Score

常匯證券

http://www.stockwellonline.com/

Website

Rating Index

Brokerage Appraisal

Products

2

Futures、Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01253

Brokerage Information

More

Company Name

Stockwell Securities Limited

Abbreviation

常匯證券

Platform registered country and region

Company address

Company website

http://www.stockwellonline.com/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

常匯證券 Earnings Calendar

Currency: HKD

Cycle

FY2023 Annual Report

2025/01/09

Revenue(YoY)

40.82B

+18.67%

EPS(YoY)

8.97

+81.21%

常匯證券 Earnings Estimates

Currency: HKD

- DateCycleRevenue/Estimated

- --2024/H2--/19.201B

- --2024/H1--/20.657B

- 2024/02/212023/H220.882B/20.580B

- 2023/08/012023/H119.940B/20.854B

- 2023/02/212022/H219.028B/18.474B

Internet Gene

Gene Index

APP Rating

| Stockwell |  |

| WikiStocks Rating | ⭐⭐⭐ |

| Fees | Service Fees:HK$399 per month |

| Interests on uninvested cash | 2.13% |

| Mutual Funds Offered | Yes |

| Platform/APP | Real-time online trading platform |

| Promotion | N/A |

Stockwell Information

Stockwell is a financial service provider offering a real-time online trading platform with a service fee of HK$399 per month.

It stands out for its relatively high interest rate of 2.13% on uninvested cash and the availability of mutual funds. However, the lack of promotional offers might be a drawback for some users.

Pros & Cons

| Pros | Cons |

| Multiple Tradable Securities(Stocks,Bonds,EFTs and others) | High Commissions($300 per month) |

| Regulated by SFC | No Education and Analysis Tools |

| Unique Trading Platform(Online Trading Platform) | Limited Information on the Official Website |

Pros:

Stockwell offers multiple tradable securities including stocks, bonds, and ETFs, providing a diverse range of investment options. It is regulated by the SFC, ensuring compliance and security. The platform features a unique and real-time online trading platform, making it user-friendly and efficient for traders.

Cons:

Stockwell charges high commissions at $300 per month, which can be a significant expense for some users. The official website provides limited information, which might be insufficient for some users. Additionally, the platform lacks educational and analysis tools, which could be a drawback for beginners.

Is Stockwell Safe?

Regulations:

Stockwell is regulated by the Securities and Futures Commission (SFC) of Hong Kong, under license number BSM120.

The SFC is an independent statutory body established in 1989 to oversee Hong Kong's securities and futures markets, ensuring compliance with the Securities and Futures Ordinance (SFO) and subsidiary legislation. This regulatory status affirms that Stockwell operates under stringent rules designed to protect investors and maintain market integrity.

Funds Safety:

Stockwell is regulated by the SFC and typically involves adherence to standards that protect client assets, though investors should verify the exact coverage and insurance details directly with Stockwell for assurance.

Safety Measures:

Stockwell employs encryption technologies to safeguard the security of funds storage and protect sensitive client information. While specific account safety measures, such as two-factor authentication or alerts for unusual activities, are not detailed, standard practices usually include these features to prevent unauthorized access and data breaches. Investors are encouraged to confirm the presence of these safety measures directly with the broker.

What are securities to trade with Stockwell?

Stockwell Securities Limited offers a variety of tradable securities for its clients.

Stocks: Stockwell Securities Limited allows clients to trade stocks, providing access to shares of publicly traded companies. This enables investors to participate in the equity markets, with the potential to earn returns through price appreciation and dividends. The firm offers professional advice and market analysis to help clients make informed stock trading decisions.

Futures: Stockwell offers trading in futures contracts, allowing clients to speculate on the future price movements of various assets. This includes financial instruments like commodities, currencies, and market indices. Futures trading can be a powerful tool for hedging risks or seeking speculative gains, supported by Stockwell's market insights and quick execution services.

Index Futures: Clients can also trade index futures with Stockwell, which involves contracts based on the performance of a specific market index. This provides an efficient way to gain exposure to broader market movements, hedge against potential downturns, or leverage market trends. Stockwell's advanced trading platform and up-to-date information services facilitate effective trading in index futures.

