amana, established in 2010 and headquartered in Dubai, stands as a leading MENA neo-broker, with a thriving community that reaches over 175,000+ customers in 80 countries.

Amana Information

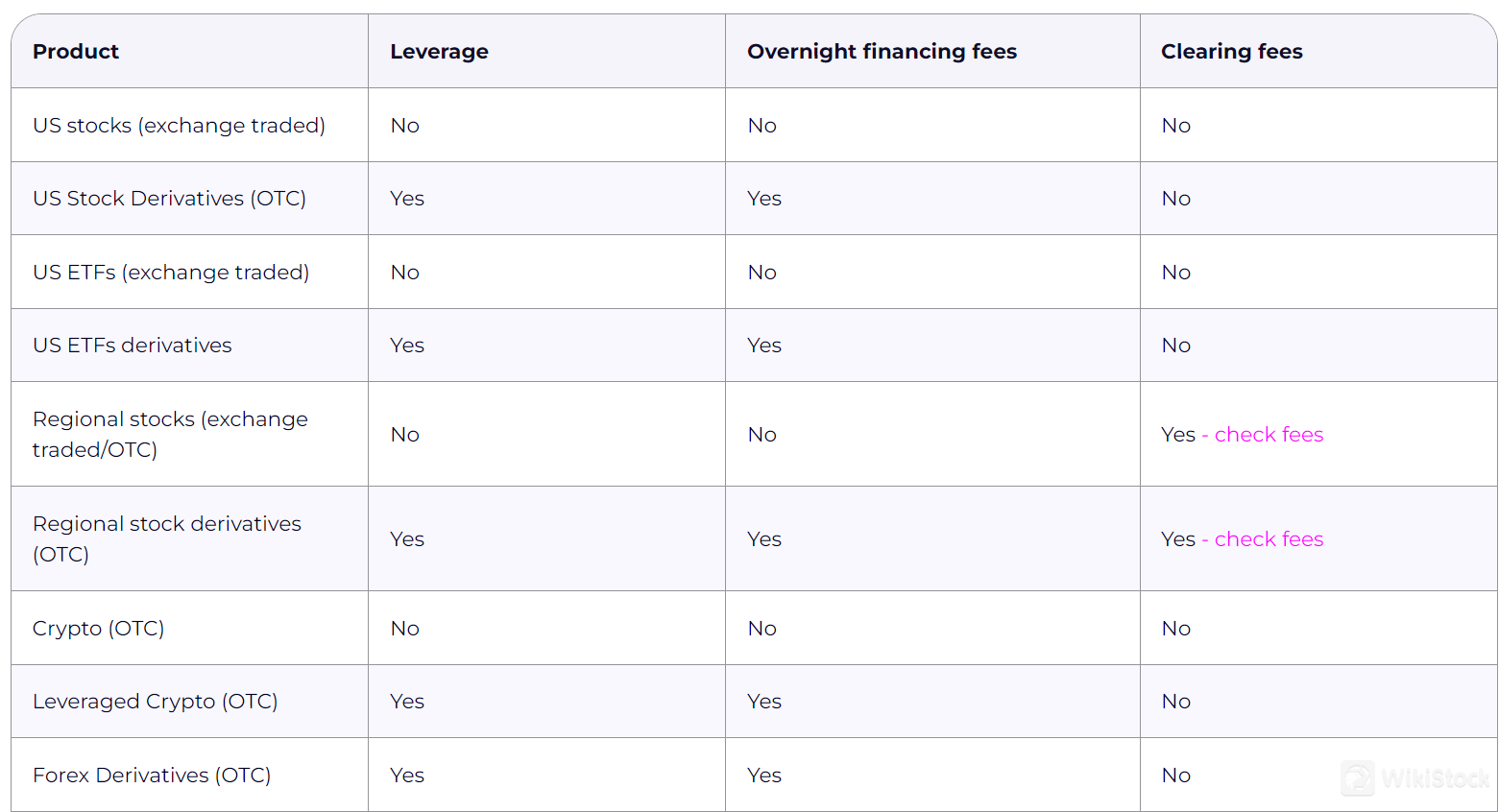

Amana offers a commission-free trading platform available on iOS, Android, and Web, making it accessible across devices. The service imposes no account minimums or fees for new accounts, providing a cost-effective entry point for investors. However, details on interest rates for uninvested cash and margin rates are not specified. Notably, Amana does not offer mutual funds, focusing instead on direct investment options. This platform caters to users seeking straightforward, no-fee trading with convenient mobile and web accessibility.

