Score

中國公平集團

https://www.gongpinggroup.com/zh_hk

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

3

Futures、Investment Advisory Service、Stocks

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Derivatives Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01921

Brokerage Information

More

Company Name

中國公平集團有限公司

Abbreviation

中國公平集團

Platform registered country and region

Company address

Company website

https://www.gongpinggroup.com/zh_hkCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 2153

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Senegal

109350.76%Kyrgyzstan

98645.80%Lebanon

743.44%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.118%

Funding Rate

8.88%

New Stock Trading

Yes

Margin Trading

YES

| GongPing Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Commissions:From HK$2 to HK$10 |

| Interests on uninvested cash | N/A |

| Margin Interest Rates | 10% |

| Mutual Funds Offered | Stocks(Hong Kong and Mainland),warrant, CBBC (Callable Bull/Bear Contracts),futures,option,Margin stock service |

| Platform/APP | Ayers Security Code,HK Express,Fair Securities,Tele-Trend and other many apps |

What is GongPing Securities?

GongPing Securities is a financial services firm specializing in brokerage and asset management, offering a variety of trading platforms such as Ayers Security Code, HK Express, and others.

The firm charges commission fees ranging from HK$2 to HK$10 and maintains a margin interest rate of 10%. It provides a wide array of mutual funds and securities, including stocks from Hong Kong and Mainland China, warrants, CBBC, futures, options, and margin stock services, meeting diverse investment needs.

However, its margin rate might limit frequent leveraged trading.

Pros & Cons

| Pros | Cons |

| Multiple Tradable Assets(From commodities to Precious Metal) | No 24/7 Live Chat |

| Regulated by SFC | No Promotion For Users |

| Diverse Trading Platform Version(Over 4 Platforms) | No Diverse Account |

| Low Commissions (From HK $2) |

Pros:

GongPing Securities offers a range of tradable assets, including commodities and precious metals, which appeals to diverse investment preferences. The firm is regulated by the Securities and Futures Commission (SFC), adding a layer of security and trust for its clients. Additionally, it features low commission rates starting from HK$2, making it cost-effective for frequent traders. The availability of over four different trading platforms also provides flexibility and choice to meet various trading needs.

Cons:

On the downside, GongPing Securities does not provide 24/7 live chat support, potentially limiting immediate assistance for international clients. The absence of promotional incentives may also make it less attractive to new or existing clients looking for added value. Furthermore, the lack of diverse account types could be a drawback for traders seeking specific features or customization options in their trading accounts.

Is GongPing Securities Safe?

Regulations:

Funds Safety:

Safety Measures:

Stocks (Hong Kong and Mainland): This encompasses a range of equities from both the Hong Kong and Mainland China stock markets, allowing investors to buy and sell shares of publicly listed companies in these regions.

Warrants: These are derivatives that give the holder the right, but not the obligation, to buy or sell a security—most commonly an equity—at a certain price before the expiration date.

CBBC (Callable Bull/Bear Contracts): These are structured financial instruments that offer investors an opportunity to speculate on the rise (Bull) or fall (Bear) of the underlying asset or market index. They have a mandatory call feature that can be activated under certain conditions.

Futures: Futures contracts are agreements to buy or sell an underlying asset at a predetermined price at a specified time in the future. These can include a wide range of assets such as commodities, currencies, or financial instruments.

Options: Options are financial derivatives that provide the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price within a set time period.

