Score

金山金融

http://www.gmfutures.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

2

Futures、Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Brokerage Information

More

Company Name

Golden Mountain Financial Limited

Abbreviation

金山金融

Platform registered country and region

Company address

Company website

http://www.gmfutures.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Golden Mountain |  |

| WikiStocks Rating | ⭐⭐⭐ |

| Fees | Commissions:from $15(Depends on the products) |

| Unique Trading APP(Golden Mountain APP) | N/A |

| Mutual Funds Offered | Yes |

| Platform/APP | Golden Mountain Platform(PC version) |

| Promotion | N/A |

Golden Mountain Information

Golden Mountain is known for its competitive pricing with commissions starting at $15, depending on the product, and offers a user-friendly PC-based trading platform. However, it lacks a mobile trading app, which could limit accessibility for users on the go.

Pros & Cons

| Pros | Cons |

| Convenient and fast account opening | High Commissions(Commissions From $15) |

| Regulated by SFC | No Diverse Account |

| Unique Trading APP(Golden Mountain Platform) | Limited Tradable Assets |

| Avaible in Both Hongkong and Mainland(Shanghai) Market | Complicated online trading process |

| No IPO Subscription |

Pros:

Golden Mountain offers the convenience of quick account opening and is regulated by the SFC, providing a layer of trust and security. It features a unique trading platform accessible via PC, attracting users who prefer a dedicated trading environment. The company operates in both the Hong Kong and Mainland (Shanghai) markets, expanding its accessibility and market reach.

Cons:

However, Golden Mountain charges high commissions, starting from $15, which might be costly for frequent traders. It offers a limited variety of account types and tradable assets, potentially restricting investment options. The online trading process is noted to be complicated, which could deter less experienced traders. Additionally, the lack of services for IPO subscriptions may be a significant drawback for investors interested in newly listed companies.

Is Golden Mountain Safe?

When assessing the safety of Golden Mountain, three key aspects are considered:

Regulations:

Golden Mountain is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is an independent statutory body responsible for overseeing the securities and futures markets in Hong Kong. T Golden Mountain's regulatory status, listed under License No. AYI978, indicates it complies with the regulations necessary to provide financial services in Hong Kong.

Funds Safety:

Golden Mountain adheres to regulatory guidelines that mandate stringent measures for the protection of client funds. Although specific insurance details were not explicitly mentioned, the broker's regulation by the SFC typically ensures that client accounts are managed with high standards of safety and compliance.

Clients are advised to review the brokers terms of service for precise information on fund protection measures, such as segregated accounts and compensation schemes, to ascertain the level of security provided for their investments.

Safety Measures:

Golden Mountain has implemented robust safety measures to secure client transactions and protect user information. Following the guidelines of the SFC to enhance cybersecurity management, the trading system requires “dual authentication” for login.

This means that in addition to entering a login password, users must also enter a “one-time password” to successfully access their accounts for trading. These measures significantly reduce the risk of unauthorized access and ensure the security of funds and personal data.

What are securities to trade with Golden Mountain?