Pros and Cons of Amana

Amana stands out for its compliance with financial regulations and its diverse range of available assets, appealing to investors looking for regulatory adherence and asset variety. The platform is accessible across multiple operating systems including iOS, Android, Mac, Windows, and Web, enhancing its usability. However, potential drawbacks include unspecified margin interest rates and unclear information regarding interest on uninvested cash. Additionally, specific account types are not detailed, which may limit its suitability for investors with specialized needs. Overall, Amana offers a user-friendly, regulated trading environment with broad asset options, albeit with some transparency gaps regarding financial terms and account specifics.

Is Amana safe?

Amana Financial Services UK Limited is a broker-dealer registered with the United Kingdom Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

Client Money Protection: AFSL is subject to the FCA's Client Money Rules, which require them to safeguard client funds and assets. These rules ensure that client money is held separately from the company's own funds and that it is protected in the event of the company's insolvency.

Investor Compensation Scheme: As an FCA-regulated firm, AFSL is also a member of the Financial Compensation Scheme (FSCS). The FSCS is a UK government-backed compensation scheme that protects eligible customers in the event of a financial firm's failure. Under the FSCS, eligible customers can claim up to £85,000 per person for their losses.

Additional Safety Measures: AFSL employs additional measures to protect its clients' funds, including:

- Segregation of Client Funds: Client funds are held in segregated bank accounts separate from the company's own funds.

- Regular Audits: AFSL's accounts are regularly audited by independent auditors to ensure compliance with regulatory requirements and the proper safeguarding of client funds.

- Insurance Coverage: AFSL maintains professional indemnity insurance to protect clients from losses arising from errors or omissions by the company.

