Established in 2011, CLC is a Hong Kong-based investment firm managing multiple strategies worldwide. We generate attractive investment returns by following a disciplined approach with unique insights and deep research. Our distinctive culture has gathered like-minded, high-quality people to grow with us and provided our investment partners with ever-improving solutions.

What is CLC?

CLC is a regulated investment management firm known for its comprehensive services, including investment management, investment services, and corporate management. They offer tailored solutions and have a team of experienced professionals. However, recent concerns about fund withdrawal issues and potential scams raise questions about its reliability.

Pros and Cons of CLC

CLC offers a comprehensive suite of services spanning investment management, investment services, and corporate management, showcasing a commitment to tailored solutions and continuous improvement. While it boasts expertise and dedication to client success, recent concerns regarding legitimacy and potential scams warrant caution.

Is CLC safe?

Regulation

CLC is regulated by the Securities and Futures Commission (SFC) is a positive indicator of its legitimacy and adherence to regulatory standards. However, recent concerns regarding difficulties in fund withdrawal, platform accessibility issues, and allegations of scams and fraudulent activities suggest potential risks associated with CLC.

While regulatory oversight provides a level of assurance, individuals should exercise caution and conduct thorough due diligence before engaging with CLC or any similar investment platform. It is essential to weigh the benefits of CLC's services against the reported risks and make informed decisions to protect one's financial well-being. Therefore, it is recommended to proceed with caution and consider seeking advice from financial professionals before investing with CLC.

CLC Services

CLC offers a comprehensive range of products and services across investment management, investment services, and corporate management. Let's delve into each category:

Investment Management:

Continuous Learning and Improvement: CLC fosters a culture of continuous learning and improvement within its team, emphasizing the importance of staying updated on industry trends, refining methodologies, and enhancing investment strategies to deliver optimal outcomes for clients.

Systematic Strategies: Through systematic strategies, CLC utilizes data-driven and algorithmic approaches to investment, aiming for consistent returns and effective risk management. These strategies are designed to adapt to market dynamics and enhance portfolio performance over time.

Discretionary Macro Strategies: CLC invests in discretionary macro strategies, leveraging its expertise to make strategic decisions based on macroeconomic trends and market analysis. This approach allows for flexible allocation of assets to capture opportunities in evolving market conditions.

Investment Services:

Complex Task Resolution: CLC's dedicated team excels in solving complex and challenging tasks, drawing on their expertise and resources to address clients' unique financial requirements and objectives effectively.

Comprehensive Financial Solutions: With a team of experienced industry professionals, CLC offers a wide range of financial solutions, including wealth management, asset allocation, and risk management, tailored to meet the diverse needs of its clients.

Long-Term Partnership Building: CLC focuses on building long-term partnerships with its clients, understanding their unique financial objectives, and providing customized financing and investment solutions to support business growth and wealth accumulation.

Corporate Management:

Culture Cultivation and Automation: CLC focuses on cultivating a strong corporate culture conducive to innovation, collaboration, and growth, while also leveraging automation to streamline and execute routine processes efficiently.

Internal and Outsourced Services Management: CLC efficiently manages both internal and outsourced services, ensuring seamless execution of corporate strategies and routine procedures while optimizing resource allocation.

Strategic Corporate Management: CLC's corporate management division oversees various functions crucial for business growth and success, including human capital management, legal and compliance, accounting and finance, and corporate strategy.

Customer Service

CLC Asset Management Limited offers comprehensive customer service support through various contact methods, including phone and email channels. Clients can reach out to CLC's dedicated team by calling the Global Trading Hotline at (852) 3153 1128 for immediate assistance or inquiries regarding investment management and services. Additionally, clients can contact CLC via email at cs@clchk.com to communicate specific queries, request information, or seek assistance with account-related matters. With a commitment to providing responsive and personalized support, CLC ensures that clients have convenient access to assistance and guidance, facilitating seamless interactions and fostering strong client relationships.

