COL Global Access is a registered trademark for the service offered by COL Securities (HK) Limited a limited liability company incorporated in Hong Kong and licensed in the regulated activity of Securities Dealing AHF149. COL Securities (HK) Limited is a wholly owned subsidiary of COL Financial Philippines which is a leading online stock brokerage firm in the Philippines. It is the first and only online stockbroker to list in the Philippine Stock Exchange (PSE) with a total paid-up capital of over Php 0.5 billion.

COL Global Access Information

COL Global Access is a Hong Kong-based brokerage firm that offers online trading services for stocks, futures, and other securities. It is a member of the Hong Kong Securities and Futures Commission (SFC) and is regulated by the Hong Kong Securities Investor Compensation Fund (SICF). They satisfy international investors with a focus on Asian markets.

Pros and Cons of Kyokuto Securities

Pros

Well-regulated (Hong Kong SFC): COL Global Access is regulated by the Hong Kong Securities and Futures Commission (SFC), which provides a layer of security and oversight for investors. This can be especially important when choosing a brokerage firm, as it helps ensure they are operating according to financial regulations.

Multiple trading platforms: COL Global Access offers a variety of trading platforms to suit different needs. This includes a downloadable desktop platform (Trader Workstation) with advanced features, a web-based platform (Global Access WebTrader) for simple trading and those behind firewalls, and a mobile app (Global Access Handy Trader) for on-the-go trading.

Wide range of securities: They offer a diverse selection of investment options, including stocks, options, futures, forex, bonds, and mutual funds. This allows investors to build a well-diversified portfolio across various asset classes.

Account types for self-directed and full-service investing: COL Global Access satisfies both experienced and beginner investors by offering two account types: Self-Directed Account and Full Service Brokerage Account. Self-directed accounts allow investors to make their own investment decisions, while full-service accounts provide access to a dedicated advisor for guidance and recommendations.

Cons

Complex fee structure: COL Global Access has a tiered fee structure that can be complex for new investors to understand. Fees vary depending on the account type (self-directed vs full-service), the asset class being traded (stocks, options, forex, etc.), and trading volume. There also are additional fees such as account management fees, data fees, and inactivity fees.

Limited educational resources for new investors: While COL Global Access provides guides for their trading platforms and account management, they lack comprehensive educational resources on general investing or trading strategies. This can be a drawback for new investors who are just starting out.

Customer services are limited to English: Currently, COL Global Access customer support appears to be available only in English. This can be a barrier for non-English speaking investors who need assistance.

Is Kyokuto Securities Market safe?

Regulations

COL Global Access is regulated by the Hong Kong Securities and Futures Commission (SFC). Their regulatory status is listed as “Regulated” with license number AHF149.

Funds Safety

COL Global Access is a member of the Hong Kong Securities Investor Compensation Fund (SICF), which provides insurance coverage for customer losses in the event of a broker insolvency. The maximum coverage per customer is HK$1,000,000 for eligible securities and HK$500,000 for eligible futures contracts.