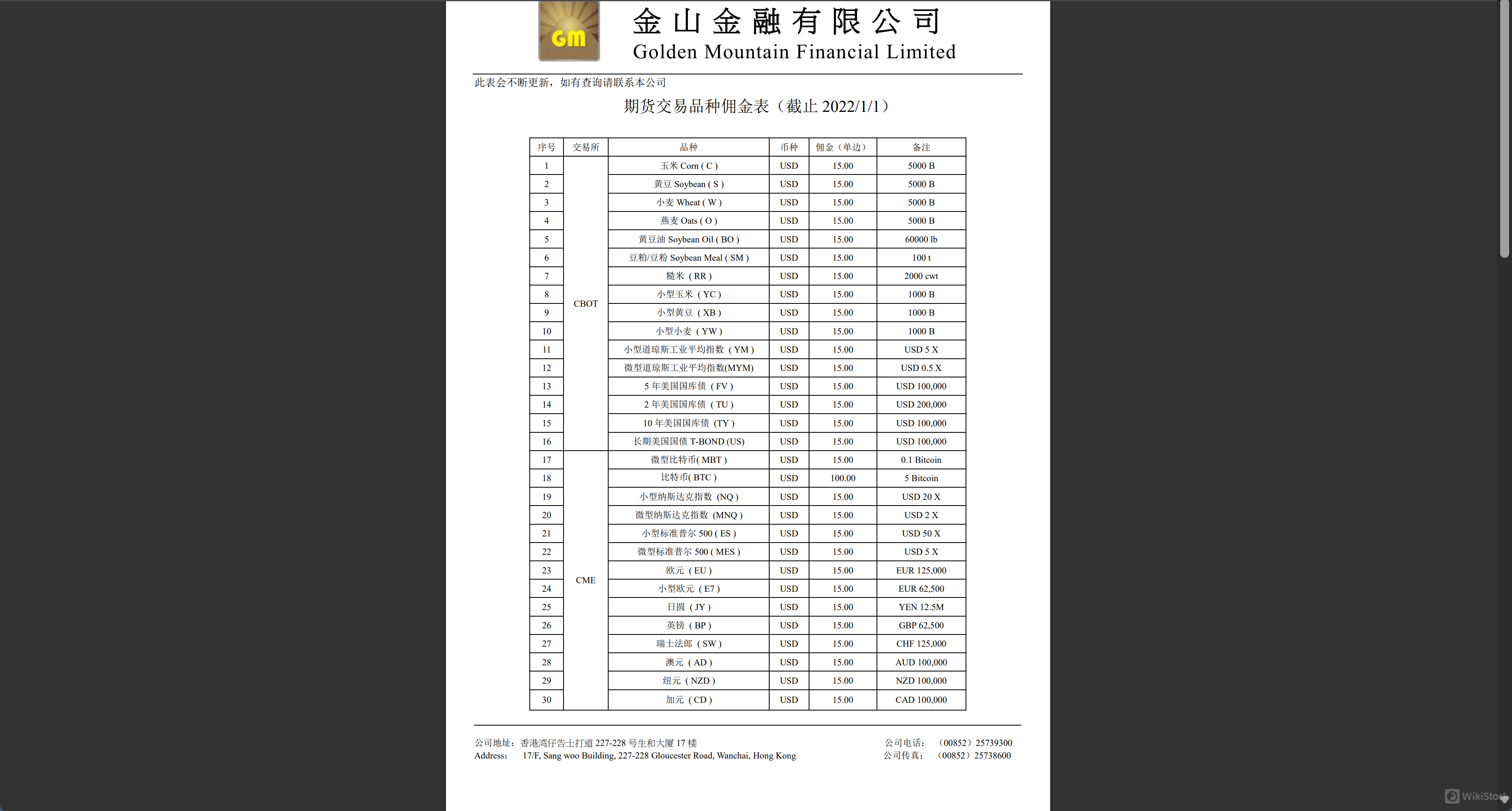

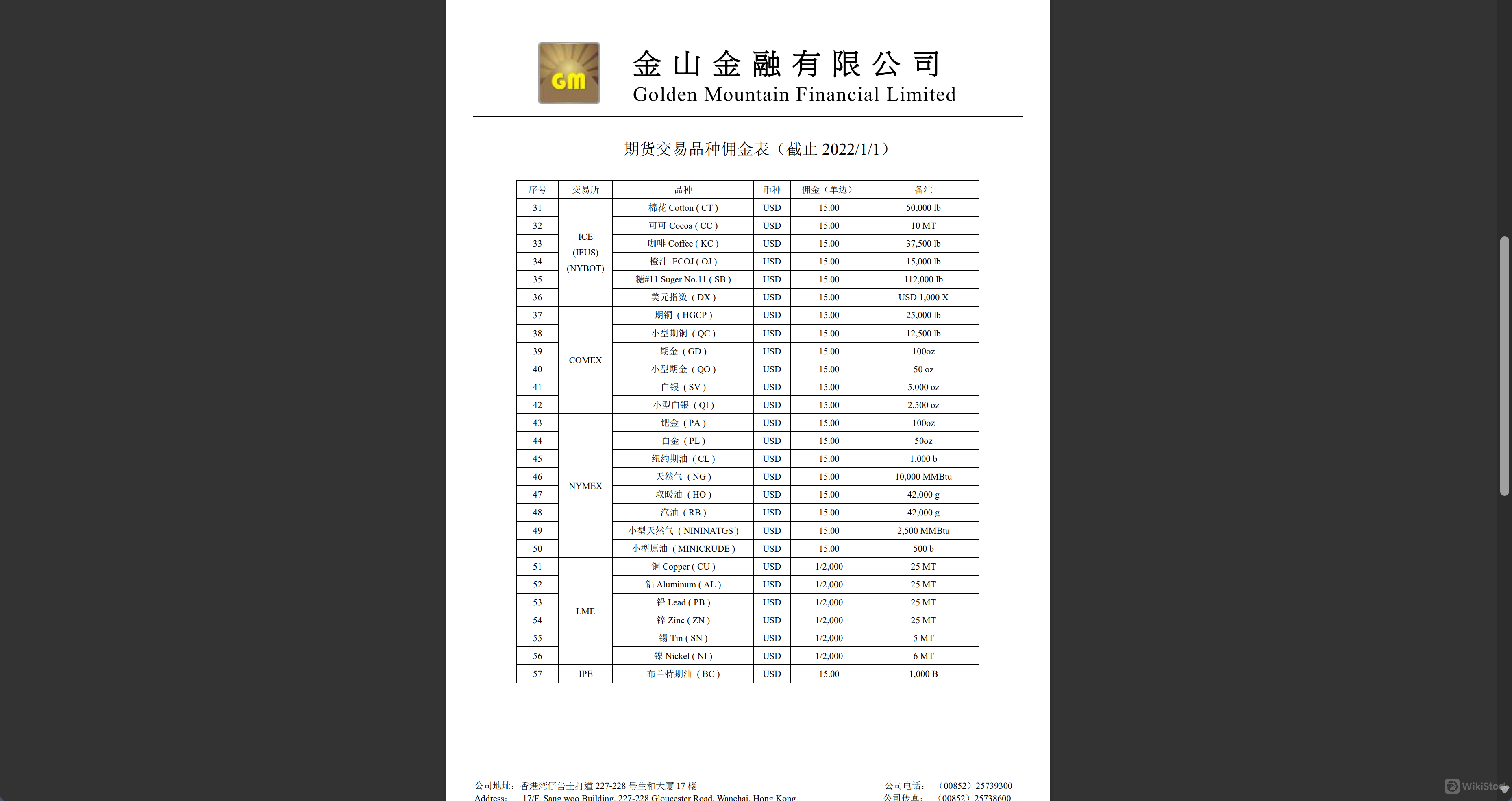

Golden Mountain Financial Limited offers a broad spectrum of securities for trading, primarily focusing on futures across various commodities and financial instruments. Here are some of the key securities available for trade:

Commodities: Traders can engage with a variety of agricultural products such as corn, soybeans, wheat, oats, soybean oil, and soybean meal. Other commodities include cotton, cocoa, coffee, frozen concentrate orange juice (FCOJ), sugar, copper, aluminum, lead, zinc, tin, and nickel.

Precious Metals: The trading options extend to precious metals like gold, silver, platinum, and palladium.

Energy and Oil Products: Available products include crude oil, natural gas, heating oil, and gasoline. This sector also includes less common energies like mini natural gas and mini crude oil futures.