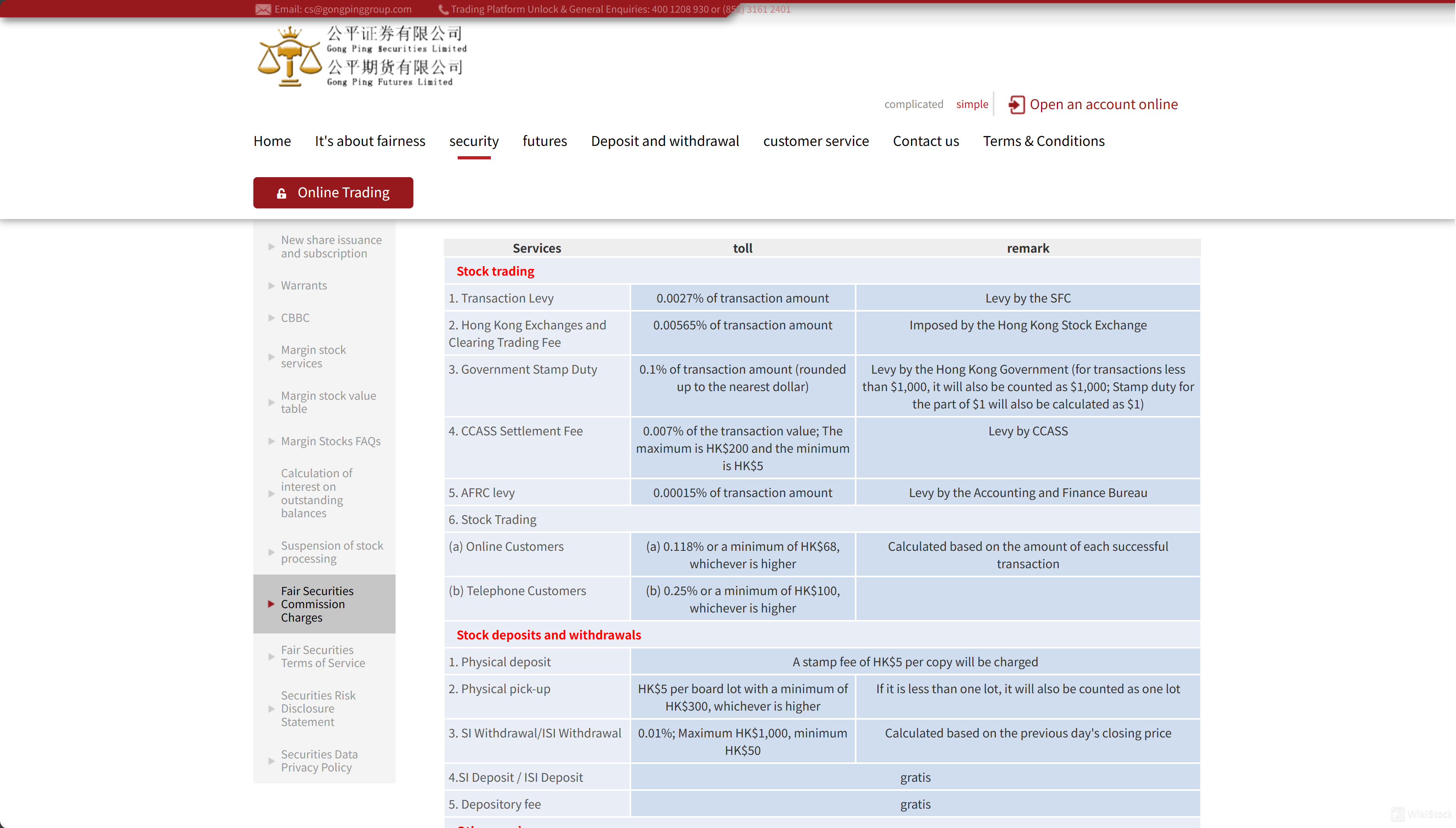

Transaction Levy: Imposed at 0.0027% of each transaction amount by the Securities and Futures Commission (SFC).

Hong Kong Exchange and Clearing (HKEX) Trading Fee: Charged at 0.00565% of each transaction amount.

Government Stamp Duty: Levied at 0.1% of each transaction amount, with a minimum charge of HK$1 even for amounts less than HK$1. Transactions under HK$1,000 are assessed as if they were HK$1,000; stamp duties under HK$1 are rounded up to HK$1.

Central Clearing Charge: 0.007% of each transaction amount, with a cap at HK$200 and a minimum of HK$5, collected by the Central Clearing House.

Levy by Financial Reporting Council: 0.00015% of each transaction amount.

Stock Buying and Selling Commission:

For online clients: 0.118% or a minimum of HK$68, whichever is higher, per successful transaction.

For phone clients: 0.25% or a minimum of HK$100, whichever is higher.

