Forwin Holding Limited was established to develop financial businesses in Hong Kong in 2006. In 2016, Forwin Financial Group (Hong Kong) Limited (“Forwin Group”) was formed with its base in Hong Kong to leverage its position in bridging domestic and overseas markets. Adhering to our corporate belief in offering reliable management with focus on integrity and trustworthiness, Forwin Group has collaborated with renowned global financial institutions to provide diversified financial services such as asset management, securities trading and investment advice for various types of investors (including institutional investors, high-net-worth investors and individuals). We are dedicated to become leaders in the financial industries in Hong Kong and China.

What is Forwin Holding?

Forwin Holding is a dynamic financial service provider that offers a diverse portfolio of mutual funds, including Hong Kong stocks, China A-shares, and other securities.

The company is known for its trading platforms such as Forwin HoldingTrade Go and Forwin HoldingTrade Pro, along with a dedicated securities trading app available for both iOS and Android devices. Forwin Holding extends various services such as private funds, investment advisory, margin trading, discretionary account services, underwriting and placing services, and money lending.

However, a higher margin interest rate of 13% could pose a challenge for investors who frequently engage in leveraged trading, potentially increasing the cost of borrowing.

Pros & Cons

Pros:

Forwin Holding offers a wide range of tradable assets across Hong Kong and Mainland markets, regulated by the SFC, ensuring security. They provide a user-friendly trading app compatible with both Android and iOS and charge low commissions at just 0.25% per trade.

Cons:

However, there are no promotional offers for users, reducing its appeal compared to competitors. Additionally, the company only accepts FPS and bank transfers for deposits and withdrawals, which may not suit all users.

Is Forwin Holding Safe?

1. Regulations:

Forwin Holding is robustly regulated by the Securities and Futures Commission (SFC) of Hong Kong, enhancing its credibility and safety for investors. It operates under two distinct SFC license numbers, BEI223 and BDD860, which underlines its commitment to adhering to strict regulatory standards.

2. Funds Safety:

Forwin Holding places high importance on the security of client funds. The company strictly prohibits third-party deposits and withdrawals, ensuring that all transactions undergo rigorous compliance checks and adhere to anti-money laundering (AML) regulations. This policy is vital for maintaining the legality of fund movements and minimizing the risk of financial fraud.

3. Safety Measures:

Forwin Holding has implemented several safety measures to protect client assets and ensure the integrity of transactions. The company confirms the identity of depositors and the legitimacy of funds for each transaction, permitting only authorized and lawful activities. Suspicious transactions are rejected, and the platform retains the right to return funds to the original source if discrepancies are detected.

What are securities to trade with Forwin Holding?

Forwin Holding offers a variety of securities for trading, satisfying a wide range of investor interests.

Hong Kong Stocks: Forwin Holding offers investors the opportunity to trade in a range of Hong Kong stocks, providing access to one of Asia's most vibrant financial markets. This includes both blue-chip companies and smaller, growth-oriented stocks, allowing investors to diversify their portfolios and leverage the potential of Hong Kong's dynamic economy.

China A-shares: Investors at Forwin Holding can also trade China A-shares, which are shares of mainland China-based companies that are denominated in renminbi and traded on Chinese stock exchanges like the Shanghai and Shenzhen stock exchanges. This offers a direct entry into the Chinese domestic market, appealing to those looking to invest in one of the worlds largest and fastest-growing economies.

Other Securities and Financial Products: Besides stocks, Forwin Holding provides a variety of other securities and financial products. This includes mutual funds, which pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They also offer more specialized financial products, satisfying diverse investment strategies and risk profiles.

Private Funds and Investment Advisory: Forwin Holding attracts sophisticated investors with private fund offerings, which typically involve investments in less liquid assets and require higher minimum investments. Alongside these, they provide investment advisory services, helping clients to tailor their investment strategies based on personal goals, risk tolerance, and market conditions.

Margin Trading and Discretionary Account Services: The firm supports margin trading, allowing clients to borrow money to purchase stocks, potentially increasing their purchasing power and investment returns. They also offer discretionary account services, where a portfolio manager makes investment decisions on behalf of the client, suited for those who prefer to delegate their investment management.

Underwriting and Placing Services: Forwin Holding assists companies in raising capital through underwriting and placing services, facilitating the issuance of new stocks or bonds to the public or private investors. This service is crucial for companies looking to expand and invest in growth opportunities.

Money Lending: Additionally, Forwin Holding provides money lending services, offering loans to individuals or corporations. This can be a valuable resource for clients needing additional capital for investment or other financial needs.

