Score

华源证券

https://www.huayuanstock.com/

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China

ChinaProducts

10

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

CSRCRegulated

ChinaSecurities Trading License

Global Seats

![]() Owns 2 seat(s)

Owns 2 seat(s)

China BSE

Seat No. 000119

China SZSE

Seat No. 000659

Brokerage Information

More

Company Name

华源证券股份有限公司

Abbreviation

华源证券

Platform registered country and region

Company address

Company website

https://www.huayuanstock.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 4790

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

China

289660.46%Azerbaijan

74815.61%Macao

4529.44%Tanzania

3527.35%Others

3427.14%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.3%

Funding Rate

7.50%

New Stock Trading

Yes

Margin Trading

YES

| Huayuan Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | N/A |

| Trading Fees | Commission fees capped at 0.03% |

| Account Related Fees | Not required |

| Interests on Uninvested Cash | No |

| Margin Interest Rates | Margin trading rate 7.50% annually; Annual margin lending fee rate 10.35% |

| Mutual Funds Offered | Yes |

| App/Platform | Huayuan Securities app and Huayuan Flash |

| Promotion | No |

Huayuan Securities Information

Huayuan Securities offers a wide range of tradable securities including stocks, bonds, ETFs, and futures. Their services encompass investment banking, asset management, and brokerage.

While their commissions and fees vary, they generally charge up to 0.03%. Headquartered in China, Huayuan Securities operates under the regulatory oversight of the China Securities Regulatory Commission (CSRC), ensuring compliance with industry standards.

Pros and Cons

Huayuan Securities boasts a diverse array of tradable securities, offering investors ample opportunities to build diversified portfolios and explore different investment avenues. This breadth of options empowers investors to tailor their strategies according to their risk tolerance and financial goals. Additionally, the availability of a user-friendly mobile platform enhances accessibility and convenience for clients, enabling them to monitor their investments and execute trades on the go.

However, the brokerage's high commissions, which can reach up to 0.03%, may deter cost-conscious investors seeking more competitive pricing. Furthermore, the absence of research reports may pose a challenge for clients seeking in-depth market analysis and recommendations. While regulated by the CSRC, the brokerage's limited customer support options may also detract from the overall user experience, potentially leaving clients with unresolved queries or concerns.

| Pros | Cons |

| Various tradable securities | High commissions up to 0.03% |

| User-friendly mobile platform available | Lack of research reports |

| Regulated by the CSRC | Limited customer support options |

| Various services provided |

Is Huayuan Securities Safe?

- Regulations:

- Funds Safety:

- Safety Measures:

- Commissions and Fees

- Margin Interest Rate

- Is it safe to trade on Huayuan Securities?

- Huayuan Securities prioritizes the security of its users' assets, employing robust encryption and adhering to regulatory standards to safeguard transactions and personal information.

- Is Huayuan Securities a good platform for beginners?

- Yes, Huayuan Securities offers a user-friendly interface and educational resources, making it suitable for beginners to learn and navigate the world of investing.

- Is Huayuan Securities legit?

- Yes, Huayuan Securities is a legitimate brokerage firm regulated by the China Securities Regulatory Commission (CSRC), ensuring compliance with industry standards and investor protection measures.

- Is Huayuan Securities good for investing/retirement?

- Huayuan Securities offers a variety of investment options and services, making it suitable for individuals looking to build long-term investment portfolios or plan for retirement.

Huayuan Securities holds one securities license issued by the China Securities Regulatory Commission (CSRC), which regulates its operations. The specific license, known as the China Securities Trading License, grants the company authorization to engage in securities trading activities within the country.

Huayuan Securities does not provide insurance coverage for customer account balances. However, as a regulated brokerage firm, it adheres to strict security protocols and regulatory requirements to safeguard client assets and transactions, providing peace of mind to investors despite the absence of insurance protection for account balances.

Huayuan Securities employs a multifaceted approach to security, integrating robust encryption protocols and advanced authentication measures to protect user data and transactions.

Continuous monitoring and regular audits bolster cybersecurity defenses, while comprehensive risk management strategies mitigate potential threats. Furthermore, client education initiatives emphasize awareness of phishing scams and other fraudulent activities, empowering users to make informed decisions and maintain the integrity of their accounts.

What are Securities to Trade with Huayuan Securities?