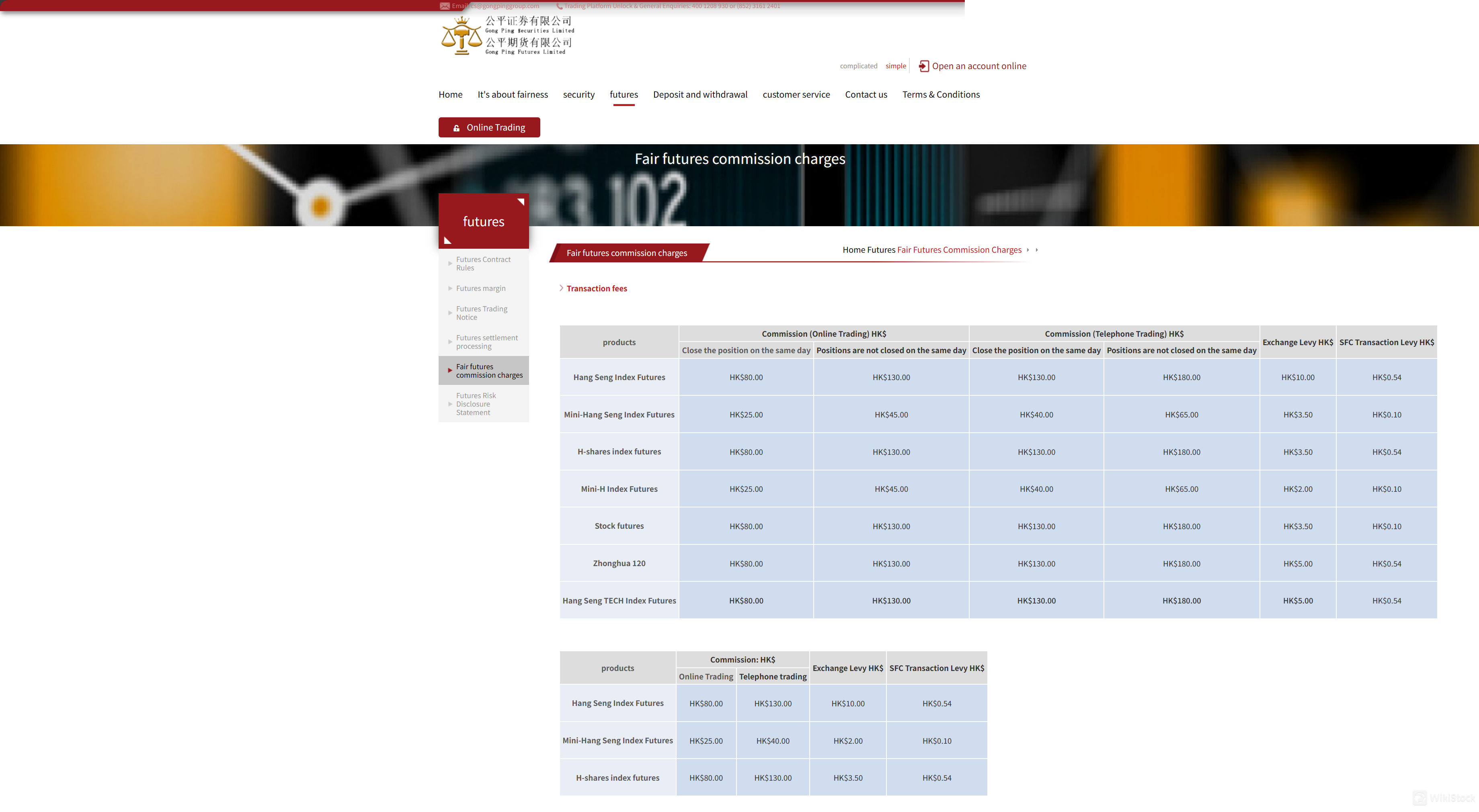

Hang Seng Index Options:

Online Trading: HK$40 for same-day square-off, HK$65 for non-same-day square-off.

Phone Trading: HK$65 for same-day square-off, HK$90 for non-same-day square-off.

Exchange Fee: HK$10.

SFC Transaction Levy: HK$0.54.

Mini Hang Seng Index Options:

Online Trading: HK$12.50 for same-day square-off, HK$22.50 for non-same-day square-off.

Phone Trading: HK$20 for same-day square-off, HK$32.50 for non-same-day square-off.

Exchange Fee: HK$3.50.

SFC Transaction Levy: HK$0.10.

H-Share Index Options:

Same rates as Hang Seng Index Options.

Mini H-Share Index Options:

Same rates as Mini Hang Seng Index Options.

