Score

弘业国际金融

https://www.ftol.com.hk/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02106

Brokerage Information

More

Company Name

Holly International Financial Holdings Limited

Abbreviation

弘业国际金融

Platform registered country and region

Company address

Company website

https://www.ftol.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

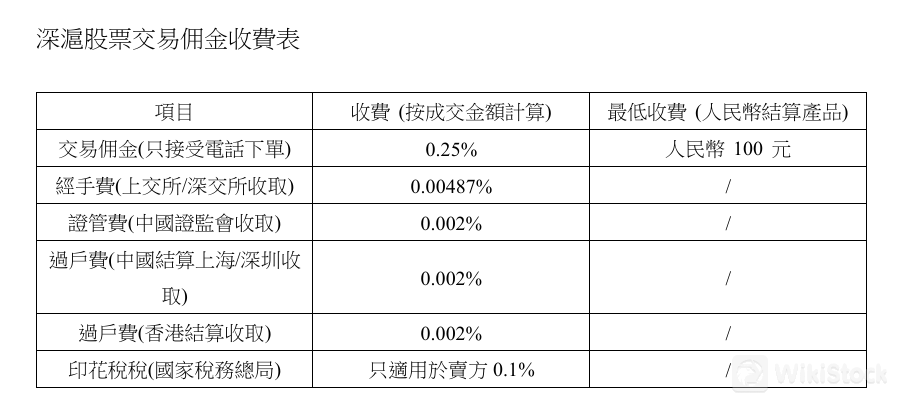

| Holly International Financial Holdings |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | Not mentioned |

| Fees | Stock: 0.25% of transaction amount, min. RMB 100 for phone orders |

| Account Fees | Securities account fee: 0.002% of transaction amount |

| Mutual Funds Offered | Yes |

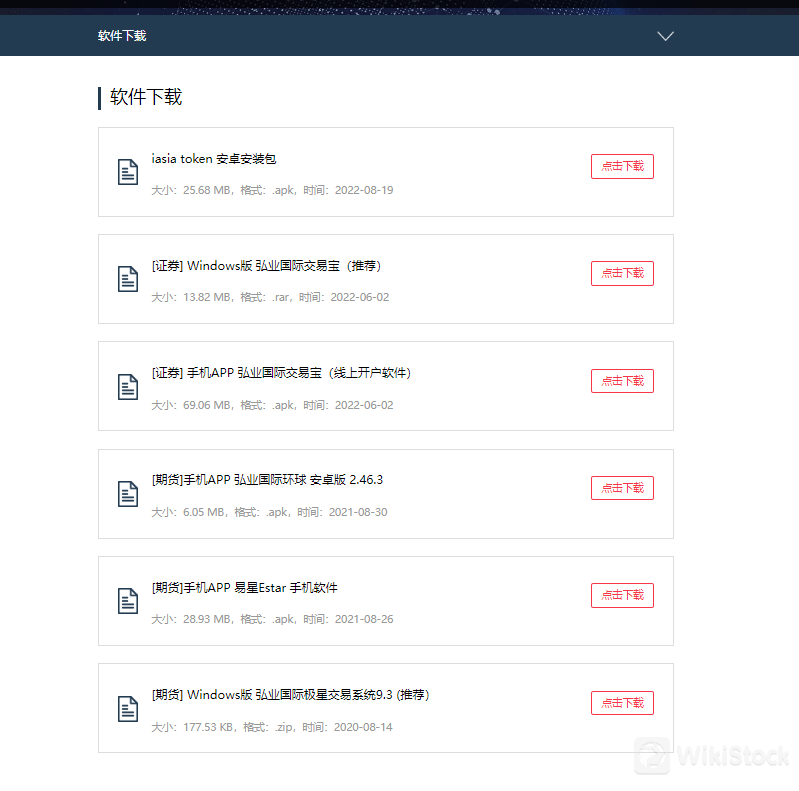

| App/Platform | iasia token (Android) |

| Securities trading: Holly International Trading Treasure (Windows), Holly International Trading Treasure APP | |

| Futures trading: Holly International Global APP Version 2.46.3 (Android), Estar APP, Holly International Polaris Trading System 9.3 (Windows) |

Holly International Information

Holly International Financial Holdings Limited, originally “Hong Su Futures”, is a state-owned financial institution established in Hong Kong on October 20, 2011. It was renamed in December 2019 and operates under the supervision of the Hong Kong Securities and Futures Commission. The company provides a full spectrum of financial services, focusing on asset management and investment solutions for a global clientele.