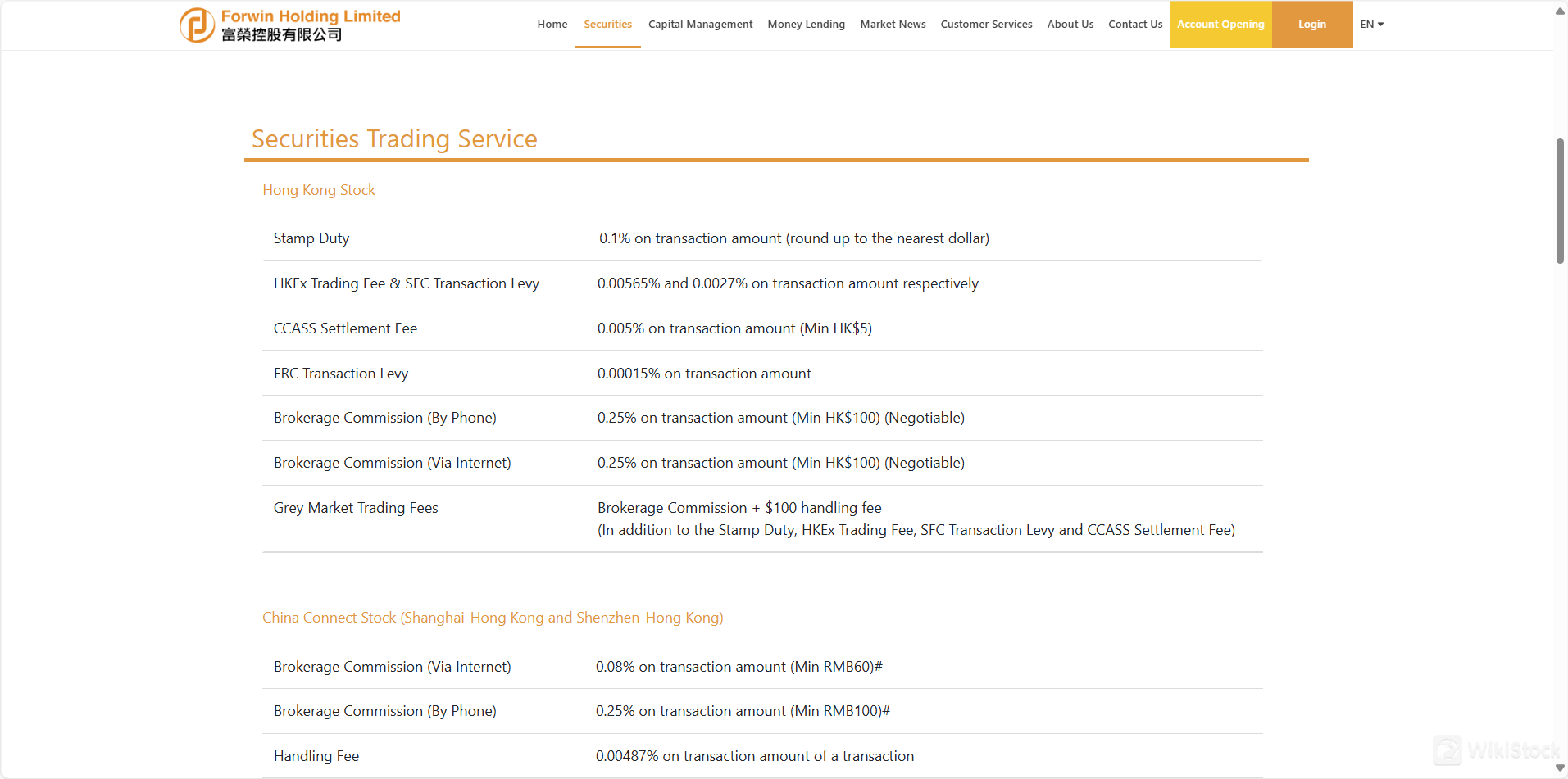

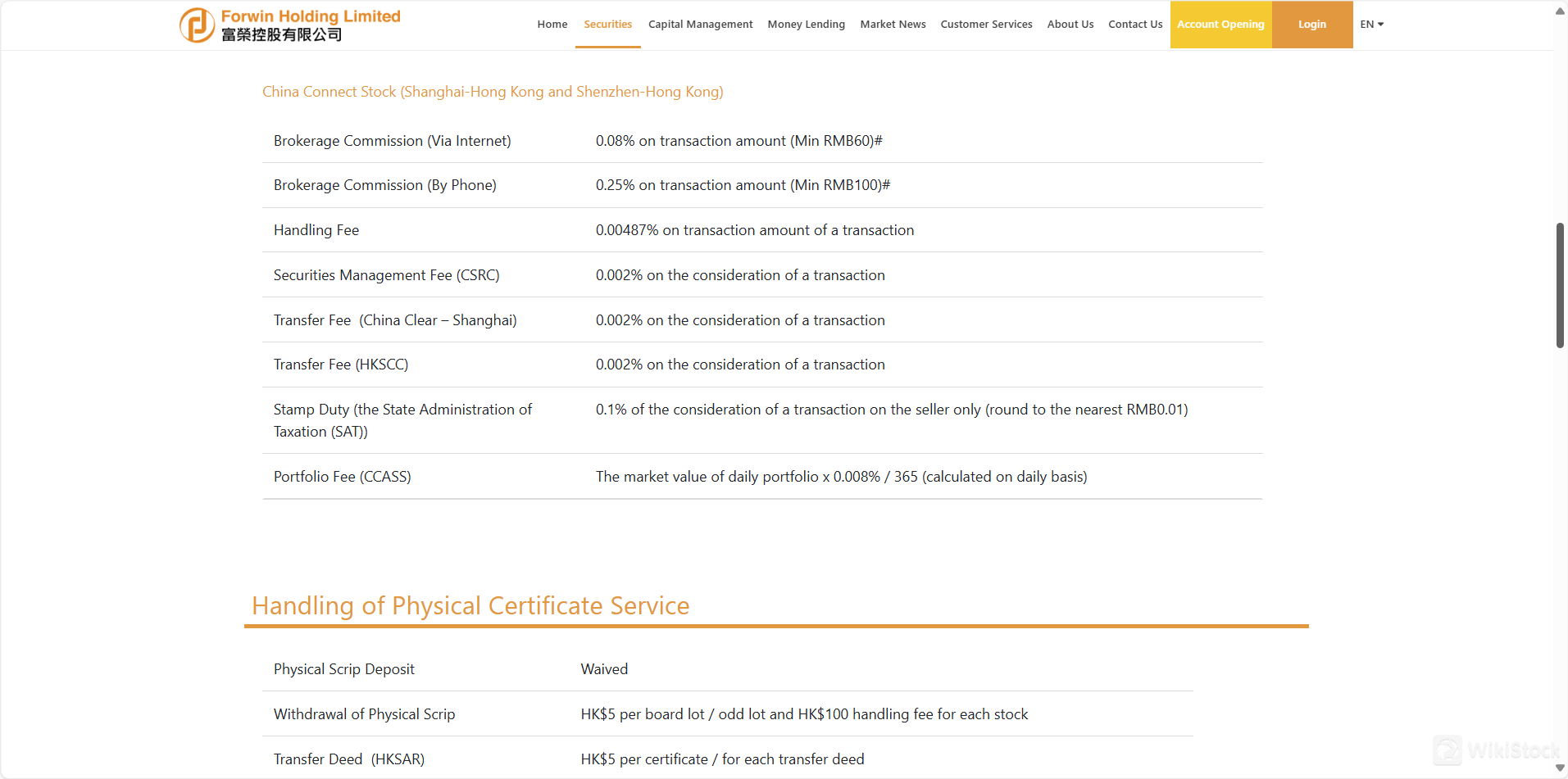

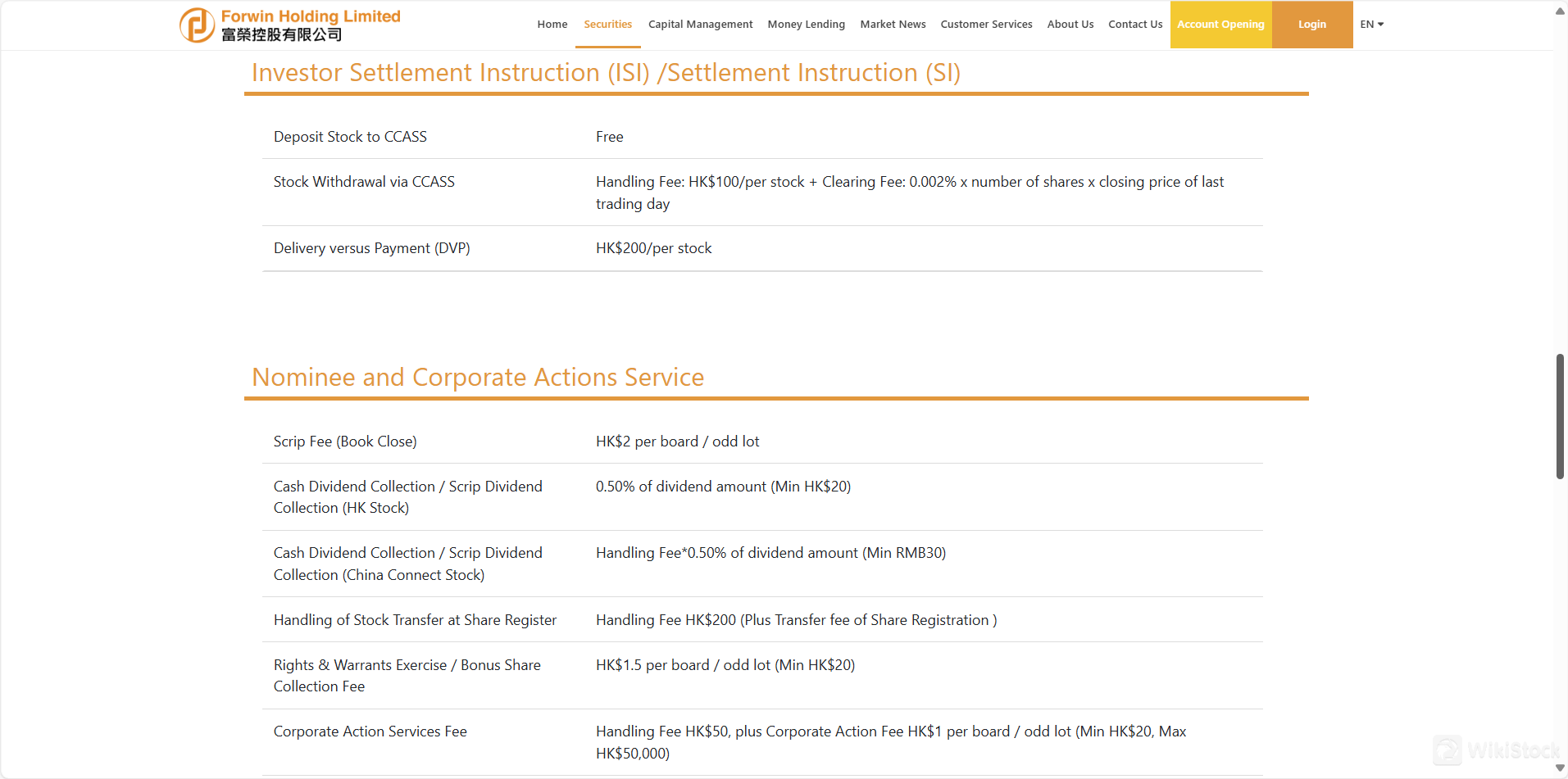

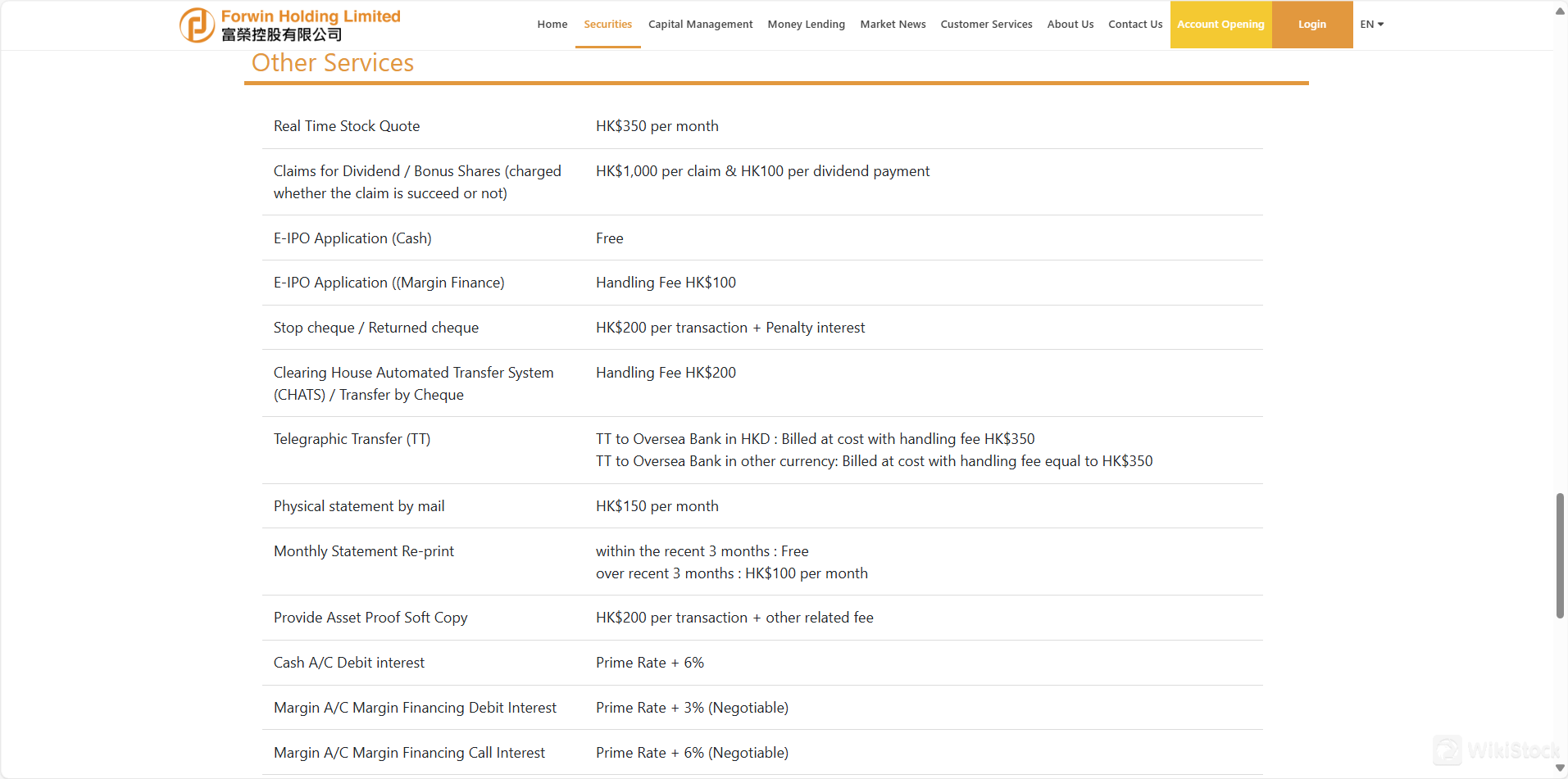

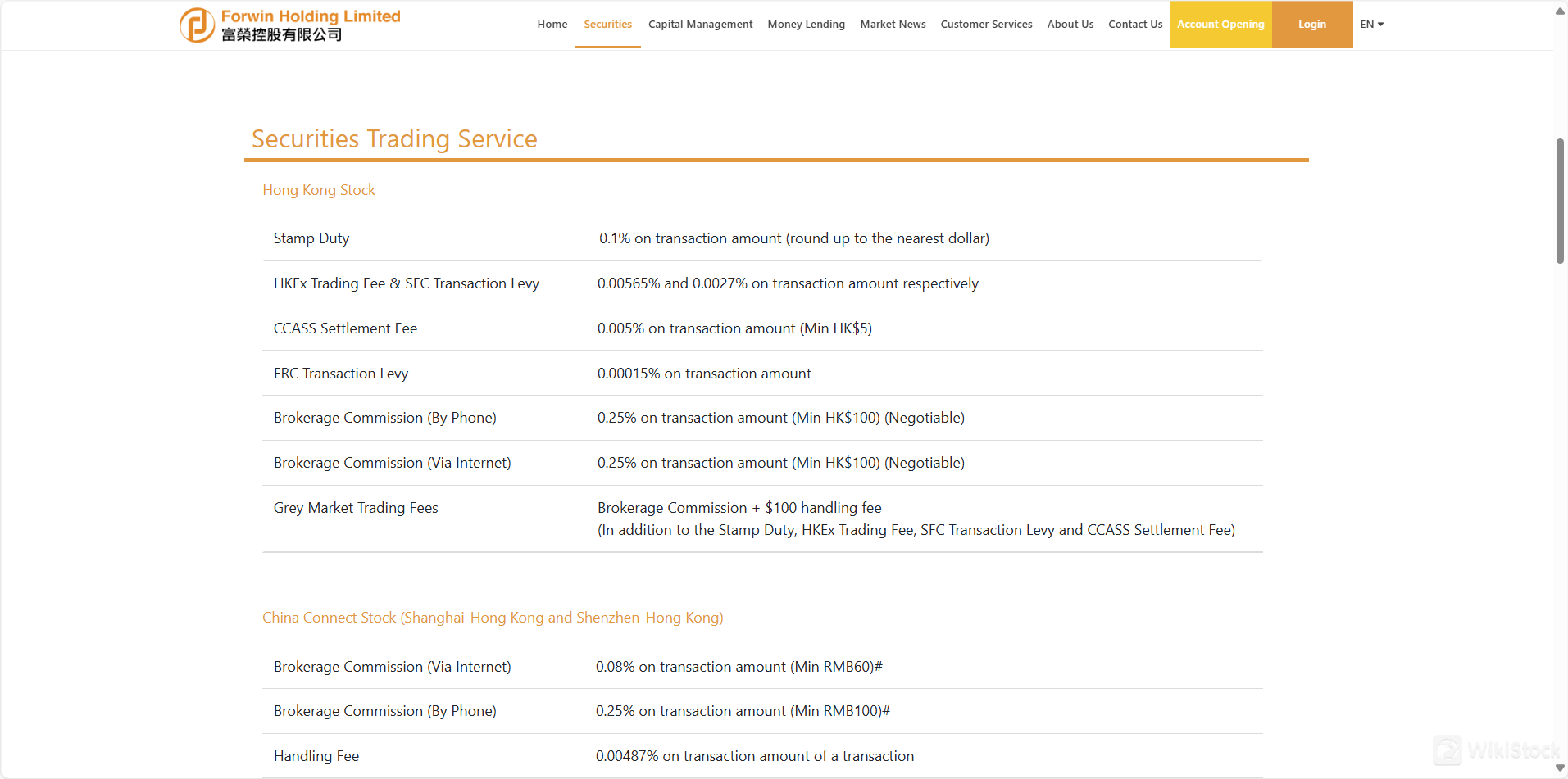

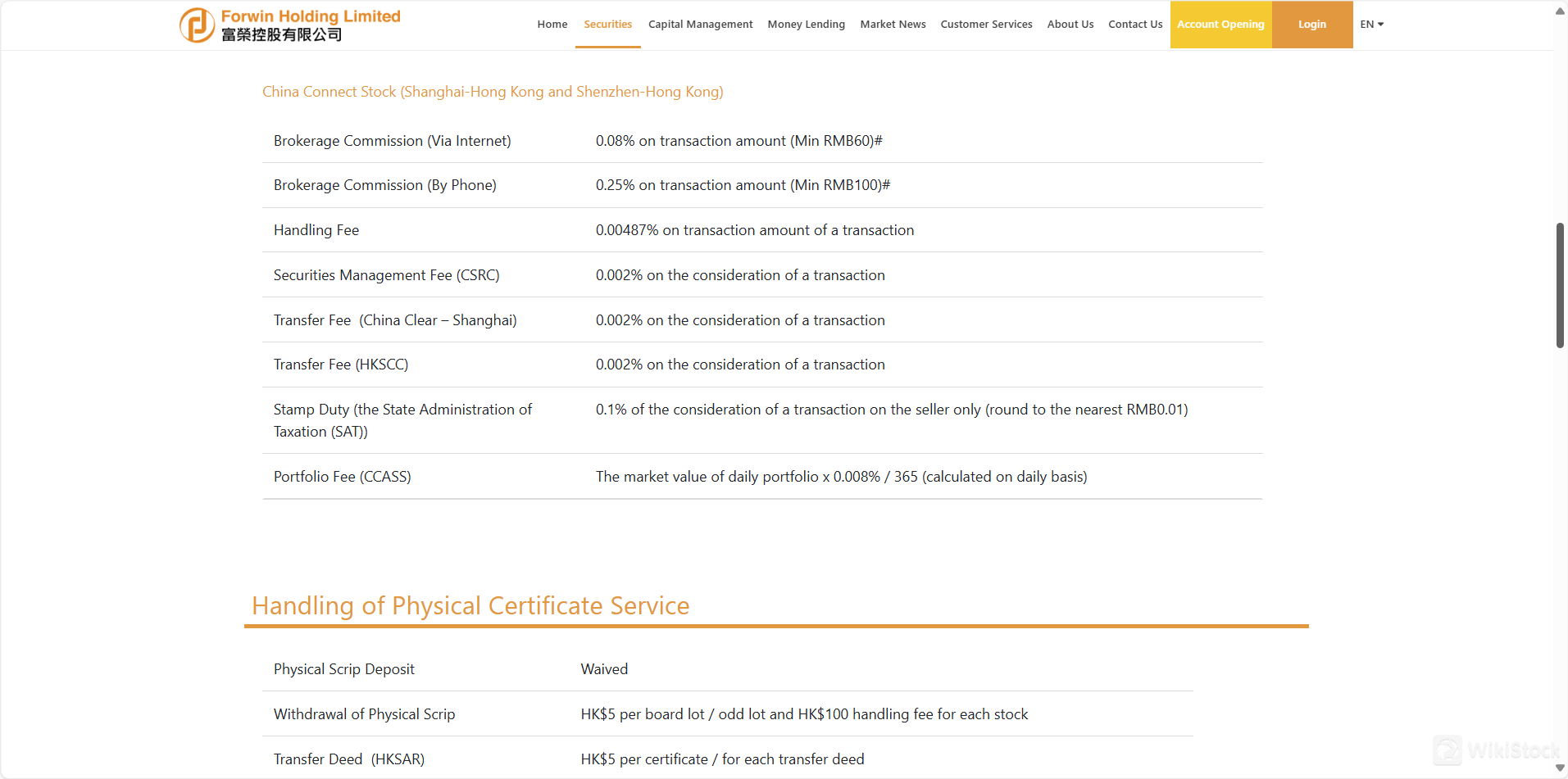

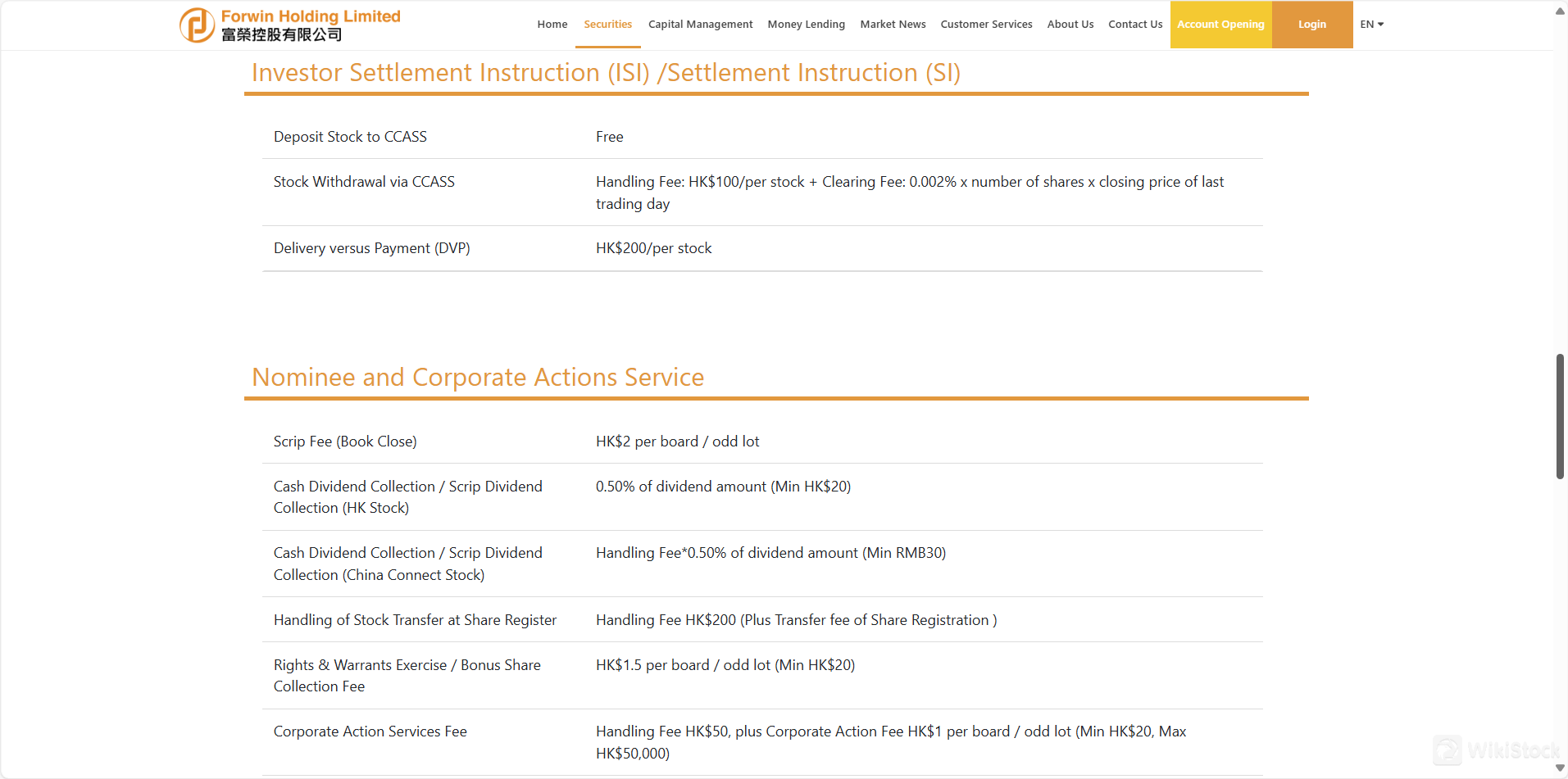

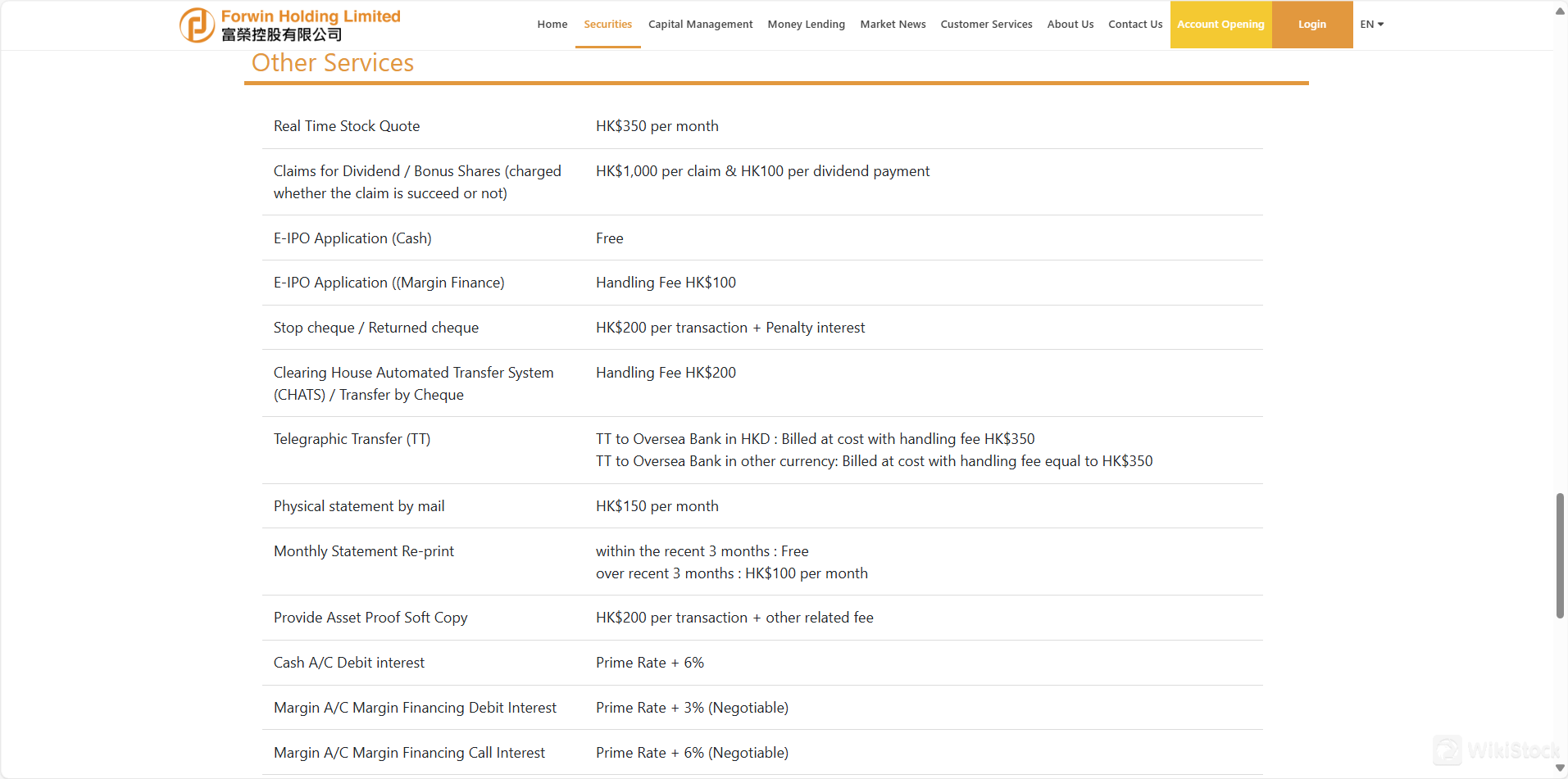

Forwin Holding Fees Review

The Forwin Holding asks these fees:

Trading Fees: Forwin Holding applies various fees for trading activities including stamp duty, trading fees (HKEx and SFC levies), and brokerage commissions both via phone and internet, which are negotiable but have a set minimum. For China Connect stocks, there are differentiated brokerage fees and additional handling fees which are relatively low.

Service Fees: For services like withdrawing physical scrips and real-time stock quotes, Forwin Holding charges specific fees, with the cost for real-time quotes being notably high at HK$350 per month.