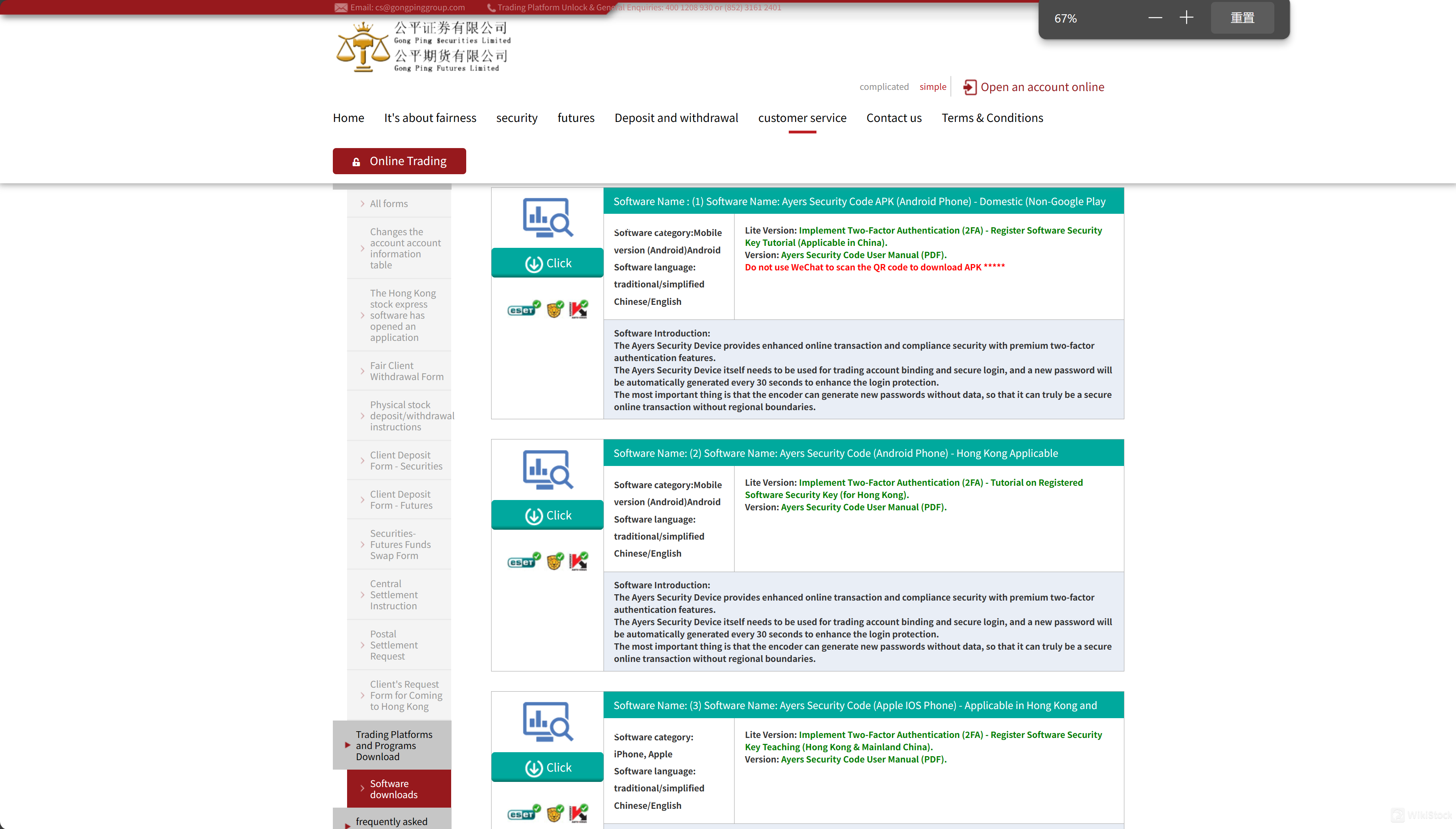

Ayers Security Code APK: For Android users in Mainland China, featuring two-factor authentication (2FA) and password generation every 30 seconds, available in simplified/traditional Chinese and English.

Ayers Security Code (Android & iOS): Tailored for Hong Kong and Mainland China, offering similar security features across both operating systems.

Hong Kong Stocks Express Professional Version: A professional app with real-time Hong Kong stock quotes, expert analysis, and fee rebates based on trading volume.

Fair Hong Kong Stocks Express Standard Version: Provides real-time futures and delayed stock quotes for free.

