China Shandong International Asset Management Limited (“CSIAM”) was established in 2019 and was approved by the Securities and Futures Commission (SFC) to engage in Type 1 (Dealing in Securities), Type 4 (Advising on Securities) and Type 9 (Asset Management) regulated activities.As an investment and financing management platform of China Shandong Group Company Limited (“CSGL”) in Hong Kong, CSIAM provides securities trading and asset management service related to fixed income, equity, privatization, mergers and acquisitions investment and financing, cornerstone investment and Pre-IPO services to investors.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is CSIAM?

CSIAM is a reputable investment platform offering a wide array of financial services to cater to the diverse needs of its clients. As an established entity in the financial landscape, CSIAM operates under the regulatory oversight of the Securities and Futures Commission of Hong Kong (SFC), ensuring compliance with stringent standards and regulations. With a focus on securities trading, CSIAM provides clients with access to various investment opportunities, including stocks, bonds, IPO underwriting, and bond underwriting.

Pros & Cons

Pros Regulated by SFC: CSIAM is regulated by the Securities and Futures Commission of Hong Kong (SFC), ensuring compliance and investor protection.

Diverse Range of Trading Securities: CSIAM offers a wide array of trading securities, including stocks, bonds, IPO underwriting, and bond underwriting.

Comprehensive Customer Support: Offers multiple contact methods including phone, email, address, and an contact form, ensuring accessible customer support.

Cons Lack of Fee Information: Detailed fee information such as account minimums, commissions, and interest rates on uninvested cash is not provided.

Platform Information Not Provided: There is no detailed information about the trading platform, including its features, usability, and accessibility. This can be a significant disadvantage for traders who rely on robust and user-friendly platforms for their trading activities.

No Promotions Available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is CSIAM Safe?

CSIAM is regulated by the oversight of the oversight of the Securities and Futures Commission of Hongkong (SFC), holding license No. BNH481. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, CSIAM ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with CSIAM?

CSIAM provides a diverse range of trading securities to cater to the investment needs of its clients.

With a focus on securities trading, clients have access to various financial instruments to build and diversify their portfolios effectively. The platform offers trading in stocks, enabling investors to buy and sell shares of publicly listed companies. Additionally, CSIAM facilitates bond trading, providing access to fixed-income securities issued by governments, municipalities, and corporations.

Moreover, CSIAM offers IPO underwriting services, allowing clients to participate in initial public offerings of companies seeking to raise capital by offering their shares to the public for the first time. Lastly, CSIAM also engages in bond underwriting, assisting governments and corporations in issuing bonds to raise funds for various projects and initiatives.

