Score

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Germany

GermanySecurities license

Brokerage Information

More

Company Name

ICAP do Brasil Corretora de Títulos e Valores Mobiliários Ltda

Abbreviation

MyCAP

Platform registered country and region

Company website

https://www.mycap.com.br/Check whenever you want

WikiStock APP

Previous Detection: 2025-01-15

- It has been verified that this brokerage firm currently has no effective regulation, please be aware of the risk!

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 9634

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Others

568917.90%Uruguay

110022.94%Jordan

99520.68%Angola

95119.79%Kyrgyzstan

89918.69%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0%

New Stock Trading

Yes

Margin Trading

YES

Long-Short Equity

YES

| MyCAP |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | Free |

| Fees | R$89.90/month for Profit One, |

| R$180.00/month for Profit Plus | |

| Account Fees | No custody fees |

| Interests on Uninvested Cash | Not mentions |

| Margin Interest Rates | 4% per month |

| App/Platform | MyCAP Power Broker APP, TradeMap, Profit one, Profit Plus, and Power Broker |

| Promotions | 3 months of zero brokerage, free trail, custody transfer, free Profit Pro trading platform |

What is MyCAP?

Pros & Cons of MyCAP

Is MyCAP Safe?

What are Securities to Trade with MyCAP?

MyCAP Accounts

MyCAP Fees Review

MyCAP App Review

MyCAP Power Broker APP

TradeMap

Research & Education

Customer Service

Conclusion

Is MyCAP regulated?

MyCAP, a financial platform, was established with a mission to democratize access to the Stock Exchange and share its vast expertise in the financial market. MyCAP offers a diverse range of investment options, including stocks, crypto funds, index funds, fixed and variable income options, Real Estate Funds, futures, and more. Investors can access many trading platforms. However, it is not regulated and other transaction protection measures.

| Pros | Cons |

| Diverse investment options | Lack of regulation |

| Multiple platforms for portfolio management | |

| Promotions and free trials | |

| Research resources |

- Diverse investment options: The platform offers a range of investment options and tailored account types to cater to different investor preferences and risk profiles.

- Multiple platforms for portfolio management: MyCAP provides investors with multiple platforms to manage their portfolios conveniently, offering flexibility and accessibility.

- Promotions and free trials: Promotional offers such as zero brokerage for three months and free trials enhance the value proposition for clients, potentially attracting more users to the platform.

- Research resources: The platform offers resources such as a Research Team and FAQs center, which can empower investors with insights and information to make better investment decisions.

Cons of MyCAP:- Lack of valid regulation: Operating without valid regulation raises concerns about investor protection and oversight.

MyCAP asserts its commitment to safeguarding investors through various protective measures, notably its Cyber Security Policy, which extends across all levels of the organization, including subsidiaries and external consultants. This policy ensures a robust defense against cyber threats, encompassing employees globally, irrespective of their role or location within the company hierarchy.

However, despite these internal safeguards, MyCAP currently operates without valid regulation. This absence of governmental or financial oversight poses significant risks for investors. Without regulatory oversight, the platform's operators are not held accountable for their actions. This lack of accountability opens the door for potential malfeasance, where individuals managing the platform could potentially abscond with investors' funds without facing legal repercussions.

