Score

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

China

ChinaProducts

10

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 76.20% brokers

Securities license

Obtain 1 securities license(s)

CSRCRegulated

ChinaSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China SSE

申万宏源证券有限公司

Brokerage Information

More

Company Name

申万宏源证券有限公司

Abbreviation

申万宏源证券

Platform registered country and region

Company address

Company website

https://www.swhysc.com/swhysc/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Funding Rate

8.35%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Shenwan Hongyuan Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| A/B Shares Fee/Hong Kong Stock Fee | 3% |

| Convertible Corporate Bonds Fee | Shanghai: 0.2% |

| Shenzhen: 0.2% | |

| Beijing: 1% | |

| Asset-Backed Securities Fee | 0.2% |

| ETF Options Fee | 10 yuan per contract |

| Financing Interest Rate/Brokerage Rates | 8.35% |

| Mutual Funds Offered | Yes |

| App/Platform | Shenwan Hongyuan Securities trading platform |

Shenwan Hongyuan Securities Information

Headquartered in Shanghai, the company operates under the strict regulatory oversight of the China Securities Regulatory Commission (CSRC). It offers a diverse array of services including stock trading across major exchanges like the GEM and Science and Technology Innovation Board, access to funds and bonds,margin trading through the Hong Kong Stock Connect, and advanced financial products such as options and futures.

The firm also provides trading platforms tailored for both desktop and mobile users, featuring advanced functionalities like multi-field query options and access to detailed market data. Moreover, Shenwan Hongyuan Securities delivers research and educational resources such as current market insights, portfolio strategies, and in-depth analyses.

Pros & Cons

| Pros | Cons |

| Regulated by CSRC | Margin Interest Rates Not Specified |

| Diverse Investment Options | |

| Comprehensive Research & Education | |

| Advanced Trading Platforms | |

| Comprehensive Customer Support |

Pros

Regulated by CSRC: Regulated by the China Securities Regulatory Commission (CSRC).

Diverse Investment Options: Offers a wide range of investment products including stocks, funds, bonds, options, futures, and access to various stock exchanges and trading platforms.

Comprehensive Research & Education: Provides extensive research reports, current news, and educational resources.

Advanced Trading Platforms: Features versatile trading platforms for desktop and mobile users with robust query functions, market data access, and optimized order execution speeds.

Comprehensive Customer Support: Offers multiple communication channels including telephone, fax, and email.

Cons

Margin Interest Rates Not Specified: Lack of specified information regarding margin interest rates can lead to uncertainty for investors interested in leveraging their investments.

Is Shenwan Hongyuan Securities Safe?

Shenwan Hongyuan Securities is regulated by the oversight of the oversight of the China Securities Regulatory Commission (CSRC). This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Shenwan Hongyuan Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Shenwan Hongyuan Securities?

Shenwan Hongyuan Securities offers stock trading across various exchanges including the GEM, Science and Technology Innovation Board, Beijing Stock Exchange, and Shanghai-London Stock Connect. They also provide access to funds, bonds, and facilitate margin trading through the Hong Kong Stock Connect. For advanced investors, options, futures, and asset securitization options are available.