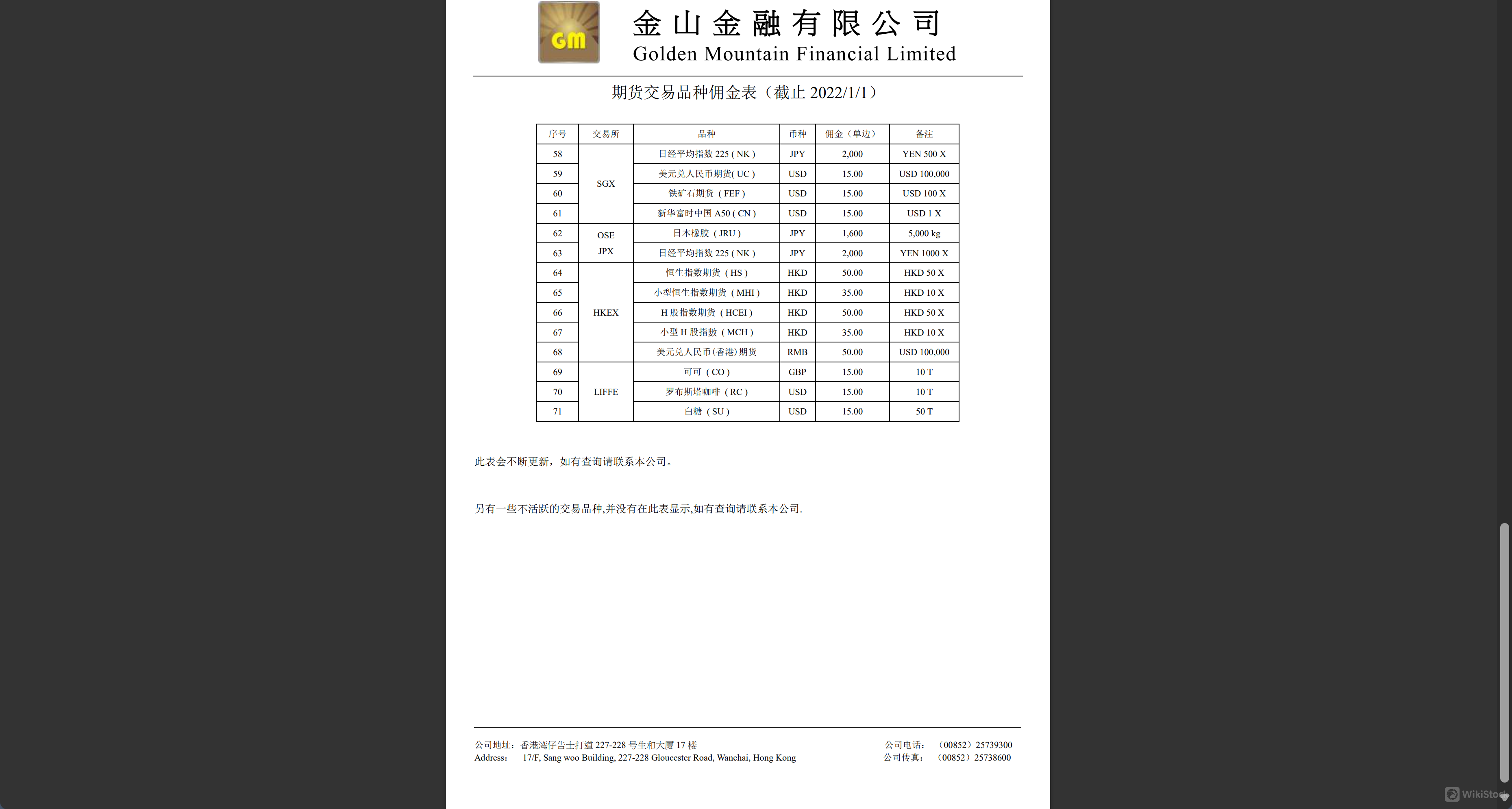

Financial Instruments: Futures trading is offered on major indices like the Dow Jones Industrial Average (both regular and mini sizes), Nasdaq, S&P 500, European currencies (Euro, British Pound, Swiss Franc), and the Japanese Yen. Also available are futures on U.S. Treasury bonds and notes ranging from 2-year to 30-year maturities.

Global Market Indices and Futures: Golden Mountain facilitates trading in major global market indices such as the Nikkei 225, Chinese A50, and the Hang Seng Index, along with forex futures like the USD/CNY.

Commodities and Financial Instruments on Major Exchanges (CBOT, ICE, NYMEX, COMEX, LME):

Common commodities such as corn, soybeans, wheat, oats, soybean oil, and soybean meal have a commission of USD 15.00 per side.

Precious metals like gold and silver, energy products including crude oil and natural gas, and financial instruments such as U.S. Treasury bonds and notes are also charged at USD 15.00 per side.

Less common commodities such as cocoa, coffee, and orange juice are similarly priced at USD 15.00 per side.

For metals traded on the London Metal Exchange (LME), such as copper, aluminum, lead, zinc, tin, and nickel, the fees are significantly lower, marked at USD 1 per 2,000 metric tons.

Cryptocurrencies and Mini Contracts:

Bitcoin futures command a higher fee at USD 100.00 per side for 5 bitcoins, while mini Bitcoin futures are USD 15.00 per side for 0.1 bitcoin.

Mini indices and smaller versions of commodities (like mini gold and mini silver) maintain the standard USD 15.00 fee.

Global Indices and Currency Futures:

Futures on major indices like the Nikkei 225, and currency futures such as the EUR/USD and USD/JPY, are typically USD 15.00 per side.

Specific futures like the Nikkei 225 index futures traded on SGX are charged at JPY 2,000 for the larger contract size and a proportional fee for smaller or mini contracts.

User Interface: Designed to be user-friendly, the platform offers a clean and intuitive interface that allows traders to navigate efficiently through various trading instruments and market data.

Technical Analysis Tools: It includes various analytical tools and charts, enabling traders to perform detailed market analysis and make informed decisions based on trends and historical data.

Real-time Data: Traders receive real-time market data, which is crucial for the fast-paced trading environment, especially when dealing with volatile markets like commodities and cryptocurrencies.

Security Measures: The platform incorporates advanced security protocols to ensure the safety of client funds and information. This includes dual authentication systems to prevent unauthorized access.

Accessibility: While primarily available for PC, it provides all necessary functionalities required for professional trading, though it does lack a mobile trading app, which might be a limitation for traders who prefer to trade on the go.

Customer Support Integration: Users can easily access customer support directly through the platform, allowing for quick resolution of issues or questions regarding their trades or account.

Key economic data releases and forecasts for the week.