Stockwell Fee Review

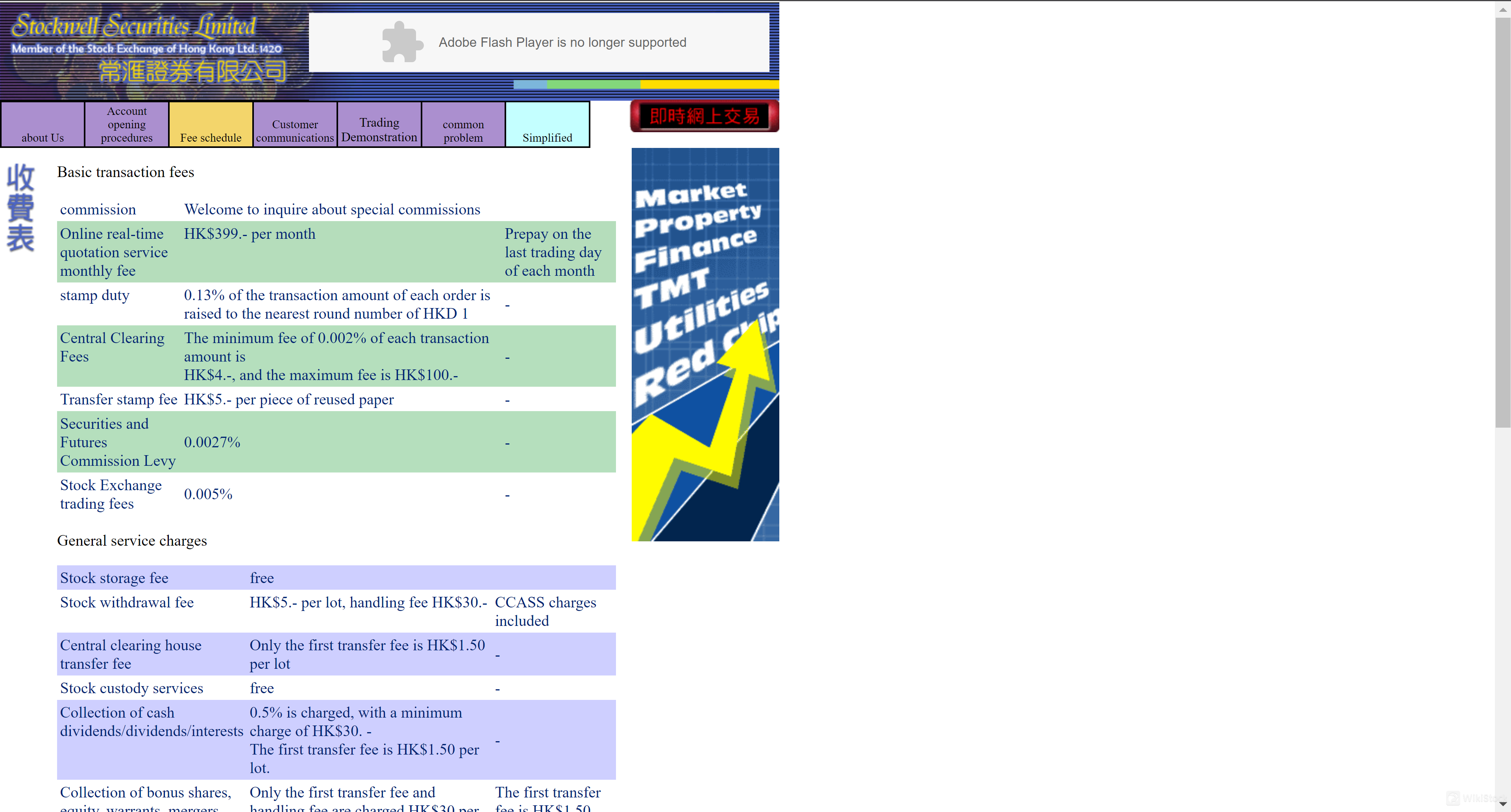

Here's the fee structure for Stockwell Securities Limited:

Basic Trading Fees:

Commission: Special commission rates are available upon inquiry.

Monthly Fee for Real-time Online Quote Service: HK$399, prepaid on the last trading day of each month.

Stamp Duty: 0.1% of the transaction amount, rounded up to the nearest HK$1.

Central Clearing and Settlement System (CCASS) Fee: 0.002% of the transaction amount, minimum charge HK$4, maximum charge HK$100.

Transfer Deed Stamp Duty: HK$5 per transfer deed.

SFC Levy: 0.0027% of the transaction amount.

SEHK Trading Fee: 0.005% of the transaction amount.

General Service Fees:

Stock Depository Fee: Free.

Stock Withdrawal Fee: HK$5 per lot, plus a handling fee of HK$30 (includes CCASS fee).

CCASS Transfer Fee: HK$1.50 per lot, charged only for the first transfer.

Stock Custody Service: Free.

Dividend Bonus Interest Collection Fee: 0.5% of the amount, minimum charge HK$30, plus HK$1.50 per lot for the first transfer.

Bonus Share, Rights Issue, Warrants, Consolidation, Subdivision Collection Fee: HK$30 per transaction, plus HK$1.50 per lot for the first transfer.

