CNI Securities Group focuses on providing high-quality securities related services to our customers, including securities trading, underwriting and placing, investment banking, securities advisory and research services, prime brokerage and DMA trading service.

What is CNI Securities Group?

CNI Securities Group is a financial services provider offering securities brokerage, asset management, and various trading services.

They charge a 0.25% commission (minimum HK$100) and a 9.52% margin interest rate. The firm operates through the CNI Mobile APP and Integrated Trading Platform, attracting diverse investors but the high margin interest may limit frequent leveraged traders.

Pros & Cons

Pros:

CNI Securities offers multiple tradable assets and is regulated by the SFC. It features a unique trading app for both mobile and PC, and charges low commissions at just 0.25% per trade.

Cons:

However, the firm is limited to only three banks for deposits, does not provide diverse account options, and offers limited analysis tools, which may restrict comprehensive trading strategies.

Is CNI Securities Group Safe?

1. Regulations:

CNI Securities Group is robustly regulated by the Securities and Futures Commission (SFC) of Hong Kong, which enhances its credibility and safety for investors. The firm operates under SFC license numbers ATM582 and AXV375, showcasing its commitment to adhering to strict regulatory standards.

2. Funds Safety:

CNI Securities Group places high importance on the security of client funds, strictly prohibiting third-party deposits and withdrawals. All transactions undergo rigorous compliance checks and adhere to Anti-Money Laundering (AML) regulations. This policy is crucial for maintaining the legality of fund movements and minimizing the risk of financial fraud, ensuring that clients' investments are secure.

3. Safety Measures:

The company has implemented several safety measures to protect client assets and ensure the integrity of transactions. CNI Securities Group verifies the identity of depositors and the legitimacy of funds for each transaction, allowing only authorized and lawful activities. Suspicious transactions are promptly rejected, and the platform retains the right to return funds to the original source if discrepancies are detected, further securing client assets.

What are securities to trade with CNI Securities Group?

CNI Securities Group offers a large range of securities and investment services, making it an appealing choice for various types of investors:

Securities Brokerage: CNI provides brokerage services for trading in a wide array of securities, including stocks, bonds, and other financial instruments.

Margin Trading Financing: The firm offers financing options that allow clients to trade securities on margin, giving them the ability to leverage their positions in the market.

Asset and Wealth Management: CNI engages in asset management and wealth management services, helping clients to optimize their investment portfolios according to individual goals and risk tolerance.

Futures and Commodities Brokerage: For those interested in derivatives, CNI offers brokerage services for futures and commodities, allowing investors to speculate on or hedge against future price movements in various markets.

Initial Public Offers (IPOs): The group provides access to initial public offerings, giving clients the opportunity to invest in companies at the time of their market debut.

Underwriting and Placements: CNI is involved in the underwriting and placement of securities, facilitating the issuance of new securities and helping companies raise capital.

Prime Execution Service and Direct Market Access: The firm offers prime execution services and direct market access, ensuring that clients can execute trades efficiently at the best available prices.

