Zeal group of companies (collectively Zeal Group) is a business portfolio comprising regulated financial institutions (trading as ZFX) and fintech companies specializing in multi-asset liquidity solutions in regulated markets backed by proprietary technology, with presence in major global locations. Founded by a group of veteran traders with decades-long experience in the industry who not only share appreciation for the complexity the world of financial trading itself may present but also have the expertise and commitment to change, Zeal has a deep-rooted existential reason and has set its goal to deliver multi-asset trading services of next level to retail and institutional investors alike.

ZFX Information

ZFX offers a range of trading products with no commissions, leveraging up to 1:100, and competitive trading costs through its industry benchmark trading platform, Zeal MT4.

It is regulated by the Financial Conduct Authority (FCA) and provides client protection up to £85,000 through the FSCS.

While ZFX excels in offering low-cost trading and reliable execution, it is primarily targeted at professional clients and will not be suitable for all retail investors.

Pros & Cons

Pros:

ZFX is regulated by the Financial Conduct Authority (FCA), providing a high level of trust and security for investors. Clients are also protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. The platform supports multi-lingual client support, ensuring effective communication across various languages. ZFX offers no dealing desk execution, leading to more transparent and fair trading conditions, and charges 0 commission, making it cost-effective for traders.

Cons:

The fee structure of ZFX is uncertain, potentially leading to unexpected costs for traders. Additionally, the range of tradable securities is limited compared to other platforms, which will not meet the needs of investors looking for a wider variety of investment options.

Is ZFX Safe?

Regulations:

ZFX operates under stringent regulatory oversight. In the United Kingdom, it is regulated by the Financial Conduct Authority (FCA) with the license number 768451, ensuring adherence to robust regulatory standards.

Additionally, ZFX is authorized(but suspicious cloned)by the Seychelles Financial Services Authority (FSA) under license number SD027. The FCA is a highly reputable regulatory body known for maintaining the integrity of financial markets and protecting consumers.

Funds Safety:

Clients' account funds at ZFX are insured through the Financial Services Compensation Scheme (FSCS) in the UK, which provides protection up to £85,000 per client in the event of the company's default. This coverage ensures that clients' investments are safeguarded against unforeseen financial issues within the company. ZFX's corporate governance and financial procedures are meticulously managed and audited, further enhancing fund security.

Safety Measures:

ZFX employs advanced encryption technologies to secure the storage of funds and user information, ensuring that data in transit and at rest is well-protected. The company also implements stringent internal procedures and financial management practices, which are regularly vetted by specialists. This includes performing regular security audits and monitoring systems to prevent unauthorized access or data breaches, thus maintaining a high standard of account safety and user data protection.

What are securities to trade with ZFX?

ZFX offers a variety of trading products, allowing clients to invest in multiple international financial markets through a single account. The available securities include:

- Stocks: Trade shares of various companies listed on global stock exchanges.

- Exchange-Traded Funds (ETFs): Access a wide range of ETFs representing different sectors and asset classes.

- Contracts for Difference (CFDs): Engage in trading CFDs on various underlying assets, including indices, commodities, and forex.

- Forex: Trade major, minor, and exotic currency pairs with competitive spreads.

- Commodities: Invest in precious metals, energy products, and agricultural commodities through CFDs.

- Indices: Trade CFDs on major global indices, gaining exposure to market movements in leading economies.

ZFX provides a robust platform for trading these securities, ensuring tight spreads, no commissions, and reliable order execution.

ZFX Fee Review

ZFX offers commission-free trades with no specified account fees. They provide interest on uninvested cash at 1.78% and competitive trading costs, including tight spreads that vary by asset and swap charges for overnight positions.