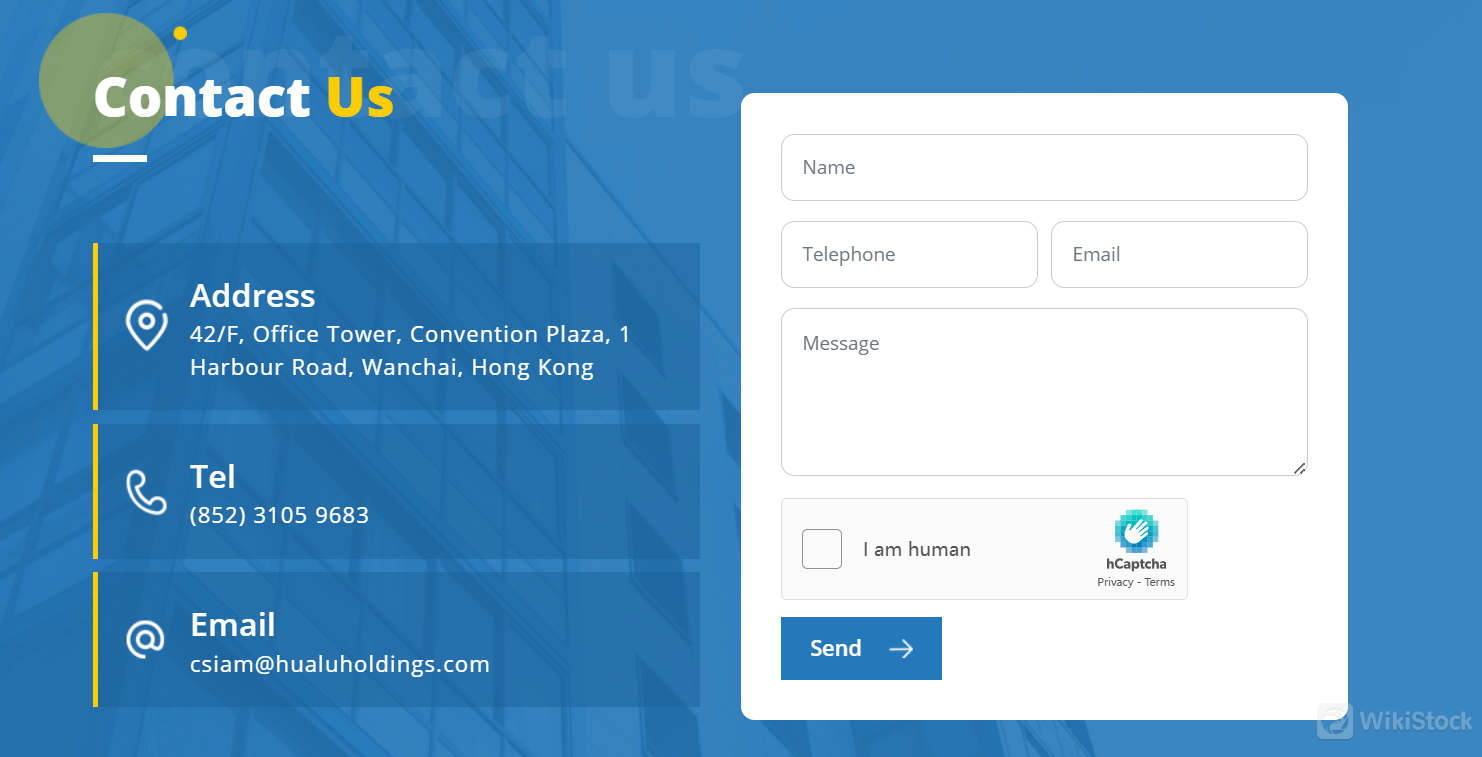

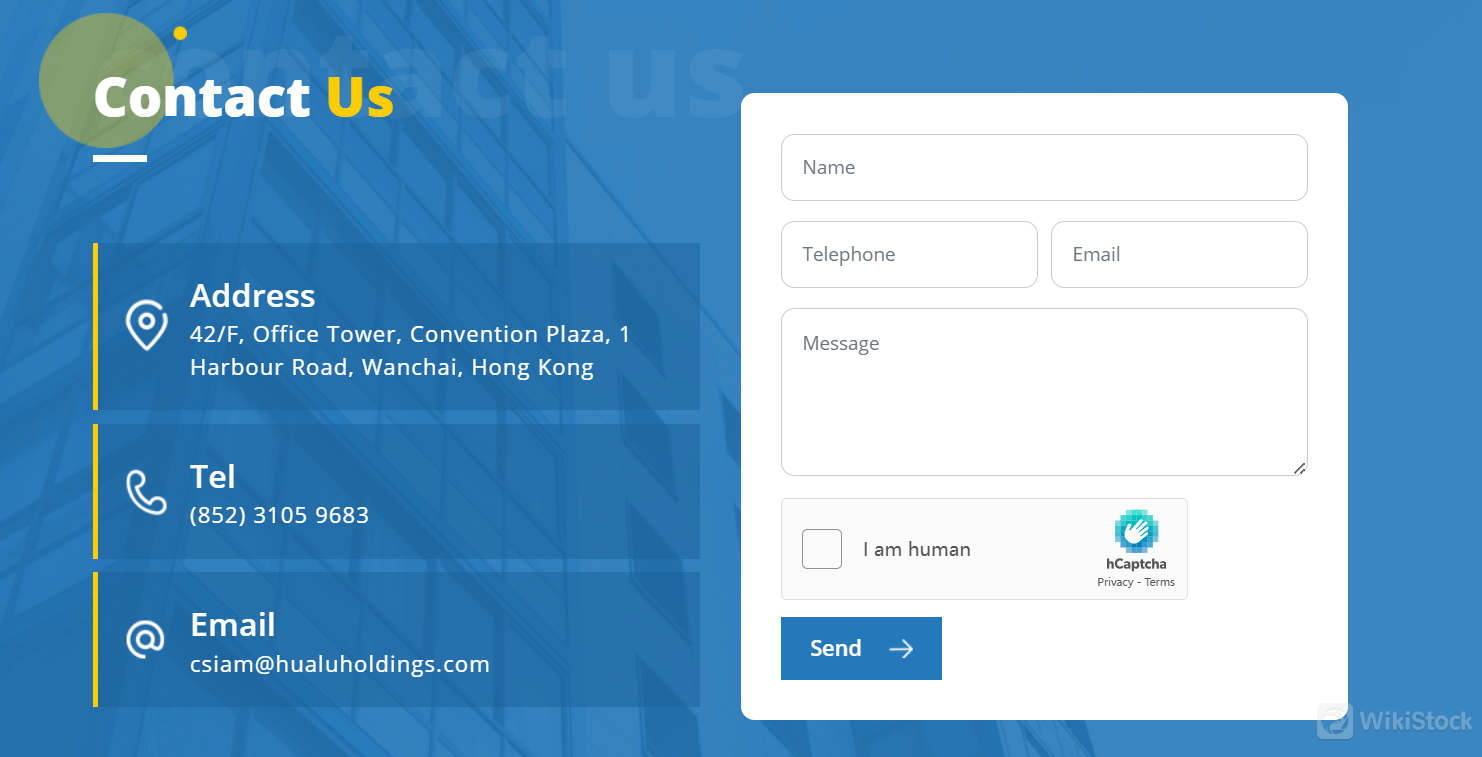

Customer Service

CSIAM provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: 42/F, Office Tower, Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong

Tel: (852) 3105 9683

Email: csiam@hualuholdings.com

Contact form

Conclusion

In conclusion, CSIAM offers a comprehensive suite of trading services regulated by SFC, ensuring compliance with stringent standards and investor protection. With a diverse range of trading securities, CSIAM caters to the investment needs of its clients effectively. Additionally, the provision of accessible customer support channels reflects a commitment to client satisfaction and assistance.

However, the lack of detailed fee information and platform features could be areas for improvement to enhance transparency and provide a more comprehensive trading experience. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is CSIAM suitable for beginners?

CSIAM is not the best choice for beginners due to the lack of detailed fee information and transparency regarding its trading platform.

Is CSIAM legit?

Yes, CSIAM is regulated by the Securities and Futures Commission of Hong Kong (SFC).

What types of securities can I trade with CSIAM?

CSIAM offers a diverse range of trading securities, including stocks, bonds, IPO underwriting, and bond underwriting, providing clients with various investment opportunities.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Ghana

GhanaObtain 1 securities license(s)

--

--