Golden Rich Securities Limited is a wholly owned subsidiary of China Finance Investment Holdings Limited (“CFIH”) (HKEx. 875). CFIH has been actively developing its financial service business. CFIH is currently engaged in money lending business in Hong Kong. It provides comprehensive and diversified commercial and personal loan financing services including personal and home equity financing. It has also entered mainland P2P lending business.

What is GRS?

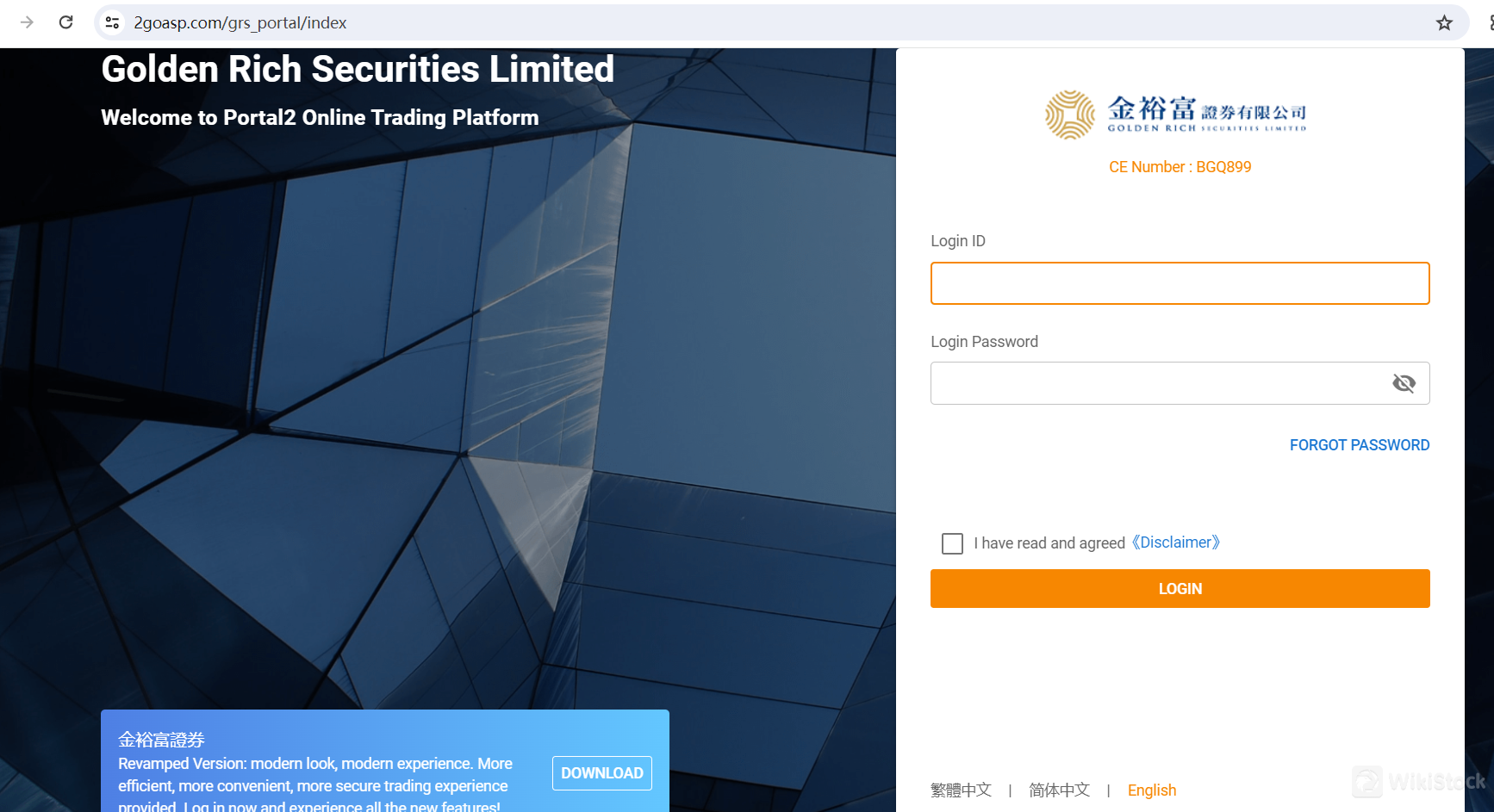

Golden Rich Securities Limited (GRS) is a Hong Kong-based financial services firm regulated by the Securities and Futures Commission (SFC). It offers low-cost online trading, user-friendly mobile apps, and a comprehensive range of trading options, including stocks, IPOs, convertible bonds, and warrants. However, some services come with high fees.

Pros and Cons of GRS

Golden Rich Securities Limited (GRS) is a Hong Kong-based financial services firm regulated by the Securities and Futures Commission (SFC), ensuring compliance with high standards of financial practice. GRS offers a wide range of trading options including stocks, IPOs, convertible bonds, and warrants, providing investors with diverse opportunities. The firm also supports its clients with comprehensive customer service, including mobile apps for trading on the go. However, while GRS employs security measures to protect client funds, specific details about insurance coverage are not provided. Additionally, some services come with high fees, which investors should consider when using GRSs platform.

Is GRS safe?

