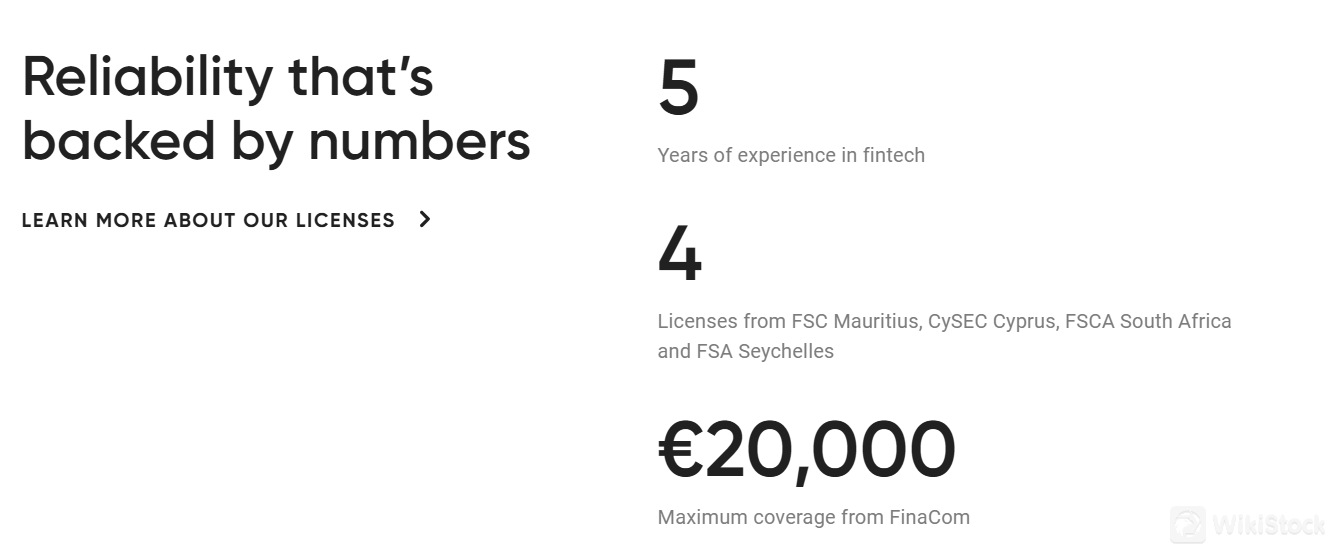

Doto operates under the regulatory oversight of several regulatory bodies, holding four licenses:

- CYSEC (Cyprus Securities and Exchange Commission) - License No. 399/21

- FSA (Seychelles Financial Services Authority) - License No. SD0063 (offshore regulated)

- FSC (Mauritius Financial Services Commission) - License No. C119023978 (offshore regulated)

- FSCA (South Africa Financial Sector Conduct Authority) - License No. 50451

These licenses showcase Doto's dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Doto's commitment to integrity and credibility in its services.

Fund Safety:

Doto also ensures an added layer of security for its clients by providing maximum coverage of €20,000 through its membership with the Financial Commission (FinaCom). This independent organization acts as an external dispute resolution (EDR) body, providing additional protection and assurance for traders.

Safety Measures:

Doto guarantees the protection of traders' personal data and assets through robust security measures.

All user funds are held in segregated bank accounts with reputable financial institutions, ensuring that client assets are kept separate from the company's operational funds. This segregation provides an additional layer of security and transparency.

In addition, Doto employs advanced encryption technologies to safeguard data and transactions, maintaining the confidentiality and integrity of client information.

What are Securities to Trade with Doto?

Doto offers a comprehensive range of trading instruments across various markets, allowing traders to diversify their portfolios and capitalize on different financial opportunities.

In the Forex market, traders can hit the currency rollercoasters to make the most of exchange rate fluctuations.

The Indices market provides access to major economies with just one trade, featuring well-known indices like the S&P 500 and DAX.

The timeless classics of the Commodities market, such as gold and oil, present ongoing trading opportunities.

