Redmayne Bentley LLP is a Limited Liability Partnership. Redmayne Bentley is an independent full-service stock brokerage firm based in the UK, with a history dating back to 1875. It is one of the oldest and most respected investment management and stock brokerage companies in the UK. The company is known for providing professional and personalized services, including securities brokerage, investment management, and wealth planning, among other areas.

What is Redmayne Bentley?

Redmayne Bentley is a reputable and FCA-regulated platform for investors seeking income-focused investments with a focus on security and regulatory oversight. However, it's important to consider their commission structure, investment focus, and suitability for beginners before making a decision. They offer a range of services, including investment management, stockbroking, and research.

Pros & Cons of Redmayne Bentley

Pros: Formal regulation: Redmayne Bentley is regulated by the FCA (Financial Conduct Authority) with license No: 499510.

Security measures: Employs data encryption in transit, which helps protect your personal information from unauthorized access during transmission.

Variety of investments: Redmayne Bentley offers gilts and bonds, ETFs and ETCs, PIBS and REITs.

Research and analysis: They provide valuable research and analysis, empowering clients with informed decision-making based on expert perspectives

Cons: Higher Commissions: Compared to some other platforms, Redmayne Bentley's tiered commission structure can result in higher overall costs, especially for smaller transactions.

No Fractional Shares: Redmayne Bentley does not currently offer fractional shares, which can limit investment flexibility for smaller investors.

Is Redmayne Bentley Safe?

Regulation

Redmayne Bentley is regulated by the Financial Conduct Authority (FCA) under license number 499510. This provides a significant layer of protection for clients as the FCA enforces strict rules and standards for financial conduct. Being FCA-regulated means Redmayne Bentley must adhere to regulations regarding client money handling, transparency, and fair treatment.

Fund Safety

All Redmayne Bentley client nominee accounts are covered by their professional indemnity insurance policy for up to £10 million per claim. This provides an additional layer of security for investments, offering peace of mind in the event of an unforeseen error or negligence.

Safety Measures

Redmayne Bentley complies with relevant data protection regulations and has appointed a dedicated Data Protection lead. Additionally, they employ data encryption in transit, which helps protect your personal information from unauthorized access during transmission.

What are Securities to Trade with Redmayne Bentley?

Customers can invest in gross income paying investments, such as fixed-interest stocks like gilts and bonds, Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs), permanent interest bearing shares (PIBS) and Real Estate Investment Trusts (REITs).

Fixed-interest securities: Gilts and bonds provide regular interest payments, offering a stable source of income.

Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs): These offer exposure to a basket of underlying assets, allowing for diversification and potentially higher returns.

Permanent interest-bearing shares (PIBS): These are special types of shares that pay a fixed rate of interest, similar to a bond.

Real Estate Investment Trusts (REITs): These invest in income-generating real estate properties, providing investors with a share of the rental income.

Redmayne Bentley Fees Review

Redmayne Bentley charges a variety of fees for its services, including annual management fees, dealing charges, and other ancillary charges:

Annual management fee: 0.85% of the portfolio's value plus VAT, with a minimum of £600 plus VAT. This fee is collected in four quarterly installments.

Dealing charges: Commissions on equities and funds are 1.75% on the first £10,000 and 0.5% thereafter. Commissions on gilts and bonds are 1% on the first £10,000, 0.45% on the next £10,000, and 0.2% thereafter. All transactions have a minimum commission charge of £25.

Ancillary charges: These include fees for segregated portfolios, pooled portfolios, transferring holdings, and closure fees. For example, segregated portfolios have an annual fee of £1,995 plus VAT, while pooled portfolios have no charge. Transferring holdings out of a nominee or SIPP costs £15 per line of stock, up to a maximum of £195 per portfolio.