Transactional Services: Fees for services such as E-IPO applications vary depending on the method (cash or margin finance). Telegraphic transfers and physical statements also incur fees, reflecting the administrative costs associated with these services.

Interest and Account Fees: The company charges interest on debit balances in cash and margin accounts, with rates based on the prime rate plus a margin. Additionally, an inactive account fee is levied annually to maintain accounts that are not actively trading.

This structure ensures that traders and investors are aware of the costs associated with their trading activities and financial services at Forwin Holding.

Forwin Holding App Review

Forwin Holding offers a securities trading app as their primary trading platform, designed to facilitate trading activities efficiently for their clients.

The app is available for both iOS and Android devices, ensuring broad accessibility across different mobile platforms. Users can download the app by scanning the provided QR codes or through the app store icons listed on their website.

This app supports various securities trading functions and is integrated with features suitable for both novice and experienced traders.

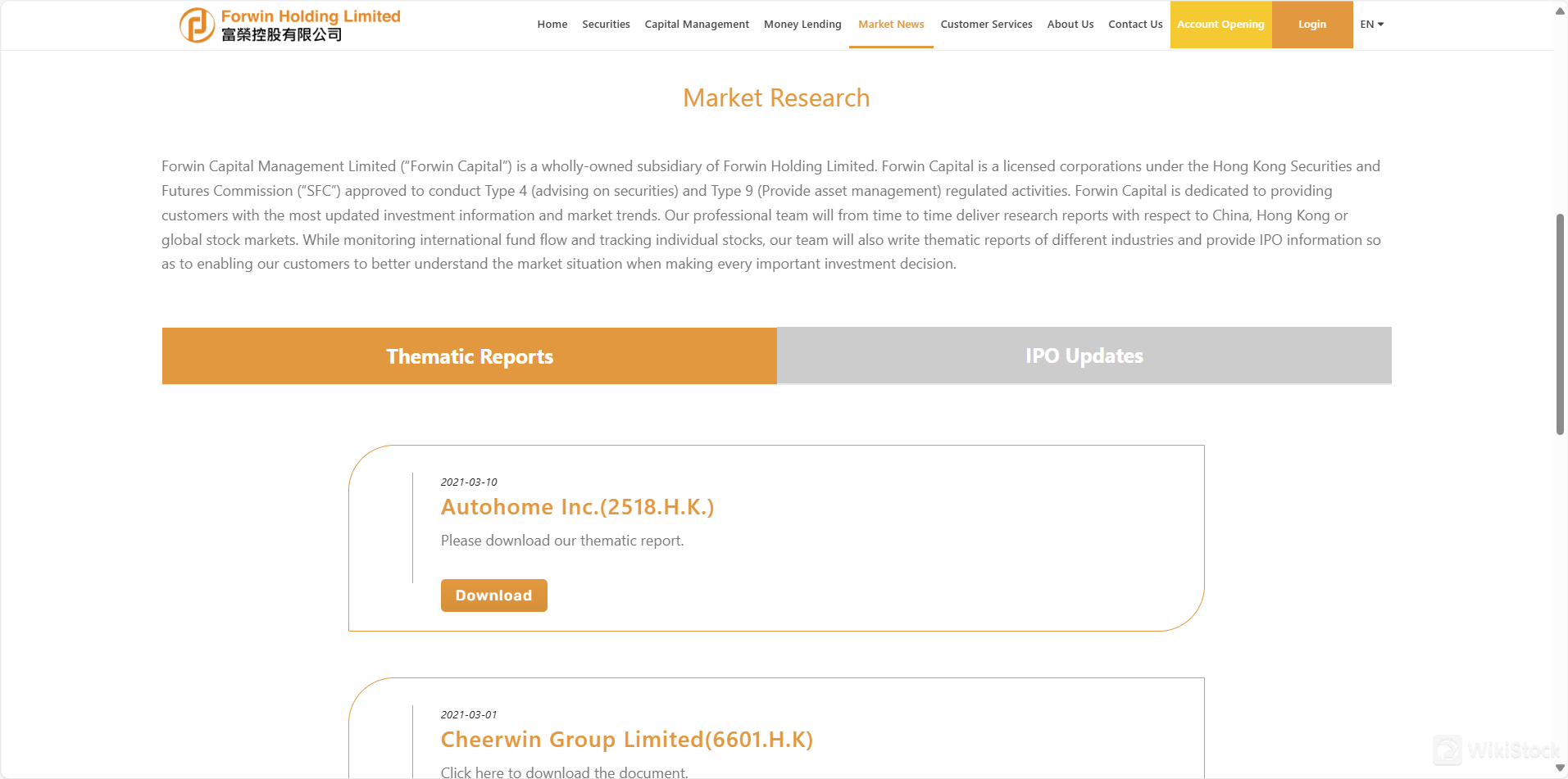

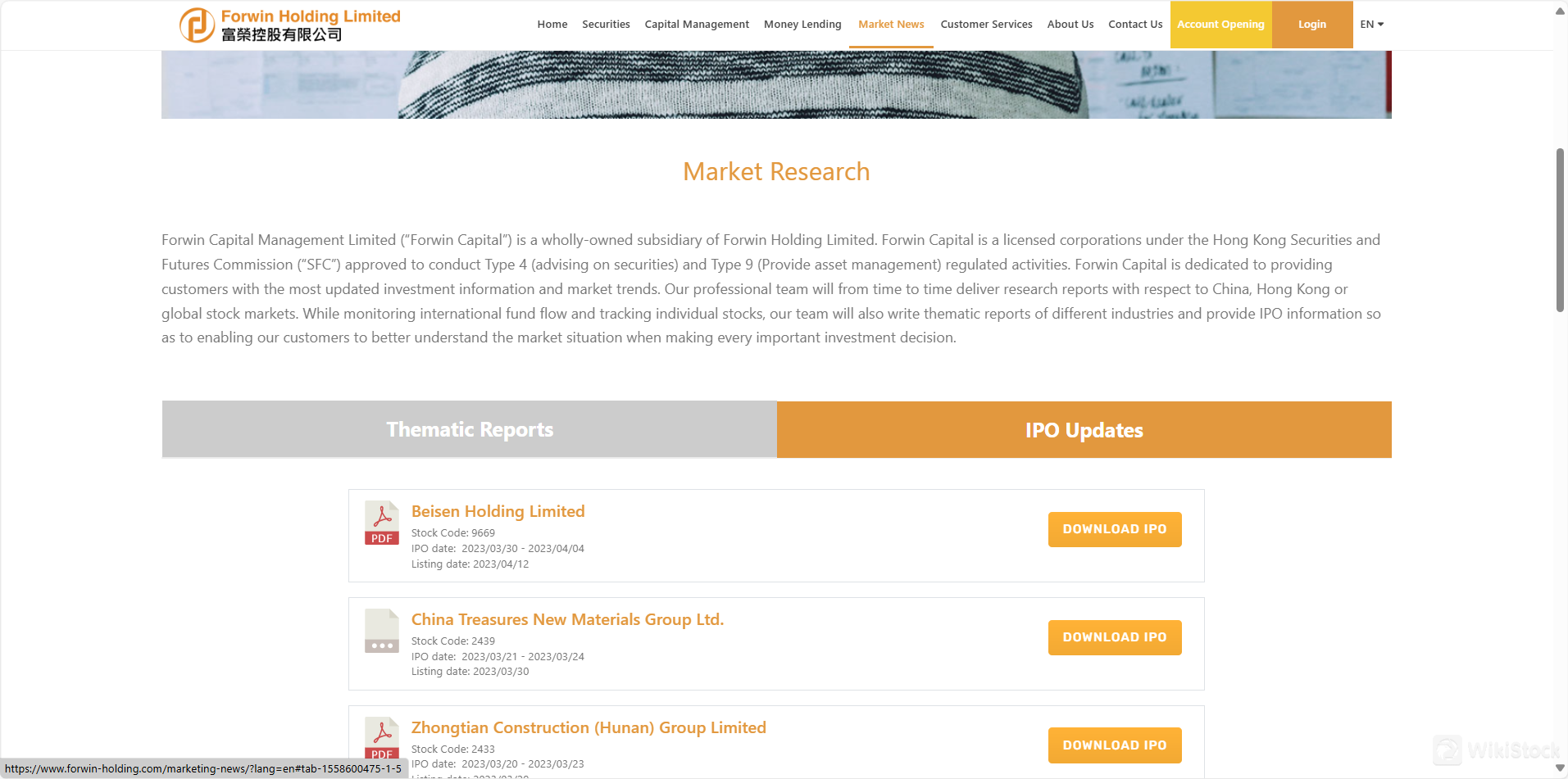

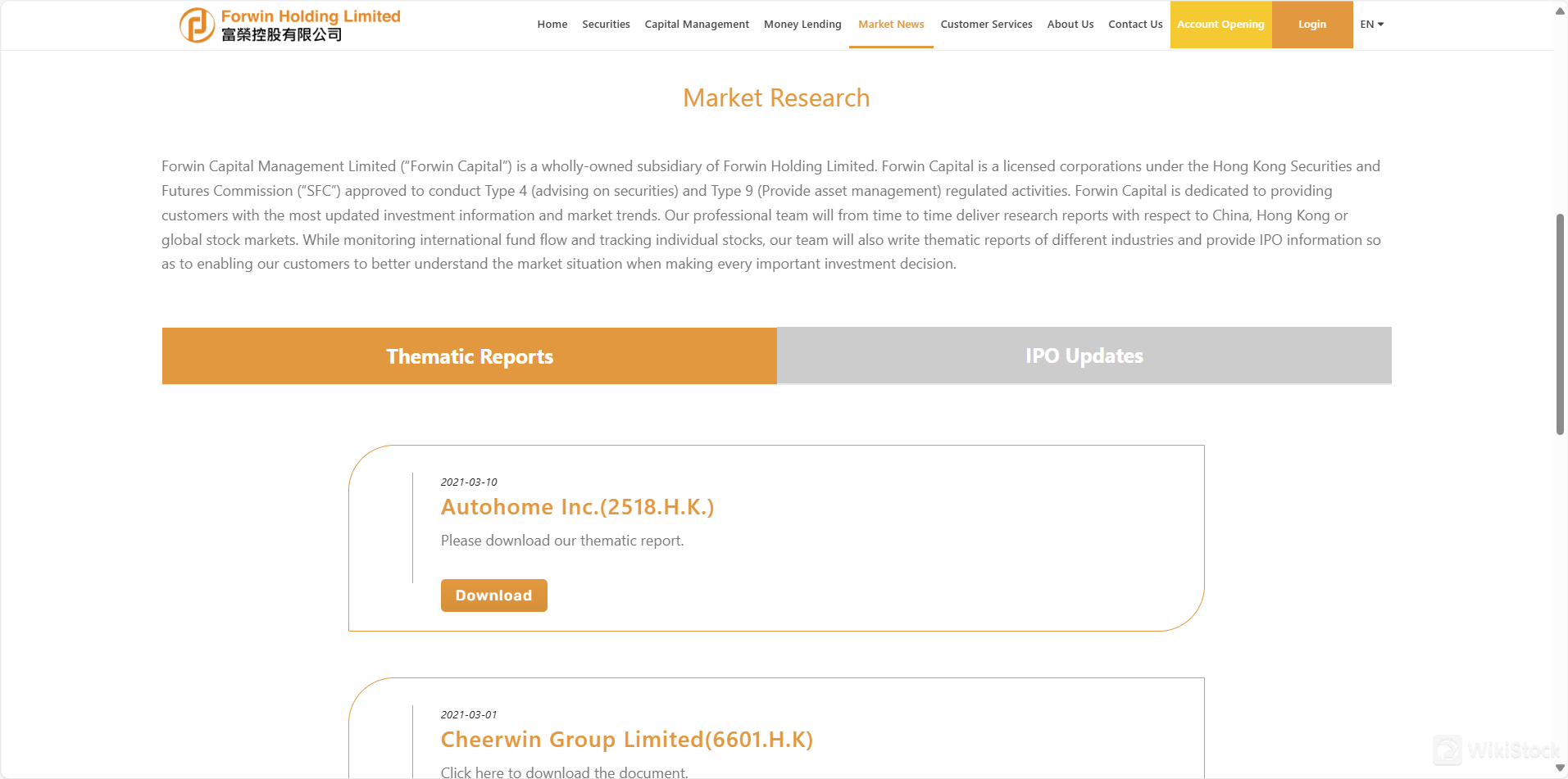

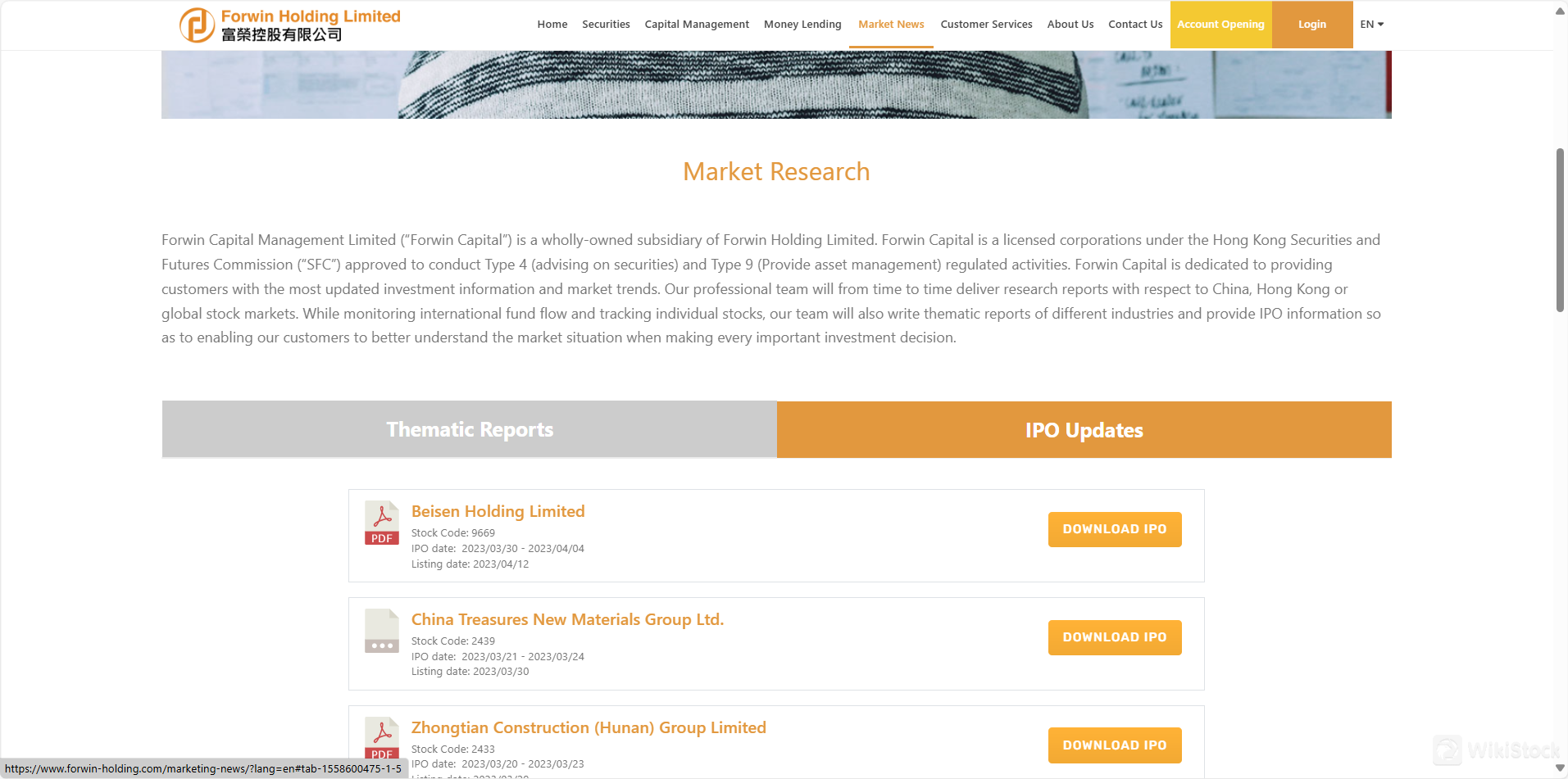

Research & Education

Dedicated to providing updated investment information and market trends, Forwin Capital delivers timely research reports covering China, Hong Kong, and global stock markets, helping investors stay informed about international fund flows and individual stock performances.