The rapidly evolving Crypto market lets traders ride the wave of digital currencies, including Bitcoin and other popular cryptocurrencies.

Additionally, Doto is preparing to introduce Stock market trading, enabling clients to trade shares of the biggest global companies.

Accounts

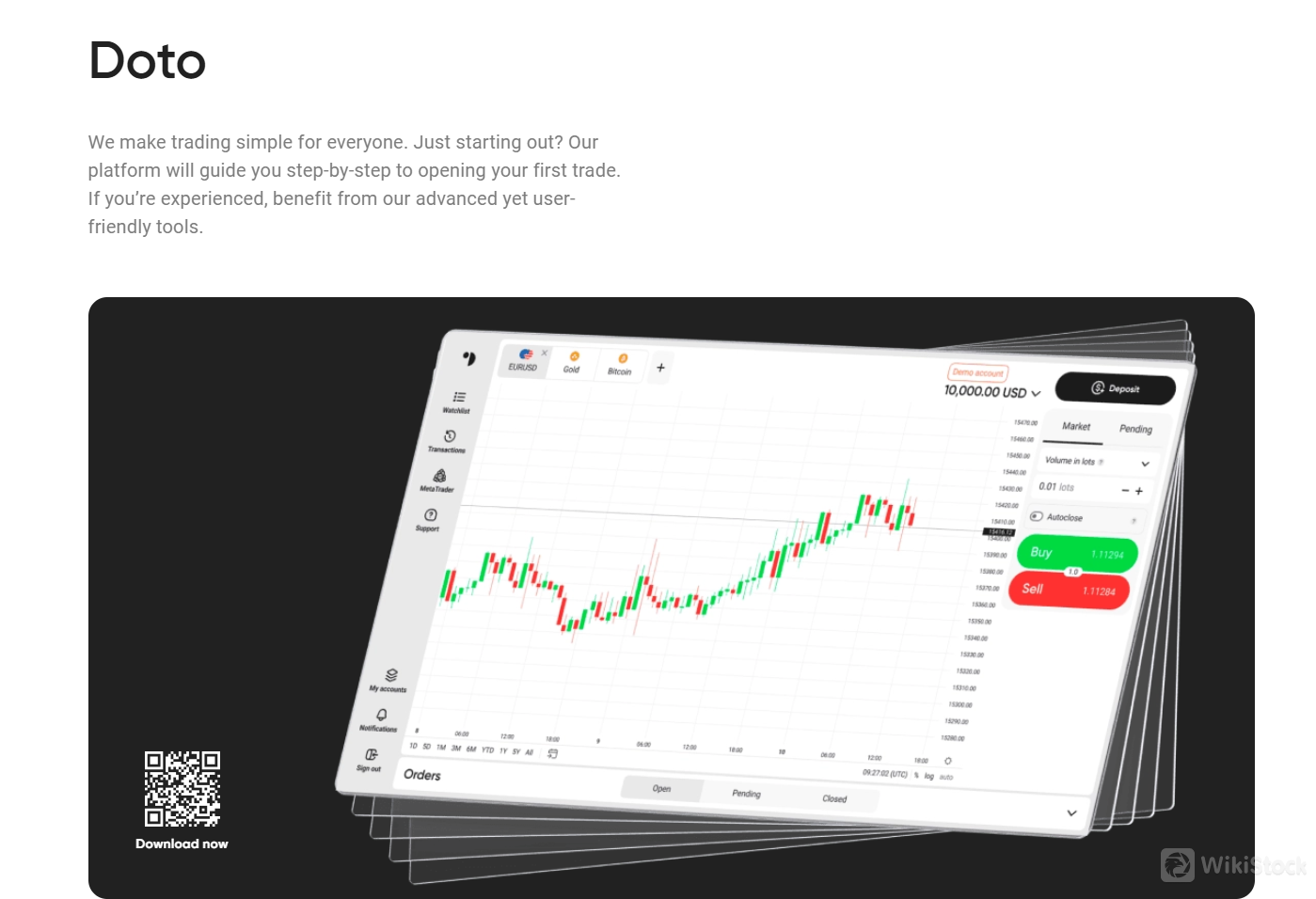

Doto offers both demo and live account types to cater to traders of all experience levels.

