China Securities Limited (collectively “CSL”) was established in 2017 providing securities trading, margin financing and securities placing services to both local and global investors.

CSL is licensed by Hong Kong’s Securities and Futures Commission (SFC) (CE No. BMI548) for Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities and an exchange participant of the Hong Kong Exchanges and Clearing Limited.

What is CSL?

China Securities Limited (CSL), established in 2017, is a comprehensive financial services provider offering securities trading, margin financing, and securities placing services to both local and global investors. CSL operates under the regulatory oversight of SFC of Hong Kong. CSL charges various types of fees to support its services. The firm provides different account types to cater to various client needs, including Individual/Joint Name Accounts, Corporate Accounts, and Professional Investor Accounts.

Pros & Cons of CSL

Pros: Regulated by SFC: CSL is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with rigorous standards for market integrity and investor protection. This regulatory oversight enhances trust and reliability for clients.

Comprehensive Services: CSL offers a wide range of financial services including securities trading, margin financing, underwriting, and advisory services. They cater to various types of clients including individual investors, corporations, and professional investors, meeting diverse financial needs.

Global Reach: CSL supports both local and international investors, providing tailored financial solutions that cater to the specific requirements of global clients. This makes it accessible for international investors looking to participate in the Hong Kong financial markets.

Cons: Fee Complexity: While CSL provides transparency in its fee structures, the variety of fees charged (including brokerage fees, custody fees, etc.) may appear complex to some clients. Understanding the total cost of transactions and services could require careful review.

Is CSL Safe?

CSL operates under the regulatory oversight of the Securities and Futures Commission (SFC) of Hong Kong, holding License No. BMI548. The SFC, as a prominent financial regulator in a globally recognized financial hub, is dedicated to enhancing and safeguarding the credibility and stability of Hong Kong's securities and futures markets. This commitment is aimed at fostering a secure and transparent environment that serves the best interests of both investors and the financial industry as a whole.

The primary objective of the SFC is to fortify the integrity and robustness of the securities and futures markets in Hong Kong. By ensuring adherence to stringent regulatory standards, the SFC plays a pivotal role in maintaining market order and promoting investor protection. Through its regulatory framework, the SFC establishes rules and guidelines that govern the conduct of market participants, bolstering market integrity and instilling investor confidence.

CSL Services Review

CSL offers securities brokerage, margin financing, placing and underwriting, and advising on securities.

Securities Brokerage:

CSL provides high-quality securities brokerage services facilitated by a team of experienced professionals. They handle all aspects of order handling, trade execution, clearing, settlement, and fund transfers efficiently. Their online trading platform, available on desktop and smartphones, enhances convenience for clients, allowing them to trade seamlessly.

Margin Financing:

CSL offers margin financing services with a focus on prudent margin ratios and competitive interest rates. This enables clients to leverage their portfolios effectively while maintaining proper risk management.

Placing and Underwriting:

The firm acts as an underwriter, sub-underwriter, or placing agent for companies listed on the Hong Kong Stock Exchange. CSLs institutional sales team facilitates fund-raising activities such as rights issues, placements of existing or new shares, and Initial Public Offerings (IPOs).

Advising on Securities:

CSLs investment experts possess in-depth knowledge of global and domestic capital markets. They provide clients with insightful investment analysis and personalized investment solutions tailored to individual needs. .