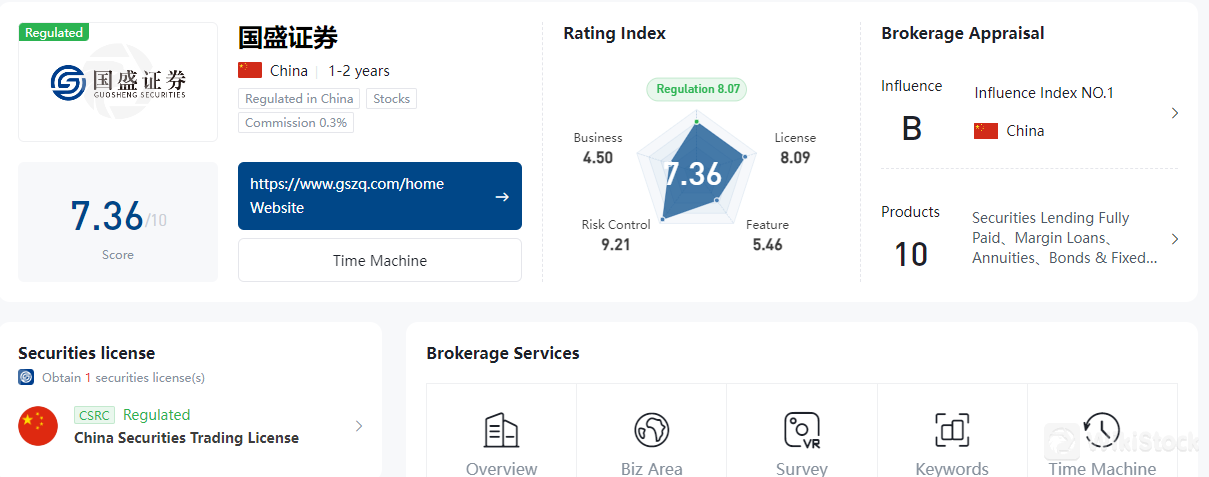

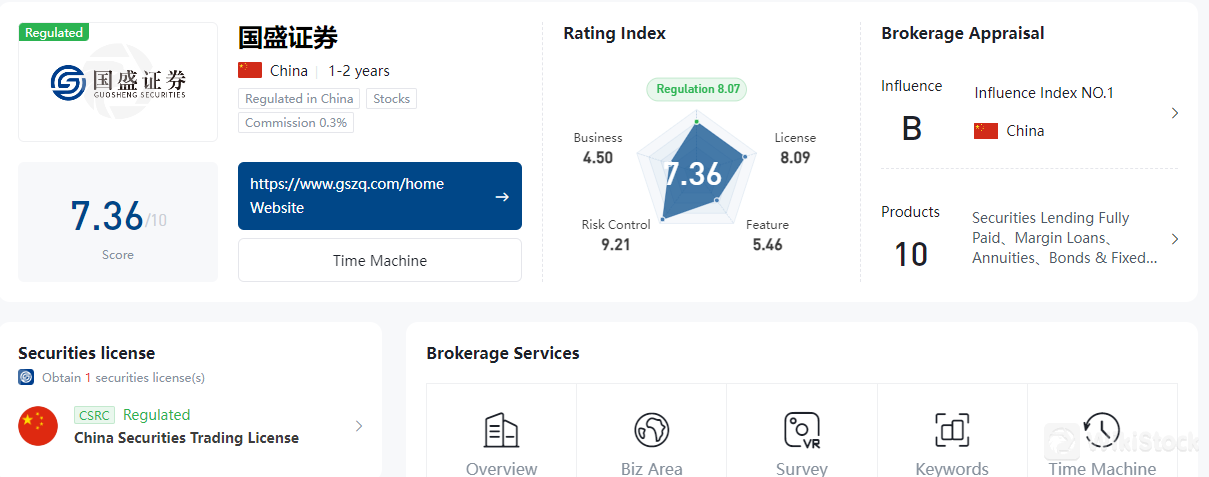

Regulation

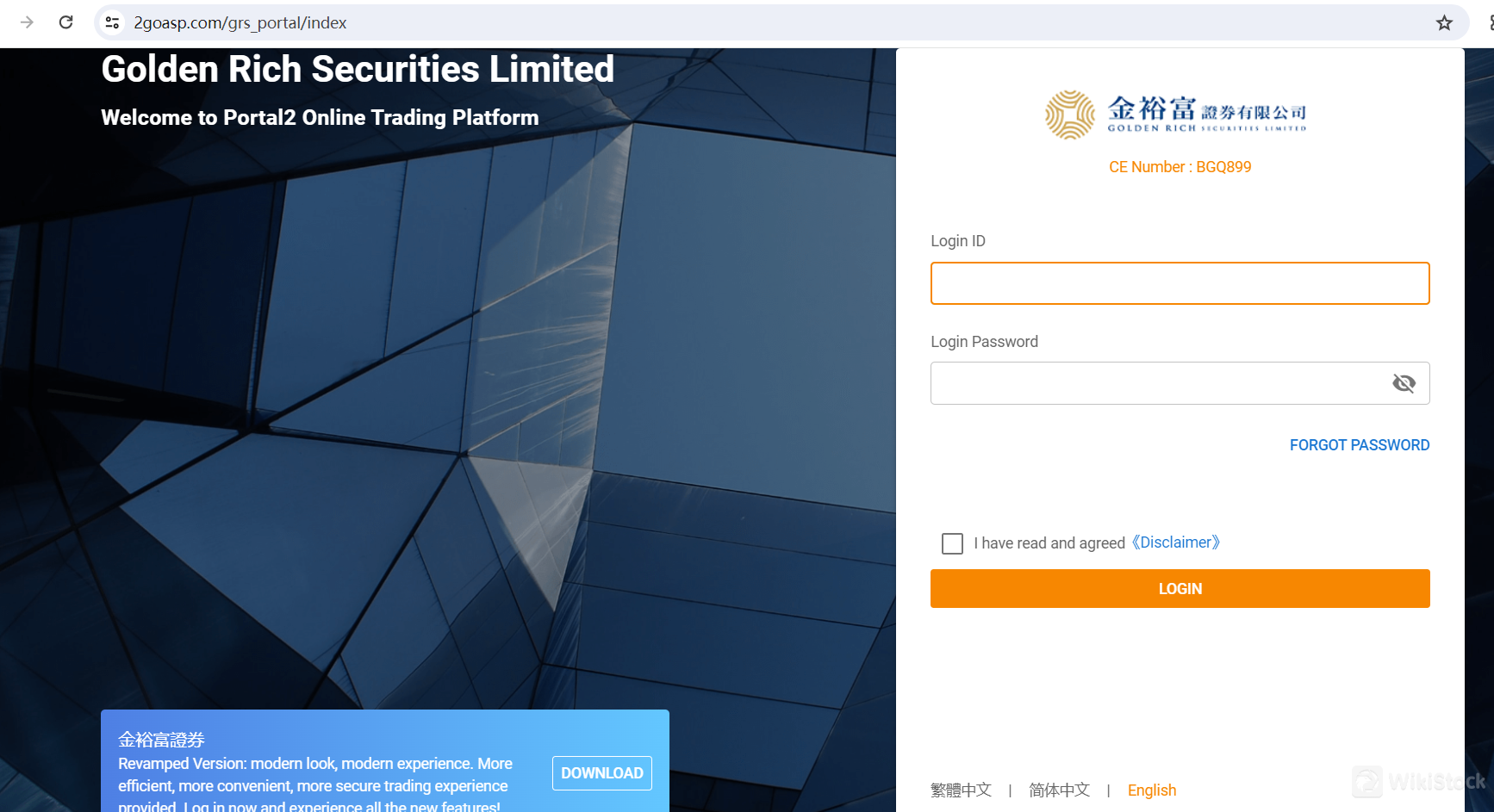

Golden Rich Securities Limited (GRS) operates under stringent regulatory oversight, ensuring the safety and security of client investments. It is licensed by the Securities and Futures Commission (SFC) of Hong Kong to conduct type 1 regulated activities, which include dealing in securities (CE number BGQ899). This regulatory framework provides a robust layer of oversight and compliance, ensuring that GRS adheres to high standards of financial practice and client protection.

What are securities to trade with GRS?

Golden Rich Securities Limited (GRS) is a Hong Kong-based financial services firm that provides a comprehensive range of trading solutions. The firm enables clients to trade stocks listed on the Hong Kong Stock Exchange (HKEX), offering access to a diverse array of equity securities. Investors can take advantage of GRSs services to participate in the dynamic stock market, benefiting from the firm's expertise and extensive market knowledge.