Pros & Cons of Holly International

| Pros | Cons |

| Regulated by SFC | Complex fee structure |

| Many years of industry experience | Lack of educational resources |

| Multiple trading apps offered |

Pros:

Holly International has extensive industry experience and operates under the regulation of the Securities and Futures Commission (SFC) of Hong Kong, ensuring adherence to stringent financial standards and investor protection. This regulatory oversight instills confidence in clients, knowing their investments are handled with transparency and accountability.

The availability of multiple trading apps (iasia token, Holly International Trading Treasure, Holly International Trading Treasure APP, Holly International Global APP Version 2.46.3, Estar APP, Holly International Polaris Trading System 9.3) enhances accessibility and convenience, catering to diverse client preferences across various devices.

Cons:

Despite its strengths, Holly International's fee structure is perceived as complex, potentially posing challenges for clients seeking clarity on transaction costs and other charges. This complexity could lead to confusion or unexpected costs for users, particularly those new to investing.

Another drawback is the reported lack of sufficient educational resources tailored for beginners. This gap may hinder new investors from acquiring essential knowledge and skills needed to navigate the complexities of financial markets effectively.

Is Holly International Safe?

Holly International is a regulated company with a license effective from June 29, 2012, under the Securities and Futures Commission (SFC) of Hong Kong, License No. AYT086. The company offers a comprehensive range of financial services including ETFs, mutual funds, stocks, bonds, annuities, margin loans, options, futures, securities lending, and investment advisory services.

Another entity, Holly International Asset Management, also regulated by the SFC with License No. BHY994, has an effective license date of August 28, 2018, and operates from a different address in the JLL Center, Hong Kong. Both entities are subject to the regulatory oversight of the SFC, ensuring a high standard of compliance and safety for their operations.

What are Securities to Trade with Holly International?

Specializing in securities and futures trading, Holly International provides robust platforms and tools that enable clients to trade with confidence across global markets. Their asset management services are designed to optimize investment portfolios, leveraging strategic insights and risk management expertise to maximize returns.

Holly International Accounts

Holly International offers actual personal accounts and corporate accounts.

For personal accounts, they provide a seamless and secure platform for trading securities and futures, accompanied by personalized investment advice and access to a wide range of financial products.

Corporate accounts at Holly International cater to businesses seeking sophisticated financial solutions. These accounts are designed to support corporate finance needs, including treasury management, hedging strategies, and asset diversification.

Holly International Fees Review

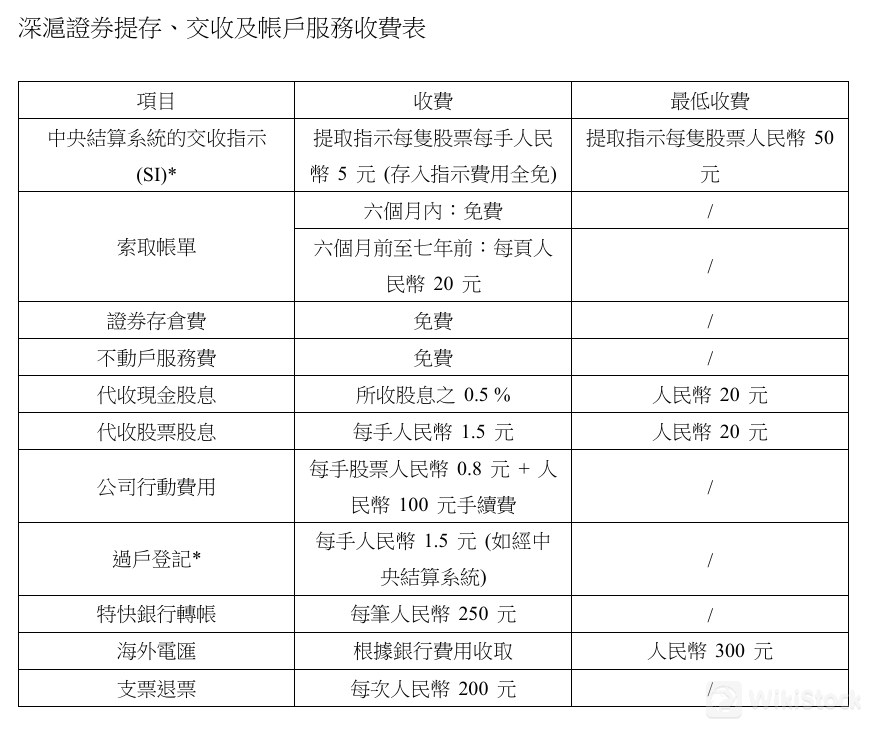

Central Securities Depository and Account Services:

- Delivery instructions for shares: RMB 50 per hand, with a minimum charge of RMB 5.