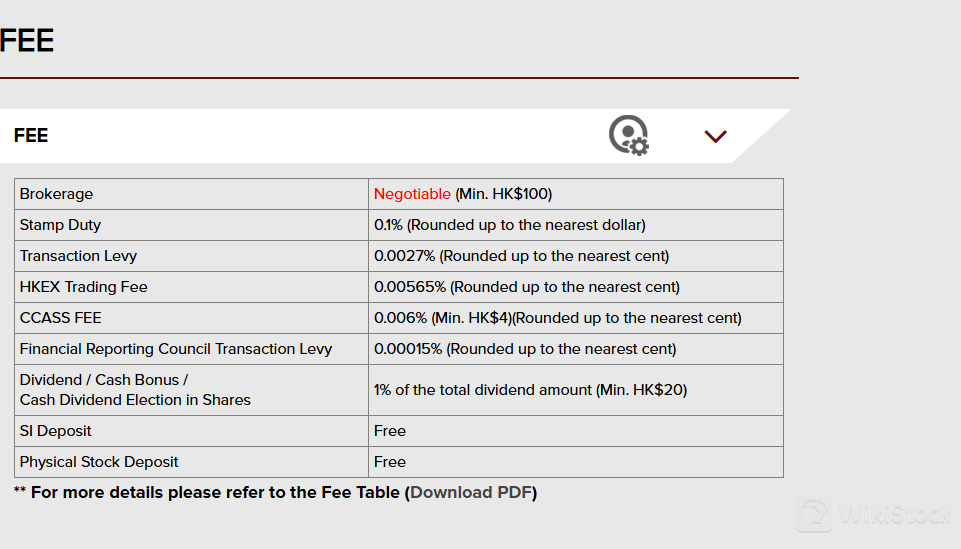

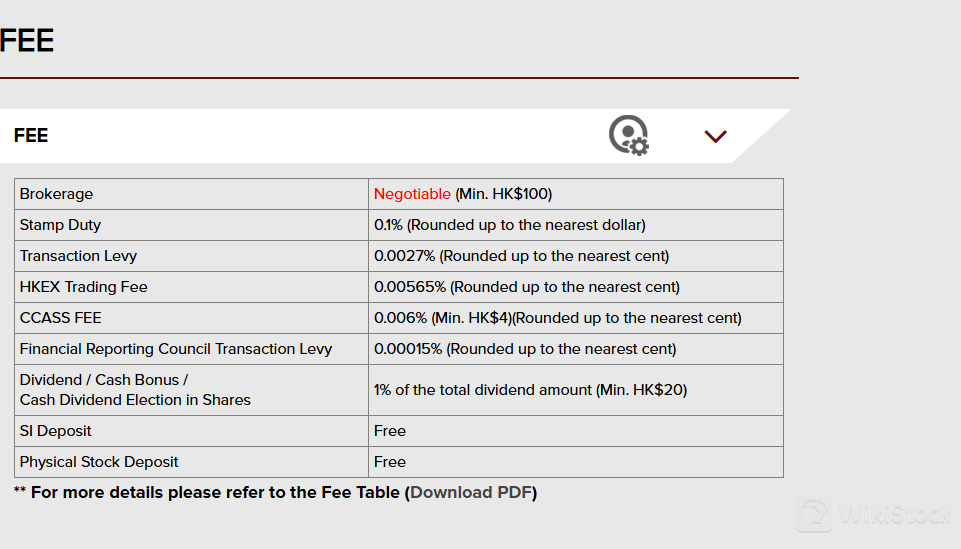

CSL Fees Review

CSL charges different types of fee items, including:

· Brokerage: Fees for buying and selling stocks on the Hong Kong Exchange (HKEX). Minimum fee applies.

· Exchange and Regulatory Fees: Fees charged by the HKEX and regulatory bodies for stock transactions.

· Custody Fees: Fees for holding stocks and other assets in your CSL account.

· Account Management Fees: Fees for account-related services like statement requests and address changes.

· Transaction Fees: Fees associated with specific transactions like rights subscriptions and cash offers.

· Other Fees: Fees for services like money transfers, returned checks, and inactive accounts.

