Deutsche Bank is the leading German bank with strong European roots and a global network. The bank focuses on its strengths in a Corporate Bank newly created in 2019, a leading Private Bank, a focused investment bank and in asset management. Deutsche Bank provides financial services to companies, governments, institutional investors, small and medium-sized businesses and private individuals.

What is Deutsche Bank?

Deutsche Bank is a leading German multinational investment bank and financial services company. Founded in 1870, it has a long history and extensive global presence, with a network of branches in over 70 countries. Deutsche Bank offers a wide range of financial services to individuals, small and medium-sized businesses, corporations, and governments. The bank is divided into four main divisions: the Private Bank, the Corporate Bank, the Investment Bank, and DWS (Asset Management). These divisions offer services such as wealth management, investment banking, commercial banking, and asset management.

Despite its historical significance and extensive service offerings, Deutsche Bank currently operates without a valid securities license.

Pros & Cons of Deutsche Bank

Pros:

Global Reach: Deutsche Bank boasts a vast network with over 1,400 branches worldwide, offering access to financial services in many countries.

Wide Range of Services: They cater to a diverse clientele through their four main divisions, providing services like wealth management, investment banking, commercial banking, and asset management for individuals, businesses, and institutions.

Experience and Reputation: Founded in 1870, Deutsche Bank has a long history and is a recognized name in the financial industry.

Sustainable Investment Options: Deutsche Bank offers financial products that consider environmental and social responsibility factors alongside financial returns.

Cons:

Regulatory Issues: A lack of a valid securities license suggests potential regulatory issues, which poses a risk for clients.

Complexity and Size: The bank's large and complex structure can lead to operational inefficiencies and challenges in providing consistent service across all regions and divisions.

Unclear Fees: Information on account minimums, account fees, and interest rates is unavailable, potentially leading to higher costs for clients.

Is Deutsche Bank Safe?

Determining the safety of Deutsche Bank involves considering various factors. As one of the largest financial institutions in the world, Deutsche Bank has a significant presence and a long history and global presence. This suggests a certain level of stability.

However, there is a lack of effective regulation for their brokerage services. Effective regulation is essential for ensuring a banks operations are transparent, secure, and in line with legal standards. The absence of regulation can pose risks for customers in terms of reduced oversight and fewer protections. Therefore, we can not definitely say that Deutsche Bank is completely safe.