Huayuan Securities offers a broad selection of investment products for its clients. Here's a breakdown of the main tradable securities:

Bonds & Fixed Income:

Huayuan Securities offers a variety of bonds and fixed income securities, including corporate bonds, government bonds, municipal bonds, and other debt instruments. These securities provide investors with a fixed income stream over a specified period, making them attractive for income-focused investors and those seeking portfolio diversification.

Futures:

Futures contracts available through Huayuan Securities cover a wide range of underlying assets such as commodities, currencies, and financial indices. Futures trading allows investors to speculate on the future price movements of these assets, providing opportunities for hedging, speculation, and portfolio management.

Options:

Huayuan Securities provides options trading services, enabling investors to buy or sell options contracts on various underlying assets, including stocks, indices, and commodities. Options offer flexibility and risk management capabilities, allowing investors to hedge against potential losses or speculate on price movements.

Stocks:

As a leading securities firm, Huayuan Securities offers a comprehensive range of stocks for trading on both domestic and international markets. Stocks represent ownership in publicly traded companies, offering investors the opportunity to participate in company growth and profit from price appreciation.

ETFs (Exchange-Traded Funds):

Huayuan Securities provides access to a wide selection of ETFs, which are investment funds traded on stock exchanges. ETFs offer exposure to various asset classes, sectors, and investment strategies, providing investors with a cost-effective and efficient way to diversify their portfolios.

Mutual Funds:

Huayuan Securities offers a wide range of mutual funds, including equity funds, bond funds, money market funds, and balanced funds. Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, providing investors with access to professional portfolio management and diversified exposure to different asset classes.

