10% for margin accounts.

Account Confirmation Fee: HK$100 per request.

Reissue of Statements: HK$50 per statement.

Long-term Dormant Account FeeMiscellaneous Fees

Custody Fee for Bonds and Funds: 0.2% annually, charged quarterly plus counterparty custody fee, minimum HK$1,000 per quarter.

IISL App Review

Online Version

The online version of the IISL trading platform allows users to engage directly with the market from any web browser. Key features include the ability to subscribe to initial public offerings (IPOs), place Good-till-Date (GTD) orders which remain active until a specified date unless executed or canceled, and receive important market notifications via email. This version is ideal for traders who prefer accessibility without the need for downloads.

Download Version

IISL's downloadable trading platform is designed for those who require robust trading functionality on their desktop. It supports multiple program trading, allowing users to execute complex trading strategies simultaneously. Additionally, the platform offers shortcut keys for orders, enhancing trading speed and efficiency for frequent traders.

Mobile Apps

The mobile apps version of the IISL trading platform ensures traders can stay connected to the markets on the go. It features real-time stock quotes and charts for various market analysis, a top-ranking system to quickly view leading stocks, and a portfolio checking tool for continuous monitoring and management of personal investments. This app is perfect for active traders who need to make quick decisions from anywhere.

Research & Education

IISL's latest news section provides essential educational resources, keeping clients informed about significant changes and updates that impact their trading activities.

Key updates include changes to bank account details for deposits, cessation of specific futures trading services, adjustments to margin requirements, updates on service fees, and enhancements to trading platforms.

Additionally, information on regulatory requirements and system maintenance helps ensure clients are prepared for compliance and operational shifts.

Customer Service

IISL offers various customer support through multiple channels to ensure clients can easily access assistance and manage their investments. Heres a summary of the available support options:

Address: Customers can visit IISL at Room 2603A, 26/F, One Harbour Square, 181 Hoi Bun Road, Kwun Tong, Kowloon, Hong Kong for in-person inquiries.

Customer Services Hotline / Order Placing Hotline: IISL provides a dedicated hotline for securities and futures at (852) 3585 8988, meeting both general customer service inquiries and specific order placements.

Email: For detailed inquiries, customers can contact IISL via email. The email addresses provided are cs.securities@imperiumhk.com for securities-related queries and cs.futures@imperiumhk.com for futures-related queries.

Fax: Customers can send documents or written queries via fax to (852) 3585 3622.

Instant Messaging: For quicker, on-the-go communications, IISL supports instant messaging through WhatsApp at 6827 2953, WeChat at imperiumhk, and QQ at 2069960345.

Working Hours: The customer service team is available from Monday to Friday, 8:30 am to 6:00 pm, ensuring that client needs are addressed promptly during business hours.

Conclusion

Throughout the exchange, we have explored various aspects of IISL's services, including their detailed fee structure, customer support options, trading platform variations, and the educational resources provided through their latest news updates.

IISL offers a large suite of services and tools that meet diverse trading needs, ensuring clients have access to necessary information and support to navigate the financial markets effectively.

FAQs

Question: What types of trading platforms does IISL offer?

Answer: IISL provides three types of trading platforms: an online version accessible through web browsers, a downloadable version for desktops, and mobile apps for trading on the go.

Question: How can I contact IISL customer support?

Answer: IISL customer support can be reached via their hotline at (852) 3585 8988, email (cs.securities@imperiumhk.com for securities and cs.futures@imperiumhk.com for futures), or instant messaging services like WhatsApp, WeChat, and QQ.

Question: Are there any specific fees for trading Hong Kong stocks with IISL?

Answer: Yes, the fees include a standard trading commission of 0.25%, with additional charges such as a stamp duty of 0.1% and a transaction levy of 0.0027%, among others.

Question: What should I know about the security measures at IISL?

Answer: IISL emphasizes online security with stringent measures, including regular updates and compliance with regulatory standards, to ensure the safety of client transactions and data.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Malaysia

MalaysiaObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--