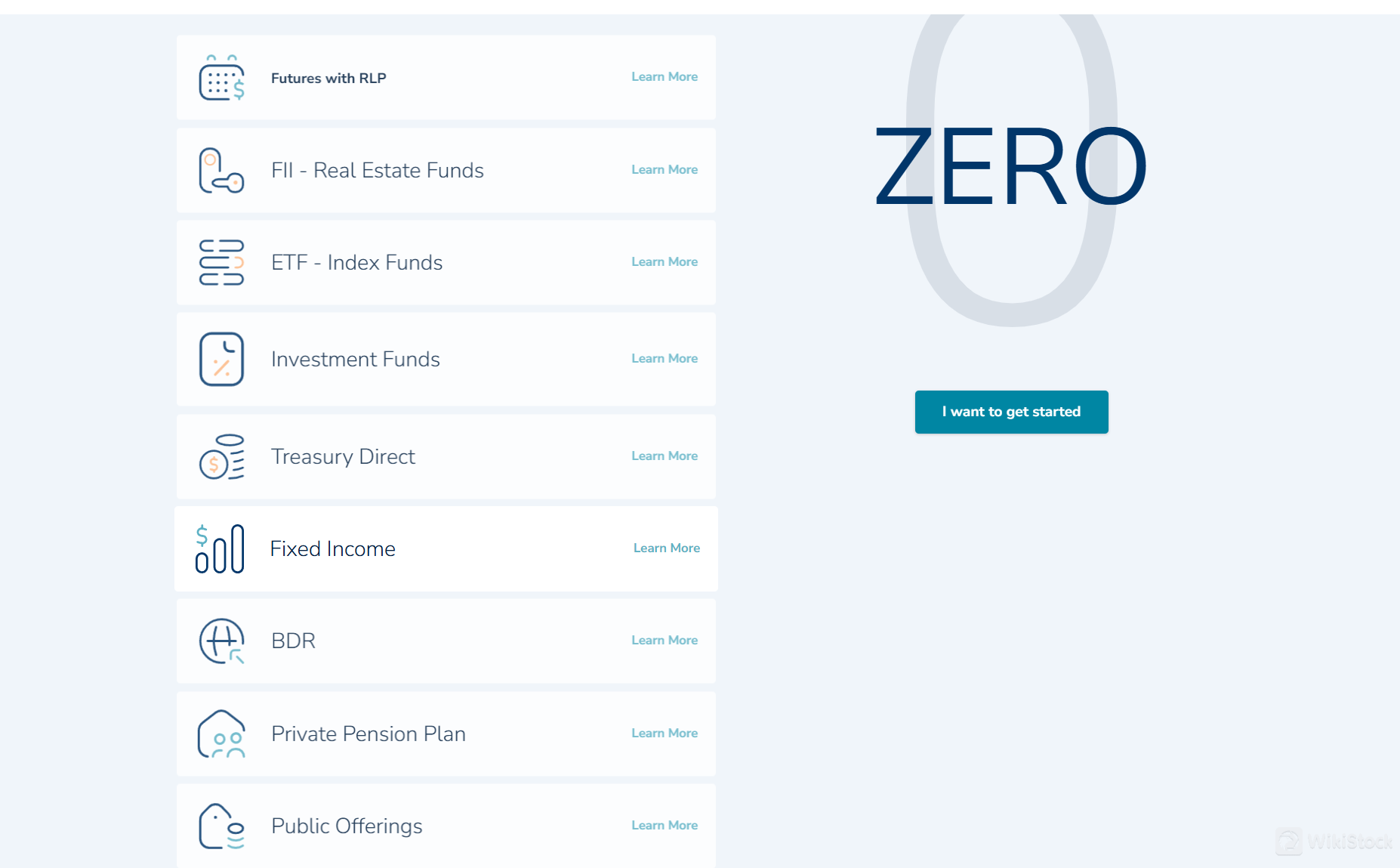

MyCAP offers a diverse range of securities, including stocks, crypto funds, crypto ETFs, BDR, index funds, fixed and variable income options, Real Estate Funds, futures, public offerings, and treasury direct.

- Stocks: MyCAP provides access to a wide range of stocks, allowing investors to buy and sell shares in individual companies listed on various stock exchanges.

- Crypto Funds: MyCAP offers several crypto funds managed by Hashdex, including the Hashdex bitcoin full fic end, Hashdex 40 nasdaq crypto index fic order, Hashdex 20 nasdaq crypto index fic order, and Hashdex gold bitcoin risk parity ficfim. These funds provide exposure to different segments of the cryptocurrency market.