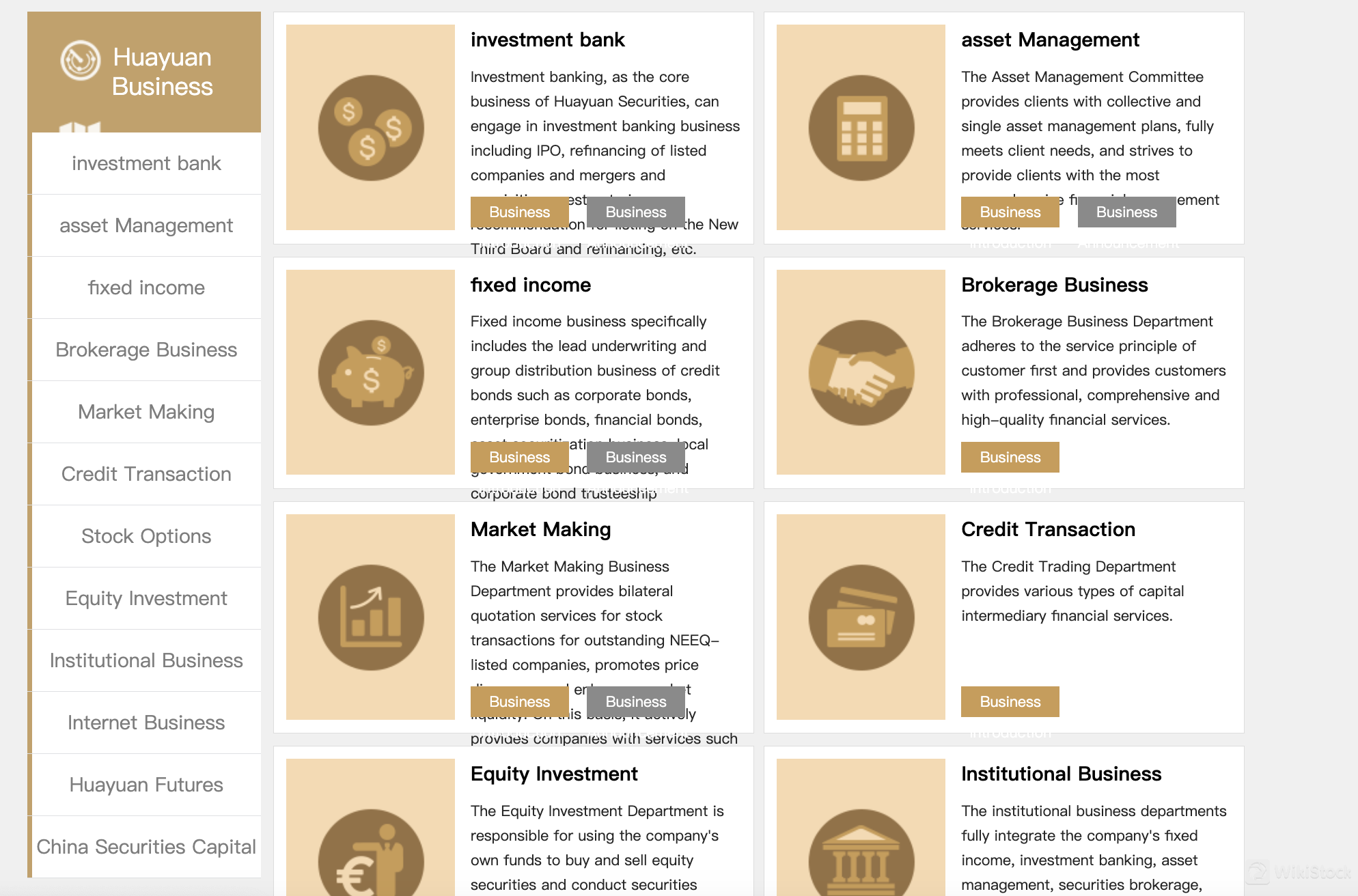

Services

Huayuan Securities provides a comprehensive range of financial services including investment banking, asset management, fixed income, brokerage, market making, credit transactions, equity investment, institutional business, Jiuzheng investment, internet business, Huayuan Futures, and China Securities Capital.

Investment Banking:

As the core business of Huayuan Securities, investment banking covers a wide range of services including IPOs, refinancing for listed companies, mergers and acquisitions, restructuring, and recommendations for listings on platforms like the New Third Board. This department plays a pivotal role in facilitating capital market activities and corporate finance operations.

Asset Management:

The Asset Management Committee accommodates clients' needs by offering both collective and single asset management plans. Their aim is to provide comprehensive financial management services, ensuring that clients receive tailored solutions to meet their investment objectives effectively.

Fixed Income:

Huayuan Securities' fixed income business encompasses activities such as lead underwriting and group distribution of credit bonds, asset securitization, and corporate bond trusteeship management. This department handles various fixed income instruments, contributing to the diversification of investment portfolios.

Brokerage Business:

With a customer-centric approach, the Brokerage Business Department delivers professional, comprehensive, and high-quality financial services to clients. Their commitment lies in providing tailored solutions and support to meet clients' investment needs efficiently.

Market Making:

The Market Making Business Department enhances market liquidity by providing bilateral quotation services for stock transactions. They facilitate price discovery and offer consulting services for stock transactions under agreement transfer and market-making transfer.

Credit Transaction:

The Credit Trading Department offers a range of capital intermediary financial services.

Equity Investment:

Responsible for proprietary trading, the Equity Investment Department utilizes the company's funds to buy and sell equity securities, contributing to the company's investment strategies.

Institutional Business:

Integrating various business line resources, the Institutional Business Departments provide institutional clients with high-level, comprehensive, diversified, and professional investment and financing solutions.

Jiuzheng Investment:

Jiuzheng Investment Management Co., Ltd., a subsidiary of Huayuan Securities, serves as a comprehensive investment platform, extending the company's investment reach and capabilities.

Internet Business:

The Internet Business Department integrates various business lines to create a one-stop off-site convenient transaction platform, focusing on providing humane, professional, and convenient investment services, particularly for individual investors.

Huayuan Futures:

As a subsidiary of Huayuan Securities, Huayuan Futures engages in futures trading, offering a range of futures products and services to clients.

China Securities Capital:

Established as a subsidiary of Huayuan Securities, Huazheng Capital Investment Co., Ltd. operates under the umbrella of Huayuan Securities, contributing to the company's overall investment strategy and activities.