ZFX Trading Platrform Review

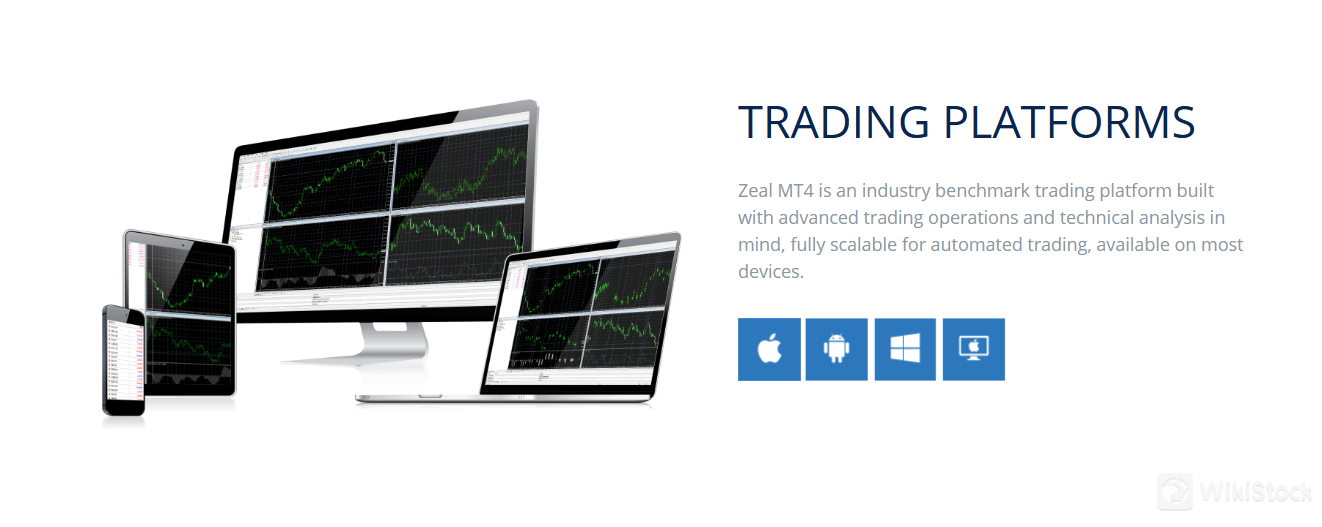

ZFX offers the Zeal MT4 trading platform, renowned as an industry benchmark for its robust capabilities in advanced trading operations and technical analysis. Designed to be fully scalable for automated trading, Zeal MT4 is accessible on multiple devices including iOS, Android, Windows, and mac.

It features a user-friendly interface tailored for both novice traders and seasoned investors, providing tools for charting, market analysis, and execution of trades across various financial instruments.

