Sorrento provides full-range cross-border securities and financial services for customers by fully utilizing the brand, business and network advantages. Sorrento Capital Limited is a licensed corporation under the SFO to engage in Type 6 (advising on corporate finance) regulated activities. Today we are one of the most active financial advisory groups based in Hong Kong.

What is Sorrento?

Sorrento shines with its accessibility to Initial Public Offerings (IPOs), offering investors opportunities to engage in new investment ventures. However, the brokerage lacks support for forex and cryptocurrency trading, limiting options for traders interested in these markets.

Pros and Cons of Sorrento?

Sorrento, regulated by the Securities and Futures Commission (SFC) in Hong Kong, stands out for its accessibility to Initial Public Offerings (IPOs), providing investors with opportunities to participate in new investment ventures. However, the brokerage does not support forex and cryptocurrency trading, which may restrict options for traders interested in these markets. Moreover, the absence of live chat support could inconvenience clients seeking immediate online assistance. Additionally, Sorrento lacks comprehensive educational resources, which could hinder the learning process for beginner investors. Furthermore, detailed information regarding account types is limited, potentially posing challenges for clients in selecting the most suitable account for their needs.

Is Sorrento safe?

Regulations

Sorrento is licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong, holding license numbers BHG995 and BGQ967.

Safety Measures

Sorrento employs an approach to safeguarding clients' personal, financial, and account information. This includes implementing physical, electronic, and procedural safeguards to ensure a secure trading environment. Each client receives a unique account number and password, as well as a distinct user ID and password for accessing the Secure Access Website. Employees adhere to strict confidentiality standards and established procedures to protect client information. Access to data is restricted to authorized personnel only. Security measures are aligned with recognized international standards to prevent unauthorized disclosure, compromise, or leakage of personal information. Additionally, Sorrento follows a data retention policy that ensures the disposal of client information in compliance with international standards, seven years after an account has been closed.

What are securities to trade with Sorrento?

Sorrento specializes in stock trading exclusively, offering a focused range of tradable securities and services tailored for equity investors. However, the broker does not offer a variety of trading instruments such as bonds, futures, or forex.

Sorrento Accounts

Sorrento offers three account types to cater to different investor needs:

Individual Account: This account is designed for single investors, providing personalized access to stock trading and investment opportunities.

Joint Account: This account type is tailored for two or more individuals who wish to combine their investments. It allows for shared management of stock trading and investment decisions, making it suitable for partners or family members.

Corporate Account: This account is specifically structured for businesses and corporate entities. It offers tailored services to meet the unique requirements of corporate investments and stock trading, enabling companies to manage their portfolios efficiently.