Services

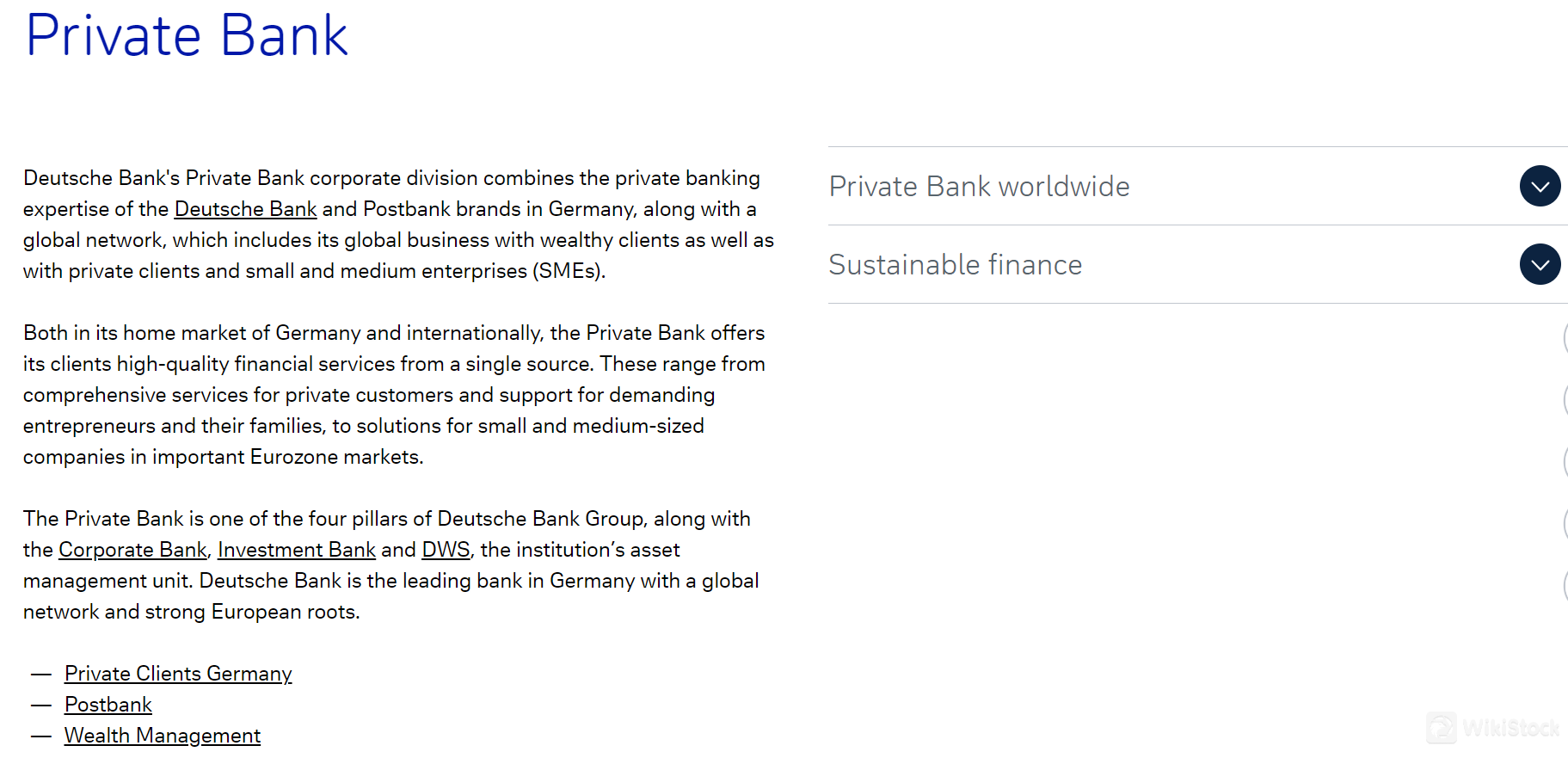

Deutsche Bank offers a wide range of financial services through its various divisions, serving both individual and institutional clients.

Private Banking: The Private Bank division offers wealth management services, including investment management, financial planning, and customized banking solutions for high-net-worth individuals and families.

Corporate Banking: Deutsche Bank provides cash management, trade finance, lending, and treasury solutions to corporate clients, helping them manage finances and support growth.

Investment Banking: Deutsche Bank's Investment Bank offers services such as mergers and acquisitions, equity and debt capital markets, and strategic advisory services to help clients raise capital and achieve strategic goals.

Asset Management: Through its DWS division, Deutsche Bank offers a range of investment products including mutual funds and ETFs, catering to both individual and institutional investors.

What are Securities to Trade with Deutsche Bank?

Deutsche Bank offers various investment products, including mutual funds, through its asset management division (DWS). Mutual funds are pooled investment vehicles that invest in a diversified portfolio of securities, such as stocks, bonds, or real estate, depending on the fund's investment objective.

Thematic Funds: These funds invest in companies that are expected to benefit from specific themes or trends, such as technological innovation, sustainability, or demographic shifts.

Equity Funds: Equity funds invest primarily in stocks or shares of companies. They can focus on specific regions, industries, or market capitalization (such as large-cap, mid-cap, or small-cap stocks).

Bond Funds: Bond funds invest in fixed-income securities, such as government bonds, corporate bonds, or municipal bonds. These funds may vary in terms of risk and return potential based on the types of bonds they hold.