Safety Measures

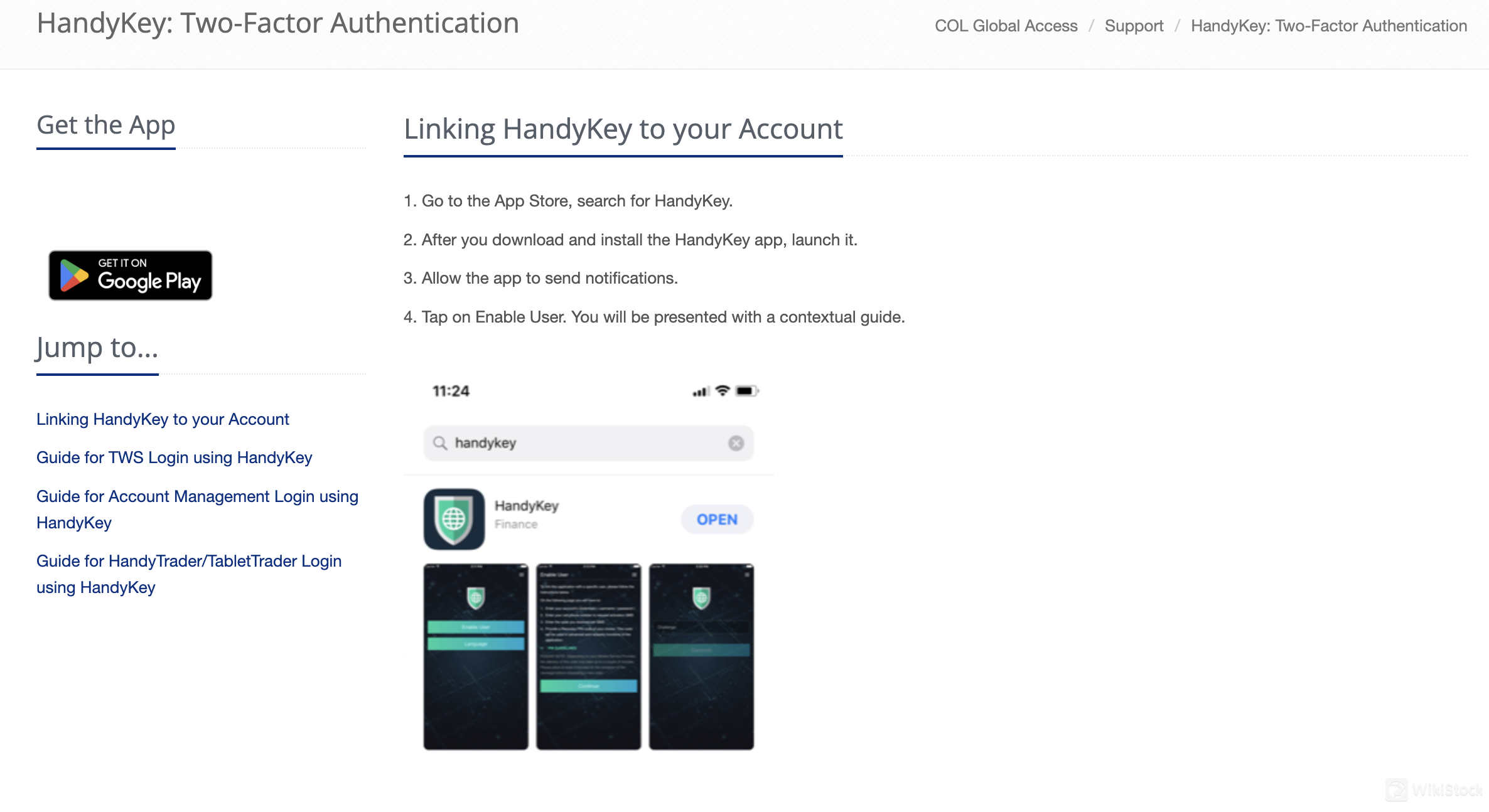

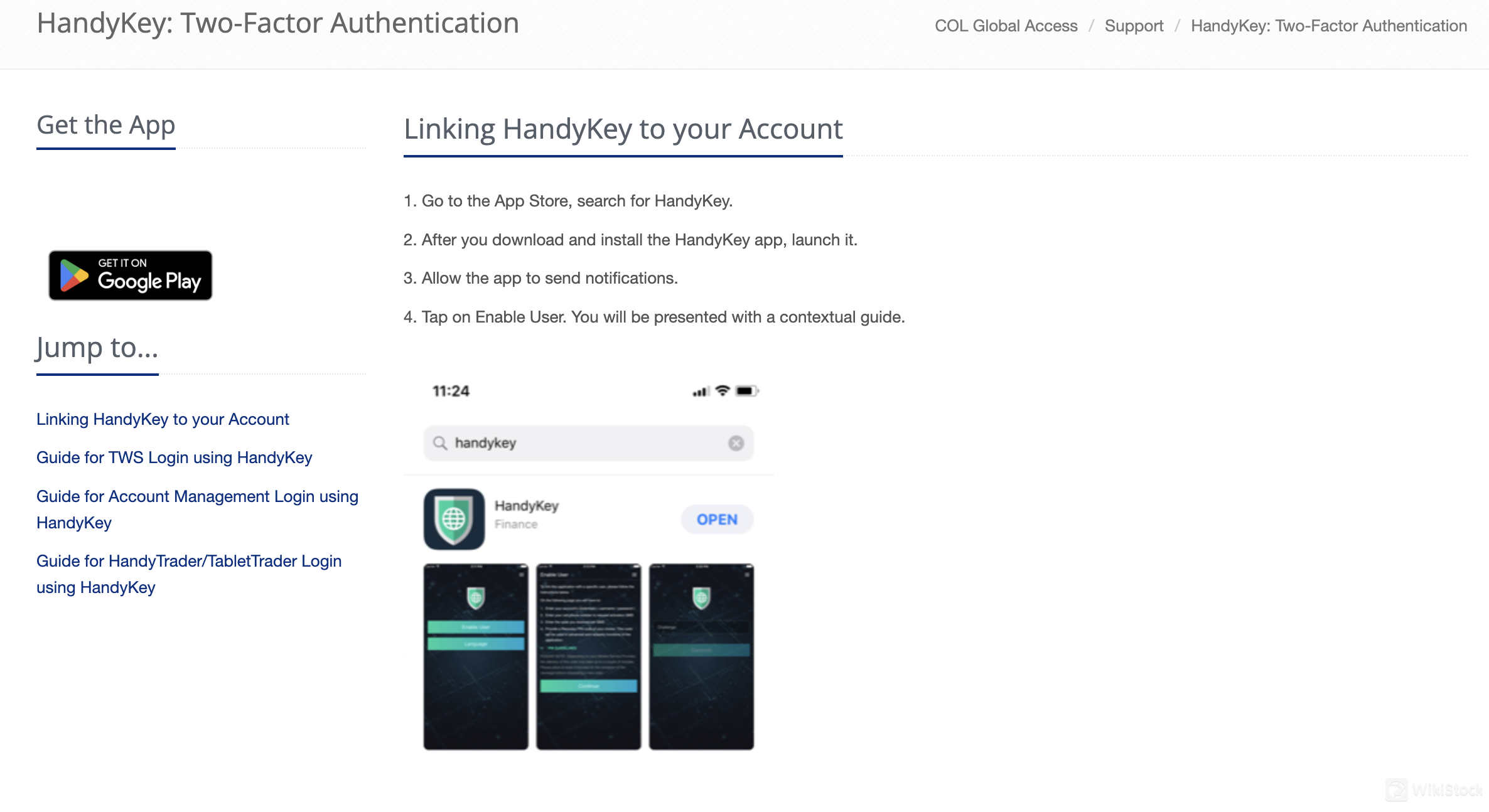

COL Global Access prioritizes security by employing a multi-layered approach to protect your information and funds. They encrypt your data using strong algorithms, offer two-factor authentication for logins, monitor accounts for suspicious activity, and conduct regular security audits to identify and fix weaknesses. Remember, even with these measures, cybersecurity is a shared responsibility.

What are securities to trade with COL Global Access?

COL Global Access offers a one-stop service to trade securities in various markets including Tokyo Stock Exchange, Hong Kong Stock Exchange, Singapore Stock Exchange, Frankfurt Stock Exchange and the United States Stock Exchanges (NYSE and NASDAQ). You can trade stocks, options, futures, forex, bonds and funds.

COL Global Access Accounts

There are two types of accounts offered by COL Global Access: Self-Directed Account and Full Service Brokerage Account.

A Self-Directed Account is an account where you make all the investment decisions yourself. You can enter orders using the various channels of COL Global Access. This account is suitable for investors who are comfortable with making their own investment decisions and who have a good understanding of the financial markets.

A Full Service Brokerage Account is an account where you have a dedicated person who will assist you in managing your account. This person will provide you with investment advice and recommendations, and will help you to execute your trades. This account is suitable for investors who are new to investing or who do not have the time or experience to manage their own investments.

