Score

晉商證券

https://www.jssecurities.jsfinancial.com.hk/

Website

Rating Index

Brokerage Appraisal

Products

2

Investment Advisory Service、Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01697

Brokerage Information

More

Company Name

JS Securities Limited

Abbreviation

晉商證券

Platform registered country and region

Company address

Company website

https://www.jssecurities.jsfinancial.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 3851

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

China Hong Kong

281573.10%Egypt

101826.43%Others

180.47%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.15%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| JS Securities Limited |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | None |

| Fees | 0.0027% of transaction levy, 0.005% of trading fee |

| Mutual Funds Offered | Yes |

| App/Platform | Jinshang Financial Go Portal online trading platform and GoTrade2 Mobile Trading Software |

| Promotions | No |

| Customer Support | Office Hours: 09:00 - 18:00 (Monday to Friday, except Hong Kong public) Phone, email and fax |

What is JS Securities Limited?

JS Securities Limited, regulated by SFC, offers a comprehensive array of investment opportunities. Specializing in equities, fixed income bonds, and a variety of alternative investment products such as ETFs and derivatives, JS Securities provides clients the flexibility to diversify their portfolios according to their financial objectives and risk tolerance.

Pros & Cons

| Pros | Cons |

| Regulated and Licensed | Limited Promotional Offers |

| User-Friendly Trading Platforms | Restricted Customer Support Hours |

| Transparent Fee Structure |

Regulated and Licensed: JS Securities Limited operates under the supervision of Hong Kongs Securities and Futures Commission (SFC), providing a level of regulatory oversight and investor protection.

User-Friendly Trading Platforms: They provide intuitive trading platforms like the Jinshang Financial Go Portal and GoTrade2 Mobile Trading Software.

Transparent Fee Structure: JS Securities discloses various fee items such as commissions on equities, spreads on fixed income bonds, and other charges.

Cons:Limited Promotional Offers: They do not offer promotional incentives or bonuses to attract new clients, which could be a drawback for investors looking for initial incentives.

Restricted Customer Support Hours: Customer support is available during office hours (09:00 - 18:00, Monday to Friday, excluding Hong Kong public holidays), which may not fully meet the needs of clients in different time zones or require after-hours assistance.

Is JS Securities Limited Safe?

JS Securities Limited operates under the regulation of the Securities and Futures Commission (SFC) with License No. AFK563. The SFC, serving as a key financial regulator in a global financial hub, is committed to bolstering and safeguarding the integrity and stability of Hong Kong's securities and futures markets. This oversight is designed to ensure a robust framework that enhances investor protection and fosters market confidence.

What are Securities to Trade with JS Securities Limited?

JS Securities Limited offers a range of securities for investment:

Equities: They provide opportunities for investing in stocks of various companies listed on recognized stock exchanges. Clients can diversify their portfolios across different sectors and geographical regions based on their investment strategies.

Fixed Income Bonds: JS Securities Limited offers fixed income securities such as bonds, which provide regular interest payments over a specified period.

Other Investment Products: Beyond equities and fixed income bonds, JS Securities Limited offers other financial instruments such as exchange-traded funds (ETFs), and derivatives (like futures and options).

JS Securities Limited Platforms Review

JS Securities Limited offers two primary trading platforms: Jinshang Financial Go Portal online trading platform and GoTrade2 Mobile Trading Software for iOS and Android.

Jinshang Financial Go Portal:

Jinshang Financial Go Portal is an advanced online trading platform designed to facilitate electronic trading and online transactions. It provides a comprehensive suite of features aimed at enhancing trading efficiency, convenience, and security.

GoTrade2 Mobile Trading Software:

On the other hand, GoTrade2 Mobile Trading Software caters to users who prefer trading on their smartphones. Available for both iOS and Android devices, this mobile app extends the capabilities of the Jinshang Financial Go Portal to handheld devices. It offers seamless integration with the online platform, allowing users to trade securely on the go.

JS Securities Limited Accounts Review

JS Securities Limited offers individual and joint securities investment accounts without requiring a minimum deposit to open an account. This feature makes their services accessible to a wide range of investors, from beginners to experienced traders. By not imposing a minimum deposit requirement, JS Securities Limited aims to lower the barrier for entry into securities trading, allowing clients to start investing according to their financial capacity and goals.