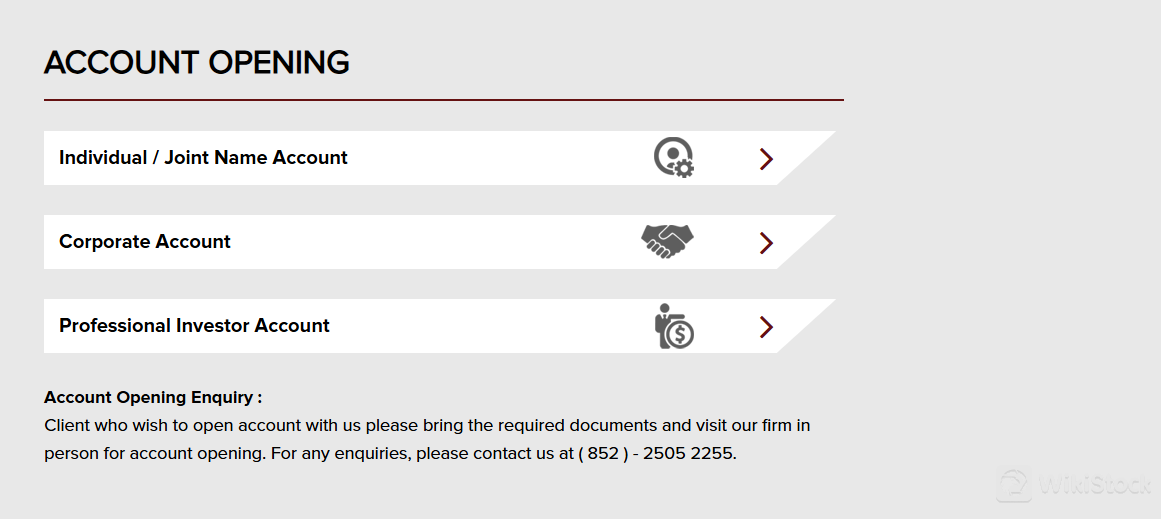

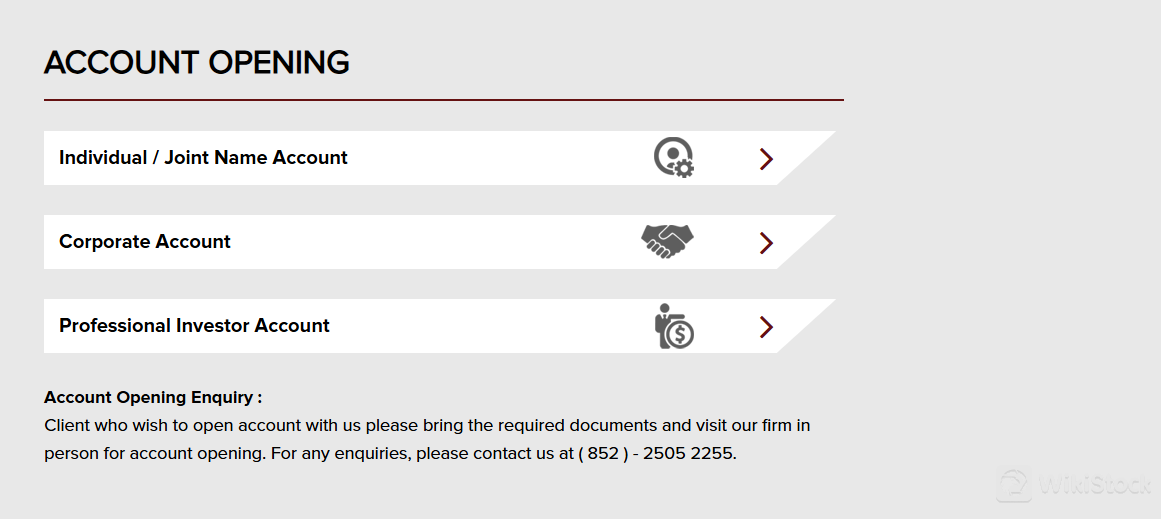

CSL Accounts Review

CSL offers Individual/ Joint Name Account, Corporate account and Professional Investor account.

Individual/Joint Name Account:

CSL caters to high net worth individuals and couples looking to manage their investments jointly. To qualify, individuals must have a portfolio of at least HK$8 million. This account type provides personalized service and access to CSLs full range of financial products and services, including securities brokerage, margin financing, underwriting, and investment advisory.

Corporate Account:

This account type is designed for corporations whose primary activity is investment holding. To qualify, the corporation must be wholly owned by an individual (or couple) meeting the HK$8 million portfolio requirement. Corporate accounts benefit from CSLs expertise in handling corporate investments, accessing margin financing, and participating in underwriting and placing activities on the Hong Kong Stock Exchange.

Professional Investor Account:

CSL offers an account specifically tailored for professional investors. To qualify, a corporation must either have a portfolio of at least HK$8 million or total assets exceeding HK$40 million. This account type is suited for sophisticated investors seeking comprehensive investment services and specialized financial advice tailored to their investment strategies and goals.