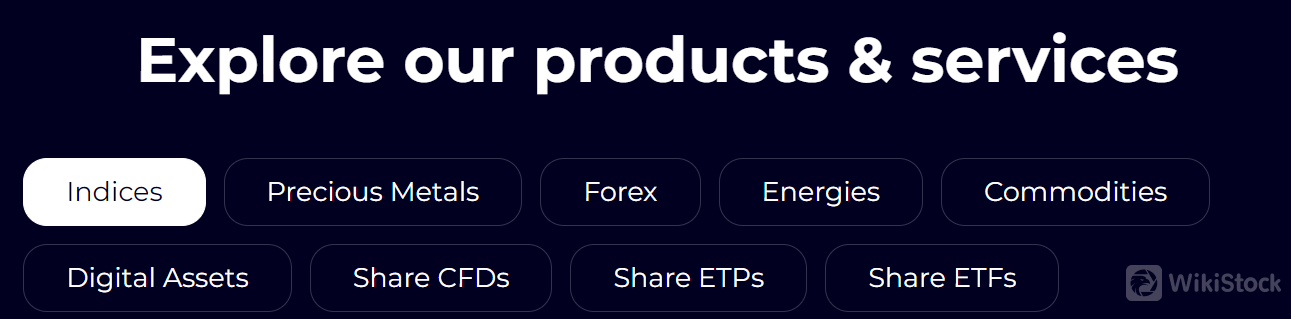

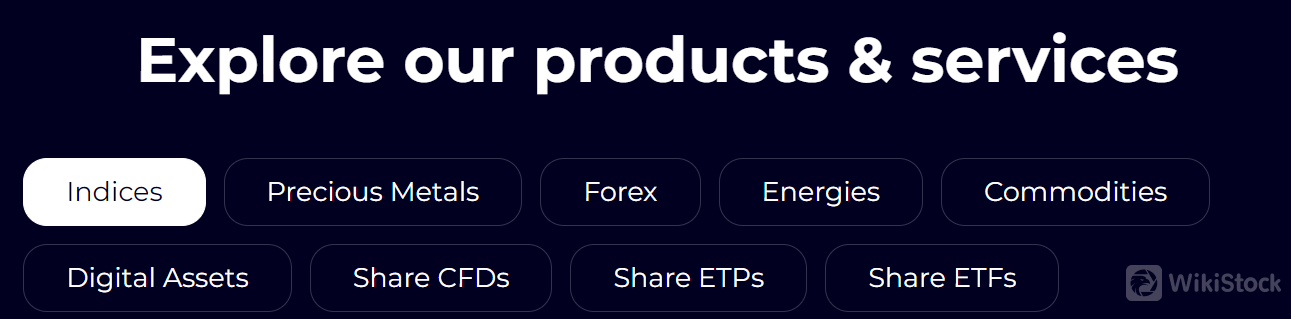

What are securities to trade with Amana?

Amana offers a variety of investment tools, including indexes, precious metals, forex, energies, commodities, and digital assets. These products help investors achieve diversified portfolios and select different risk-reward options. However, it does not provide products like annuities and mutual funds.

- Indexes: Benchmarks representing market performance, ideal for diversified investment tracking.

- Precious Metals: Direct investment in gold, silver, etc., offering a hedge against inflation and geopolitical risk.

- Forex : Currency pair trading for investors capitalizing on global economic trends.

- Energies: Investment in commodities like oil and natural gas, influenced by global supply-demand dynamics.