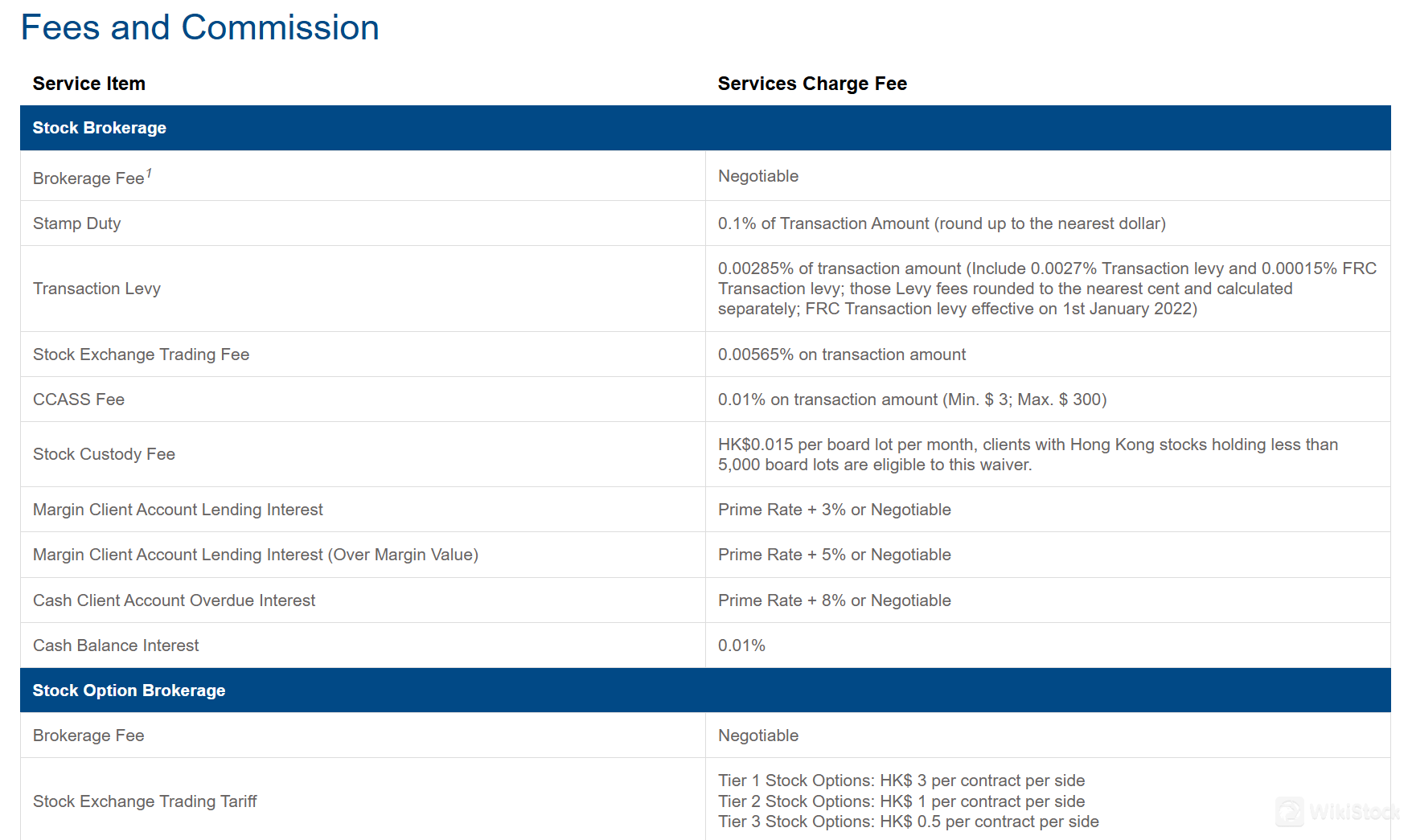

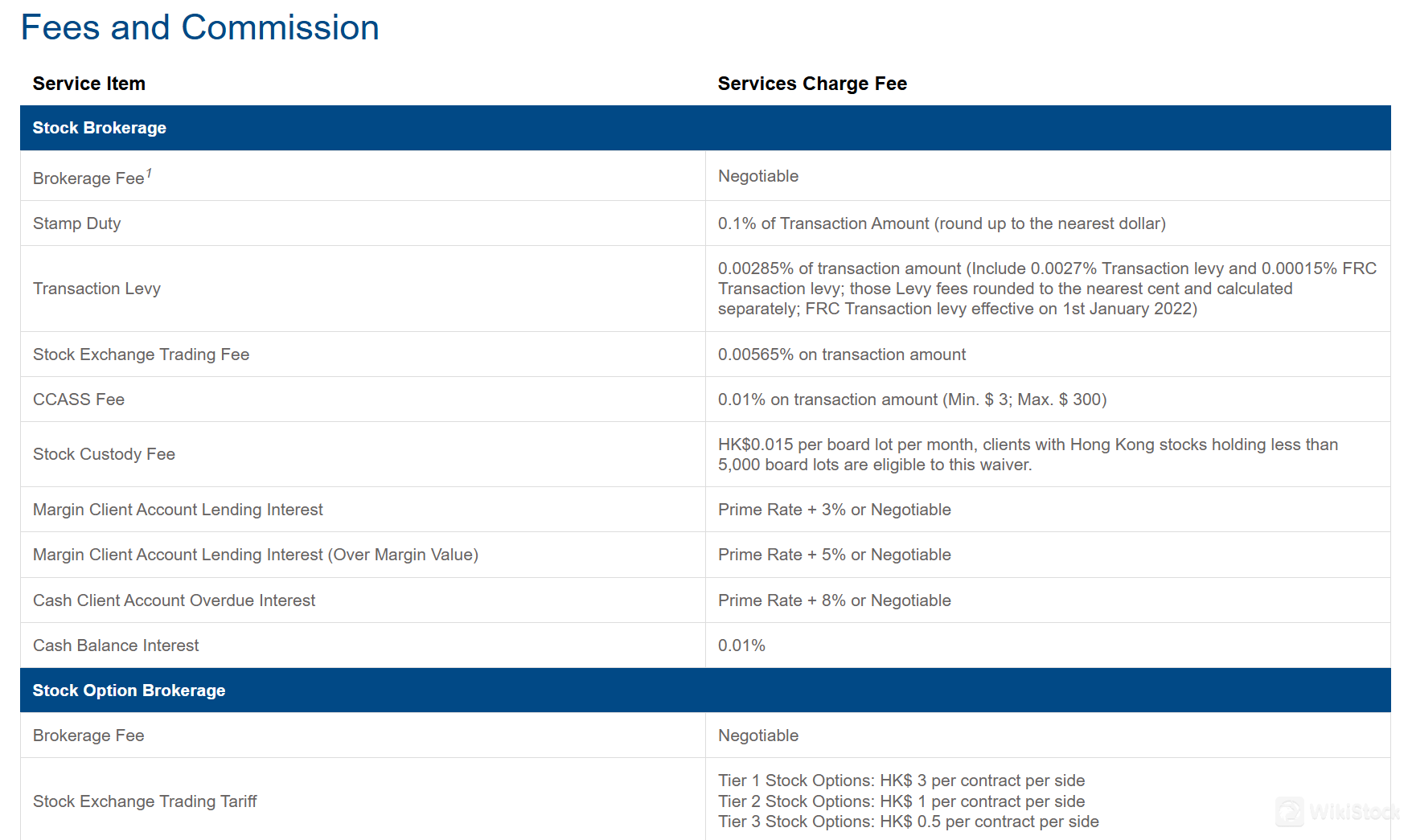

Sorrento Fees Review

Sorrento offers a detailed fee structure for stock brokerage services.

The brokerage fee is negotiable, allowing clients to agree on a rate that suits their trading activity.

A stamp duty of 0.1% of the transaction amount is applied, rounded up to the nearest dollar.

Additionally, a transaction levy totaling 0.00285% of the transaction amount is charged, including a 0.0027% transaction levy and a 0.00015% FRC transaction levy.

The stock exchange trading fee is 0.00565% on the transaction amount.

For the Central Clearing and Settlement System (CCASS), there is a fee of 0.01% on the transaction amount, with a minimum charge of $3 and a maximum of $300.

Sorrento also charges a stock custody fee of HK$0.015 per board lot per month, but clients with holdings of less than 5,000 board lots in Hong Kong stocks can get a waiver for this fee.

