Victory Securities (stock code: 8540. HK), rooted in Hong Kong for over 50 years, offers comprehensive and fully-licensed financial services. Over the past over 50 years, Victory Securities obtained multiple awards and essential business qualifications in the Asia-Pacific region, including the first batch of China Connect Exchange Participant and China Connect Clearing Participants, formally launched the "Shanghai-Hong Kong Stock Connect" and "Shenzhen-Hong Kong Stock Connect" services in 2014 and 2016, and was approved by Bond Connect as a qualified investor and approved by the China Securities Regulatory Commission as a Qualified Foreign Institutional Investor (QFII) in 2020.

What is Victory Securities?

Victory Securities is a regulated securities firm in Hong Kong that offers a wide range of investment products and services, including index funds, mutual funds, stocks, bonds, corporate pensions, options, derivatives, and more. They also provide wealth management services, insurance products, and corporate finance advisory services. Victory Securities is known for its competitive fees, user-friendly trading platforms, and educational resources. However, their fee structure are complex, and some account types require additional documentation.

Pros and Cons of Victory Securities

Pros:

Regulation: Victory Securities is a regulated firm overseen by the Securities and Futures Commission (SFC) of Hong Kong. This adds a layer of security and accountability, as the SFC enforces regulations designed to protect investors.

Investment Options: Victory Securities offers a diverse range of investment products and services. This satisfies various investor needs and risk tolerances, including index funds, mutual funds, stocks, bonds, corporate pensions, options, derivatives, and more. They also provide wealth management services, insurance products, and corporate finance advisory services.

Trading Platforms: Victory Securities provides multiple trading platforms to suit different preferences. This includes VictoryX, a mobile app for real-time transactions, a Securities Trading Mobile App, and a Securities Trading desktop application. The recent addition of the “Simplified Direct Debit Authorization” function in the VictoryX app streamlines the process of making real-time transfers for users on the go.