Huayuan Securities Fees Review

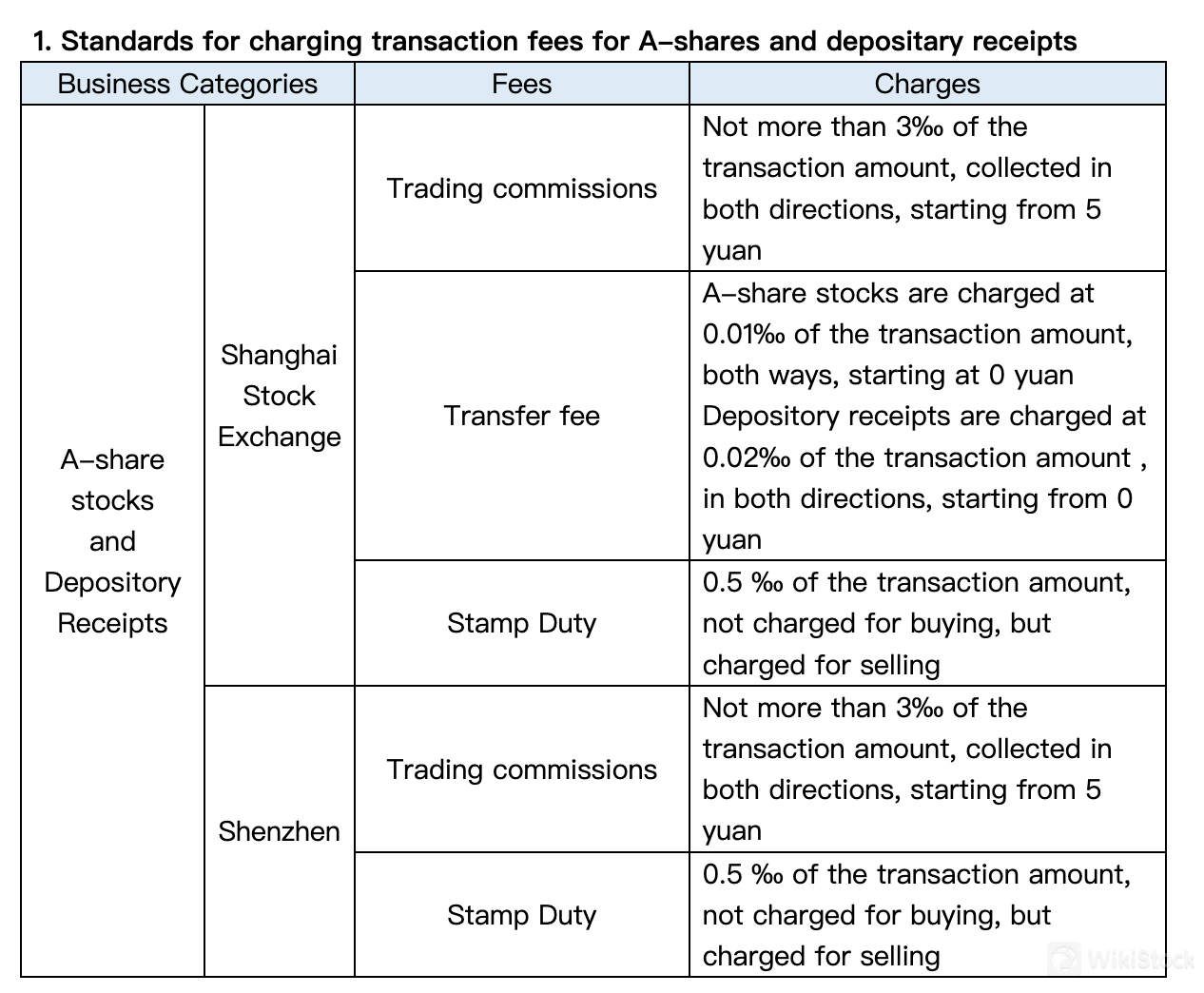

A-share Stocks and Depository Receipts Trading Fees:

For transactions on the Shanghai Stock Exchange and Shenzhen, Huayuan Securities charges trading commissions not exceeding 3‰ of the transaction amount, collected in both directions, with fees starting from 5 yuan. Stamp duty is also applied at 0.5‰ of the transaction amount, levied only when selling.