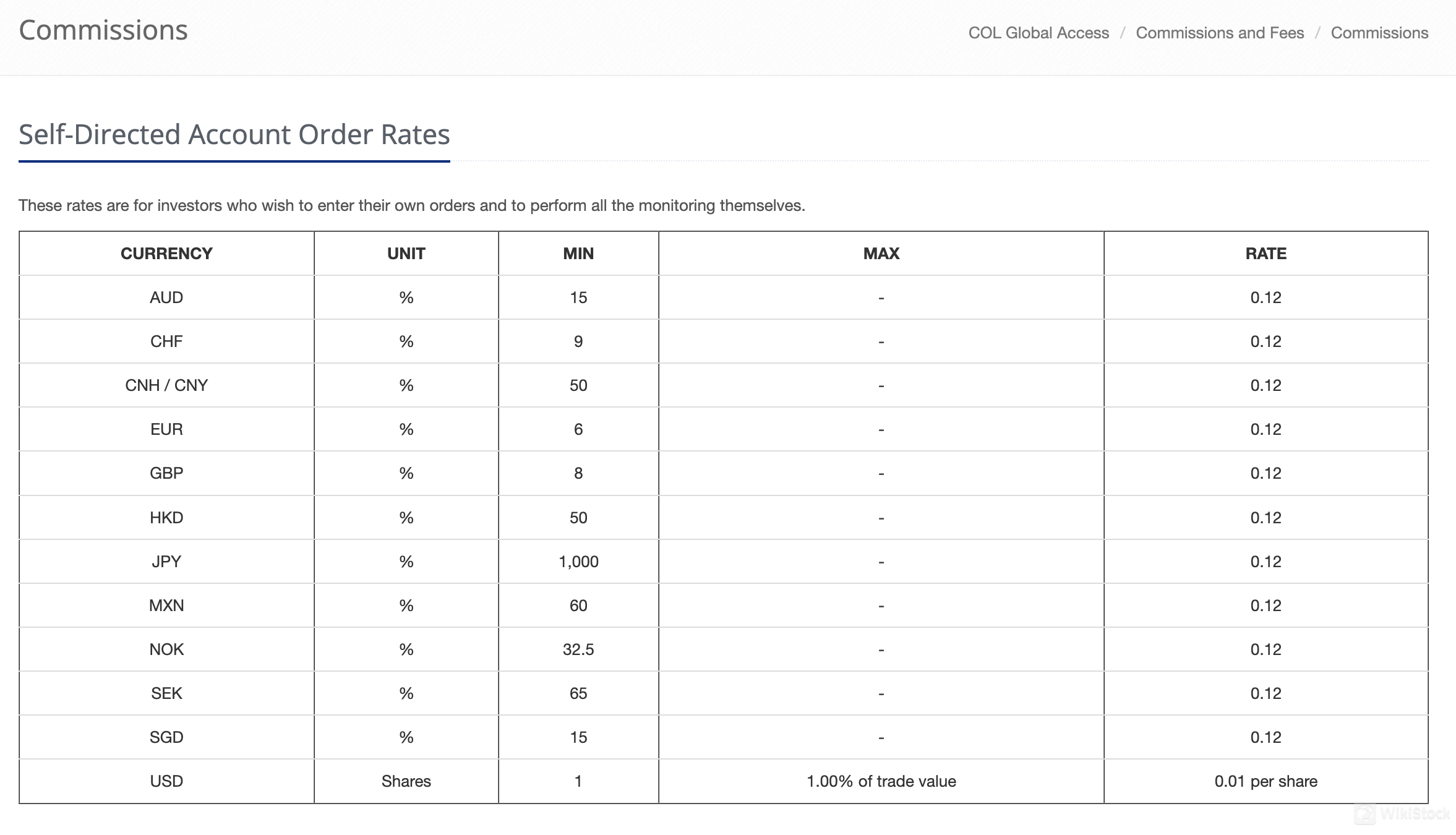

COL Global Access Fees Review

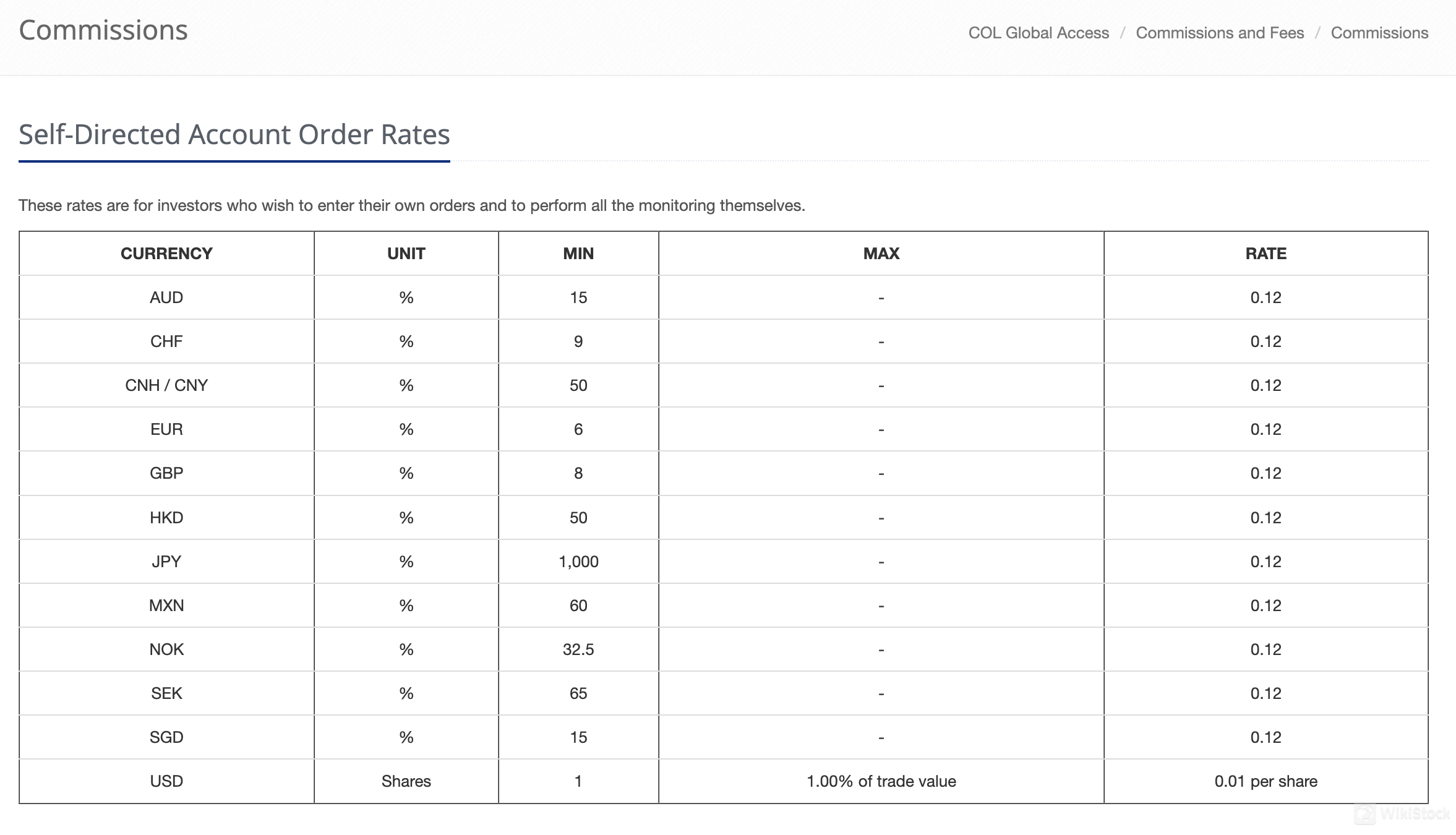

COL Global Access charges commissions based on your account type and the asset you trade. Self-directed accounts have a minimum commission of HKD 50 or 0.12% for stocks, variable fees for options, and a tiered commission for forex. Full-service accounts pay a flat 0.5% for stocks (with minimums) and tiered fees for bonds. There are also inactivity fees, potential exposure fees for risky positions, margin loan interest, and market data fees depending on your usage.