- Crypto ETFs: Investors can access crypto exchange-traded funds (ETFs) through MyCAP, enabling them to invest in baskets of cryptocurrencies traded on stock exchanges.

- BDR (Brazilian Depositary Receipts): BDRs represent ownership of shares in foreign companies traded on the Brazilian stock exchange. MyCAP offers BDRs as a way for investors to diversify their portfolios with international exposure.

- Index Funds: MyCAP offers index funds that track various stock market indices, allowing investors to gain exposure to broad market movements or specific sectors.

- Fixed and Variable Income: Investors can choose from a variety of fixed-income and variable-income options, including government and corporate bonds, as well as other interest-bearing securities.

- Real Estate Funds: MyCAP provides access to real estate investment funds (REITs), allowing investors to invest in a diversified portfolio of real estate assets.

- Futures: MyCAP facilitates trading in futures contracts, which are agreements to buy or sell assets at a predetermined price on a specified date in the future.

- Public Offerings: MyCAP offers access to initial public offerings (IPOs) and secondary public offerings (SPOs), allowing investors to participate in the early stages of a companys public listing or subsequent capital raising.

- Treasury Direct: Investors can invest directly in government securities through MyCAPs treasury direct service, including Treasury bills, notes, and bonds issued by the Brazilian government.

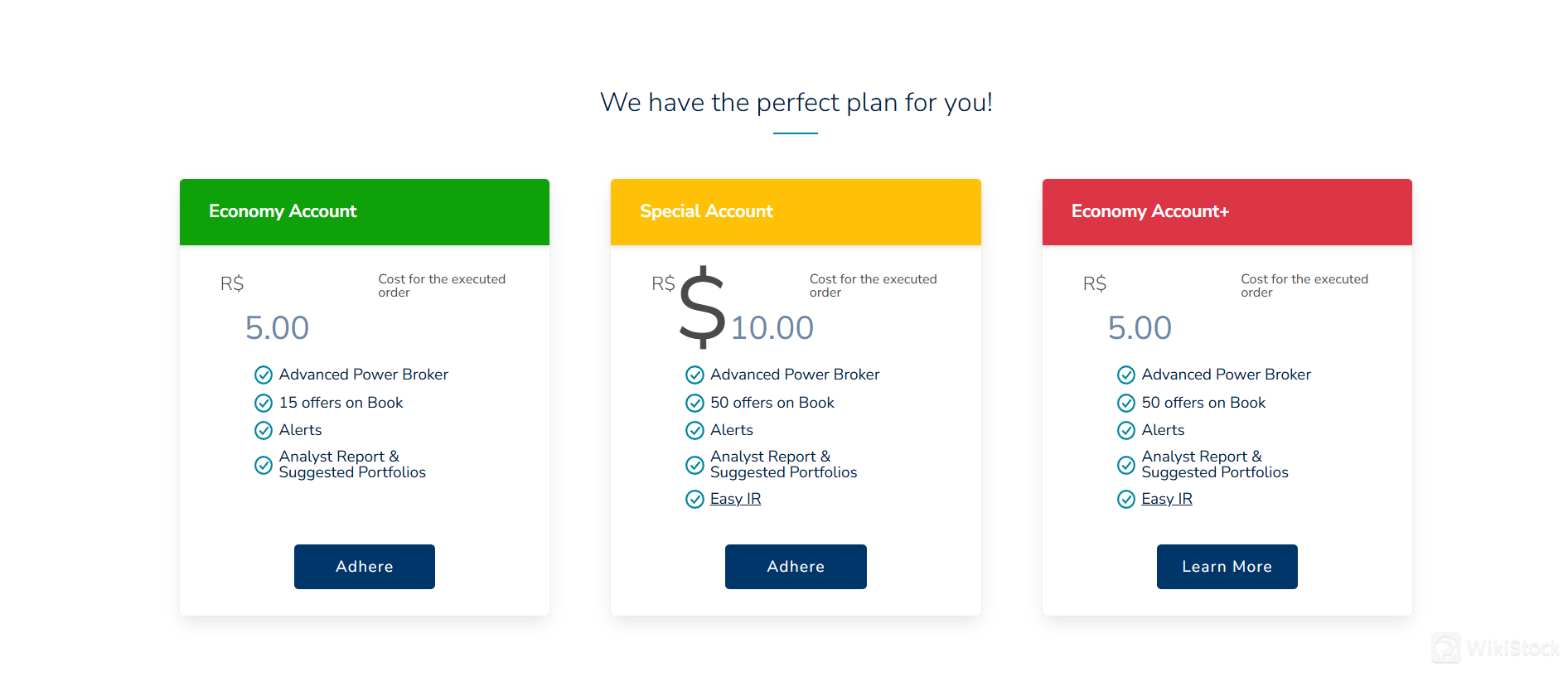

MyCAP offers three types of accounts tailored to meet the varying needs of investors: Economy Account, Special Account, and Economy Account+.

- Economy Account: Designed for cost-conscious investors, the Economy Account offers a minimal cost for executed orders, providing affordability and accessibility to the financial markets. It includes features such as access to the Advanced Power Broker, a limited number of offers on the book, alerts, analyst reports, and suggested portfolios. R$5.00 of cost for the executed order.

- Special Account: The Special Account caters to investors seeking more advanced features and capabilities. While it incurs a slightly higher cost for executed orders, it provides greater benefits, including access to the Advanced Power Broker with a larger number of offers on the book, alerts, analyst reports, suggested portfolios, and Easy IR (presumably referring to simplified tax reporting). R$10 of cost for the executed order.

- Economy Account+: Combining affordability with enhanced features, the Economy Account+ offers a balance between cost-effectiveness and functionality. It includes access to the Advanced Power Broker with a generous number of offers on the book, alerts, analyst reports, suggested portfolios, and Easy IR for streamlined tax reporting. R$5.00 of cost for the executed order.

Besides, customers whose account remains inactive for 4 years will be charged a monthly fee of R$7.63. Customers with a cancelled account must go through the reopening process.

MyCAPs fee structure includes:

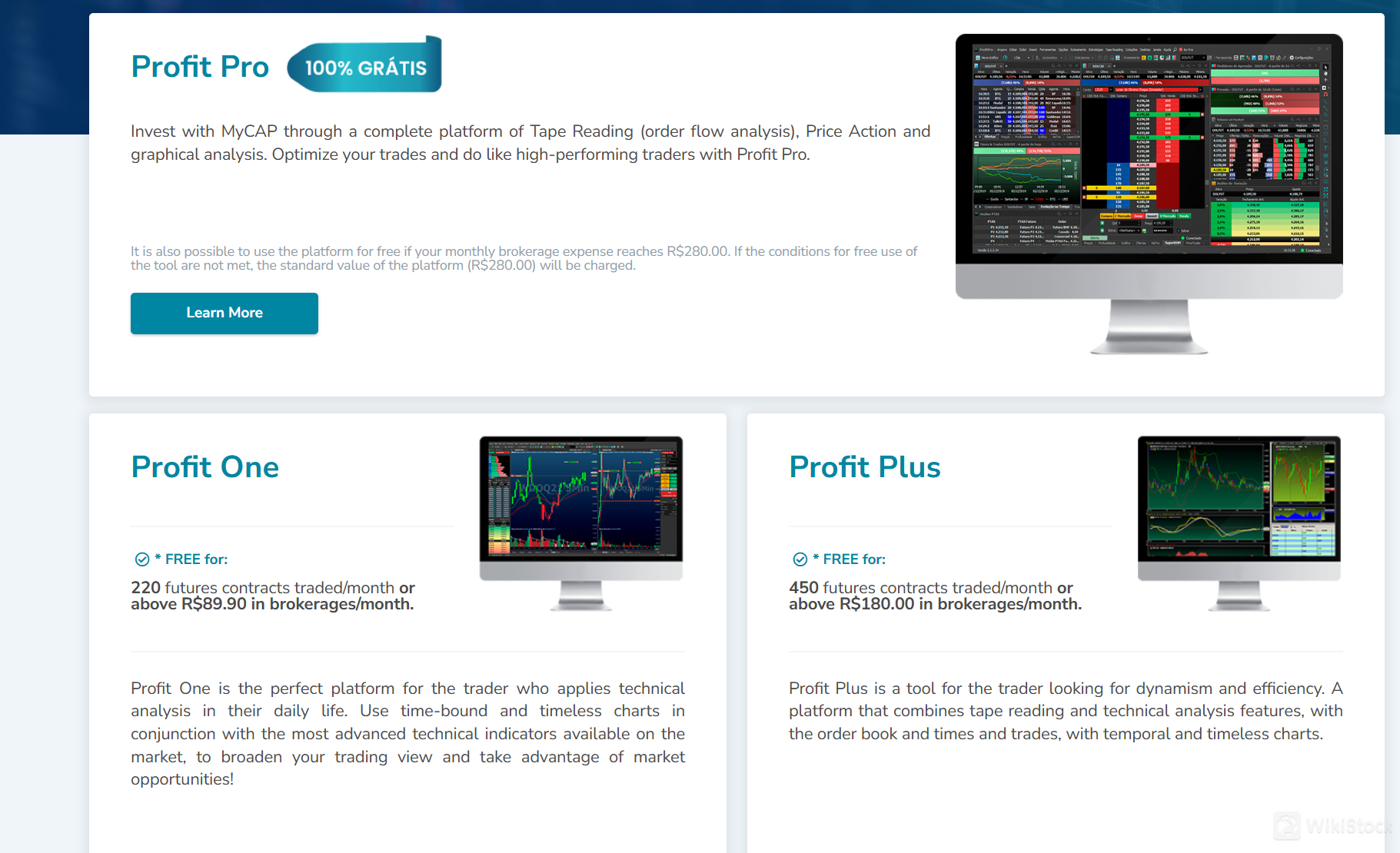

- Brokerage Fees: These fees depend on the chosen trading platform (Profit One or Profit Plus) and the volume of futures contracts traded per month. For Profit One, trading 220 futures contracts or above incurs R$89.90/month, while for Profit Plus, trading 450 futures contracts or above incurs R$180.00/month.

- Execution Costs: Investors can opt for either a per-contract model or a per-executed-order plan. The per-contract option charges R$1.00 per full contract or mini-contract. The per-executed-order plan offers two tiers: the Economic Plan at R$5.00 per executed order and the Special Plan at R$10.00 per executed order.

- Margin Account Costs: Margin account costs include interest at 4% per month, calculated proportionally to the daily amount of resource usage, and IOF (tax) at 0.38% (fixed) on the total amount requested, plus a daily rate based on the individual or entity status.

- Bureau Costs: These are charged at 0.5% of the volume of the requested operation, with a minimum fee of R$25.00.

- Structured Operation Costs: For structured operations with options, long positions (buying options) are executed via the Home Broker with brokerage fees, while short positions (selling options) are executed through the trading desk with desk brokerage fees. Bureau costs also apply.

- IOF: IOF percentages vary from 96% to 0%, depending on the number of days elapsed from the application, and are levied only on the investment yield.