JS Securities Limited Fees Review

JS Securities Limited charges different fee items such as certificate withdrawal fee, share registration fee, handling fee for application for new share issue by written instruction, custodian fee and so on, commission on Limited Markets (equities), spread on fixed income bonds and so on.

| Transaction Levy | 0.0027% on gross consideration |

| Trading Fee | 0.005% on gross consideration |

| Stamp Duty | 0.13% on gross consideration (rounded up) |

| Stock Clearing Fee | 0.002% on gross consideration |

| Mutual Funds Fees | |

| Subscription Fee | Min USD 100 or equivalent |

| Money Market Funds | Up to 1% |

| Equity Funds | Up to 2% |

| Bonds Funds | Up to 1% |

| Alternative Investment Funds | Up to 2% |

| Redemption Fee | Free |

| Management Fee | Up to 1.5% |

| Transfer Fees | |

| Transfer In | FreeHKD 500 per fund or equivalent |

| Transfer Out | |

JS Securities Limited Deposit & Withdrawal Review

JS Securities Limited provides clear guidelines for depositing and withdrawing funds to ensure smooth transactions for their clients.

Deposit Process:

Clients can deposit funds into their accounts through Internet Banking, Cheque, or FPS (Faster Payment System). After making a deposit, clients are required to notify their broker or salesperson for confirmation. Alternatively, they can submit a deposit confirmation instruction via JS Securities Limiteds 2Go online trading platform or app.

Timely submission of proof of deposit is necessary to avoid delays in the crediting of funds to the clients account. JS Securities Limited emphasizes that they do not accept third-party deposits or cash withdrawals. If a third-party deposit is identified, the company will refuse to accept it and return the deposit to the depositor, deducting any bank charges incurred.

Withdrawal Process:

Clients can initiate withdrawal requests through their broker/salesperson or directly via the 2Go online trading platform or app. Withdrawal requests are processed following the companys internal procedures to ensure security and accuracy.

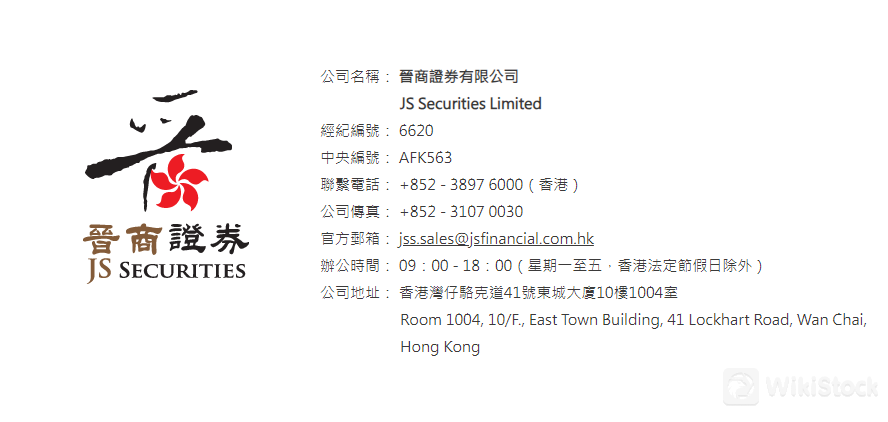

Customer Service

Customers can visit their office or get in touch with customer service 09:00 - 18:00 (Monday to Friday, except Hong Kong public holidays) using the information provided below:

Telephone: +852 - 3897 6000 (Hong Kong)

Fax: +852 - 3107 0030

Email: jss.sales@jsfinancial.com.hk

Address: Room 1004, 10th Floor, East Castle Building, 41 Lockhart Road, Wan Chai, Hong Kong

Conclusion

JS Securities Limited emerges as a reputable investment firm regulated by Hong Kong's SFC, offering a comprehensive array of investment products. With no minimum deposit requirement, they prioritize accessibility for a wide range of investors, supported by user-friendly trading platforms and a transparent fee structure. While it lacks promotional incentives and has limited customer support hours.

Frequently Asked Questions (FAQs)

Is JS Securities Limited regulated?

Yes. It is regulated by SFC.

What are platforms offered by JS Securities Limited?

Jinshang Financial Go Portal online trading platform and GoTrade2 Mobile Trading Software.

How can I contact JS Securities Limited?

You can contact via telephone: +852 - 3897 6000 (Hong Kong), fax: +852 - 3107 0030 and email: jss.sales@jsfinancial.com.hk.

What is the minimum deposit for JS Securities Limited?

There is no minimum initial deposit to open an account.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Investment Advisory Service、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

晉商金融控股有限公司

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

DL Securities

Score

Sanfull Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score