COL Global Access also charges various fees for trading in different markets. These fees can be broken down into three main categories: exchange fees, clearing fees, and pass-through fees. Exchange fees are charged by the exchange itself, while clearing fees are charged by the clearing house. Pass-through fees are taxes or other charges that COL Global Access is required to pass on to the client.

COL Global Access App Review

COL Global Access offers three main trading platforms:

Trader Workstation (TWS): This is a downloadable platform for desktops and provides the most powerful and feature-rich experience. It satisfies experienced traders and institutions with functionalities like advanced order types, sophisticated risk management tools, and built-in option pricing.

Global Access WebTrader: This web-based platform requires no downloads and is ideal for those who prefer a simple interface or work behind firewalls. It offers core trading functionalities like stock, option, and forex trading, along with features like streaming market data, charts, and basic order management.

Global Access Handy Trader: This mobile app (available for iOS and Android) allows you to trade and manage your account on the go. It provides features like real-time quotes, mobile trading functionalities (limited compared to TWS), and basic account information access.

Research and Eduation

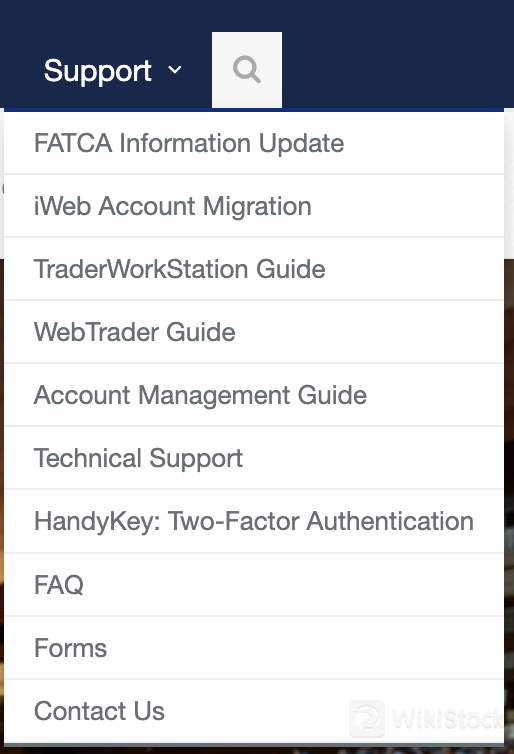

COL Global Access offers educational resources. While they provide guides for their trading platforms (Trader Workstation, WebTrader, and Handy Trader) and account management, they lack materials on general investing or trading strategies. There's also information on account migration and FATCA compliance, but no instructional content for new investors.