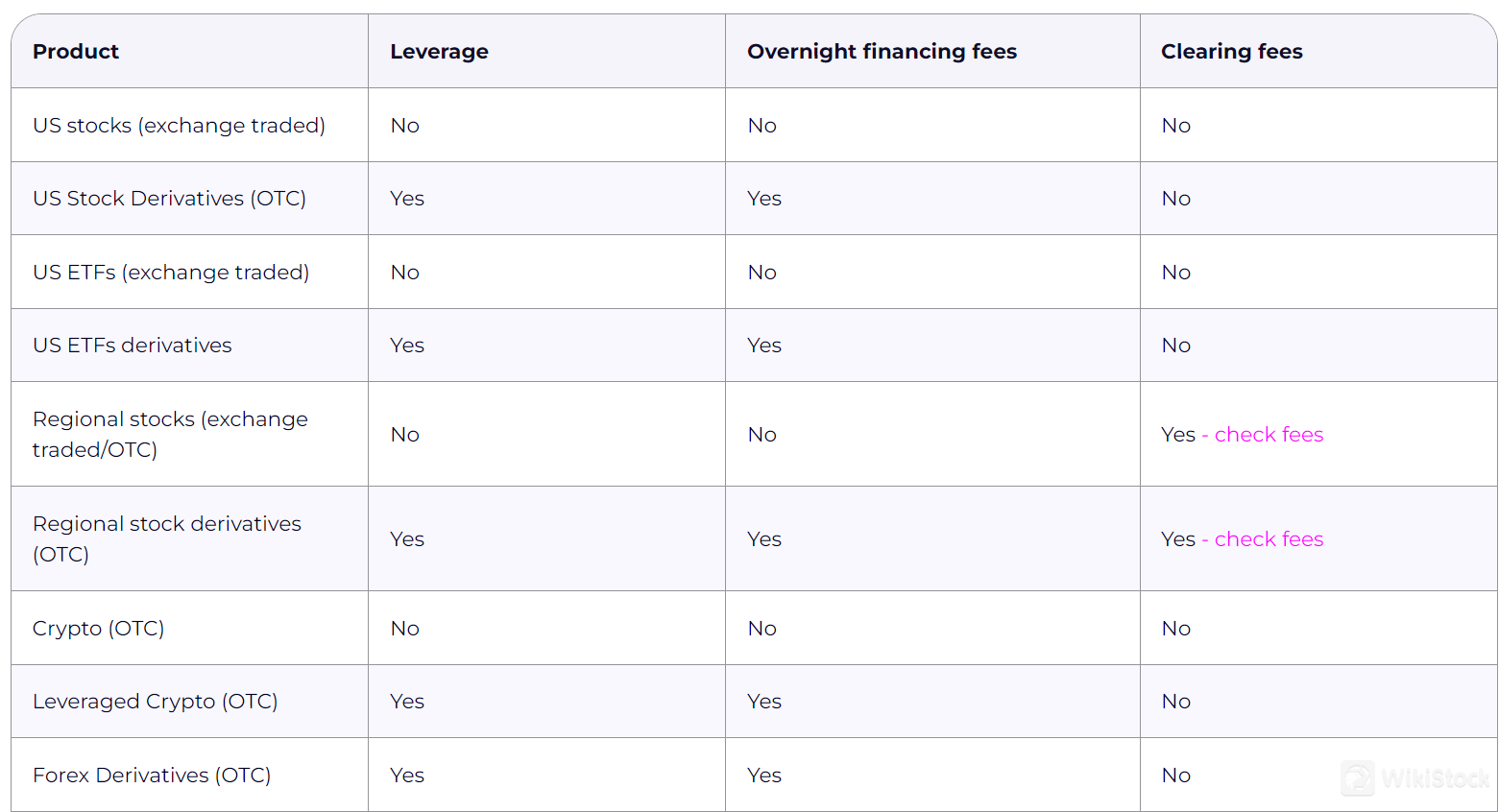

Amana Fees Review

Amana's Fees Review underscores its commitment to transparency and client satisfaction with its zero-commission structure. This approach ensures that investors can trade without worrying about additional costs typically associated with transactions. By eliminating commissions, Amana empowers traders to maximize their investment potential without compromising on quality or service. This fee structure reflects Amana's dedication to providing a straightforward and cost-effective trading environment, enhancing accessibility and value for its clients.

Amana App Review

Amana's mobile app is a cutting-edge and intuitive trading platform designed for on-the-go traders. It provides a comprehensive trading experience, available on iOS and Android devices, facilitating easy access to markets anytime, anywhere. In addition to the mobile app, Amana also offers a versatile range of platforms and tools for different devices and operating systems, including Web Trading platforms, as well as dedicated applications for Mac and Windows. This variety ensures that all users, regardless of their preferred device, can access the trading services seamlessly.