The demo account allows users to practice trading skills in a risk-free environment, providing real market conditions, live quotes, and powerful trading tools. With 10,000 virtual demo dollars, traders can gain confidence and hone their strategies before transitioning to a live account.

For those ready to enter the market, Dotos live account requires a minimum deposit of just USD 15. It offers competitive leverage options: 1:500 for Forex, 1:100 for commodities, 1:200 for indices, and 1:20 for cryptocurrencies.

Fees Review

Doto maintains a cost-efficient fee structure designed to benefit traders.

The platform operates with zero commissions on trades, allowing clients to maximize their profits. While there are no fees charged by Doto for deposits or withdrawals, traders should be aware that overnight fees do apply.These fees are not specified and require direct consultation with Doto for precise details.

App Review

Doto provides a variety of trading platforms designed to cater to both novice and experienced traders. The Doto proprietary platform is known for its ease of use, featuring an intuitive interface and a step-by-step trading tutorial that simplifies the trading process for beginners.

For those who prefer trading on the go, the Doto mobile app is available for iOS and Android devices, easily downloadable by scanning a QR code. The platform boasts high reliability with an order-matching engine located in London LD4 and integrates TradingView charts, offering powerful indicators and charting tools loved by millions of traders.

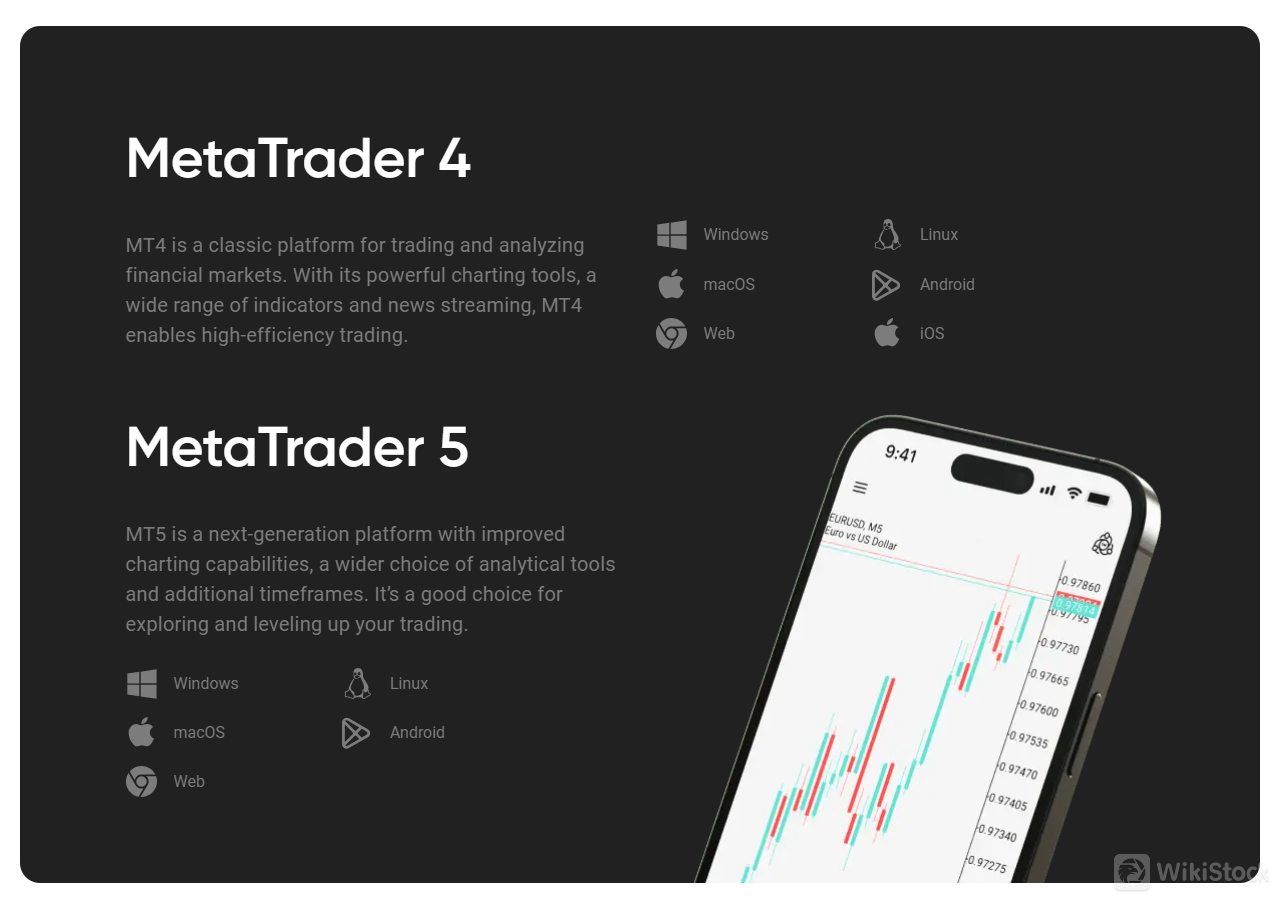

Additionally, Doto supports the renowned MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. MT4 is favored for its robust charting tools, extensive indicators, and news streaming capabilities, while MT5 offers advanced charting, a broader range of analytical tools, and additional timeframes, making it ideal for traders looking to elevate their trading experience. Both MT4 and MT5 are accessible on Windows, Linux, macOS, Android, iOS, and web platforms, ensuring comprehensive accessibility for all users.