Customer Service

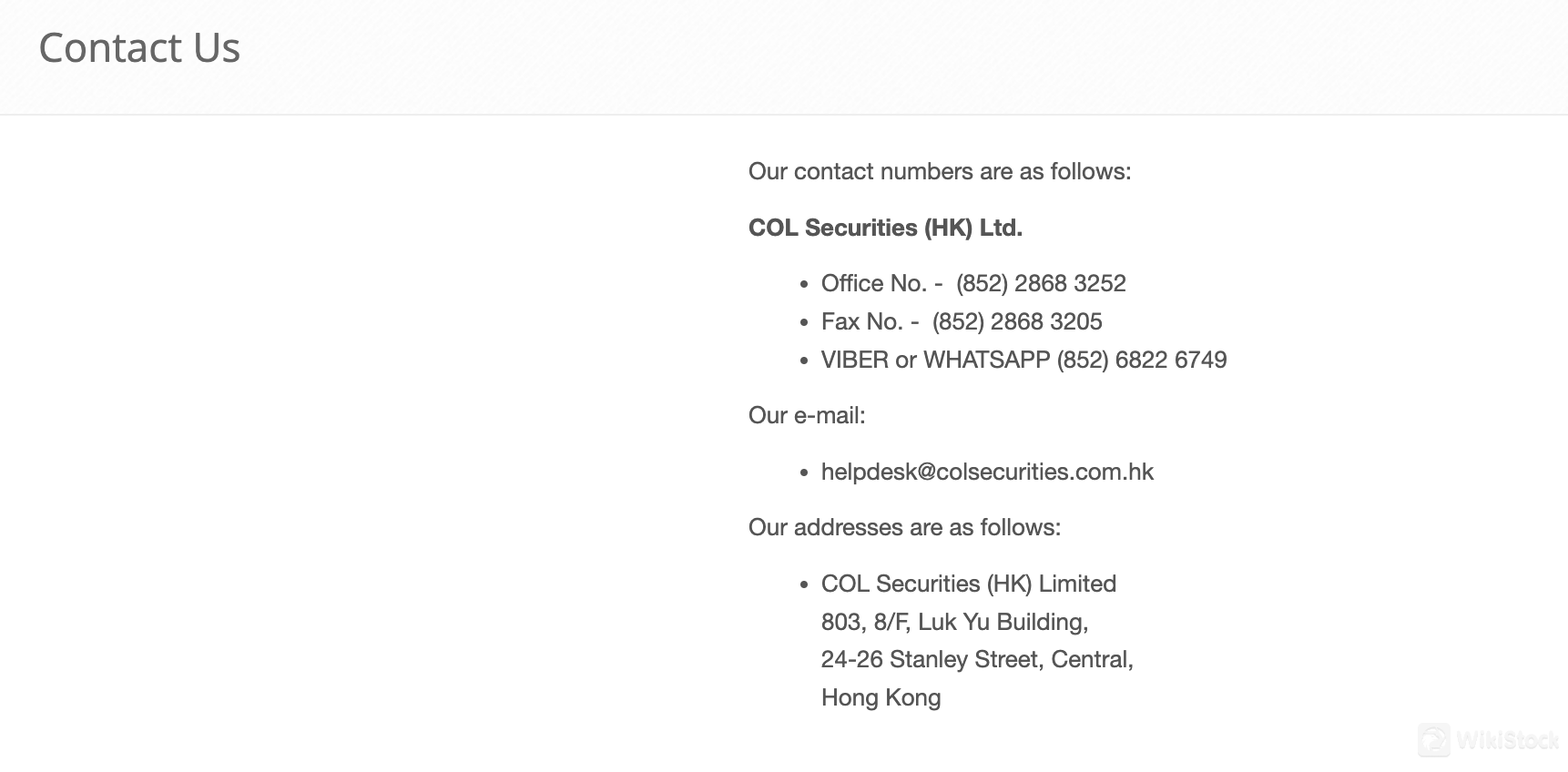

COL Global Access offers customer support through email (helpdesk@colsecurities.com.hk) and phone numbers in Hong Kong +(852) 2868 3252 and +(852) 6822 6749 (via Viber or WhatsApp). They also have a physical office located at 803, 8/F, Luk Yu Building, 24-26 Stanley Street, Central, Hong Kong.

Conclusion

COL Global Access is a Hong Kong-based brokerage firm that offers online trading services for stocks, futures, and other securities. They are well-regulated and provide a variety of trading platforms and a wide range of securities to trade. It is a solid option for experienced international investors seeking a low-cost brokerage firm with a wide range of products and user-friendly platforms. However, new investors will want to consider a brokerage firm that offers more educational resources.

FAQs

Is COL Global Access a safe and reliable broker?

Yes, COL Global Access is regulated by the Hong Kong Securities and Futures Commission (SFC), providing a layer of security for investors.

Does COL Global Access offer educational resources for new investors?

While they provide guides for their platforms and account management, COL Global Access has limited educational materials on general investing or trading strategies.

Does COL Global Access protect my funds?

Yes, COL Global Access is a member of the Hong Kong Securities Investor Compensation Fund (SICF), which provides insurance coverage for customer losses in case of broker insolvency.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

Philippines