ICBC, or Industrial and Commercial Bank of China, is one of the largest and most prominent banks in China. It is a state-owned financial institution that offers a wide range of banking products and services, including personal and corporate banking, investment banking, wealth management, and international banking. ICBC has a significant presence both domestically and internationally, with a strong emphasis on digital banking services and innovation.

Industrial and Commercial Bank of China (ICBC) provides a range of products and services to its customers, including E-banking, Bank Card, Personal Loan, Personal Deposit, Global Market, and Bill Business. These offerings cater to various financial needs and preferences of individuals and businesses.

E-banking: ICBC offers electronic banking services that allow customers to manage their accounts, make transactions, pay bills, transfer funds, and access financial information online through a secure platform. This service provides convenience and flexibility for customers to conduct their banking activities anytime, anywhere.

Bank Card: ICBC offers a range of bank card options, including debit cards, credit cards, and prepaid cards, that allow customers to make purchases, withdraw cash, and perform other financial transactions both domestically and internationally. Bank cards provide a convenient and secure way for customers to access their funds and make payments.

Personal Loan: ICBC provides personal loan products to help individuals finance various needs and expenses, such as purchasing a home or car, funding education, or covering unexpected costs. Customers can apply for a personal loan with flexible terms and competitive interest rates based on their financial circumstances.

Personal Deposit: ICBC offers personal deposit accounts, such as savings accounts, current accounts, and time deposits, for customers to securely store and grow their funds. These accounts provide options for customers to manage their savings, earn interest, and access their money when needed.

Global Market: ICBC provides global market services, including investment products, foreign exchange services, and trade finance solutions, to assist customers in managing their international financial activities. These services offer opportunities for customers to invest in global markets, conduct foreign currency transactions, and facilitate international trade transactions.

Bill Business: ICBC's bill business service enables customers to conveniently pay bills, such as utility bills, credit card bills, and other expenses, through the bank's platform. Customers can set up automated bill payments, view payment history, and manage their bills in a streamlined and efficient manner.

ICBC Accounts

ICIndustrial and Commercial Bank of China (ICBC) offers personal banking and corporate banking accounts to meet the financial needs of individuals and businesses.

Personal banking accounts cater to individuals looking for a range of banking services, including savings accounts, current accounts, and investment products.

On the other hand, the corporate banking accounts are designed for businesses seeking comprehensive financial solutions, such as loans, trade finance, cash management, and other corporate banking services.

ICBC Fees Review

Industrial and Commercial Bank of China (ICBC) offers a comprehensive range of services and benefits for holders of their Peony Platinum Credit Cards. These premium cards come with a variety of perks, including waived or reduced annual fees based on spending thresholds and the ability to redeem bonus points for fee mitigation.

For Peony Platinum MasterCard Credit Card holders, spending RMB 200,000 or more through RMB/FX accounts in a year can result in an annual fee waiver or reduction on the principal card and any secondary cards. Additionally, cardholders who spend RMB 4 million or more and earn 4 million bonus points can enjoy permanent annual fee waivers. The card also offers waived or reduced fees for services such as inter-city cash advance and payment transfers, statement copies, and loss reporting.

Similarly, Peony Platinum American Express Credit Card holders can benefit from waived or reduced annual fees based on spending thresholds, bonus point redemptions, and fee waivers for certain services. Cardholders who meet the spending criteria can enjoy fee waivers on the principal card and any secondary cards.

ICBC App Review

The ICBC mobile banking app is highly regarded and has received impressive rankings in the “2013 China Top 100 Apps” list. It offers a wide range of features such as account management, market news, wealth management services, and remote interaction with ICBC service staff. Additional services like cash withdrawal appointments and 2D code functionalities enhance the user experience. The app has surpassed 100 million users and witnessed increased transaction volumes.

However, users have reported issues with stability and performance, including frequent crashes and slow loading times. The user interface is considered outdated and not as user-friendly as other banking apps. Customization options and remote interaction with service staff can also be inconsistent. While the app has strengths and innovative services, improvements could be made to enhance the overall user experience.

Research & Education

ICBC provides various research initiatives and resources to enhance understanding and insight into financial trends and developments. These include the Research Institute, China Urban Financial Society, Post-Doctoral Research Center, Periodical, and Research Report offerings.

The Research Institute conducts studies and analyses on economic and financial topics, contributing to industry knowledge and thought leadership.

The China Urban Financial Society engages in research focusing on urban finance and related areas within the Chinese financial landscape.

The Post-Doctoral Research Center supports advanced research in finance and economics through specialized programs and collaborations.