- Withdrawal Fees: MyCAP does not charge fees for withdrawals of funds.

| Fee Item | |

| Brokerage Fees | Dependent on chosen platform (Profit One or Profit Plus) and monthly volume of futures contracts traded. |

| Execution Costs | Option of per-contract model (R$1.00 per full or mini contract) or per-executed-order plan (Economic Plan at R$5.00 per order, Special Plan at R$10.00 per order). |

| Margin Account Costs | Interest at 4% per month, IOF at 0.38% fixed + daily rate based on individual/entity status, charged on total amount requested. |

| Bureau Costs | 0.5% of volume of requested operation, with minimum fee of R$25.00. |

| Structured Op Costs | Long positions (buying options) executed via Home Broker, short positions (selling options) via trading desk, both incurring brokerage and bureau costs. |

| IOF | Varies from 96% to 0%, levied only on investment yield, depending on elapsed days from application. |

| Withdrawal Fees | None |

MyCAP offers a suite of trading platforms designed to meet the diverse needs of modern investors.

The flagship offering, the MyCAP Power Broker APP, empowers users to take control of their investments anytime, anywhere. With features like the ability to schedule orders, real-time trading on the Stock Exchange, and seamless synchronization with the Home Broker MyCAP, investors can manage their portfolios with ease and convenience. It can be downloaded via Apple Store and Google Store.

Additionally, MyCAP provides access to TradeMap, a comprehensive financial market monitoring platform in Brazil. With real-time stock quotes, portfolio control, and news updates, TradeMap aims to educate and empower investors of all levels. Whether you're a beginner looking to learn or an experienced trader seeking advanced tools, TradeMap offers resources to enhance your investment journey.

Moreover, MyCAP's trading platforms, such as Profit one, Profit Plus, and Power Broker, cater to different trading styles and preferences. From simplified interfaces for new investors to advanced features for seasoned professionals, these platforms offer flexibility and functionality to suit diverse trading strategies.