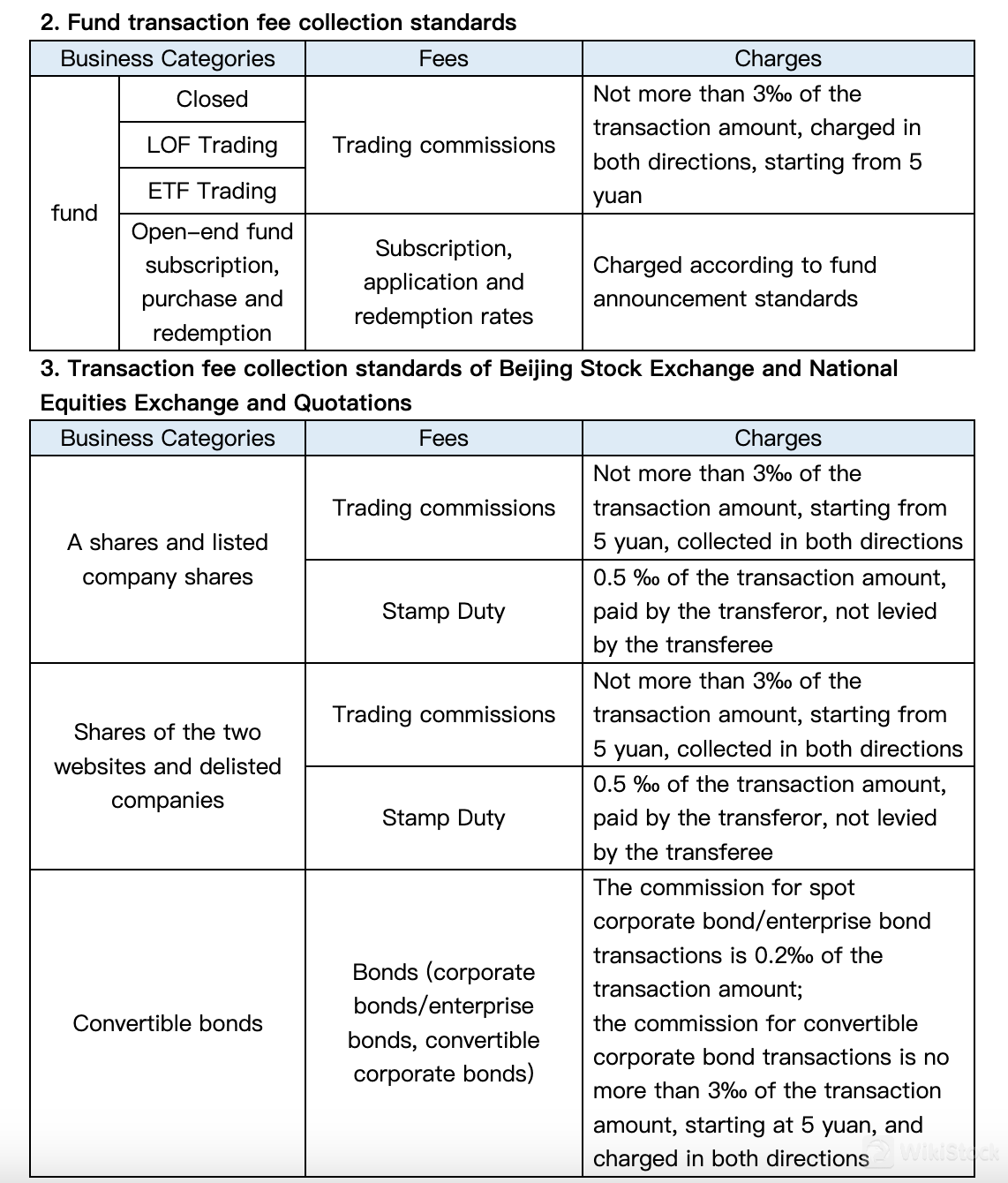

Fund Transaction Fees:

Huayuan Securities imposes trading commissions on closed-end funds, LOF trading, and ETF trading, not exceeding 3‰ of the transaction amount, collected in both directions, with fees starting from 5 yuan. Subscription, application, and redemption rates for open-end funds are charged according to fund announcement standards.

Transaction Fees for A-shares, Listed Company Shares, and Convertible Bonds:

Trading commissions for A-shares, listed company shares, and convertible bonds are capped at 3‰ of the transaction amount, starting from 5 yuan, collected in both directions. Stamp duty is also applied at 0.5‰ of the transaction amount, paid by the transferor.

Bond Trading Fees:

For bonds traded on the Shanghai and Deep, trading commissions do not exceed 0.2‰ of the transaction amount, starting from 1 yuan. Additionally, for convertible corporate bond transactions, the commission is capped at 3‰ of the transaction amount, collected in both directions, starting from 5 yuan.

Hong Kong Stock Connect Transaction Fees:

Huayuan Securities applies trading commissions not higher than 3‰ of the transaction amount (HKD), collected bilaterally, starting from RMB 5 for Hong Kong Stock Connect transactions. Stamp duty, transaction levy, transaction fee, stock settlement fee, financial remittance fee, and securities portfolio fee are also charged according to specified rates.