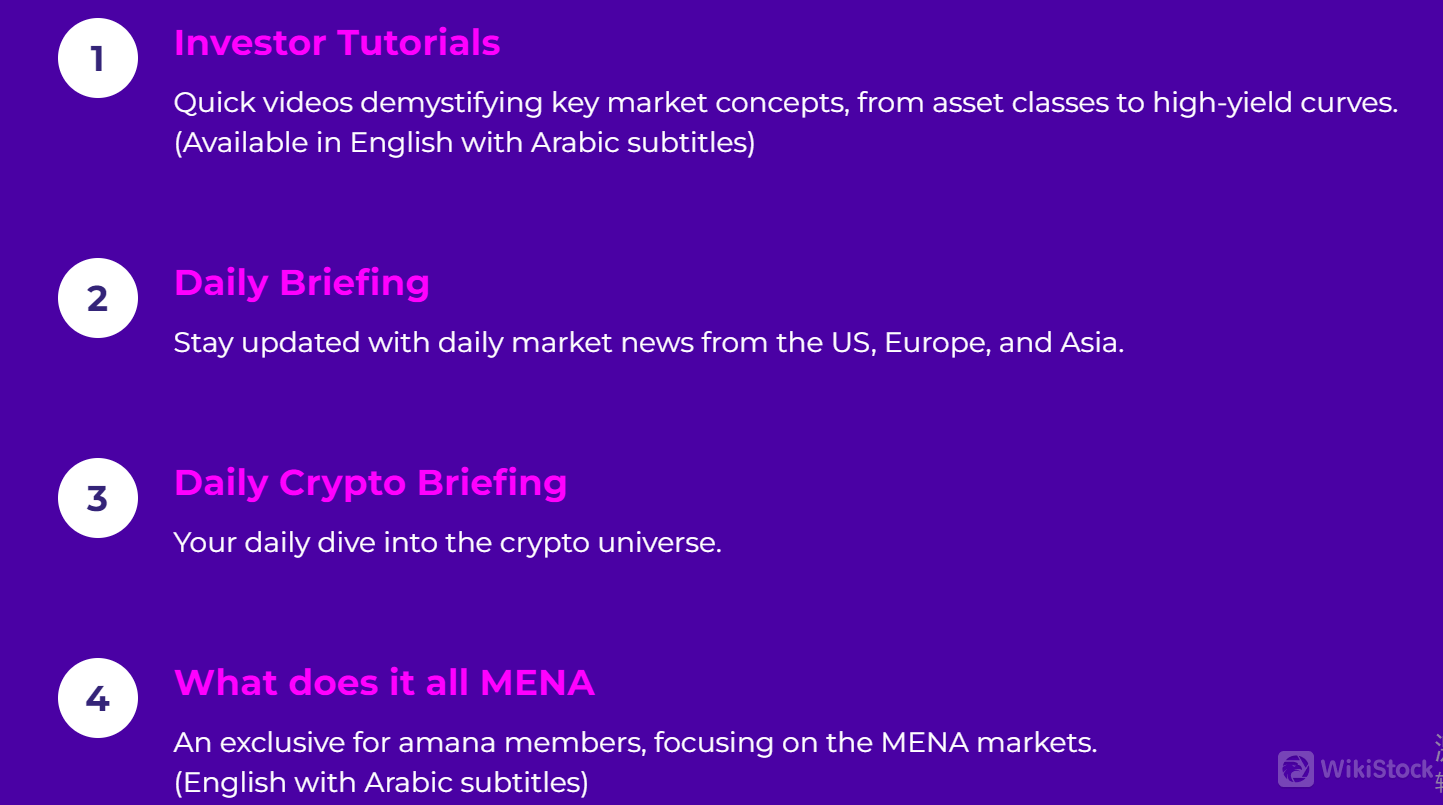

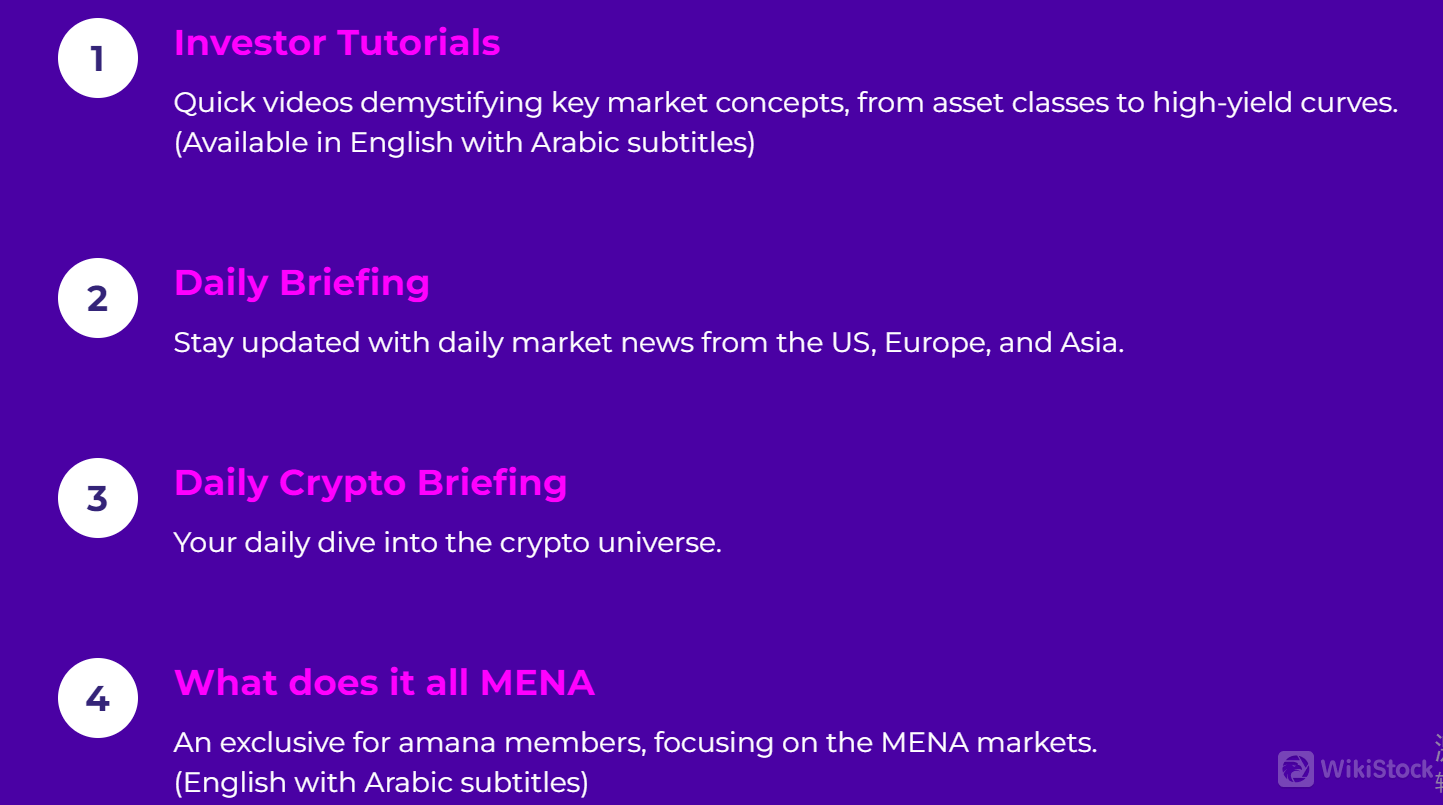

Research and Education

Real Vision by Amana provides a comprehensive platform for research and education tailored to investors. It features Investor Tutorials, offering quick, insightful videos that demystify fundamental market concepts with the convenience of Arabic subtitles. Subscribers also benefit from the Daily Briefing, keeping them abreast of market developments across the US, Europe, and Asia, as well as the Daily Crypto Briefing for deep dives into the cryptocurrency landscape. Exclusive to Amana members is “What does it all MENA,” focusing specifically on the MENA markets in English with Arabic subtitles. Moreover, Real Vision offers The Real Investing Course, a flagship program designed to empower traders and investors with essential skills and strategies.

Customer Service

Amana offers dedicated customer support available 24/6 in English and Arabic, ensuring continuous assistance through various communication channels including email, live chat, WhatsApp, Telegram, and Messenger. Whether through support@amana.app or instant messaging, customers can expect prompt and multilingual service, underscoring Amana's commitment to accessible and responsive support for its users.

Conclusion

Amana emerges as a robust choice for investors seeking a commission-free trading platform with a wide array of assets including indexes, precious metals, forex, energies, commodities, and digital assets. It stands out for its regulatory compliance with the UK's FCA and CySEC, offering robust client fund protection through segregation and insurance. Amana's user-friendly interfaces across iOS, Android, Mac, Windows, and Web, coupled with comprehensive educational resources like Real Vision and dedicated multilingual customer support, enhance its appeal. While ideal for traders looking to trade various securities without transaction fees, potential investors should note its focus on direct investment options rather than mutual funds or annuities. Overall, Amana caters well to both novice and experienced traders alike, providing a secure and accessible trading environment with ample educational support.

FAQs

Is Amana safe to trade?

Yes, Amana is considered safe to trade due to its regulation by the UK's FCA and Cyprus's CySEC, along with client fund protection measures such as segregation and insurance.

Is Amana a good platform for beginners?

Yes, Amana offers a user-friendly interface and educational resources that make it suitable for beginners who want to start trading without worrying about commissions.

Is Amana legit?

Yes, Amana is a legitimate trading platform regulated by respected financial authorities, ensuring compliance with industry standards and client protection rules.

Is Amana good for investing/retirement?

Amana is suitable for investing due to its diverse range of investment tools and regulatory adherence. However, it focuses on direct investment options rather than traditional retirement products like annuities.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 4 securities license(s)

--

--

--

--

--