予約を取る:法人口座開設申請のための予約をスケジュールしてください。代表者がプロセスをサポートします。

必要な書類を準備する:申請に必要な書類のリストが提供されます。

口座開設フォームを記入する:関連するすべてのセクションを記入し、必要なすべてのサポート書類を提供してください。情報が完全であることを確認し、遅延を避けてください。

スタッフの前で署名する:Huafu Internationalのスタッフの証人のもとで、口座開設フォームおよびその他の必要な書類に署名してください。

クライアント契約書とリスク開示書をお読みください:クライアント契約書とリスク開示書の文書を注意深くご確認ください。必要に応じて独立した専門家の助言を求めてください。

重要な書類を保管してください:クライアント契約書、手数料、手数料、および料金のコピーを将来の参照のために保管してください。

最終的な署名と提出:宣言を完了し、書類に署名してください。申請を処理に提出してください。

審査と確認:審査が成功した場合、登録されたメールアドレスに確認メールが送信されます。

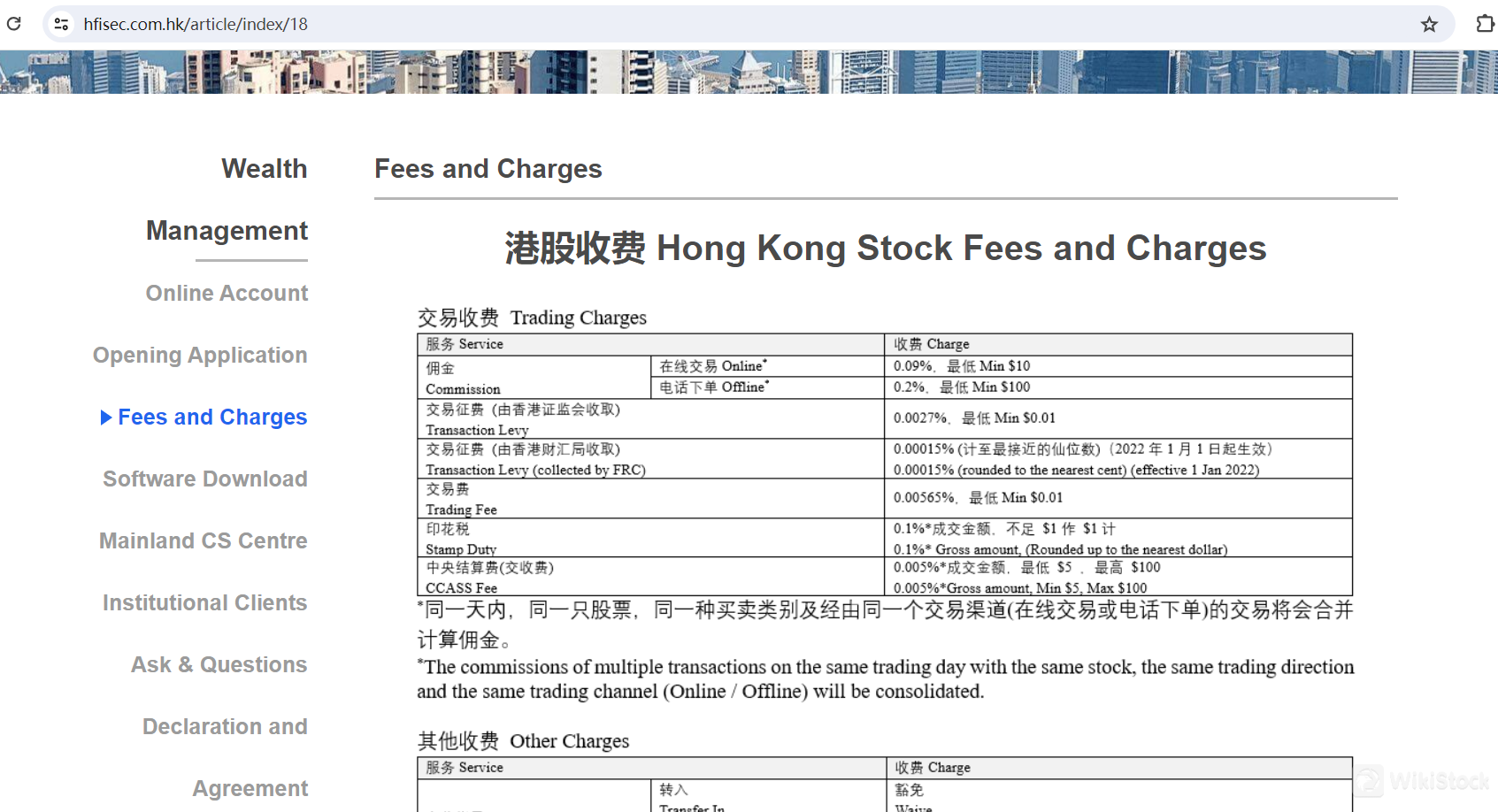

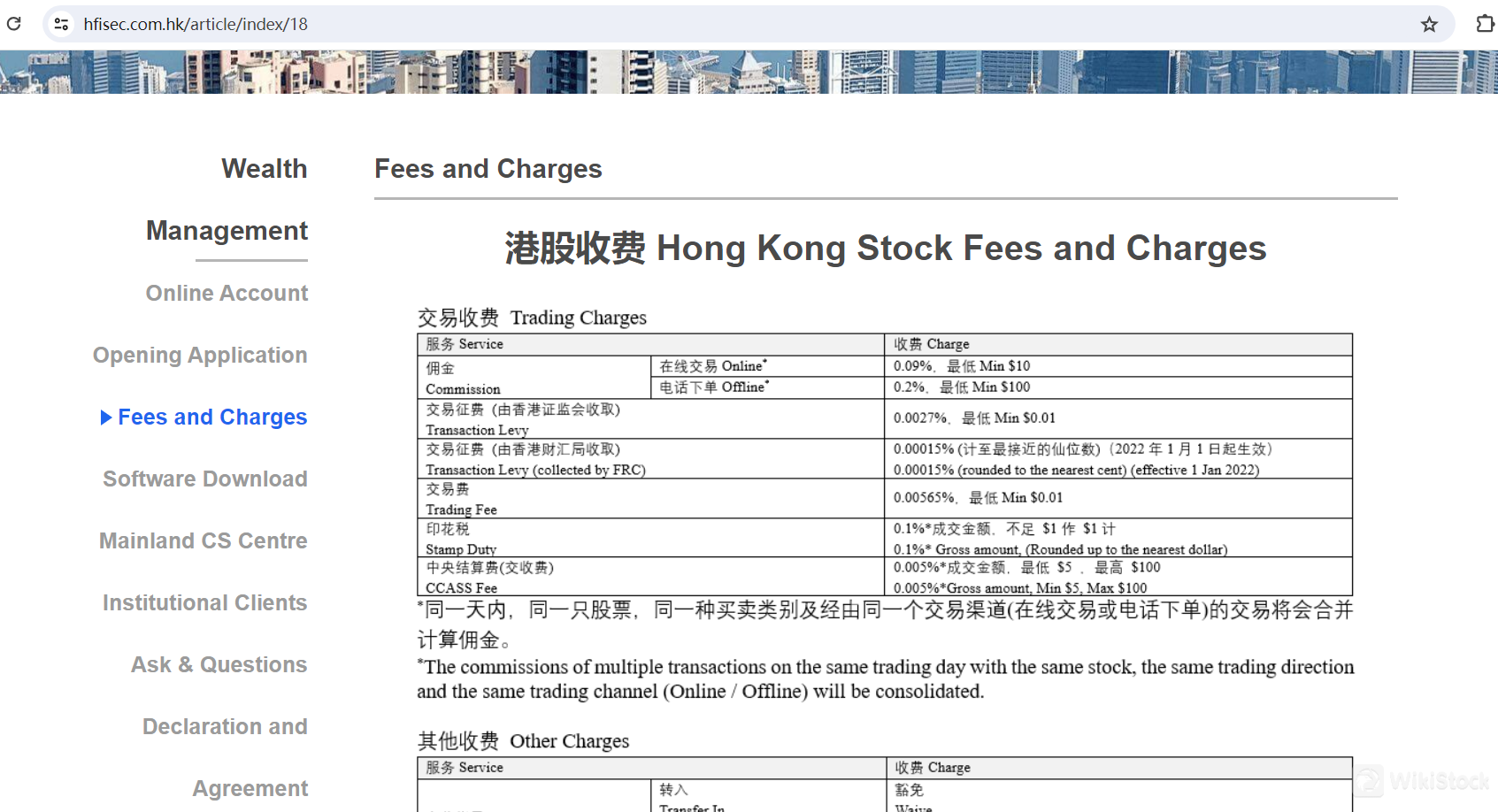

Huafu International (HK) 手数料の見直し

香港証券取引所(HKEX)の手数料

Huafu International (HK)は、香港証券取引所(HKEX)での取引の手数料の詳細な内訳を提供しています。