Customers can access periodicals and research reports published by ICBC to stay informed about key industry trends and insights.

Customer Service

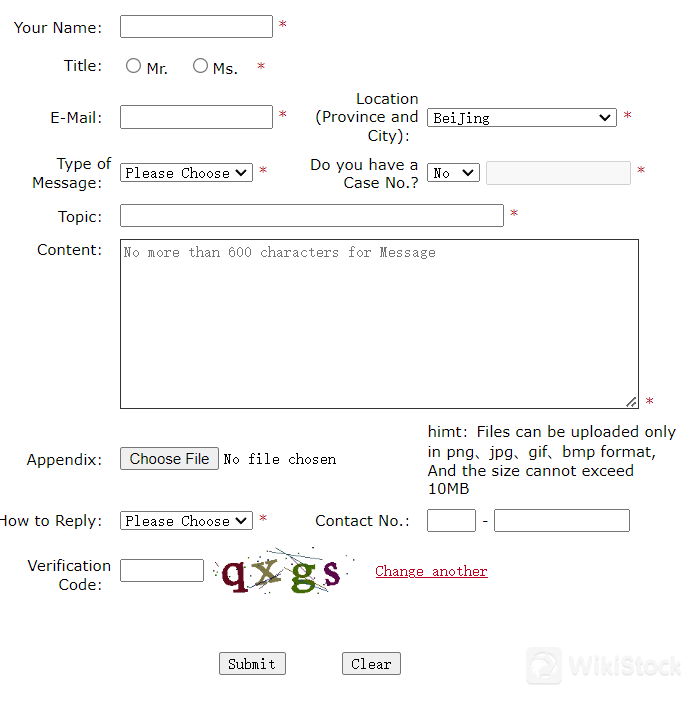

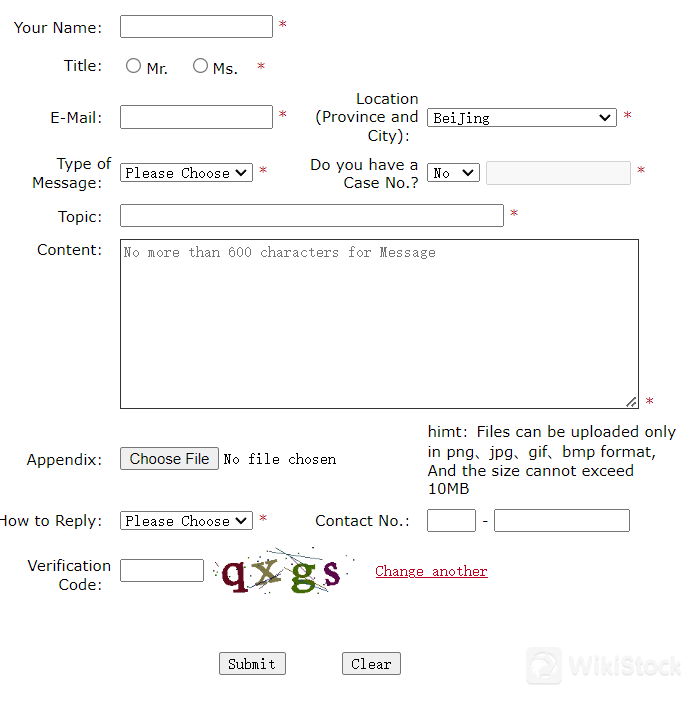

ICBC offers comprehensive customer support to its clients.Clients can reach out to ICBC through various channels.

Telephone: Clients can call their number 95588 for any queries.

Contact form

Company address: No.55 FuXingMenNei Street, Xicheng District, Beijing, P.R.C.

Conclusion

In conclusion, ICBC offers a wide range of banking services with an extensive network of branches and ATMs. Despite its strong financial stability and reputation, the bank faces challenges such as a limited international presence, complex fee structure, and less robust digital banking features. However, ICBC's competitive interest rates, diverse credit card offerings, and reputable status make it a viable choice for customers in China seeking efficient and reliable banking services.

FAQs

Is my money safe with ICBC?

Yes, ICBC is a reputable bank with a strong financial position and regulatory oversight. Deposits in ICBC accounts are typically insured up to a certain amount by the China Deposit Insurance Corporation, providing protection for customers' funds in the event of bank failure.

Can I trade international stocks through ICBC's trading platform?

ICBC offers opportunities to trade international stocks, but the availability and specific procedures may vary. It is recommended to inquire with ICBC for more information on international stock trading options.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China

China