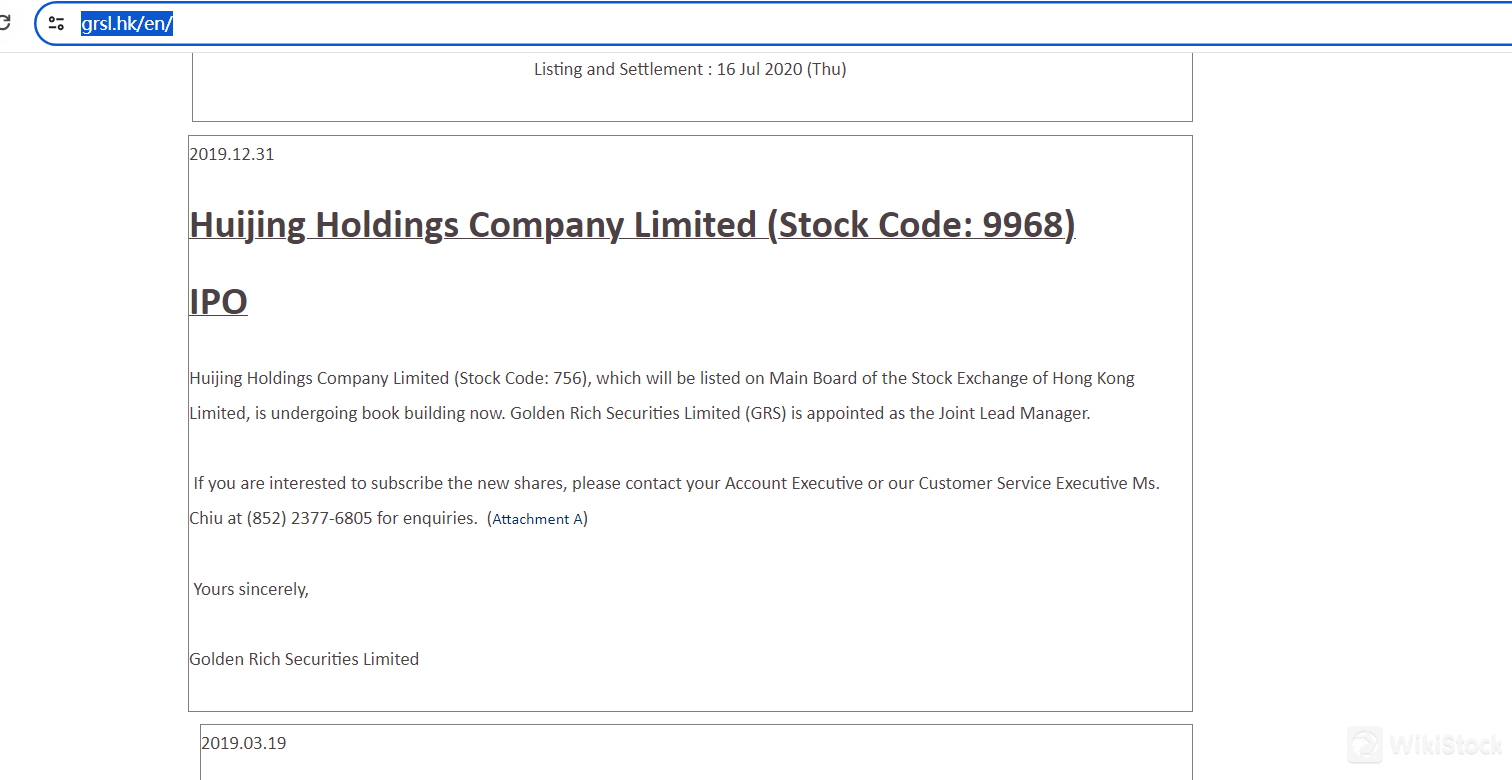

In addition to stock trading, GRS facilitates participation in initial public offerings (IPOs), allowing investors to subscribe to new shares before they are listed on the exchange. This service provides opportunities for clients to invest in companies at the early stages of their public market journey, potentially capitalizing on future growth. GRS's IPO subscription services are designed to streamline the process and provide clients with essential information and support.