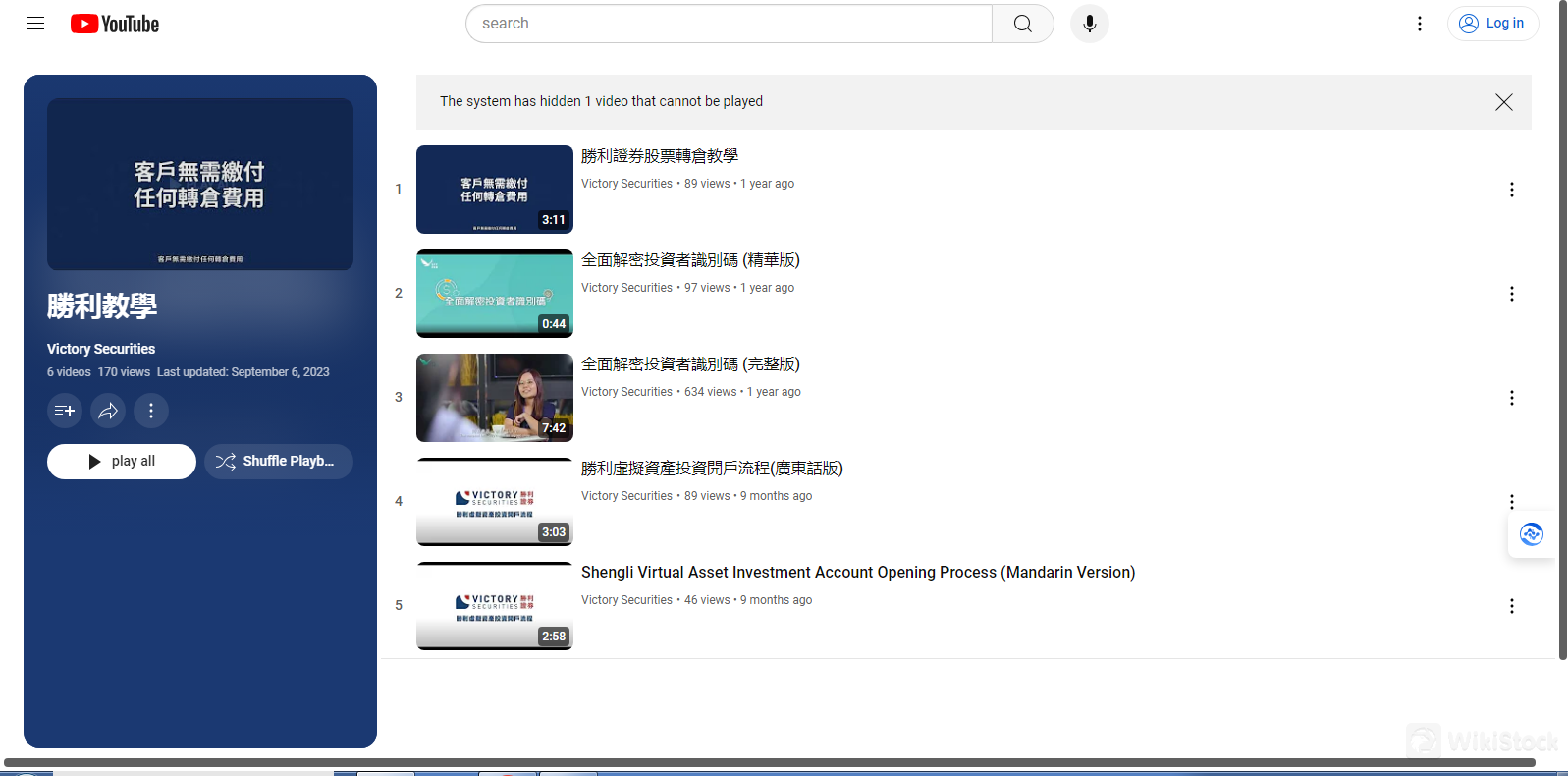

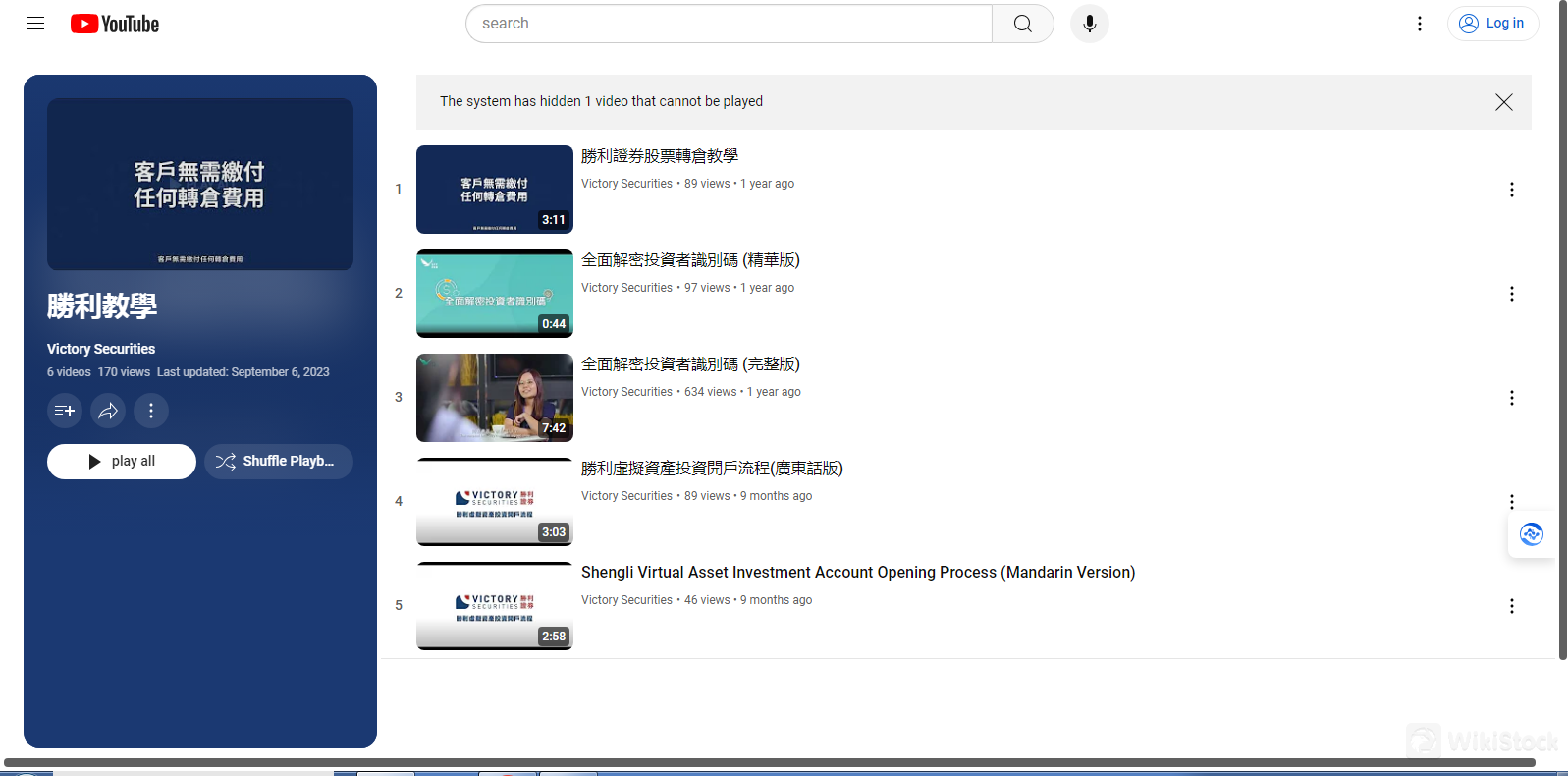

Educational Resources: Victory Securities offers educational resources like instructional videos, FAQs, and guides. These resources can be valuable for new or existing clients to learn about investing, navigate the platforms, understand financial instruments, and manage risk.

Customer Support: Clients have various options to receive customer support, including phone numbers, email addresses, and in-person visits. This allows them to reach the appropriate department for inquiries related to securities services, asset management, insurance, or other investment products.

Cons:

Complex Fee Structure: Victory Securities has a complex fee structure with various minimum fees depending on the investment product and service chosen. This can make it challenging for new investors to understand the total cost associated with their trades.

Account Requirements: While Victory Securities offers various account types, some require additional documentation. For example, opening a Virtual Asset Account requires additional documents compared to a Personal Account.

Is Victory Securities Market safe?

Regulations

Victory Securities is a regulated securities firm in Hong Kong with license number ABN091. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The firm is authorized to conduct business in a variety of areas, including index funds, mutual funds, stocks, bonds/fixed income, corporate pensions, leverage, options, derivatives, cash business, and securities consulting.

Funds Safety

Victory Securities, like other brokerage firms, provides insurance coverage for its customers' accounts through the Securities Investor Protection Corporation (SIPC). The SIPC protects customer accounts against the loss of cash and securities, such as stocks and bonds, held at financially troubled SIPC-member brokerage firms. The standard coverage limit is $500,000 per customer, which includes up to $250,000 for cash claims.

Safety Measures

Victory Securities use 256-bit AES encryption for all stored customer data, including personal and financial information. All client transaction data is encrypted using TLS 1.2 during transmission. To prevent unauthorized access, they utilize firewalls and other security measures. Clients are required to use strong passwords containing at least 8 characters, including uppercase and lowercase letters, numbers, and special characters. They also offer two-factor authentication (2FA), requiring a one-time code sent via SMS or generated by an authentication app, in addition to the password. The system is regularly monitored to detect and block suspicious activities.