Settlement Instruction (SI) - Stock Withdrawal Fee (Stock Deposit Free): HK$2.50 per transaction, handling fee HK$30, CCASS fee: 0.01% of the transaction value, minimum charge HK$2, maximum charge HK$100.

Investor Settlement Instruction (ISI): HK$2.50 per transaction, handling fee HK$30.

Rights Issue Fee: HK$100 per transaction.

Acceptance of Takeover Offer Fee: HK$100 per transaction.

Account Balance Interest: Calculated based on Hong Kong savings deposit interest rates.

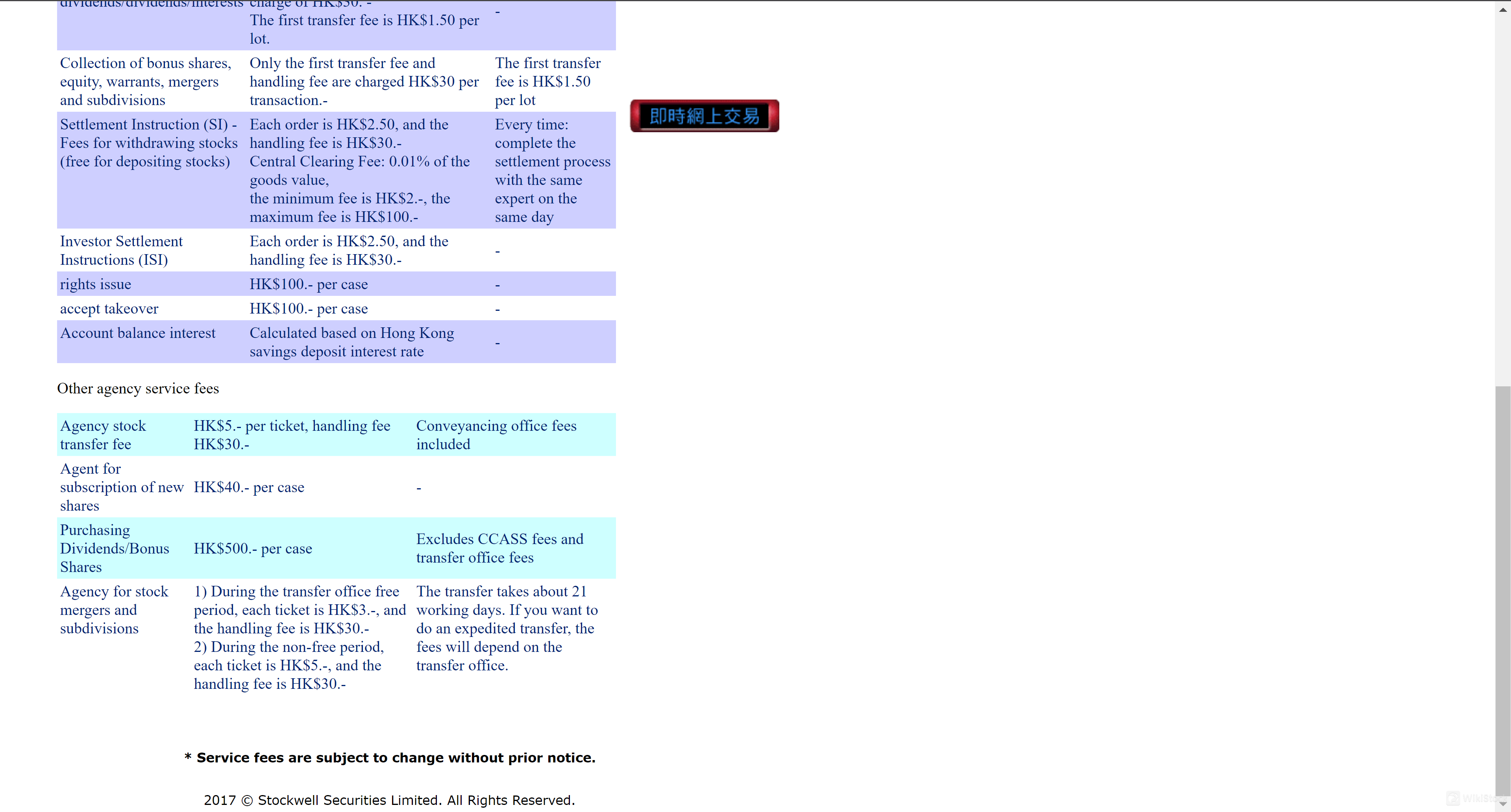

Other Handling Service Fees:

Stock Transfer Fee: HK$5 per transfer deed, handling fee HK$30 (includes transfer office fee).

New Stock Subscription Handling Fee: HK$40 per transaction.