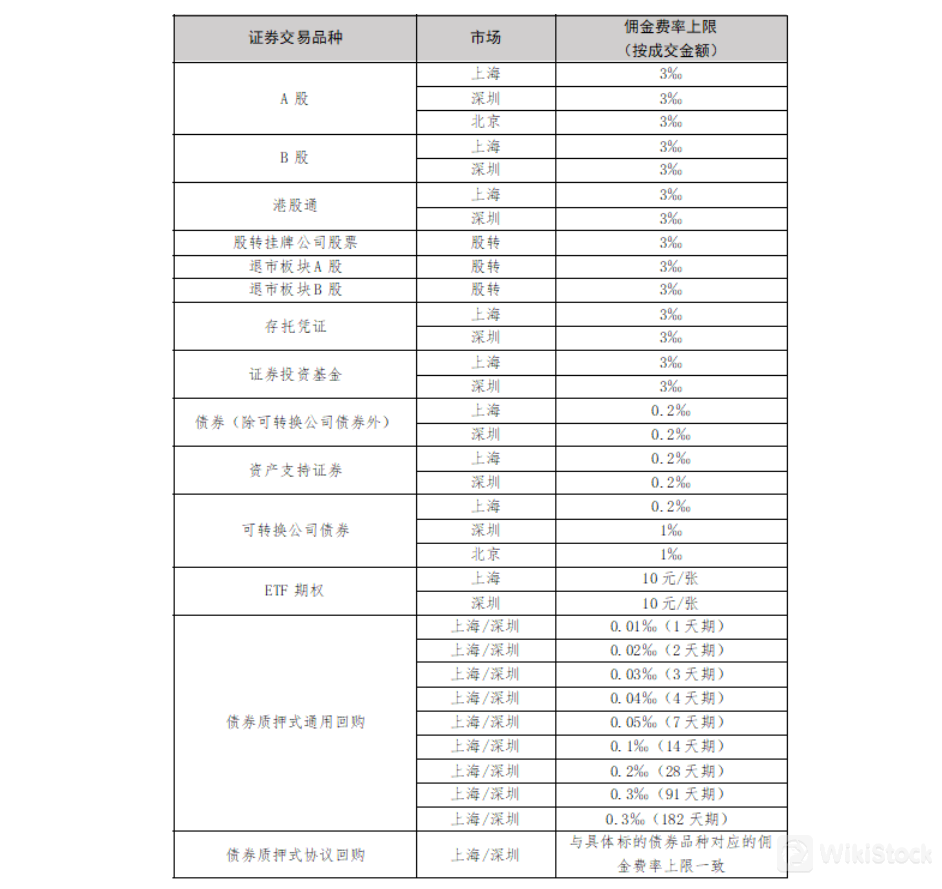

Shenwan Hongyuan Securities Fees Review

Shenwan Hongyuan Securities has established a comprehensive fee structure for various types of securities transactions. For A shares traded on the Shanghai, Shenzhen, and Beijing markets, the brokerage fee is capped at 3% of the transaction amount. The same 3% cap applies to B shares traded on the Shanghai and Shenzhen markets, as well as for Hong Kong stocks and preferred shares.

The fees for convertible corporate bonds and asset-backed securities are set at a lower rate of 0.2% of the transaction amount on the Shanghai and Shenzhen markets. Convertible corporate bonds traded on the Beijing market have a higher cap of 1%. For ETF options, the fee is fixed at 10 yuan per contract.

Additionally, Shenwan Hongyuan Securities charges a range of fees for bond repurchase transactions, with different rates based on the term length. For example, the fee for a one-day bond repurchase is 0.01%, while the fee for a 182-day bond repurchase is 0.30%. These fees are consistently applied across the Shanghai and Shenzhen markets.

The company also applies fees for open-ended bond repurchases and agreements, which are aligned with the corresponding bond repurchase rates.

Shenwan Hongyuan Securities App Review

Shenwan Hongyuan Securities excels in providing versatile trading platforms tailored for both mobile and desktop users. Their platforms feature robust query functions with clear classification and effective linkage, supporting multi-field filtering for precise queries. They optimize market order refresh speeds, ensuring timely and accurate trading execution.

For enhanced market insight, they offer access to 10 levels of market data (L2 data available for purchase), facilitating in-depth analysis and decision-making.