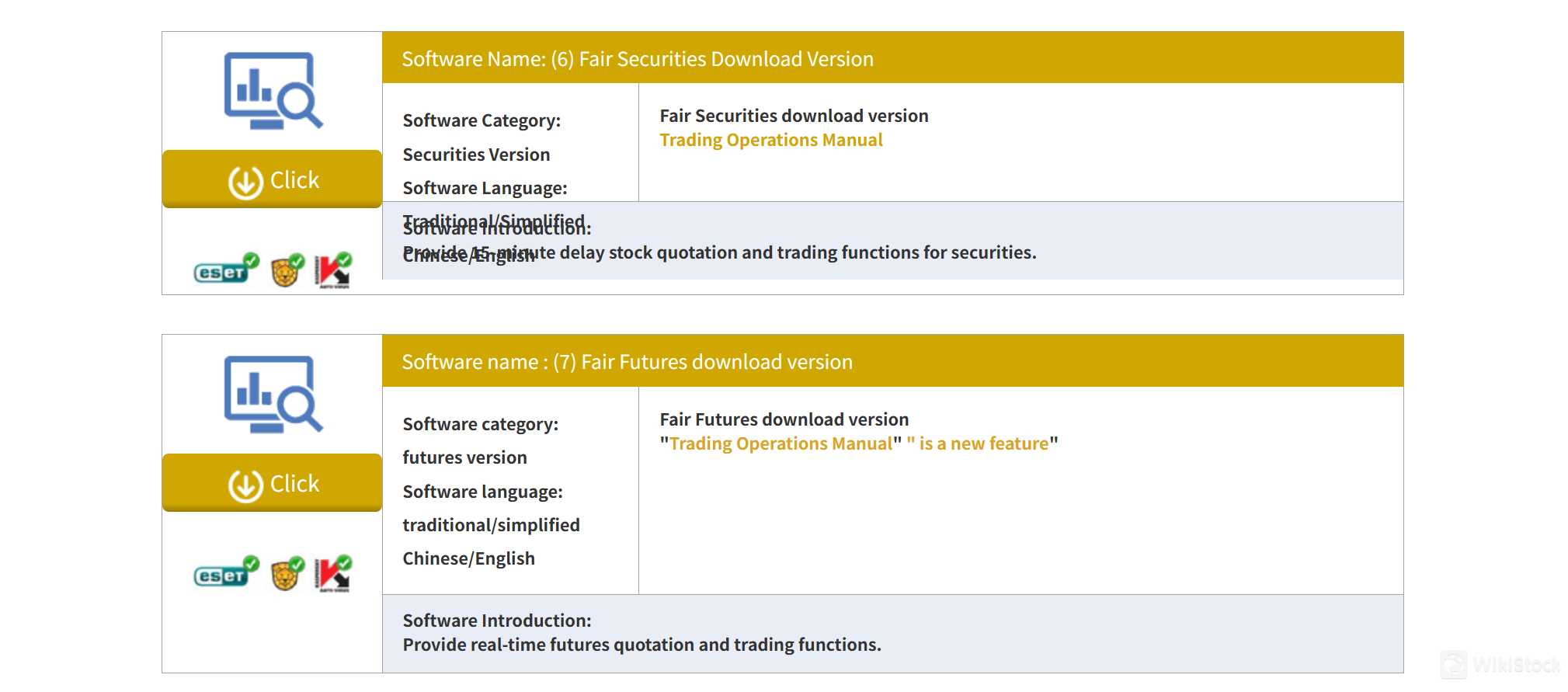

Fair Securities & Fair Futures Download Versions: Dedicated platforms for securities and futures trading with real-time functionality.

Fair Trading Treasure (Tele-Trend) for Android & iOS: Offers real-time and delayed stock quotes.

Tele-Trend: Tele-Trend enhancing platform functionality on various Windows versions.

GongPing Securities is regulated by the Securities and Futures Commission of Hong Kong (SFC), ensuring compliance with strict regulatory standards. The firm holds SFC licenses numbered AVW221 and AXK956, which mandate adherence to high standards of financial integrity and operational security. As an independent statutory body, the SFC ensures that its regulated entities, like GongPing Securities, operate with the utmost transparency and accountability, safeguarding the interests of investors.

GongPing Securities prioritizes the safety of client funds through rigorous internal policies and compliance with Anti-Money Laundering (AML) regulations. These measures are designed to prevent unauthorized access and misuse of client assets, ensuring that all transactions are conducted securely and transparently. This systematic approach underpins the trust that clients place in GongPing Securities, making it a reliable choice for managing investments.