Summaries of important speeches by influential figures such as Jerome Powell, highlighting market-moving information.

Regular market updates that include brief insights into major market movements and specific dates, providing traders with a daily snapshot of financial markets.

Special reports during key financial events like Federal Reserve meetings or major economic announcements, detailing potential market impacts and strategies.

Guides and tutorials on how to use their trading platforms effectively.

Webinars or live sessions that delve into trading strategies, market analysis, and risk management.

Articles and insights that help both novice and experienced traders understand complex market dynamics and improve their trading skills.

What types of securities can I trade with Golden Mountain?

You can trade a variety of securities including commodities, futures, and indices across global markets.

How can I contact Golden Mountain customer support?

Customer support can be reached via phone at 00852-25739300, email at cs@gmfutures.com, or QQ at 1265725760.

Does Golden Mountain provide a mobile trading platform?

No, currently Golden Mountain offers a trading platform only for PC users.

Golden Mountain Fee Review

Golden Mountain Financial Limited offers a thorough fee structure for various futures trading across different exchanges. The commission fees are generally standardized at USD 15.00 per side for most products, although some specific instruments and quantities differ. Here's a breakdown of the fee structure:

Here's an expanded chart listing 15 representative products from Golden Mountain Financial Limited, showcasing a diverse array of commodities, financial instruments, and markets:

| No. | Exchange | Commodity/Instrument | Currency | Commission per Side | Quantity |

| 1 | CBOT | Corn (C) | USD | $15.00 | 5000 bushels |

| 2 | CBOT | Wheat (W) | USD | $15.00 | 5000 bushels |

| 3 | CBOT | Soybean (S) | USD | $15.00 | 5000 bushels |

| 4 | CME | Bitcoin (BTC) | USD | $100.00 | 5 Bitcoins |

| 5 | CME | Mini S&P 500 (ES) | USD | $15.00 | $50 x index |

| 6 | ICE | Coffee (KC) | USD | $15.00 | 37,500 lb |

| 7 | ICE | Cotton (CT) | USD | $15.00 | 50,000 lb |

| 8 | NYMEX | Crude Oil (CL) | USD | $15.00 | 1,000 barrels |

| 9 | NYMEX | Natural Gas (NG) | USD | $15.00 | 10,000 MMBtu |

| 10 | LME | Copper (CU) | USD | $1/2,000 | 25 MT |

| 11 | LME | Aluminum (AL) | USD | $1/2,000 | 25 MT |

| 12 | HKEX | Hang Seng Index Futures (HS) | HKD | $50.00 | HKD 50 x index |

| 13 | COMEX | Gold (GD) | USD | $15.00 | 100 oz |

| 14 | COMEX | Silver (SV) | USD | $15.00 | 5,000 oz |

| 15 | SGX | Nikkei 225 Index (NK) | JPY | ¥2,000 | YEN 500 x |

Golden Mountain Trading Platform Review

Golden Mountain Financial Limited provides its trading services through a dedicated platform known as the Golden Mountain Platform. This platform is available on PC, offering a robust environment for trading a wide array of financial instruments, including futures on commodities, indices, and other securities. Here are some key features and characteristics of the Golden Mountain Platform:

Research & Education

Golden Mountain Financial Limited offers a robust set of research resources and educational materials to support its clients' trading activities. Heres a breakdown of what is available:

Research Reports:

Golden Mountain provides timely and detailed market briefings, which are essential for traders who need to stay updated with market trends and significant financial events. These reports cover a variety of topics, including:

Educational Materials:

While specific details on the format and depth of educational content are not explicitly mentioned in the text, it's typical for firms like Golden Mountain to offer:

Customer Service

Golden Mountain Financial Limited offers detailed customer support through multiple channels to ensure effective communication and assistance for its clients.

The primary customer hotline is available at 00852-25739300, allowing clients to speak directly with a representative for immediate help.

Additionally, clients can reach out via email at cs@gmfutures.com for support inquiries that may require detailed responses or documentation.

For those who prefer instant messaging, the company also provides support through QQ with the ID 1265725760, facilitating quick and convenient communication for users familiar with this platform.

Conclusion

Golden Mountain Financial Limited is a versatile financial service provider based in Hong Kong, offering a wide range of trading options including commodities, metals, and futures on various global exchanges.

The company supports its clients with a dedicated PC trading platform, detailed research reports, and educational resources, ensuring a well-rounded trading experience. Security measures are robust, with dual authentication for enhanced safety.

FAQs

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

10-15 years

Regulated Countries

1

Products

Futures、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

Sanfull Securities

Score

DL Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score