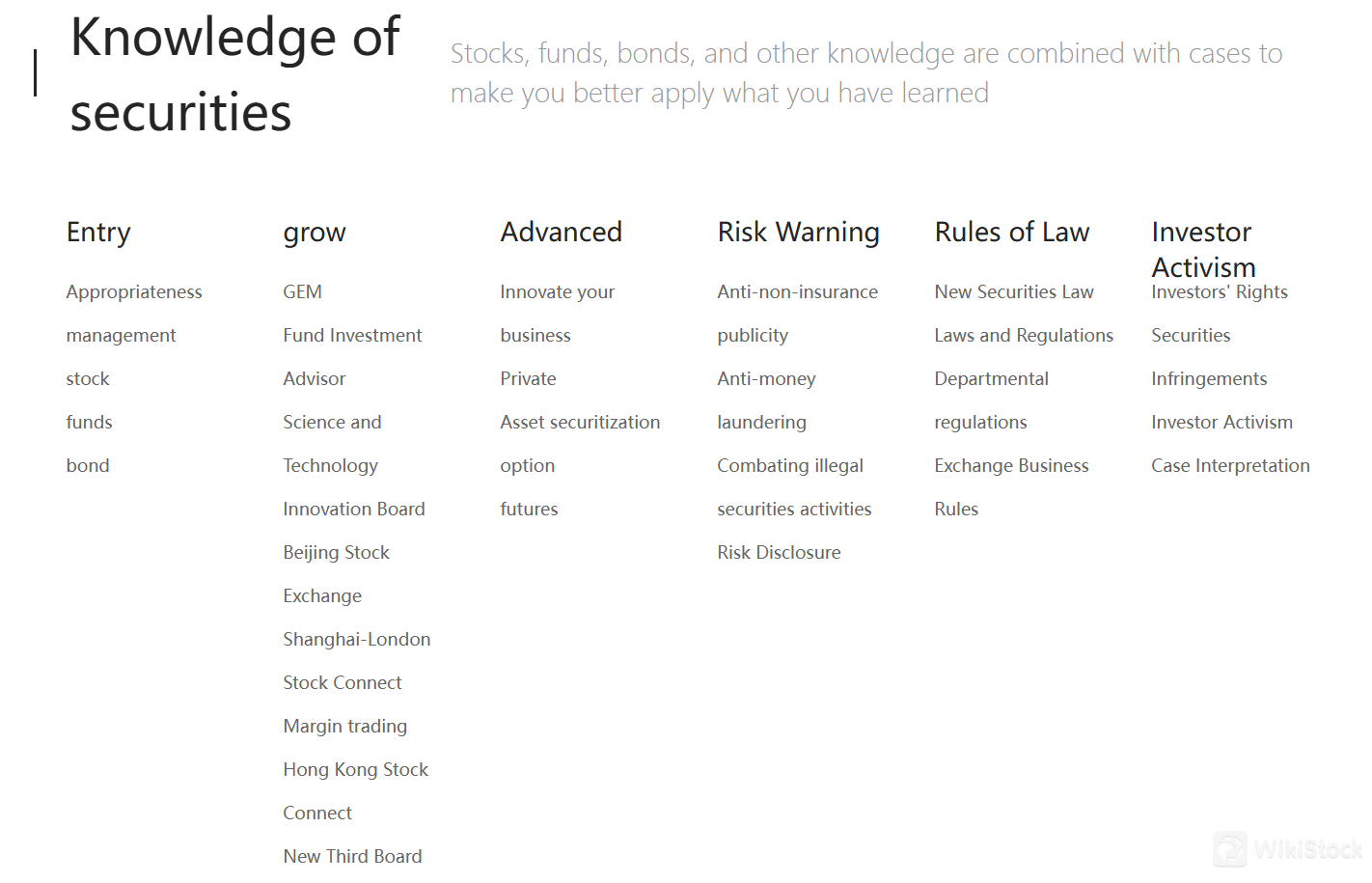

Research & Education

Shenwan Hongyuan Securities offers current news and exclusive analysis, curated into consultation packages such as Classic, Essential, Gold, Platinum, Diamond, and Premium levels. They provide editorial consultations covering wealth management, dynamic portfolio advice, margin trading strategies, and a compilation of diverse financial products. Investors benefit from in-depth A-share research reports, morning meeting minutes, industry analyses, company research, and macroeconomic insights.

Additionally, Shenwan Hongyuan Securities offers an investor education base featuring AI-synthesized videos, concise content from investment advisors, and quick guides to grasp evolving business dynamics.

Customer Service

Shenwan Hongyuan Securities's support team can be reached through:

- Tel: 95523, 400-889-5523

- Zip code: 200031

- Fax: 021-54035333

- Headquarters address: 45th Floor, Century Trade Plaza, No. 989 Changle Road, Xuhui District, Shanghai

- E-mail: swhysc@swhysc.com

Conclusion

In conclusion, Shenwan Hongyuan Securities presents a regulated and diversified platform for investment, offering a wide array of financial products and robust trading platforms. However, clients should note the limited transparency on the absence of specified margin interest rates, which requires direct inquiry for clarity. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

Q&A

Is Shenwan Hongyuan Securities suitable for beginners?

Yes, it is suitable for beginners due to its user-friendly platform, educational resources, and comprehensive customer support.

Is Shenwan Hongyuan Securities legit?

Yes, it is regulated by the China Securities Regulatory Commission (CSRC).

What financial products does Shenwan Hongyuan Securities offer?

Stocks, funds, bonds, options, futures, and margin trading.

What trading platforms does Shenwan Hongyuan Securities provide?

It offers versatile trading platforms for both desktop and mobile users.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

China

中国光大集团股份公司

Group Company

China

中央汇金资产管理有限公司

Group Company

China

中国建银投资有限责任公司

Group Company

China

中国投资有限责任公司

Group Company

China

申万宏源集团股份有限公司

Parent company

--

申银万国期货有限公司

Group Company

--

申万宏源(香港)有限公司

Group Company

--

申银万国投资有限公司

Group Company

--

宏源期货有限公司

Group Company

Review

No ratings

Recommended Brokerage FirmsMore

财通证券

Score

中天国富证券

Score

高盛中国

Score

HSBC Qianhai

Score

Zheshang Securities

Score

华兴证券

Score

粤开证券

Score

财达证券

Score

金圆统一证券

Score

东亚前海证券

Score