CNI Securities Group Fees Review

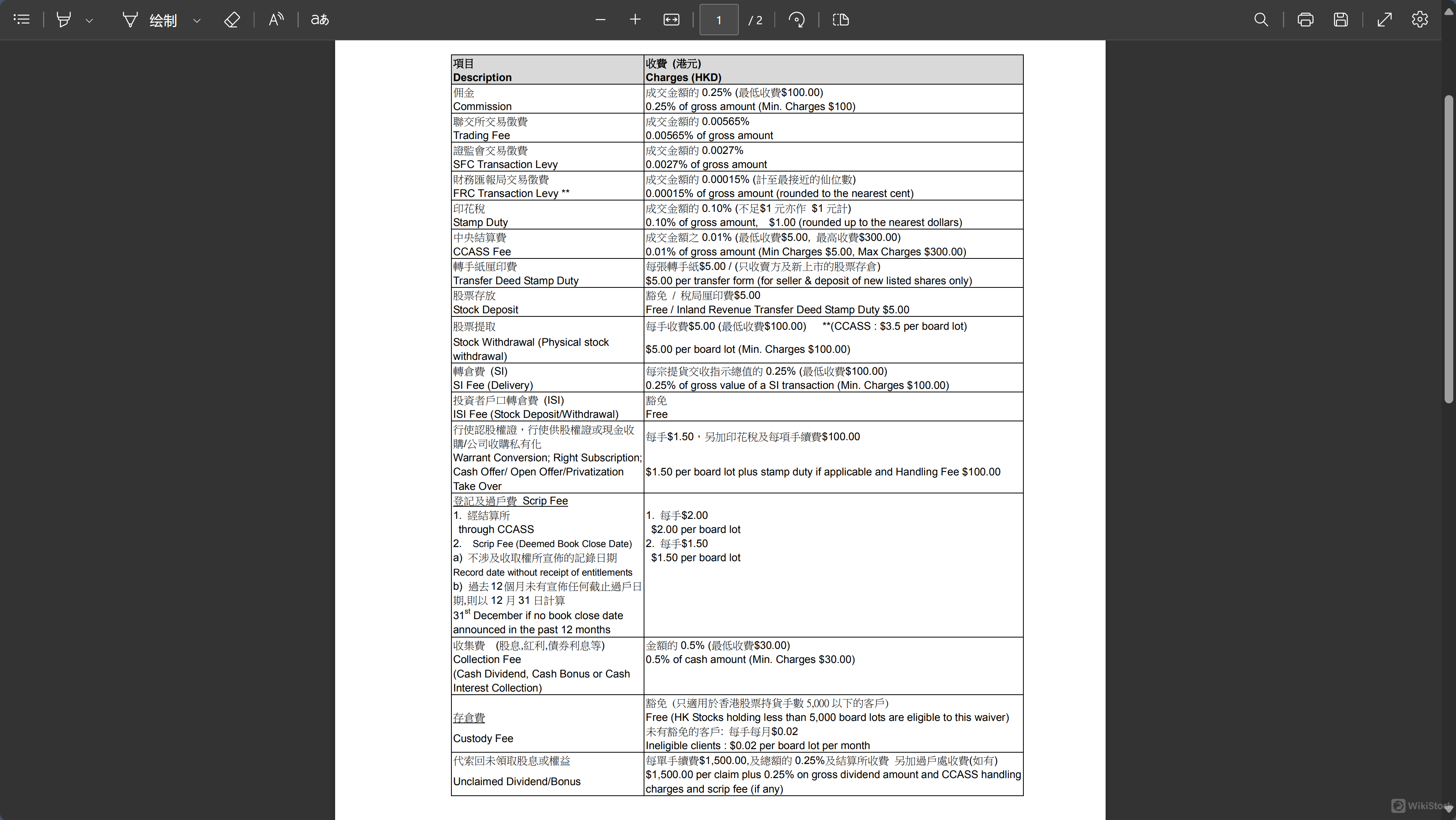

CNI Securities Group offers a clear and structured fee schedule for its financial services, meeting a diverse range of trading and investment needs. Here is an overview of their primary charges:

Commission Fees: CNI Securities charges a standard commission of 0.25% on the gross amount of each transaction, with a minimum charge of HK$100.

Trading-Related Fees: Additional trading fees include a Trading Fee of 0.00565%, an SFC Transaction Levy of 0.0027%, and an FRC Transaction Levy of 0.00015% of the gross transaction amount.

Settlement and Handling Fees: For securities clearing and settlement, the CCASS fee is 0.01% of the gross amount, with a minimum of HK$5 and a maximum of HK$300.

Custodial and Miscellaneous Fees: The custody fee is waived for Hong Kong stock holdings below 5,000 board lots, which benefits small-scale investors.

IPO and Margin Services: IPO applications are free for online cash applications, but a non-refundable HK$100 fee applies to all margin applications and non-online cash applications.