オンライン取引の手数料は0.09%で、最低料金はHKD 10です。電話注文によるオフライン取引の場合、手数料は0.2%で、最低料金はHKD 100です。

取引手数料には、香港証券先物委員会によって請求される取引金額の0.0027%、最低手数料はHKD 0.01が含まれます。さらに、2022年1月1日から有効な0.00015%の金融報告評議会(FRC)による徴収があります。

取引手数料は取引金額の0.00565%で、最低料金はHKD 0.01です。

印紙税は総取引金額の0.1%で、最も近いドルに切り上げられ、最低料金はHKD 1です。

CCASS(中央清算及び結算システム)の手数料は総額の0.005%です。

米国株式市場の手数料

米国株式市場での取引には、Huafu Internationalが以下の手数料を示しています:

オンライン取引の手数料は0.09%で、最低料金はUSD 10です。

クリアリング手数料は株式あたり0.003 USDで、最低料金はUSD 0.50です。

SEC手数料(売り注文の場合のみ)は総額の0.000278%で、最低料金はUSD 0.01です。

取引活動手数料(売り注文の場合のみ)は株式あたり0.000119 USDで、最低料金はUSD 0.01、最大料金はUSD 5.95です。

上海香港ストックコネクトの手数料

上海香港ストックコネクトを通じて取引する場合、以下の手数料が適用されます:

オンライン取引の手数料は0.09%で、最低料金はCNY 10です。電話注文によるオフライン取引の場合、手数料は0.2%で、最低料金はCNY 100です。

取引手数料は総取引金額の0.00341%です。

証券管理手数料は総額の0.002%です。

印紙税(売り注文のみに課金)は総額の0.1%で、最も近いCNYに切り上げられます。

振替手数料は総額の0.003%で、最低でもCNY 0.02です。

これらの手数料を理解することは投資家にとって重要です。これらは取引のコストや異なる市場での投資の総収益に直接影響を与えます。

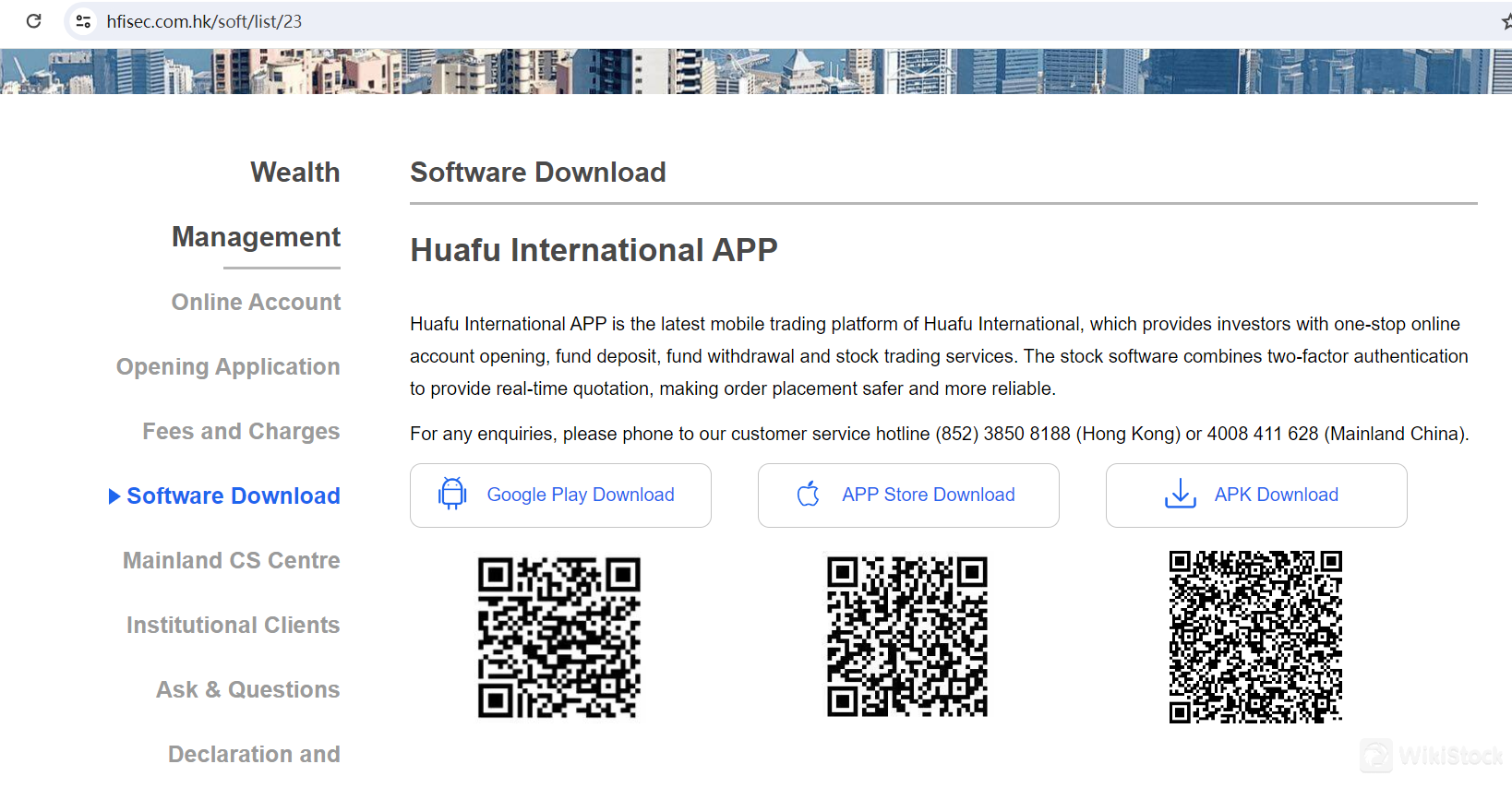

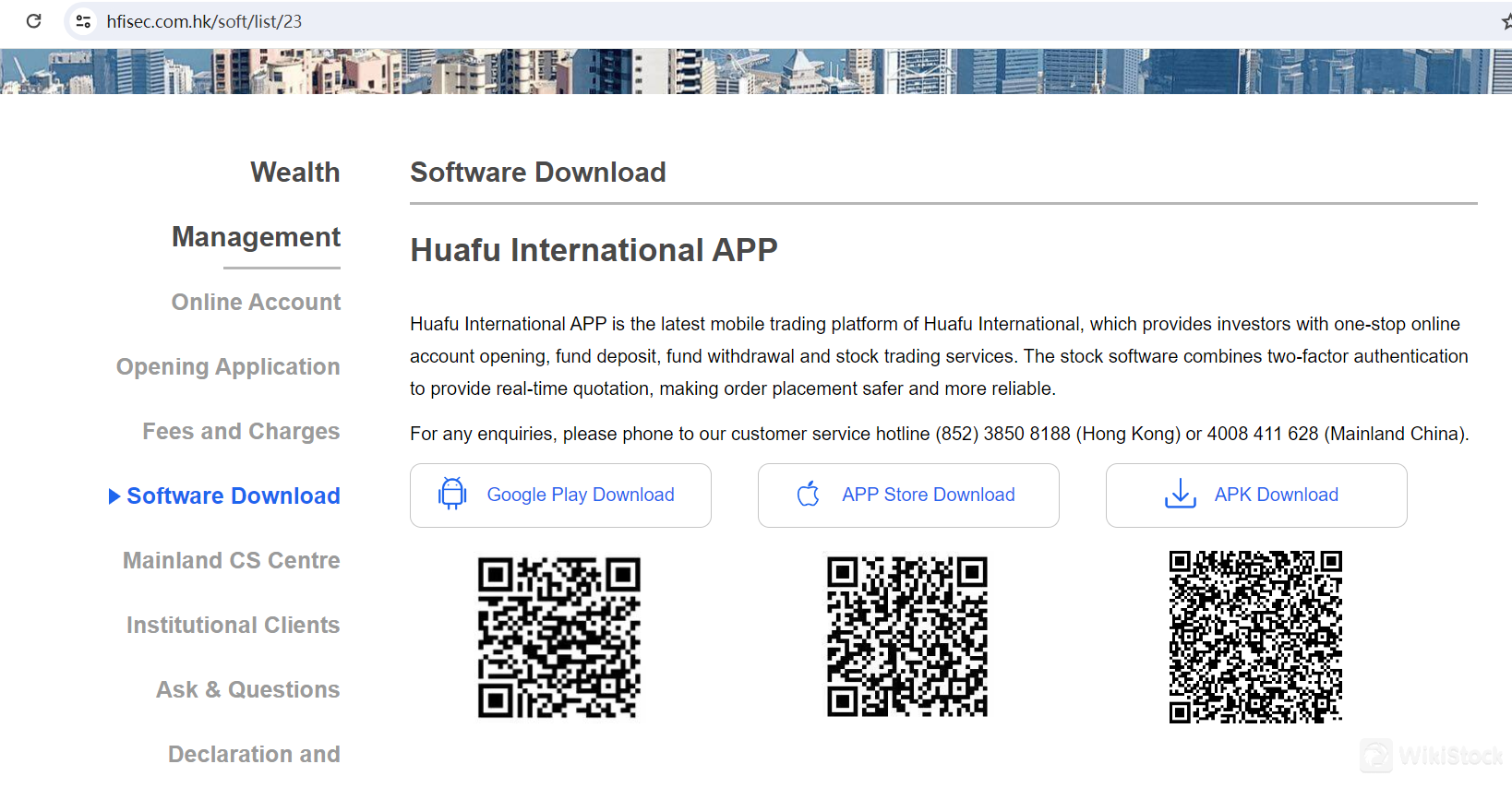

Huafu International (HK)アプリレビュー

Huafu Internationalアプリは、Huafu Internationalによるモダンなモバイル取引プラットフォームです。オンライン口座開設、資金の入出金、株式取引など、幅広いサービスを提供しています。

主な特徴:

二要素認証:より安全で信頼性の高い注文の配置をサポートします。

リアルタイムの見積もり:最新の市場価格とトレンドを提供し、投資家が情報を元に意思決定を行うのを支援します。

アカウント管理:ユーザーはオンラインで口座を開設し、迅速かつ簡単に資金を入出金できます。