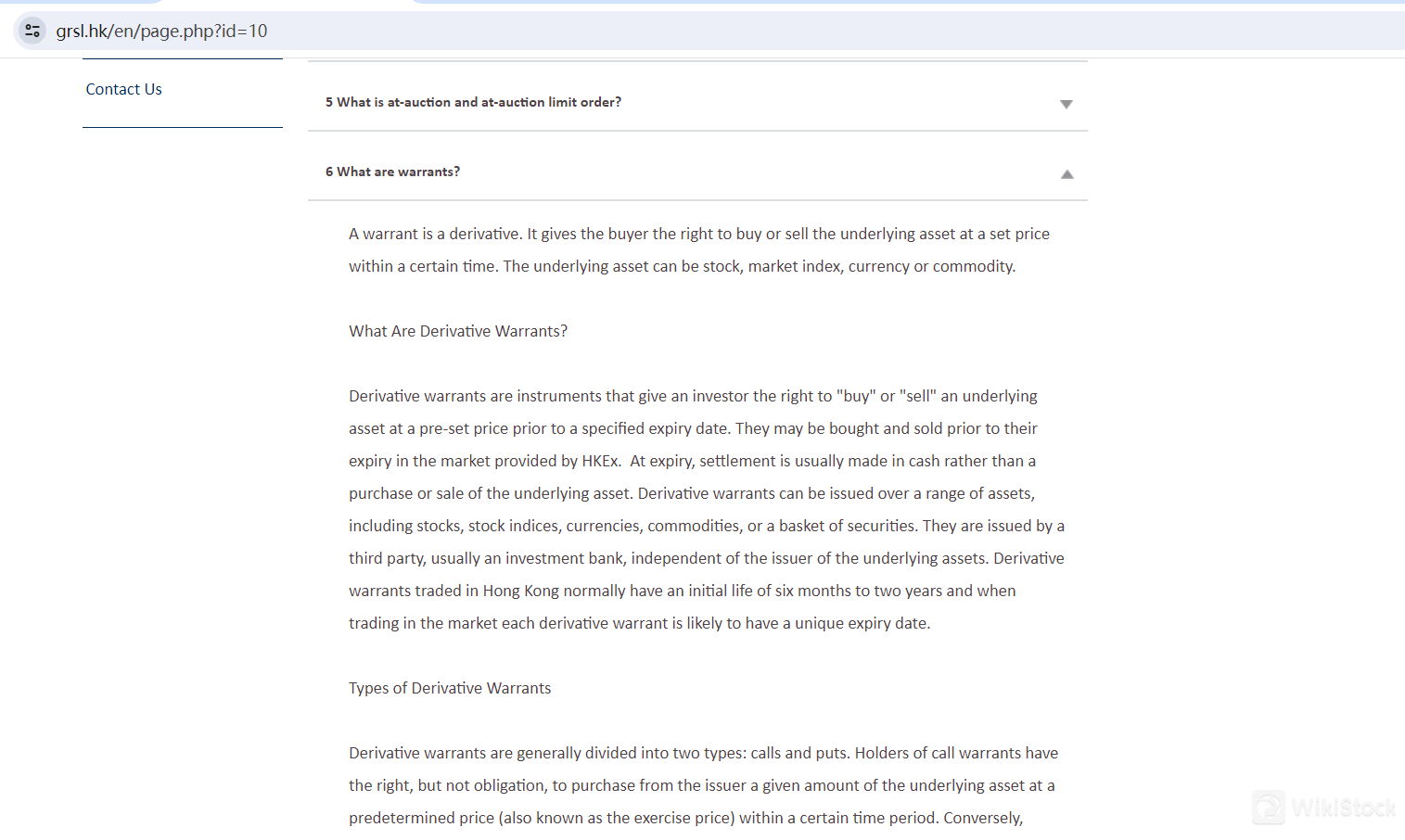

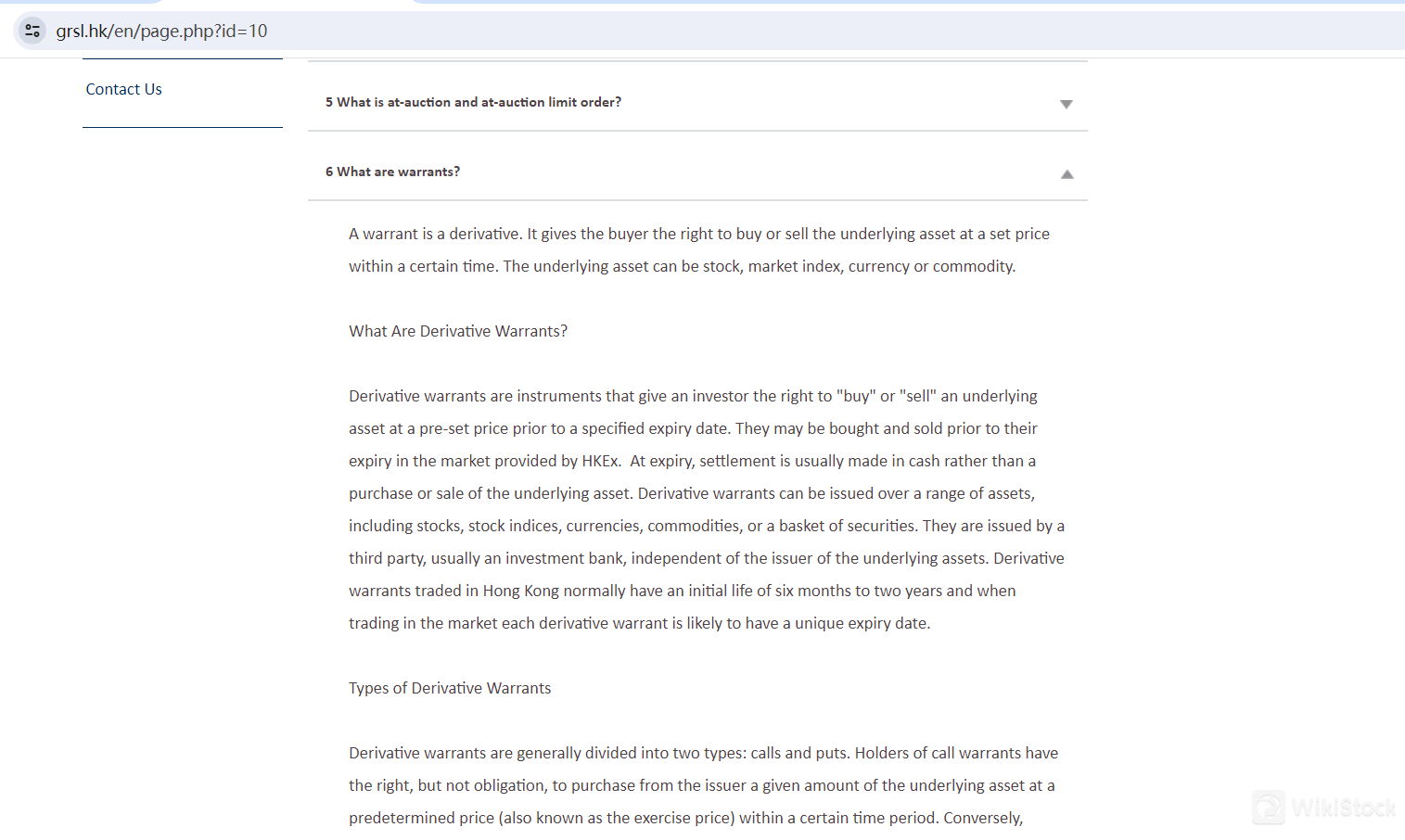

GRS also offers trading in convertible bonds and warrants, catering to investors seeking diversified financial instruments. Convertible bonds provide the flexibility to convert bonds into shares, blending the features of debt and equity securities. Warrants, on the other hand, are derivatives that grant the right to purchase company shares at a predetermined price before a specified expiration date. These instruments offer additional strategies for investors to optimize their portfolios and manage risks effectively. With its wide range of services, GRS aims to meet the varied needs of its clients in the financial markets.