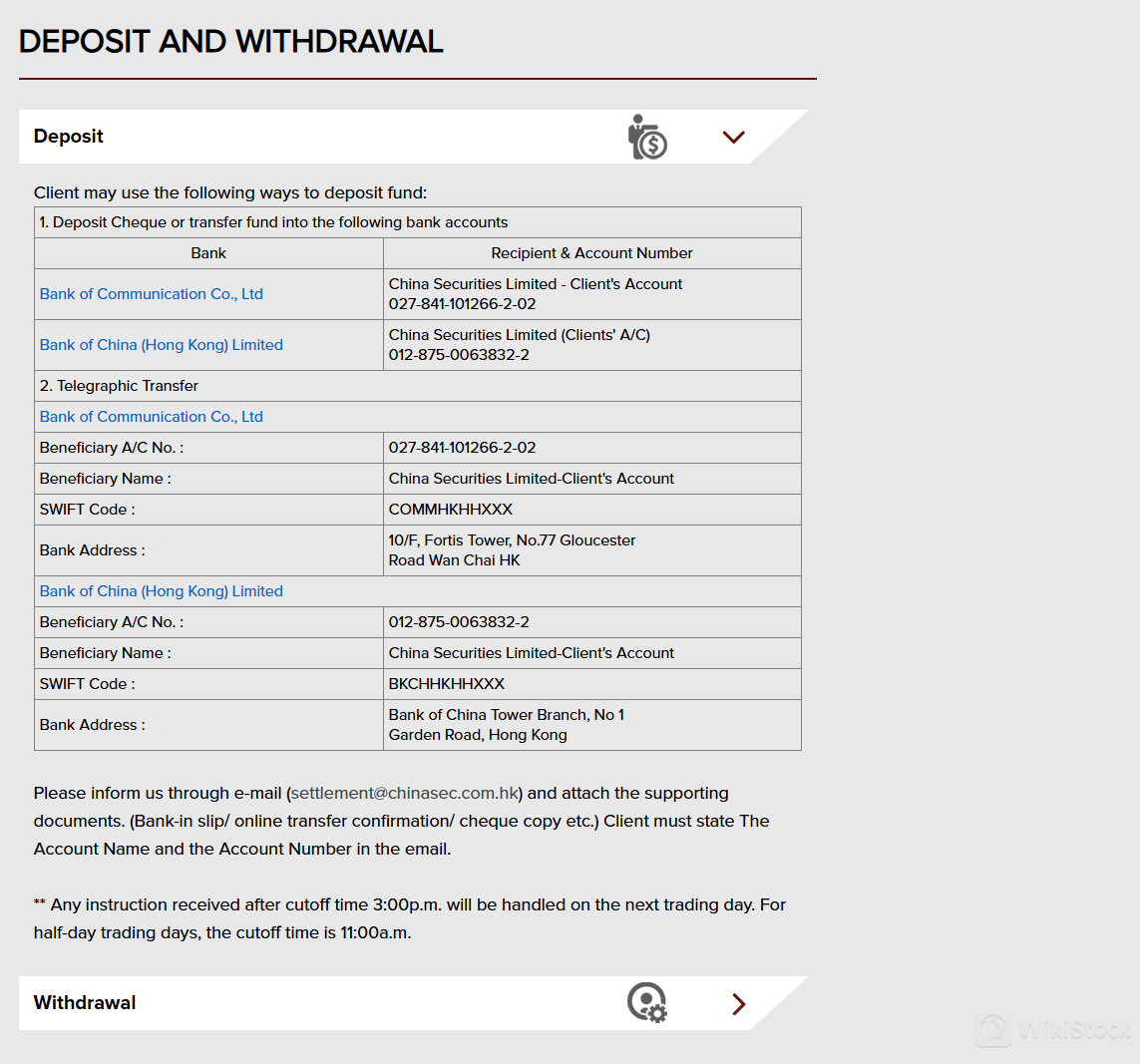

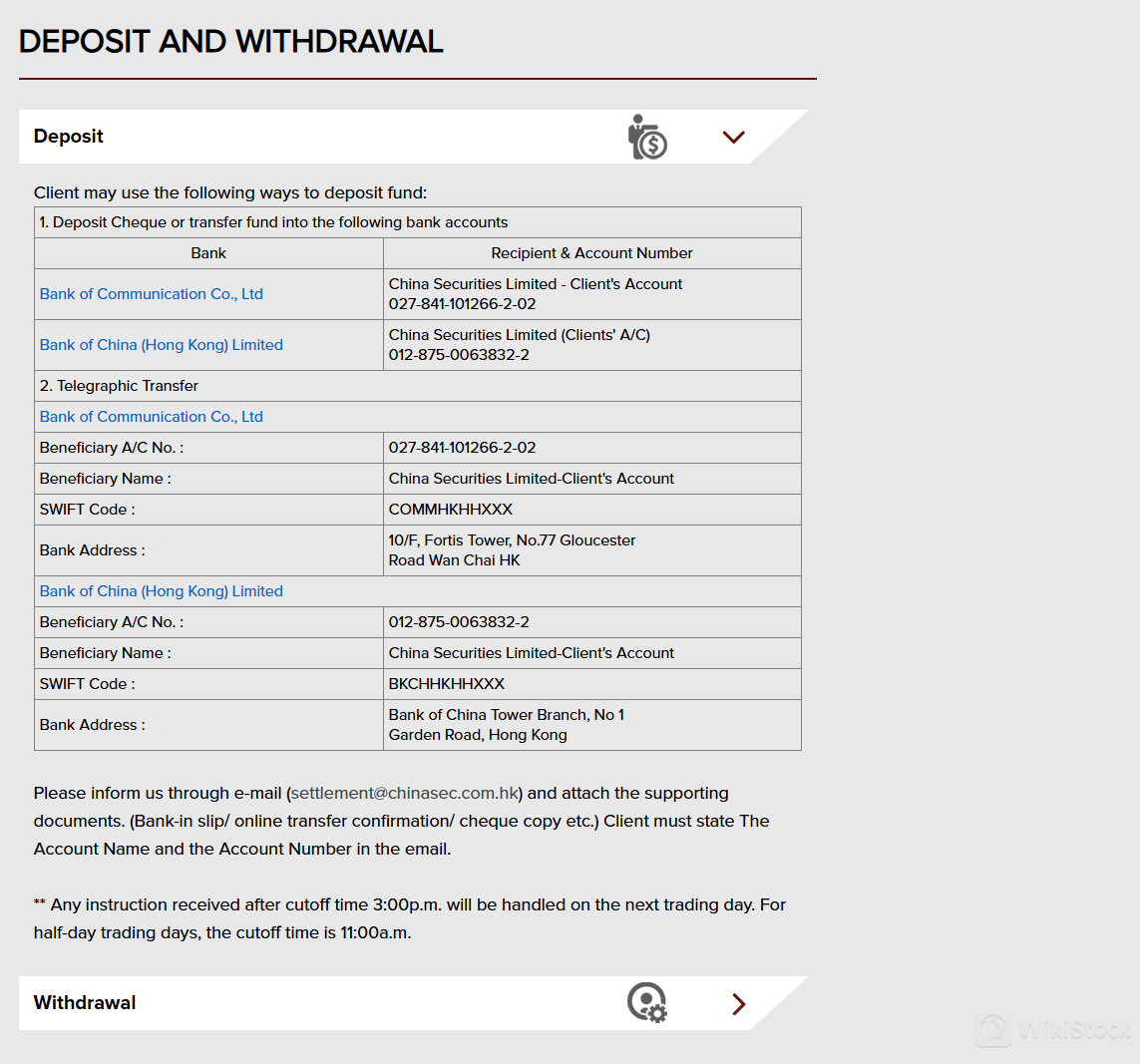

CSL Deposit & Withdrawal Review

Clients of CSL can deposit funds into their accounts using the following methods:

Bank Transfer or Deposit:

Clients can deposit funds via bank transfer or deposit into CSLs designated bank accounts at Bank of Communication Co., Ltd. and Bank of China (Hong Kong) Limited. Specific account details are provided for each bank.

For Bank of Communication, the account details include the recipient and account number.

For Bank of China (Hong Kong) Limited, the account details include the beneficiary account number and name.

Telegraphic Transfer:

Clients can also use telegraphic transfer (SWIFT) to deposit funds into CSLs accounts at the designated banks. Each bank has its SWIFT code and beneficiary account details provided.

Cutoff Times:

Deposits should be instructed before the cutoff time of 11:00 a.m. on trading days to ensure same-day processing. Instructions received after this time will be processed on the next trading day. For half-day trading days, the cutoff time is earlier at 11:00 a.m.

For withdrawals, clients can initiate the process by:

- Contacting CSLs Settlement Department at +852 2505 1198 or sending a withdrawal form to settlement@chinasec.com.hk.

- Similar to deposits, withdrawals are subject to cutoff times. Any withdrawal instructions received after the cutoff time of 3:00 p.m. on regular trading days will be processed on the next trading day.

