Spring Gold has been established for more than ten years, and the company has grown rapidly. It currently serves retail and institutional customers in more than 100 countries and is still growing.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Spring Gold Information

Spring Gold is a dynamic financial services provider that offers a robust platform for trading in global markets. Regulated by the Australian Securities and Investments Commission (ASIC), Spring Gold ensures a secure and transparent trading environment for its clients with over 1200 instruments available, including Forex, indices, commodities, and shares.

Spring Gold caters to both retail and professional clients, offering flexible account types with competitive spreads, tailored leverage options, and advanced MT4 trading platforms.

Pros & Cons

Pros

Regulatory Oversight by ASIC: Spring Gold is regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with stringent standards for investor protection.

Wide Range of Trading Instruments: Offers over 1200 trading instruments including Forex, indices, commodities, and shares.

Competitive Spreads and Commissions: Competitive pricing with tight spreads (ECN account) and no commission options (Standard account), enhancing cost-efficiency for traders.

Comprehensive Trading Platforms: Supports MT4 platforms (PC MT4, MT4 iPhone, MT4 Android, MT4 iPad) with advanced features like real-time quotes and technical indicators.

Cons

Limited Educational Resources: There is no mention of extensive educational resources or trading tools beyond the platforms themselves, which is a drawback for traders seeking educational support.

Is Spring Gold Safe?

Spring Gold is regulated by the oversight of the oversight of the Australian Securities and Investments Commission (ASIC), holding license No. 545560. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Spring Gold ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Spring Gold?

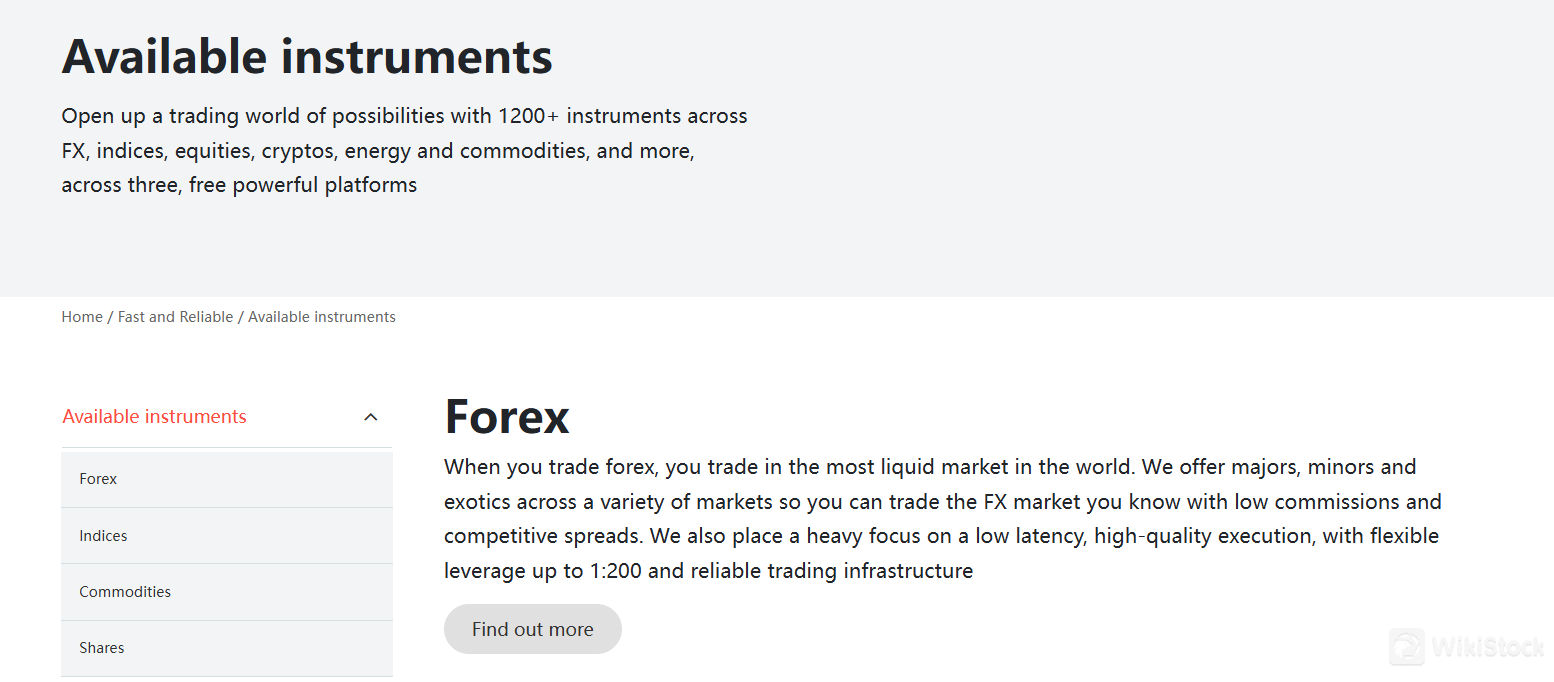

Spring Gold provides over 1200 instruments trading securities to cater to various investment strategies and preferences.