Mixed Funds: Mixed funds, also known as balanced funds, invest in a mix of stocks, bonds, and other securities. They are designed to provide a balanced approach to investing, offering potential for growth and income.

Open-ended Real Estate Funds: These funds invest in real estate properties, such as commercial buildings, residential complexes, or real estate investment trusts (REITs). They provide exposure to the real estate sector without the need to directly own physical properties.

Deutsche Bank App Review

Deutsche Bank offers a comprehensive platform catering to a wide range of financial needs for individuals, businesses, and institutions.

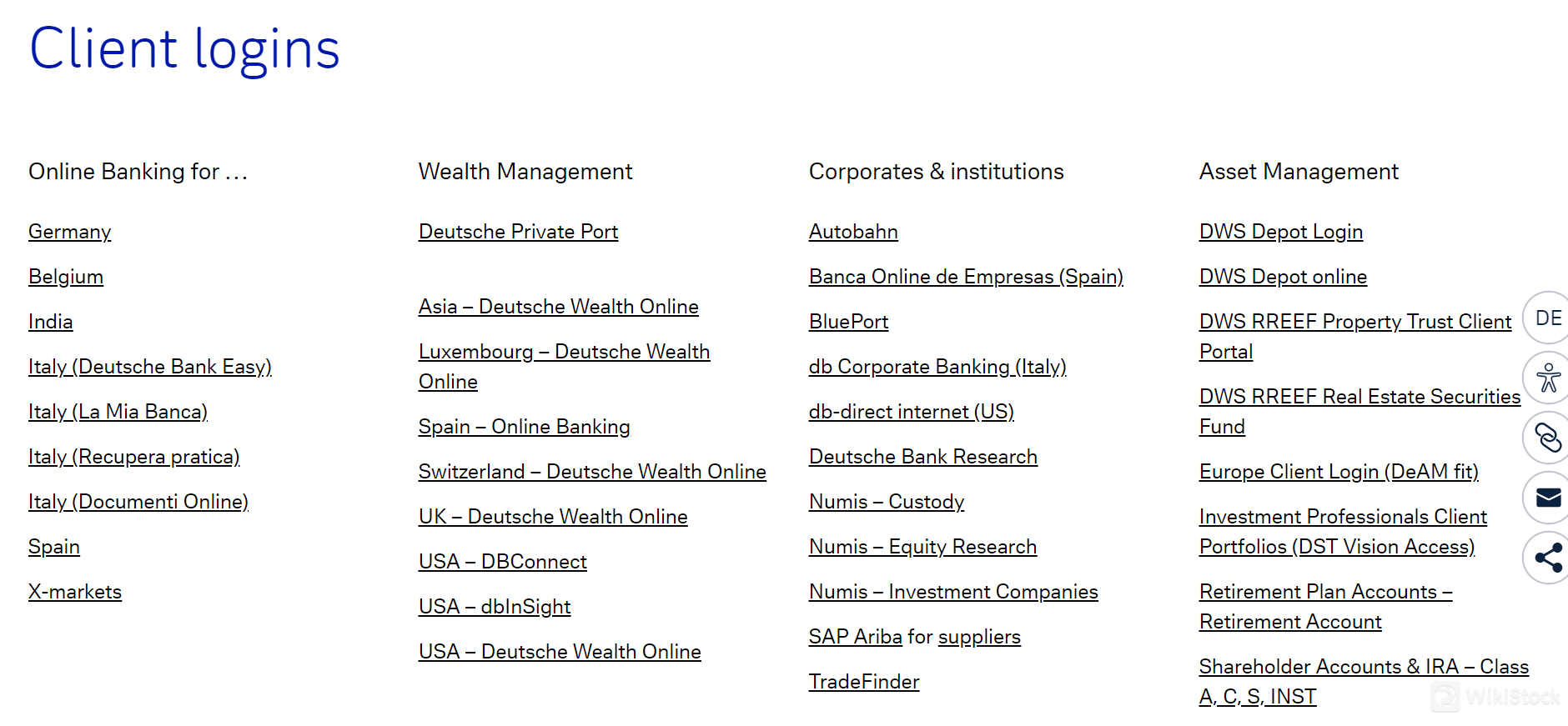

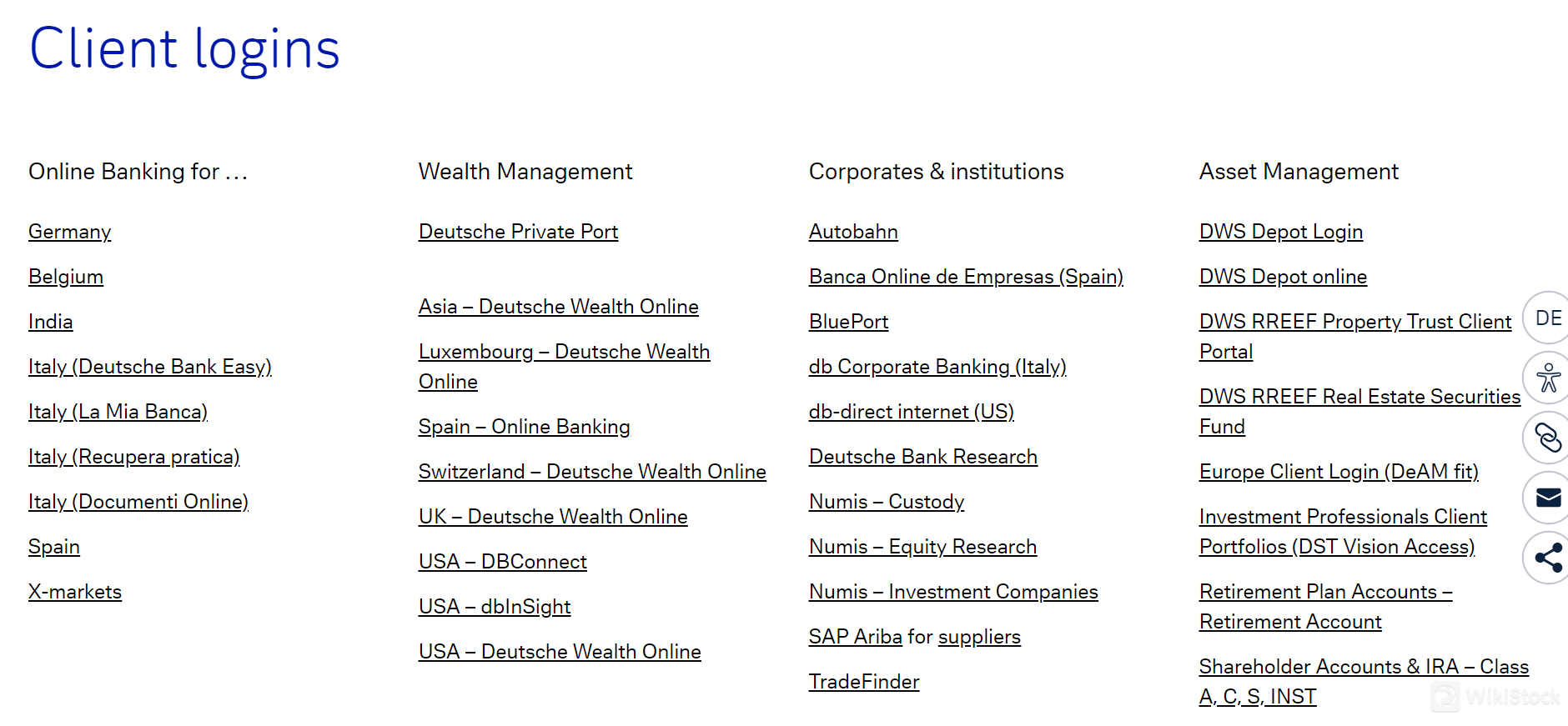

Their online banking services provide convenient access for clients across several countries, including Germany, Belgium, India, Italy, Spain, and more.