Tools

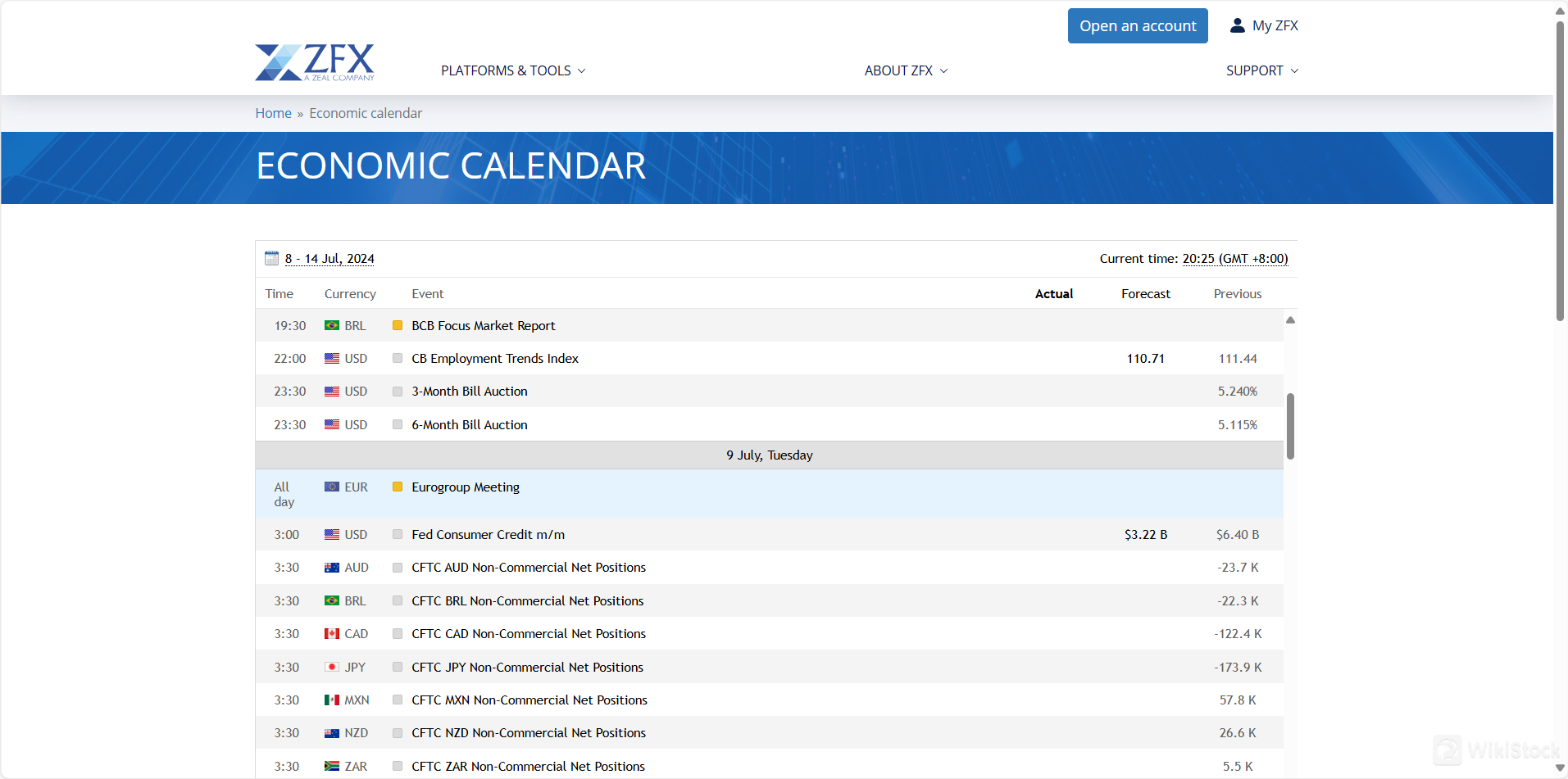

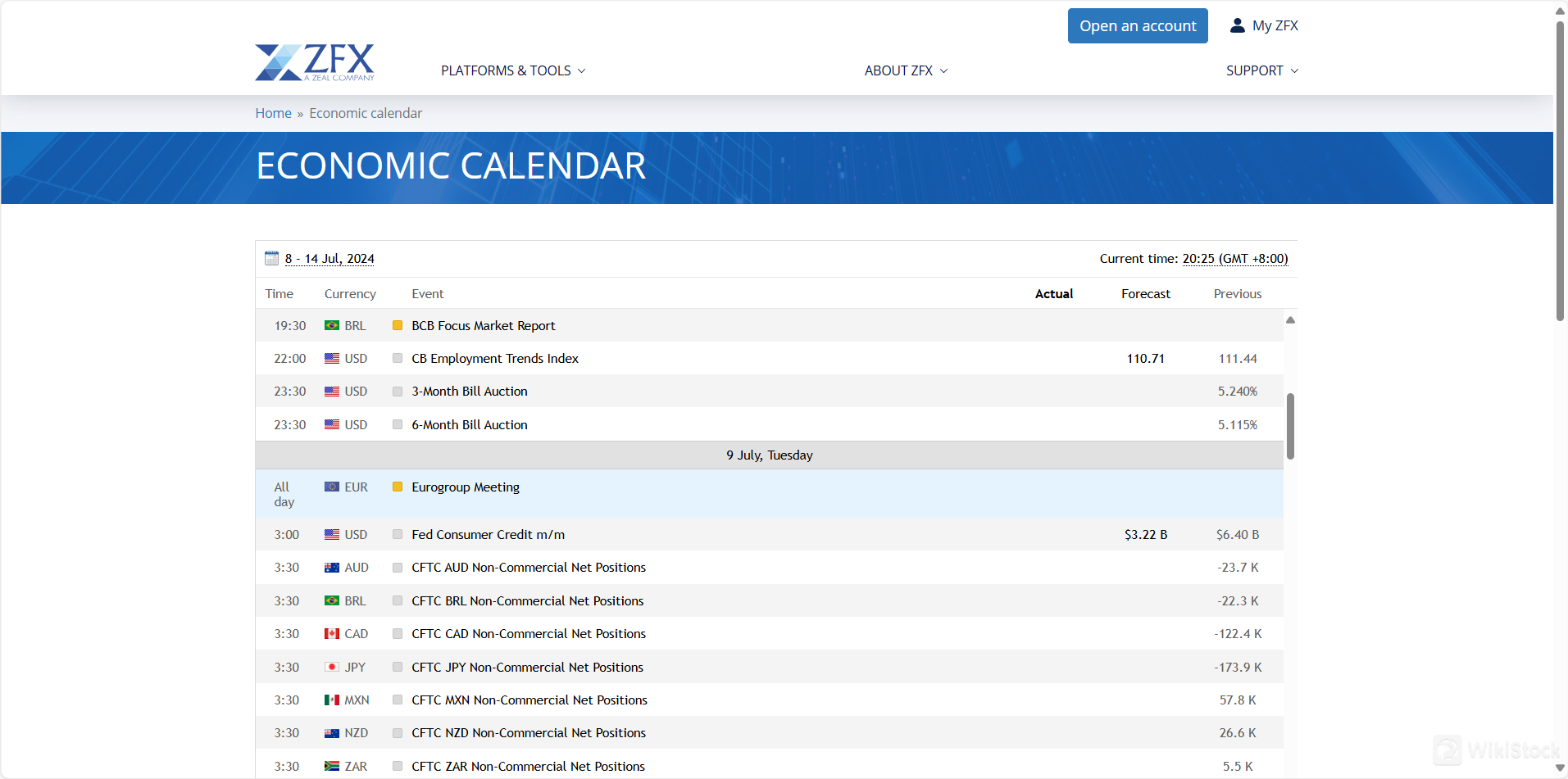

ZFX provides an economic calendar tool, essential for traders to stay informed about key economic events and their potential impact on global markets. This tool allows users to track important announcements such as economic indicators, central bank meetings, and geopolitical events that could influence asset prices and trading strategies.