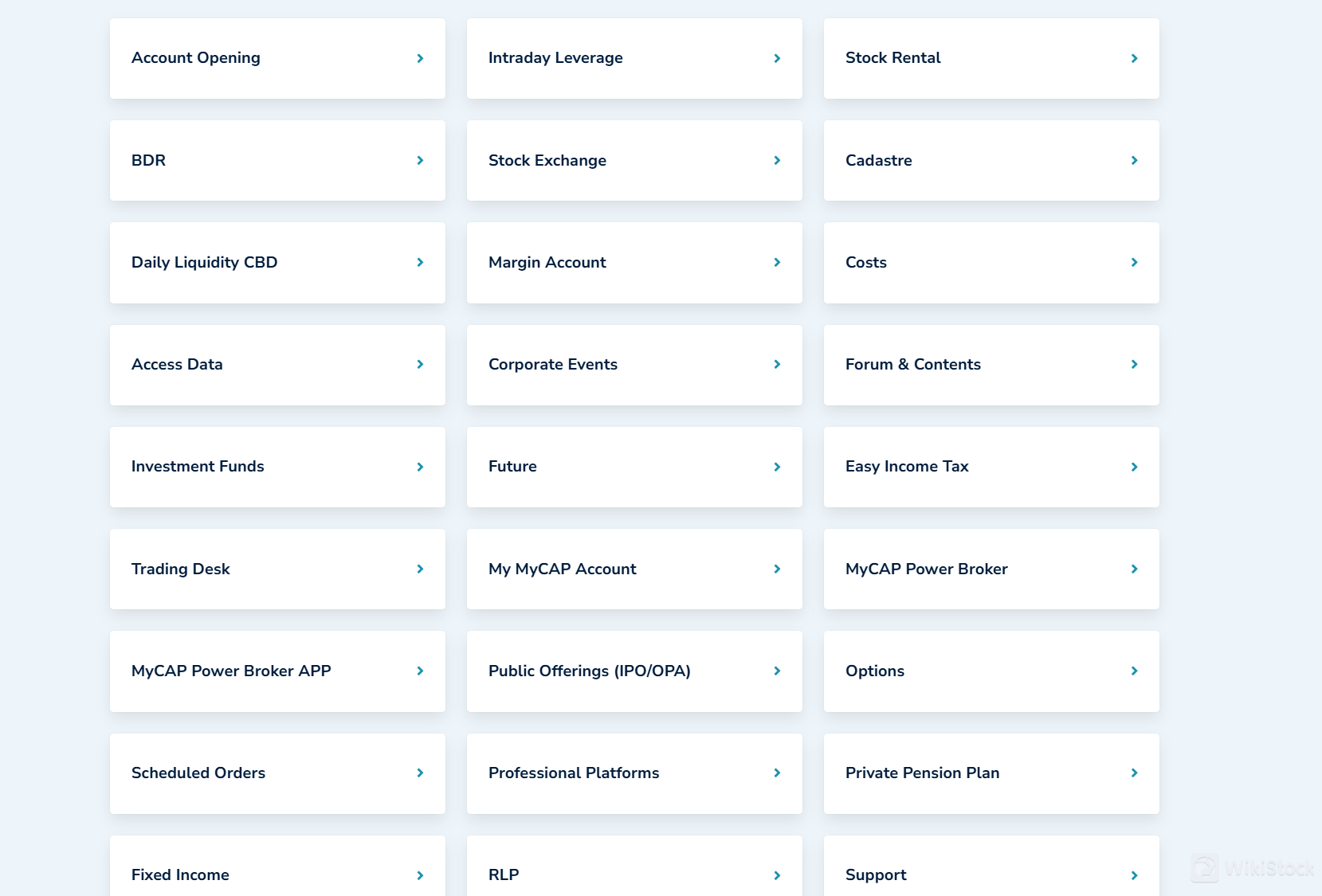

MyCAP's Research Team and FAQs center serve as valuable resources for investors seeking to enhance their understanding of the market and make informed decisions. The Research Team diligently analyzes market trends, economic indicators, and other relevant factors to provide investors with insightful reports and analysis. These reports help investors stay updated on the latest developments and make informed investment decisions.

Additionally, the FAQs center serves as a knowledge hub where investors can find answers to common questions about investing, trading strategies, risk management, and more. This resource aims to empower investors with the information they need to navigate the complexities of the financial markets confidently.

Furthermore, MyCAP's news section delivers timely updates and relevant news articles to keep investors abreast of market-moving events, regulatory changes, and other pertinent information. By staying informed through these resources, investors can deepen their understanding of the market and make well-informed investment choices.