In comparison with popular brokers, Huayuan Securities' commission rates are relatively high.

| Fee Type | Fee Amount |

| Trading Commissions | Not more than 3‰ of the transaction amount, starting from 5 yuan |

| Stamp Duty | 0.5 ‰ of the transaction amount (charged for selling) |

| Transfer Fee | A-share stocks: 0.01‰ of the transaction amount (both ways, starting at 0 yuan); Depository Receipts: 0.02‰ of the transaction amount (both ways, starting at 0 yuan) |

| Subscription Fee | Charged according to fund announcement standards |

| Stamp Duty (Hong Kong) | 1.0‰ of the transaction amount (HKD) |

| Transaction Levy (Hong Kong) | 0.027‰ of the transaction amount (HKD) |

| Transaction Fee (Hong Kong) | 0.0565‰ of the transaction amount (HKD) |

| Stock Settlement Fee (Hong Kong) | 0.02‰ of the transaction amount (HKD) |

| Financial Remittance Fee (Hong Kong) | 0.0015‰ of the transaction amount (HKD) |

| Securities Portfolio Fee | Charged based on the market value of securities held, with a fixed fee for each calendar day |

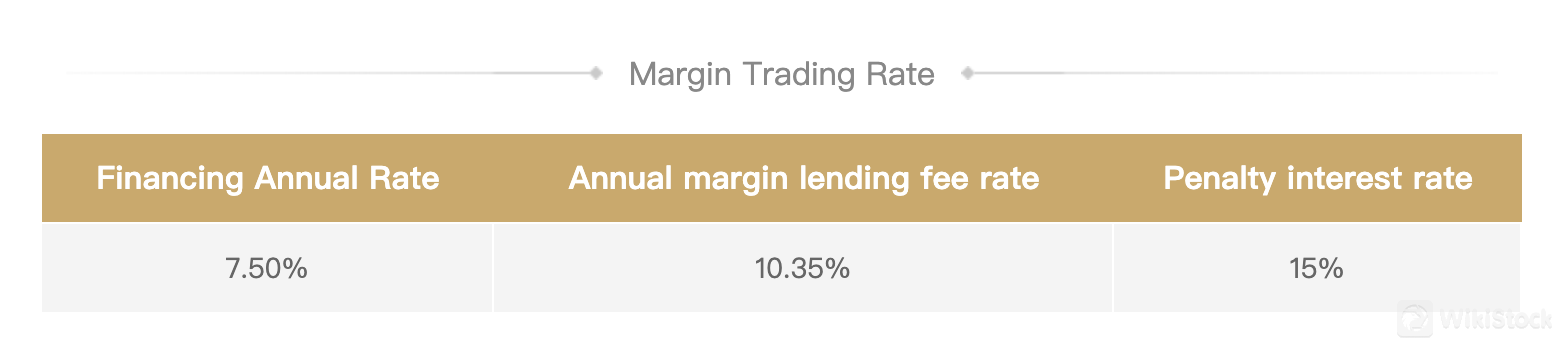

Huayuan Securities' margin trading rate is 7.50% annually, with an annual margin lending fee rate of 10.35%. If payments are late, a penalty interest rate of 15% per year applies. These rates determine the cost of borrowing and penalties for late repayments in margin trading with Huayuan Securities.