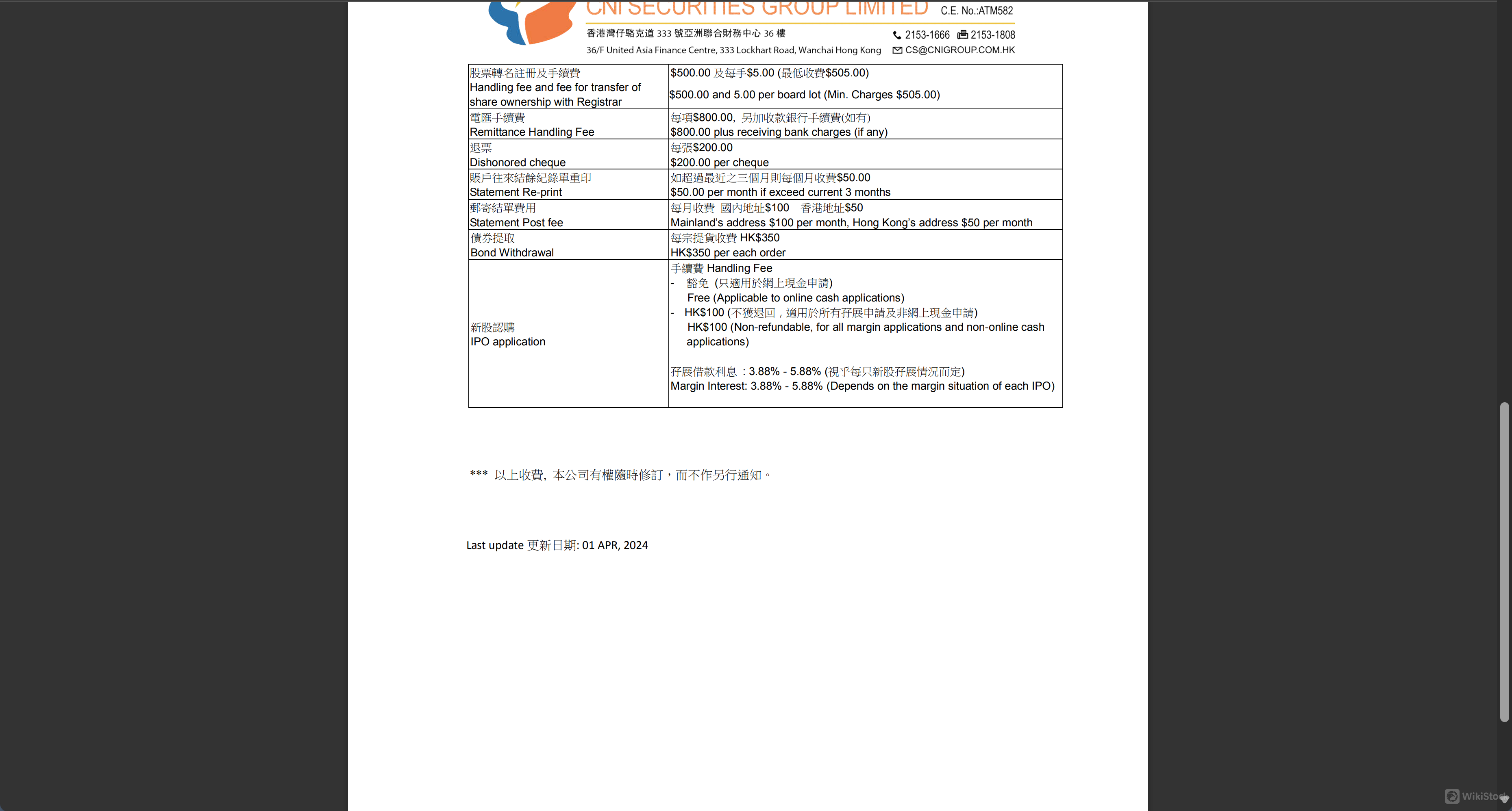

Other Service Fees: Additional services such as remittance handling charge a fee of HK$800 plus potential receiving bank charges.

CNI Securities Group App Review

CNI Securities Group offers an integrated trading platform that supports instant transactions and rapid investment decision-making.

The platform is accessible through both the CNI Mobile APP and the CNI Integrated Trading Platform, meeting different user preferences and technological needs. These platforms provide real-time quotes for stocks, stock indexes, chart analysis, and related news, assisting investors in closely monitoring the investment market and capturing trading opportunities for better returns.

The trading software is available for download directly from their website for users in different regions, including a specific version for China Users, ensuring that all clients have tailored access to their trading tools.

Research & Education

CNI Securities Group actively engages in providing up-to-date market research and educational content, as evident from their website's news and events section.

They regularly publish information on significant company activities, such as new stock listings, bond issuances, and other financial events, offering both current and prospective investors valuable insights into market trends and investment opportunities.

This focus on disseminating timely and relevant information helps clients make informed decisions, enhancing their understanding of market dynamics and potential investment strategies.