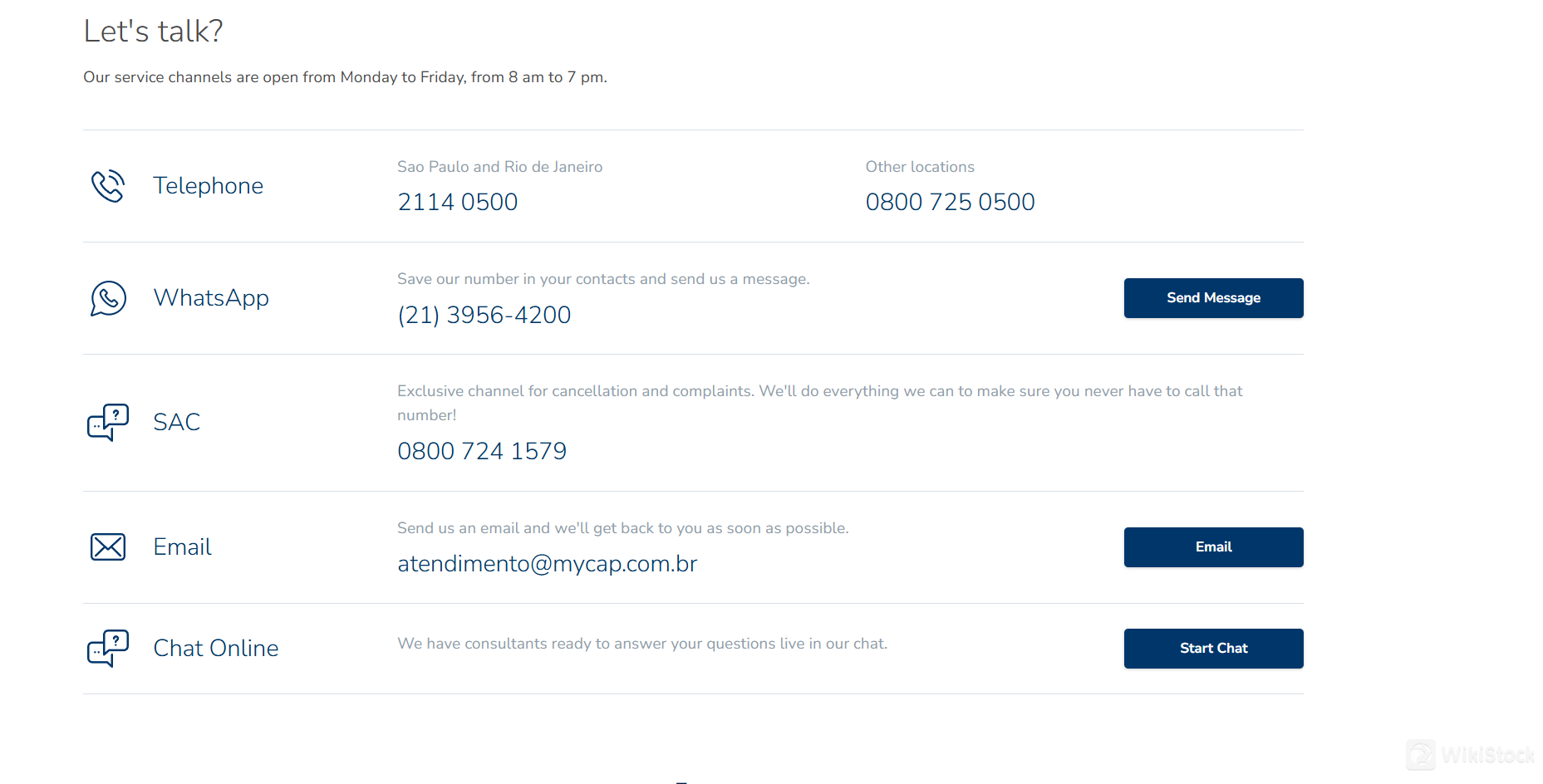

MyCAP offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can get in touch with customer service line using the information provided below:

Monday to Friday, from 8 am to 7 pm

Telephone: 2114 0500

WhatsApp: (21) 3956-4200

Email: atendimento@mycap.com.br

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

In conclusion, MyCAP stands out as a forward-thinking financial platform dedicated to democratizing access to the Stock Exchange and sharing its expertise in the financial market. MyCAP offers a diverse range of investment options and tailored account types to meet the varying needs of investors. Promotions such as three months of zero brokerage and free trial further enhance the value proposition for clients. The platform's Research Team and FAQs center serve as valuable resources to empower investors with insights and information to make informed decisions. However, clients should should shed light on its unregulated conditions before trading with it. Therefore, it is more suitable for professional traders.

Frequently Asked Questions (FAQs)

No. It has been verified that this broker currently has no valid regulation.

What App and platforms MyCAP provides?It provides MyCAP Power Broker APP, TradeMap, Profit one, Profit Plus, and Power Broker.

How can I withdraw money from MyCAP?You can withdraw via TED or DOC or via MyCAP App portal.

What types of securities can I invest in with MyCAP?You can trade stocks, crypto funds, crypto ETFs, BDR, index funds, fixed and variable income options, Real Estate Funds, futures, public offerings, and treasury direct.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

United Kingdom

Years in Business

15-20 years

Relevant Enterprises

Countries

Company name

Associations

--

TP ICAP

Parent company

Review

No ratings