CS Wealth Securities Limited (formerly known as Harmony Securities Limited) (CE No.: AAD244, Broker No.: 8459), is a securities brokerage company wholly owned by CSC Holdings Limited (HKEx No.: 235), and is licensed by the Hong Kong Securities and Futures Commission to carry on Type 1 dealing in securities regulated activities.

What is CS Wealth Securities?

CS Wealth Securities Limited, previously known as Harmony Securities Limited (CE No.: AAD244, Broker No.: 8459), is a securities brokerage firm fully owned by CSC Holdings Limited (HKEx No.: 235). One of its key strengths is its extensive asset management services, which cater to both retail and professional investors. In addition, it has a good reputation. However, there is the lack of cryptocurrency trading options, which could limit its appeal to investors seeking these products.

Pros and Cons of CS Wealth Securities

Cswsec boasts a stellar reputation, functioning under strict regulatory supervision and supported by a well-informed investment team that enforces stringent security measures for client accounts and funds. Nonetheless, there is room for enhancement in clearly disclosing the costs associated with margin interest rates, as well as in offering extensive educational materials and more accessible customer service channels to better equip clients with the knowledge and support needed for making informed decisions.

Is CS Wealth Securities safe?

Yes, CS Wealth Securities operates under strict regulatory oversight and is regulated. The firm offers margin interests, providing advantageous features for its clients. However, it is recommended that potential clients conduct thorough research and carefully consider all factors before beginning trading activities. This careful preparation ensures a safer and more secure trading experience.

CS Wealth Securities Accounts

To make an appointment and open an account, please visit CS Wealth Securities physically or call at 2521 1261

CS Wealth Securities Fees Review

Securities Trade Services FeeBrokerage Commission: 0.25% of transaction amount, minimum HK$ 100

Stamp Duty: 0.13% of transaction amount (rounded up to the nearest dollar)

FRC Transaction Levy: 0.00015% of transaction amount

Transaction Levy: 0.0027% of transaction amount

Trading Fee: 0.00565% of transaction amount

CCASS Fee: 0.01% of transaction amount, minimum HK$ 2, maximum HK$ 500

Scrip Handling and Settlement Related Fees

Physical Scrip Withdrawal Fee (for each stock): HK$ 5 per lot (minimum HK$ 30)

Transfer Deed Stamp Duty: HK$ 5 per transfer deed

Settlement Instruction Fee (stock deposit): waived

Settlement Instruction (SI) Fee: 0.10% of market value 0.10%,0.02% of market value

Investor Settlement Instruction (ISI) Fee: (based on previous closing price), minimum handling fee HK$ 50 per stock

Money Settlement Fee: Returned Cheque: HSBC Prime Rate + 5% per annum (minimum HK$ 200)

Compulsory Share Buy-Back: 0.50% on consideration + trade related services charge + penalty HK$300

Securities Information Services

Hong Kong Stock Streaming Plan (provided by etnet): Monthly fee HK$ 468Hong Kong Stock Snapshot Plan (provided by etnet): First 300 free Snapshot Real Time Quote subsequent HK$0.07/each

Nominee Services and Corporate ActionsScrip Fee: HK$ 1.8 per lot (shares held under HKSCC Nominees before book-close date)

Handling /Collection of Cash /Scrip Dividends: 0.25% of the dividend amount (minimum HK$30)

Handling /Collection of Bonus Shares: waived

Share Registration (for each stock): $5 per lot ($50 per share)

Handling of Rights Issue /Rights or Warrants Exercise: HK$ 1 per lot, plus HK$ 50 handling fee

Tendering Shares Under a Takeover Bid: 0.25% of the transaction amount (minimum HK$100)

Handling Share Consolidation /Split: waived

Custodian Fee for CCASS Securities: $0.015 per lot monthly

Custodian Fee for OTC Securities: 0.04% per annum on Principal Value (for OTC bond, charged quarterly)

Other Services

Client's Deposit Interest Rates: 0.1875% per annum (HKD500,000 or above)

Lending Rate of Margin Account: HSBC Prime rate per annum +3.5%

Overdue Interest of Cash Account: HSBC Prime rate per annum +7%

CHATS Charges: Per transaction HK$200

Overdue Interest of Cash Account: HK$50 per transaction

Duplicate Statement Copy: HK$ 30 for each statement copy

Reference Letter: HK$ 100 per letter

Stock Segregated Account Service Fee (With CCASS Statement): HK$ 100 monthly

CS Wealth Securities App Review

CS Wealth Securities provides an App for clients to use, which could be downloaded via App Store and Android.