Additionally, Forwin Capital offers thematic industry reports and IPO updates to assist clients in understanding specific market dynamics and potential investment opportunities. These resources are designed to enhance investors' decision-making processes by providing deep insights into market conditions and trends, accessible through direct downloads from their website.

Customer Service

Forwin Holding Limited provides several contact options across its various departments, ensuring comprehensive customer service coverage:

Headquarter

Address: Unit 2201, 22/F, Office Tower Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong

Phone: (852) 2895 9999

Fax: (852) 2572 9166

Operating Hours: Monday to Friday: 9:00 AM to 6:00 PM; Closed on Saturdays, Sundays, and public holidays.

Forwin Securities Group Limited - Settlement Department

Forwin Securities Group Limited - Dealing and Investment Department

Forwin Capital Management Limited

Conclusion

Forwin Holding Limited, through its subsidiary Forwin Capital Management Limited, offers many financial services including securities trading, capital management, and money lending.

Licensed by the Hong Kong Securities and Futures Commission, Forwin provides a robust platform for trading and investment advice, supported by research and educational resources that help investors make informed decisions.

The company's headquarters in Wanchai, Hong Kong, serves as a central hub for customer support during business hours.

FAQs

Question: What services does Forwin Holding offer?

Answer: Forwin Holding offers services including securities trading, capital management, money lending, and providing investment research and educational resources.

Question: Where is Forwin Holding headquartered?