Huayuan Securities App Review

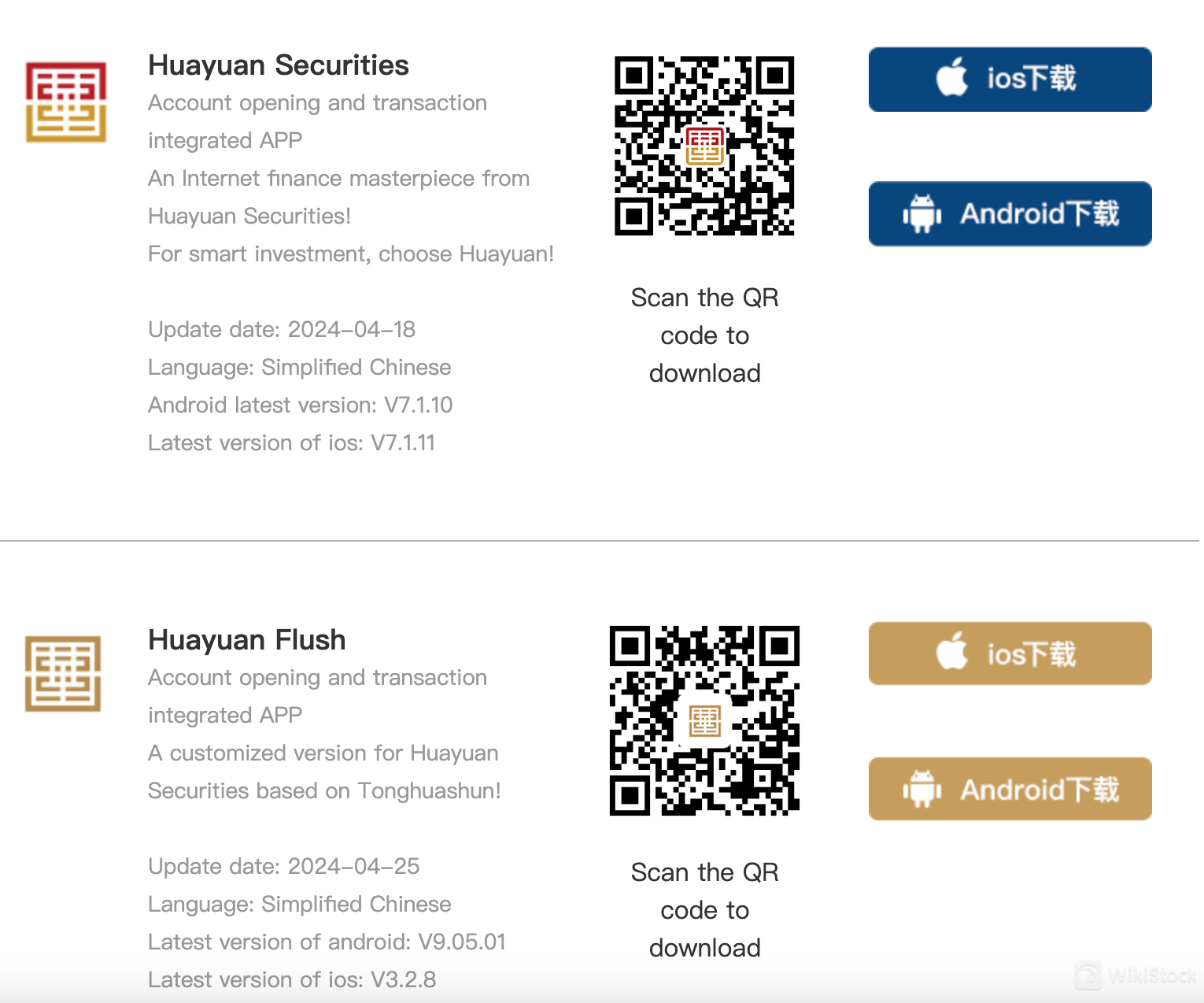

Huayuan Securities provides two apps: Huayuan Securities app and Huayuan Flash.

The Huayuan Securities app is a comprehensive wealth management platform crafted by the fully licensed state-owned securities firm, Huayuan Securities. It offers a one-stop solution for stocks, funds, and financial management. Key features include 24/7 online account opening services for stocks and funds, providing a secure and hassle-free process, along with the “Cash Management” feature for intelligent and rapid withdrawals to bank accounts within seconds. Additionally, the app ensures quick and reliable trading services with a user-friendly interface, facilitating easy transitions between regular and margin trading.

Huayuan Flash is a mobile securities trading app launched by Huayuan Securities Co., Ltd. It integrates high-speed market data from multiple markets, stock selection, professional information, and commission services into one platform. The app supports a wide range of trading functionalities, including stock trading, fund management (bank-to-broker transfers and multi-party bank custody), ChiNext Board trading, margin trading, IPO subscriptions, open-end funds, money market funds, exchange-traded funds, after-hours funds, collective wealth management, Hong Kong stock connect, online voting, fund regular investment, and stock account opening. It boasts fast response times, transaction security, and stable usage, making it a reliable choice for traders.

Research & Education

Huayuan Securities provides investor education, risk disclosure, and anti-fraud measures to enhance clients' understanding and safety in financial markets.

While it lacks research reports, its comprehensive registration system and zones for major stock exchanges offer valuable insights. However, compared to brokers offering research reports, Huayuan Securities seem less competitive in terms of providing in-depth market analysis and recommendations.