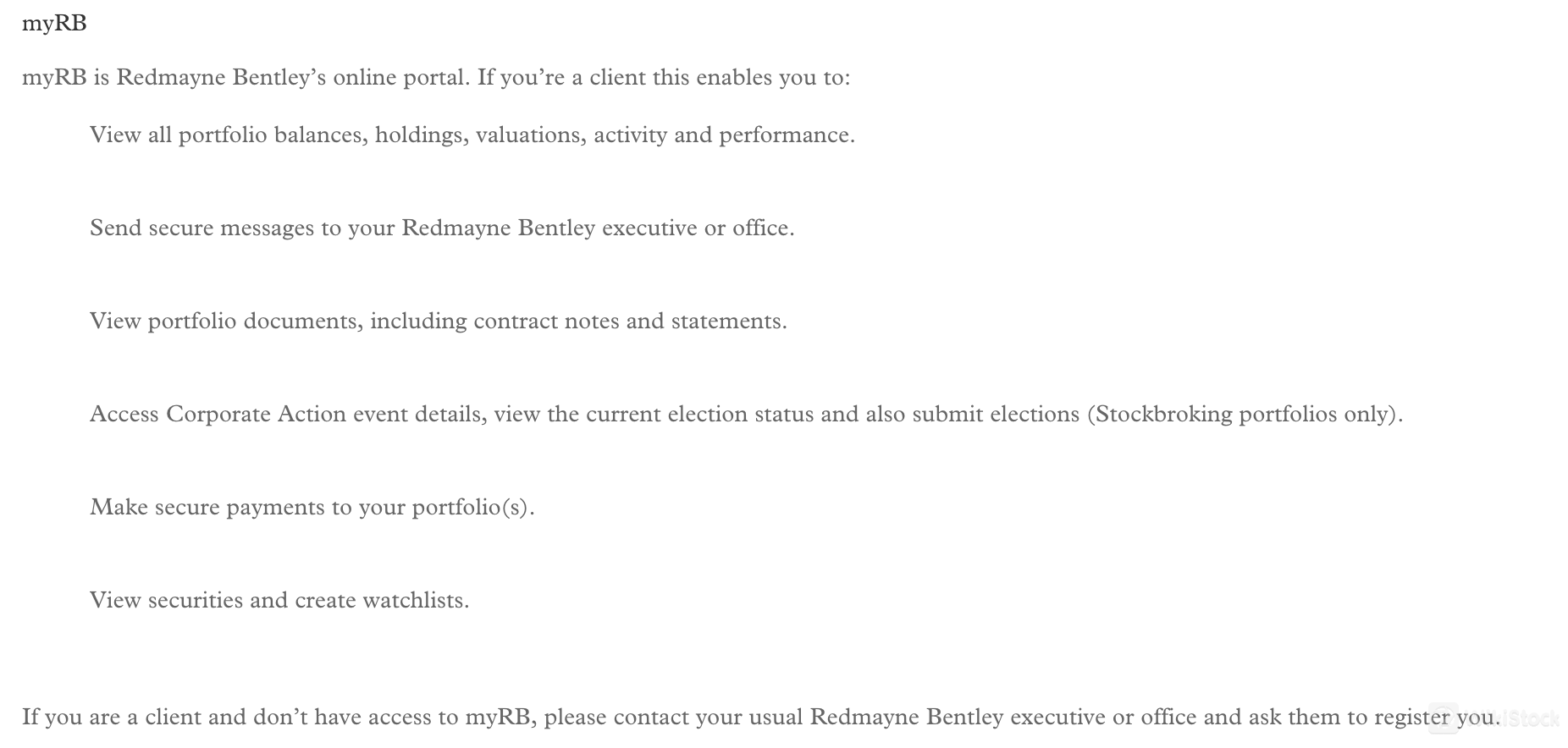

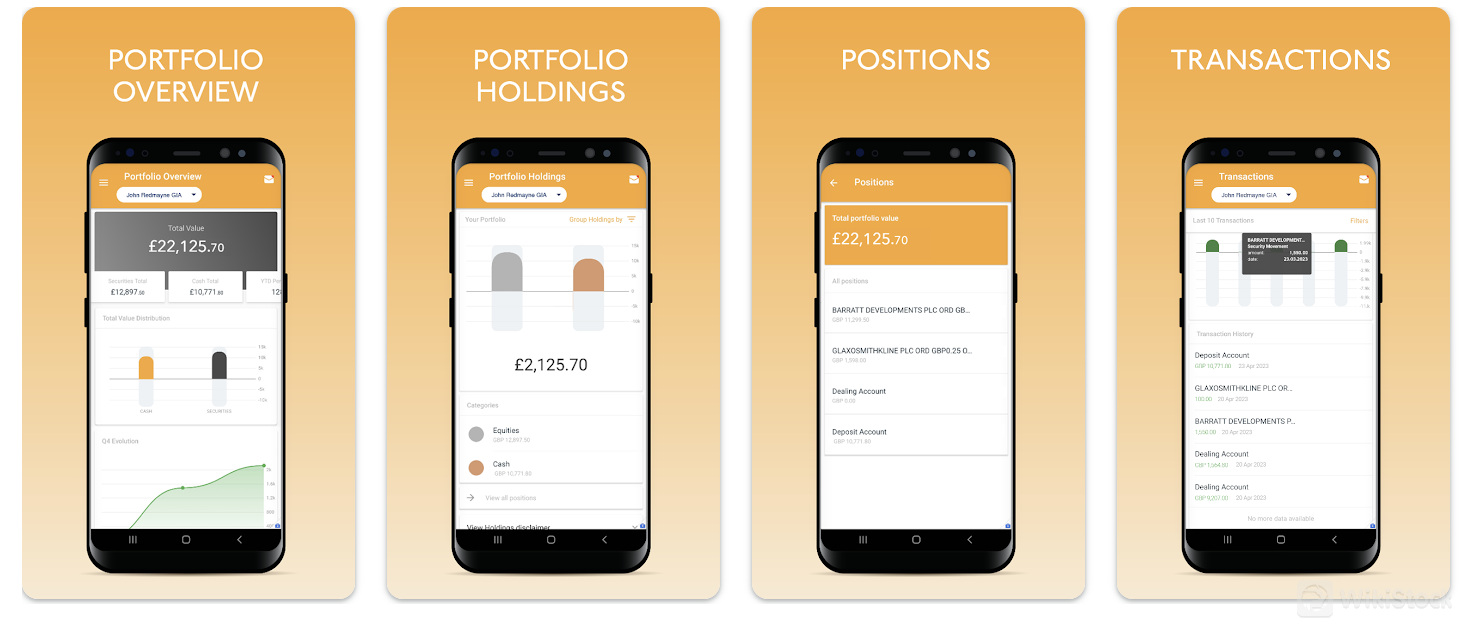

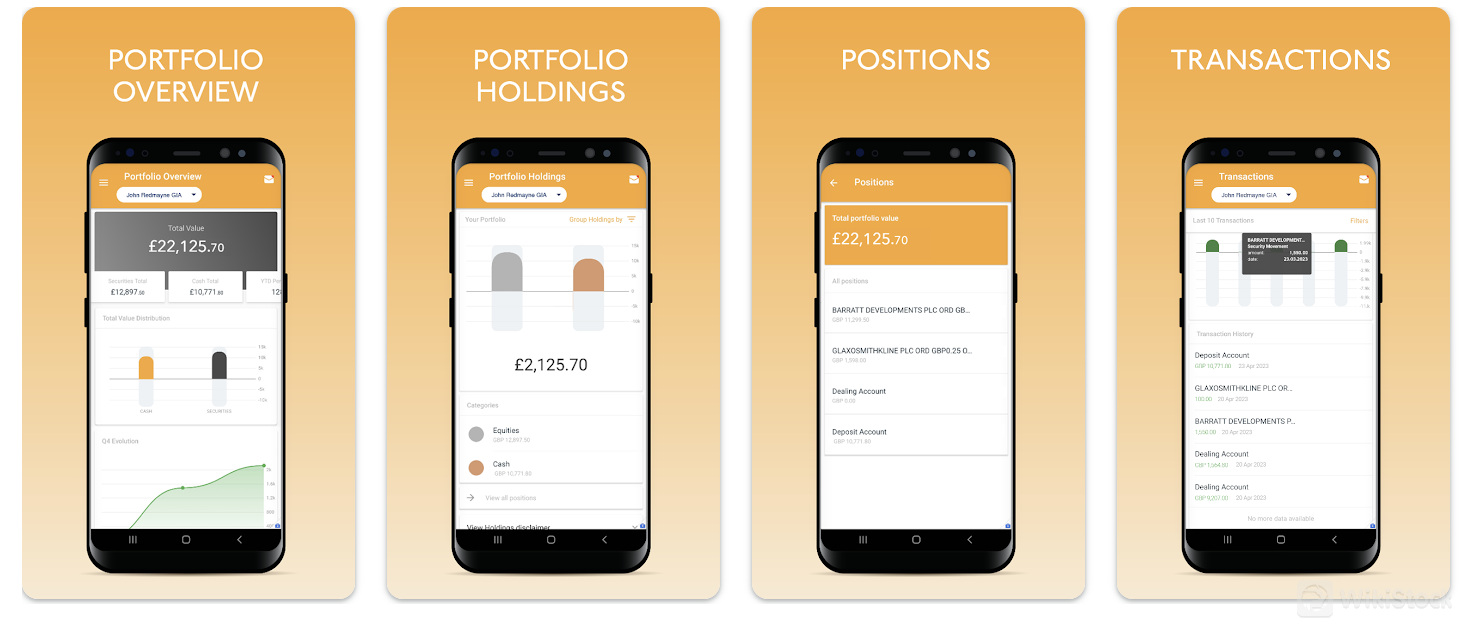

Redmayne Bentley App Review

The myRB app from Redmayne Bentley offers a convenient way to manage investments. It provides a comprehensive overview of portfolio, including balances, holdings, valuations, activity, and performance. Customers can also send messages to Redmayne Bentley contacts, view portfolio documents, access corporate action details, submit elections, make secure payments, and even create watchlists for specific securities. Available on both iOS and Android devices, the myRB app offers a convenient and user-friendly experience for managing investments.

Research & Education

Redmayne Bentley offers a research publication called “Market Insight,” which provides insights for investors. This publication, available via email every other month, offers expert analysis and practical ideas for gaining exposure