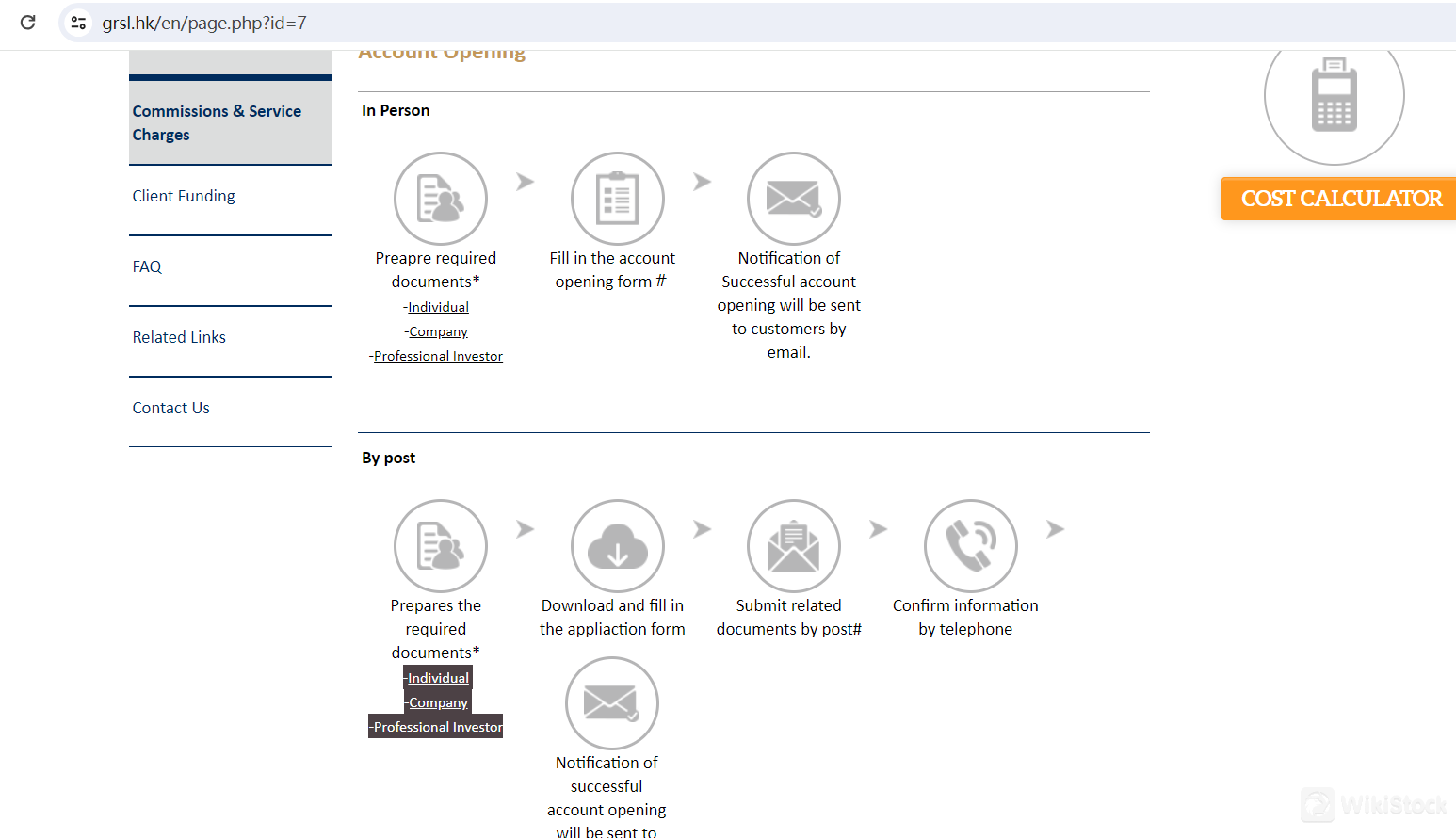

GRS Account Types and Opending Process

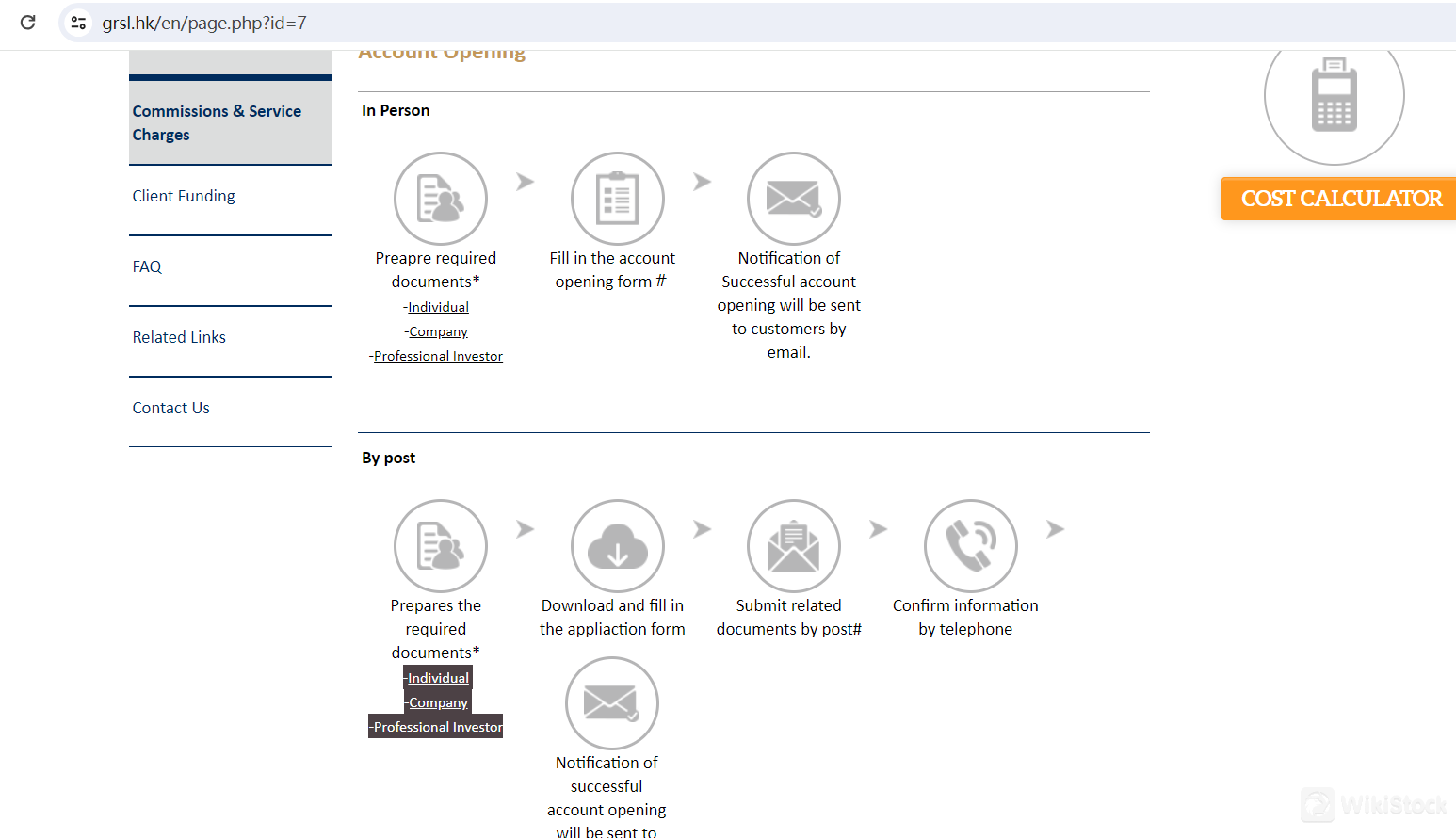

Golden Rich Securities Limited (GRS) offers different types of accounts to cater to the needs of various investors: individual investors, companies, and professional investors.

For individual investors, GRS provides a straightforward account opening process. Individuals need to submit required documents such as a copy of their passport or ID card and an address proof. These documents must be recent, typically within the last three months, and can include statements or correspondences from government entities, public utilities, or financial institutions. The account setup is designed to be efficient, allowing individual investors to start trading in the Hong Kong Stock Exchange and other markets supported by GRS.

Companies looking to open accounts with GRS need to follow a similar process, tailored to the requirements of corporate entities. This involves submitting corporate documents, including a self-certification form and documents related to the controlling person if applicable. The company's authorized representatives must provide valid identification and address proof. GRS ensures that the companys trading activities are well-supported with comprehensive services that include stock trading, IPO participation, and access to various financial instruments.

For professional investors, GRS offers specialized account types that cater to more sophisticated trading needs. These accounts are designed for individuals or entities that meet specific regulatory criteria and possess significant investment experience and knowledge. Professional investors must provide detailed documentation to verify their status, including self-certification forms and relevant financial information. GRS provides these investors with advanced trading tools, access to a broader range of securities, and personalized services to support their complex trading strategies.