- Account statements older than six months: RMB 20 per page.

- No charges for securities custody, inactive account service, and deposit instructions.

- Dividend collection: 0.5% of cash dividends, with a minimum of RMB 20; RMB 1.5 per hand for stock dividends, with a minimum charge.

- Corporate action handling: RMB 0.8 per stock hand plus RMB 100 per transaction.

- Express bank transfer: RMB 250.

- Overseas wire transfer: Minimum RMB 300, with additional bank fees.

- Check bounce fee: RMB 200.

Stock Trading Commissions:

- Trading commission: 0.25% of transaction amount, with a minimum of RMB 100 for phone orders.

- Handling fee: 0.00487% of transaction amount (Shanghai and Shenzhen Stock Exchanges).

- Regulatory fee: 0.002% of transaction amount (China Securities Regulatory Commission).

- Securities account fee: 0.002% of transaction amount (China Securities Depository and Shanghai/ Shenzhen).

- Stamp duty: 0.1% applicable only to sellers (National Tax Bureau).

Holly International App Review

Holly International offers a range of applications for both Android and Windows platforms, tailored for securities and futures trading.

- iasia token (Android): A large 25.68MB APK file, released on 2022-08-19, suggesting a feature-rich application possibly related to token management or services.

- Holly International Trading Treasure (Windows) - Securities: A recommended 13.82MB .rar file, dated 2022-06-02, likely offering trading functionalities for securities.

- Holly International Trading Treasure APP - Securities: A substantial 69.06MB .apk file for Android, also dated 2022-06-02, which might provide comprehensive trading and account management features.

- Holly International Global APP Version 2.46.3 (Android) - Futures: A smaller 6.05MB APK, released in 2021, possibly a lighter version of the trading platform.

- Estar APP - Futures: A 28.93MB APK, dated 2021-08-26, which could be a specialized app for futures trading.

- Holly International Polaris Trading System 9.3 (Windows) - Futures: A recommended and compact 177.53KB .zip file from 2020, suggesting a streamlined trading system.

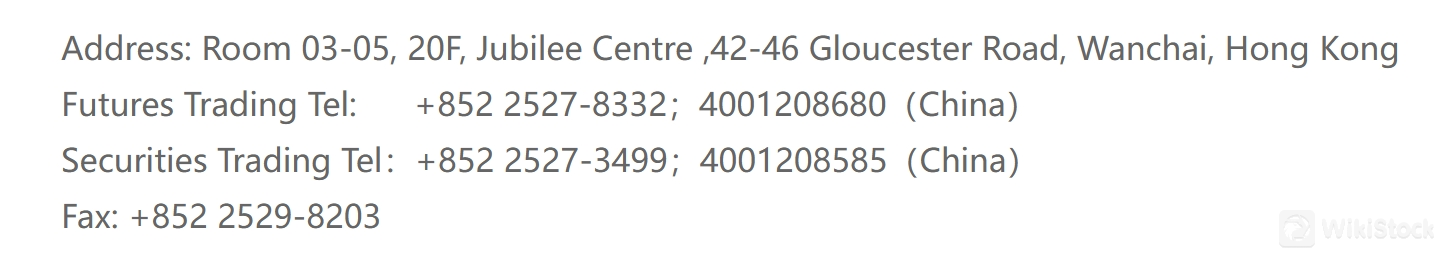

- Address: Unit 03-05, 20th Floor, Cheung Hing Centre, 42-46 Gloucester Road, Wan Chai, Hong Kong

- Phone: (Futures) +852 2527-8332, 400-120-8680

- Phone: (Securities) +852 2527-3499, 400-120-8585

- Fax: +852 2529-8203

- Email: holly@ftol.com.hk

- Is Holly International legit?

- Yes. It is regulated by SFC.

- Is Holly International a broker for beginners?

- No. Although it is regulated and has many years' experience in the industry, it doesn't offer educational resources for beginners.

- How about the fee structure of Holly International?

- It doesn't reveal fees clearly on its website. Instead, you can only find fees through files, and it's complex.

Customer Service

Conclusion

Holly International presents a robust option for investors seeking regulated access to a variety of financial instruments, supported by a solid customer service network and commitment to regulatory compliance. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

Frequently Asked Questions (FAQs)

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

弘业期货股份有限公司

Group Company

--

弘业国际资产管理有限公司

Subsidiary

--

苏豪控股集团有限公司

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

Sanfull Securities

Score

DL Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score