Answer: Forwin Holding is headquartered at Unit 2201, 22/F, Office Tower, Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong.

Question: What are Forwin Holding's business hours for customer support?

Answer: Customer support at Forwin Holding is available from Monday to Friday, 9:00 AM to 6:00 PM. The office is closed on Saturdays, Sundays, and public holidays.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--

![暂时无法在飞书文档外展示此内容 What is Forwin Holding? Forwin Holding is a dynamic financial service provider that offers a diverse portfolio of mutual funds, including Hong Kong stocks, China A-shares, and other securities. The company is known for its trading platforms such as Forwin HoldingTrade Go and Forwin HoldingTrade Pro, along with a dedicated securities trading app available for both iOS and Android devices. Forwin Holding extends various services such as private funds, investment advisory, margin trading, discretionary account services, underwriting and placing services, and money lending. However, a higher margin interest rate of 13% could pose a challenge for investors who frequently engage in leveraged trading, potentially increasing the cost of borrowing. [图片] Pros & Cons 暂时无法在飞书文档外展示此内容 Pros: Forwin Holding offers a wide range of tradable assets across Hong Kong and Mainland markets, regulated by the SFC, ensuring security. They provide a user-friendly trading app compatible with both Android and iOS and charge low commissions at just 0.25% per trade. Cons: However, there are no promotional offers for users, reducing its appeal compared to competitors. Additionally, the company only accepts FPS and bank transfers for deposits and withdrawals, which may not suit all users. Is Forwin Holding Safe? 1. Regulations: Forwin Holding is robustly regulated by the Securities and Futures Commission (SFC) of Hong Kong, enhancing its credibility and safety for investors. It operates under two distinct SFC license numbers, BEI223 and BDD860, which underlines its commitment to adhering to strict regulatory standards. [图片] [图片] 2. Funds Safety: Forwin Holding places high importance on the security of client funds. The company strictly prohibits third-party deposits and withdrawals, ensuring that all transactions undergo rigorous compliance checks and adhere to anti-money laundering (AML) regulations. This policy is vital for maintaining the legality of fund movements and minimizing the risk of financial fraud. 3. Safety Measures: Forwin Holding has implemented several safety measures to protect client assets and ensure the integrity of transactions. The company confirms the identity of depositors and the legitimacy of funds for each transaction, permitting only authorized and lawful activities. Suspicious transactions are rejected, and the platform retains the right to return funds to the original source if discrepancies are detected. What are securities to trade with Forwin Holding? Forwin Holding offers a variety of securities for trading, satisfying a wide range of investor interests. Hong Kong Stocks: Forwin Holding offers investors the opportunity to trade in a range of Hong Kong stocks, providing access to one of Asia's most vibrant financial markets. This includes both blue-chip companies and smaller, growth-oriented stocks, allowing investors to diversify their portfolios and leverage the potential of Hong Kong's dynamic economy. China A-shares: Investors at Forwin Holding can also trade China A-shares, which are shares of mainland China-based companies that are denominated in renminbi and traded on Chinese stock exchanges like the Shanghai and Shenzhen stock exchanges. This offers a direct entry into the Chinese domestic market, appealing to those looking to invest in one of the worlds largest and fastest-growing economies. Other Securities and Financial Products: Besides stocks, Forwin Holding provides a variety of other securities and financial products. This includes mutual funds, which pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They also offer more specialized financial products, satisfying diverse investment strategies and risk profiles. [图片] Private Funds and Investment Advisory: Forwin Holding attracts sophisticated investors with private fund offerings, which typically involve investments in less liquid assets and require higher minimum investments. Alongside these, they provide investment advisory services, helping clients to tailor their investment strategies based on personal goals, risk tolerance, and market conditions. Margin Trading and Discretionary Account Services: The firm supports margin trading, allowing clients to borrow money to purchase stocks, potentially increasing their purchasing power and investment returns. They also offer discretionary account services, where a portfolio manager makes investment decisions on behalf of the client, suited for those who prefer to delegate their investment management. Underwriting and Placing Services: Forwin Holding assists companies in raising capital through underwriting and placing services, facilitating the issuance of new stocks or bonds to the public or private investors. This service is crucial for companies looking to expand and invest in growth opportunities. [图片] Money Lending: Additionally, Forwin Holding provides money lending services, offering loans to individuals or corporations. This can be a valuable resource for clients needing additional capital for investment or other financial needs. [图片] Forwin Holding Fees Review The Forwin Holding asks these fees: - Trading Fees: Forwin Holding applies various fees for trading activities including stamp duty, trading fees (HKEx and SFC levies), and brokerage commissions both via phone and internet, which are negotiable but have a set minimum. For China Connect stocks, there are differentiated brokerage fees and additional handling fees which are relatively low. - Service Fees: For services like withdrawing physical scrips and real-time stock quotes, Forwin Holding charges specific fees, with the cost for real-time quotes being notably high at HK$350 per month. - Transactional Services: Fees for services such as E-IPO applications vary depending on the method (cash or margin finance). Telegraphic transfers and physical statements also incur fees, reflecting the administrative costs associated with these services. - Interest and Account Fees: The company charges interest on debit balances in cash and margin accounts, with rates based on the prime rate plus a margin. Additionally, an inactive account fee is levied annually to maintain accounts that are not actively trading. Service Fee Stamp Duty 0.1% of transaction amount HKEx Trading Fee 0.00565% of transaction amount SFC Transaction Levy 0.0027% of transaction amount CCASS Settlement Fee 0.005% of transaction amount (Min HK$5) Brokerage Commission (Phone/Internet) 0.25% of transaction amount (Min HK$100) Grey Market Trading Fees Brokerage commission + HK$100 handling fee China Connect Brokerage Commission 0.08% via Internet (Min RMB60); 0.25% by Phone (Min RMB100) Handling Fee (China Connect) 0.00487% of transaction amount Securities Management Fee (CSRC) 0.002% of transaction consideration Physical Scrip Withdrawal HK$5 per board lot + HK$100 handling fee per stock Real Time Stock Quote HK$350 per month E-IPO Application Free (Cash); HK$100 (Margin Finance) Telegraphic Transfer HK$350 handling fee, billed at cost Physical Statement by Mail HK$150 per month Cash A/C Debit Interest Prime Rate + 6% Margin A/C Margin Financing Debit Interest Prime Rate + 3% (Negotiable) Inactive Account Fee HK$200 per year This structure ensures that traders and investors are aware of the costs associated with their trading activities and financial services at Forwin Holding. [图片] [图片] [图片] [图片] Forwin Holding App Review Forwin Holding offers a securities trading app as their primary trading platform, designed to facilitate trading activities efficiently for their clients. The app is available for both iOS and Android devices, ensuring broad accessibility across different mobile platforms. Users can download the app by scanning the provided QR codes or through the app store icons listed on their website. This app supports various securities trading functions and is integrated with features suitable for both novice and experienced traders. [图片] Research & Education Dedicated to providing updated investment information and market trends, Forwin Capital delivers timely research reports covering China, Hong Kong, and global stock markets, helping investors stay informed about international fund flows and individual stock performances. [图片] Additionally, Forwin Capital offers thematic industry reports and IPO updates to assist clients in understanding specific market dynamics and potential investment opportunities. These resources are designed to enhance investors' decision-making processes by providing deep insights into market conditions and trends, accessible through direct downloads from their website. [图片] Customer Service Forwin Holding Limited provides several contact options across its various departments, ensuring comprehensive customer service coverage: Headquarter - Address: Unit 2201, 22/F, Office Tower Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong - Phone: (852) 2895 9999 - Fax: (852) 2572 9166 - Operating Hours: Monday to Friday: 9:00 AM to 6:00 PM; Closed on Saturdays, Sundays, and public holidays. Forwin Securities Group Limited - Settlement Department - Email: settlement@forwin-holding.com - Phone: (852) 2895 9993 - Fax: (852) 2572 9166 Forwin Securities Group Limited - Dealing and Investment Department - Email: dealing@forwin-holding.com - Phone: (852) 2895 9991 - Fax: (852) 2572 9166 Forwin Capital Management Limited - Email: fwcm.info@forwin-holding.com - Phone: (852) 2895 9906 - Fax: (852) 2572 9166 [图片] Conclusion Forwin Holding Limited, through its subsidiary Forwin Capital Management Limited, offers many financial services including securities trading, capital management, and money lending. Licensed by the Hong Kong Securities and Futures Commission, Forwin provides a robust platform for trading and investment advice, supported by research and educational resources that help investors make informed decisions. The company's headquarters in Wanchai, Hong Kong, serves as a central hub for customer support during business hours. FAQs Question: What services does Forwin Holding offer? Answer: Forwin Holding offers services including securities trading, capital management, money lending, and providing investment research and educational resources. Question: Where is Forwin Holding headquartered? Answer: Forwin Holding is headquartered at Unit 2201, 22/F, Office Tower, Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong. Question: What are Forwin Holding's business hours for customer support? Answer: Customer support at Forwin Holding is available from Monday to Friday, 9:00 AM to 6:00 PM. The office is closed on Saturdays, Sundays, and public holidays. Risk Warning The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial. 