to the featured topic. This research resource can be a helpful tool for clients seeking to stay informed about market trends and make informed investment decisions.

Customer Service

Redmayne Bentley offers customer service through various channels, including:

Head office: Located at 3 Wellington Place, Leeds, LS1 4AP, the head office can be contacted by phone at 0113 243 6941 or by email at info@redmayne.co.uk.

Local offices: Redmayne Bentley has offices nationwide, each with its own contact information. Clients can find the details of their nearest office on the company website.

myRB portal: Clients can also send secure messages to their Redmayne Bentley contact directly through the myRB online portal

Conclusion

Redmayne Bentley offers a comprehensive investment platform with a focus on income-generating securities. They provide a user-friendly mobile app for managing portfolios, prioritize data security, and are regulated by the FCA, ensuring client protection. Their research publication, Market Insight, offers valuable insights for investors, while a multi-channel approach ensures convenient customer service. While their commission structure is tiered, it's important to consider the minimum commission charge.

FAQs

Is Redmayne Bentley safe to trade?

Yes, Redmayne Bentley is a legitimate platform for trading because the Financial Conduct Authority regulates it and the company employs encryption measures to protect client information.

Is Redmayne Bentley a good platform for beginners?

While they offer educational resources, beginners can benefit from platforms with more extensive educational tools and guidance.

Is Redmayne Bentley legit?

Yes, Redmayne Bentley is legally regulated by the Financial Conduct Authority (FCA) under license number 499510.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United Kingdom

United KingdomObtain 1 securities license(s)