Traders can access a wide range of Forex pairs, allowing them to capitalize on currency market fluctuations. Additionally, Spring Gold offers indices, enabling clients to trade on the performance of major stock market indices from around the world.

For those interested in the raw materials market, a variety of commodities are available, including precious metals, energy products, and agricultural goods. Furthermore, traders can invest in shares of leading companies, gaining exposure to the equity markets.

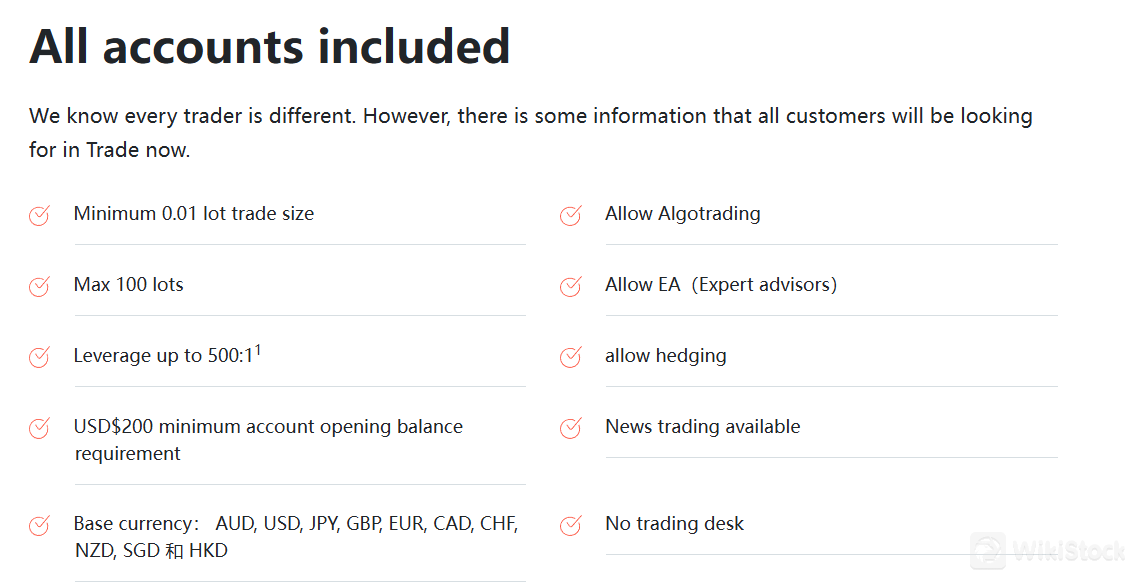

Spring Gold Accounts

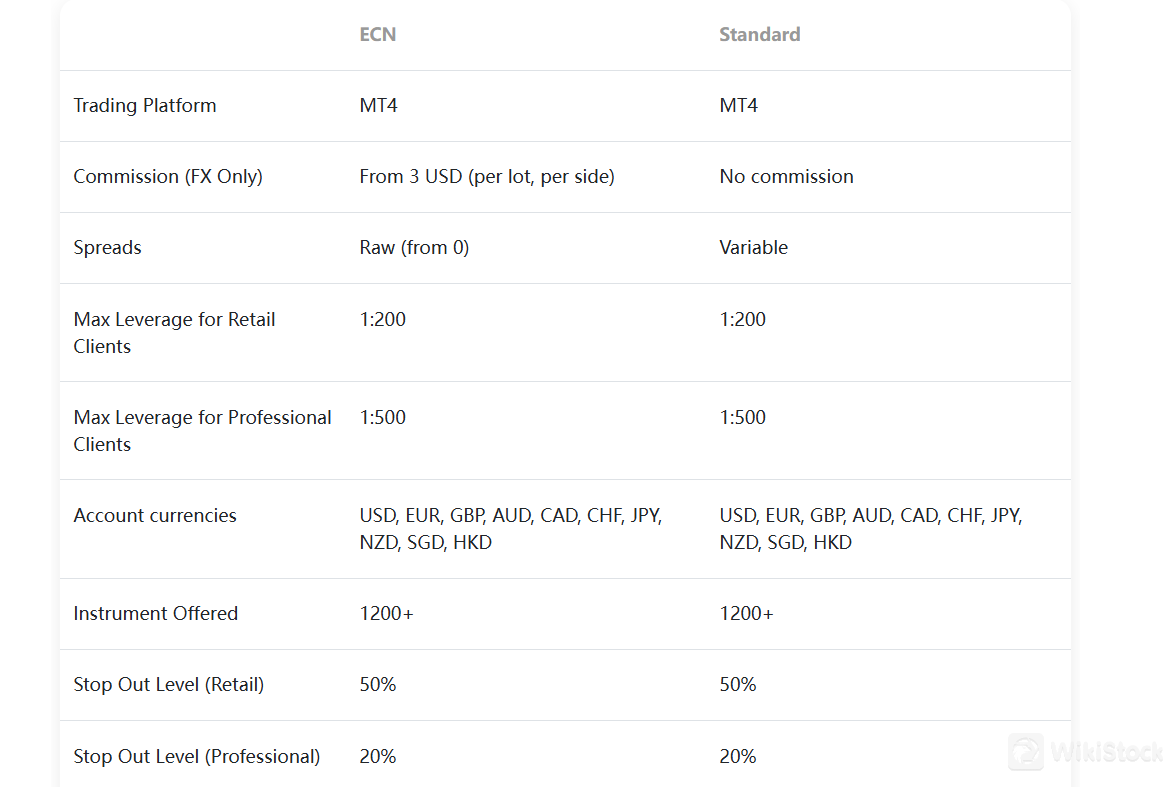

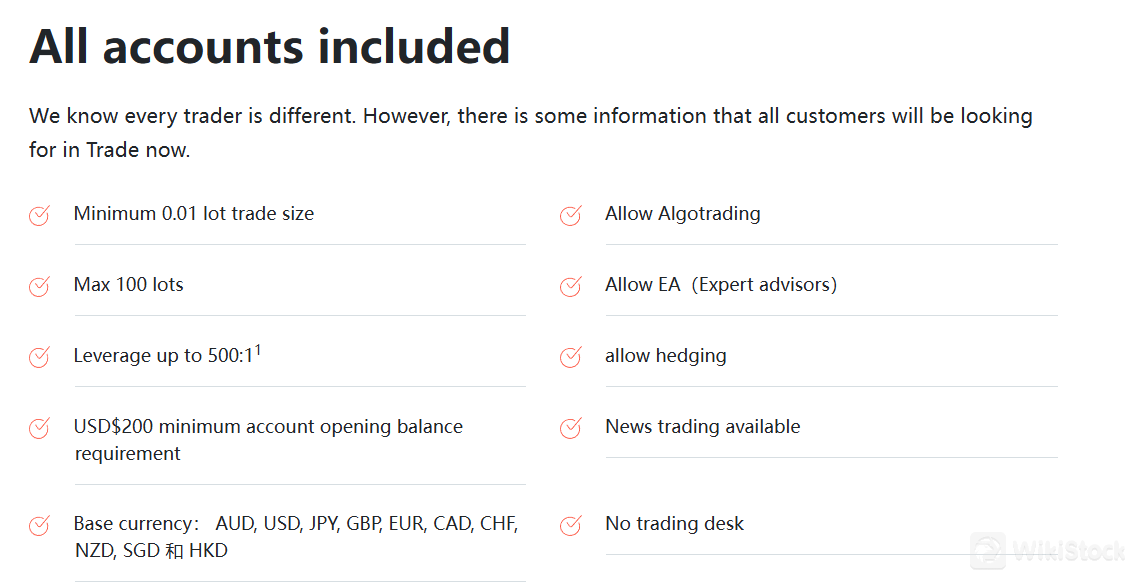

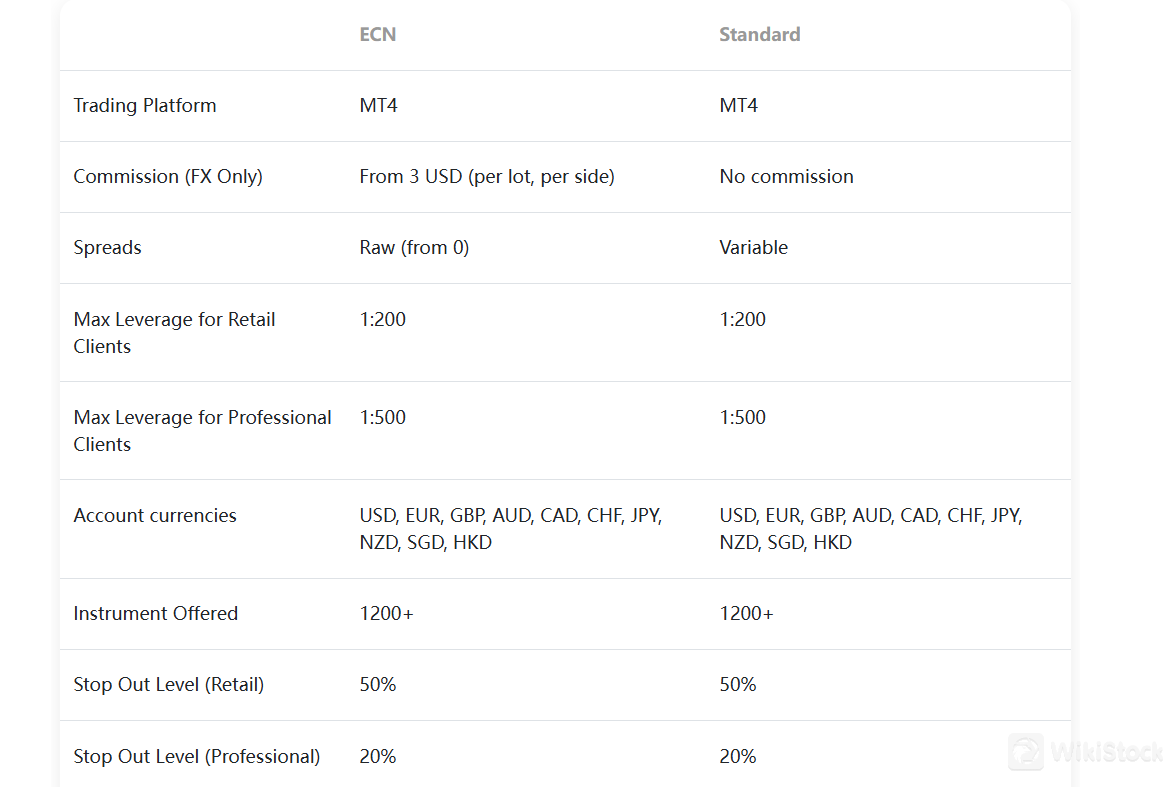

Spring Gold provides two distinct account types: ECN and Standard accounts. Both account options come with a minimum deposit requirement of just $200.

The ECN account is designed for those who seek tighter spreads and faster execution speeds, ideal for active traders and professionals. Meanwhile, the Standard account offers a straightforward trading experience with competitive spreads and user-friendly features, perfect for beginners or those who prefer a more traditional trading setup.

Spreads & Commissions

Spring Gold provides competitive spreads and commission structures tailored to different trading preferences through its ECN and Standard accounts.

For the ECN account, traders can benefit from raw spreads starting from 0, offering exceptional pricing and tighter spreads ideal for high-frequency trading. Additionally, the ECN account includes a commission on Forex trades, starting from just $3 per lot, per side, ensuring transparency and cost efficiency.