Customer Service

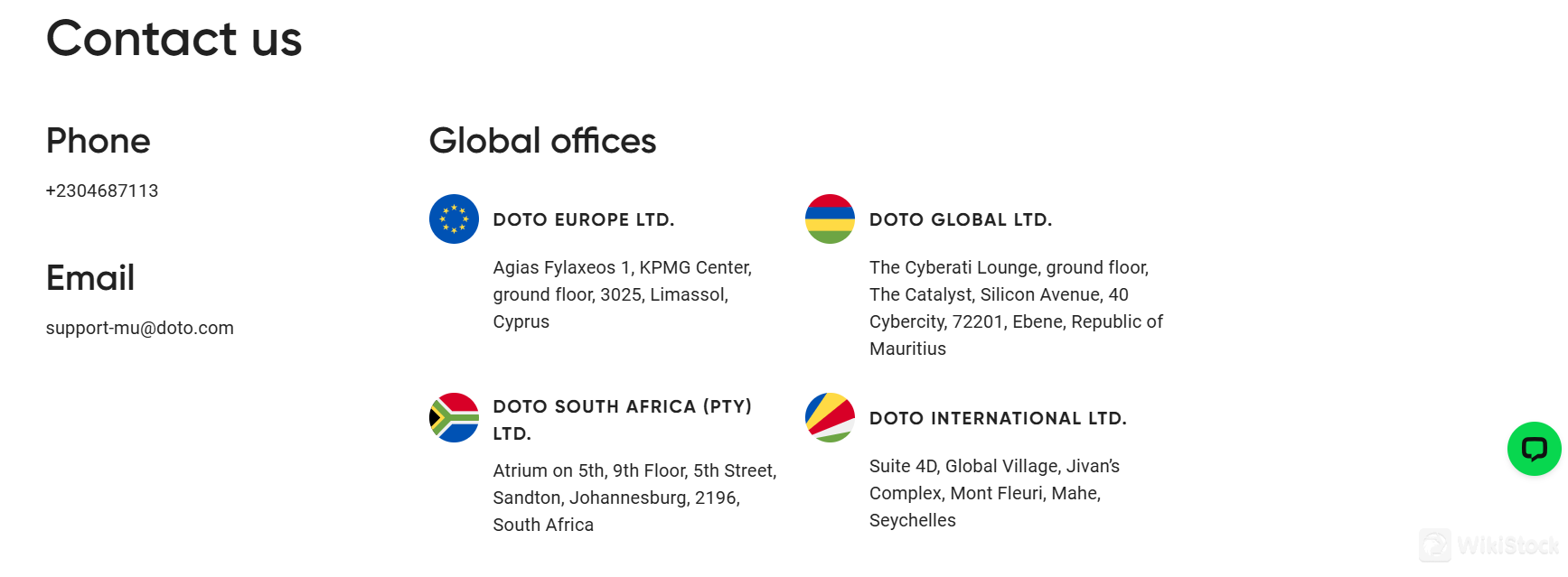

Doto provides extensive customer service channels to ensure comprehensive support for its clients. Traders can reach out via phone at +2304687113 or email at support-mu@doto.com for direct assistance. The company maintains a global presence with offices in key locations:

- DOTO EUROPE LTD.: Agias Fylaxeos 1, KPMG Center, ground floor, 3025, Limassol, Cyprus

- DOTO GLOBAL LTD.: The Cyberati Lounge, ground floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201, Ebene, Republic of Mauritius

- DOTO SOUTH AFRICA (PTY) LTD.: Atrium on 5th, 9th Floor, 5th Street, Sandton, Johannesburg, 2196, South Africa

- DOTO INTERNATIONAL LTD.: Suite 4D, Global Village, Jivans Complex, Mont Fleuri, Mahe, Seychelles

Furthermore, an FAQ section is for quick lookup for the answers to general inquiries.

Additionally, Doto offers live chat support for immediate inquiries. The company is active on social media platforms, including Facebook, Instagram, Telegram, YouTube, and LinkedIn, providing multiple avenues for clients to engage and seek help.

Conclusion

In conclusion, Doto stands out as a global trading platform offering a user-friendly experience with its proprietary and renowned MetaTrader platforms. Regulated by CYSEC (Cyprus Securities and Exchange Commission) with license no. 399/21, FSA (Seychelles Financial Services Authority) with license no. SD0063 (offshore), FSC (Mauritius Financial Services Commission) with license no. C119023978 (offshore), and FSCA (South Africa Financial Sector Conduct Authority) with license no. 50451, Doto ensures compliance with stringent regulatory standards. With a commitment to security, competitive fee structures, and robust customer support across multiple channels, Doto provides traders with confidence and reliability in navigating the global financial markets.