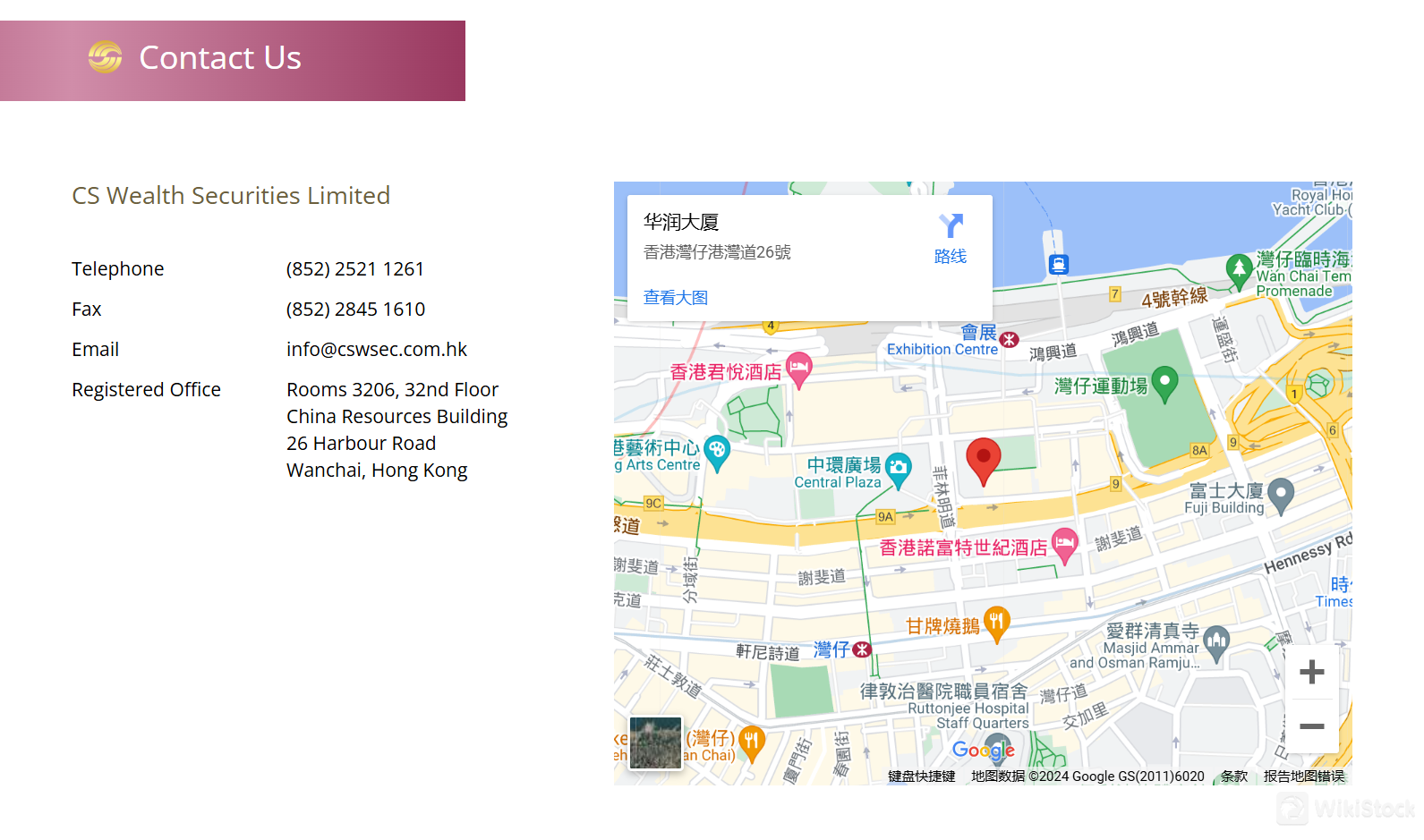

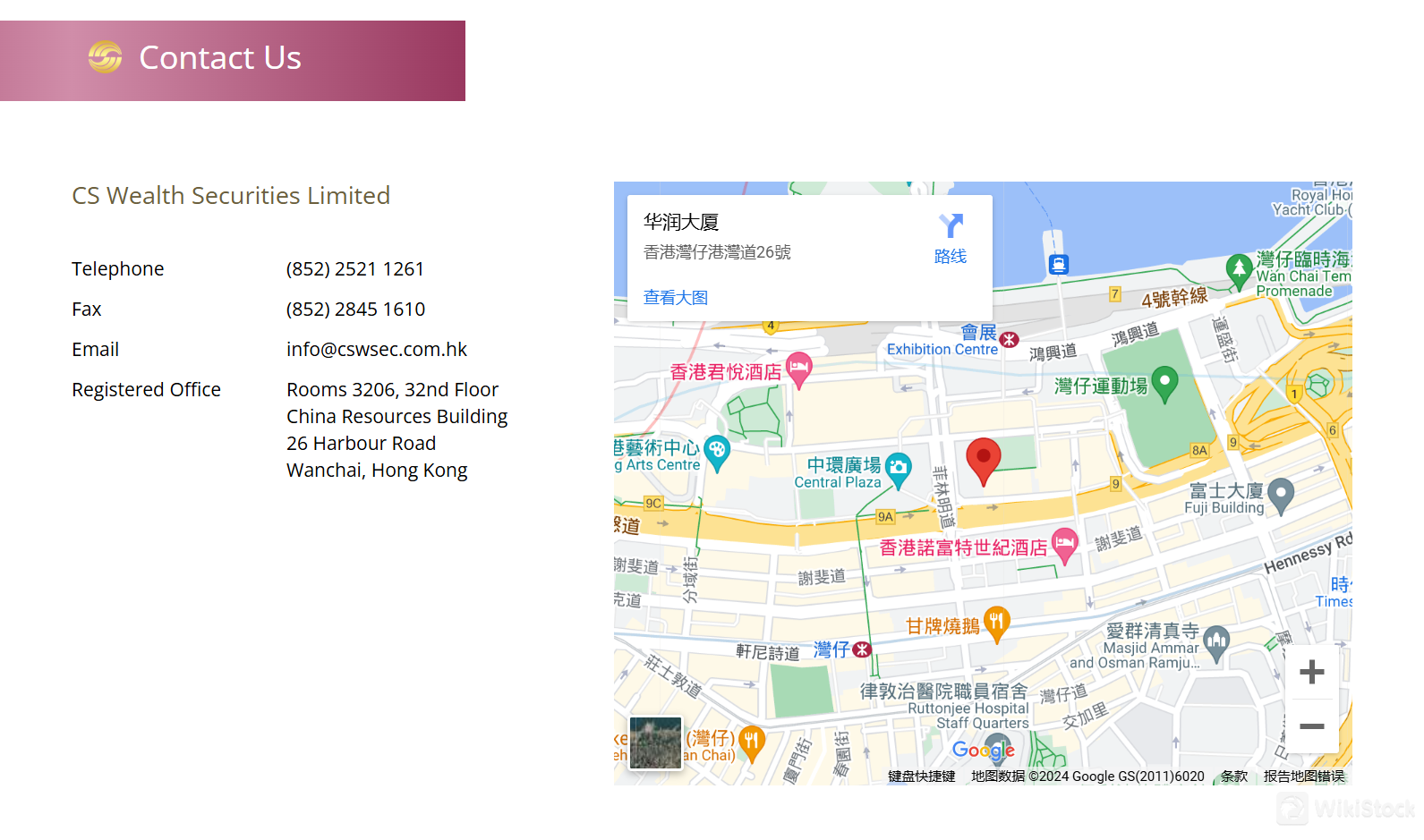

Customer Service

The company can be contact at 2521 1261 by call or info@cswsec.com.hk by email for any questions.

Conclusion

In conclusion, CS Wealth Securities is operated under strict regulatory supervision by the Hong Kong Securities and Futures Commission, the firm offers Type 1 dealing in securities activities. Located in the bustling area of Wanchai, Hong Kong, CS Wealth Securities is accessible for inquiries via phone or email. While the company upholds a strong reputation with effective oversight and security measures for client accounts and funds, it could improve in areas such as transparency regarding margin interest rates and the enhancement of educational resources. This would further empower clients to make informed decisions. Potential clients are advised to conduct thorough research to ensure a secure trading experience with CS Wealth Securities.

FAQs

Is CS Wealth Securities safe to trade with?

Yes, CS Wealth Securities is safe to trade with. It is regulated by the Hong Kong Securities and Futures Commission and adheres to strict regulatory standards to ensure the security of client accounts and funds. However, clients are advised to conduct their own due diligence before engaging in trading activities.

Is CS Wealth Securities a good platform for beginners?

While CS Wealth Securities provides robust trading services, it may not offer extensive educational resources for beginners. New traders might need to seek additional learning materials or support externally.

Is CS Wealth Securities legit?

Yes, CS Wealth Securities is a legitimate brokerage firm. It operates under the regulatory framework of the Hong Kong Securities and Futures Commission and is a fully owned subsidiary of CSC Holdings Limited, listed on the HKEx.

Is CS Wealth Securities good for investing/retirement?

CS Wealth Securities offers various financial products including mutual funds, which can be suitable for long-term investing and retirement planning. However, potential investors should evaluate their personal financial goals and risk tolerance in consultation with financial advisors at CS Wealth Securities to tailor an investment strategy that fits their needs.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)