On the other hand, the Standard account features variable spreads, providing flexibility for various trading strategies without any commission fees, making it an attractive option for traders who prefer straightforward cost structures.

Leverage

Spring Gold caters to both retail and professional clients by offering tailored maximum leverage options to suit different trading needs and risk appetites.

Retail clients can access a maximum leverage of 1:200, allowing them to amplify their trading positions while maintaining a balanced approach to risk management.

For professional clients, Spring Gold extends leverage up to 1:500, catering to those with a deeper understanding of the markets and the ability to manage higher levels of risk. This higher leverage empowers professional traders to maximize their capital efficiency and take advantage of market opportunities with greater agility.

Spring Gold Platforms Review

Spring Gold offers a comprehensive suite of trading platforms designed to cater to the diverse needs of modern traders. With options including PC MT4, MT4 iPhone, MT4 Android, and MT4 iPad, users can access their trading accounts and manage their portfolios seamlessly from any device. These platforms provide robust features such as real-time quotes, advanced charting tools, and a variety of technical indicators to help traders make informed decisions.

Customer Service

Customers can reach out via email to info@springgold.net or admin@springgold.net for assistance with any issues or questions they may have. Additionally, for those who prefer in-person interactions or need to send correspondence, Spring Golds customer service team is conveniently located at Level 35, Tower One, 100 Barangaroo Ave, Barangaroo NSW 2000, Australia.

Conclusion

In conclusion, Spring Gold offers a robust and regulated trading environment with over 1200 instruments. The availability of ECN and Standard accounts, competitive spreads, and flexible leverage options accommodates traders of all levels. The MT4 trading platforms provide advanced tools for technical analysis and seamless trading across devices. Overall, its regulatory compliance, extensive asset coverage, and tailored trading solutions make it a compelling choice for traders at any stage.

FAQs

Is Spring Gold suitable for beginners?

No. The minimum deposit of $200 may be high for beginners. If you are a beginner, you can choose other brokers with no minimum deposit requirement.

Is Spring Gold legit?

Yes, Spring Gold is regulated by the Australian Securities and Investments Commission (ASIC).

What trading instruments are available at Spring Gold?

Forex pairs, indices, commodities (such as precious metals, energy products, and agricultural goods), and shares of leading global companies.

What is the minimum deposit required to open an account with Spring Gold?

$200.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)