What are securities to trade with Victory Securities?

Victory Securities offers a variety of wealth management services, including investment products, financial solutions, and brokerage services. They can help you create a personalized wealth management plan that meets your needs and risk tolerance.

Victory Securities also offers insurance products to help you manage risks and protect your assets. They offer a wide range of insurance products, including life insurance, health insurance, and home insurance.

In addition, Victory Securities provides corporate finance advisory services to businesses. They can help businesses with mergers and acquisitions, initial public offerings (IPOs), and other capital market transactions.

Victory Securities Accounts

There are three types of accounts offered by Victory Securities: Personal Account, Company Account and Virtual Asset Account.

For Personal Account, applicants can be Hong Kong residents or Mainland China residents. Documents required include Hong Kong Resident Identity Card, address proof, email address and Hong Kong bank account number.

Company Account can be opened by HK companies or Overseas Companies. Documents required include board resolutions, ID/Passport and address proof for directors, authorized persons and authorized signatories, company incorporation certificate, address proof, bank account information, company annual return documents, business registration certificate and organization chart.

Virtual Asset Account can only be opened by professional investors who already have a Personal Account or Company Account with Victory Securities. Additional documents required include VA additional agreement, risk disclosure statement, knowledge questionnaire and professional investor assessment form.

Victory Securities Fees Review

Victory Securities charges various fees depending on the investment product and service.

Virtual Asset Trading: Commission fee is 0.25% to 1% with a minimum fee. An insurance coverage fee of 0.1% of the monthly portfolio value will also be deducted.

Trading Commission: Fee varies depending on the market and account type. It can be as low as 0.25% with a minimum fee or a fixed commission rate.

Other Fees: There are various other fees such as exchange fees, stamp duty, custody fee, inactivity fee, and account management fee.

Victory Securities App Review

Victory Securities offers multiple trading platforms including VictoryX, a mobile app for real-time transactions, a Securities Trading Mobile App, and a Securities Trading desktop application. They recently launched a new “Simplified Direct Debit Authorization” function allowing clients to easily set up and make real-time transfers through the VictoryX app. This streamlines the transaction process for users on the go.

Research and Eduation

Victory Securities appears to offer several educational resources for its clients.These resources can be a valuable tool for new or existing clients to learn about investing and using Victory Securities' services.

Instructional Videos could cover a variety of topics related to investing, trading platforms, specific products, or market trends. They would likely be helpful for visual learners who prefer video explanations.

FAQ (Frequently Asked Questions) section would likely address common questions clients have about various aspects of investing, account management, or using Victory Securities' platforms. It's a good resource for quick answers to basic questions.

Guides could be downloadable documents or online resources that provide more in-depth information on specific topics. They might cover things like investment strategies, navigating the platform, understanding financial instruments, or risk management.

Customer Service

Victory Securities offers a variety of customer support options, including phone numbers, email addresses, and in-person support. Clients can contact the general customer service line or reach out to specific departments for inquiries related to securities services, asset management, insurance, or other investment products.

Here's a table summarizing the contact information:

Conclusion

Victory Securities is a regulated Hong Kong brokerage firm offering a diverse range of investment products and services, including wealth management, insurance, and corporate finance advisory. Their competitive fees, user-friendly trading platforms, and educational resources make them a compelling choice for many investors.

FAQs

Is Victory Securities a safe and legitimate broker?

Yes, Victory Securities is a regulated firm in Hong Kong by the Securities and Futures Commission (SFC). This adds a layer of security and accountability.

What are the fees associated with investing through Victory Securities?

Victory Securities has a complex fee structure with various minimums depending on the chosen product and service.

Does Victory Securities offer educational resources for investors?

Yes, Victory Securities provides educational resources such as instructional videos, FAQs, and guides.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)