Customer Service

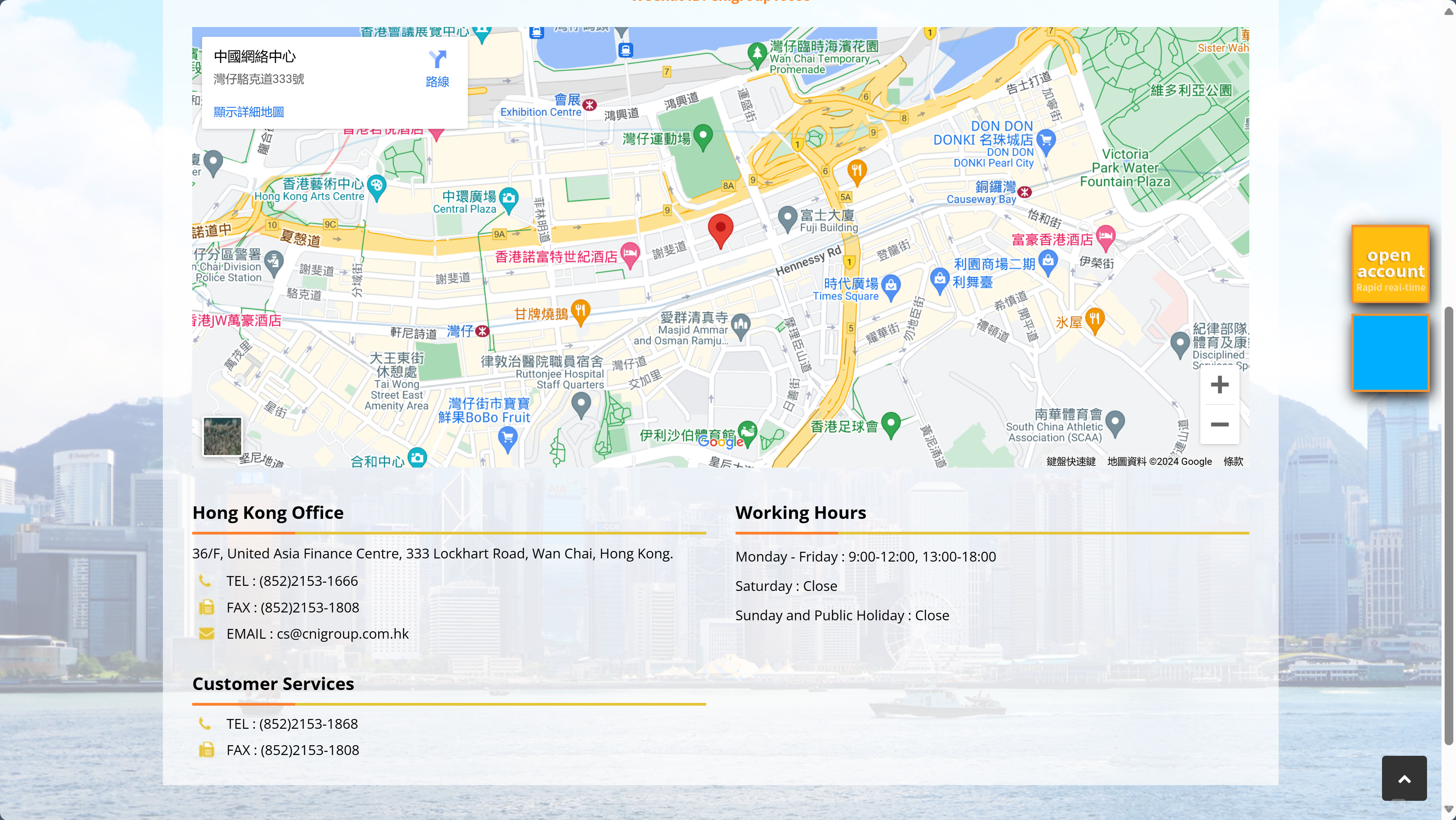

CNI Securities Group's Hong Kong office is located on the 36th floor of the United Asia Finance Centre at 333 Lockhart Road, Wan Chai.

For customer support, clients can contact them via telephone at (852) 2153-1868 or via fax at (852) 2153-1808. Email inquiries can be directed to cs@cnigroup.com.hk.

The office operates from Monday to Friday, with hours from 9:00 AM to 12:00 PM and from 1:00 PM to 6:00 PM. The office is closed on Saturdays, Sundays, and public holidays, ensuring support is available during standard business hours throughout the workweek.

Conclusion

CNI Securities Group is a dynamic financial services provider based in Hong Kong, offering a large range of services including securities trading, asset management, and research.

The firm is committed to delivering cutting-edge trading technology through its mobile and integrated trading platforms, and it emphasizes timely market insights through regular updates on company activities and financial events.

CNI Securities Group strives to provide high-quality customer service with accessible support channels and detailed market research to assist clients in making informed investment decisions.

FAQs

What services does CNI Securities Group offer?

CNI Securities Group offers securities trading, asset management, and detailed market research, along with state-of-the-art trading platforms.

How can I contact CNI Securities Group's customer service?

You can contact CNI Securities Group's customer service by phone at (852) 2153-1868, by fax at (852) 2153-1808, or via email at cs@cnigroup.com.hk.

What are the office hours for CNI Securities Group's Hong Kong office?

The Hong Kong office is open Monday through Friday from 9:00 AM to 12:00 PM and 1:00 PM to 6:00 PM. The office is closed on Saturdays, Sundays, and public holidays.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--