Frequently Asked Questions (FAQs)

1: Is Doto regulated by any financial authority?

Yes, Doto is regulated by several financial authorities, including CYSEC (Cyprus Securities and Exchange Commission), offshore FSA (Seychelles Financial Services Authority), offshore FSC (Mauritius Financial Services Commission), and FSCA (South Africa Financial Sector Conduct Authority).

2: What types of products does Doto provide?

Forex, Commodities, Indices, Cryptocurrencies, and soon, Stocks.

3: Is Doto suitable for beginners?

Yes, Doto is well regulated by several authorities and offers a user-friendly interface, step-by-step trading tutorials, and demo accounts for practice.

4: Does Doto charge any commissions or fees?

Doto does not charge commissions on trades. However, traders should check directly with Doto for details on overnight fees and other potential charges.

5: What are the deposit and withdrawal options?

Doto supports deposits and withdrawals via Visa/Mastercard, bank transfers and cryptos, with no internal fees.

6: Are there any restrictions on Doto' services based on client location?

Yes, Doto Ltd does not provide services to residents of American Samoa, Australia, Belgium, Brazil, Canada, the Central African Republic, the Democratic Republic of the Congo, the Republic of the Congo, Côte dIvoire, Eritrea, Guam, Heard Island and McDonald Islands, Hong Kong, Iran, Iraq, Israel, Japan, Lebanon, Liberia, Libya, Mali, Mauritius, Myanmar, New Zealand, North Korea, Northern Mariana Islands, Puerto Rico, Russia, Somalia, Sudan, the Syrian Arab Republic, the United Kingdom of Great Britain and Northern Ireland, the United States Minor Outlying Islands, the United States of America, the Virgin Islands of the United States or Yemen.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Obtain 4 securities license(s)

--

--

--

--