Customer Support

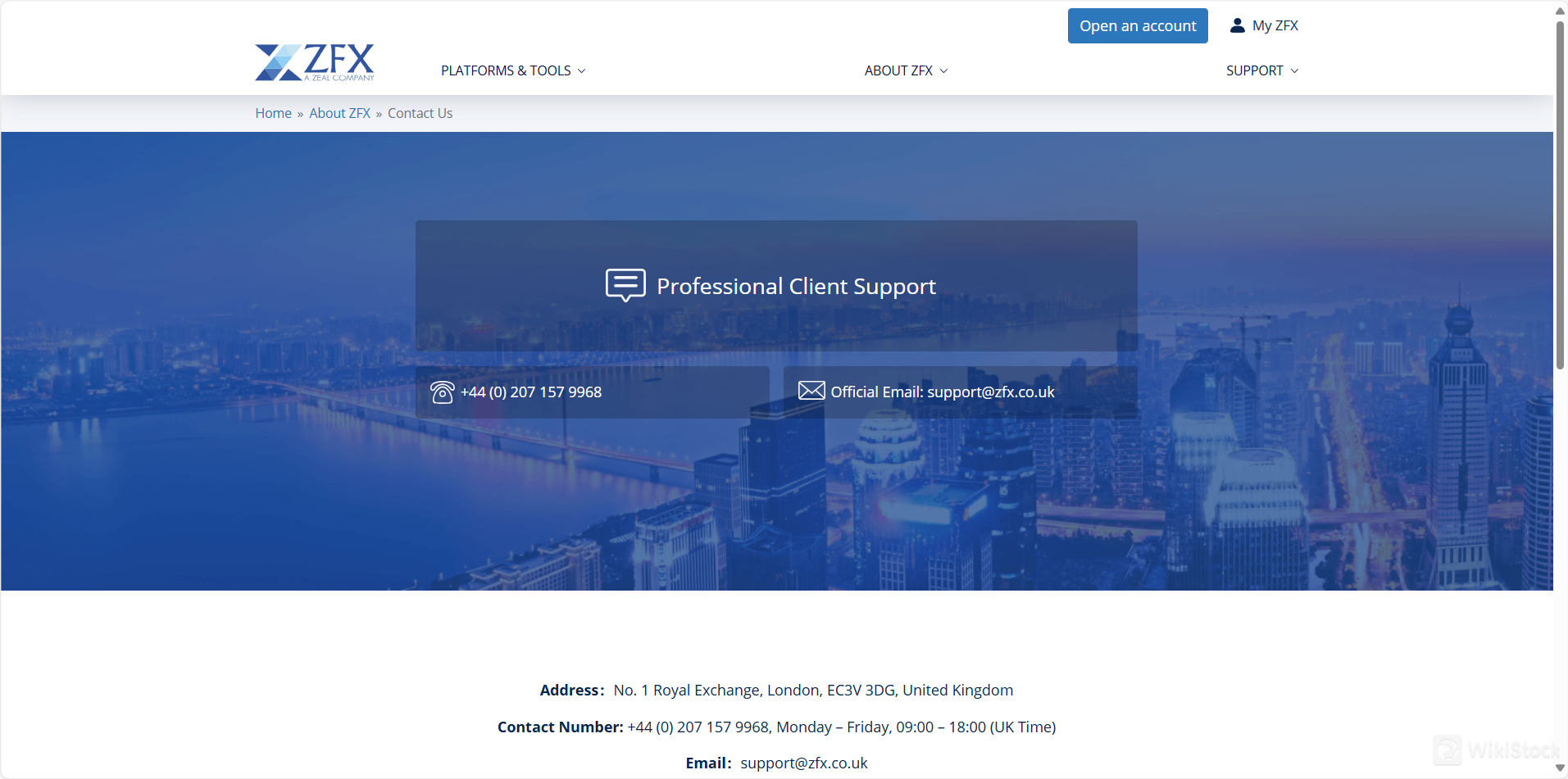

ZFX offers robust customer support through multiple channels, including a dedicated phone line at +44 (0) 207 157 9968, available Monday to Friday from 09:00 to 18:00 UK time, and email support via support@zfx.co.uk.

Located at No. 1 Royal Exchange, London, ZFX provides professional client assistance and ensures compliance with regulatory standards set by the Financial Conduct Authority (FCA).

Conclusion

In conclusion, ZFX, operated by Zeal Capital Market (UK) Limited, stands out as a regulated trading platform offering a range of financial products and services tailored for professional clients.

With a focus on transparency and compliance with the Financial Conduct Authority (FCA), ZFX provides access to the Zeal MT4 trading platform equipped for advanced technical analysis and automated trading.

FAQs

- What trading platforms does ZFX offer?

ZFX offers the Zeal MT4 platform, known for its advanced trading features and compatibility across various devices.

- How can I contact ZFX customer support?

You can reach ZFX customer support by phone at +44 (0) 207 157 9968 or via email at support@zfx.co.uk during business hours, Monday to Friday.

- Is ZFX regulated?

Yes, ZFX is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring compliance with stringent regulatory standards for financial services.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 2 securities license(s)

--

--