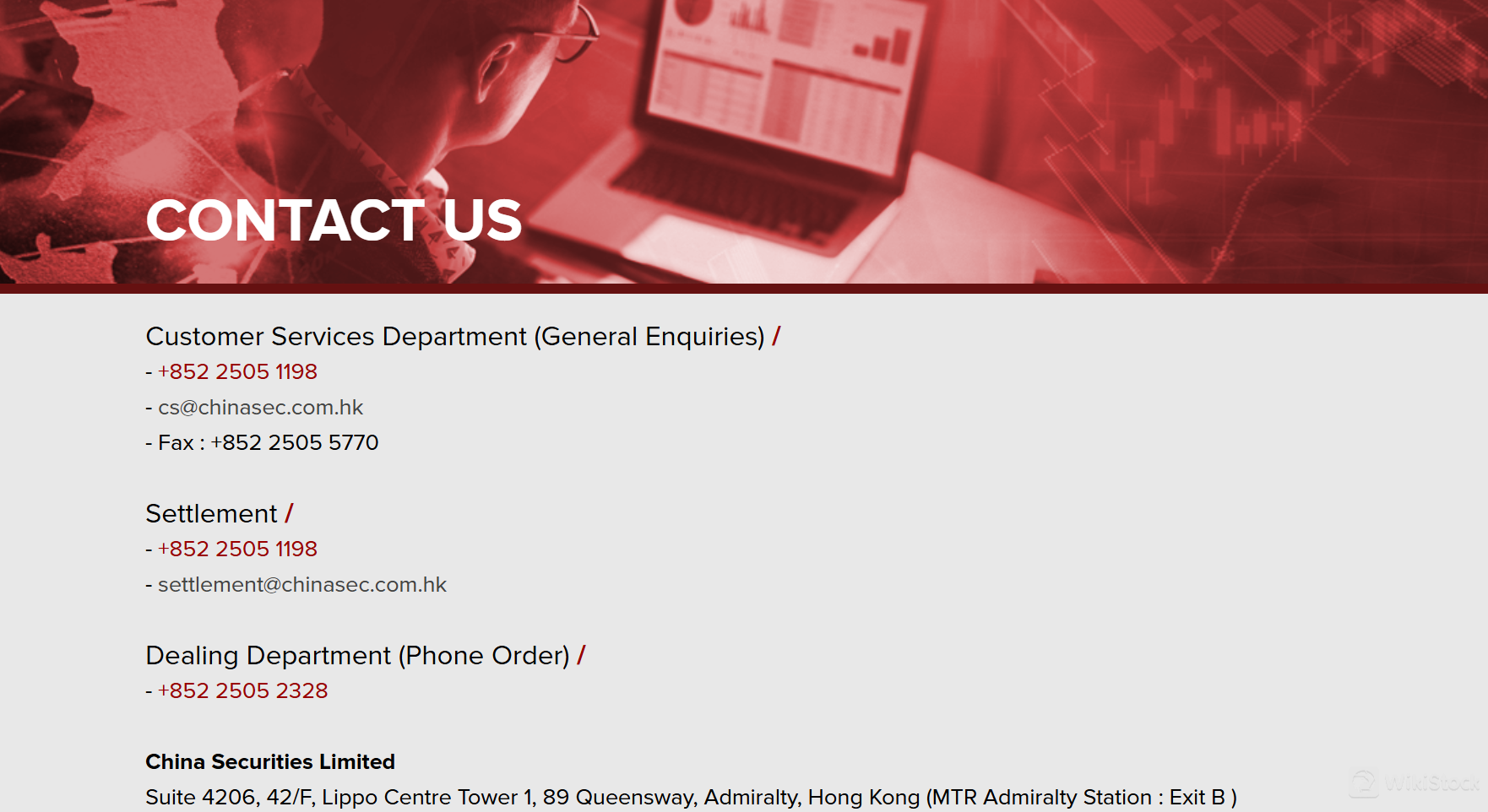

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +852 2505 1198

Fax: +852 2505 5770

Email: cs@chinasec.com.hk

Address: Suite 4206, 42/F, Lippo Centre Tower 1, 89 Queensway, Admiralty, Hong Kong (MTR Admiralty Station: Exit B)

Conclusion

In conclusion, China Securities Limited (CSL) stands out as a reputable and regulated financial institution offering a comprehensive range of services to both local and international investors. Its strong regulatory oversight, efficient operations, and global reach make it a competitive choice in the financial services sector. While there are considerations such as fee complexity and customer service quality, CSL's commitment to market integrity, client transparency, and tailored financial solutions solidify its position as a trusted partner for investors seeking opportunities in the Hong Kong financial markets.

Frequently Asked Questions (FAQs)

Is CSL regulated?

Yes. It is regulated by SFC.

What types of securities can I invest in with CSL?

CSL provides securities trading, margin financing, securities placing, underwriting, and advisory services.

How does CSL facilitate deposit and withdrawal processes?

CSL offers efficient deposit and withdrawal services through methods such as bank transfers and telegraphic transfers.

How can I contact CSL?

You can contact via telephone: +852 2505 1198, fax: +852 2505 5770 and email: cs@chinasec.com.hk.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Malaysia

MalaysiaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)