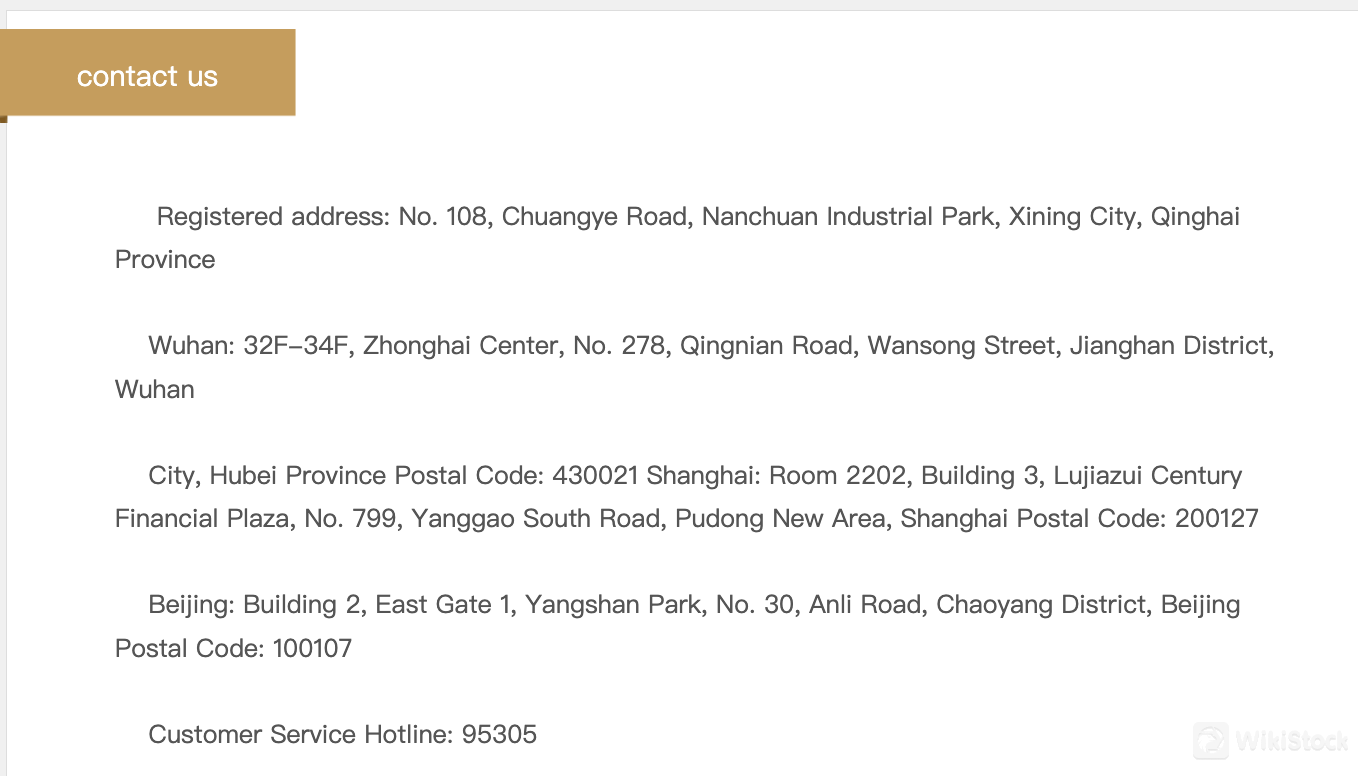

Customer Service

For customer support, Huayuan Securities offers a hotline reachable at 95305. Their dedicated team provides assistance with various inquiries and concerns related to their financial services. The hotline operates during regular business hours, ensuring timely support for clients.

Conclusion

In conclusion, Huayuan Securities offers wide range of tradable securities and comprehensive services offer flexibility and convenience for investors.

However, the platform's high trading fees deter some users, particularly those seeking cost-effective options or detailed fee structures. With a user-friendly mobile platform and regulatory oversight, Huayuan Securities appeals to experienced investors who prioritize accessibility and regulatory compliance over lower fees.

FAQs

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China

Years in Business

Within 1 year(s)

Products

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

九证资本

Subsidiary

--

九州期货

Subsidiary

Review

No ratings

Recommended Brokerage FirmsMore

山西证券

Score

信达证券

Score

民生证券

Score

国金证券

Score

金元证券

Score

长江证券

Score

大通证券

Score

平安证券

Score

渤海证券

Score

西部证券

Score