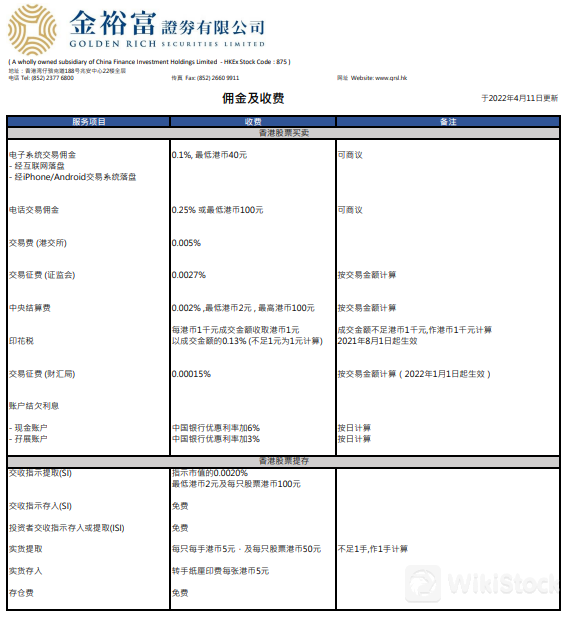

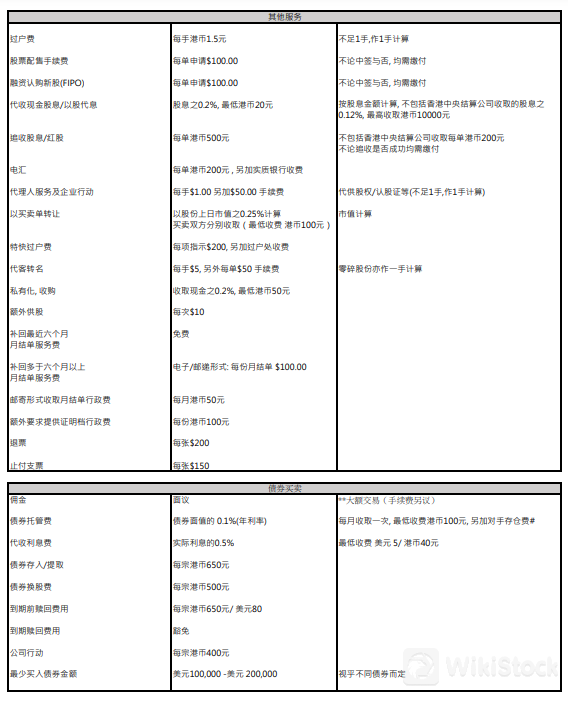

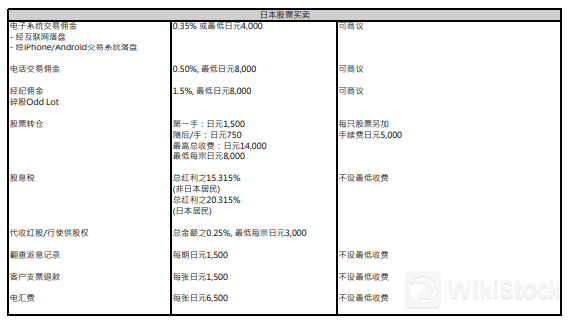

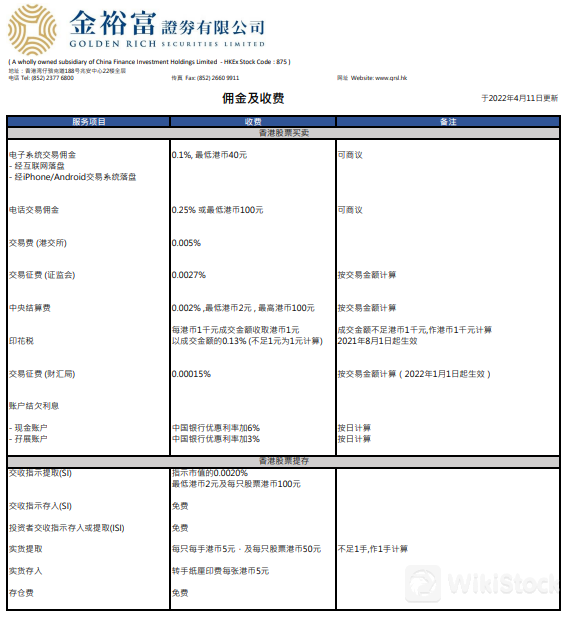

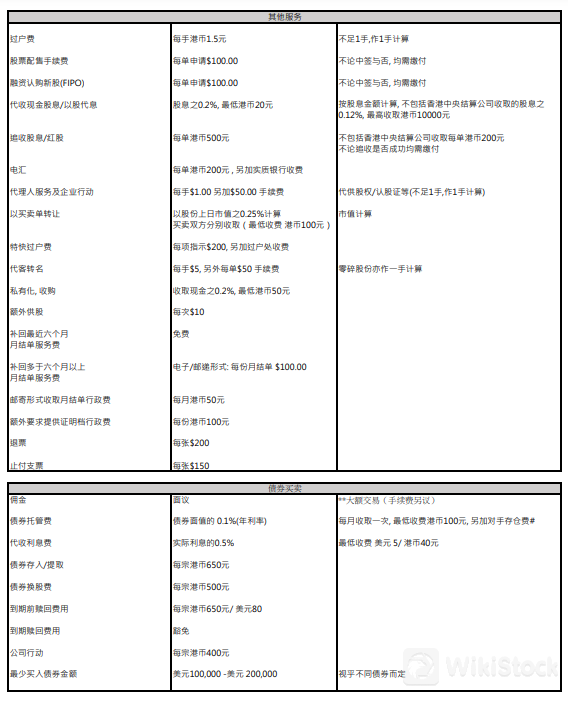

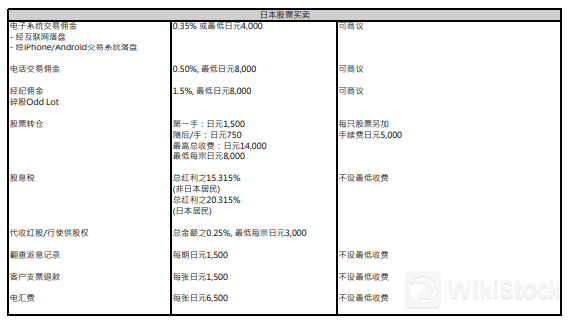

GRS Fees Review

Golden Rich Securities Limited (GRS) offers a detailed and structured fee schedule for various trading and investment services. For online trading, GRS charges a commission of 0.1% of the trade value, with a minimum fee of HKD 40 per order placed via the internet or their mobile app. For orders placed over the phone, the commission is higher at 0.25%, with a minimum fee of HKD 100. These fees ensure that clients are aware of the costs associated with their trading activities, whether conducted online or via direct communication.

Transaction-related fees include a trading fee of 0.005% and a transaction levy of 0.0027%, both applied to the gross trade amount. Additional costs include a CCASS fee of 0.002%, which has a minimum charge of HKD 2 and a maximum of HKD 100. Stamp duty is calculated at HKD 1 per thousand dollars, or 0.13% of the transaction value, rounded up to the nearest dollar. There is also a transaction levy of 0.00015% from the Financial Reporting Council (FRC), which further adds to the overall trading expenses.

GRS also imposes miscellaneous fees for various services. Overdue interest for cash accounts is set at P+6%, while margin accounts incur a rate of P+3%. Physical stock deposits are subject to a HKD 5 stamp duty per transfer deed. For delivery instructions, there is a charge of 0.0020% of the stock value, with a minimum fee of HKD 2 and a maximum of HKD 100 per share. Receiving investor SI instructions is free of charge. Additionally, there are fees for physical stock withdrawals, scrip fees, IPO subscriptions, dividend collection, and other corporate actions, ensuring that clients are well-informed about all potential costs associated with their investments.

These detailed charges cover a wide range of services provided by GRS, ensuring transparency and helping clients manage their investment costs effectively.