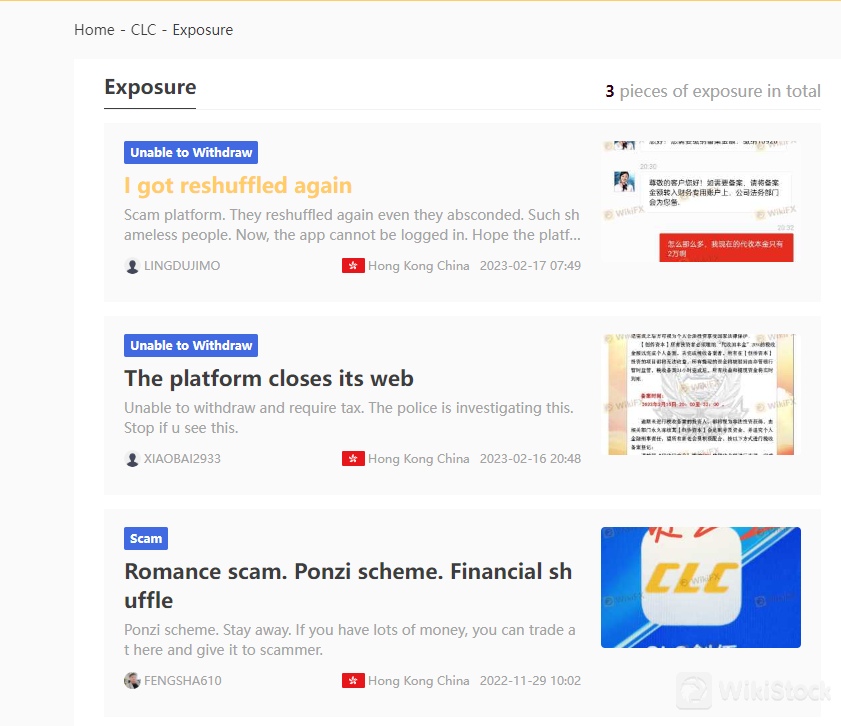

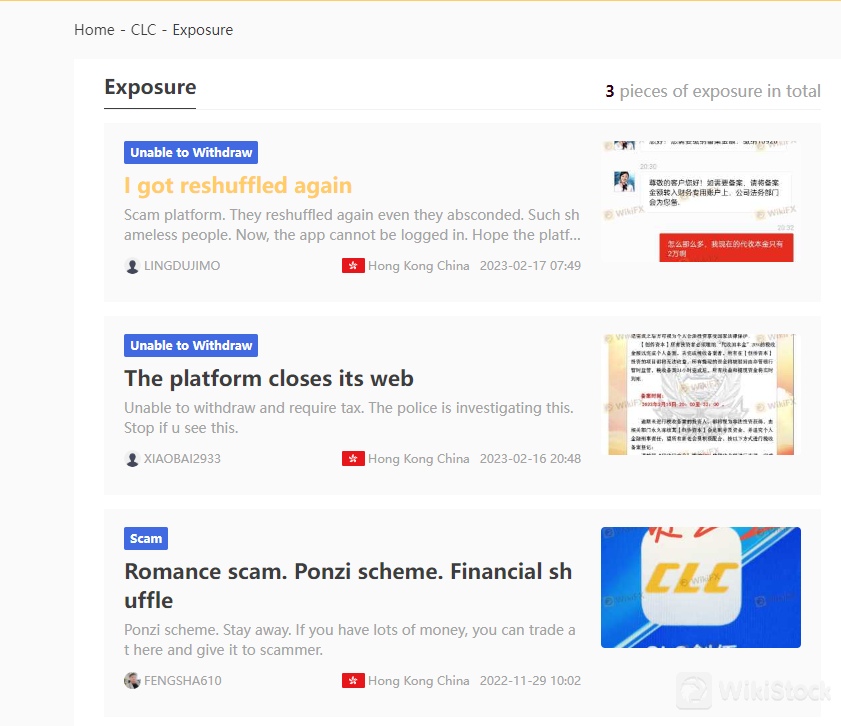

Warning: Beware of Potential Scams Associated with CLC

Concerns have been raised regarding the legitimacy and practices of CLC, with users reporting troubling experiences. Alleged misconduct includes difficulties in withdrawing funds, sudden platform closures, and suspicions of fraudulent activities.

Users have encountered obstacles when attempting to access their funds or transfer money from their accounts, with some experiencing abrupt shutdowns of the platform's web interface, leaving them unable to access investments.

Additionally, there are reports of individuals being lured into romance scams and Ponzi schemes, resulting in significant financial losses.

Given these risks, exercise extreme caution when dealing with CLC. Thoroughly research any investment platform before entrusting them with your funds. Stay vigilant for suspicious activities and report any concerns to the appropriate authorities.

Protect your financial well-being by remaining informed and proactive against potential threats associated with CLC or similar entities. Your financial security is paramount.

Conclusion

In conclusion, while CLC offers a comprehensive range of services and is regulated by the Securities and Futures Commission (SFC), recent concerns about legitimacy and potential scams necessitate caution. It is essential for individuals to conduct thorough research, exercise vigilance, and seek professional advice before engaging with CLC or any similar investment platform. Protecting one's financial well-being should always be the top priority.

FAQs

Is CLC safe to trade?

While CLC is regulated by the Securities and Futures Commission (SFC), recent concerns about fund withdrawal difficulties, platform accessibility issues, and allegations of scams suggest potential risks. It is advisable to exercise caution and conduct thorough due diligence before trading with CLC.

Is CLC a good platform for beginners?

CLC offers a comprehensive suite of investment management and financial services, which might be beneficial for experienced investors. However, due to recent concerns about the platform's legitimacy and accessibility issues, beginners might want to consider more established and transparent platforms.

Is CLC legit?

CLC is regulated by the Securities and Futures Commission (SFC), which provides a level of legitimacy. However, there have been recent reports of fraudulent activities, difficulties in fund withdrawals, and platform closures. It is essential to research thoroughly and exercise caution before engaging with CLC.

Is CLC good for investing/retirement?

CLC provides a range of investment management services that could be useful for long-term investment and retirement planning. However, considering recent concerns about the platform's reliability and potential risks, it is crucial to consult with a financial advisor and explore alternative options to ensure the safety of your investments.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 2 securities license(s)

--