暂时无法在飞书文档外展示此内容 What is Forwin Holding? Forwin Holding is a dynamic financial service provider that offers a diverse portfolio of mutual funds, including Hong Kong stocks, China A-shares, and other securities. The company is known for its trading platforms such as Forwin HoldingTrade Go and Forwin HoldingTrade Pro, along with a dedicated securities trading app available for both iOS and Android devices. Forwin Holding extends various services such as private funds, investment advisory, margin trading, discretionary account services, underwriting and placing services, and money lending. However, a higher margin interest rate of 13% could pose a challenge for investors who frequently engage in leveraged trading, potentially increasing the cost of borrowing. [图片] Pros & Cons 暂时无法在飞书文档外展示此内容 Pros: Forwin Holding offers a wide range of tradable assets across Hong Kong and Mainland markets, regulated by the SFC, ensuring security. They provide a user-friendly trading app compatible with both Android and iOS and charge low commissions at just 0.25% per trade. Cons: However, there are no promotional offers for users, reducing its appeal compared to competitors. Additionally, the company only accepts FPS and bank transfers for deposits and withdrawals, which may not suit all users. Is Forwin Holding Safe? 1. Regulations: Forwin Holding is robustly regulated by the Securities and Futures Commission (SFC) of Hong Kong, enhancing its credibility and safety for investors. It operates under two distinct SFC license numbers, BEI223 and BDD860, which underlines its commitment to adhering to strict regulatory standards. [图片] [图片] 2. Funds Safety: Forwin Holding places high importance on the security of client funds. The company strictly prohibits third-party deposits and withdrawals, ensuring that all transactions undergo rigorous compliance checks and adhere to anti-money laundering (AML) regulations. This policy is vital for maintaining the legality of fund movements and minimizing the risk of financial fraud. 3. Safety Measures: Forwin Holding has implemented several safety measures to protect client assets and ensure the integrity of transactions. The company confirms the identity of depositors and the legitimacy of funds for each transaction, permitting only authorized and lawful activities. Suspicious transactions are rejected, and the platform retains the right to return funds to the original source if discrepancies are detected. What are securities to trade with Forwin Holding? Forwin Holding offers a variety of securities for trading, satisfying a wide range of investor interests. Hong Kong Stocks: Forwin Holding offers investors the opportunity to trade in a range of Hong Kong stocks, providing access to one of Asia's most vibrant financial markets. This includes both blue-chip companies and smaller, growth-oriented stocks, allowing investors to diversify their portfolios and leverage the potential of Hong Kong's dynamic economy. China A-shares: Investors at Forwin Holding can also trade China A-shares, which are shares of mainland China-based companies that are denominated in renminbi and traded on Chinese stock exchanges like the Shanghai and Shenzhen stock exchanges. This offers a direct entry into the Chinese domestic market, appealing to those looking to invest in one of the worlds largest and fastest-growing economies. Other Securities and Financial Products: Besides stocks, Forwin Holding provides a variety of other securities and financial products. This includes mutual funds, which pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They also offer more specialized financial products, satisfying diverse investment strategies and risk profiles. [图片] Private Funds and Investment Advisory: Forwin Holding attracts sophisticated investors with private fund offerings, which typically involve investments in less liquid assets and require higher minimum investments. Alongside these, they provide investment advisory services, helping clients to tailor their investment strategies based on personal goals, risk tolerance, and market conditions. Margin Trading and Discretionary Account Services: The firm supports margin trading, allowing clients to borrow money to purchase stocks, potentially increasing their purchasing power and investment returns. They also offer discretionary account services, where a portfolio manager makes investment decisions on behalf of the client, suited for those who prefer to delegate their investment management. Underwriting and Placing Services: Forwin Holding assists companies in raising capital through underwriting and placing services, facilitating the issuance of new stocks or bonds to the public or private investors. This service is crucial for companies looking to expand and invest in growth opportunities. [图片] Money Lending: Additionally, Forwin Holding provides money lending services, offering loans to individuals or corporations. This can be a valuable resource for clients needing additional capital for investment or other financial needs. [图片] Forwin Holding Fees Review The Forwin Holding asks these fees: - Trading Fees: Forwin Holding applies various fees for trading activities including stamp duty, trading fees (HKEx and SFC levies), and brokerage commissions both via phone and internet, which are negotiable but have a set minimum. For China Connect stocks, there are differentiated brokerage fees and additional handling fees which are relatively low. - Service Fees: For services like withdrawing physical scrips and real-time stock quotes, Forwin Holding charges specific fees, with the cost for real-time quotes being notably high at HK$350 per month. - Transactional Services: Fees for services such as E-IPO applications vary depending on the method (cash or margin finance). Telegraphic transfers and physical statements also incur fees, reflecting the administrative costs associated with these services. - Interest and Account Fees: The company charges interest on debit balances in cash and margin accounts, with rates based on the prime rate plus a margin. Additionally, an inactive account fee is levied annually to maintain accounts that are not actively trading. Service Fee Stamp Duty 0.1% of transaction amount HKEx Trading Fee 0.00565% of transaction amount SFC Transaction Levy 0.0027% of transaction amount CCASS Settlement Fee 0.005% of transaction amount (Min HK$5) Brokerage Commission (Phone/Internet) 0.25% of transaction amount (Min HK$100) Grey Market Trading Fees Brokerage commission + HK$100 handling fee China Connect Brokerage Commission 0.08% via Internet (Min RMB60); 0.25% by Phone (Min RMB100) Handling Fee (China Connect) 0.00487% of transaction amount Securities Management Fee (CSRC) 0.002% of transaction consideration Physical Scrip Withdrawal HK$5 per board lot + HK$100 handling fee per stock Real Time Stock Quote HK$350 per month E-IPO Application Free (Cash); HK$100 (Margin Finance) Telegraphic Transfer HK$350 handling fee, billed at cost Physical Statement by Mail HK$150 per month Cash A/C Debit Interest Prime Rate + 6% Margin A/C Margin Financing Debit Interest Prime Rate + 3% (Negotiable) Inactive Account Fee HK$200 per year This structure ensures that traders and investors are aware of the costs associated with their trading activities and financial services at Forwin Holding. [图片] [图片] [图片] [图片] Forwin Holding App Review Forwin Holding offers a securities trading app as their primary trading platform, designed to facilitate trading activities efficiently for their clients. The app is available for both iOS and Android devices, ensuring broad accessibility across different mobile platforms. Users can download the app by scanning the provided QR codes or through the app store icons listed on their website. This app supports various securities trading functions and is integrated with features suitable for both novice and experienced traders. [图片] Research & Education Dedicated to providing updated investment information and market trends, Forwin Capital delivers timely research reports covering China, Hong Kong, and global stock markets, helping investors stay informed about international fund flows and individual stock performances. [图片] Additionally, Forwin Capital offers thematic industry reports and IPO updates to assist clients in understanding specific market dynamics and potential investment opportunities. These resources are designed to enhance investors' decision-making processes by providing deep insights into market conditions and trends, accessible through direct downloads from their website. [图片] Customer Service Forwin Holding Limited provides several contact options across its various departments, ensuring comprehensive customer service coverage: Headquarter - Address: Unit 2201, 22/F, Office Tower Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong - Phone: (852) 2895 9999 - Fax: (852) 2572 9166 - Operating Hours: Monday to Friday: 9:00 AM to 6:00 PM; Closed on Saturdays, Sundays, and public holidays. Forwin Securities Group Limited - Settlement Department - Email: settlement@forwin-holding.com - Phone: (852) 2895 9993 - Fax: (852) 2572 9166 Forwin Securities Group Limited - Dealing and Investment Department - Email: dealing@forwin-holding.com - Phone: (852) 2895 9991 - Fax: (852) 2572 9166 Forwin Capital Management Limited - Email: fwcm.info@forwin-holding.com - Phone: (852) 2895 9906 - Fax: (852) 2572 9166 [图片] Conclusion Forwin Holding Limited, through its subsidiary Forwin Capital Management Limited, offers many financial services including securities trading, capital management, and money lending. Licensed by the Hong Kong Securities and Futures Commission, Forwin provides a robust platform for trading and investment advice, supported by research and educational resources that help investors make informed decisions. The company's headquarters in Wanchai, Hong Kong, serves as a central hub for customer support during business hours. FAQs Question: What services does Forwin Holding offer? Answer: Forwin Holding offers services including securities trading, capital management, money lending, and providing investment research and educational resources. Question: Where is Forwin Holding headquartered? Answer: Forwin Holding is headquartered at Unit 2201, 22/F, Office Tower, Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong. Question: What are Forwin Holding's business hours for customer support? Answer: Customer support at Forwin Holding is available from Monday to Friday, 9:00 AM to 6:00 PM. The office is closed on Saturdays, Sundays, and public holidays. Risk Warning The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.](https://stockwzimg.tech004.com/article/2024-06-07/638533812429987015/ART638533812429987015_991891.jpg-wikistock_articlepic)