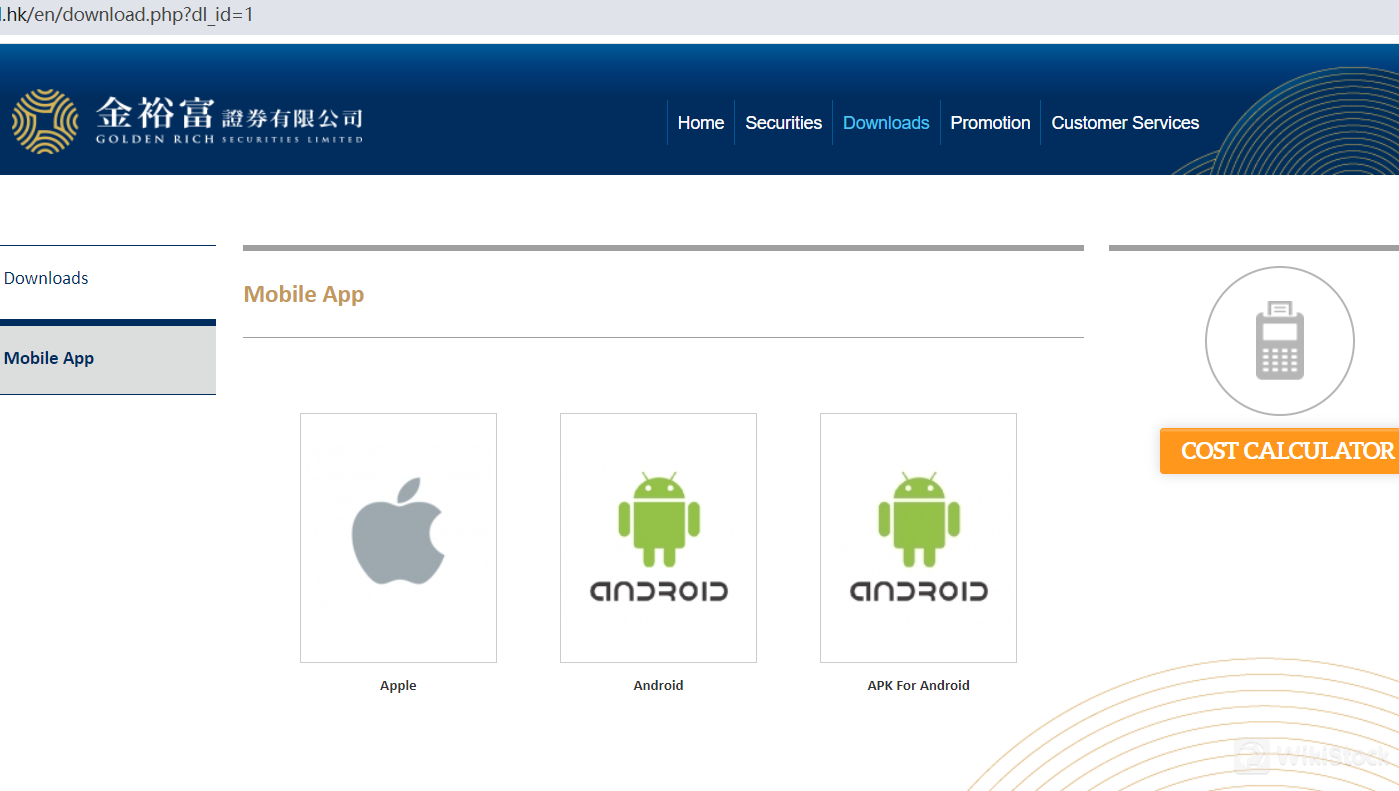

GRS App Review

Golden Rich Securities Limited (GRS) offers mobile applications to enhance the trading experience for its clients. Available on both Apple and Android platforms, these apps provide users with convenient access to their accounts and the ability to trade on the go. The Apple app is available for download from the App Store, while Android users can download the app from Google Play or directly via an APK file for Android. These apps are designed to facilitate seamless trading, enabling users to place orders, monitor their portfolios, and stay updated with market movements in real time, ensuring that clients can manage their investments efficiently and effectively from their mobile devices.

Research and Eduation

Golden Rich Securities Limited (GRS) provides a comprehensive range of customer services to support their clients. Their educational and research offerings include resources and tools to help investors make informed decisions. GRS ensures clients have access to essential market data, research reports, and financial news to stay updated on market trends and opportunities. They offer detailed information on initial public offerings (IPOs) and provide support for clients interested in subscribing to new shares. Additionally, GRS's website features a customer service section with detailed guides on account opening, commissions, service charges, client funding, and frequently asked questions (FAQ) to assist both new and experienced investors.