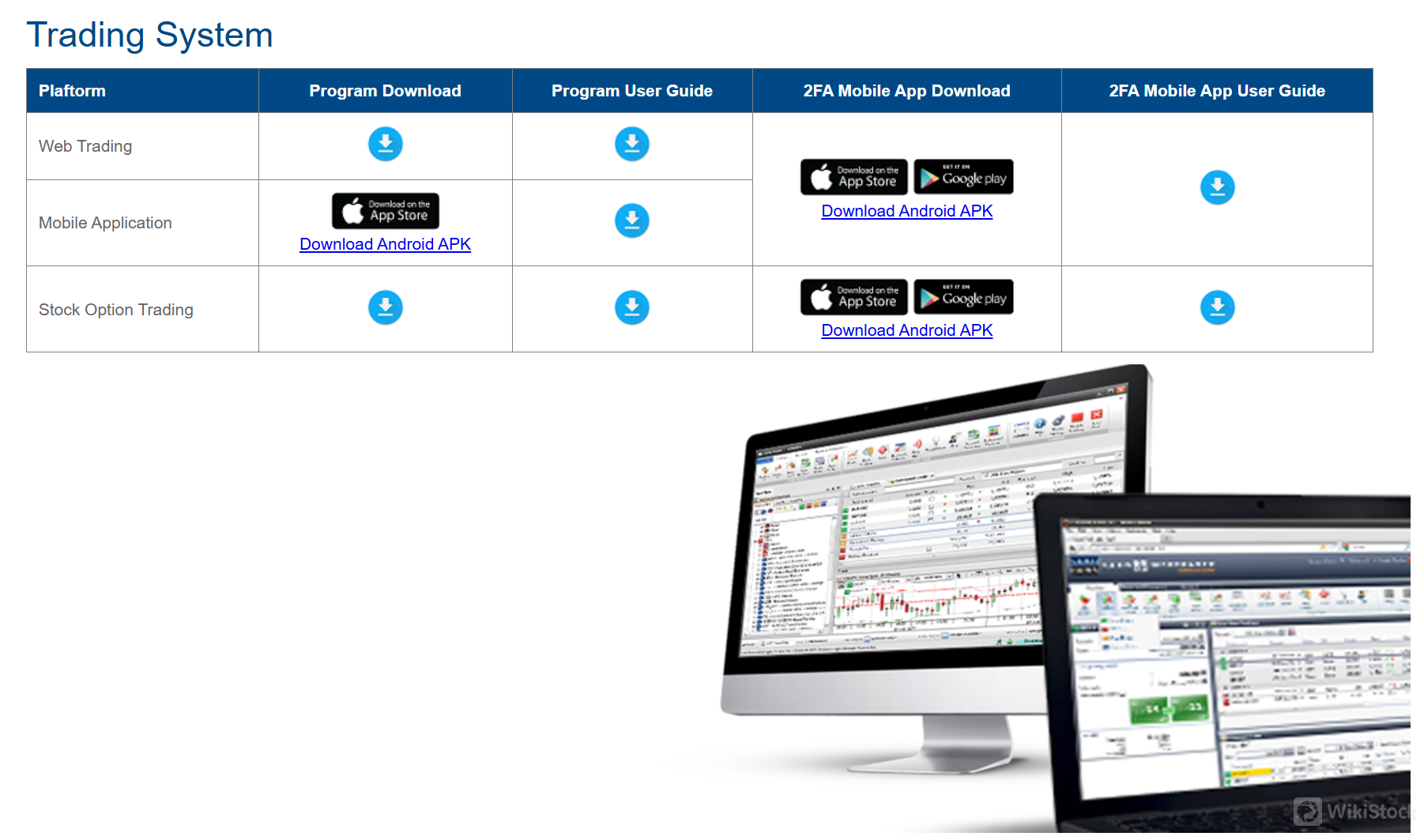

Sorrento App Review

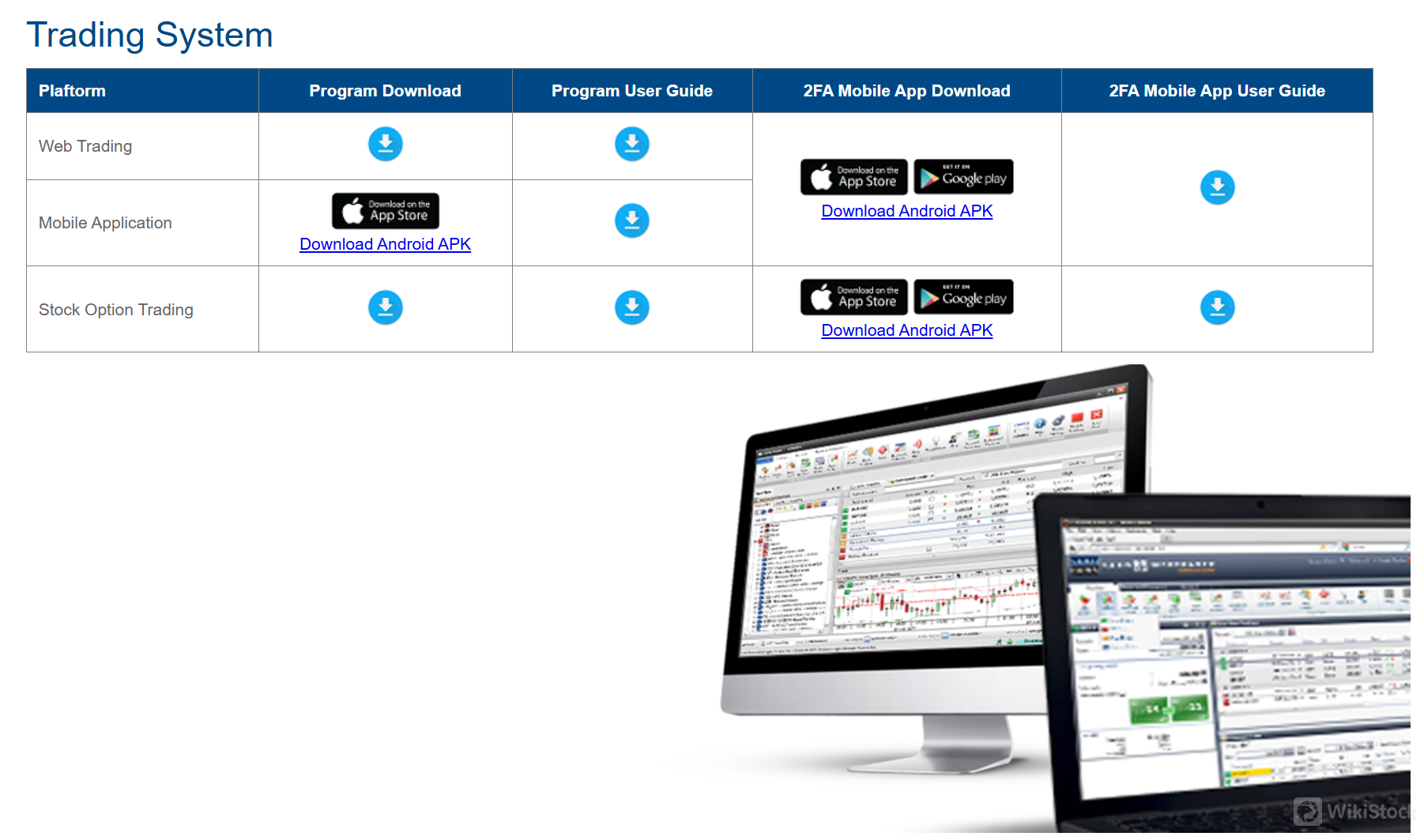

Sorrento offers three trading platforms: Sorrento Web Trading, Sorrento Mobile App, and a Stock Option Trading platform.

Customer Service

Customers can reach Sorrento via telephone at +852-3959-9800, send faxes to +852-3959-9801, or email their inquiries to info@sorrento.com.hk.

Conclusion

Sorrento stands out with its exclusive access to Initial Public Offerings (IPOs), providing investors with opportunities for new and potentially lucrative investments. However, the brokerage caters primarily to equity investors due to its focus on stock trading and limited support for other asset classes like forex and cryptocurrencies.

FAQs

Is Sorrento safe to trade?

Sorrento is licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with regulatory standards. The brokerage employs robust security measures to safeguard clients' personal, financial, and account information, including physical, electronic, and procedural safeguards.

Is Sorrento a good platform for beginners?

While Sorrento offers web trading and a mobile app for convenient trading access, it lacks comprehensive educational resources. This may pose challenges for beginners seeking to enhance their knowledge and skills in trading.

Is Sorrento legit?

Yes, Sorrento is licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong, holding license numbers BHG995 and BGQ967.

Risk Warning

The details presented are derived from WikiStock's thorough assessment of the brokerage's website data and may be subject to updates. It's essential to recognize that online trading carries significant risks, which could result in the complete loss of invested capital. Therefore, gaining a comprehensive understanding of these risks before participating is essential.

China Hong Kong

China Hong Kong Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--