The firm employs a large range of security measures to protect client information and funds. These include strong password policies, regular updates to security protocols, and diligent monitoring for suspicious activities. GongPing Securities also educates its clients on maintaining security through various online tips, helping them protect their accounts from fraudulent activities.

Additionally, the company provides robust support for any security concerns, with dedicated customer service hotlines in China and Hong Kong to address and resolve issues promptly.

What are securities to trade with GongPing Securities?

The products offered by Gong Ping Futures Limited and Gong Ping Securities Limited, as regulated by the Securities and Futures Commission of Hong Kong, typically include a range of financial instruments and services in the futures and securities markets.

Services

The services offered by Gong Ping (presumably a financial services company) is margin stock service.

Margin Stock ServiceThis service allows investors to borrow money to purchase stocks. The stocks themselves are used as collateral for the loan. This enables investors to leverage their positions, potentially increasing their return on investment, but also involves higher risks.

GongPing Securities Fee Review

Here's the revised fee structure for GongPing Securities, detailing commissions for both stocks and options:

| Category | Description |

| Stocks Commissions | |

| Transaction Levy | 0.0027% by SFC |

| HKEX Trading Fee | 0.01% |

| Government Stamp Duty | 0.1% (min HK$1) |

| Central Clearing Charge | 0.007% (max HK$200, min HK$5) |

| Financial Reporting Council Levy | 0.00% |

| Stock Buying/Selling Commission | Online: 0.118% or min HK$68; Phone: 0.25% or min HK$100 |

| Options Commissions (Hang Seng Index) | |

| Online Trading (same-day) | HK$40 |

| Online Trading (non-same-day) | HK$65 |

| Phone Trading (same-day) | HK$65 |

| Phone Trading (non-same-day) | HK$90 |

| Exchange Fee | HK$10 |

| SFC Transaction Levy | HK$0.54 |

| Options Commissions (Mini Hang Seng Index) | |

| Online Trading (same-day) | HK$12.50 |

| Online Trading (non-same-day) | HK$22.50 |

| Phone Trading (same-day) | HK$20 |

| Phone Trading (non-same-day) | HK$32.50 |

| Exchange Fee | HK$3.50 |

| SFC Transaction Levy | HK$0.10 |

Commissions for Stocks:

Commissions for Options:

GongPing Securities Trade Platform Review

The company offers a range of trading platforms for various devices and needs:

Customer Service

Gong Ping Group provides customer support through various channels. Their office is located in Hong Kong at Room D, 8/F, Block B, Yee King Centre, 1 Wang Kwong Road, Kowloon Bay, Kowloon.

For general inquiries and trading platform assistance, customers can contact the main line at (852) 3161 2400 or the specific trading platform support at 400 1208 930 or (852) 3161 2401. For securities and futures trading queries, they offer dedicated lines at 400 1208 929 or (852) 3161 2480.

Account opening inquiries and online customer service can be reached at 400 1208 930 or (852) 3161 2490. They also provide a fax line at (852) 2377 1100 and an email contact at cs@gongpinggroup.com. The postal code for their Hong Kong office is 999077.

Conclusion

GongPing Securities offers a suite of trading services with a detailed and transparent fee structure.

Regulated by the Securities and Futures Commission (SFC) of Hong Kong, the firm ensures compliance with strict regulatory standards. It provides a broad spectrum of tradable assets and utilizes multiple trading platforms to attract both online and phone-based clients.

While its fee structure is competitive, especially in terms of low stock commission rates, the firm lacks 24/7 support and diverse account types, which might be a limitation for some traders.

FAQs

Question: Is GongPing Securities regulated?

Answer: Yes, it's regulated by the SFC.

Question: Does GongPing offer 24/7 customer support?

Answer: No, it does not offer 24/7 support.

Question: Are there any promotions for new clients at GongPing Securities?

Answer: No, GongPing does not offer promotions for new clients.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Futures、Investment Advisory Service、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

公平期货有限公司

Subsidiary

--

公平证券有限公司

Subsidiary

Review

No ratings

Recommended Brokerage FirmsMore

SWHYHK

Score

Ever-Long

Score

VC

Score

Funderstone

Score

国都香港

Score

Cinda International

Score

恒大證券

Score

GoFintech

Score

寶新金融

Score

Anuenue

Score