Customer Service

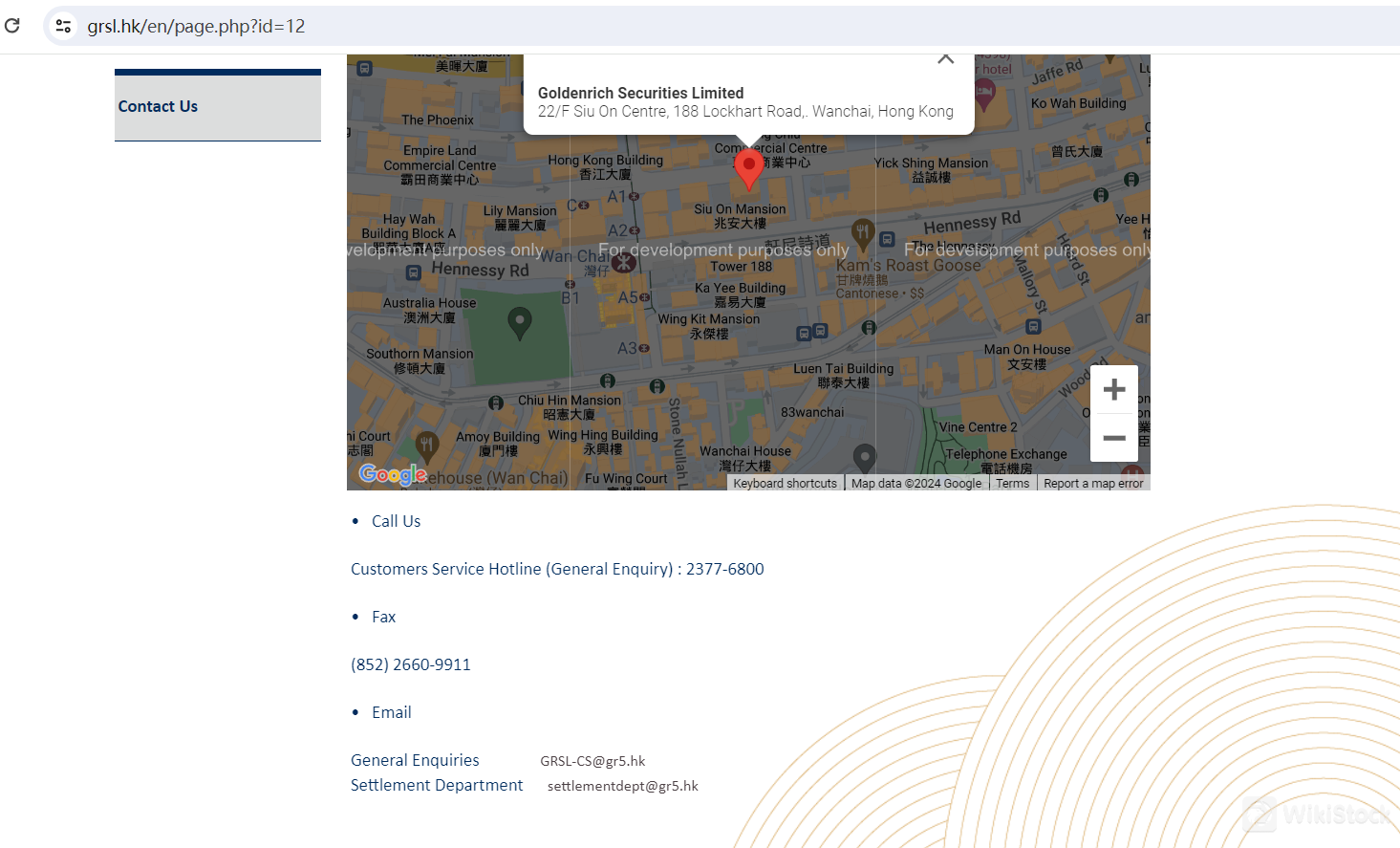

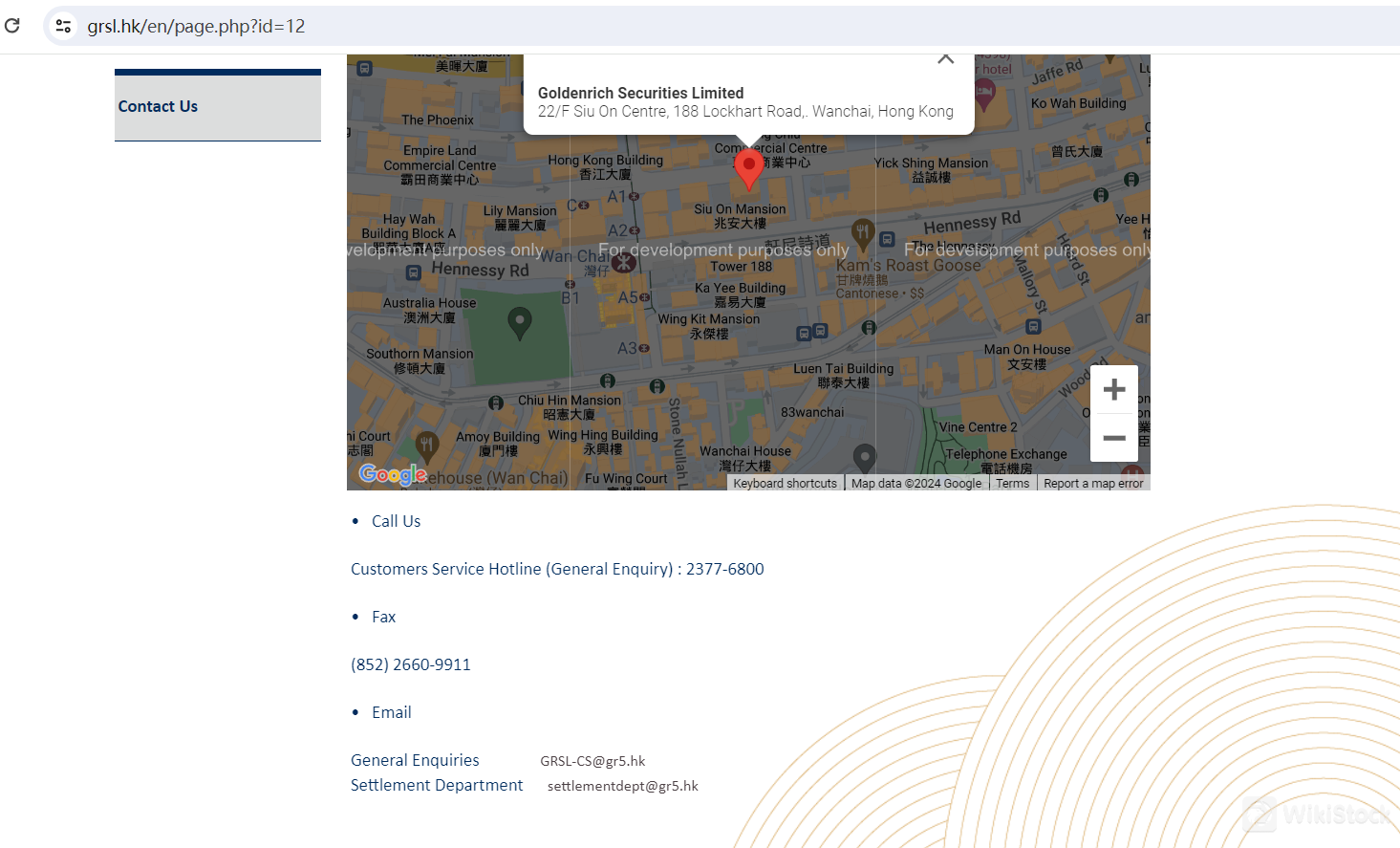

Golden Rich Securities Limited (GRS) offers robust customer support through multiple channels to ensure clients receive timely and efficient assistance. Their main office is located at Unit 2201B, 22/F, China Hong Kong City Tower 1, 33 Canton Road, Kowloon, Hong Kong, with an additional office at 22/F Siu On Centre, 188 Lockhart Road, Wanchai, Hong Kong.

Clients can contact GRS through their customer service hotline at 2377-6800 for general inquiries. Additionally, fax services are available at (852) 2660-9911. For email support, general inquiries can be directed to GRSL-CS@gr5.hk, while settlement-related queries should be sent to settlementdept@gr5.hk. This multi-faceted support structure ensures that clients have access to help whenever needed, enhancing their overall experience with GRS.

Conclusion

Golden Rich Securities Limited (GRS) is a Hong Kong-based financial services firm regulated by the Securities and Futures Commission (SFC), offering a wide range of trading options such as stocks, IPOs, convertible bonds, and warrants. It stands out for its user-friendly mobile apps and comprehensive customer support. However, while it provides diverse investment opportunities, some services have high associated fees. Overall, GRS is a reliable platform with robust security measures and diverse offerings, suitable for both individual and professional investors.

FAQs

Is Golden Rich Securities Limited (GRS) safe to trade?

Yes, Golden Rich Securities Limited (GRS) is safe to trade. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with stringent financial and operational standards. GRS also employs encryption technologies and rigorous account security measures to protect client information and funds.

Is Golden Rich Securities Limited (GRS) a good platform for beginners?

GRS can be a good platform for beginners due to its user-friendly mobile apps and comprehensive customer support. The platform offers educational resources and research tools that can help new investors understand market trends and make informed decisions. However, beginners should be aware of the various fees associated with different services.

Is Golden Rich Securities Limited (GRS) legit?

Yes, Golden Rich Securities Limited (GRS) is a legitimate financial services firm. It holds a license from the Securities and Futures Commission (SFC) of Hong Kong, allowing it to conduct regulated activities such as dealing in securities. This regulatory oversight ensures that GRS operates with integrity and professionalism.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Taiwan

China TaiwanObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--