サポートについては、ユーザーは(852) 3850 8188(香港)または4008 411 628(中国本土)のカスタマーサービスに連絡することができます。

このアプリは、Google Play、App Store、および手動インストール用のAPKとしてダウンロードできるため、さまざまなデバイスで利用できます。

カスタマーサービス

Huafu Internationalは、複数のチャネルを通じて強力なカスタマーサポートを提供しています。彼らのホットラインは、中国本土の4008 411 628および香港の(852) 3850 8188および(852) 2388 3618で利用できます。メールサポートでは、お客様はcs@hfisec.com.hkまで連絡することができます。彼らの実際のオフィスは、香港上環德輔道中199号無限楽座26階2603-2604室にあります。これにより、お問い合わせやサービスへのサポートなど、さまざまなお客様のニーズに対して包括的なサポートが提供されます。

結論

Huafu International (HK)は、競争力のあるオンライン取引手数料と使いやすいモバイルアプリを備えた、規制の整った証券取引プラットフォームです。主に香港特別行政区(HKSAR)の居住者を対象に、包括的なカスタマーサポートと幅広い金融商品を提供しています。オフライン取引の手数料が高く、未投資の現金に対する利息など一部のサービスに関する情報が限られているものの、信頼性の高い安全な取引プラットフォームを求める投資家にとっては、堅実な選択肢となります。

よくある質問

Huafu International (HK)は安全な取引ができますか?

はい、Huafu International (HK)は香港証券先物委員会(SFC)の規制を受けており、厳格な金融規制に準拠しています。彼らはまた、高度な暗号化技術と二要素認証を使用して資金を保護し、ユーザー情報を守っています。

Huafu International (HK)は初心者に適したプラットフォームですか?

Huafu International (HK)は使いやすいモバイルアプリと包括的なカスタマーサポートを提供しており、初心者に適しています。このプラットフォームはリアルタイムの見積もりと幅広い金融商品を提供し、新規投資家が情報を元に意思決定を行うのをサポートします。

Huafu International (HK)は合法ですか?

はい、Huafu International (HK)は香港証券先物委員会(SFC)によって規制された合法的な取引プラットフォームであり、厳格な金融基準と規制に準拠しています。

リスク警告

提供される情報は、WikiStockの専門家による証券会社のウェブサイトデータの評価に基づいており、変更される可能性があります。また、オンライン取引には大きなリスクが伴い、投資資金の全額損失につながる可能性があるため、参加する前に関連するリスクを理解することが重要です。

香港、中国

香港、中国Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--