For wealth management, Deutsche Bank offers the Deutsche Private Port platform, along with specific platforms for different regions like Asia, Luxembourg, Spain, Switzerland, the UK, and the USA, providing tailored services to meet the needs of their clients worldwide.

In the corporate and institutional banking sector, Deutsche Bank offers platforms like Autobahn, BluePort, and db Corporate Banking, providing a suite of services including cash management, trade finance, and investment banking solutions. These platforms cater to businesses of all sizes, from small enterprises to large corporations, offering a range of digital tools and services to facilitate efficient financial management.

For asset management, Deutsche Bank's platform includes DWS Depot Login and DWS Depot online, providing clients with access to a wide range of investment products and services. Additionally, their platforms for retirement accounts and shareholder accounts offer convenience and flexibility for managing investments.

Additionally, if you prefer mobile banking, Deutsche Bank also offers mobile apps for Android and iOS devices. You can find all of the Deutsche Bank Apps on Google Play or the Apple App Store.

Research & Education

Deutsche Bank's Research and Education initiatives are geared towards providing valuable insights, knowledge, and thought leadership to its clients and the public.

Through collaborations with industry partners and internal teams, Deutsche Bank produces research papers, articles, and reports on various topics, including blockchain interoperability, healthcare, labor market transformations, and sustainable mobility. These efforts aim to keep clients informed about emerging trends, technologies, and societal issues, empowering them to make informed decisions.

The bank's educational endeavors extend to promoting skills development and re-skilling programs, such as the “Skills DNA” initiative, which addresses the transformation of global labor markets. Deutsche Bank also supports initiatives related to climate change, social responsibility, and governance, providing clients with resources to integrate environmental, social, and governance (ESG) considerations into their investment processes.

Customer Service

Deutsche Bank offers customer service through various channels. For general inquiries, you can contact them by phone at the following numbers.

English-language customer service: +49(69)910-10000 (Monday to Friday, 8 am - 8 pm)

Service Hotline for International Students: +49(69)910-10006

For other inquiries, you can email Deutsche Bank at deutsche.bank@db.com.

For specific inquiries related to online banking, security topics, phishing, PIN/TAN numbers, banking terminals, lost or stolen credit cards, loans, savings, and other similar topics, it's recommended to visit the relevant section of your local Private Bank website or contact the appropriate office directly.

Additionally, Deutsche Bank also has a presence on social media, such as Facebook, Twitter, and YouTube.

Conclusion

Deutsche Bank is a global financial services company with a long history and extensive reach. It offers a wide range of services, including wealth management, investment banking, commercial banking, and asset management. While Deutsche Bank boasts a strong reputation and experience, some potential downsides need consideration. The lack of a valid securities license, the unclear fee structure, and the bank's complex structure indicate risks associated with it.

Whether Deutsche Bank is a good fit for you depends on your specific needs and risk tolerance. It is recommended to choose a well-regulated company.

Frequently Asked Questions (FAQs)

What services does Deutsche Bank offer?

Deutsche Bank offers a wide range of financial services through its four main divisions: Private Bank, Corporate Bank, Investment Bank, and DWS (Asset Management).

What investment products can I trade with Deutsche Bank?

Deutsche Bank offers various investment products through its asset management division (DWS), including a diversified portfolio of securities such as stocks, bonds, or real estate.

Does Deutsche Bank offer mobile banking?

Yes, Deutsche Bank offers mobile banking apps for both Android and iOS devices.

Is Deutsche Bank Regulated?

No, Deutsche Bank operates without a valid securities license.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Italy

ItalyObtain 1 securities license(s)

--

--