Dividend Bonus Follow-up Fee: HK$500 per transaction, excluding CCASS and transfer office fees.

Stock Consolidation Subdivision Handling Fee:

During free transfer period: HK$3 per transfer deed, handling fee HK$30.

Outside free transfer period: HK$5 per transfer deed, handling fee HK$30 (transfer takes about 21 working days; expedited service fees vary by transfer office).

| Category | Item | Charge | Notes |

| Commission | Special commission rates available upon inquiry | ||

| Real-time Online Quote Service | HK$399 per month | Prepaid on the last trading day of each month | |

| Stamp Duty | 0.13% of transaction amount, rounded up to nearest HK$1 | ||

| CCASS Fee | 0.002% of transaction amount | Minimum charge HK$4, maximum charge HK$100 | |

| Transfer Deed Stamp Duty | HK$5 per transfer deed | ||

| SFC Levy | 0.0027% of transaction amount | ||

| SEHK Trading Fee | 0.005% of transaction amount | ||

| General Service Fees | Stock Depository Fee | Free | |

| Stock Withdrawal Fee | HK$5 per lot | Handling fee HK$30 (includes CCASS fee) | |

| CCASS Transfer Fee | HK$1.50 per lot | Charged only for the first transfer | |

| Stock Custody Service | Free | ||

| Dividend Bonus Interest Collection Fee | 0.5% of amount | Minimum charge HK$30, plus HK$1.50 per lot for the first transfer | |

| Bonus Share, Rights Issue, Warrants, Consolidation, Subdivision Collection Fee | HK$30 per transaction | Plus HK$1.50 per lot for the first transfer | |

| Settlement Instruction (SI) - Stock Withdrawal Fee (Stock Deposit Free) | HK$2.50 per transaction | Handling fee HK$30, CCASS fee: 0.01% of transaction value, minimum charge HK$2, maximum charge HK$100 | |

| Investor Settlement Instruction (ISI) | HK$2.50 per transaction | Handling fee HK$30 | |

| Rights Issue Fee | HK$100 per transaction | ||

| Acceptance of Takeover Offer Fee | HK$100 per transaction | ||

| Account Balance Interest | Based on Hong Kong savings deposit interest rates | ||

| Other Handling Service Fees | Stock Transfer Fee | HK$5 per transfer deed | Handling fee HK$30 (includes transfer office fee) |

| New Stock Subscription Handling Fee | HK$40 per transaction | ||

| Dividend Bonus Follow-up Fee | HK$500 per transaction | Excluding CCASS and transfer office fees | |

| Stock Consolidation Subdivision Handling Fee | During free transfer period: HK$3 per transfer deed, handling fee HK$30 | Outside free transfer period: HK$5 per transfer deed, handling fee HK$30 (transfer takes about 21 working days; expedited service fees vary by transfer office) |

Stockwell Trading Platform Review

The trading platform used by Stockwell Securities Limited is a real-time online trading platform. This platform provides clients with up-to-date market data, quick execution of trades, and a user-friendly interface, enabling efficient and effective trading of securities.

It is designed to meet the needs of both novice and experienced traders, ensuring that they have the tools necessary to make informed investment decisions.

Customer Service

Stockwell Securities Limited offers customer support through multiple channels. Clients can visit their office at Unit 406-410, 4/F, Tower 2, Silvercord, 30 Canton Road, Tsim Sha Tsui, Kowloon.

For inquiries or assistance, they can contact the support team by phone at (852) 2313 5110 or by fax at (852) 2721 5955. These options ensure that clients have access to support for any issues or questions they may have regarding their trading activities.

Conclusion

Stockwell Securities Limited is a well-established brokerage firm that provides a large range of trading services, including stocks, futures, and index futures. They offer a robust real-time online trading platform, ensuring efficient and effective trading experiences.

With regulatory oversight from the Securities and Futures Commission (SFC) of Hong Kong, Stockwell ensures a secure and reliable environment for its clients. Their customer support is readily available through phone, fax, and in-person visits, addressing clients' needs promptly.

FAQs

What types of securities can I trade with Stockwell Securities?

You can trade stocks, futures, and index futures.

What is the monthly fee for the real-time online quote service?

The monthly fee for the real-time online quote service is HK$399.

How can I contact Stockwell Securities for support?

You can contact them by phone at (852) 2313 5110 or by fax at (852) 2721 5955.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

More than 20 year(s)

New Stock Trading

Yes

Regulated Countries

1

Products

Futures、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

華信集團

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

匯誠證券

Score

SDG Securities (HK)

Score

Siu On Securities

Score

Morton Securities

Score

KFS

Score

GMSL

Score

Wellfull

Score

Jimei Investment

Score

協聯證券

Score

BMI

Score